CMS Info Systems PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CMS Info Systems Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping CMS Info Systems's future. Our comprehensive PESTLE analysis provides the crucial insights you need to anticipate market shifts and make informed strategic decisions. Don't get left behind; download the full, actionable report now and gain a significant competitive advantage.

Political factors

The Indian government's strong commitment to Digital India, particularly through initiatives like the Unified Payments Interface (UPI) and Jan Dhan Yojana, significantly shapes the demand for cash management services. While digital payments are on the rise, these programs also drive economic formalization, which can boost the need for secure cash logistics in areas still reliant on physical currency.

For instance, UPI transactions in India saw a remarkable surge, reaching an estimated 130 billion transactions in FY24, a testament to the government's digital push. This growth, however, doesn't negate the continued importance of cash, especially in semi-urban and rural regions. CMS Info Systems, as a key player in cash logistics, benefits from this dual ecosystem, ensuring secure cash movement even as digital adoption accelerates.

The Reserve Bank of India (RBI) is the primary regulator for financial services in India, directly influencing cash management and logistics. Changes to RBI guidelines regarding cash handling, ATM operations, and security for cash transportation can significantly alter CMS Info Systems' operational methods and associated compliance expenses. For example, the RBI's focus on the digital ecosystem, including mandates for higher run-off rates on digital deposit accounts, aims to reduce risks within fast-growing fintech sectors, indirectly affecting cash demand and management strategies.

Government policies aimed at boosting India's logistics infrastructure, such as continued investment in road and rail networks, directly benefit CMS Info Systems by enabling more efficient and secure transit of cash and valuables. This improved connectivity can translate to lower operational expenses and enhanced service reliability.

The Union Budget 2024-25 is anticipated to prioritize further infrastructure development and regulatory simplification within the logistics sector, creating a more favorable operating environment for companies like CMS Info Systems.

Financial Inclusion Initiatives

Government initiatives like the Payments Infrastructure Development Fund (PIDF) are crucial for expanding financial services, including ATM and cash point access, into underserved regions. This directly influences the demand for cash handling services, particularly in areas where digital payment adoption is still growing.

The Reserve Bank of India's Financial Inclusion Index (FI Index) demonstrates a positive trend, indicating increased participation in formal financial systems. For instance, the FI Index for March 2023 stood at 60.1, a rise from 56.4 in March 2022, highlighting deeper financial engagement across India.

- Growing Demand for Cash Services: Despite digital advancements, the continued expansion of financial inclusion often necessitates robust cash infrastructure, especially in rural and semi-urban locations.

- RBI's Financial Inclusion Index Growth: The consistent upward trajectory of the FI Index, reaching 60.1 in March 2023, signals a growing customer base for financial services, including those reliant on cash transactions.

- Impact on ATM Networks: Increased financial inclusion can lead to a sustained or even increased need for physical touchpoints like ATMs and cash deposit machines as new users enter the formal banking system.

Geopolitical Stability and Security Concerns

Geopolitical stability and internal security are paramount for CMS Info Systems, directly impacting the safety and efficiency of its cash logistics operations. A volatile political climate or a surge in crime rates, for instance, could force the company to bolster its security protocols, thereby increasing operational expenditures. Given the inherent security risks associated with handling cash, a stable political landscape is a fundamental requirement for CMS Info Systems' continued business operations.

For example, in India, where CMS Info Systems has a significant presence, the government's focus on internal security initiatives, such as the Safe City projects launched in various metropolitan areas, aims to reduce crime and enhance public safety. These initiatives, while beneficial for overall security, can also influence the operational environment for cash logistics providers by potentially raising expectations for security standards and compliance. The company's 2024 financial reports indicated that security-related expenditures formed a notable portion of its operating costs, underscoring the direct link between political stability and financial performance in this sector.

- Political stability is crucial for minimizing disruptions in cash-in-transit services.

- Increased crime rates necessitate higher security spending, impacting profit margins.

- Government initiatives focused on internal security can indirectly affect operational costs and compliance for cash logistics firms.

- CMS Info Systems' operational resilience is directly tied to the prevailing geopolitical and security conditions in its operating regions.

Government initiatives like Digital India continue to drive the adoption of electronic payments, yet simultaneously foster economic formalization, increasing the demand for secure cash logistics. The Reserve Bank of India's regulatory framework significantly influences operational costs and compliance for cash management services, with a recent focus on digital ecosystem risks. Furthermore, government investments in logistics infrastructure, as highlighted in the Union Budget 2024-25, are expected to enhance efficiency and reduce operational expenses for companies like CMS Info Systems.

| Factor | Impact on CMS Info Systems | Supporting Data/Trend (2024-2025) |

| Digital India Initiatives | Drives digital payments but also formalization, boosting cash logistics demand. | UPI transactions projected to exceed 130 billion in FY24. |

| RBI Regulations | Dictates operational methods and compliance costs for cash handling. | RBI's focus on digital risks and fintech sector influences cash management strategies. |

| Infrastructure Development | Improves efficiency and security of cash transit, lowering operational costs. | Union Budget 2024-25 expected to prioritize logistics infrastructure. |

| Financial Inclusion | Increases demand for cash services, especially in underserved areas. | RBI's FI Index reached 60.1 in March 2023, indicating deeper financial engagement. |

What is included in the product

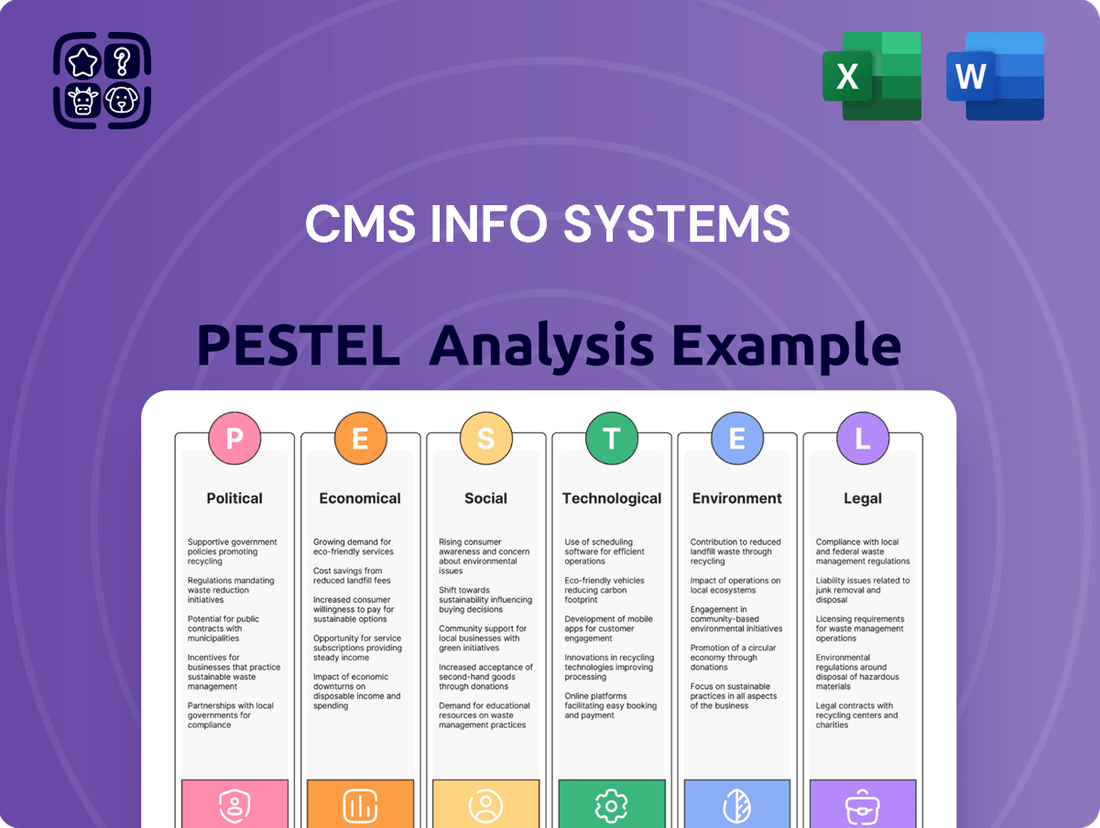

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing CMS Info Systems, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It equips stakeholders with actionable insights to navigate market dynamics and leverage opportunities by identifying key trends and potential challenges.

A concise PESTLE analysis for CMS Info Systems that highlights key external factors, serving as a readily accessible reference to alleviate concerns about market volatility and inform strategic decision-making.

Economic factors

India's economic engine is firing on all cylinders, with projections for FY 2024-25 indicating a robust GDP growth of 6.3%. This expansion directly fuels increased consumer spending and a higher volume of financial transactions, encompassing both digital and traditional cash-based activities. A thriving economy naturally leads to more money circulating, boosting the demand for essential services like ATM operations and efficient retail cash management.

CMS Info Systems' internal data underscores this trend, offering granular insights into how cash-driven domestic spending patterns are playing out across various sectors and states. Their analysis confirms that despite the digital push, cash continues to hold significant relevance in the Indian economic landscape, directly benefiting companies like CMS that manage cash infrastructure.

Digital payments, especially UPI, are booming in India, yet cash usage remains strong, particularly outside major cities, making up around 60% of consumer spending. This dual reality means CMS Info Systems must balance supporting the digital shift with serving the enduring cash economy.

The continued reliance on cash, especially in semi-urban and rural areas, highlights a persistent demand for cash-related services. CMS Info Systems' ability to manage and process physical currency remains a critical component of its operations, even as digital transaction volumes climb.

The Reserve Bank of India's (RBI) monetary policy decisions significantly shape the interest rate environment. For instance, a repo rate hike, like the one seen in early 2023 which brought the rate to 6.50%, increases borrowing costs for banks. This can make them more cost-conscious about their operational expenses, potentially leading them to seek more efficient outsourcing partners for cash management services, benefiting companies like CMS Info Systems.

Liquidity management is becoming increasingly sophisticated. The push towards real-time payment systems, such as UPI, has accelerated the need for businesses to manage cash flows with greater precision. CMS Info Systems, by leveraging AI-driven tools for forecasting and optimizing cash movement, can offer enhanced value to clients navigating this dynamic liquidity landscape. For example, improved forecasting can reduce idle cash balances, thereby lowering the effective cost of capital for businesses.

Inflation and Cost of Operations

Inflationary pressures directly impact CMS Info Systems' operational expenses. Rising fuel prices, for instance, increase the cost of cash logistics, while higher wage demands for security personnel and increased maintenance costs for ATMs and other equipment add to the financial burden. For example, India's retail inflation averaged 5.4% in 2023, a slight increase from 4.7% in 2022, indicating persistent cost pressures.

Effectively managing these escalating costs while ensuring competitive service pricing presents a significant ongoing challenge for the company. This balancing act is crucial for maintaining profitability and market share in the cash management and technology solutions sector.

- Fuel Price Volatility: Fluctuations in global crude oil prices directly affect the cost of transporting cash and servicing ATMs, impacting CMS Info Systems' logistics operations.

- Labor Costs: Increased inflation often leads to demands for higher wages for security personnel and other staff, raising salary expenses.

- Equipment Maintenance: The cost of spare parts and technical services for maintaining a large fleet of ATMs and other critical infrastructure can rise with inflation.

- Pricing Strategy: CMS Info Systems must carefully calibrate its service pricing to absorb increased operational costs without alienating its client base.

Credit Growth and Financial Sector Health

The financial sector's vitality is crucial for CMS Info Systems, as banks and MSMEs are its core clientele. Robust credit growth, especially in retail and MSME lending, fuels increased banking activity, directly boosting demand for cash management and managed services. A strong credit environment means more transactions and greater need for the services CMS provides.

Recent data indicates a positive trend in the financial sector's health. For instance, as of March 2024, the Gross Non-Performing Asset (GNPA) ratio for Scheduled Commercial Banks (SCBs) in India had declined to approximately 3.2%, a significant improvement from previous periods. This signifies a healthier credit environment.

Furthermore, the Capital Adequacy Ratio (CAR) for SCBs remained robust, standing at around 16.0% in early 2024, well above the regulatory minimum. This strong capital base allows banks to lend more confidently, supporting economic activity and, consequently, the demand for CMS Info Systems' services.

- Improved NPA Ratios: The GNPA ratio for Indian SCBs fell to about 3.2% by March 2024, indicating reduced credit risk.

- Healthy Capital Adequacy: SCBs maintained a CAR of roughly 16.0% in early 2024, ensuring lending capacity.

- Increased Lending: Growth in retail and MSME credit translates to higher transaction volumes for banks.

- Demand for Services: A more active banking sector directly correlates with increased demand for cash and managed services offered by CMS Info Systems.

India's projected GDP growth of 6.3% for FY 2024-25 fuels consumer spending and financial transactions, directly benefiting cash management services. Despite digital payment growth, cash still accounts for about 60% of consumer spending, especially outside major cities, ensuring continued demand for CMS Info Systems' core business. Rising inflation, with retail inflation averaging 5.4% in 2023, increases operational costs for CMS, particularly in logistics and labor, necessitating careful pricing strategies.

| Economic Factor | 2023 Data/Projection | Impact on CMS Info Systems |

| GDP Growth (FY 2024-25 Projection) | 6.3% | Increased consumer spending and financial transactions. |

| Cash Usage Share | ~60% of consumer spending | Sustained demand for cash management services. |

| Retail Inflation (2023 Average) | 5.4% | Increased operational costs (logistics, labor). |

Full Version Awaits

CMS Info Systems PESTLE Analysis

The preview shown here is the exact CMS Info Systems PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting CMS Info Systems. It provides critical insights for strategic decision-making.

Sociological factors

Despite the growing adoption of digital payment methods in India, a substantial segment of the population, especially in rural and semi-urban regions, still favors cash for everyday purchases. This persistent preference is rooted in a combination of factors such as varying levels of financial literacy, limited access to robust digital infrastructure, and deeply ingrained cultural habits around cash transactions.

CMS Info Systems' own 'CMS Consumption Report 2025' underscores the continued significance of cash in the Indian economy, indicating that cash still accounted for approximately 70% of all retail transactions in 2024, a figure expected to remain above 60% through 2025. This enduring reliance on physical currency directly impacts the demand for cash management services.

Financial literacy significantly shapes how readily people embrace digital payment systems. As more people understand financial concepts, the shift towards digital transactions is likely to increase, potentially impacting the long-term need for physical currency. For instance, in India, the government's push for financial literacy, coupled with initiatives like the Pradhan Mantri Jan Dhan Yojana, has seen a rise in digital payment adoption, with UPI transactions alone reaching over 10 billion in the fiscal year 2023-24.

However, greater financial inclusion, while promoting digital banking, also expands the customer base for traditional financial services. This expansion can sustain or even increase the demand for physical cash access points, such as ATMs, as new users integrate into the formal financial system. In 2024, global ATM cash withdrawal volumes are projected to remain robust, indicating that despite digital growth, physical cash still plays a crucial role in many economies.

India's rapid urbanization, with an estimated 35% of its population living in cities by 2024, presents a dual-edged sword for CMS Info Systems. While urban centers drive demand for sophisticated cash management and digital transaction support, the expansion of banking into tier 2 and tier 3 cities, along with rural areas, is equally significant.

This rural reach, however, often hinges on robust physical cash infrastructure. As of early 2025, a substantial portion of financial transactions in these areas still rely on cash, underscoring the continued need for ATMs and secure cash collection points. CMS Info Systems plays a vital role in facilitating this, ensuring that financial services reach underserved populations.

The company's ability to manage cash logistics effectively in diverse geographical settings is key to bridging the digital divide and promoting financial inclusion across India. This includes supporting the deployment and maintenance of ATM networks, which are critical touchpoints for rural banking.

Demographic Shifts and Youth Adoption

Demographic shifts significantly influence payment preferences. In 2024, India's population, with a median age around 28, boasts a substantial youth segment eager to embrace digital solutions. This youthful, tech-savvy demographic is a key driver for the increased adoption of digital payment methods, potentially signaling a long-term trend away from cash for this group.

However, CMS Info Systems must also consider the persistent reliance on cash by older demographics and those in less digitally integrated areas. This creates a bifurcated market. For instance, while digital transactions surged in urban centers, rural cash withdrawal volumes remained considerable in 2023, highlighting the need for continued cash management services.

- Youthful Demographics: India's median age of approximately 28 years in 2024 indicates a large proportion of the population is digitally native and open to new payment technologies.

- Digital Adoption Trends: Reports from 2023 and early 2024 show a consistent rise in digital transaction volumes, particularly among younger, urban populations.

- Cash Dependency: Despite digital growth, a significant portion of the population, especially in rural areas and among older age groups, continues to rely on cash for daily transactions.

- Dual Market Opportunity: CMS Info Systems can capitalize on this by offering both advanced digital payment infrastructure and robust cash handling and ATM services.

Trust in Formal Financial Systems

Public confidence in formal financial systems underpins the stability and efficiency of the entire economic landscape. For CMS Info Systems, a vital player in cash management, this trust is a foundational element. When people trust banks and financial institutions, they are more likely to engage with them, which in turn drives the need for services like secure cash handling and ATM management that CMS provides.

Recent data indicates a generally stable, albeit varied, level of trust in financial institutions globally. For instance, a 2024 Edelman Trust Barometer report showed that while trust in business and government fluctuated, financial services often remained a sector with moderate to high trust levels in many developed economies. However, specific events, like the regional banking concerns in early 2023, can temporarily shake this confidence, potentially influencing consumer behavior regarding cash versus digital transactions.

The reliance on cash management services is directly correlated with public engagement in the formal financial system. If trust falters, leading to increased cash hoarding or a shift away from traditional banking, it could impact the volume of transactions CMS handles. Conversely, a strengthening of trust, perhaps through enhanced regulatory oversight and improved digital security, would likely bolster demand for their services. For example, in India, the demonetization drive in 2016 initially disrupted cash flows but ultimately led to increased digital adoption and a renewed focus on secure cash logistics for the remaining cash economy, highlighting the dynamic interplay.

- Global Trust Levels: Edelman's 2024 Trust Barometer indicated that financial services generally maintained moderate to high trust levels in many developed markets.

- Impact of Shocks: Events like the 2023 regional banking concerns can cause temporary dips in public trust, potentially affecting cash usage.

- CMS's Indirect Benefit: CMS Info Systems benefits indirectly from a high-trust environment, as it supports the demand for secure cash handling services.

- Correlation with Cash Usage: Erosion of trust can lead to increased cash preference, impacting transaction volumes for cash management providers.

Societal norms and cultural preferences significantly shape payment behaviors. In India, the deep-seated habit of using cash for daily transactions, particularly in rural and semi-urban areas, persists despite the rise of digital payments. This cultural inertia, combined with varying levels of financial literacy and access to digital infrastructure, means cash management services remain essential. For example, CMS Info Systems' own data from early 2025 indicated that cash still represented a substantial portion of retail transactions, likely exceeding 60% through the year, directly influencing the demand for their services.

Technological factors

The proliferation of digital payment platforms, particularly India's Unified Payments Interface (UPI), is fundamentally reshaping transaction habits, directly impacting the demand for cash handling services. As of early 2024, UPI transactions were consistently exceeding 10 billion monthly volumes, a stark indicator of its growing dominance. This rapid digital adoption presents a significant technological factor for CMS Info Systems, as it necessitates a strategic shift towards managing and securing a more diverse payment ecosystem.

While UPI's trajectory is undeniably upward, cash continues to demonstrate remarkable resilience, especially in smaller value transactions and certain demographic segments, creating a hybrid payment environment. CMS Info Systems must therefore focus on technological integration, potentially through advanced cash recycling machines and secure digital payment processing solutions, to remain relevant and competitive. Adapting to this evolving landscape by offering innovative, technology-driven cash management and payment solutions will be crucial for sustained growth.

The banking sector's embrace of automation and AI is rapidly transforming cash management. These technologies are streamlining operations, from real-time cash tracking to sophisticated risk assessment. For instance, by mid-2024, many major banks reported significant reductions in transaction processing times due to AI-driven automation, with some seeing efficiency gains of up to 30%.

CMS Info Systems can harness these advancements to its advantage. Implementing AI for predictive analytics can optimize ATM cash replenishment schedules, reducing both stock-outs and overstocking. This data-driven approach, coupled with automated processing of cash movements, promises to boost operational efficiency and cost savings, aligning with the industry's push towards digital transformation.

As financial transactions increasingly shift to digital channels, the demand for strong cybersecurity and data protection solutions is escalating. For CMS Info Systems, this translates to a critical need for ongoing investment in sophisticated security measures to safeguard sensitive information concerning cash flows and client operations, particularly given the escalating cyber threats targeting the banking industry.

The banking sector, a primary client base for CMS Info Systems, witnessed a significant surge in cyberattacks in 2024. Reports indicate a 30% increase in ransomware attacks targeting financial institutions compared to the previous year, highlighting the urgent need for advanced defense mechanisms to protect client data and maintain operational integrity.

Banking Automation and Managed Services

Technological advancements in banking automation, particularly the rise of smarter ATMs and advanced self-service kiosks, directly impact CMS Info Systems. These innovations create a demand for enhanced managed services, allowing CMS to broaden its offerings beyond traditional ATM maintenance to include more complex, technology-driven solutions for financial institutions.

The increasing adoption of digital banking channels and the need for seamless customer experiences are driving further investment in ATM technology. For instance, by the end of 2024, it's projected that over 70% of banking transactions in India will occur through digital channels, pushing banks to upgrade their ATM networks to support more varied services like cash recycling and video teller capabilities.

- ATM Network Growth: The Indian ATM market is expected to reach approximately 300,000 units by 2025, a significant increase from around 220,000 in 2023, indicating sustained demand for ATM deployment and managed services.

- Self-Service Kiosks: Banks are increasingly deploying self-service kiosks for tasks like account opening and loan applications, creating new managed service opportunities for companies like CMS.

- Cash Recycling Technology: The adoption of cash recycling ATMs, which can both dispense and accept cash, is growing, requiring specialized maintenance and management that CMS can provide.

Innovation in Cash Handling Technology

Advancements in cash handling technologies are significantly reshaping operational efficiencies. Innovations like smart safes, which automatically count and secure cash, and automated cash processing machines streamline the entire cash management cycle. Biometric authentication further bolsters security by ensuring only authorized personnel can access cash repositories, directly impacting CMS Info Systems' operational integrity and client trust.

The adoption of these cutting-edge solutions offers tangible benefits. For instance, smart safes can reduce cash handling errors by up to 90% compared to manual methods, as reported by industry studies. This heightened accuracy, coupled with faster processing times, translates into substantial cost savings for CMS Info Systems and demonstrably enhances the quality of service provided to their diverse clientele.

Key technological factors influencing CMS Info Systems include:

- Smart Safes: These devices automate cash counting, verification, and secure storage, reducing manual errors and increasing speed.

- Automated Cash Processing Machines: Capable of high-volume sorting, counting, and bundling of currency, these machines significantly boost efficiency in cash centers.

- Biometric Authentication: Implementing fingerprint or facial recognition for access control to cash vaults and processing areas adds a robust layer of security against unauthorized access.

- Real-time Tracking and Reporting: Advanced software solutions provide instant visibility into cash inventory and movement, enabling better forecasting and fraud detection.

The rapid growth of digital payments, exemplified by India's UPI consistently processing over 10 billion monthly transactions as of early 2024, necessitates CMS Info Systems' adaptation to a hybrid payment landscape. This digital shift, while reducing reliance on physical cash for some transactions, also creates opportunities for integrated digital payment solutions alongside cash management.

AI and automation are transforming banking operations, leading to streamlined cash tracking and risk assessment, with banks reporting up to 30% efficiency gains by mid-2024. CMS can leverage these technologies for optimized ATM cash replenishment and enhanced operational efficiency.

The increasing demand for robust cybersecurity, driven by a 30% rise in ransomware attacks on financial institutions in 2024, requires CMS to invest heavily in protecting sensitive financial data and ensuring operational integrity against escalating cyber threats.

Technological advancements in ATMs and self-service kiosks are expanding managed service opportunities for CMS, as banks aim to offer more diverse services and improve customer experiences, with over 70% of Indian banking transactions projected to be digital by end-2024.

| Technology | Impact on CMS Info Systems | Key Data/Trend |

| UPI Growth | Shift towards hybrid payment management | 10+ billion monthly transactions (early 2024) |

| AI & Automation | Operational efficiency, predictive analytics | Up to 30% efficiency gains in banking (mid-2024) |

| Cybersecurity Demand | Need for enhanced security solutions | 30% increase in ransomware attacks (2024) |

| ATM/Kiosk Advancements | Expanded managed service offerings | 70%+ digital transactions projected (end-2024) |

Legal factors

The Digital Personal Data Protection Act (DPDP Act), 2023, along with the anticipated Draft Digital Personal Data Protection Rules, 2025, introduces significant legal obligations for CMS Info Systems regarding the handling of personal data. This legislation mandates strict adherence to consent mechanisms, data minimization, and transparent data processing practices.

CMS Info Systems must navigate new requirements concerning data breach notifications and the appointment of a Data Protection Officer, ensuring robust data governance frameworks are in place. Failure to comply with these evolving regulations could lead to substantial penalties, potentially impacting financial performance and operational continuity.

The Reserve Bank of India (RBI) imposes stringent regulations on cash logistics, dictating security protocols for cash vans, vault specifications, and personnel vetting and training. CMS Info Systems must comply with these mandates to maintain its operational license.

Recent RBI directives, for instance, have emphasized enhanced GPS tracking and tamper-evident seals for cash vans, impacting operational costs and requiring continuous investment in technology upgrades to meet these evolving security standards.

CMS Info Systems, as a prominent cash management entity, faces significant legal obligations under Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These rules are designed to thwart illicit financial flows and require the company to implement rigorous internal checks and reporting systems. For instance, the Reserve Bank of India's (RBI) master direction on KYC, updated periodically, mandates specific customer identification procedures that CMS must adhere to.

Any shifts or enhancements in these regulatory frameworks, such as stricter beneficial ownership disclosure requirements or new reporting thresholds, can directly influence CMS Info Systems' operational workflows and compliance costs. The Financial Action Task Force (FATF) recommendations, which often inform national legislation, continue to evolve, pushing for greater transparency and robust detection of suspicious transactions, impacting how CMS verifies customer identities and monitors transactions.

Labor Laws and Employment Regulations

CMS Info Systems, operating in cash logistics and managed services, is deeply affected by India's labor laws. These regulations govern everything from minimum wages to workplace safety, directly influencing the company's operational costs and its ability to adapt its workforce. For instance, the Code on Industrial Relations, 2020, aims to consolidate and simplify existing labor laws, potentially altering compliance requirements for companies like CMS.

Changes in employment regulations can significantly impact human resource expenses. For example, an increase in the minimum wage mandated by the government, or new provisions for employee benefits, would directly raise CMS Info Systems' payroll costs. The company's operational flexibility is also tied to these laws, particularly concerning hiring, firing, and working hours.

Key labor laws impacting CMS Info Systems include:

- The Code on Wages, 2019: This code consolidates laws relating to wages, including minimum wages, equal remuneration, and payment of wages, impacting CMS's compensation structures.

- The Code on Industrial Relations, 2020: This code covers trade unions, conditions of employment, and industrial disputes, affecting CMS's employee relations and workforce management.

- The Code on Social Security, 2020: This code deals with social security and welfare measures for workers, potentially increasing employer contributions for schemes like provident fund and gratuity.

Adherence to these evolving legal frameworks is crucial for CMS Info Systems to maintain smooth operations and avoid penalties, ensuring a stable and compliant business environment.

Competition Law and Market Dominance

CMS Info Systems, as India's leading cash management services provider, navigates a landscape shaped by robust competition laws. These regulations are designed to prevent monopolistic practices and ensure a level playing field for all market participants. For CMS, this means adhering strictly to fair competition principles and avoiding any actions that could be construed as anti-competitive behavior, especially given its significant market share.

The regulatory environment, particularly concerning market dominance, poses a critical factor for CMS Info Systems. Any investigation or stricter enforcement by competition authorities, such as the Competition Commission of India (CCI), could lead to significant operational constraints or even penalties. For instance, the CCI actively scrutinizes mergers and acquisitions to prevent undue concentration of market power, which could affect CMS's future expansion strategies.

- Regulatory Scrutiny: CMS must ensure its market practices comply with India's Competition Act, 2002, which prohibits anti-competitive agreements and abuse of dominant position.

- Merger & Acquisition Impact: Potential acquisitions by CMS could face rigorous review by the CCI, impacting its growth trajectory and market consolidation efforts.

- Fair Play: The company is expected to maintain fair pricing and service provision, preventing any actions that could disadvantage smaller competitors or consumers.

CMS Info Systems must strictly adhere to the Digital Personal Data Protection Act (DPDP Act), 2023, and upcoming rules, focusing on consent, data minimization, and breach notifications. The Reserve Bank of India (RBI) imposes stringent security and operational standards for cash logistics, requiring continuous investment in technology like enhanced GPS tracking for cash vans. Furthermore, compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, as updated by the RBI and influenced by Financial Action Task Force (FATF) recommendations, is critical for preventing illicit financial flows.

Environmental factors

The extensive cash logistics network of CMS Info Systems relies heavily on a large fleet of vehicles, a significant contributor to carbon emissions. In 2023, the global logistics sector saw a notable increase in discussions around decarbonization, with many companies setting targets for fleet electrification and route optimization to curb environmental impact.

As environmental consciousness escalates and regulatory frameworks become more stringent, CMS Info Systems is likely to encounter increasing pressure to integrate sustainable logistics practices. This could involve investments in electric vehicles (EVs) or advanced route planning software to minimize fuel consumption and reduce their carbon footprint, aligning with the industry's growing emphasis on sustainability.

CMS Info Systems, involved in ATM maintenance and technology, faces increasing scrutiny regarding electronic waste (e-waste) generated from its operations. Stricter regulations, like those in India's E-Waste (Management) Rules, 2022, mandate responsible collection, recycling, and disposal of discarded electronic equipment, impacting CMS's operational costs and supply chain management.

The company's commitment to sustainability, often detailed in its annual reports, is crucial for navigating these environmental factors. For instance, a focus on extending the lifespan of ATM components or partnering with certified e-waste recyclers can mitigate compliance risks and enhance corporate social responsibility, a growing concern for investors and stakeholders in 2024.

CMS Info Systems' operations, including its extensive ATM network, cash processing facilities, and logistics for cash transportation, inherently require significant energy and fuel. For instance, in 2023, global energy prices saw fluctuations, with Brent crude oil averaging around $82 per barrel, impacting fuel costs for transportation fleets.

The increasing focus on environmental sustainability and potential future regulations could push CMS Info Systems to explore more energy-efficient technologies and alternative energy sources. Companies in the logistics and cash management sectors are increasingly looking at electric vehicles for their fleets to reduce their carbon footprint and operational costs, a trend likely to accelerate through 2024 and 2025.

Climate Change and Extreme Weather Events

Climate change is increasing the frequency and intensity of extreme weather events, posing a significant risk to CMS Info Systems' cash logistics operations. For instance, the increasing prevalence of heavy rainfall and flooding in India, as observed in the monsoon seasons of 2023 and projected for 2024, could disrupt the movement of cash, particularly in vulnerable regions. This necessitates strong contingency planning and investment in resilient infrastructure to ensure business continuity.

CMS Info Systems must prepare for potential disruptions to its supply chain and operational efficiency due to these environmental shifts. The company's reliance on physical transportation networks makes it susceptible to weather-related delays and damage.

- Increased operational costs: Rerouting, repairs, and emergency services due to extreme weather can escalate expenses.

- Service delivery interruptions: Delays in cash replenishment or withdrawal services can impact customer satisfaction and revenue.

- Infrastructure vulnerability: Facilities in flood plains or coastal areas face higher risks of damage.

- Supply chain resilience: Ensuring the availability of vehicles and secure cash transit routes during adverse weather is crucial.

Corporate Social Responsibility and Green Initiatives

CMS Info Systems faces growing pressure from stakeholders, including investors and customers, to enhance its Corporate Social Responsibility (CSR) and environmental, social, and governance (ESG) performance. This trend is likely to push the company towards adopting more sustainable operational practices and transparently reporting on its environmental footprint.

The increasing focus on green initiatives means CMS Info Systems may need to invest in eco-friendly technologies and processes to meet evolving market expectations and regulatory demands. For instance, a growing number of institutional investors, such as BlackRock, have been vocal about prioritizing companies with strong ESG credentials, impacting capital allocation decisions.

- Investor Scrutiny: Investors increasingly use ESG ratings to guide investment decisions, potentially influencing CMS Info Systems' access to capital.

- Client Demand: Corporate clients are often seeking partners with demonstrable commitments to sustainability, creating a competitive advantage for environmentally conscious firms.

- Regulatory Landscape: Evolving environmental regulations globally could necessitate changes in operational practices for companies like CMS Info Systems.

- Public Perception: A strong CSR and green initiative profile can positively impact brand image and public trust, which is crucial in the service industry.

CMS Info Systems' operations are significantly impacted by environmental factors, particularly concerning carbon emissions from its extensive cash logistics fleet. The global push for decarbonization, with many companies setting targets for fleet electrification, directly influences CMS's need to adopt greener transportation solutions through 2024 and 2025.

The company must also contend with increasing electronic waste (e-waste) regulations, such as India's E-Waste (Management) Rules, 2022, which mandate responsible disposal and recycling of discarded equipment, adding to operational costs and supply chain considerations.

Extreme weather events, amplified by climate change, pose a direct risk to CMS's cash logistics and ATM network, potentially causing service disruptions and increased operational expenses. For instance, India's monsoon patterns in 2023 and projections for 2024 highlight the vulnerability of transportation networks.

Growing stakeholder demand for Corporate Social Responsibility (CSR) and strong Environmental, Social, and Governance (ESG) performance means CMS needs to invest in sustainable practices and transparently report its environmental footprint to maintain investor confidence and competitive advantage.

PESTLE Analysis Data Sources

Our PESTLE Analysis for CMS Info Systems is meticulously constructed using data from reputable sources like the World Economic Forum, national statistical offices, and leading technology research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the information systems sector.