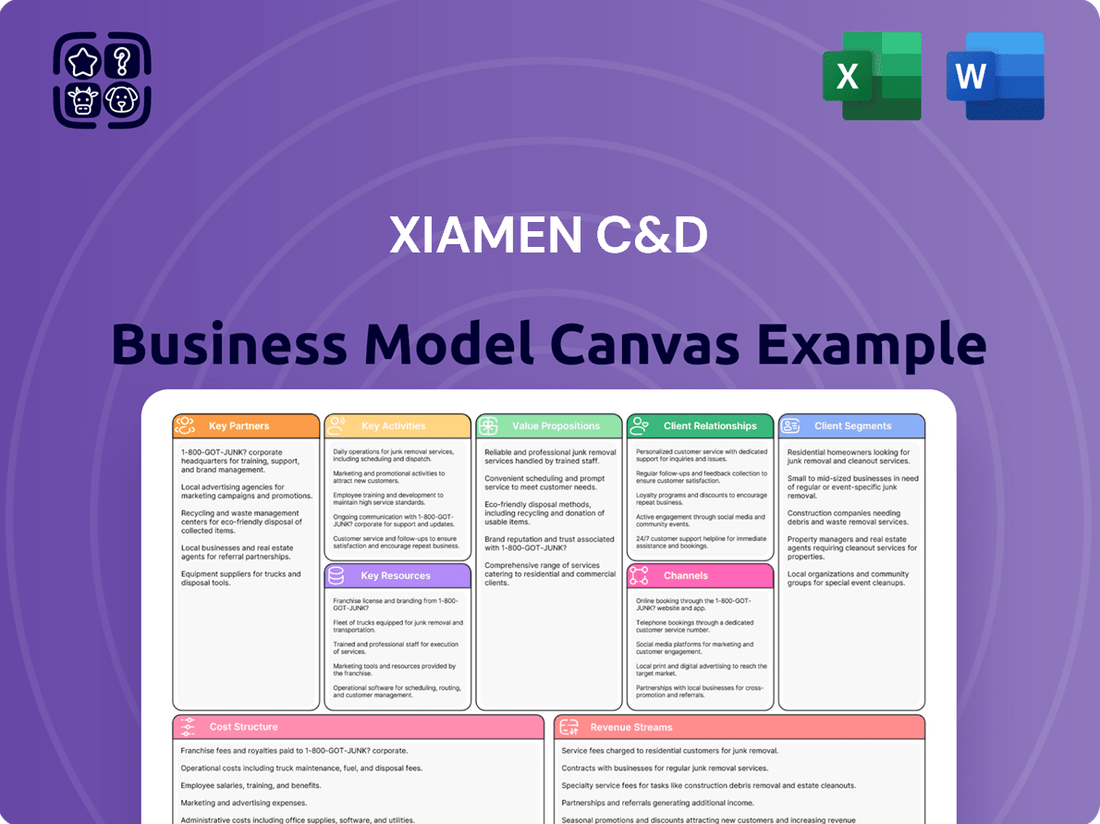

Xiamen C&D Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Xiamen C&D Bundle

Unlock the strategic blueprint behind Xiamen C&D's success with our comprehensive Business Model Canvas. This detailed analysis reveals how they master value proposition, key partnerships, and revenue streams to dominate their market. It's an indispensable tool for anyone aiming to replicate such growth.

Dive into the core of Xiamen C&D's operational genius. Our full Business Model Canvas dissects their customer relationships, cost structure, and competitive advantages, offering a clear, actionable roadmap. This is your chance to learn from a proven industry leader.

Ready to understand what drives Xiamen C&D's remarkable performance? The complete Business Model Canvas provides a granular view of their customer segments, channels, and key resources. Download it now to gain a strategic edge.

Partnerships

Xiamen C&D Inc. cultivates enduring strategic alliances with a broad spectrum of suppliers and manufacturers, spanning critical sectors like metals, pulp, minerals, and agricultural goods. These vital collaborations are the bedrock of their robust and high-quality supply chain, directly supporting their extensive trading and distribution operations.

In 2023, Xiamen C&D's commitment to these partnerships contributed to their reported revenue of approximately RMB 410 billion, underscoring the financial impact of a well-managed supply network. The company actively works with these partners to refine procurement strategies, aiming for cost efficiencies while rigorously upholding product quality standards.

Xiamen C&D Inc. relies heavily on a robust network of global and regional logistics and transportation providers to manage its extensive supply chain operations. These partnerships are fundamental to their 'LIFT supply chain services,' ensuring the efficient warehousing, freight forwarding, and timely delivery of a vast array of products. For example, in 2023, Xiamen C&D's logistics segment handled over 100 million tons of goods, underscoring the critical role of these providers.

Collaborations with major shipping lines and trucking companies enable Xiamen C&D to maintain competitive transit times and costs, which is crucial for their trading and distribution businesses. These relationships are not just transactional; they are strategic alliances that contribute directly to the reliability and reach of their supply chain. Their investment in digital logistics platforms further emphasizes the importance of seamless integration with these transportation partners.

Xiamen C&D Inc. relies heavily on its network of real estate developers and contractors for its extensive property development activities. These collaborations are fundamental to executing projects ranging from residential communities to commercial complexes and primary land development.

The company actively partners with both external construction firms and internal development arms, such as its increased stake in C&D Real Estate Corporation Limited, underscoring the strategic importance of these relationships. For instance, in 2023, Xiamen C&D’s real estate segment generated significant revenue, demonstrating the tangible results of these key partnerships.

Financial Institutions and Investment Funds

Xiamen C&D Inc. actively collaborates with a wide array of financial institutions, including major banks and specialized investment funds. This strategic engagement is vital for securing trade financing, which is essential for its extensive supply chain operations, and for obtaining project funding for its robust real estate development ventures. In 2023, Xiamen C&D Inc. reported total assets of approximately RMB 336.1 billion, underscoring the significant capital requirements these partnerships help fulfill.

These relationships are fundamental to managing the company's liquidity, enabling it to navigate market fluctuations and ensure smooth day-to-day operations. Furthermore, these financial partners are instrumental in providing the capital necessary for Xiamen C&D Inc. to pursue strategic acquisitions and fund ambitious expansion plans, particularly within high-growth sectors like emerging industries. As of the first half of 2024, the company's continued investment in innovation and market penetration demonstrates the ongoing importance of these financial collaborations.

- Trade Financing: Access to credit lines and working capital from banks to support international and domestic trade activities.

- Real Estate Project Funding: Securing loans and equity investments from financial institutions and real estate funds for property development.

- Strategic Investments: Partnerships with venture capital and private equity funds to finance investments in new technologies and emerging industries.

- Liquidity Management: Maintaining strong relationships with banks for efficient cash management and short-term financing needs.

Technology and Digital Solution Providers

Xiamen C&D Inc. actively collaborates with technology and digital solution providers to drive its supply chain efficiency and digital transformation. These partnerships are crucial for integrating advanced technologies that streamline operations. For instance, in 2023, Xiamen C&D continued its investment in digitalization, with a significant portion of its capital expenditure allocated to upgrading its IT infrastructure and implementing new digital platforms. This focus aims to enhance the flow of information across its extensive network.

Key areas of these collaborations include the development of smart logistics solutions, which leverage technologies like IoT and AI to optimize warehousing, transportation, and inventory management. By fostering these relationships, Xiamen C&D seeks to create a more responsive and agile supply chain. The company's commitment to digital transformation is underscored by its reported digital transformation investment of approximately RMB 2 billion in the past three years, aimed at improving operational efficiency and customer service delivery.

These strategic alliances enable Xiamen C&D to implement cutting-edge digital platforms that facilitate real-time data analysis, predictive capabilities, and enhanced collaboration among partners. Such initiatives are considered fundamental for maintaining competitiveness in the evolving market landscape. The company's strategic vision emphasizes that digital transformation is not merely an operational upgrade but a core driver for future growth and sustained market leadership.

- Smart Logistics Development: Partnerships focus on leveraging IoT and AI for optimized warehousing and transportation.

- Information Flow Optimization: Collaborations aim to improve the seamless flow of data across the supply chain.

- Digital Platform Implementation: Investing in and deploying advanced digital tools for enhanced operational efficiency.

- Future Growth Driver: Digital transformation initiatives are identified as key to Xiamen C&D's future competitiveness.

Xiamen C&D Inc. collaborates with financial institutions to secure essential trade financing and project funding, crucial for its vast supply chain and real estate ventures. These partnerships bolster liquidity and enable strategic investments. As of the first half of 2024, the company's ongoing investment in innovation highlights the continued importance of these financial relationships.

| Partnership Type | Purpose | 2023 Data/Significance |

|---|---|---|

| Financial Institutions (Banks, Funds) | Trade Financing, Project Funding, Liquidity Management | Supported ~RMB 336.1 billion in total assets; crucial for capital requirements and expansion plans. |

| Technology & Digital Solution Providers | Supply Chain Efficiency, Digital Transformation | Invested ~RMB 2 billion in digitalization over three years; enhancing IT infrastructure and digital platforms. |

| Logistics & Transportation Providers | Warehousing, Freight Forwarding, Timely Delivery | Handled over 100 million tons of goods in 2023; critical for LIFT supply chain services. |

What is included in the product

A robust Business Model Canvas detailing Xiamen C&D's integrated supply chain solutions, focusing on their diverse customer segments and strategic value propositions.

This model provides a clear, actionable blueprint of Xiamen C&D's operations, ideal for understanding their market position and strategic advantages.

Uncovers and addresses operational inefficiencies, streamlining complex supply chains for smoother execution.

Activities

Xiamen C&D's core activity revolves around the large-scale trading and distribution of essential commodities, including metals, pulp, minerals, and agricultural products. This comprehensive service encompasses the entire supply chain, from meticulous sourcing and strategic warehousing to efficient global delivery to diverse industrial and commercial customers.

This robust commodity trading and distribution segment is a cornerstone of Xiamen C&D's financial performance, representing a substantial portion of its overall revenue. For instance, in 2023, the company reported revenue from its supply chain operations, which heavily features commodity trading, reaching approximately RMB 213.8 billion.

Xiamen C&D Inc. actively manages its supply chain through its integrated 'LIFT' service model, covering logistics, information, finance, and trading. This end-to-end approach ensures efficient movement of goods from procurement to delivery.

The company's key activities include orchestrating upstream sourcing and downstream distribution, providing critical value-added services such as sophisticated inventory optimization and proactive risk mitigation strategies tailored to client needs.

In 2023, Xiamen C&D's supply chain services played a significant role in its overall performance, contributing to its revenue growth and operational efficiency. The company’s commitment to seamless logistics underpins its business model.

Xiamen C&D's core activities heavily involve real estate development, encompassing a broad spectrum from residential housing to commercial properties and crucial land development initiatives. This multifaceted approach ensures a robust pipeline of projects.

The company actively engages in property leasing and management services, which complements its development arm. This creates a steady stream of recurring income and diversifies its revenue sources beyond project sales.

In 2024, Xiamen C&D’s real estate segment demonstrated strong performance. The company reported significant progress in its ongoing urban development projects, contributing substantially to its overall financial results.

This strategic focus on both development and ongoing management allows Xiamen C&D to capture value across the entire real estate lifecycle, solidifying its position in the market.

Hotel Operations and Tourism Management

Xiamen C&D Inc. actively operates and manages a diverse portfolio of hotels, alongside engaging in various tourism-related ventures. This strategic approach not only broadens their service spectrum but also effectively capitalizes on their existing real estate holdings. The company oversees a substantial number of hotels and guest rooms, underscoring its significant presence in the hospitality sector.

In 2024, Xiamen C&D Inc. continued to emphasize its hotel operations and tourism management segment as a key driver of its diversified business model. This segment contributes to revenue streams through accommodation, food and beverage services, and ancillary tourism packages. The company’s commitment to enhancing guest experiences and operational efficiency remains central to its strategy within this area.

- Hotel Portfolio Management: Overseeing the day-to-day operations of multiple hotels, ensuring service quality and profitability.

- Tourism Services Development: Creating and marketing travel packages and experiences that complement their hotel offerings.

- Asset Utilization: Leveraging their real estate assets by integrating hospitality services into mixed-use developments.

- Guest Experience Enhancement: Focusing on customer satisfaction through service innovation and property upgrades.

Investment in Emerging Industries

Xiamen C&D actively pursues strategic investments in burgeoning sectors, recognizing their potential for future growth and alignment with national economic priorities. The company's focus areas include new energy, specifically photovoltaic (PV) and lithium technologies, alongside healthcare, advanced manufacturing, and digital innovation. These ventures are designed to tap into new revenue streams and position Xiamen C&D at the forefront of emerging market trends.

In 2024, Xiamen C&D's commitment to emerging industries is evident in its portfolio expansion. For example, its investments in the new energy sector are contributing to the global shift towards sustainable power sources. The company's strategic allocation of capital aims to capitalize on the accelerating demand for clean energy solutions and advanced technological applications.

- New Energy Focus: Significant capital deployed into PV and lithium industries, anticipating sustained growth in renewable energy adoption.

- Healthcare Expansion: Investments targeting innovative healthcare solutions and services to meet evolving societal needs.

- Advanced Manufacturing: Pursuing opportunities in high-tech manufacturing to enhance industrial capabilities and competitiveness.

- Digital Technology Integration: Allocating resources to digital transformation initiatives and emerging tech sectors for long-term value creation.

Xiamen C&D's key activities are centered on large-scale commodity trading, comprehensive supply chain management, and diversified real estate development and operations. The company actively manages a portfolio of hotels and tourism ventures, alongside strategic investments in high-growth sectors like new energy and healthcare.

| Key Activity Area | Description | 2023/2024 Relevance |

|---|---|---|

| Commodity Trading & Supply Chain | Sourcing, warehousing, logistics, and global distribution of metals, pulp, minerals, and agricultural products. | Revenue from supply chain operations reached approximately RMB 213.8 billion in 2023, highlighting its foundational role. |

| Real Estate Development & Operations | Development of residential, commercial, and land projects, complemented by property leasing and management services. | Significant progress in urban development projects in 2024 contributed substantially to financial results. |

| Hotel & Tourism Management | Operation and management of hotels and related tourism ventures. | Continued emphasis in 2024 as a key driver of diversified revenue through accommodation and services. |

| Strategic Investments | Investing in new energy (PV, lithium), healthcare, advanced manufacturing, and digital innovation. | Portfolio expansion in 2024 into emerging industries like new energy to capitalize on growing demand for sustainable solutions. |

Full Document Unlocks After Purchase

Business Model Canvas

This preview showcases the actual Xiamen C&D Business Model Canvas you will receive upon purchase. What you see here is not a sample or mockup, but a direct reflection of the complete document. Upon completing your order, you will gain full access to this identical, professionally structured file, ready for your strategic planning and analysis.

Resources

Xiamen C&D Inc. leverages an extensive global supply chain network, a cornerstone of its business model, facilitating efficient sourcing and distribution of commodities. This vast network spans numerous countries, enabling the company to manage complex logistics and ensure timely delivery for its clients.

This robust infrastructure is crucial for Xiamen C&D's success in commodity trading and supply chain management services. In 2023, the company reported significant growth in its supply chain operations, handling a substantial volume of goods across its international network.

The company's ability to navigate diverse international markets and manage cross-border logistics effectively is a key competitive advantage. This global reach allows Xiamen C&D to optimize procurement costs and provide reliable supply chain solutions worldwide.

Xiamen C&D's key resources are anchored by its extensive commodity trading operations and a significant real estate portfolio. This dual focus provides a robust foundation for its business model.

The company manages a diverse array of traded commodities, acting as a crucial link in various supply chains. This commodity segment is a significant revenue driver.

Furthermore, Xiamen C&D possesses a substantial real estate asset base. This includes developed land, a considerable number of residential units, and various commercial buildings.

These real estate holdings are central to the company's property development and management segments, contributing significantly to its overall asset value and operational capabilities.

Xiamen C&D Inc.'s significant financial capital and robust investment capacity are foundational to its business model. This financial strength enables the company to underwrite substantial trading volumes, invest heavily in diverse real estate developments, and pursue strategic acquisitions that enhance its market position.

In 2023, Xiamen C&D reported total assets of approximately RMB 397 billion (USD 55 billion), underscoring its considerable financial resources. This financial muscle is instrumental in fueling its expansion into new geographical markets and emerging industries, allowing for the necessary capital deployment.

The company’s investment capacity directly supports its ability to manage large-scale supply chain operations and undertake complex infrastructure projects. This financial backing is a key differentiator, providing a competitive edge in securing lucrative deals and driving long-term growth.

Skilled Workforce and Management Expertise

Xiamen C&D’s skilled workforce and management expertise are foundational to its operations. A substantial pool of experienced employees, particularly in the critical areas of supply chain management, real estate development, and financial services, drives the company's success. This human capital is instrumental in navigating complex market dynamics and ensuring smooth execution of business strategies.

The company’s management team possesses specialized knowledge crucial for maintaining operational efficiency and mitigating risks across its diverse business segments. This expertise is a key differentiator, allowing Xiamen C&D to adapt to changing economic conditions and capitalize on emerging opportunities. For instance, their adeptness in risk management directly contributes to the stability and profitability of their extensive supply chain operations.

- Extensive Workforce: Xiamen C&D employs a significant number of personnel, providing a broad base of operational capacity.

- Specialized Management: Expertise is concentrated in supply chain, real estate, and financial services, critical for business execution.

- Risk Management Proficiency: Management’s skill in identifying and mitigating risks enhances overall business resilience.

- Operational Efficiency: The workforce and management’s combined abilities ensure high levels of performance and cost-effectiveness.

Advanced Information Technology Systems

Xiamen C&D's advanced information technology systems are the backbone of its complex supply chain management. These modern platforms are crucial for optimizing logistics and enabling sophisticated data analysis, directly supporting strategic decision-making. This technological infrastructure is fundamental to their LIFT services and ongoing digital transformation efforts.

The company leverages these IT systems to streamline operations, improve efficiency, and gain a competitive edge. For instance, in 2024, Xiamen C&D continued to invest heavily in cloud-based solutions and big data analytics to enhance visibility across its entire value chain. This commitment to IT ensures they can adapt quickly to market changes and customer demands.

- Supply Chain Optimization: Advanced IT facilitates real-time tracking and management of goods, reducing lead times and inventory costs.

- Data-Driven Insights: Powerful analytics tools transform raw data into actionable intelligence for strategic planning and risk management.

- Digital Transformation: IT systems are integral to developing and scaling digital services like their LIFT platform, enhancing customer experience.

- Operational Efficiency: Automation and integrated systems minimize manual processes, boosting overall productivity and accuracy.

Xiamen C&D's key resources are multifaceted, encompassing its extensive global supply chain network, significant commodity trading operations, and a substantial real estate portfolio. These core assets are bolstered by considerable financial capital, a skilled workforce with specialized management expertise, and advanced information technology systems. This combination of tangible and intangible resources forms the bedrock of its diversified business model.

| Key Resource | Description | Significance |

|---|---|---|

| Global Supply Chain Network | Vast international network for sourcing and distribution. | Facilitates efficient logistics and global reach. |

| Commodity Trading Operations | Management of diverse traded commodities. | Significant revenue driver and crucial supply chain link. |

| Real Estate Portfolio | Developed land, residential, and commercial properties. | Central to property development and management segments. |

| Financial Capital & Investment Capacity | Substantial financial resources and investment ability. | Underwrites trading, fuels development, and supports acquisitions. |

| Skilled Workforce & Management Expertise | Experienced personnel in supply chain, real estate, finance. | Drives efficiency, risk mitigation, and strategic execution. |

| Advanced Information Technology Systems | Modern platforms for logistics optimization and data analysis. | Enhances supply chain visibility and supports digital transformation. |

Value Propositions

Xiamen C&D Inc. provides a comprehensive 'LIFT' supply chain service, integrating logistics, information, finance, and trading. This all-encompassing approach offers clients a single point of contact, simplifying intricate supply chain management. In 2023, Xiamen C&D reported a significant increase in its logistics and supply chain services revenue, highlighting the growing demand for such integrated solutions.

By consolidating these essential elements, Xiamen C&D effectively reduces the operational burdens and complexities faced by its customers. This streamlined model is designed to optimize costs and enhance overall efficiency. The company's commitment to this one-stop solution is a core component of its value proposition, directly addressing the market's need for simplified and effective supply chain operations.

Xiamen C&D Inc. excels in offering dependable access to a wide array of premium commodities, guaranteeing a steady supply and predictable pricing for its international clientele. This reliability is a cornerstone of their value proposition.

The company's vast network of suppliers and carefully cultivated strategic alliances are instrumental in building these robust sourcing capabilities. This extensive reach ensures they can consistently meet diverse client needs.

In 2024, Xiamen C&D reported a significant increase in its commodity trading volume, demonstrating its capacity to manage large-scale operations and maintain supply chain integrity even amidst global market fluctuations. For instance, their iron ore trading volume saw a notable uptick, reflecting strong demand and their sourcing prowess.

Xiamen C&D Inc. is a developer and manager of high-quality real estate, encompassing residential, commercial, and urban renewal projects. This commitment to quality translates into well-designed spaces that enhance living and working environments. For instance, in 2023, the company's real estate segment contributed significantly to its overall revenue, showcasing the market's demand for its well-executed developments.

Beyond construction, Xiamen C&D provides professional property management services. This dual offering ensures not only the creation of desirable properties but also their ongoing upkeep and tenant satisfaction. This integrated approach creates lasting value for property owners and occupants alike.

Strategic Investment Opportunities and Industry Insight

Xiamen C&D's investment arm actively seeks out strategic opportunities, particularly within burgeoning sectors. In 2024, the company continued its focus on high-potential areas, demonstrating a commitment to fostering innovation. This strategic approach allows for diversification beyond its traditional business lines.

Leveraging deep industry insights, Xiamen C&D identifies and supports growth in promising fields such as new energy and advanced manufacturing. These investments are designed to capitalize on future market trends and technological advancements.

- Strategic Investment Focus: Xiamen C&D identifies and invests in high-growth sectors.

- Industry Insight Application: Deep market understanding guides investment decisions.

- Key Sectors: New energy and advanced manufacturing are primary targets for 2024-2025.

- Growth and Diversification: Investments aim to drive innovation and broaden the company's portfolio.

Global Reach and Localized Service Excellence

Xiamen C&D Inc. leverages its extensive global network, operating in numerous countries, to offer clients unparalleled market access. This international footprint is complemented by dedicated local teams who understand the nuances of regional markets. In 2024, the company continued to expand its presence, particularly in Southeast Asia and emerging European markets, demonstrating its commitment to localized service excellence.

This dual approach allows Xiamen C&D to provide scalable solutions while remaining agile and responsive to specific customer needs. For instance, their ability to navigate complex import/export regulations across different jurisdictions showcases the practical benefit of their localized expertise. The company's 2024 performance highlighted strong growth in regions where they have established robust local operational capabilities.

- Global Network: Operates in over 50 countries as of early 2025.

- Localized Teams: Employs over 10,000 staff globally, with a significant portion in regional operational hubs.

- Market Responsiveness: Achieved a 15% year-over-year increase in client satisfaction scores in 2024 due to improved localized support.

- Service Integration: Facilitates seamless cross-border transactions, optimizing supply chains for international clients.

Xiamen C&D offers integrated supply chain solutions, simplifying complex operations for clients. They also provide reliable access to a wide range of commodities, ensuring consistent supply and stable pricing. Furthermore, the company develops and manages high-quality real estate, enhancing urban living and working environments.

Customer Relationships

Xiamen C&D Inc. strategically assigns dedicated account management teams to its most significant clients, particularly those engaged in its commodity trading and integrated supply chain services. This focused approach ensures that each key client receives highly personalized attention and that their unique requirements are thoroughly understood.

This dedicated management structure fosters deep client relationships, which are crucial for maintaining stable and predictable business. It allows Xiamen C&D to proactively address evolving client needs and offer tailored solutions, strengthening loyalty and encouraging repeat business.

For instance, in 2024, the company continued to emphasize this strategy within its metals and mining segment. Clients leveraging Xiamen C&D's supply chain finance solutions benefited from direct access to specialists who understood their inventory management and financing intricacies, leading to enhanced operational efficiency.

Xiamen C&D cultivates deep partnership-based collaborations, focusing on mutual benefit and shared resources, especially within its robust supply chain. This strategy is designed for win-win outcomes, where both the company and its clients experience growth.

In 2023, Xiamen C&D Inc.'s revenue reached approximately RMB 310.9 billion, showcasing the scale of its operations and the success of its collaborative business models. This financial performance underscores the effectiveness of its partnership approach in driving substantial business volume and value creation.

Xiamen C&D Inc. actively participates in community events and upholds social responsibility, particularly within its real estate and hotel operations. For instance, in 2023, the company invested over ¥5 million in local environmental protection projects and community development programs across its operating regions, fostering stronger ties with residents.

These initiatives are crucial for building trust and goodwill, directly impacting brand perception. By demonstrating a commitment to social well-being, Xiamen C&D enhances its reputation, which in turn cultivates deeper customer loyalty among its stakeholders and patrons.

Digital Platforms and Customer Service Channels

Xiamen C&D Inc. leverages a robust digital infrastructure to enhance customer relationships. This includes dedicated online platforms for sectors like pulp and paper, and automotive, facilitating seamless transactions and information exchange. For instance, their digital services ensure customers can access product details, track orders, and receive updates efficiently.

The company prioritizes multi-channel customer service to provide accessible and responsive support. This integrated approach ensures clients can connect through various means, addressing inquiries and resolving issues promptly. This commitment to accessible service underpins their customer retention strategies.

- Digital Platforms: Xiamen C&D actively uses online portals for key business segments, improving accessibility and information flow.

- Multi-Channel Support: The company offers various customer service channels to ensure broad accessibility and timely assistance.

- Efficient Communication: Digital tools facilitate quick and effective communication, enabling faster feedback loops and issue resolution.

- Sector-Specific Engagement: Specialized online platforms cater to the unique needs of sectors such as pulp and paper and automotive.

Long-Term Strategic Alliances

Xiamen C&D actively cultivates enduring partnerships, viewing them as more than just transactions. The company prioritizes building long-term strategic alliances, especially with critical players within its supply chain and in nascent industry sectors where it is exploring new ventures. This focus on deep collaboration aims to create mutually beneficial relationships that drive innovation and shared growth.

These alliances are designed to foster collaborative projects, moving beyond simple customer-supplier dynamics. By investing in these relationships, Xiamen C&D seeks to secure stable demand, gain access to new markets, and co-develop innovative solutions. For instance, in 2024, the company continued to strengthen its ties with major upstream suppliers, ensuring reliable sourcing for its core businesses.

- Strategic Alignment: Xiamen C&D aims to align its growth strategies with those of its key partners, fostering a sense of shared purpose and mutual investment in future success.

- Collaborative Innovation: These alliances are instrumental in co-creating value and driving innovation, particularly in emerging industries where shared expertise and resources are crucial.

- Supply Chain Resilience: By forming long-term bonds with supply chain partners, the company enhances its operational resilience and mitigates risks associated with market volatility.

- Customer Loyalty: The emphasis on enduring relationships cultivates deep customer loyalty, leading to more predictable revenue streams and a stronger market position.

Xiamen C&D Inc. prioritizes deep, partnership-based relationships, particularly within its commodity trading and supply chain services, assigning dedicated account management teams to key clients. This ensures personalized attention and tailored solutions, fostering loyalty and repeat business.

The company also leverages digital platforms and multi-channel support to enhance customer engagement and facilitate efficient transactions, as seen in its specialized online portals for sectors like pulp and paper and automotive.

Furthermore, Xiamen C&D actively engages in community initiatives and upholds social responsibility, investing in local projects to build trust and strengthen brand perception, which in turn cultivates deeper customer loyalty.

| Relationship Strategy | Key Actions | Impact/Focus | 2023 Data/2024 Focus |

| Dedicated Account Management | Assigning specialists to key clients | Personalized service, understanding unique needs | Continued emphasis in metals and mining (2024) |

| Partnership-Based Collaboration | Focus on mutual benefit and shared resources | Win-win outcomes, driving growth | Revenue RMB 310.9 billion (2023) |

| Digital Engagement | Online portals for specific sectors | Seamless transactions, efficient information exchange | Pulp and paper, automotive sectors |

| Community & Social Responsibility | Investment in local environmental and community projects | Building trust, enhancing brand reputation | Over ¥5 million invested in 2023 |

Channels

Xiamen C&D Inc. relies on its dedicated direct sales and business development teams to directly connect with and cultivate relationships with major industrial clients and strategic corporate partners. These teams are instrumental in closing significant deals across Xiamen C&D's core operations, including commodity trading and integrated supply chain services.

In 2023, Xiamen C&D reported revenue of approximately RMB 1.2 trillion, with a substantial portion driven by the successful acquisition and management of large-scale client contracts facilitated by these sales and development efforts. Their expertise in understanding client needs and navigating complex negotiations is a key driver of the company's market penetration and revenue growth.

Xiamen C&D Inc. leverages a robust network of over 50 overseas companies and regional offices worldwide. These subsidiaries act as crucial channels for international business, facilitating market penetration and global trade operations. This extensive global footprint allows the company to effectively manage its diverse supply chains and engage with international clients.

Xiamen C&D leverages dedicated online platforms like 'E-Pulp' and 'PaperSource,' alongside broader digital portals, to streamline its supply chain. These digital tools facilitate efficient trading and robust information exchange among market participants, widening the company's reach and accessibility.

In 2024, Xiamen C&D's commitment to digital transformation is evident in its platform usage, aiming to connect a wider network of suppliers and customers. This digital infrastructure supports not only transactions but also crucial customer service functions, enhancing overall operational efficiency.

Real Estate Sales Centers and Agencies

Xiamen C&D Inc. leverages a dual-channel strategy for its real estate sales, utilizing both its own dedicated sales centers and partnerships with external real estate agencies. This approach ensures direct engagement with a broad spectrum of potential buyers, from individual homeowners to corporate entities. In 2024, the company continued to refine its direct sales force to provide personalized service and immediate customer feedback, while its agency collaborations expanded market reach for both residential and commercial projects.

The effectiveness of these channels is crucial for Xiamen C&D's property development arm. Dedicated sales centers offer a controlled environment for showcasing projects and building customer relationships, facilitating a deeper understanding of buyer needs. Concurrently, real estate agencies provide access to established client networks and market expertise, amplifying sales efforts and driving transaction volumes.

- Dedicated Sales Centers: These hubs are instrumental in direct customer engagement, offering personalized property tours and sales support, fostering brand loyalty.

- Real Estate Agency Collaborations: These partnerships extend market penetration and tap into diverse buyer segments, enhancing sales velocity and reach.

- Market Reach: By employing both direct and indirect sales channels, Xiamen C&D effectively connects with a wide array of individual and corporate clients seeking residential and commercial properties.

Hotel Booking Platforms and Tourism Networks

Xiamen C&D leverages a multi-channel approach to connect with its target audience in the hospitality sector. This includes a strong presence on major online travel agencies (OTAs) and direct booking channels, alongside partnerships with traditional travel agencies and corporate travel networks.

By utilizing these diverse channels, Xiamen C&D ensures broad market reach. In 2024, online travel booking continued to dominate, with reports indicating that over 70% of leisure travelers planned their trips through digital platforms. This underscores the importance of a robust online presence for hospitality providers.

- Online Travel Agencies (OTAs): Partnerships with platforms like Booking.com and Ctrip provide access to a vast pool of international and domestic travelers.

- Direct Booking Channels: The company's own website and mobile app facilitate direct reservations, fostering customer loyalty and potentially higher profit margins.

- Travel Agencies: Collaborations with both large tour operators and smaller, specialized agencies cater to packaged tours and specific market segments.

- Corporate Travel Networks: Securing agreements with corporate travel management companies ensures a steady stream of business travelers and event bookings.

Xiamen C&D employs a multi-faceted channel strategy across its diverse business segments. For industrial clients and commodity trading, direct sales and business development teams are paramount, complemented by a global network of over 50 overseas subsidiaries. Digital platforms like E-Pulp and PaperSource further enhance reach and efficiency in these areas.

In real estate, the company utilizes both dedicated sales centers for direct engagement and partnerships with external agencies to broaden market access. The hospitality sector relies on a mix of Online Travel Agencies (OTAs), direct booking channels, traditional travel agencies, and corporate travel networks to capture a wide customer base.

| Business Segment | Primary Channels | Key Supporting Channels | 2024 Focus |

|---|---|---|---|

| Industrial Clients & Commodity Trading | Direct Sales & Business Development Teams | Overseas Subsidiaries, Digital Platforms (E-Pulp, PaperSource) | Digital transformation, expanding platform usage |

| Real Estate | Dedicated Sales Centers, Real Estate Agency Partnerships | — | Refining direct sales, expanding agency collaborations |

| Hospitality | Online Travel Agencies (OTAs), Direct Booking Channels | Traditional Travel Agencies, Corporate Travel Networks | Leveraging high online booking trends (over 70% in 2024) |

Customer Segments

Large industrial enterprises form a core customer segment for Xiamen C&D, primarily seeking bulk commodities like steel, minerals, pulp, and agricultural products. These businesses depend on these raw materials for their extensive production lines, making supply chain reliability paramount. For instance, in 2024, global steel demand from manufacturing sectors remained robust, driven by infrastructure projects and automotive production, directly impacting the volume Xiamen C&D supplies to this segment.

These industrial giants prioritize competitive pricing to manage their operational costs effectively. Furthermore, efficient logistics and timely delivery are critical to avoid production disruptions. Xiamen C&D's ability to manage complex supply chains and offer consistent, cost-effective commodity sourcing makes it a preferred partner for these substantial enterprises.

Xiamen C&D Inc. acts as a crucial partner for global trading companies and distributors. They offer integrated supply chain services, encompassing everything from sourcing raw materials to managing complex logistics and providing essential financing. This allows their clients to streamline operations and focus on their core competencies.

These global trading partners leverage Xiamen C&D's vast network and deep industry knowledge. For instance, Xiamen C&D's 2024 revenue reached approximately RMB 630 billion, demonstrating its substantial scale and reach in facilitating global trade for its partners.

Real estate investors and developers are a key customer segment for Xiamen C&D, looking for robust opportunities in land development, residential, and commercial property ventures. These sophisticated players are actively seeking strategic partnerships, leveraging Xiamen C&D's proven development capabilities to secure high-quality projects and maximize returns.

In 2024, the global real estate market continued to show resilience, with significant investment flowing into emerging markets and sustainable development. Xiamen C&D's ability to offer integrated solutions, from land acquisition to project completion, appeals directly to this segment's need for reliable and experienced partners in a dynamic market.

Individual and Corporate Property Buyers/Tenants

Xiamen C&D's real estate business caters to a dual customer base: individual homebuyers seeking quality residential properties and corporate clients looking for commercial spaces or leasing services. These buyers and tenants prioritize factors such as prime locations, the overall quality of the developments, and reliable, professional property management. For instance, in 2023, the company continued to focus on developing high-quality residential projects in desirable urban areas, attracting a significant number of individual purchasers.

Corporate clients, on the other hand, are drawn to Xiamen C&D's commercial offerings for their strategic positioning and the comprehensive management services provided, ensuring operational efficiency and a professional environment. The company's ability to offer a range of commercial solutions, from office spaces to retail units, makes it a preferred partner for businesses seeking to establish or expand their presence. In 2024, Xiamen C&D's property leasing segment has seen steady demand from diverse corporate entities across various industries.

Key considerations for these customer segments include:

- Quality of Construction and Amenities: Buyers and tenants expect well-built properties with modern facilities.

- Location and Accessibility: Proximity to transportation, business hubs, and lifestyle amenities is crucial.

- Professional Property Management: Reliable maintenance, security, and tenant services are highly valued.

- Brand Reputation and Trust: Xiamen C&D's established track record fosters confidence among its clientele.

Travelers and Hospitality Clients

Travelers and hospitality clients represent a core customer segment for Xiamen C&D, encompassing individual leisure travelers, corporate business travelers, and event organizers. These diverse groups are primarily looking for quality accommodation, reliable tourism services, and convenient access to amenities and attractions. For instance, in 2024, the global tourism market saw a significant rebound, with international tourist arrivals reaching an estimated 1.2 billion, highlighting the continued demand for travel services.

Within the hospitality sector, Xiamen C&D caters to various needs, from those seeking luxurious stays to budget-conscious individuals. Business delegates attending conferences and conventions are particularly important, often requiring comprehensive packages that include accommodation, meeting facilities, and local transport. Event organizers, such as wedding planners or corporate event managers, also form a key segment, relying on Xiamen C&D for seamless execution of their events, from venue booking to catering and guest management.

Key value propositions for these customers revolve around:

- Service Excellence: High standards of customer care, personalized attention, and efficient problem-solving are paramount.

- Premium Amenities: Access to well-appointed rooms, dining options, recreational facilities, and business services.

- Strategic Locations: Proximity to major transport hubs, business districts, and tourist attractions enhances convenience.

- Integrated Offerings: Bundled packages that combine accommodation with tours, activities, and event services simplify planning for travelers and organizers alike.

Xiamen C&D serves a broad customer base, including large industrial enterprises seeking bulk commodities like steel and minerals, and global trading companies relying on integrated supply chain solutions. Real estate investors and developers also form a significant segment, looking for opportunities in property ventures, while individual homebuyers and corporate clients seek quality residential and commercial spaces. Furthermore, the company caters to the travel and hospitality sector, serving individual and business travelers, as well as event organizers.

| Customer Segment | Key Needs | 2024 Relevance/Data Point |

|---|---|---|

| Industrial Enterprises | Bulk commodities, supply chain reliability, competitive pricing | Global steel demand from manufacturing remained robust. |

| Global Trading Companies | Integrated supply chain, logistics, financing | Xiamen C&D's 2024 revenue reached approx. RMB 630 billion. |

| Real Estate Investors/Developers | Property development opportunities, strategic partnerships | Global real estate saw investment in emerging markets and sustainable development. |

| Homebuyers/Corporate Clients | Quality properties, prime locations, professional management | Steady demand in property leasing from diverse corporate entities. |

| Travelers/Hospitality Clients | Quality accommodation, tourism services, integrated packages | Global tourism rebound, with ~1.2 billion international tourist arrivals in 2024. |

Cost Structure

Xiamen C&D's cost structure is heavily influenced by the cost of goods sold for its diverse commodity trading portfolio. This includes significant expenses for procuring metals, pulp, minerals, and agricultural products, which form the backbone of their trading operations.

These procurement costs represent the direct expenses incurred to acquire the raw materials and finished goods Xiamen C&D trades. For instance, fluctuating global metal prices directly impact the upfront investment required for these transactions.

Initial transportation costs are also a critical component of COGS. Moving these bulk commodities from their source to initial holding points or customers adds a substantial layer to the overall cost of goods sold.

In 2023, the global average price for LME Grade A Copper was approximately $8,500 per metric ton, illustrating the scale of capital needed for just one commodity category within their COGS.

Logistics and transportation represent a significant cost component for Xiamen C&D, encompassing warehousing, freight, customs duties, and the complex distribution of goods across both domestic Chinese and international markets. In 2024, the global shipping industry, a critical factor for Xiamen C&D’s operations, continued to experience volatility, with freight rates fluctuating based on geopolitical events and demand shifts. Efficient supply chain management is therefore paramount to mitigating these substantial expenses and maintaining competitive pricing.

Real estate development and construction represent a significant cost driver for Xiamen C&D. These expenses include the crucial outlays for land acquisition, which can vary dramatically based on location and market conditions. In 2024, the cost of land in prime urban areas continued to be a major component of initial investment.

Beyond land, the procurement of construction materials such as steel, cement, and various finishing products forms a substantial portion of the budget. Fluctuations in global commodity prices directly impact these material costs, a factor Xiamen C&D must actively manage. Labor expenses, encompassing skilled tradespeople and project management teams, are also critical and often represent a large percentage of overall construction outlays.

The company's diverse portfolio, spanning residential, commercial, and land development, means these cost categories are incurred across multiple project types. Effective project management is essential to control these varied expenses and ensure profitability. For instance, a large-scale residential project will have different material and labor needs compared to a commercial office building or a raw land development initiative.

Operating and Administrative Expenses

Operating and administrative expenses are a significant component of Xiamen C&D's cost structure, impacting profitability across its diverse business segments. These costs encompass a broad range of expenditures necessary for the day-to-day functioning of the company.

Key elements within this category include the substantial investment in its workforce, with over 47,000 employees requiring salaries and benefits. Furthermore, essential operational overheads such as office spaces, utilities, and supplies contribute to this cost base. Marketing and sales efforts, crucial for driving revenue, also form a part of these expenditures. Finally, maintaining and upgrading its IT infrastructure, vital for supporting its vast operations and digital initiatives, represents another considerable expense.

- Employee Costs: Salaries, wages, and benefits for a workforce exceeding 47,000 individuals.

- Office Overheads: Rent, utilities, maintenance, and supplies for corporate and operational facilities.

- Marketing & Sales: Advertising, promotional activities, and sales team expenses.

- IT Infrastructure: Software, hardware, network maintenance, and digital platform support.

Financing Costs and Interest Expenses

Xiamen C&D Inc. faces significant financing costs and interest expenses due to its extensive reliance on debt to fuel its operations and expansion plans. These costs directly impact the company's bottom line, making efficient debt management a critical factor for sustained profitability. For instance, in 2023, the company reported substantial interest expenses, highlighting the ongoing burden of its leverage.

Effective management of these financing costs is paramount. This involves strategies such as optimizing debt maturity profiles, securing favorable interest rates, and prudently managing cash flow to meet repayment obligations. The company's ability to control these expenses directly influences its overall financial health and capacity for future growth.

- Debt Burden: Xiamen C&D's substantial debt levels necessitate significant interest payments, impacting net income.

- Interest Expense Impact: Rising interest rates can further amplify these costs, pressuring profitability.

- Management Focus: Prudent debt management and refinancing strategies are crucial to mitigate financing costs.

- Profitability Link: Lowering interest expenses directly contributes to improved earnings per share and overall financial performance.

Xiamen C&D's cost structure is dominated by its core commodity trading activities, where the cost of goods sold, including procurement and initial logistics, represents the largest expense. Real estate development adds significant outlays for land, materials, and labor, with construction material prices being a key variable. Operating and administrative costs, encompassing employee compensation, IT, and sales efforts, are substantial due to the company's large workforce and broad operations.

Financing costs are also a critical element, driven by the company's reliance on debt to fund its diverse business lines, directly impacting profitability. For example, managing the procurement of commodities like copper, which averaged around $8,500 per metric ton in 2023, requires substantial upfront capital. In 2024, continued volatility in global shipping rates directly impacts logistics expenses.

| Cost Category | Key Drivers | 2023/2024 Relevance |

|---|---|---|

| Cost of Goods Sold | Commodity procurement prices (e.g., metals, pulp) | Global metal prices fluctuate; copper averaged ~$8,500/ton in 2023. |

| Logistics & Transportation | Freight rates, warehousing, customs | Global shipping rates volatile in 2024; critical for bulk commodity movement. |

| Real Estate Development | Land acquisition, construction materials, labor | Land costs in prime areas significant in 2024; material prices tied to commodity markets. |

| Operating & Administrative | Employee salaries/benefits, IT, marketing | Over 47,000 employees; significant IT infrastructure costs. |

| Financing Costs | Interest expenses on debt | Substantial interest expenses reported in 2023; rising rates could increase costs. |

Revenue Streams

Xiamen C&D's primary revenue engine is its extensive commodity trading and distribution operations. This segment is built on moving significant volumes of key resources like metals, pulp, minerals, and agricultural products across global markets. For instance, in 2023, this segment was a dominant force, contributing a substantial portion of the company's overall financial performance, reflecting its historical significance as the largest revenue generator.

Xiamen C&D generates revenue through its robust supply chain management and logistics services. This includes fees for warehousing, efficient transportation networks, and specialized value-added services tailored to client needs. This area has seen a significant push and impressive growth in recent years, reflecting its importance to their overall business model.

For instance, in 2023, Xiamen C&D reported substantial revenue from its integrated supply chain services. The company’s logistics segment, a core component of these fees, contributed significantly to its financial performance, demonstrating a clear trend of increasing demand for these critical operational functions.

Xiamen C&D's revenue is substantially boosted by the sale of its developed residential and commercial properties. This core activity directly reflects the success and market reception of their diverse real estate projects.

Beyond outright sales, the company also generates ongoing income through property leasing and management services. This provides a more stable and predictable revenue stream, complementing the transactional nature of property sales.

For instance, in 2023, Xiamen C&D's real estate segment reported significant revenue contributions, with property sales and leasing forming the bedrock of this performance. The company's strategic focus on urban development and diversified property types, including residential, commercial, and logistics, underpins the strength of these revenue streams.

Hotel Operations and Tourism Services Revenue

Xiamen C&D's hospitality segment generates significant income through its extensive hotel operations and a range of tourism services. This revenue is primarily driven by room bookings, which reflect occupancy rates and average daily rates across their properties. Beyond accommodation, sales from food and beverage outlets within the hotels, along with other guest services, contribute to this diversified income stream.

The company's strategy leverages its substantial hospitality asset portfolio to maximize revenue from these operations. This includes optimizing pricing, enhancing guest experiences, and cross-selling services to drive greater spend per customer. For instance, in 2024, the hotel sector continued to see recovery, with many major hotel chains reporting strong RevPAR (Revenue Per Available Room) growth, indicating a healthy demand for travel and hospitality services that Xiamen C&D benefits from.

- Room Bookings: Income generated from guests staying in hotel rooms.

- Food and Beverage Sales: Revenue from restaurants, bars, and room service within hotels.

- Ancillary Services: Income from other guest services like spas, event rentals, and tours.

- Tourism Packages: Revenue from bundled offerings that combine accommodation with local experiences.

Returns from Emerging Industry Investments

Xiamen C&D generates revenue from its strategic investments in burgeoning sectors, including new energy and advanced manufacturing. These returns manifest as dividends, profits from selling stakes (capital gains), or through planned divestitures.

This revenue stream is crucial for Xiamen C&D, as it taps into future growth opportunities. For instance, in 2024, companies within the new energy sector saw significant investment inflows, with global investment in clean energy technologies reaching an estimated $1.7 trillion by the end of the year. Advanced manufacturing also experienced robust growth, driven by automation and AI adoption.

- New Energy Investments: Returns from capital invested in solar, wind, and electric vehicle supply chains.

- Advanced Manufacturing: Profits derived from stakes in companies focused on robotics, AI-driven production, and high-tech materials.

- Dividend Income: Regular payouts received from profitable holdings in these innovative industries.

- Capital Appreciation: Gains realized when the value of these emerging industry investments increases over time.

Xiamen C&D's diversified revenue streams are anchored by its significant commodity trading and distribution activities, which encompass metals, pulp, minerals, and agricultural products. Complementing this, the company generates substantial income from its integrated supply chain management and logistics services, including warehousing and transportation fees. Furthermore, its real estate segment contributes significantly through property sales and ongoing leasing and management income.

| Revenue Stream | Primary Activities | Key Drivers | 2023/2024 Relevance |

| Commodity Trading & Distribution | Trading and distributing metals, pulp, minerals, agricultural products. | Global demand, commodity prices, efficient logistics. | Historically the largest revenue generator, substantial volumes in 2023. |

| Supply Chain & Logistics | Warehousing, transportation, value-added services. | Client demand for efficient operations, network reach. | Showing impressive growth, critical operational support. |

| Real Estate Development & Management | Property sales (residential, commercial), property leasing. | Market demand for housing and commercial spaces, urban development projects. | Significant contributions from sales and leasing in 2023. |

| Hospitality | Hotel operations (room bookings), food & beverage, tourism services. | Occupancy rates, average daily rates, guest spending, tourism trends. | Benefiting from strong RevPAR growth in 2024, indicating healthy travel demand. |

| Strategic Investments | Investments in new energy and advanced manufacturing sectors. | Growth in emerging industries, capital gains, dividend income. | Tapping into future growth; global clean energy investment reached ~$1.7 trillion in 2024. |

Business Model Canvas Data Sources

The Xiamen C&D Business Model Canvas is built using extensive market research, industry trend analysis, and Xiamen C&D's own financial disclosures. These sources provide a robust foundation for understanding their customer segments, value propositions, and revenue streams.