CMS Info Systems Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CMS Info Systems Bundle

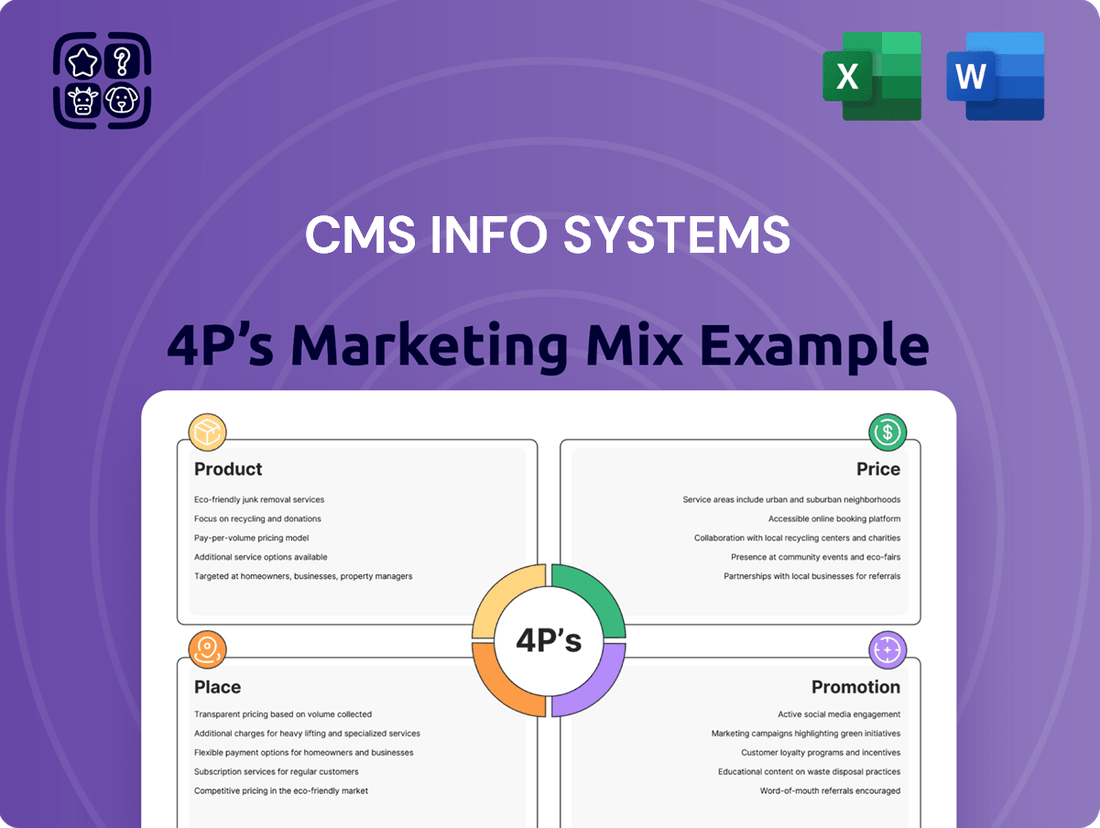

Dive into the strategic brilliance behind CMS Info Systems' marketing efforts with our comprehensive 4Ps analysis. We dissect their product innovation, pricing strategies, distribution channels, and promotional campaigns to reveal the secrets to their market dominance.

Go beyond the surface-level understanding and unlock actionable insights into how CMS Info Systems leverages each element of the marketing mix for maximum impact. This ready-to-use analysis is your key to understanding their success.

Save countless hours of research and gain a competitive edge. Our full 4Ps Marketing Mix Analysis for CMS Info Systems provides a detailed, professionally written blueprint, perfect for business professionals, students, and consultants seeking strategic advantages.

Product

CMS Info Systems' ATM and Retail Cash Management services form the core of their Product strategy, offering end-to-end solutions for cash logistics. This includes vital services like ATM replenishment and maintenance, ensuring machines remain operational for consumers. For retailers, CMS handles everything from cash collection to secure delivery and verification, a critical function for businesses reliant on physical currency transactions.

In 2023, CMS Info Systems managed approximately 234,000 ATMs, processing a significant volume of cash transactions. Their retail cash management segment saw continued growth, serving a vast network of retail outlets across India. This focus on essential, high-volume cash handling demonstrates their commitment to maintaining the smooth flow of currency within the Indian economy.

CMS Info Systems provides comprehensive managed services for banking automation, encompassing the entire lifecycle from sales and deployment to ongoing annual maintenance. This robust offering supports a range of banking automation products, including their brown label ATM solutions. These services are specifically designed to boost operational efficiency and simplify banking processes for financial institutions.

CMS Info Systems is making significant strides in technology, integrating AI and machine learning to enhance its cash management services. This focus on innovation is evident in their investment in advanced software solutions and AIoT remote monitoring, exemplified by offerings like HAWKAI and Retail 360.

These technological advancements provide clients with sophisticated analytics, streamlining cash operations and payment workflows. CMS's proprietary technology stack is crucial for deploying new AI modules, enabling detailed surveillance and management of entire branch networks.

Financial Card Issuance and Management

CMS Info Systems extends its services beyond traditional cash handling to encompass crucial financial card issuance and management for banking clients. This strategic diversification taps into the growing digital payments landscape.

Their card personalization services are a key component, utilizing advanced technology to prepare cards for customer use. This includes everything from embossing to magnetic stripe encoding and chip personalization, ensuring a seamless customer experience for banks.

This offering supports the entire payment ecosystem by providing end-to-end solutions for financial institutions. For instance, CMS Info Systems has been a significant player in enabling the digital transformation of payments for numerous banks across India.

- Card Issuance: Facilitating the creation and distribution of debit, credit, and prepaid cards.

- Personalization Services: Offering secure and efficient data embedding onto cards.

- Card Management: Providing ongoing support for card lifecycle management, including activation and replacement.

- Ecosystem Support: Integrating card services with broader banking and payment networks.

Integrated Business Services Platform

CMS Info Systems' Integrated Business Services Platform, under its new branding 'Unified Platform. Limitless Possibilities,' represents a significant evolution. This platform moves beyond traditional cash logistics, offering technology-driven solutions to foster client growth and digital transformation. For instance, in FY24, CMS reported a revenue of ₹1,726.6 crore, showcasing its expanded service offerings and market reach.

The product's value proposition lies in its integrated nature, leveraging CMS's vast network, technological advancements, and industry knowledge. This allows for a comprehensive suite of services, catering to diverse client needs. The company's commitment to innovation is evident in its continuous investment in technology, aiming to provide seamless and efficient business operations for its partners.

- Product: Integrated Business Services Platform

- Key Feature: Unified technology-driven solutions for client growth.

- Market Position: Evolved from cash logistics to a comprehensive service provider.

- Brand Promise: 'Unified Platform. Limitless Possibilities.'

CMS Info Systems' product strategy centers on its Integrated Business Services Platform, branded as 'Unified Platform. Limitless Possibilities.' This platform has evolved significantly from its origins in cash logistics to encompass a broader range of technology-driven solutions designed to fuel client growth and digital transformation.

The platform’s core strength lies in its comprehensive, end-to-end approach, integrating services like ATM and retail cash management with card issuance and personalization, all powered by advanced technology. This integrated offering aims to provide clients with seamless and efficient business operations.

CMS Info Systems is actively investing in AI and machine learning, evident in solutions like HAWKAI and Retail 360, to enhance its service delivery and provide sophisticated analytics. This technological focus underscores their commitment to innovation and expanding their value proposition beyond traditional cash handling.

In FY24, CMS Info Systems reported revenues of ₹1,726.6 crore, reflecting the expanded scope and market penetration of its diverse product and service offerings.

| Service Area | Key Offerings | Technology Focus | FY24 Revenue Contribution (Illustrative) |

|---|---|---|---|

| Cash Management | ATM Replenishment, Retail Cash Collection | AI for route optimization, AIoT monitoring | Significant portion of total revenue |

| Banking Automation | ATM Deployment & Maintenance, Brown Label ATMs | Managed services, operational efficiency tools | Growing segment |

| Card Services | Card Issuance, Personalization, Management | Advanced personalization technology | Expanding reach in digital payments |

| Integrated Platform | Unified technology solutions | AI, ML, proprietary software stack | Enabling cross-selling and new revenue streams |

What is included in the product

This analysis offers a comprehensive breakdown of CMS Info Systems' marketing mix, detailing their Product, Price, Place, and Promotion strategies with real-world examples and strategic implications.

Simplifies complex marketing strategies into actionable insights, relieving the pain of overwhelming data for clear decision-making.

Place

CMS Info Systems operates India's most extensive cash management network, covering all significant market segments like ATM cash replenishment and retail cash collection. This vast geographical reach and high route density are significant competitive differentiators, allowing them to serve a broad customer base efficiently.

Their network strategically links bank branches and currency chests, ensuring smooth and reliable cash movement across the entire nation. As of FY23, CMS managed cash for over 90,000 ATMs and processed cash for more than 150,000 retail touchpoints, highlighting the sheer scale of their operations.

CMS Info Systems boasts an impressive network, reaching 140,000 business touchpoints in Q1 FY25 and expanding to 143,000 by Q2 FY25. This growth underscores their commitment to broad market penetration.

This expansive network includes a significant number of ATM points and retail pick-up locations, demonstrating CMS Info Systems' dedication to accessibility and customer convenience across various service channels.

The sheer scale of these touchpoints allows CMS Info Systems to serve a diverse and widespread client base efficiently, maximizing their market presence and operational effectiveness.

CMS Info Systems prioritizes direct client engagement, building strong relationships with major banks and financial institutions. This strategy allows them to secure long-term, integrated contracts that are crucial for stable revenue streams. For example, their focus on end-to-end solutions for cash management and digital payment infrastructure is key to retaining these valuable clients.

Their direct sales model fosters deep enterprise engagement, ensuring that CMS understands and meets the specific needs of its clients, which include organized retail and e-commerce businesses. This tailored approach is a significant differentiator, leading to higher customer satisfaction and reduced churn. The recurring revenue generated from these long-term partnerships underpins their business model.

Strategic Partnerships and Outsourcing Trends

CMS Info Systems strategically positions itself as a vital partner for financial institutions and businesses, capitalizing on outsourcing trends in cash management and banking automation. This approach allows them to efficiently serve banks, Non-Banking Financial Companies (NBFCs), retailers, and e-commerce platforms.

Key growth drivers for CMS include the expansion of branch infrastructure by banks and the increasing trend of outsourcing within the retail sector. These trends directly translate into greater demand for CMS's specialized services.

- Partnership Focus CMS acts as a critical outsourcing partner for cash management and banking automation needs across various sectors.

- Growth Drivers Expansion of bank branches and retail sector outsourcing are significant contributors to CMS's business growth.

- Market Penetration In FY23, CMS Info Systems reported a significant increase in its ATM network, reaching over 138,000 touchpoints, highlighting its extensive reach through these partnerships.

Robust Logistics Infrastructure

CMS Info Systems leverages a robust logistics infrastructure for secure and efficient intra- and inter-city bulk currency transit. This network is crucial for maintaining product availability across its extensive operations, connecting over 14,000 bank branches.

This established network ensures timely and secure delivery, a cornerstone of their service. The efficiency of this logistics backbone directly impacts their ability to meet client demands across India.

- Extensive Network: Connects over 14,000 bank branches nationwide.

- Secure Transit: Facilitates safe and efficient bulk currency movement.

- Operational Efficiency: Guarantees product availability where and when needed.

- Inter-city Connectivity: Manages complex logistics for nationwide service.

CMS Info Systems' place strategy is defined by its unparalleled reach across India, touching over 143,000 business touchpoints by Q2 FY25. This expansive network, including a significant number of ATMs and retail pick-up locations, ensures broad market penetration and customer convenience.

Their strategic placement within the financial ecosystem, connecting over 14,000 bank branches, facilitates efficient cash movement and operational effectiveness. This deep integration allows them to serve a diverse client base, from major banks to e-commerce platforms, solidifying their position as a critical outsourcing partner.

The company's robust logistics infrastructure underpins its nationwide service, ensuring secure and timely transit of bulk currency. This established network is vital for maintaining product availability and meeting client demands across all service channels.

| Metric | Q1 FY25 | Q2 FY25 | FY23 |

|---|---|---|---|

| Total Business Touchpoints | 140,000 | 143,000 | N/A |

| ATM Network Managed | N/A | N/A | >90,000 |

| Retail Touchpoints Processed | N/A | N/A | >150,000 |

| Bank Branches Connected | N/A | N/A | >14,000 |

What You See Is What You Get

CMS Info Systems 4P's Marketing Mix Analysis

The preview you see here is the actual, complete CMS Info Systems 4P's Marketing Mix Analysis document you’ll receive instantly after purchase. This means you're viewing the exact version you'll download, ensuring no surprises. Our commitment is to provide you with the full, finished product, ready for immediate use.

Promotion

CMS Info Systems' new brand positioning, 'Unified Platform. Limitless Possibilities,' launched in early 2025, reflects a significant shift from its cash logistics roots. This rebranding emphasizes their evolution into a comprehensive business services provider, driven by a tech-led transformation.

This updated identity underscores CMS Info Systems' commitment to enabling innovation, showcasing a platform strength that extends far beyond its historical operational focus. The company's strategic move aims to capture a wider market by offering integrated solutions.

CMS Info Systems prioritizes transparent investor relations by consistently publishing financial results, press releases, and investor presentations. For instance, their proactive communication around their fiscal year-end results, often released by April of the following year, ensures stakeholders have timely access to performance data.

The company actively engages with the financial community through quarterly earnings calls. These calls, typically held within weeks of financial reporting periods, provide a platform to discuss performance, strategic direction, and address analyst questions, fostering a clear understanding of their business trajectory.

This commitment to open communication, including detailed responses to investor inquiries and readily available financial disclosures, cultivates trust and confidence among individual investors, financial professionals, and business strategists alike.

CMS Info Systems actively cultivates thought leadership through its publications, exemplified by initiatives like the 'CMS Consumption Report 2025.' This report offers critical insights into India's domestic spending trends, particularly those driven by cash transactions.

By releasing such detailed analyses, CMS Info Systems establishes itself as a key authority and contributor to discussions surrounding financial market dynamics. This strategic approach highlights their profound understanding of the sector and dedication to market intelligence.

Enhanced Digital Presence

CMS Info Systems' enhanced digital presence, particularly through their refreshed website cms.com, acts as a crucial element in their marketing mix. This platform effectively showcases their broad range of solutions and services, emphasizing how these offerings drive operational efficiency and positively impact customer business outcomes.

The website clearly articulates CMS Info Systems' dedication to providing solutions that are not only scalable and innovative but also deeply focused on customer needs. This strategic digital approach aims to attract and engage a diverse audience, from individual investors to business strategists, by providing accessible information on their capabilities.

- Website Refresh: CMS Info Systems has updated cms.com to better represent its service portfolio.

- Customer Value Proposition: The site highlights how their solutions improve operational efficiency and business results.

- Brand Messaging: It communicates a commitment to scalable, innovative, and customer-centric solutions.

- Digital Engagement: This enhanced online presence supports their broader marketing efforts to reach key stakeholders.

Emphasis on Technology-Driven Innovation

CMS Info Systems consistently highlights its technological prowess and sophisticated risk management. Their marketing efforts underscore investments in automation and bespoke in-house solutions, showcasing a commitment to innovation.

A significant aspect of their strategy is the integration of Artificial Intelligence (AI) and Machine Learning (ML). This focus aims to enhance operational efficiency and bolster security, positioning CMS as a forward-thinking technology partner.

This emphasis on technology serves as a key differentiator in the competitive landscape.

- Technology Investment: CMS Info Systems has been actively investing in AI and ML capabilities to streamline operations and enhance security protocols.

- Risk Management Focus: The company's promotional materials consistently emphasize its robust risk management framework, built on technological advancements.

- Customized Solutions: CMS offers tailored in-house solutions, demonstrating a capacity to adapt technology to specific client needs.

- Market Differentiation: By highlighting its technological innovation, CMS aims to stand out against competitors in the financial services technology sector.

CMS Info Systems leverages thought leadership, exemplified by its 2025 Consumption Report, to showcase deep market understanding and influence financial discourse. Their refreshed website, cms.com, serves as a central hub, clearly communicating their expanded service offerings and commitment to customer-centric, innovative solutions.

The company's promotional activities heavily emphasize technological advancements, particularly AI and ML integration, alongside robust risk management frameworks. This focus on innovation and tailored solutions aims to differentiate CMS in a competitive market, attracting a broad range of stakeholders.

| Marketing Activity | Key Message | Target Audience | Data Point/Example |

|---|---|---|---|

| Thought Leadership | Market insights and financial trends | Financial professionals, Business strategists | CMS Consumption Report 2025 |

| Digital Presence | Comprehensive solutions, operational efficiency | All stakeholders | Refreshed cms.com |

| Technology Focus | AI/ML integration, risk management | Investors, Business strategists | Investment in automation and bespoke solutions |

Price

CMS Info Systems likely employs a value-based pricing strategy, recognizing that their services in cash management, security, and operational efficiency are critical for banks and financial institutions. This means their pricing is set to reflect the substantial benefits clients receive, such as optimized cash operations and streamlined payment processes.

The company's pricing structure is designed to directly correlate with the significant value proposition they offer, ensuring that the perceived worth of their solutions is accurately represented in the cost. For instance, a reduction in cash handling errors or improved transaction speed directly translates into tangible cost savings and enhanced customer satisfaction for their clients.

This value-based approach is crucial in a sector where reliability and security are paramount. CMS Info Systems' ability to provide these essential services justifies a pricing model that captures the economic advantage and risk mitigation their solutions deliver to financial entities.

CMS Info Systems operates in India's regulated cash logistics sector, where pricing is a delicate balance between competitiveness and the significant costs of compliance. The Reserve Bank of India's stringent operating regulations act as a high entry barrier, fostering a stable competitive environment. This allows CMS to implement pricing strategies that are both sustainable and cost-effective, solidifying its market leadership. For instance, in the fiscal year 2023-24, CMS reported a revenue of ₹1,575 crore, demonstrating its ability to generate substantial income within this structured market.

CMS Info Systems heavily relies on recurring revenue, with a significant portion stemming from long-term contracts for cash logistics and managed services. This structure provides substantial financial predictability and stability for the company.

This recurring revenue model is a key driver of CMS Info Systems' consistent revenue growth, enabling robust strategic long-term planning and investment in service enhancements.

Profitability-Focused Pricing and Margin Management

CMS Info Systems employs a profitability-focused pricing strategy, evident in its healthy financial metrics. For fiscal year 2024, the company reported a gross profit margin of 40% and a net profit margin of 12%, showcasing its ability to manage costs effectively and price its services competitively while ensuring strong profitability.

The company's approach to margin management is proactive, with a keen focus on contract-level profitability. This is particularly crucial in growing areas like card services, where CMS Info Systems aims to secure sustainable revenue streams and maintain robust financial health through careful pricing and operational efficiency.

- Healthy Margins: FY24 gross profit margin at 40% and net profit margin at 12%.

- Contract Profitability: Active management of profitability at the individual contract level.

- Segment Focus: Emphasis on profitable growth within expanding segments like card services.

- Sustainable Growth: Pricing strategies designed to ensure long-term financial strength.

Strategic Pricing for Advanced Solutions

As CMS Info Systems ventures into advanced solutions like AIoT remote monitoring and banking automation, their pricing strategy reflects the significant value and innovation embedded within these offerings. These sophisticated technologies, built on proprietary tech stacks, are positioned at a premium to capture the enhanced efficiency and data-driven insights they deliver to clients.

This premium pricing aligns with the industry trend for advanced technological services, where customers are willing to invest more for solutions that offer tangible benefits such as reduced operational costs and improved security. For instance, in the banking sector, automation solutions can lead to substantial cost savings, justifying a higher initial investment. CMS's focus on proprietary technology further supports this pricing model, as it signifies unique capabilities not easily replicated by competitors.

- Value-Based Pricing: Pricing is tied to the quantifiable benefits and operational improvements delivered by AIoT and automation solutions.

- Premium for Innovation: The specialized nature of their advanced technology stack and data analytics commands a higher price point.

- Market Alignment: Pricing reflects industry benchmarks for advanced technological services in the financial and IoT sectors.

CMS Info Systems' pricing strategy is deeply rooted in the value delivered to its clients, especially within India's tightly regulated cash logistics sector. The company has demonstrated strong financial performance, with revenues reaching ₹1,575 crore in FY24, reflecting its ability to command competitive pricing in a market with high entry barriers. This pricing reflects the significant cost savings and operational efficiencies their services provide.

The company's profitability focus is evident in its healthy margins, with a gross profit margin of 40% and a net profit margin of 12% reported for FY24. CMS actively manages profitability at the contract level, particularly in growth areas like card services, ensuring sustainable revenue streams and financial health through strategic pricing and operational efficiency.

CMS Info Systems also leverages a premium pricing model for its advanced solutions, such as AIoT remote monitoring and banking automation. This strategy is supported by the unique value proposition of their proprietary technology stacks, which offer enhanced efficiency and data-driven insights, aligning with industry trends for advanced technological services.

| Financial Metric | FY23 | FY24 |

| Revenue (₹ Crore) | 1,341 | 1,575 |

| Gross Profit Margin (%) | 39.5 | 40.0 |

| Net Profit Margin (%) | 11.2 | 12.0 |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis is grounded in official company disclosures, including financial reports and investor presentations, alongside direct observations of product offerings, pricing strategies, and distribution channels. We also incorporate data from reputable industry publications and competitive intelligence platforms.