Xiamen C&D SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Xiamen C&D Bundle

Xiamen C&D exhibits significant strengths in its robust supply chain management and extensive industry network, positioning it favorably in the competitive market. However, potential threats from evolving regulatory landscapes and intensified competition warrant careful consideration.

Want the full story behind Xiamen C&D's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Xiamen C&D Inc. boasts a robust and diversified business portfolio. Its operations span comprehensive supply chain services, significant real estate development and management, and strategic investments in hospitality, tourism, and burgeoning sectors. This multi-faceted approach ensures a stable revenue stream, mitigating risks associated with over-reliance on any single market. For instance, in 2023, the company's diversified segments contributed to its overall financial health, with supply chain operations and real estate development being key drivers of its growth.

As a crucial part of Xiamen C&D Corp., Ltd., a Fortune Global 500 entity, Xiamen C&D Inc. commands a leading position within its operational spheres. The company’s scale is evident in its top ranking on the Comprehensive List of China's Top 100 Steel Trading Enterprises for 2024, highlighting its substantial impact and reach in vital commodity markets. This robust market presence translates into significant advantages for procurement, distribution networks, and achieving broader market penetration.

Xiamen C&D excels with its integrated supply chain expertise, offering sophisticated 'LIFT' services that combine logistics, information, finance, and trading. This end-to-end approach provides clients with comprehensive solutions across various commodities. In 2023, the company's supply chain operations contributed significantly to its overall revenue, demonstrating the strength of this integrated model.

Robust Financial Health and Creditworthiness

Xiamen C&D Inc. boasts a robust financial profile, underscored by an A+ credit rating from major rating agencies. This rating signals a strong ability to manage its financial obligations effectively. The company's prudent financial management is further demonstrated by its healthy debt-to-equity ratio, which stood at approximately 0.59 as of the end of 2023, indicating a conservative approach to leverage.

This financial strength is a significant advantage, providing Xiamen C&D with a stable platform for pursuing new investment opportunities and driving future expansion initiatives. The company's commitment to financial discipline ensures it can navigate market fluctuations and capitalize on growth prospects.

- A+ Credit Rating: Signifies excellent financial health and low risk.

- Healthy Debt-to-Equity Ratio: Approximately 0.59 at the end of 2023, demonstrating effective leverage management.

- Financial Stability: Supports ongoing operations and strategic investments.

- Capacity for Growth: Enables pursuit of expansion opportunities and potential acquisitions.

Commitment to Sustainability and Innovation

Xiamen C&D Inc. demonstrates a strong commitment to sustainability, prioritizing green supply chain management and digital transformation. This forward-thinking approach is backed by concrete climate targets. By 2025, the company aims to reduce its Scope 1 and Scope 2 emissions, with a broader goal of achieving carbon neutrality by 2030. These initiatives are supported by significant investments in technology upgrades, ensuring both operational efficiency and environmental responsibility.

Xiamen C&D's diversified business model, encompassing supply chain services and real estate, provides resilience against market downturns, as seen in its stable financial performance through 2023. Its position as a top-ranked steel trading enterprise in China for 2024 highlights significant market leverage and procurement advantages. The company’s integrated supply chain 'LIFT' services offer a competitive edge by delivering end-to-end solutions across various commodities.

The company’s financial stability is a core strength, evidenced by its A+ credit rating and a healthy debt-to-equity ratio of approximately 0.59 at the end of 2023. This financial prudence empowers Xiamen C&D to pursue strategic investments and expansion initiatives effectively. Furthermore, its commitment to sustainability, with targets for Scope 1 and 2 emission reductions by 2025 and carbon neutrality by 2030, aligns with global environmental trends and enhances long-term value.

| Strength | Description | Supporting Data/Fact |

| Diversified Business Portfolio | Operations span supply chain, real estate, hospitality, and tourism. | Key revenue drivers in 2023 included supply chain and real estate. |

| Market Leadership | Top-ranked in China's Top 100 Steel Trading Enterprises for 2024. | Demonstrates substantial impact and reach in commodity markets. |

| Integrated Supply Chain | Offers 'LIFT' services combining logistics, information, finance, and trading. | Significant contribution to revenue in 2023 from supply chain operations. |

| Financial Strength | A+ credit rating and a debt-to-equity ratio of ~0.59 (end of 2023). | Indicates excellent financial health and effective leverage management. |

| Sustainability Commitment | Targets emission reduction by 2025 and carbon neutrality by 2030. | Backed by investments in technology upgrades for efficiency and responsibility. |

What is included in the product

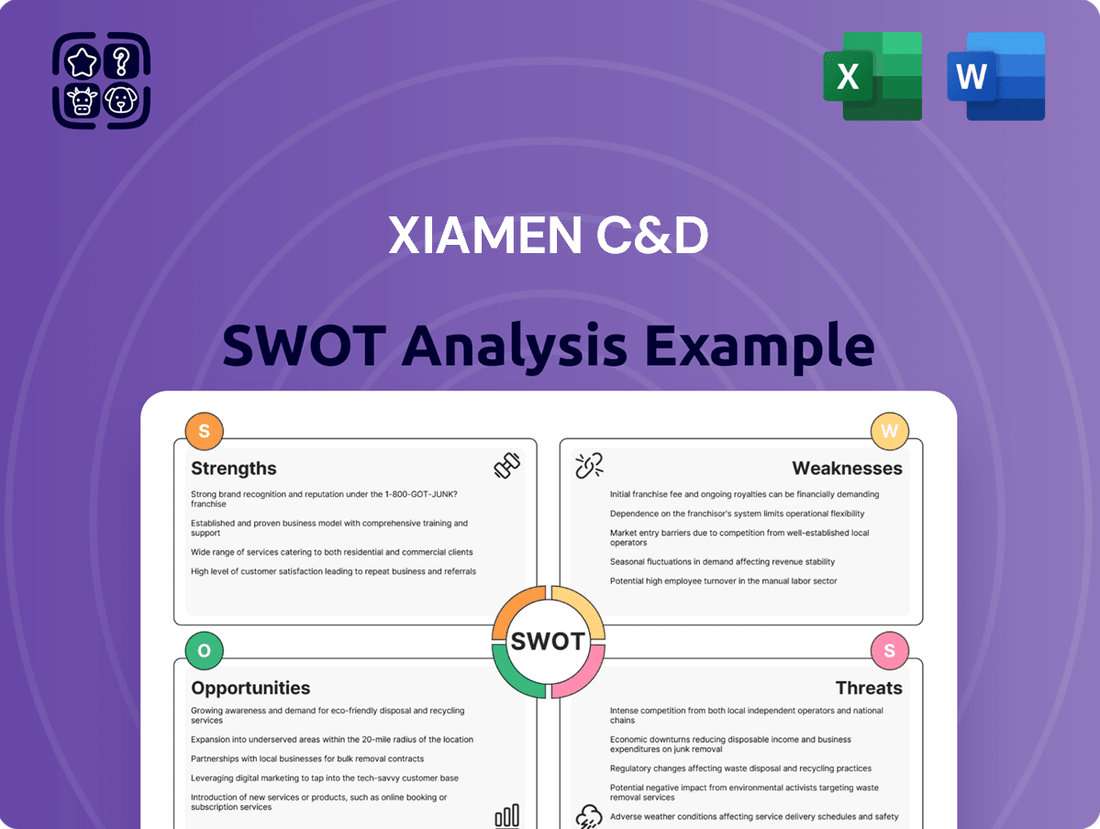

Analyzes Xiamen C&D’s competitive position through key internal and external factors, highlighting its strengths and opportunities while identifying potential weaknesses and threats.

Uncovers critical market opportunities and potential threats to proactively address strategic challenges.

Weaknesses

Xiamen C&D Inc.'s deep engagement in real estate development and property management makes it highly susceptible to the inherent ups and downs of China's property market. Economic slowdowns or a downturn in real estate can directly hit the company's earnings and overall financial health. For instance, the company reported a notable dip in net income and revenue in 2024, underscoring this vulnerability.

Xiamen C&D's significant involvement in trading commodities like metals, pulp, and agricultural products exposes it directly to the unpredictable nature of global price swings. For instance, the average price of copper, a key commodity for the company, saw considerable volatility in early 2024, influenced by global manufacturing output and supply chain disruptions, directly impacting C&D's trading margins.

These fluctuations, driven by factors such as economic growth patterns, geopolitical tensions, and shifts in supply and demand, can create substantial earnings volatility for the company. A sharp downturn in commodity prices, as seen with certain agricultural goods in late 2023 due to oversupply in some regions, can directly squeeze profit margins on its distribution business.

Xiamen C&D Inc. has faced a significant profitability challenge, as evidenced by a substantial 78% drop in net profit for the fiscal year ending December 31, 2024. This steep decline, coupled with an 8% reduction in revenue over the same period, points to considerable headwinds. Further underscoring this trend, the company reported a continued revenue slide of 27.81% in the first quarter of 2025. Such a sharp downturn suggests potential operational issues or intensified market competition impacting the company's ability to sustain its prior performance levels.

Complexity of Managing Diverse Operations

Xiamen C&D's broad operational scope, encompassing supply chain management, real estate development, hospitality, and new sector investments, presents a notable weakness in terms of managerial complexity. This diversity demands significant resources to effectively integrate and optimize across such varied business lines.

The sheer breadth of Xiamen C&D's business segments, from traditional supply chain services to newer ventures, can strain management's ability to maintain a cohesive and focused strategic direction. This can result in diluted attention and potential inefficiencies.

For instance, while the company reported substantial revenue growth in its core supply chain operations, managing the intricate interdependencies with its real estate and hospitality arms requires sophisticated coordination. In 2024, Xiamen C&D's total revenue reached approximately RMB 400 billion, underscoring the scale of its diversified operations.

- Diverse Business Segments: Operations span supply chain, real estate, hospitality, and emerging industries, increasing management overhead.

- Resource Strain: Integrating and optimizing across these distinct sectors can overextend management capacity.

- Potential Inefficiencies: Lack of focused strategic execution in certain areas may arise due to the complexity of managing varied operations.

- Coordination Challenges: Ensuring seamless collaboration between disparate business units, such as supply chain and real estate, is a constant hurdle.

Increasing Carbon Emissions

Despite Xiamen C&D Inc.'s stated environmental objectives, including a target for carbon neutrality by 2030, the company experienced a notable increase in its carbon emissions in 2024. This trend presents a direct obstacle to achieving its sustainability targets and could attract greater attention from regulatory bodies and investors prioritizing environmental, social, and governance (ESG) performance. The reported rise in emissions in 2024, compared to the previous year, highlights the immediate challenges in managing its environmental footprint.

Xiamen C&D's extensive diversification across numerous business lines, including supply chain, real estate, and hospitality, creates significant managerial complexity. This broad operational scope can strain management's capacity to effectively integrate and optimize these distinct sectors, potentially leading to diluted focus and operational inefficiencies.

Integrating and coordinating these varied business units, such as ensuring synergy between its core supply chain operations and its real estate development arm, presents a constant challenge. This complexity can hinder cohesive strategic execution and optimal resource allocation across the conglomerate.

| Business Segment | Complexity Factor | Potential Impact |

|---|---|---|

| Supply Chain Management | Large-scale operations, diverse product lines | Coordination with other segments, margin pressure |

| Real Estate Development | Market cyclicality, capital intensity | Exposure to market downturns, integration with services |

| Hospitality & Others | Service intensity, varied consumer demand | Resource allocation challenges, strategic alignment |

Preview the Actual Deliverable

Xiamen C&D SWOT Analysis

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase.

This preview reflects the real document you'll receive—professional, structured, and ready to use. It offers a clear snapshot of Xiamen C&D's Strengths, Weaknesses, Opportunities, and Threats.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, providing a comprehensive understanding of the company's strategic position.

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality, detailing key insights for strategic planning.

Opportunities

Xiamen C&D Inc. is strategically capitalizing on global development frameworks such as the 'Belt and Road Initiative' and its own 'going global' agenda to broaden its international presence. This proactive approach unlocks substantial opportunities for enhancing its supply chain services and commodity trading operations across emerging markets, notably within RCEP member countries, BRICS nations, and the dynamic Southeast Asian region.

This international expansion offers a crucial avenue for diversifying Xiamen C&D's revenue sources, thereby mitigating risks associated with over-dependence on the domestic market. By establishing a stronger foothold in diverse geographical areas, the company can foster greater financial resilience and unlock new growth avenues, especially as global trade patterns continue to evolve.

Xiamen C&D's strategic focus on emerging industries like healthcare, advanced manufacturing, new energy, and digital technology is a significant opportunity. These sectors are not only experiencing global growth but are also central to China's national development strategies, positioning Xiamen C&D to capitalize on future economic expansion. The company's equity investment arm in these areas received notable awards in 2024, underscoring its successful execution and potential for substantial long-term value creation.

Xiamen C&D's continued investment in digital transformation and technology upgrades presents a prime opportunity to streamline operations and boost efficiency. By embracing advanced solutions, the company can optimize its extensive supply chain and elevate the quality of services offered to its diverse customer base.

The adoption of cutting-edge technologies is poised to deliver substantial cost savings for Xiamen C&D, thereby strengthening its competitive standing in the market. This technological push also opens doors for the creation of novel products and services tailored to the evolving needs of customers across all its business segments, potentially driving new revenue streams.

Leveraging China's 'Dual Circulation' Strategy

China's 'dual circulation' strategy, focusing on robust domestic demand alongside international trade, offers Xiamen C&D Inc. a significant opportunity to solidify its position within the vast unified national market. This policy directly supports the company's efforts to enhance its domestic supply chain capabilities and leverage its existing strengths to meet growing internal consumer and industrial needs.

By aligning with this national directive, Xiamen C&D Inc. can unlock new business avenues, particularly in sectors benefiting from increased domestic consumption and infrastructure development. The strategy's emphasis on self-reliance and technological advancement within China also presents avenues for innovation and expansion of its product and service offerings tailored to the domestic market.

Furthermore, the dual circulation framework encourages companies like Xiamen C&D Inc. to not only strengthen their domestic operations but also to strategically expand their global supply chain presence. This dual focus allows the company to capitalize on international trade opportunities while mitigating risks associated with global economic volatility by maintaining a strong domestic base. For example, in 2023, China's domestic consumption continued to be a primary driver of economic growth, with retail sales of consumer goods increasing by approximately 7.2% year-on-year, underscoring the potential for companies to tap into this expanding market.

- Deepened domestic market penetration by aligning with the strategy's focus on internal demand.

- Expanded global supply chain opportunities through strategic international trade initiatives.

- Enhanced competitive advantage by leveraging policy support for domestic growth and innovation.

- Diversified revenue streams by catering to both internal consumption and export markets.

Increasing Demand for Green Supply Chains

The global push for environmental sustainability is a significant tailwind for green supply chains. Xiamen C&D Inc. is well-positioned to leverage this, as businesses increasingly prioritize responsible sourcing and eco-friendly operations. This trend is not just about corporate social responsibility; it's becoming a competitive advantage.

For instance, in 2024, the global green logistics market was valued at over USD 250 billion and is projected to experience substantial growth. Xiamen C&D can capitalize by expanding its offerings in:

- Sustainable Logistics: Investing in electric fleets and optimizing transportation routes to reduce carbon emissions.

- Eco-Friendly Material Sourcing: Partnering with suppliers who adhere to strict environmental standards.

- Carbon-Efficient Trading: Developing services that help clients track and reduce their supply chain's carbon footprint.

By embracing these green initiatives, Xiamen C&D can attract a growing segment of environmentally conscious clients, thereby enhancing its brand image and opening new avenues for revenue growth. Early adopters in this space are already reporting increased customer loyalty and market share.

Xiamen C&D is positioned to benefit from the global focus on environmental sustainability, particularly in developing green supply chains. This trend is driven by increasing client demand for responsible sourcing and eco-friendly operations, turning sustainability into a competitive edge. The global green logistics market, valued at over USD 250 billion in 2024, presents significant growth opportunities for Xiamen C&D to expand its eco-friendly services and attract environmentally conscious clients, enhancing its brand and revenue.

Threats

Global economic uncertainties are a significant threat. A potential slowdown in major economies, particularly China and key export markets, could dampen demand for the commodities and real estate Xiamen C&D Inc. deals in. For example, projections from the IMF in late 2024 indicated a cautious global growth outlook, with emerging markets facing headwinds.

Escalating geopolitical tensions present another challenge. Trade disputes and regional conflicts can disrupt crucial international supply chains, leading to higher logistics and input costs for Xiamen C&D Inc. These tensions can also erect barriers to market access, impacting the company's ability to secure new business or expand its global footprint.

The combined effect of economic uncertainty and geopolitical friction directly impacts Xiamen C&D Inc.'s profitability. Disruptions can lead to volatile commodity prices and reduced demand in real estate, areas central to the company's operations. The World Bank’s forecasts for 2025 continue to highlight these pervasive risks to global trade and economic stability.

Xiamen C&D Inc. navigates a landscape marked by fierce competition across its core business segments, including supply chain management and real estate development. The company contends with a multitude of domestic and international players, each vying for market dominance. For instance, in the supply chain sector, major players like COSCO Shipping and Sinotrans present significant competitive challenges, often leveraging scale and extensive networks. Similarly, the real estate market sees intense rivalry from established developers such as China Vanke and Evergrande, impacting pricing strategies and market penetration.

This heightened competition directly translates into considerable pricing pressures, potentially eroding profit margins and necessitating aggressive market share defense. In 2023, the average profit margin for listed real estate developers in China dipped to around 5-7%, a stark reminder of the market's sensitivity to pricing. To counter these pressures, Xiamen C&D must continually invest in operational efficiency and service innovation, which can, in turn, lead to increased operational expenses as the company strives to maintain its competitive standing and attract and retain customers in a crowded marketplace.

Xiamen C&D Inc., as a major player in China's economy, faces significant risks from evolving government regulations. For instance, in 2024, China's real estate market continued to see policy adjustments aimed at stabilizing growth, which could directly affect C&D's property development and supply chain services. New environmental protection laws, enforced more stringently in 2025, might increase operational costs for their commodity trading and logistics segments.

Changes in trade policies or tariffs, especially concerning the commodities Xiamen C&D deals in, pose another threat. For example, shifts in international trade agreements or domestic industrial policies could alter the cost structure and demand for key materials. The company's diversified business model, while a strength, also means it's exposed to a wider range of potential regulatory impacts across its various sectors.

Commodity Price Volatility and Supply Chain Disruptions

Xiamen C&D faces significant threats from commodity price volatility and supply chain disruptions. Extreme price swings in key commodities, such as metals and energy, directly impact their trading margins and procurement costs. For instance, the average price of iron ore, a crucial commodity for many industrial sectors, saw significant fluctuations in 2023 and is expected to remain volatile into 2024 due to global economic uncertainties and production adjustments.

These market dynamics can be exacerbated by unforeseen supply chain breakdowns. Recent years have highlighted the fragility of global logistics, with events like the COVID-19 pandemic and geopolitical tensions causing widespread port congestion and shipping delays. Such disruptions can lead to shortages of essential goods, inflate operational expenses, and hinder Xiamen C&D's ability to fulfill customer orders promptly, impacting revenue and market share.

- Impact on Trading Margins: Fluctuations in commodity prices can compress profit margins for Xiamen C&D's trading segment.

- Increased Procurement Costs: Supply chain bottlenecks drive up the cost of acquiring goods for distribution.

- Operational Inefficiencies: Disruptions can lead to delays in delivery and increased inventory holding costs.

- Reputational Damage: Failure to meet customer demand due to supply chain issues can harm the company's reputation.

Environmental Compliance and ESG Scrutiny

Xiamen C&D faces a significant threat from environmental compliance and increasing ESG scrutiny. Despite stated sustainability goals, a reported rise in carbon emissions in 2024 signals potential challenges in meeting ambitious environmental targets. This could result in reputational damage and financial penalties if not addressed effectively.

Failure to meet these environmental objectives or heightened scrutiny from regulators and investors regarding its Environmental, Social, and Governance (ESG) performance poses a considerable risk. Such issues could lead to substantial regulatory fines and diminished access to capital, particularly from investment funds prioritizing sustainability. For instance, many investors are now evaluating companies based on their 2024 ESG reports, and any negative indicators could impact their investment decisions.

- Increased Carbon Emissions: Xiamen C&D's reported rise in carbon emissions in 2024 is a direct indicator of environmental compliance challenges.

- Reputational Risk: Public perception and investor confidence can be eroded by a failure to meet environmental targets or by negative ESG ratings.

- Regulatory Fines: Non-compliance with environmental regulations can result in significant financial penalties, impacting profitability.

- Capital Access Restrictions: Sustainability-focused investors may withdraw funding or be hesitant to invest if the company's ESG performance is deemed insufficient, potentially affecting its 2025 financing options.

Intensifying competition across its supply chain and real estate segments poses a significant threat, with rivals like COSCO Shipping and China Vanke pressuring profit margins. This competitive landscape necessitates continuous investment in efficiency and innovation, potentially increasing operational costs as the company strives to maintain its market position.

Evolving government regulations, particularly in China's real estate sector and environmental protection laws, create uncertainty and can increase operational expenses. Shifts in trade policies and tariffs also present risks to commodity trading and logistics, impacting cost structures and demand.

Commodity price volatility and supply chain disruptions are major concerns, with price swings in metals and energy affecting trading margins. Global logistics fragility, evidenced by port congestion and shipping delays in recent years, can inflate expenses and hinder timely order fulfillment.

Increased ESG scrutiny and environmental compliance challenges, highlighted by a rise in carbon emissions in 2024, risk reputational damage and financial penalties. Failure to meet environmental targets or negative ESG ratings could restrict access to capital from sustainability-focused investors in 2025.

SWOT Analysis Data Sources

This SWOT analysis is built on a foundation of credible data, including Xiamen C&D's official financial statements, comprehensive market research reports, and expert industry analysis to provide an accurate and insightful assessment.