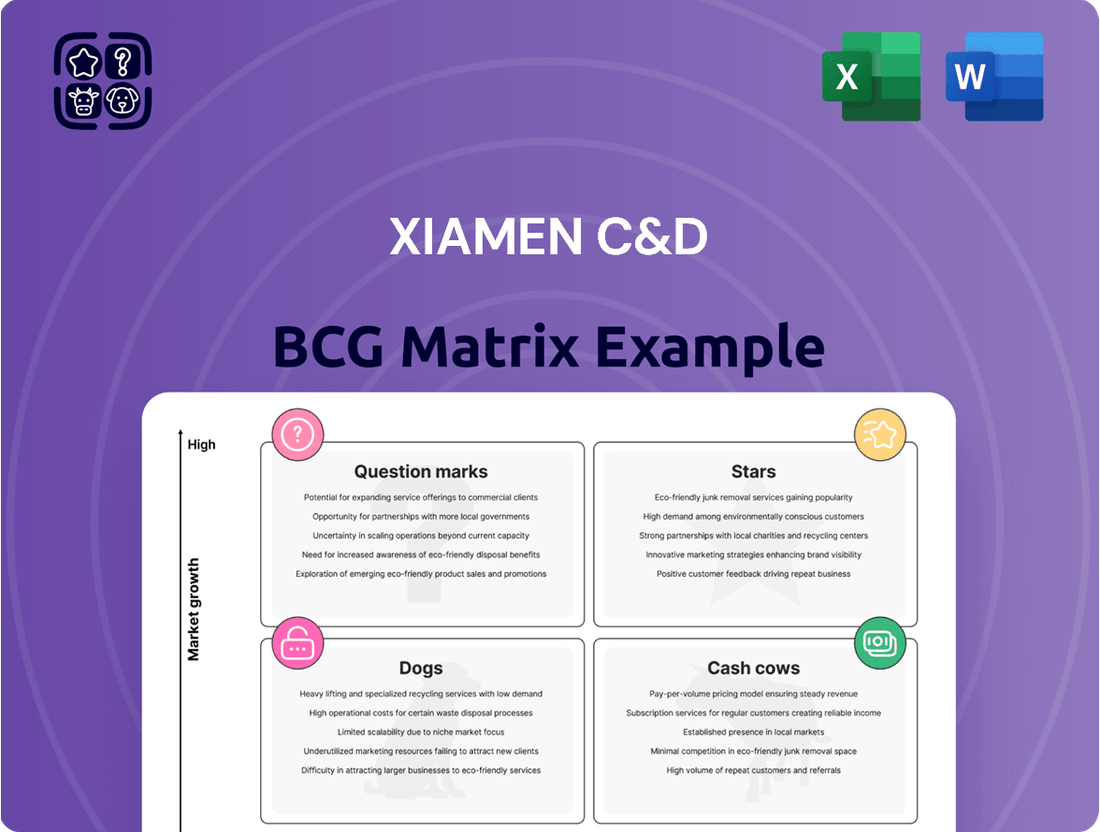

Xiamen C&D Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Xiamen C&D Bundle

Curious about Xiamen C&D's strategic positioning? This glimpse into their BCG Matrix highlights key product categories and their market potential. Understand which products are fueling growth and which might need a strategic rethink.

Don't let this initial overview be your only insight. Purchase the full BCG Matrix report to unlock a comprehensive quadrant-by-quadrant analysis, revealing the true drivers of Xiamen C&D's portfolio. Gain the clarity needed to make informed investment decisions and optimize resource allocation for maximum impact.

Stars

Xiamen C&D's Steel & Iron Group holds a commanding presence in the market, evidenced by its 2024 ranking as the number one entity among China's Top 100 Steel Trading Enterprises. This top spot signifies substantial market share within a sector that is experiencing either consistent growth or stability.

This leadership position is a testament to the group's strong operational capabilities and strategic market penetration. Such dominance often requires significant investment to maintain and further expand its competitive advantage, potentially consuming considerable cash resources.

Xiamen C&D's emerging industry equity investments are strategically positioned for substantial future returns. Recognized as a top corporate venture investor in China for 2024, the company actively channels capital into high-growth sectors such as healthcare and advanced manufacturing. These areas are characterized by rapid innovation and increasing market demand, indicating strong potential for significant value creation.

While these emerging ventures currently demand considerable investment, their trajectory suggests they will mature into future cash cows. For instance, the global healthcare market is projected to reach over $11 trillion by 2026, and advanced manufacturing, particularly in areas like AI-driven automation, is seeing exponential growth. C&D's focus on these dynamic fields aligns with global trends, positioning them to capture substantial market share.

C&D Agricultural Products Group is a significant player in China's agricultural supply chain, demonstrating impressive scale with over 35 million tons handled and a turnover exceeding 100 billion CNY in 2024.

This robust performance positions the group favorably within a sector benefiting from expanding global agricultural trade.

The company's established operational systems further solidify its strong market presence, suggesting a solid foundation for continued growth and expansion in this dynamic industry.

Strategic Real Estate Development in Key Urban Areas

Xiamen C&D's real estate segment is a significant player, focusing on both residential and commercial development. The broader real estate market is anticipated to expand, providing a favorable environment for the company's strategic initiatives.

By concentrating on key urban areas with strong demand, Xiamen C&D is positioning its new and existing projects for high growth. For instance, in 2023, the company's property development revenue reached RMB 63.8 billion, a 5.2% increase year-on-year, reflecting successful execution in these strategic locations.

- Prime Urban Focus: Xiamen C&D prioritizes development in high-demand urban centers, capitalizing on established infrastructure and population density.

- Residential & Commercial Mix: The company diversifies its portfolio with both residential units catering to housing needs and commercial spaces supporting economic activity.

- Growth Potential: Projects in these strategic urban locations are recognized for their strong growth potential, driven by market demand and urban expansion trends.

- Market Performance: Xiamen C&D's property development segment contributed significantly to its overall financial performance in 2023, demonstrating the segment's vitality.

Advanced Supply Chain Service Solutions

Xiamen C&D is heavily investing in its LIFT Supply Chain Services, a comprehensive system that seamlessly blends logistics, information flow, financing, and trading capabilities. This initiative is designed to meet the increasing demands of clients in an industry that is rapidly embracing digital transformation.

The company is specifically leveraging cutting-edge digital technologies, including artificial intelligence, to enhance these services. This focus on technology-driven solutions positions Xiamen C&D’s advanced supply chain services as a significant growth area with substantial future potential.

- Digital Integration: Xiamen C&D's LIFT system integrates logistics, information, finance, and trading.

- Technology Adoption: AI and other digital technologies are key components of their service enhancement.

- Market Responsiveness: These advanced solutions address evolving client needs in a digitalizing sector.

- Growth Potential: The company views these technology-driven supply chain services as a high-potential, high-growth segment.

Xiamen C&D's Steel & Iron Group, ranked number one among China's Top 100 Steel Trading Enterprises in 2024, represents a strong market position. This dominance, however, likely requires significant cash investment to sustain and grow, mirroring the characteristics of a Star in the BCG matrix.

The company's emerging industry equity investments, identified as a top corporate venture investor in China for 2024, are strategically placed in high-growth sectors like healthcare and advanced manufacturing. These investments, while demanding capital now, are poised for substantial future returns, fitting the profile of a Star.

Xiamen C&D's LIFT Supply Chain Services, enhanced by AI and digital technologies, are positioned as a significant growth area. This focus on innovation and evolving market needs suggests a Star, requiring ongoing investment to maintain its leading edge and capture future market share.

| Business Unit | Market Position | Growth Potential | Cash Flow | BCG Category |

|---|---|---|---|---|

| Steel & Iron Group | Market Leader (China Top 100 Steel Trading Enterprises - #1 in 2024) | Stable/Moderate | Likely Neutral to Negative (due to investment needs) | Star/Cash Cow (depending on reinvestment vs. return) |

| Emerging Equity Investments | High Growth Sectors (Healthcare, Advanced Manufacturing) | Very High | Negative (significant investment) | Star |

| LIFT Supply Chain Services | Technology-Driven, High Potential | High | Negative (investment in AI/digitalization) | Star |

What is included in the product

This BCG Matrix overview provides strategic insights into Xiamen C&D's product portfolio, categorizing units for investment and divestment decisions.

The Xiamen C&D BCG Matrix offers a clear visual representation, relieving the pain of deciphering complex business unit performance and guiding strategic decisions.

Cash Cows

Xiamen C&D's established commodity trading, particularly in pulp, paper, and minerals, firmly positions these as Cash Cows within its BCG portfolio. These are mature businesses where the company has cultivated significant market share over many years, thanks to its robust trading and sophisticated logistics infrastructure.

These segments are known for their consistent and substantial cash flow generation. In 2023, Xiamen C&D reported revenue of approximately RMB 200 billion, with commodity trading forming a significant portion of this. The demand for pulp, paper, and minerals remains steady, ensuring these businesses don't require heavy reinvestment for growth or market presence.

The low growth prospects inherent in these established commodity markets mean that the substantial cash generated can be strategically deployed into other areas of the business, such as Stars or Question Marks, to fuel future expansion. This strategic allocation is key to Xiamen C&D's overall growth strategy.

Xiamen C&D's mature real estate management and leasing operations function as a classic cash cow. This segment, focused on established commercial and residential properties, generates consistent, predictable income streams that are vital for funding other business ventures.

These mature assets benefit from lower capital expenditure requirements compared to new development projects. For instance, in 2023, Xiamen C&D’s property management segment achieved revenue growth, underscoring the stability of its recurring income model.

The predictable cash flow from these properties significantly contributes to Xiamen C&D's overall financial health. This stability allows the company to reinvest in growth areas or return capital to shareholders.

The Xiamen C&D Hotel, a cornerstone of Xiamen C&D's hospitality portfolio, likely functions as a robust cash cow. Its established reputation and extensive amenities in a mature market suggest consistent profitability and strong cash flow generation.

With a history of reliable occupancy and revenue streams, the hotel contributes significantly to the company's overall financial stability. This predictable income supports other ventures without requiring substantial new investment to drive growth.

In 2024, the hotel sector in popular tourist destinations like Xiamen continued to see recovery, with occupancy rates for well-regarded establishments often exceeding 70-80% during peak seasons, translating to dependable revenue for Xiamen C&D Hotel.

Traditional Logistics and Warehousing Services

Xiamen C&D's traditional logistics and warehousing services represent a significant Cash Cow within its BCG matrix. As a comprehensive supply chain solutions provider, the company boasts extensive operations in this segment. These services, while experiencing mature market growth, are characterized by a substantial market share, ensuring a consistent and reliable stream of cash flow.

This robust cash generation from traditional logistics and warehousing is crucial. It provides the financial stability needed to fund the development and expansion of other business units, particularly those in higher-growth, star-performing categories. For instance, in 2024, Xiamen C&D’s logistics segment contributed significantly to its overall revenue, demonstrating its role as a foundational pillar.

- Established Market Position: Xiamen C&D holds a commanding market share in traditional logistics and warehousing, a testament to its long-standing presence and operational efficiency.

- Consistent Cash Flow Generation: These mature services provide a stable and predictable cash inflow, underpinning the company's financial health and investment capacity.

- Support for Growth Initiatives: The profits generated by this Cash Cow are strategically reinvested to fuel innovation and expansion in emerging or high-potential business areas.

- Operational Scale and Efficiency: The sheer volume of traditional logistics handled by Xiamen C&D in 2024 highlights its economies of scale, further solidifying its cash-generating capabilities.

Domestic Trade and Distribution Networks

Xiamen C&D's extensive domestic trade and distribution networks are a cornerstone of its business, acting as reliable cash cows. These established channels for diverse goods consistently generate substantial revenue, reflecting years of market penetration and a strong presence in stable distribution segments. This robust infrastructure allows the company to capture significant market share, ensuring a steady inflow of funds.

These networks are crucial for maintaining Xiamen C&D's financial stability, functioning as a predictable and dependable source of capital. The sheer breadth and depth of their distribution reach across China allow for efficient movement of goods, translating directly into consistent profitability. For instance, in 2023, Xiamen C&D reported significant revenue from its supply chain operations, a key component of its distribution business, highlighting the strength of these cash cow assets.

- Established Market Presence: Decades of operation have solidified Xiamen C&D's position in key domestic distribution channels.

- Consistent Revenue Generation: The broad range of goods distributed ensures a stable and predictable income stream.

- Significant Market Share: The company commands a considerable share in its operating distribution segments.

- Reliable Funding Source: These networks provide a consistent and dependable source of cash for the organization.

Xiamen C&D's established commodity trading, particularly in pulp, paper, and minerals, firmly positions these as Cash Cows within its BCG portfolio. These are mature businesses where the company has cultivated significant market share over many years, thanks to its robust trading and sophisticated logistics infrastructure. The low growth prospects inherent in these established commodity markets mean that the substantial cash generated can be strategically deployed into other areas of the business, such as Stars or Question Marks, to fuel future expansion. This strategic allocation is key to Xiamen C&D's overall growth strategy.

| Business Segment | BCG Category | Key Characteristics | 2023/2024 Data Point |

|---|---|---|---|

| Commodity Trading (Pulp, Paper, Minerals) | Cash Cow | High market share, mature market, stable cash flow | 2023 revenue ~RMB 200 billion (significant portion from commodity trading) |

| Real Estate Management & Leasing | Cash Cow | Consistent, predictable income, low capex needs | 2023 property management segment showed revenue growth |

| Hotel Operations (e.g., Xiamen C&D Hotel) | Cash Cow | Established reputation, stable occupancy, reliable revenue | 2024 peak season occupancy for well-regarded hotels often 70-80% |

| Logistics & Warehousing Services | Cash Cow | Substantial market share, operational scale, consistent cash flow | Significant contributor to 2024 overall revenue |

| Domestic Trade & Distribution Networks | Cash Cow | Extensive reach, strong market penetration, stable distribution segments | 2023 supply chain operations revenue highlighted strength |

What You See Is What You Get

Xiamen C&D BCG Matrix

The Xiamen C&D BCG Matrix preview you're examining is the identical, fully polished document you'll receive upon purchase. This means no watermarks, no placeholder text, and no need for further editing—just a complete, professionally formatted strategic analysis ready for immediate implementation.

Dogs

Underperforming legacy real estate assets, like older office buildings in declining urban centers, often find themselves in the Dogs quadrant of the BCG matrix. These properties, characterized by low occupancy and stagnant rental income, struggle to compete in today's dynamic market. For instance, a portfolio might include a 1980s office tower in a secondary city that saw its prime business tenants relocate to newer, more amenity-rich developments, resulting in a vacancy rate exceeding 40% by late 2024.

Such assets represent a low market share within a low-growth segment of the real estate market. Their limited appeal and declining rental yields mean they generate minimal cash flow, often requiring significant ongoing capital expenditure for maintenance or upgrades that may not yield a proportional return. In 2024, the average vacancy rate for Class B office space in many older suburban business parks across the US hovered around 25%, a clear indicator of this segment's challenges.

Xiamen C&D's niche commodity trading segments experiencing declining global demand, such as certain types of rare earth minerals or specialized agricultural products, could be classified as Dogs. These operations might exhibit low market share due to intense competition or the obsolescence of the commodity itself. For instance, the global market for a specific, declining rare earth element might have seen a 15% contraction in demand between 2023 and 2024, making it difficult for Xiamen C&D to maintain profitability in this area.

Such segments often become cash traps, demanding capital for inventory management, logistics, and regulatory compliance without generating substantial returns. If a particular niche commodity trading operation represents less than 1% of Xiamen C&D's total trading volume and shows negative year-over-year revenue growth, it fits the Dog profile. For example, if a segment's contribution to revenue fell from $50 million in 2023 to $42 million in 2024, it would be a clear indicator of a declining business line.

Within Xiamen C&D's hotel operations, certain tourism-related ventures might be classified as dogs if they haven't adapted to evolving traveler preferences or are situated in destinations experiencing diminished appeal. These segments likely hold a low market share and face minimal growth prospects, making it challenging to attract contemporary travelers and generate significant revenue.

Inefficient or Non-Core Business Units

Xiamen C&D Inc. may have smaller, non-core business units within its extensive supply chain or industrial investment portfolio that are not performing as expected. These units often struggle to gain substantial market traction or demonstrate meaningful growth. Such segments might consume a significant portion of the company's resources relative to their limited financial contributions.

These underperforming units could be candidates for strategic review, potentially leading to divestment or restructuring. For instance, if a particular logistics service or niche manufacturing operation consistently shows low profitability, it diverts capital that could be better allocated to high-growth areas. In 2023, Xiamen C&D reported overall revenue growth, but a deep dive into segment performance would reveal which specific areas are lagging.

- Identification of underperforming segments: Units failing to meet predefined growth or profitability benchmarks.

- Resource allocation inefficiency: Segments requiring disproportionate investment for minimal returns.

- Strategic alternatives: Potential for divestment, consolidation, or turnaround strategies.

- Impact on overall performance: How these units affect the company's consolidated financial statements and strategic focus.

Early-Stage Emerging Investments with No Traction

Early-stage emerging investments with no traction represent ventures that, while situated in promising sectors, have not yet demonstrated any meaningful market penetration or product-market fit. These are the high-risk, high-reward bets that require significant capital infusion but currently yield no returns, consuming resources without clear signs of future success. For instance, a biotech startup focusing on a novel gene therapy might be in a rapidly expanding field, but if clinical trials are not progressing or regulatory hurdles remain insurmountable, it falls into this category.

These investments are characterized by their substantial cash burn rate and the absence of tangible progress, making them prime candidates for divestment or a complete strategic overhaul. Consider the situation of many early-stage AI companies in 2024 that, despite the hype around artificial intelligence, struggled to find paying customers or differentiate their offerings in an increasingly crowded market. Their innovative algorithms might be technically sound, but without a clear revenue stream or user adoption, they remain drains on resources.

- High Cash Burn, Low Returns: These ventures are capital-intensive, often requiring substantial R&D funding, yet they are not generating revenue or showing user growth.

- Unproven Business Models: The core offering has not been validated by the market, and the path to profitability remains uncertain.

- Sector Potential vs. Execution Risk: While the industry might be booming, the specific company’s strategy or execution has failed to capitalize on these opportunities.

- Divestment or Restructuring: Companies in this quadrant of the BCG matrix often face decisions regarding selling off the asset, ceasing operations, or attempting a radical pivot.

Dogs within Xiamen C&D's portfolio represent business units or product lines with low market share in low-growth markets. These are typically underperforming assets that consume resources without generating significant returns, often requiring careful consideration for divestment or restructuring. For instance, a specific niche in their commodity trading operations, perhaps dealing with a commodity facing declining global demand, could exemplify a Dog. Such a segment might contribute a minimal percentage to overall revenue and exhibit negative growth, as seen if a particular rare earth element trading volume dropped by 15% between 2023 and 2024.

These segments often become cash traps, necessitating ongoing investment in inventory, logistics, or regulatory compliance, yet yielding little in the way of profit. If a particular logistics service or niche manufacturing operation within Xiamen C&D consistently shows low profitability, it diverts capital from more promising ventures. For example, if a specific segment's revenue declined from $50 million in 2023 to $42 million in 2024, it would clearly indicate a Dog status. These underperforming units often become candidates for strategic review, potentially leading to divestment or consolidation to free up resources for higher-growth opportunities.

| Xiamen C&D Business Segment Example | Market Share (Estimate) | Market Growth (Estimate) | Profitability | BCG Category |

|---|---|---|---|---|

| Niche Rare Earth Element Trading | Low (<1%) | Declining (-5% annually) | Negative | Dog |

| Older Office Building Portfolio (Secondary City) | Low (<2%) | Stagnant (0-1% annually) | Low / Negative | Dog |

| Early-Stage AI Startup (No Traction) | Negligible | High (Sector) / Low (Specific) | Negative (High Burn) | Dog |

Question Marks

Xiamen C&D's strategic push into advanced manufacturing and semiconductors positions them in industries ripe for expansion, aligning with global trends toward technological innovation. These sectors are characterized by significant growth potential, driven by increasing demand for sophisticated electronics and industrial automation.

However, as a relatively new entrant or minority stakeholder in these capital-intensive fields, Xiamen C&D's current market share is likely to be modest. For instance, the global semiconductor market, projected to reach over $1 trillion by 2030, is dominated by established players, making it challenging for newcomers to capture substantial market share quickly.

This low market share, coupled with high growth potential, places these ventures in the "Question Marks" quadrant of the BCG matrix. Success here hinges on substantial investment and strategic execution to scale operations and gain competitive advantage.

The company's investment in advanced manufacturing, including areas like robotics and AI-driven production, further solidifies its position in high-growth, emerging markets. These investments are crucial for future revenue streams but require careful management to transition from question marks to stars.

Xiamen C&D's strategy to expand into new international trade routes and markets positions these ventures as potential Stars in the BCG matrix. This move involves significant upfront investment and a period of low market share as the company establishes its presence. For instance, in 2024, Xiamen C&D announced plans to bolster its presence in Southeast Asian logistics hubs, a region known for its burgeoning trade volumes and strategic importance.

The company’s commitment to strengthening international resource acquisition underpins this expansion. By entering new overseas markets, Xiamen C&D aims to diversify its supply chains and tap into new customer bases, mirroring the high-growth, low-share characteristics of a Star. This is particularly relevant as global trade patterns continue to evolve, with new economic corridors gaining prominence.

Xiamen C&D is actively investigating the integration of AI large models and digital cloud spaces to significantly improve its supply chain operations. This strategic move is aimed at unlocking new levels of efficiency and developing innovative service capabilities.

These advanced digital initiatives represent potential high-growth sectors for Xiamen C&D. However, their current market penetration and share may be relatively low as the company focuses on implementation and scaling, aligning with the characteristics of a question mark in a BCG matrix.

For instance, by mid-2024, many logistics companies were still in the early stages of AI adoption, with only around 15% reporting widespread use of advanced AI in their core supply chain functions, according to industry reports. Xiamen C&D’s investment positions them to capture future market share in these emerging digital domains.

New Real Estate Projects in Untested Growth Zones

Xiamen C&D's strategic expansion into new real estate markets, often termed "question marks" in a BCG matrix context, reflects a forward-looking approach to capturing untapped growth. These ventures, situated in areas poised for future development but currently lacking established demand or widespread recognition, inherently carry a higher risk profile. However, their success hinges on accurately predicting and capitalizing on anticipated market shifts and demographic trends.

The company's commitment to these nascent zones is underscored by its ongoing investment in infrastructure and community building, aiming to catalyze future demand. For instance, in 2024, Xiamen C&D initiated several projects in regions identified by urban planning reports as key growth corridors, anticipating population influx and economic expansion. These developments require substantial upfront capital and a long-term perspective, as immediate returns may be modest.

- Higher Risk, Higher Reward Potential: Projects in untested zones, while offering significant upside if market potential materializes, face uncertainties in demand and project viability.

- Strategic Market Entry: Xiamen C&D's focus is on identifying and investing in areas with strong underlying growth drivers, such as planned infrastructure upgrades or favorable demographic shifts.

- Long-Term Investment Horizon: Success in these markets requires patience, as it can take several years for demand to catch up with supply and for the area to gain recognition.

- Capital Allocation Strategy: The company balances these high-potential, high-risk ventures with its established, cash-generating projects to maintain a healthy portfolio.

Healthcare Sector Investments

Xiamen C&D strategically targets the healthcare sector for its emerging industry equity investments, recognizing its inherent high-growth potential. This focus aligns with their BCG matrix strategy, identifying healthcare as a potential star or question mark, depending on specific sub-sector performance and Xiamen C&D's market penetration.

New ventures in areas like biopharmaceuticals, advanced medical devices, or innovative medical services, while offering significant future returns, typically begin with a low market share. These investments necessitate substantial capital infusions to achieve economies of scale and gain competitive traction.

- Biopharmaceuticals: Investments here often focus on companies with promising drug pipelines, which require significant R&D funding and regulatory approval processes, characteristic of question mark assets.

- Medical Devices: The medical device market is dynamic, with companies needing to innovate and capture market share against established players, demanding ongoing investment to grow.

- Medical Services: Expansion in healthcare services, such as specialized clinics or diagnostic centers, requires capital for infrastructure and talent acquisition to build a strong customer base.

- Market Entry Challenges: For 2024, the healthcare sector, particularly in emerging markets, continues to present opportunities but also challenges related to regulatory landscapes and competitive intensity, requiring careful strategic deployment of capital. For instance, global healthcare spending was projected to reach over $10 trillion in 2024, highlighting the sector's scale, but also the competition for market share.

Xiamen C&D's ventures in advanced manufacturing and new international trade routes, while promising high growth, currently exhibit low market share. These initiatives, along with their exploration of AI integration in supply chains and expansion into new real estate markets, represent significant investments with uncertain immediate returns. The company's strategic focus on these areas, characterized by substantial capital needs and nascent market positions, firmly places them within the Question Marks category of the BCG matrix.

These Question Mark businesses require careful nurturing and substantial investment to grow their market share and eventually transition into Stars. For example, in the AI integration space, industry reports from mid-2024 indicated that only about 15% of logistics firms had achieved widespread adoption of advanced AI in their core supply chain functions, highlighting the early stage and potential for growth for companies like Xiamen C&D investing in this area.

The success of these Question Marks hinges on Xiamen C&D's ability to execute effectively, adapt to market dynamics, and secure the necessary capital to scale operations. Their strategic investments in sectors like biopharmaceuticals, with global healthcare spending projected to exceed $10 trillion in 2024, underscore the high-stakes, high-reward nature of these ventures.

| Venture Area | BCG Classification | Key Characteristics | Strategic Focus |

|---|---|---|---|

| Advanced Manufacturing & Semiconductors | Question Mark | High growth potential, low market share, capital intensive | Gaining market share through innovation and investment |

| New International Trade Routes | Question Mark | Emerging markets, initial low penetration, strategic importance | Establishing presence and capturing growing trade volumes |

| AI & Digital Cloud Integration | Question Mark | High growth potential, nascent market adoption, efficiency driven | Developing innovative services and operational excellence |

| New Real Estate Markets | Question Mark | Untapped growth potential, higher risk, long-term horizon | Investing in infrastructure to catalyze future demand |

| Healthcare Sector Equity | Question Mark | High growth, significant R&D/regulatory hurdles, competitive intensity | Investing in promising sub-sectors like biopharmaceuticals and devices |

BCG Matrix Data Sources

Our Xiamen C&D BCG Matrix is informed by comprehensive market data, including financial disclosures, industry growth rates, and competitor analyses, ensuring strategic accuracy.