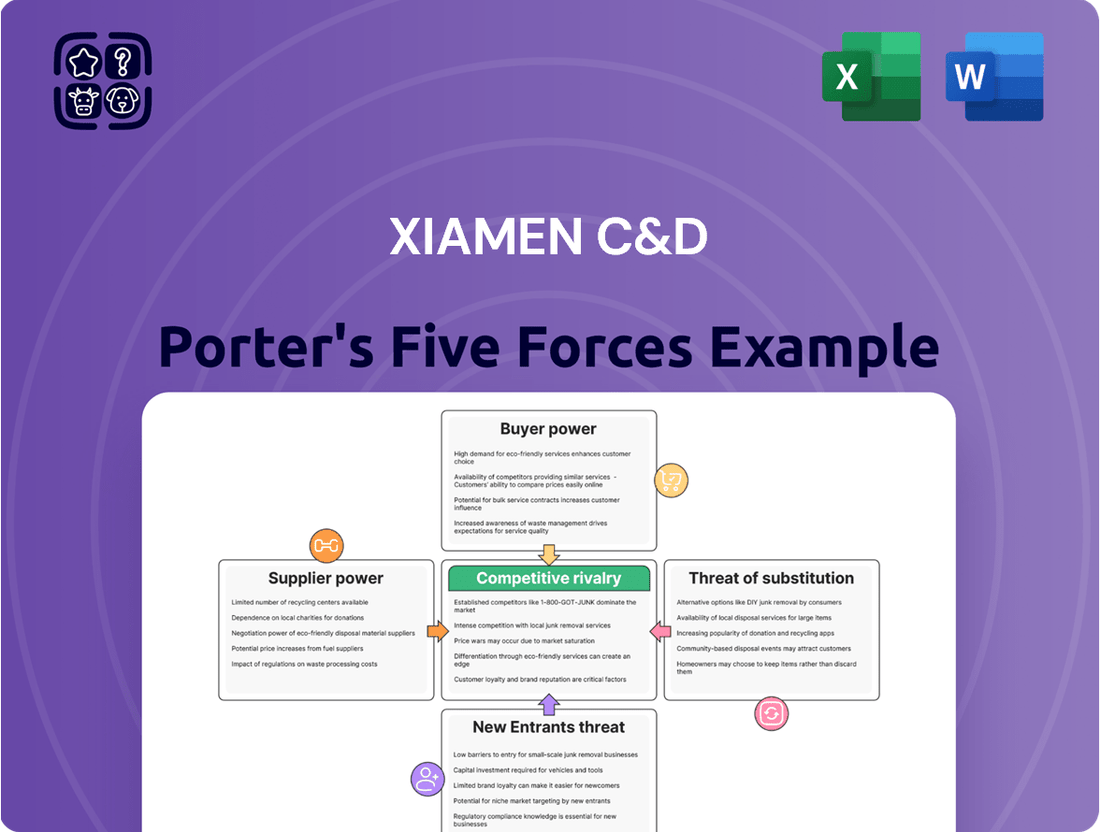

Xiamen C&D Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Xiamen C&D Bundle

Xiamen C&D faces a dynamic competitive landscape, shaped by the interplay of five key forces. Understanding the intensity of buyer power, the threat of new entrants, and the bargaining power of suppliers is crucial for navigating its market. The presence of substitute products and the level of rivalry among existing competitors further define its strategic environment.

The complete report reveals the real forces shaping Xiamen C&D’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Xiamen C&D Inc.'s bargaining power of suppliers is significantly influenced by the concentration of its key suppliers. For essential raw materials such as metals, pulp, minerals, and agricultural products, a limited number of large suppliers can exert considerable influence. Similarly, in its real estate development segment, a few dominant providers of land or specialized construction resources would bolster supplier leverage.

A high degree of supplier concentration across these varied inputs means Xiamen C&D Inc. has fewer alternatives. For instance, if only a handful of global mining conglomerates supply a critical mineral used in its supply chain, these suppliers can dictate terms, potentially raising prices or limiting availability. This concentration directly translates to increased bargaining power for those suppliers.

As of early 2024, global commodity markets have shown volatility. For example, the price of copper, a key metal for many industries, saw fluctuations driven by a concentrated supply base and geopolitical factors. Should Xiamen C&D rely heavily on such concentrated sources, these market dynamics would directly impact their cost structure and supplier negotiations.

Switching suppliers for Xiamen C&D could involve significant costs and disruptions. If Xiamen C&D relies on suppliers with highly specialized logistics or deeply integrated IT systems, moving to a new provider would necessitate substantial investment in new infrastructure and training. For instance, if a supplier provides custom-molded components requiring unique tooling, Xiamen C&D would bear the expense of re-tooling or finding a supplier with compatible equipment.

The presence of long-term contracts further solidifies supplier power. If Xiamen C&D is bound by agreements with penalty clauses for early termination, the financial implications of switching could be prohibitive. This contractual lock-in, coupled with the potential need for extensive quality assurance testing with new suppliers, significantly raises the barrier to switching, thus empowering existing suppliers.

Xiamen C&D's reliance on specialized components or critical raw materials significantly influences supplier bargaining power. If suppliers offer unique or highly differentiated products that are difficult for Xiamen C&D to source elsewhere, their negotiating leverage increases. For instance, in its real estate development arm, access to exclusive architectural designs or patented construction materials could grant suppliers considerable sway.

The degree to which Xiamen C&D's supply chain solutions depend on proprietary technology or specialized logistical services from particular suppliers also dictates supplier power. If these offerings are not easily replicated by competitors, suppliers can command better terms. For example, a supplier providing a unique, integrated logistics platform crucial for Xiamen C&D's efficient goods distribution would hold substantial bargaining power.

In 2023, Xiamen C&D reported a total cost of goods sold of approximately RMB 245.8 billion, indicating the scale of its procurement activities. The specific breakdown of this cost across various supplier categories would reveal which inputs are most critical and potentially sourced from suppliers with unique offerings, thereby highlighting areas of higher supplier bargaining power.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Xiamen C&D's operations, such as establishing their own trading or distribution channels, could significantly alter the competitive landscape. For instance, if a key supplier of construction materials were to develop its own project management services, it could directly compete with Xiamen C&D's core business. This would reduce Xiamen C&D's bargaining power by diminishing its options for sourcing and potentially increasing costs.

Assessing this threat involves considering the financial health and strategic objectives of Xiamen C&D's major suppliers. If suppliers possess substantial capital and see a clear path to higher margins by moving downstream, the likelihood of forward integration increases. For example, in 2024, many suppliers in the real estate and construction sectors have been exploring diversification strategies due to market volatility, making forward integration a more plausible consideration.

- Supplier Financial Strength: Suppliers with strong balance sheets and access to capital are better positioned to fund forward integration efforts.

- Market Opportunities: If suppliers identify significant profit potential in Xiamen C&D's value chain, they are more likely to pursue integration.

- Competitive Intensity: A highly competitive environment for suppliers might drive them to seek new revenue streams through forward integration.

Importance of Xiamen C&D to Suppliers

Xiamen C&D's significant purchasing volume across its diverse supply chains can influence supplier relationships. When Xiamen C&D constitutes a substantial percentage of a supplier's total sales, that supplier's bargaining power is inherently weakened. This is because the supplier becomes more reliant on Xiamen C&D for revenue, making them less likely to dictate terms or increase prices aggressively. For instance, if a key component supplier for Xiamen C&D's electronics division derives over 25% of its annual revenue from the company, it would be hesitant to risk losing that business by demanding unfavorable contract conditions.

The bargaining power of suppliers to Xiamen C&D is moderate, largely due to the company's scale and diversification. While Xiamen C&D is a major player, its vast network means that individual suppliers, while important, rarely represent an overwhelming portion of a supplier's overall customer base. This prevents suppliers from exerting excessive leverage. The ability of Xiamen C&D to source from multiple providers across its various business segments, including supply chain management, real estate, and investment, further dilutes any single supplier's power. As of the first half of 2024, Xiamen C&D reported revenue of approximately RMB 275 billion, underscoring its significant market presence but also its capacity to manage supplier relationships across a broad spectrum of industries.

- Supplier Dependence: A supplier's reliance on Xiamen C&D as a major customer can significantly reduce their bargaining power.

- Diversified Sourcing: Xiamen C&D's strategy of sourcing from multiple suppliers across various industries limits the leverage of any single supplier.

- Market Position: Xiamen C&D's substantial market share in its operating sectors provides it with considerable negotiating strength.

- Economic Conditions (2024): Global supply chain adjustments and commodity price fluctuations in 2024 could influence supplier pricing, but Xiamen C&D's scale helps mitigate these pressures.

Xiamen C&D's bargaining power with its suppliers is generally moderate to strong, primarily due to its substantial purchasing volume and diversified operations. The company's ability to source from numerous providers across its supply chain management, real estate, and investment segments limits the leverage of any single supplier. For example, in the first half of 2024, Xiamen C&D reported revenue of approximately RMB 275 billion, highlighting its significant scale and capacity to negotiate favorable terms.

Key factors influencing supplier power include supplier dependence on Xiamen C&D, the company's diversified sourcing strategies, and its strong market position. While global economic conditions and commodity price volatility in 2024 can impact supplier pricing, Xiamen C&D's size helps it absorb these pressures. The threat of suppliers integrating forward is also a consideration, particularly in sectors experiencing market shifts.

| Factor | Impact on Supplier Bargaining Power | Xiamen C&D Context |

| Supplier Concentration | High concentration increases supplier power. | Generally moderate, but specific critical inputs may have concentrated suppliers. |

| Switching Costs | High costs empower suppliers. | Can be high for specialized components or integrated systems. |

| Product Differentiation | Unique offerings increase supplier power. | Significant for specialized materials or proprietary technologies. |

| Forward Integration Threat | Increases supplier power if realized. | A growing consideration for suppliers in volatile markets like real estate. |

| Xiamen C&D's Purchasing Volume | High volume weakens supplier power. | Xiamen C&D's scale (e.g., RMB 245.8 billion COGS in 2023) generally reduces supplier leverage. |

What is included in the product

This analysis unpacks the competitive intensity for Xiamen C&D, examining the bargaining power of its suppliers and buyers, the threat of new entrants and substitutes, and the rivalry among existing players.

Instantly identify competitive threats and opportunities with a dynamic, interactive Porter's Five Forces model for Xiamen C&D, simplifying complex market analysis.

Customers Bargaining Power

Xiamen C&D's customer base is notably diverse, spanning commodity trading, real estate development, and hospitality services. In its commodity segment, the company interacts with a wide array of industrial buyers, with no single customer representing an overwhelming portion of sales, which generally dilutes individual customer bargaining power.

For instance, in 2023, Xiamen C&D's supply chain services reported revenue of approximately RMB 250 billion, a significant portion of which came from numerous smaller and medium-sized enterprises, limiting the leverage of any single buyer.

Similarly, in its real estate division, while there are large developers and investors, the sheer volume of projects and individual unit sales to a broad spectrum of purchasers prevents any one customer from dictating terms across the entire business.

The hospitality segment, with its numerous hotel guests, further disperses customer concentration, meaning individual guests have virtually no bargaining power over the hotel chain's pricing or services.

Xiamen C&D's customers face varying switching costs depending on the specific service. For real estate development, switching developers might involve significant disruption and cost due to project-specific contracts and established relationships. However, in the supply chain services sector, particularly for less customized logistics or trading, customers might find it easier to switch providers if pricing or efficiency gains are substantial. In 2023, the global logistics market saw increased competition, with some reports indicating a slight upward trend in customer churn for non-specialized services.

Xiamen C&D operates in markets where customer price sensitivity can significantly influence its bargaining power. For standardized commodities, like many of the raw materials and supplies it trades, customers are often highly attuned to price fluctuations. A substantial portion of Xiamen C&D's revenue comes from these less differentiated products, meaning buyers can easily switch to competitors if prices are not competitive. This sensitivity directly translates into increased pressure on Xiamen C&D to maintain aggressive pricing strategies.

In 2023, Xiamen C&D's revenue from its supply chain operations, which heavily involve commodity trading, reached approximately RMB 200 billion. This large volume underscores the importance of price as a key competitive factor. When customers can readily source similar products from multiple vendors, their ability to demand lower prices from Xiamen C&D is amplified, directly impacting the company's profit margins on these transactions.

Threat of Backward Integration by Customers

The threat of backward integration by Xiamen C&D's customers is a significant factor in their bargaining power. If customers, particularly those in large-scale manufacturing or distribution, possess the financial resources and technical expertise, they might consider developing their own supply chain operations or even producing key raw materials. This could reduce their reliance on Xiamen C&D's services.

Consider the implications for Xiamen C&D's diverse customer base, which includes sectors like electronics, automotive, and consumer goods. For instance, a major electronics manufacturer might explore establishing its own logistics network or securing direct sourcing agreements for critical components, thereby diminishing the need for Xiamen C&D's integrated supply chain solutions. In 2024, the global supply chain disruptions have further incentivized many companies to gain more control over their inputs.

- Assessing Backward Integration Potential: Customers with significant scale, such as large industrial conglomerates, have a higher propensity to explore backward integration. This involves evaluating their current operational capabilities and capital expenditure plans.

- Impact on Bargaining Power: The credible threat of a customer developing its own supply chain or manufacturing capabilities directly increases their leverage in negotiations with Xiamen C&D. This can lead to demands for lower prices or more favorable contract terms.

- Industry Trends: Recent supply chain resilience initiatives, spurred by events throughout 2023 and into 2024, have seen many companies reassessing their sourcing strategies. This may include exploring in-house production or strategic partnerships that reduce dependence on third-party providers like Xiamen C&D.

Customer Information Availability

Customers today have unprecedented access to information regarding pricing, costs, and market trends. This increased transparency directly impacts Xiamen C&D by empowering buyers. For instance, with readily available competitor pricing and detailed product specifications online, customers can more effectively compare offerings and negotiate for better terms.

This heightened information symmetry means customers are less likely to accept higher prices without scrutiny. They can easily research raw material costs, manufacturing expenses, and even profit margins of similar companies. This knowledge allows them to make well-informed demands, putting pressure on Xiamen C&D to justify its pricing and potentially reduce its profit margins to remain competitive.

Consider the implications of digital platforms and review sites. These resources provide detailed insights into product quality, service experiences, and perceived value for money. Xiamen C&D's customers can leverage this collective intelligence to bargain from a position of strength, knowing what others are paying and what quality to expect.

- Increased Price Sensitivity: Customers can compare Xiamen C&D's prices against competitors in real-time, leading to greater price sensitivity.

- Demand for Transparency: Buyers are more likely to demand clarity on pricing structures and the value proposition of Xiamen C&D's products or services.

- Negotiating Leverage: Access to cost information and market benchmarks provides customers with significant leverage in price negotiations.

- Reduced Switching Costs (Information Aspect): Knowing where else to get similar products or services easily lowers the perceived cost of switching, further empowering customers.

Xiamen C&D's customers exhibit moderate bargaining power, primarily due to the company's diverse business segments and the nature of the markets it serves. While broad customer bases in hospitality and real estate dilute individual power, price sensitivity in commodity trading and supply chain services allows buyers significant leverage.

The threat of backward integration by key industrial clients is a tangible concern, especially as global supply chain resilience efforts intensified in 2023 and 2024, prompting companies to seek greater control over their operations.

Increased information symmetry, driven by digital platforms, further empowers Xiamen C&D's customers, enabling them to readily compare pricing and demand more favorable terms.

| Factor | Impact on Xiamen C&D | Supporting Data (Approximate) |

|---|---|---|

| Customer Concentration | Low to Moderate | Supply chain revenue (RMB 250 billion in 2023) derived from a wide array of clients, limiting individual customer leverage. |

| Price Sensitivity | High (Commodities) | Commodity trading is a significant revenue driver, where buyers readily switch for better pricing, impacting profit margins. |

| Switching Costs | Varying (Low in logistics, High in real estate) | Global logistics market saw increased competition in 2023, potentially raising customer churn for non-specialized services. |

| Backward Integration Threat | Moderate | Companies in sectors like electronics and automotive are reassessing sourcing in 2024, potentially reducing reliance on integrated supply chains. |

| Information Transparency | High | Digital platforms allow customers to easily benchmark Xiamen C&D's pricing against competitors. |

Preview Before You Purchase

Xiamen C&D Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You will gain a comprehensive understanding of Xiamen C&D's competitive landscape through this detailed Porter's Five Forces Analysis. It meticulously breaks down the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within Xiamen C&D's operating environment. This in-depth analysis is ready for immediate use, providing actionable insights for strategic decision-making.

Rivalry Among Competitors

The industries Xiamen C&D operates in, such as supply chain management and real estate, are experiencing varied growth rates. While some sectors might see robust expansion, others may be maturing or facing slower demand. For instance, in 2024, the global supply chain management market is projected to grow, but the pace can differ significantly by region and specific service. Similarly, real estate market growth is highly localized and sensitive to economic conditions.

When industry growth slows, companies often intensify their efforts to capture existing market share. This heightened competition can lead to price wars, increased marketing expenditure, and a greater focus on differentiation. For Xiamen C&D, this means that in slower-growing segments, maintaining its competitive edge requires strategic agility and operational efficiency. The company must continuously innovate and adapt to maintain its position amidst competitors vying for a smaller slice of the pie.

Xiamen C&D operates in diverse sectors like supply chain, real estate, and investment, facing varying levels of competitive intensity. In its supply chain segment, which is a significant revenue driver, the company contends with numerous players, ranging from large state-owned enterprises to smaller, specialized trading firms. For instance, in 2024, the broader Chinese logistics and supply chain market saw continued growth, with companies like Sinotrans and COSCO Shipping Lines representing formidable, albeit differently focused, rivals.

The real estate development arm of Xiamen C&D encounters a landscape populated by both national giants and regional developers. This means the company must navigate strategies from those with vast land reserves and extensive project pipelines to more agile local players who understand specific market nuances. The sheer volume of developers active in China's urban and suburban expansion projects in 2024 underscores the broad competitive base.

Strategic diversity among competitors is a key characteristic. Some rivals focus purely on scale and volume, while others differentiate through innovation, service quality, or niche market specialization. This broad spectrum of approaches means Xiamen C&D must constantly adapt its own strategies to counter different competitive threats across its varied business units, ensuring its offerings remain compelling in each sector.

Xiamen C&D's supply chain services, while robust, often compete on efficiency and scale rather than unique features, increasing rivalry. Similarly, its real estate developments, though substantial, frequently face competition from developers offering comparable amenities and locations. The hotel segment also sees intense competition where differentiation can be fleeting, impacting pricing power and intensifying rivalry among players.

Exit Barriers

Xiamen C&D faces moderate exit barriers within the supply chain and logistics sector. While specialized assets like warehouses and transportation fleets represent significant capital investment, these can often be repurposed or sold, albeit with potential depreciation. The industry's relatively high fixed costs, particularly for large-scale operations, can make a complete exit costly.

However, the nature of the business, often involving long-term contracts and established relationships, can create a degree of inertia. Companies might continue operating at reduced profitability to maintain market presence or fulfill contractual obligations, rather than incurring immediate losses from asset disposal or contract termination penalties. For instance, in 2024, the global logistics market, valued at trillions, saw some consolidation but also continued activity from players with legacy infrastructure.

- Specialized Assets: While some logistics infrastructure is specific, a significant portion, such as standard warehousing or trucking, has broader applicability, mitigating extreme exit barriers.

- High Fixed Costs: The substantial investment in fleets, technology, and facilities does create a financial hurdle for complete withdrawal, potentially leading to prolonged operation even in leaner times.

- Contractual Obligations: Long-term agreements with suppliers and customers can lock companies into the market, making immediate exit difficult without incurring penalties.

- Emotional Attachment & Reputation: For family-owned or long-established firms, there can be an emotional component to exiting, alongside a desire to protect brand reputation, which can influence decisions to remain active.

Strategic Stakes

The strategic stakes in the industries Xiamen C&D operates within are quite high, particularly for state-owned enterprises like Xiamen C&D itself and many of its rivals. Success here isn't just about profit; it's often tied to national economic development goals and maintaining significant market share. This elevated importance naturally fuels aggressive competition, as companies fight to preserve or improve their standing. For instance, in 2024, the Chinese government continued to emphasize the strategic importance of supply chain management and logistics for national security and economic resilience, directly impacting companies like Xiamen C&D.

This intense focus translates into a fierce battle for market position. Competitors are often willing to invest heavily and take on greater risks to secure their future. For state-owned enterprises, maintaining leadership in key sectors is paramount, leading to a dynamic where market share gains are pursued relentlessly. Xiamen C&D's significant presence in the metals and chemicals trading sectors, for example, means that any perceived weakness by competitors can trigger aggressive moves to capture that business.

- High Importance to SOEs: Success in core industries is critical for state-owned enterprises to meet national economic mandates.

- Market Share as a Metric: Competitors are driven to aggressively defend and expand their market share, often viewing it as a strategic imperative.

- Investment in Growth: The high stakes encourage substantial investment in capacity, technology, and market penetration to outmaneuver rivals.

- Competitive Intensity: This environment fosters intense rivalry, with companies frequently engaging in price wars or strategic alliances to gain an edge.

Xiamen C&D operates in sectors characterized by a substantial number of competitors, including large, established players and more specialized firms. This broad competitive landscape, particularly evident in its supply chain and real estate segments, means Xiamen C&D constantly faces pressure to innovate and maintain efficiency. For instance, in 2024, the logistics industry alone saw numerous companies vying for market share, with major players like Sinotrans and COSCO offering significant scale.

The rivalry is further intensified by competitors employing diverse strategies, from focusing on volume and cost leadership to emphasizing service quality and niche specialization. This variety means Xiamen C&D must be adept at countering different competitive threats across its business units. The real estate sector, for example, features both national developers with extensive land banks and agile local entities, all competing for urban expansion projects in 2024.

The strategic importance of industries like supply chain management to national economic goals, especially for state-owned enterprises, fuels aggressive competition. Companies are driven to invest heavily and take risks to secure market leadership, often viewing market share as a critical metric. This high-stakes environment can lead to price wars and a constant pursuit of competitive advantage, as Xiamen C&D experiences in its metals and chemicals trading operations.

SSubstitutes Threaten

The threat of substitutes for Xiamen C&D Inc. is moderate, given the diverse nature of its business segments. In its supply chain services, for instance, customers could potentially source materials directly from manufacturers or utilize other logistics providers. The building materials sector faces competition from alternative construction methods and materials, such as pre-fabricated units or newer composites.

However, Xiamen C&D’s integrated approach and established relationships often present a compelling value proposition that is not easily replicated. For example, in 2023, the company's supply chain segment handled a significant volume of goods, demonstrating its scale and efficiency advantages that can deter customers from switching to less comprehensive alternatives.

The company's strategic focus on providing comprehensive solutions, from procurement to logistics and distribution, creates switching costs for many clients. This integration makes it more challenging for readily available substitutes to offer the same level of convenience and cost-effectiveness across multiple service points.

The threat of substitutes for Xiamen C&D hinges on the relative price-performance of alternatives. If competing products or services offer a more compelling value proposition, customers might find it attractive to switch, thereby increasing the competitive pressure. For instance, in the supply chain services sector, while Xiamen C&D provides integrated solutions, a competitor offering a slightly lower price point for basic logistics might lure price-sensitive clients if the performance difference is negligible for their specific needs.

Xiamen C&D Inc. faces a moderate threat from substitutes, largely influenced by the diversification of its product and service offerings in the supply chain sector. Customers in areas like metals and chemicals might consider alternative suppliers or integrated solutions if Xiamen C&D's pricing or service levels become uncompetitive.

However, the company's strong logistical network and established relationships across various industries create a barrier to switching for many clients. For instance, in 2023, Xiamen C&D reported revenue of approximately RMB 347.5 billion, underscoring its significant market presence and the inertia that can deter customer propensity to substitute.

The perceived risk of switching is also a key factor; disruptions to supply chains or quality concerns can make customers hesitant to move away from a known, reliable partner. This reluctance is amplified in industries where consistency and timely delivery are paramount.

Customer loyalty, cultivated through years of service and tailored solutions, further mitigates the threat. While awareness of alternatives exists, the tangible benefits and proven track record of Xiamen C&D often outweigh the perceived advantages of substitutes for a substantial portion of its customer base.

Switching Costs for Buyers to Substitutes

The threat of substitutes for Xiamen C&D is influenced by the switching costs faced by its customers. These costs can be monetary, such as the price of a new product or service, or non-monetary, including the time and effort required to learn a new system or change established processes.

For Xiamen C&D, a key consideration is how easily clients can shift to alternative suppliers for their supply chain management and distribution needs. If these substitutes offer comparable quality and service with minimal disruption and cost, the threat is elevated. For instance, in the real estate sector where Xiamen C&D is also active, switching developers might involve new contract negotiations, design approvals, and potential delays, representing significant non-monetary switching costs.

- Monetary Switching Costs: These include the direct financial outlays a customer incurs when moving from Xiamen C&D to a substitute. This might involve fees for new contracts, purchasing different equipment, or paying for data migration.

- Non-Monetary Switching Costs: These encompass the intangible costs. For Xiamen C&D's diverse operations, this could mean the time spent re-training staff on new software platforms, the effort to establish new relationships with substitute suppliers, or the potential disruption to ongoing projects and operations.

- Impact on Threat of Substitutes: High switching costs act as a barrier, making customers less likely to switch. Conversely, low switching costs empower buyers, increasing the attractiveness of substitutes and thus the overall threat.

Technological Advancements Enabling Substitutes

Technological advancements are a significant driver of substitute threats for Xiamen C&D. Innovations in areas like smart logistics and automated warehousing can streamline operations, potentially reducing the need for traditional trading and distribution services that Xiamen C&D provides. For instance, the rise of direct-to-consumer (DTC) models, facilitated by advanced e-commerce platforms, allows manufacturers to bypass intermediaries, directly impacting demand for trading companies.

The construction industry, a key sector for Xiamen C&D, is also seeing rapid technological evolution. Prefabricated and modular construction techniques, enabled by advanced manufacturing and 3D printing, offer faster and potentially more cost-effective building solutions. These methods can reduce reliance on traditional material procurement and on-site construction management, areas where Xiamen C&D holds substantial business.

Furthermore, the digital transformation of tourism and hospitality presents another avenue for substitute threats. Online travel agencies (OTAs) and direct booking platforms have significantly altered how consumers plan and book travel, diminishing the role of traditional travel agents and tour operators. In 2024, the global online travel market was valued at over $1 trillion, underscoring the scale of this digital shift.

- Emergence of DTC Models: Technological platforms enabling direct sales from manufacturers to consumers reduce the necessity for intermediary trading services.

- Prefabricated Construction: Advances in modular and 3D printed building solutions can lessen reliance on traditional construction supply chains.

- Digital Travel Platforms: Online booking sites and travel aggregators offer alternatives to traditional travel agency services, impacting demand for these sectors.

- Supply Chain Automation: Innovations in logistics and warehousing can create more efficient, self-contained supply chains, potentially disintermediating trading companies.

The threat of substitutes for Xiamen C&D Inc. remains moderate, primarily due to the diverse nature of its business and the established switching costs for its clients. While alternative suppliers or methods exist in sectors like supply chain services and building materials, the company’s integrated approach and strong client relationships often create a competitive advantage that is not easily overcome.

For example, in its supply chain operations, customers might consider direct sourcing from manufacturers or other logistics providers. However, Xiamen C&D’s comprehensive service offering, from procurement to distribution, coupled with its significant market presence, exemplified by its RMB 347.5 billion revenue in 2023, makes switching a less attractive option for many.

Technological advancements, such as direct-to-consumer (DTC) models and advanced construction techniques like modular building, do present evolving substitute threats. The global online travel market exceeding $1 trillion in 2024 also highlights the impact of digital platforms on traditional service models.

Ultimately, the degree to which substitutes threaten Xiamen C&D is tied to their price-performance ratio and the ease with which customers can transition. High switching costs, both monetary and non-monetary, for clients in areas like real estate and logistics, tend to mitigate the immediate impact of these potential alternatives.

Entrants Threaten

Xiamen C&D leverages significant economies of scale across its diverse business segments, particularly in high-volume commodity trading and large-scale real estate development. This scale allows them to negotiate better prices with suppliers and spread fixed costs over a larger output, creating a substantial cost advantage. For instance, in 2023, their supply chain management and logistics capabilities, honed through years of operation, enabled them to handle vast quantities of goods efficiently.

These cost efficiencies directly challenge potential new entrants. A new company would struggle to match Xiamen C&D's per-unit costs without achieving a comparable scale of operations, which requires significant upfront investment and time. The ability to operate at lower costs makes it difficult for smaller, less-established players to compete effectively on price, thereby deterring new market entrants.

Entering Xiamen C&D's core sectors, such as supply chain management and real estate development, demands substantial upfront capital. For instance, establishing a robust logistics network or acquiring prime development land in Xiamen can easily run into hundreds of millions of dollars. This high barrier significantly deters smaller players from even attempting to compete at a meaningful scale.

Newcomers face significant hurdles in securing access to established distribution channels, particularly in sectors like commodities, real estate, and hospitality. Xiamen C&D's deep-rooted relationships and infrastructure make it difficult for emerging players to establish their own pathways to market, effectively limiting their reach and sales potential. For instance, securing prime hotel bookings or large-scale commodity distribution agreements often requires pre-existing trust and volume commitments that new entrants simply cannot meet.

Government Policy and Regulation

Government policies and regulations in China significantly shape the threat of new entrants across Xiamen C&D’s operating sectors. For instance, stringent licensing requirements and compliance standards within the supply chain and real estate industries can impose substantial upfront costs and operational complexities, effectively deterring potential new competitors. In 2023, China's focus on supply chain resilience and national security led to increased scrutiny and regulatory frameworks, particularly for critical materials and logistics, raising the barrier to entry.

The state-owned enterprise (SOE) landscape in China often features preferential policies and established market positions that new entrants struggle to overcome. Regulations surrounding foreign investment and domestic market access, especially in sectors like infrastructure and utilities, can limit participation. For example, the real estate sector has seen evolving policies aimed at curbing speculation and promoting affordable housing, which, while intended to stabilize the market, also complicate entry for smaller or less capitalized developers.

- Regulatory Hurdles: China's evolving regulatory environment, particularly concerning environmental standards and data security, creates significant compliance costs for new entrants in the supply chain sector.

- Licensing and Permits: Obtaining necessary licenses and permits for real estate development and operations remains a complex and time-consuming process, acting as a substantial barrier.

- SOE Dominance: The entrenched market share and government support enjoyed by state-owned enterprises in key sectors limit opportunities for new, independent players.

- Policy Shifts: Frequent adjustments in government policies, such as those impacting the property market or trade practices, require new entrants to possess considerable adaptability and financial resilience.

Brand Identity and Customer Loyalty

Xiamen C&D benefits from a robust brand reputation cultivated over years of operation, particularly within its core supply chain and real estate sectors. This strong brand identity fosters significant customer loyalty, making it harder for new competitors to gain traction. For instance, in 2023, the company's extensive network and reliable service delivery contributed to its consistent performance, with revenue reaching approximately ¥218.6 billion.

Customer loyalty is a critical barrier to entry. Xiamen C&D's established relationships with suppliers and buyers across diverse industries, from raw materials to consumer goods, mean that new entrants face an uphill battle in replicating these deep-seated connections. This loyalty is built on trust and consistent value delivery, assets that are difficult and time-consuming for newcomers to build.

- Brand Strength Xiamen C&D's brand is recognized for reliability and efficiency in its supply chain operations.

- Customer Loyalty Long-standing relationships with key clients and suppliers create a sticky customer base.

- Market Presence The company's diversified market presence across various sectors reinforces its brand recognition.

- Barriers to Entry High customer loyalty and established brand equity act as significant deterrents for potential new entrants.

The threat of new entrants for Xiamen C&D is generally low due to significant capital requirements, established relationships, and strong brand loyalty. High upfront investment, particularly in logistics and real estate, alongside regulatory hurdles in China, deters new players. Xiamen C&D’s deeply ingrained customer and supplier networks, built over years of reliable service, create a substantial barrier, making it difficult for newcomers to gain market share. In 2023, the company's substantial revenue of approximately ¥218.6 billion underscores its established market position.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High investment needed for logistics, real estate development. | Deters smaller, less-capitalized firms. |

| Economies of Scale | Xiamen C&D's operational scale leads to cost advantages. | New entrants struggle to match per-unit costs. |

| Brand Loyalty & Relationships | Established trust with suppliers and customers. | Difficult for new firms to build comparable networks. |

| Government Regulations | Licensing, compliance, and policy shifts in China. | Increases complexity and cost of market entry. |

Porter's Five Forces Analysis Data Sources

Our Xiamen C&D Porter's Five Forces analysis is built upon a robust foundation of data, including official company annual reports, industry-specific market research reports, and publicly available regulatory filings. This ensures a comprehensive understanding of the competitive landscape.