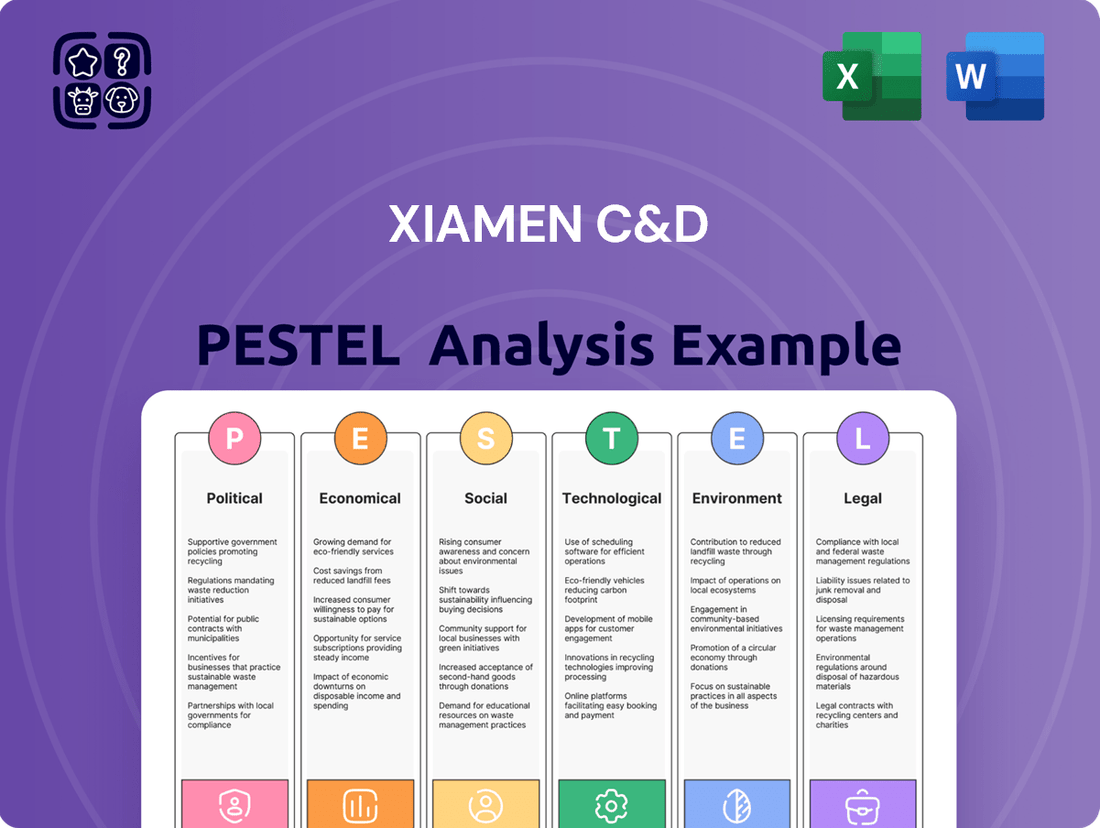

Xiamen C&D PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Xiamen C&D Bundle

Unlock the strategic advantages shaping Xiamen C&D's trajectory with our comprehensive PESTLE analysis. We delve into the political stability, economic fluctuations, and technological advancements impacting this dynamic company. Understand the social shifts and environmental regulations that present both challenges and opportunities. Don't get left behind; gain actionable intelligence to refine your own market approach. Purchase the full PESTLE analysis now for a complete picture and a competitive edge.

Political factors

China's government remains a powerful force in shaping economic growth, actively directing development through robust industrial policies and direct support for key sectors. As a state-owned enterprise, Xiamen C&D is well-positioned to leverage this government backing, aligning its strategies with national priorities like Made in China 2025. This alignment is crucial for sectors targeted by government initiatives, ensuring they benefit from preferential treatment.

This strategic alignment with national industrial policies, including those focused on digital transformation and green technologies, grants Xiamen C&D significant advantages. These include enhanced access to crucial resources, favorable financing options, and expanded market opportunities, especially within rapidly evolving industries and efforts to modernize supply chains. For instance, government subsidies for renewable energy projects in 2024 supported the expansion of green technology sectors, directly benefiting companies like Xiamen C&D involved in these areas.

Ongoing trade tensions, especially between the United States and China, continue to shape global commerce. Tariffs and export controls, such as those impacting semiconductors and advanced technologies, create ripple effects across international supply chains. For a company like Xiamen C&D, heavily involved in trading and distributing commodities like metals and agricultural goods, staying compliant with evolving trade laws and mitigating potential disruptions is crucial.

China's implementation of anti-sanction regimes and new export control regulations directly affects companies with significant international business. These policies can influence sourcing strategies and market access, requiring Xiamen C&D to adapt its operations to navigate these complexities effectively. The total value of China's exports in 2023 reached approximately $3.38 trillion, underscoring the importance of smooth international trade for its economy and companies like Xiamen C&D.

The Chinese government's ongoing efforts to stabilize its real estate market significantly shape Xiamen C&D's operations. Policies aimed at curbing speculation and managing developer debt, such as stricter lending rules and purchase restrictions, directly influence the viability of new projects and overall sales performance. For instance, measures introduced in 2024 to ease some property market restrictions in select cities, while potentially boosting demand, also signal continued government oversight.

These regulatory shifts, including directives to reduce oversupply and encourage affordable housing, directly impact Xiamen C&D's development segment, affecting project timelines and profit margins. The company’s profitability in 2024 is therefore closely tied to its ability to adapt to these evolving policy landscapes. For example, in early 2024, certain cities saw a relaxation of down payment requirements, a move that could boost Xiamen C&D's sales volume if mirrored in their key operating regions.

Furthermore, government initiatives supporting urban regeneration, such as upgrading older residential areas, present strategic opportunities for Xiamen C&D. These programs often come with incentives and clear development mandates, potentially de-risking projects and opening new avenues for growth. The ongoing commitment to urban renewal, evidenced by increased central government funding allocations in the 2025 budget for infrastructure and housing improvements, directly benefits companies like Xiamen C&D engaged in these activities.

Tourism Policy Liberalization

China's recent tourism policy liberalization, including expanded visa-free entry for citizens from over 50 countries, directly benefits Xiamen C&D's hospitality and tourism operations. This move is designed to significantly increase the number of international visitors, both for leisure and business, thereby driving demand for hotel stays and related services. For example, in early 2024, China saw a notable surge in international arrivals following these policy changes, with some cities reporting a nearly 30% year-on-year increase in foreign tourists.

Furthermore, the government's commitment to standardizing digital tourism services is crucial for enhancing the overall visitor experience. This includes streamlining online booking platforms and payment systems, which Xiamen C&D can leverage to improve customer engagement and operational efficiency. With these initiatives, the aim is to foster a more seamless and attractive travel environment, translating into increased revenue opportunities for companies like Xiamen C&D in the burgeoning tourism market.

Key aspects of the tourism policy liberalization include:

- Expanded visa-free access: Citizens from numerous countries now enjoy visa-free entry, simplifying travel.

- Simplified travel processes: Efforts to make inbound tourism smoother are underway.

- Digital service standardization: Enhancing online booking and payment for a better user experience.

- Focus on inbound tourism: Policies are specifically geared towards attracting more international visitors to China.

Investment and Market Access Policies

China's ongoing adjustments to foreign investment policies, particularly the opening of its manufacturing sector, create a dynamic market landscape. While Xiamen C&D operates as a domestic state-owned enterprise (SOE), these shifts significantly influence the competitive environment and potential growth avenues in sectors where the company is actively investing. For instance, the government's efforts to attract foreign capital, coupled with a focus on high-tech manufacturing, can introduce new players and technological advancements, impacting Xiamen C&D's strategic positioning.

The government's approach to streamlining investment processes aims to bolster foreign direct investment (FDI). In 2023, China's FDI saw a notable shift, with a decrease in overall FDI but a significant increase in investment into high-tech industries. This trend underscores the government's strategic focus, which Xiamen C&D must navigate as it seeks opportunities in these same emerging sectors. The tightening of scrutiny on foreign investments in strategic industries also necessitates careful consideration of regulatory compliance and potential partnership structures.

These policy evolutions directly affect market access and the competitive intensity for Xiamen C&D.

- Manufacturing Sector Liberalization: China has progressively eased restrictions in areas like automotive and semiconductor manufacturing, potentially increasing competition from foreign firms.

- FDI Trends: While overall FDI might fluctuate, the directed flow into advanced manufacturing and technology sectors by 2024-2025 presents both opportunities and competitive pressures.

- Strategic Sector Scrutiny: Enhanced review processes for foreign investments in areas deemed critical, such as advanced materials or new energy technologies, require Xiamen C&D to be aware of evolving national security and industrial policy considerations.

- Streamlining Measures: Efforts to simplify approval procedures for foreign investors could indirectly benefit Xiamen C&D by fostering a more efficient overall business environment, even for domestic players.

China's government continues to exert significant influence through industrial policies and direct support, which Xiamen C&D, as a state-owned enterprise, can leverage by aligning with national priorities like Made in China 2025. This strategic alignment, particularly in sectors targeted by government initiatives such as digital transformation and green technologies, provides advantages like enhanced resource access and favorable financing. For example, government subsidies for renewable energy projects in 2024 directly benefited companies like Xiamen C&D involved in these expanding sectors.

What is included in the product

This PESTLE analysis of Xiamen C&D thoroughly examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company, providing a comprehensive understanding of its external operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, helping Xiamen C&D navigate complex external factors and identify strategic opportunities.

Economic factors

China's real estate market is navigating a challenging period, marked by falling prices and sales volumes. Lower-tier cities are particularly affected by elevated vacancy rates. This downturn directly impacts Xiamen C&D's property development and sales operations.

Government efforts are underway to provide stability to the sector, aiming to mitigate broader economic headwinds. However, analysts anticipate that a widespread market recovery is unlikely to materialize throughout 2025. This suggests that Xiamen C&D's real estate segment will likely continue to experience pressure.

Xiamen C&D's core business revolves around trading and distributing a wide array of commodities, including metals, pulp, minerals, and agricultural products. This specialization means the company is directly exposed to fluctuations in global commodity prices.

Looking ahead to 2025, forecasts suggest a general decline in commodity prices. This is largely attributed to anticipated improvements in global supply chains and a projected slowdown in worldwide economic growth. For instance, the International Monetary Fund (IMF) in their April 2024 World Economic Outlook projected global growth to moderate to 3.2% in 2025, down from 3.2% in 2024, indicating a less robust demand environment.

However, certain commodity sectors may buck this trend. Metals crucial for the energy transition, such as copper and nickel, are expected to receive continued support due to strong demand from renewable energy and electric vehicle manufacturing. This presents a mixed outlook for Xiamen C&D's diverse commodity portfolio.

The inherent volatility in these markets poses a significant challenge to Xiamen C&D's supply chain operations and overall profitability. Effectively managing these price swings necessitates agile risk management strategies to mitigate potential losses and capitalize on emerging opportunities within the sector.

China's GDP growth is anticipated to moderate in 2025, with a significant emphasis on bolstering domestic demand and tackling lingering consumer confidence challenges. This economic environment presents a mixed outlook for Xiamen C&D; a stronger domestic consumption trend could positively impact its real estate and tourism divisions. However, the company's vast supply chain network relies heavily on broader economic stability.

For Xiamen C&D, the projected economic trajectory in 2025 necessitates strategic adaptation. While a focus on domestic consumption offers opportunities, particularly in sectors like real estate and tourism, the company's extensive supply chain operations remain vulnerable to fluctuations in overall economic health. Economic forecasts suggest that fiscal and monetary policies will likely remain supportive, aiming to sustain growth momentum.

Impact of Global Trade Tensions

Escalating global trade tensions, notably the United States' imposition of tariffs on Chinese goods, are fundamentally altering international supply chains. This dynamic directly impacts companies like Xiamen C&D, which rely on robust global sourcing and logistics. The ongoing trade friction, particularly tariffs enacted in 2023 and continuing into 2024, has already led to an estimated increase in import costs for many businesses.

These trade disputes necessitate a strategic re-evaluation of manufacturing locations, pushing for diversification away from China to mitigate risks. For Xiamen C&D, this means adapting sourcing strategies and navigating increased operational expenses. The company must also contend with regulatory uncertainty, which can affect shipping routes, import duties, and overall market access.

The impact on Xiamen C&D's supply chain services is multifaceted:

- Increased Costs: Tariffs directly inflate the cost of imported goods, squeezing profit margins. For example, tariffs on specific electronics components could add 7.5% or 25% to their landed cost, depending on the product category.

- Supply Chain Disruptions: Trade policy shifts can lead to sudden changes in trade flows, causing delays and requiring contingency planning for alternative shipping routes or suppliers.

- Diversification Pressure: Companies are increasingly exploring alternative manufacturing bases in countries like Vietnam, Mexico, or India to reduce reliance on single sourcing locations, impacting logistics networks.

- Regulatory Complexity: Navigating evolving trade regulations, customs procedures, and compliance requirements across different jurisdictions adds significant operational burden and risk.

Financial Performance and Investment Landscape

Xiamen C&D Inc. experienced a notable downturn in its financial results for the fiscal year ending December 31, 2024. Net income saw a significant drop compared to 2023, alongside a decline in overall sales. This performance is largely attributed to the prevailing difficult economic climate, with specific impacts felt within the real estate sector.

The investment environment in China is undergoing a transformation, with a noticeable pivot towards asset-light business models and a greater emphasis on strategic emerging industries. This evolving landscape will undoubtedly shape Xiamen C&D's future investment strategies and its capacity to secure necessary capital for growth initiatives.

- Financial Decline: Xiamen C&D Inc. reported a decrease in net income for the full year 2024.

- Sales Reduction: The company also observed a decline in its sales figures for the same period.

- Economic Headwinds: These financial results are indicative of a challenging broader economic environment, particularly affecting the real estate market.

- Investment Shift: China's investment landscape is increasingly favoring asset-light sectors and key emerging industries.

China's GDP growth is projected to moderate in 2025, with policy likely to remain supportive to sustain momentum. This environment offers potential benefits for Xiamen C&D's domestic-facing businesses, though its extensive supply chain operations are still sensitive to broader economic health.

The real estate market continues its challenging trajectory, with falling prices and sales volumes persisting. Analysts do not foresee a widespread market recovery in 2025, indicating ongoing pressure on Xiamen C&D's property development segment.

Global commodity prices are generally expected to decline in 2025 due to improved supply chains and a projected slowdown in global economic growth, with the IMF forecasting 3.2% global growth for 2025. However, critical metals for the energy transition may see continued demand support.

| Economic Factor | 2024 Projection | 2025 Projection | Impact on Xiamen C&D |

|---|---|---|---|

| China GDP Growth | ~5.0% (Estimate) | ~4.5-5.0% (Estimate) | Mixed: Supports domestic business, but supply chain sensitive to overall health. |

| Global Commodity Prices | Volatile, some decline | General decline expected | Increased risk for trading segment, but potential for energy transition metals. |

| Real Estate Market | Downturn continues | Continued pressure expected | Negative impact on property development and sales. |

Full Version Awaits

Xiamen C&D PESTLE Analysis

The preview you see here is the exact Xiamen C&D PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Xiamen C&D. It’s delivered exactly as shown, no surprises.

The content and structure shown in the preview is the same comprehensive PESTLE analysis you’ll download after payment, providing actionable insights.

What you’re previewing here is the actual, professionally structured file, offering a deep dive into the strategic environment for Xiamen C&D.

Sociological factors

China's commitment to urbanization remains a significant driver, with projections indicating a continued rise in the urban population. This sustained urban migration directly fuels demand for Xiamen C&D's core businesses, especially in residential and commercial property development, aligning with the company's strategic focus.

However, the nation is also experiencing notable demographic shifts. An aging population, coupled with evolving household structures, presents both challenges and opportunities. These changes will likely reshape consumer preferences, impacting the types of real estate and tourism services Xiamen C&D offers, necessitating agile and responsive business strategies.

The Chinese residential real estate market is seeing a notable shift as consumer preferences move beyond mere speculation towards a focus on tangible value. Buyers are increasingly prioritizing property fundamentals, construction quality, and long-term affordability, a stark contrast to previous periods of unbridled optimism. This evolving sentiment is reflected in the growing demand for government-subsidized housing and projects that offer demonstrable quality and value for money.

In 2024, this trend is becoming more pronounced. For instance, data from early 2024 indicates a slowdown in price appreciation in many Tier 1 and Tier 2 cities, prompting buyers to be more discerning. Xiamen C&D, a major player in the property sector, must adapt its development strategies to cater to these more cautious and value-conscious consumers, ensuring its projects meet these heightened expectations for quality and affordability to remain competitive.

Relaxed visa policies and a strategic focus on bolstering domestic consumption are poised to significantly elevate both international and domestic travel in 2024 and 2025. This trend is expected to translate into a substantial increase in demand for leisure activities and hospitality services.

Xiamen C&D's hotel and tourism segments are particularly well-positioned to capitalize on this anticipated surge in travel. The company's existing infrastructure and market presence provide a strong foundation to absorb and benefit from heightened visitor numbers.

The emphasis on developing richer cultural tourism experiences, alongside the integration of e-commerce platforms with tourism services, offers Xiamen C&D opportunities for innovative and diversified product development. For instance, by the end of 2023, China's domestic tourism revenue had already reached approximately 4.09 trillion yuan, demonstrating a strong recovery and growth trajectory heading into 2024.

Labor Market Dynamics and Talent Acquisition

China's economic shift towards high-tech manufacturing and digitalization is fueling a significant demand for specialized skills in areas like advanced manufacturing, AI, and sophisticated supply chain management. Xiamen C&D's strategic focus on these emerging sectors means talent acquisition in these competitive fields is crucial for its growth and operational efficiency. For instance, the average monthly wage for skilled manufacturing workers in China saw an increase, reflecting these evolving market dynamics. This trend directly impacts operational expenses for companies like Xiamen C&D.

The increasing emphasis on innovation and technological advancement within China's industrial landscape necessitates a proactive approach to talent development and retention. Companies must compete for individuals with expertise in areas such as automation, data analytics, and green supply chain practices. As of Q1 2024, the unemployment rate for college graduates in China remained a point of focus, indicating potential mismatches between available skills and industry needs, a challenge Xiamen C&D must navigate.

- Increased demand for high-tech skills: Sectors like semiconductors, electric vehicles, and renewable energy are experiencing shortages of qualified personnel.

- Rising labor costs: The average wage for manufacturing workers in China has been on an upward trajectory, impacting companies' cost structures.

- Talent retention challenges: Companies need to offer competitive compensation and career development opportunities to attract and keep skilled employees.

- Focus on vocational training: Government initiatives are increasingly supporting vocational education to bridge the skills gap in advanced manufacturing.

Corporate Social Responsibility (CSR) Expectations

Corporate social responsibility expectations in China are rapidly evolving, with a growing emphasis on environmental stewardship and ethical business conduct. For a conglomerate like Xiamen C&D, aligning with these societal shifts is not just about compliance but also about building trust and ensuring sustained growth. This means actively integrating ESG principles across its diverse operations, from the commodities sector to its property development ventures.

The drive for sustainability in China is evident in policy directives and consumer preferences, pushing companies to adopt greener practices. Xiamen C&D's commitment to responsible sourcing in its commodity trading, for instance, directly addresses concerns about supply chain transparency and environmental impact. Similarly, its real estate arm is increasingly expected to incorporate green building standards and energy-efficient designs.

In 2024, Chinese regulators continued to strengthen ESG disclosure requirements for listed companies, making robust reporting a necessity. Xiamen C&D's proactive engagement in ESG initiatives can significantly enhance its brand image and attract socially conscious investors. This focus on responsible business practices is becoming a key differentiator in the competitive Chinese market.

The company's efforts in CSR are likely to be reflected in its ability to secure favorable financing and partnerships, as global and domestic stakeholders increasingly prioritize sustainability. For instance, Xiamen C&D's progress in reducing its carbon footprint or improving labor conditions in its supply chains can directly influence its valuation and long-term resilience.

China's demographic landscape is undergoing significant shifts, with an aging population and evolving household structures influencing consumer behavior. These changes are prompting a move towards properties that prioritize quality and long-term value over speculative investment. For Xiamen C&D, adapting to these evolving buyer preferences is key to maintaining market relevance.

Technological factors

China's push for digital and intelligent supply chains, fueled by AI, blockchain, IoT, and automation, is a significant technological factor. This trend is projected to see continued strong investment and adoption through 2025.

As a key player, Xiamen C&D can harness these technologies to boost its supply chain services. For instance, real-time monitoring via IoT sensors can improve logistics visibility, a critical component for companies operating in global trade, with the global supply chain management market expected to reach $45.8 billion by 2027.

The Chinese real estate sector is rapidly embracing PropTech, with Xiamen C&D's operations poised to gain from this shift. Innovations like AI and IoT are being integrated into property management, leasing, and development, enhancing efficiency and user experience. For instance, smart building solutions can optimize energy consumption, while AIoT applications can streamline facility management. By leveraging data analytics, Xiamen C&D can improve property valuation accuracy and implement predictive maintenance strategies, as seen in the growing investment in smart city initiatives across China, which reached billions of dollars in 2024.

Xiamen C&D's strategic investments in emerging sectors like artificial intelligence (AI), 5G, advanced computing, and new energy storage directly support China's national objective of cultivating new economic engines. This alignment with state-backed innovation provides a robust foundation for growth.

The Chinese government's commitment to these high-tech fields is substantial, with significant funding allocated to research and development. For instance, China's AI market was projected to reach $26.4 billion in 2023, demonstrating the scale of opportunity Xiamen C&D can tap into.

This strong governmental backing creates a fertile ground for Xiamen C&D's ventures, enabling the company to leverage technological advancements and participate in crucial industrial modernization efforts.

E-commerce and Digital Platforms Integration

The pervasive growth of digital technologies and e-commerce is fundamentally reshaping how consumers and businesses engage in transactions. Xiamen C&D, with its broad operational scope encompassing trade and tourism, stands to benefit significantly by deepening its integration with e-commerce and digital platforms. This strategic move will unlock access to broader customer bases, optimize sales processes, and elevate overall customer satisfaction.

The company can leverage these digital channels to streamline its diverse offerings. For instance, in 2024, global e-commerce sales were projected to reach over $6.3 trillion, highlighting the immense market potential. Xiamen C&D's ability to tap into this growth through enhanced digital presence is crucial.

Furthermore, Xiamen C&D is actively supporting the expansion of cross-border e-commerce and the development of overseas warehousing logistics. This initiative is critical for facilitating international trade and providing efficient delivery solutions for its global clientele, aligning with the projected 8.1% compound annual growth rate for global e-commerce from 2024 to 2027.

Key opportunities arising from this trend include:

- Expanding Market Reach: Utilizing digital platforms to access new domestic and international customer segments.

- Optimizing Sales Channels: Implementing e-commerce solutions to streamline the transaction process and improve sales efficiency.

- Enhancing Customer Experience: Offering digital tools and personalized services to create a more engaging and convenient customer journey.

- Facilitating Cross-Border Trade: Strengthening capabilities in cross-border e-commerce and overseas logistics to support global business operations.

Cybersecurity and Data Security

As Xiamen C&D increasingly digitizes its operations, from supply chain management to real estate and tourism, the company faces escalating cybersecurity threats. The sheer volume of data handled necessitates stringent data security protocols. For instance, in 2024, global spending on cybersecurity solutions was projected to reach over $230 billion, highlighting the critical importance of this area for businesses like Xiamen C&D.

The evolving landscape of data protection laws, such as China's Personal Information Protection Law (PIPL), mandates robust compliance measures. Xiamen C&D must invest significantly in cybersecurity infrastructure to safeguard sensitive customer and operational data. This is crucial not only for regulatory adherence but also for maintaining trust and operational continuity.

- Growing Digital Footprint: Xiamen C&D's expansion into digital platforms across its diverse business segments increases its vulnerability to cyberattacks.

- Regulatory Compliance: Adherence to stringent data protection laws, like PIPL, requires continuous investment in security and privacy measures.

- Investment in Security: In 2024, global cybersecurity spending was expected to exceed $230 billion, underscoring the industry's focus on this critical area.

- Reputational Risk: Data breaches can lead to significant financial losses and severe damage to Xiamen C&D's reputation and customer trust.

Technological advancements are driving significant changes across Xiamen C&D's operational landscape. China's focus on intelligent supply chains, powered by AI and IoT, offers opportunities for enhanced logistics efficiency, with the global supply chain management market projected to reach $45.8 billion by 2027. The real estate sector's adoption of PropTech, including AI and IoT in property management, presents avenues for improved operations and user experience, mirrored in the billions invested in Chinese smart city initiatives in 2024.

Xiamen C&D's strategic alignment with China's national innovation goals, particularly in AI and 5G, is supported by substantial government R&D funding; China's AI market alone was projected to reach $26.4 billion in 2023. The pervasive growth of e-commerce, with global sales anticipated to exceed $6.3 trillion in 2024, presents a key opportunity for Xiamen C&D to expand its market reach and optimize sales channels, especially with cross-border e-commerce expected to grow at a 8.1% CAGR from 2024 to 2027.

| Technological Area | Key Trend/Opportunity | Relevant Data Point |

| Supply Chain Technology | AI, IoT, Automation for Intelligent Supply Chains | Global Supply Chain Management Market: $45.8B by 2027 |

| PropTech | AI, IoT in Property Management and Development | Smart City Initiatives Investment (China): Billions in 2024 |

| Emerging Technologies | AI, 5G, Advanced Computing | China's AI Market: $26.4B projected in 2023 |

| Digitalization & E-commerce | E-commerce Growth, Cross-border Trade | Global E-commerce Sales: >$6.3T in 2024; Cross-border E-commerce CAGR: 8.1% (2024-2027) |

| Cybersecurity | Data Protection, Regulatory Compliance | Global Cybersecurity Spending: >$230B projected in 2024 |

Legal factors

China's foreign trade landscape is dynamic, with ongoing adjustments to import/export processes, tariffs, and inspections that directly influence businesses like Xiamen C&D. Compliance with foundational laws such as the Foreign Trade Law and Customs Law is paramount.

Xiamen C&D must navigate regulations that may include specific licensing for controlled items, and be aware of potential extraterritorial application of these laws. As of late 2024, China has been actively negotiating and implementing Free Trade Agreements (FTAs), leading to shifts in tariff structures that can impact Xiamen C&D's operational costs and competitive positioning in international markets.

China's real estate market operates under a dynamic regulatory framework, with frequent policy shifts designed to ensure stability, curb excessive debt, and promote housing affordability. Xiamen C&D's operations in property development and management are directly impacted by these evolving regulations, which encompass crucial aspects like land acquisition, property titling, and securing project financing. For instance, in 2023, the central government continued to emphasize measures to stabilize the property market, with many local governments implementing policies to ease purchase restrictions and support first-time homebuyers.

Government efforts to digitize and streamline property registration processes, as seen in initiatives across various Chinese cities, indicate a trend toward regulatory modernization and increased efficiency. This technological integration aims to simplify transactions for companies like Xiamen C&D, potentially reducing administrative burdens and accelerating project timelines. These advancements are part of a broader push to create a more transparent and predictable environment for real estate investments and development.

China's commitment to environmental protection is escalating, with increasingly stringent laws and ambitious targets for carbon emission reduction. For Xiamen C&D, this translates into direct impacts on its industrial operations, logistics networks, and real estate development projects.

Compliance with these evolving environmental standards is paramount. This includes adhering to green building policies, such as those promoted by the Ministry of Housing and Urban-Rural Development which has set targets for green building coverage, and effectively managing waste and emissions throughout its extensive supply chain to mitigate risks and enhance its corporate image.

Corporate Governance and SOE Reforms

As a state-controlled entity, Xiamen C&D is significantly impacted by China's ongoing State-Owned Enterprise (SOE) reforms. These reforms, particularly those focused on enhancing corporate governance and market-based operations, directly shape the company's strategic direction and financial management. The government's push to improve SOE efficiency and reduce leverage, including debt risk mitigation, means Xiamen C&D must adapt to evolving regulatory frameworks and accountability measures.

These reforms can lead to changes in operational autonomy, investment strategies, and the potential for financial restructuring. For instance, in 2023, the State-owned Assets Supervision and Administration Commission (SASAC) continued to emphasize performance metrics and risk management for SOEs, aiming for more market-oriented decision-making. Xiamen C&D's adherence to these evolving governance standards is crucial for its continued success and access to capital.

- SOE Reforms Focus: Improving corporate governance, market-based transformation, and debt risk defusing.

- Impact on Operations: Influences operational autonomy, investment decisions, and financial restructuring.

- Regulatory Adherence: Requires compliance with evolving governance standards and accountability frameworks.

- 2023 Context: SASAC continued emphasis on SOE performance metrics and risk management.

Anti-Monopoly and Fair Competition Laws

China's commitment to a more equitable marketplace means anti-monopoly and fair competition laws are gaining traction. For a conglomerate like Xiamen C&D, which spans numerous industries, strictly following these rules is crucial. This ensures the company avoids accusations of unfair market advantages, maintains the health of its operating sectors, and sidesteps costly governmental scrutiny or fines.

The intensified enforcement of these regulations, particularly evident in recent years, impacts how Xiamen C&D must conduct its business across its diverse portfolio. Companies found in violation can face significant penalties, including substantial fines and operational restrictions. For instance, in 2023, China's State Administration for Market Regulation (SAMR) continued its focus on various sectors, issuing fines for monopolistic practices.

- Increased Scrutiny: Regulatory bodies are actively monitoring market behavior for anti-competitive actions.

- Compliance is Key: Xiamen C&D must ensure its operations in each sector align with evolving competition laws.

- Risk of Penalties: Non-compliance can lead to significant fines and operational disruptions.

- Market Integrity: Adherence to these laws supports a healthier and more transparent business environment.

Legal factors significantly shape Xiamen C&D's operations, particularly concerning foreign trade, environmental protection, and state-owned enterprise (SOE) reforms. China's evolving trade policies, including adjustments to tariffs and the implementation of Free Trade Agreements, directly affect import-export costs and competitiveness, as seen with ongoing negotiations impacting global supply chains.

The nation's stringent environmental laws, with escalating targets for carbon emission reduction and green building mandates, necessitate compliance across Xiamen C&D's industrial and development sectors. Furthermore, ongoing SOE reforms, emphasizing improved corporate governance and market-based operations, require the company to adapt its strategic direction and financial management in line with government directives, such as SASAC's 2023 focus on performance metrics.

Environmental factors

Climate change is intensifying extreme weather, posing a significant threat to global supply chains. For Xiamen C&D, with its vast trade and logistics network, this translates to potential disruptions in transportation, affecting everything from raw material sourcing to product delivery.

For instance, the increasing frequency of typhoons in the South China Sea, a key area for Xiamen C&D's operations, can lead to port closures and shipping delays. In 2023, several major shipping hubs in Asia experienced significant disruptions due to severe weather, impacting cargo movement and increasing freight costs by as much as 15% on certain routes.

Consequently, Xiamen C&D must prioritize building robust supply chain resilience. This involves strategies like diversifying sourcing regions to mitigate the impact of localized weather events and investing in adaptive logistics solutions that can reroute shipments efficiently during disruptions.

China's commitment to green building and sustainable urban development is intensifying, with national policies actively encouraging environmentally conscious construction practices. Xiamen C&D, given its substantial real estate holdings, is increasingly compelled to integrate eco-friendly designs, energy-saving technologies, and sustainable materials in both new projects and the management of its existing properties.

This strategic shift directly supports China's ambitious carbon emission reduction targets, aiming for peak emissions before 2030 and carbon neutrality by 2060. For instance, by 2025, China aims for 40% of new urban buildings to be green buildings, a significant increase from previous years, directly impacting developers like Xiamen C&D.

Xiamen C&D, a significant player in commodity trading, faces inherent risks due to resource scarcity and the need for sustainable sourcing. As global demand for minerals and pulp continues, the availability and cost of these essential materials are increasingly influenced by environmental pressures and evolving regulations. For instance, the growing focus on ethical supply chains means companies must demonstrate responsible extraction and processing practices, potentially affecting Xiamen C&D's access to certain resources.

The push towards decarbonization also reshapes commodity markets. The transition to low-carbon technologies, such as electric vehicles and renewable energy infrastructure, is driving up demand for specific metals like lithium, cobalt, and nickel. Conversely, this shift may decrease demand for other commodities, presenting both opportunities and challenges for Xiamen C&D's diversified trading portfolio. In 2024, the price volatility of many key industrial metals underscored these market dynamics, with some experiencing significant upward pressure driven by supply chain disruptions and the green energy transition.

Pollution Control and Emissions Standards

China's ongoing commitment to environmental protection means pollution control and emissions standards are becoming increasingly stringent across all sectors. For a company like Xiamen C&D, whose activities span industrial trade and logistics, staying compliant with these evolving regulations for air quality, water discharge, and waste disposal is a critical operational factor.

Adherence to these standards is not just about avoiding penalties; it's about proactive environmental stewardship. Xiamen C&D's business model, which involves significant movement and handling of goods, is directly impacted by these regulations. For instance, stricter emissions standards on transportation fleets and port operations necessitate investments in greener logistics solutions.

The company must prioritize investments in cleaner technologies and more efficient processes to meet these requirements. This includes upgrading equipment, adopting sustainable practices in warehousing and distribution, and potentially diversifying into more environmentally friendly product lines. Failure to adapt could lead to increased operational costs, supply chain disruptions, and reputational damage.

In 2024, China continued to emphasize green development, with significant national targets for reducing carbon emissions and improving air quality. For example, the Ministry of Ecology and Environment has been actively enforcing stricter standards for industrial wastewater discharge and solid waste management. Companies like Xiamen C&D need to demonstrate tangible progress in reducing their environmental footprint to align with national goals and maintain market competitiveness.

- Stricter Air Quality Standards: Xiamen C&D must ensure its logistics operations, including trucking and port activities, comply with China's latest emissions standards for vehicles and industrial equipment, aiming for reduced particulate matter and nitrogen oxide levels.

- Water Pollution Control: Regulations on industrial wastewater discharge are tightening, requiring Xiamen C&D to manage any water usage in its facilities or logistics hubs to meet stringent quality requirements before release.

- Waste Management and Recycling: Enhanced rules for solid waste management and increased emphasis on recycling mean Xiamen C&D needs robust systems for handling packaging materials, operational waste, and potentially hazardous materials involved in its trade activities.

- Carbon Emission Reduction Targets: As China pushes towards its carbon neutrality goals, Xiamen C&D may face indirect pressures or direct regulations related to the carbon intensity of its supply chain and logistics operations.

ESG Investment Trends and Reporting

The global and domestic push for Environmental, Social, and Governance (ESG) investing is gaining significant momentum. For Xiamen C&D, showcasing robust environmental stewardship and transparent ESG reporting is crucial for attracting investors and stakeholders. This involves setting clear sustainability goals, diligently reporting on emissions, and integrating eco-friendly practices throughout its various business operations.

In 2023, global sustainable investment assets reached an estimated $37.7 trillion, demonstrating a strong investor preference for companies with solid ESG credentials. Xiamen C&D's commitment to these principles can translate into tangible benefits:

- Enhanced Investor Appeal: A strong ESG profile can broaden the investor base, attracting funds focused on sustainable and responsible investing.

- Improved Risk Management: Proactive environmental management, such as reducing carbon emissions, can mitigate regulatory and operational risks. For instance, China's national carbon trading scheme, launched in 2021, is expanding, making emissions reporting increasingly vital.

- Operational Efficiencies: Adopting eco-friendly practices can lead to cost savings through reduced energy consumption and waste management.

- Stronger Stakeholder Relations: Transparent reporting on environmental impact fosters trust and positive relationships with customers, employees, and the wider community.

Xiamen C&D faces significant environmental challenges, from the intensifying impact of climate change on global supply chains to China's stringent environmental regulations. The company must navigate increasing pressure to adopt green building practices and manage resource scarcity sustainably. Adapting to stricter pollution controls and embracing ESG principles are critical for long-term success and investor confidence.

PESTLE Analysis Data Sources

Our Xiamen C&D PESTLE analysis is built upon a robust foundation of data, drawing from official Chinese government reports, international economic databases, and reputable industry-specific publications. We meticulously gather information on political stability, economic indicators, technological advancements, environmental regulations, and social trends to ensure comprehensive insights.