CMS Info Systems Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CMS Info Systems Bundle

Curious about CMS Info Systems' product portfolio performance? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. To truly understand their strategic positioning and unlock actionable insights for growth, purchase the full BCG Matrix report.

Stars

CMS Info Systems is making waves with its AIoT remote monitoring solutions, especially in bank branch surveillance. This area is experiencing rapid growth as financial institutions embrace technology for better security and efficiency. The company's focus on these advanced solutions positions it well for future expansion.

The securing of significant mandates for bank branch transformation projects highlights the demand for CMS's AIoT capabilities. This suggests a strong market appetite for these innovative services, pointing towards a high growth trajectory for this segment of their business.

With over 40 deep learning AI modules developed, CMS Info Systems is clearly shifting towards high-tech offerings. This strategic move into potentially higher-margin, technology-driven services is a key indicator of their evolving business model and future revenue potential.

CMS Info Systems' Retail Cash Management (RCM) and Retail 360 solution are poised to capitalize on India's burgeoning organized retail sector. This segment exhibits a strong need for payment automation, secure cash handling, and immediate store-level financial reconciliation. CMS's integrated approach, combining cash logistics with AIoT remote monitoring and streamlined settlements, offers a distinct advantage.

The Retail 360 platform is designed to go beyond traditional banking services, catering specifically to the evolving demands of retail businesses. This expansion into a new client base is a key driver for future growth. For instance, India's retail sector is projected to reach $1.7 trillion by 2026, according to IBEF, highlighting the substantial market opportunity for CMS's specialized solutions.

CMS Info Systems' Managed Services and Technology Solutions segment is a significant growth driver. This division, encompassing banking automation, brown label ATM services, and software solutions, has experienced a remarkable surge, with revenues climbing by over 30%.

The company is projected to surpass ₹1000 crore in revenue for this segment in FY25, highlighting its expanding footprint in the outsourcing needs of financial institutions. This performance underscores the increasing demand for integrated technology and managed services within the financial sector.

Strategic Acquisitions and Partnerships

CMS Info Systems is strategically enhancing its market position through key acquisitions and partnerships. A significant move is the binding agreement to acquire up to 100% of Securing Systems Private Limited. This acquisition targets the high-growth area of AIoT remote monitoring, bolstering CMS's technological edge.

This expansion is particularly focused on surveillance analytics and compliance technology for the banking sector. Such strategic initiatives aim to integrate advanced solutions and broaden the company's service offerings in critical financial infrastructure segments.

- Acquisition of Securing Systems Private Limited: Binding agreement to acquire up to 100% of the company specializing in AIoT remote monitoring.

- Focus Areas: Enhancing capabilities in surveillance analytics and compliance technology for banks.

- Strategic Rationale: Expansion into high-growth technology segments and strengthening of service offerings.

Expansion in Semi-Urban and Rural Areas

While digital payments are gaining traction in India's major cities, a significant portion of semi-urban and rural areas still heavily rely on physical cash. This presents a substantial opportunity for CMS Info Systems. Their established infrastructure for ATM deployment and cash logistics is crucial for serving these underserved markets.

CMS's expansion into these regions aligns with government financial inclusion efforts, which are driving increased demand for cash management services. For instance, the Pradhan Mantri Jan Dhan Yojana has significantly expanded banking access, leading to greater cash withdrawal needs in rural India.

- Growing Cash Demand: Despite digital growth, cash remains king in many rural and semi-urban pockets of India.

- Financial Inclusion Impact: Initiatives like PMJDY are boosting cash usage, creating a need for robust cash handling.

- CMS's Network Advantage: CMS's extensive ATM and cash logistics network is well-positioned to capitalize on this demand.

- Sustained Growth Potential: Expansion in these areas offers a clear path for continued revenue growth for CMS.

CMS Info Systems' AIoT remote monitoring solutions, particularly for bank branch surveillance, represent a significant "Star" in their BCG matrix. This segment is experiencing rapid growth, driven by financial institutions' increasing adoption of advanced security technologies. The company's development of over 40 deep learning AI modules underscores its commitment to high-tech, potentially high-margin offerings.

The acquisition of Securing Systems Private Limited further strengthens CMS's position in AIoT remote monitoring and surveillance analytics, targeting the high-growth banking sector. This strategic move is expected to bolster their technological capabilities and expand service offerings in critical financial infrastructure.

CMS's Managed Services and Technology Solutions segment, including banking automation and brown label ATMs, is also a strong performer, with revenues projected to surpass ₹1000 crore in FY25. This segment's remarkable revenue climb of over 30% highlights robust demand for integrated technology and managed services in the financial industry.

What is included in the product

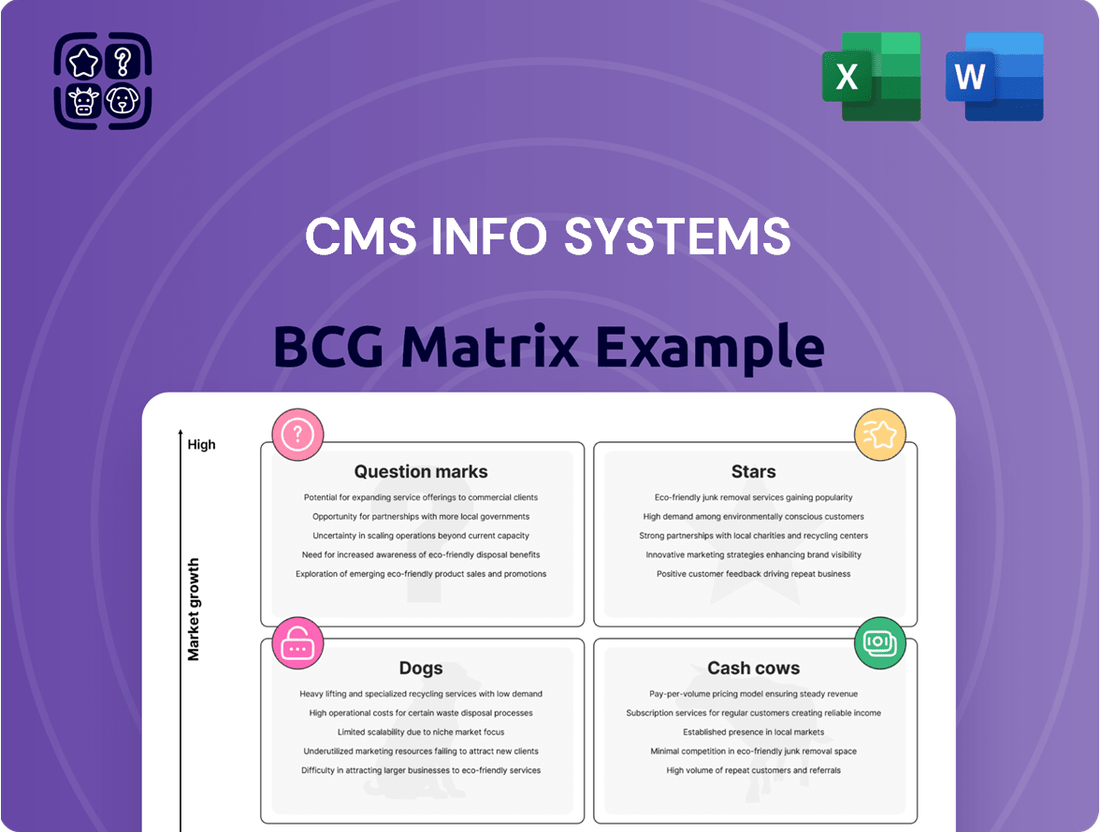

This BCG Matrix overview analyzes CMS Info Systems' product portfolio, categorizing them into Stars, Cash Cows, Question Marks, and Dogs to guide strategic decisions.

The CMS Info Systems BCG Matrix provides a clear, one-page overview, alleviating the pain of complex strategic analysis.

Cash Cows

CMS Info Systems' ATM cash management services represent a classic cash cow within its business portfolio. As India's largest player in this sector, CMS enjoys a dominant market share, ensuring a steady stream of revenue from ATM replenishment and maintenance.

This business segment thrives on the persistent demand for physical cash in India, a trend that continues even as digital payments gain traction. In the fiscal year 2023-24, CMS managed over 216,000 ATMs, processing a significant volume of cash transactions, highlighting the consistent cash generation from this operation.

CMS Info Systems' Cash-in-Transit (CIT) services represent a cornerstone of their business, firmly positioned as a Cash Cow. As a market leader in cash logistics, this segment provides secure transportation of cash, a vital service for banks and financial institutions, ensuring a stable and essential offering.

The CIT segment consistently demonstrates high operational efficiency, translating into a reliable and steady stream of cash flow for CMS. In FY23, CMS reported a revenue of ₹1,706 crore, with its cash logistics business forming a significant portion of this, highlighting its consistent performance.

CMS Info Systems' banking automation product sales and maintenance represent a classic Cash Cow. The company’s expertise in deploying and servicing ATMs, currency recyclers, and self-service kiosks leverages a substantial installed base.

While the growth rate for these established technologies may not match emerging fintech solutions, the recurring revenue from annual maintenance contracts provides a stable and highly profitable income stream. In 2024, CMS Info Systems continued to benefit from this predictable revenue, with maintenance services forming a significant portion of their profitability.

Established Client Relationships

CMS Info Systems benefits significantly from its established client relationships, particularly with major public and private sector banks. These long-standing partnerships are a cornerstone of their business, providing a predictable revenue stream and fostering trust in CMS's core service offerings.

These strong client ties translate into a stable base of recurring business, which is crucial for a Cash Cow. For example, in FY2024, CMS reported a significant portion of its revenue coming from repeat business, underscoring the value of these enduring relationships. The company's ability to retain clients and secure repeat contracts highlights their reliability and the perceived value of their services.

- Client Retention CMS has demonstrated a high client retention rate, a key indicator of a successful Cash Cow.

- Recurring Revenue Long-term contracts with major banks ensure a consistent and predictable revenue flow.

- Growth Opportunities Established relationships allow for cross-selling and up-selling of new services, driving incremental revenue growth.

- Market Stability The banking sector, a primary client base, offers a relatively stable market, further solidifying the Cash Cow status.

Large, Extensive Network and Infrastructure

CMS Info Systems leverages its vast pan-India network and high route density as a key strength, positioning it firmly within the Cash Cows quadrant of the BCG Matrix. This extensive infrastructure is not just a logistical asset but a significant competitive moat in the cash logistics industry.

The company's established network ensures operational efficiency and creates substantial barriers to entry for potential new players. This solidifies CMS Info Systems' dominant market position, allowing it to generate consistent, strong returns.

- Extensive Network: CMS Info Systems operates a widespread network across India, covering numerous cities and towns.

- High Route Density: The company benefits from high route density, optimizing its logistics and reducing per-delivery costs.

- Barriers to Entry: The significant investment required to replicate CMS's infrastructure deters new competitors.

- Market Dominance: This robust infrastructure underpins CMS's strong market share and consistent profitability.

CMS Info Systems' ATM cash management and Cash-in-Transit (CIT) services are robust cash cows, benefiting from India's continued reliance on physical cash. The company's extensive network and established client relationships, particularly with major banks, ensure a stable and predictable revenue stream.

In FY23, CMS managed over 216,000 ATMs, processing a substantial volume of transactions, underscoring the consistent cash generation from these operations. The company's strong client retention and recurring revenue from maintenance contracts further solidify its cash cow status.

CMS's banking automation product sales and maintenance, while not high-growth, provide a profitable income stream through annual maintenance contracts. This stable income, coupled with their market dominance in cash logistics, makes these segments reliable profit generators.

| Service Segment | BCG Matrix Position | Key Strengths | FY23 Revenue Contribution (Estimated) |

|---|---|---|---|

| ATM Cash Management | Cash Cow | Largest player in India, high transaction volumes | Significant portion of total revenue |

| Cash-in-Transit (CIT) | Cash Cow | Market leader, operational efficiency, vital service | Substantial portion of total revenue |

| Banking Automation Sales & Maintenance | Cash Cow | Large installed base, recurring maintenance revenue | Steady and profitable income stream |

What You’re Viewing Is Included

CMS Info Systems BCG Matrix

The BCG Matrix document you are currently previewing is the identical, fully formatted report you will receive immediately after completing your purchase. This means no watermarks, no placeholder text, and no hidden surprises – just the complete, analysis-ready strategic tool designed for clear business decision-making.

Dogs

Legacy ATM hardware sales, stripped of managed services, are increasingly categorized as a 'Dog' in the BCG Matrix for companies like CMS Info Systems. This is largely due to the industry's pivot towards ATM-as-a-Service, where banks prefer to outsource ATM operations and maintenance rather than purchase hardware outright.

This shift means that standalone hardware sales lack the recurring revenue streams and growth potential that characterize more successful business segments. For instance, in 2024, the global ATM market is seeing a significant portion of its growth driven by managed services and software solutions, with hardware sales alone showing more modest, if any, expansion.

Banks are prioritizing operational efficiency and cost reduction, making them less inclined to invest in hardware without the assurance of ongoing support and integration. This focus on outsourcing means that a simple transactional sale of ATM hardware, without the value-added services, struggles to compete in a market that demands integrated, end-to-end solutions.

For disorganized retail, basic cash pick-up and delivery services, particularly for smaller businesses lacking technology, might represent a Dogs segment within CMS Info Systems' BCG Matrix. These operations often face intense competition and struggle with scalability and profitability due to their low-margin nature.

In 2024, the unorganized retail sector in India, for instance, continues to be a significant part of the economy, but many of these businesses operate with minimal digital infrastructure, making them reliant on traditional cash handling. This scenario highlights the challenges for service providers like CMS in generating substantial returns from such basic, high-volume, low-value transactions.

Proprietary software solutions that are not regularly updated, lack AI/ML integration, or cannot be seamlessly integrated with newer digital banking platforms are considered Dogs in the BCG Matrix for CMS Info Systems. The banking sector's rapid digital transformation necessitates agile, interconnected systems, making these legacy solutions a significant drag on performance and innovation.

Manual, Labor-Intensive Processes Without Automation

Manual, labor-intensive processes without automation could be categorized as Dogs in the CMS Info Systems BCG Matrix. These are operations that require significant human effort and lack technological support, leading to inefficiencies.

In today's competitive landscape, where speed and accuracy are paramount, these manual workflows can significantly hinder a company's performance. For instance, a study by McKinsey in 2024 indicated that companies with high levels of automation experienced an average of 10-15% higher profit margins compared to those with lower automation rates.

These processes are often characterized by:

- High operational costs due to extensive labor requirements.

- Slower turnaround times and reduced output capacity.

- Increased susceptibility to human error, impacting quality and compliance.

Services Highly Susceptible to Digital Payment Dominance in Urban Areas

Services that exclusively rely on cash transactions in urban environments are particularly vulnerable as digital payment methods, especially UPI, continue their rapid expansion. This trend is underscored by a noticeable decline in ATM installations within these same urban centers. For instance, in 2023, UPI transactions in India surged to over 117 billion, a significant leap from previous years, indicating a clear shift away from cash.

This digital dominance directly impacts businesses that haven't adapted their payment infrastructure. Their reliance on cash makes them less convenient for a growing segment of the urban population. Consider the implications for small vendors or traditional service providers who have not integrated digital payment options.

- Cash-only retail outlets in metropolitan areas.

- Traditional taxi services without digital payment integration.

- Small, independent repair shops not accepting digital wallets.

- Certain types of street food vendors.

Legacy ATM hardware sales, detached from managed services, represent a 'Dog' for CMS Info Systems. The market's shift to ATM-as-a-Service and the rise of digital payments like UPI, which saw over 117 billion transactions in India in 2023, reduces demand for standalone hardware.

Manual, labor-intensive processes without automation also fall into the 'Dog' category due to high costs and inefficiencies. McKinsey data from 2024 suggests automated companies achieve 10-15% higher profit margins.

Cash-only services in urban areas, such as small vendors or traditional taxi services not accepting digital payments, are increasingly marginalized. This is evident in the declining ATM installations in urban centers, contrasting with the explosive growth of digital payment methods.

Proprietary software lacking AI/ML integration or seamless compatibility with modern digital banking platforms are also 'Dogs'. The banking sector's rapid digital transformation demands agile, interconnected systems, making these legacy solutions a performance bottleneck.

Question Marks

CMS Info Systems provides essential financial card issuance and management, alongside card personalization services. These offerings are critical components within the financial services sector.

The growth trajectory for CMS's card personalization services, particularly in light of increasing digital-only card adoption and the dominance of mobile payment solutions, will be a key determinant of its position. For example, the global digital payment market was valued at approximately $2.4 trillion in 2023 and is projected to grow significantly.

If CMS can maintain a strong market share and capitalize on evolving payment technologies, these services could potentially elevate to Star status within the BCG matrix. This would signify high growth and a strong competitive position.

CMS Info Systems' extensive development of over 40 deep learning AI modules presents a significant opportunity beyond its current surveillance applications, which are considered a 'Star' in the BCG matrix. These newer AI/ML modules, while not yet fully commercialized, represent potential 'Question Marks'.

The success of these emerging AI/ML applications hinges on their market acceptance and seamless integration into CMS's existing or new service ecosystems. For instance, AI-driven predictive maintenance for ATMs or personalized customer engagement tools could unlock new revenue streams, but their initial market penetration and scalability are yet to be proven.

CMS Info Systems is strategically eyeing expansion into high-growth adjacent sectors such as government, e-commerce logistics, and healthcare, aiming to diversify its revenue streams beyond its traditional BFSI stronghold. These sectors present significant opportunities, with the Indian e-commerce logistics market alone projected to reach approximately $100 billion by 2027, indicating substantial potential for growth.

However, establishing a strong market presence in these new territories requires considerable investment and faces intense competition. CMS's current market share in these nascent areas is minimal, meaning the company must allocate substantial resources for market penetration and brand building, which positions these ventures as potential question marks within the BCG matrix framework.

Enhanced Data Analytics and Optimization Services for Clients

CMS Info Systems provides advanced data analytics and optimization services aimed at enhancing cash operations and payment processes for its clients. These solutions leverage data to identify inefficiencies and opportunities for improvement within financial workflows.

While the demand for data-driven insights in the financial services sector is robust, the specific market penetration and growth rate of CMS's advanced analytics offerings, when viewed as a distinct service line, could be considered a Question Mark within the BCG Matrix framework. This classification suggests potential for significant growth, but also acknowledges the need for further investment to solidify market position and capitalize on emerging trends.

- Market Uncertainty: The specific market share and growth trajectory of CMS's advanced analytics services are not yet clearly defined, indicating potential but also risk.

- Investment Need: Significant investment may be required to further develop and market these specialized data analytics capabilities to compete effectively.

- Industry Trend Alignment: The services align with the broader industry trend towards data-driven decision-making in financial operations.

- Optimization Focus: CMS's analytics are designed to optimize cash operations and payment processes, offering tangible value to clients.

Blockchain-based Solutions for Financial Security

The banking sector is actively investigating blockchain technology to bolster transparency and streamline financial transactions. If CMS Info Systems is cultivating or possesses early-stage blockchain solutions aimed at content security or financial operations, these would likely be categorized as Stars in a BCG Matrix. This classification stems from their potential for high growth in a burgeoning market, coupled with the substantial investments necessary for both development and widespread adoption.

Blockchain's inherent immutability and distributed ledger capabilities offer significant promise for enhancing financial security. For instance, by mid-2024, several major financial institutions were piloting blockchain for cross-border payments, aiming to reduce settlement times and costs. CMS Info Systems' involvement in developing such solutions positions them to capitalize on this trend.

- Enhanced Transaction Security: Blockchain's cryptographic nature makes financial transactions highly secure and tamper-proof.

- Increased Transparency: All participants on a blockchain can view transaction records, fostering greater trust and accountability.

- Operational Efficiency: Automating processes through smart contracts on a blockchain can significantly reduce manual intervention and errors in financial operations.

- Market Growth Potential: The global blockchain in financial services market was projected to reach over $11 billion by 2025, indicating substantial room for growth.

CMS Info Systems' nascent AI/ML modules, beyond their established surveillance applications, represent potential Question Marks. Their success hinges on market acceptance and integration into existing or new service ecosystems, with examples like AI-driven ATM predictive maintenance holding promise but requiring proven scalability.

The company's diversification into sectors like government, e-commerce logistics, and healthcare also falls into the Question Mark category. While these areas offer substantial growth potential, evidenced by the Indian e-commerce logistics market's projected $100 billion valuation by 2027, CMS faces significant investment needs and intense competition to establish market share.

CMS's advanced data analytics and optimization services, while aligned with the industry's move towards data-driven insights, are also considered Question Marks. Their market penetration and growth rate are not yet clearly defined, necessitating further investment to solidify their position against emerging trends.

CMS Info Systems' emerging AI/ML modules and diversification efforts into new sectors like e-commerce logistics are currently classified as Question Marks in the BCG matrix. These ventures show promise, with the Indian e-commerce logistics market alone projected to reach $100 billion by 2027, but require significant investment and face unproven market acceptance and intense competition for success.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data, including financial statements, market research reports, and industry growth forecasts, to provide a clear strategic overview.