CMS Info Systems Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CMS Info Systems Bundle

Unlock the strategic core of CMS Info Systems with our comprehensive Business Model Canvas. Discover how they connect with customers, deliver value, and generate revenue in a dynamic market. This detailed canvas is your key to understanding their operational blueprint.

Want to dissect CMS Info Systems's success? Our full Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market position. Perfect for strategic analysis and competitive benchmarking.

Dive into the actionable insights of CMS Info Systems's business model. This complete canvas details their value propositions, cost structures, and channels, providing a powerful tool for anyone looking to emulate or compete with their strategy. Get the full picture today.

Partnerships

CMS Info Systems heavily relies on its partnerships with a wide array of banking and financial institutions, encompassing both public and private sector banks, as well as Non-Banking Financial Companies (NBFCs). These collaborations are fundamental to their core cash management services, which include vital operations like ATM replenishment, secure cash-in-transit, and efficient retail cash management.

These banking relationships are not just about current operations; they are also instrumental in CMS Info Systems' strategic growth, particularly in expanding their managed services. This includes the deployment and management of banking automation solutions and the operation of brown label ATMs, further solidifying their role within the financial ecosystem.

The company's success in securing new orders from the BFSI sector, as evidenced by recent contract wins, underscores the strength and ongoing vitality of these crucial partnerships. For example, in the fiscal year 2023-24, CMS Info Systems continued to strengthen its ties with leading banks, securing significant contracts that reflect their trusted position in cash logistics and managed services.

CMS Info Systems partners with major retail chains and e-commerce giants for essential cash management services. This includes the secure collection, delivery, and processing of cash, a vital function for these businesses. In 2023, CMS reported significant growth in this segment, onboarding several new large retail clients, demonstrating the increasing reliance on their expertise.

The company is actively expanding its offerings beyond traditional banking, integrating advanced technology solutions for its retail partners. For instance, CMS is providing cash reconciliation and inventory management for quick commerce dark stores, enhancing operational efficiency. This strategic move reflects the evolving needs of the retail and e-commerce landscape.

CMS Info Systems partners with technology and software providers to bolster its managed services and tech solutions. This includes collaborations for AIoT remote monitoring and multi-vendor software for banking automation, enabling the development of advanced systems like machine learning-based ATM surveillance.

ATM Original Equipment Manufacturers (OEMs)

CMS Info Systems relies heavily on partnerships with ATM Original Equipment Manufacturers (OEMs). These collaborations are fundamental for the successful deployment, ongoing maintenance, and comprehensive managed services of its extensive ATM network, including the operation of brown label ATMs. Such relationships are critical for ensuring a consistent supply of reliable hardware and the necessary technical support to maintain the vast number of ATMs CMS manages throughout India.

These partnerships are vital for several reasons:

- Hardware Supply and Innovation: CMS partners with leading ATM OEMs to source the latest hardware, ensuring their network is equipped with modern, secure, and efficient machines. This is crucial for meeting evolving customer demands and regulatory requirements.

- Maintenance and Support: OEMs provide essential technical support and spare parts, which are indispensable for the swift resolution of issues and minimizing downtime across CMS's large ATM footprint.

- Brown Label ATM Operations: For brown label ATMs, where CMS provides the complete service, strong OEM relationships guarantee access to the necessary equipment and ongoing technical expertise to manage these installations effectively.

- Strategic Alignment: These partnerships often extend to joint development and strategic planning, allowing CMS to stay ahead in the rapidly changing fintech landscape by integrating new technologies and service offerings.

Security and Surveillance Companies

CMS Info Systems relies on security and surveillance companies to safeguard its operations. These partnerships are crucial for implementing advanced monitoring solutions. For instance, CMS utilizes AI and ML-powered surveillance for remote monitoring of ATMs and bank branches, often integrating third-party technology and expertise.

These collaborations are vital for maintaining the integrity of cash management and asset protection services. In 2023, CMS Info Systems reported a significant increase in its cash management volumes, underscoring the need for robust security infrastructure. Their network of over 13,000 ATMs and 1,000 cash vans necessitates reliable surveillance technology.

- Technological Integration: Partnerships facilitate the integration of cutting-edge surveillance systems, including AI and machine learning modules, enhancing remote monitoring capabilities.

- Asset Protection: Collaborations with security firms are fundamental to protecting CMS's extensive network of ATMs and cash handling infrastructure.

- Operational Efficiency: Advanced surveillance contributes to operational efficiency by enabling proactive threat detection and rapid response, minimizing potential losses.

- Compliance and Trust: Strong security partnerships bolster client trust and ensure compliance with stringent regulatory requirements in the financial services sector.

CMS Info Systems' key partnerships are the bedrock of its operational success and strategic expansion. These alliances, particularly with the BFSI sector, are critical for delivering core cash management services and driving growth in managed solutions. The company's ability to secure new contracts, such as those reported in fiscal year 2023-24 with leading banks, directly reflects the strength and reliability of these foundational relationships.

Furthermore, collaborations with technology providers are essential for enhancing CMS's service offerings, enabling the integration of advanced solutions like AIoT for remote monitoring and sophisticated software for banking automation. These tech partnerships are vital for staying competitive and developing innovative systems, including machine learning-based ATM surveillance.

CMS also leverages partnerships with security and surveillance firms to ensure the utmost protection for its assets and operations, which is crucial given the significant volumes of cash handled. The company's extensive network, comprising over 13,000 ATMs and 1,000 cash vans, necessitates robust security measures facilitated by these specialized collaborations.

| Partner Type | Role in CMS Business | Impact/Benefit |

|---|---|---|

| BFSI Institutions | Core cash management services (ATM replenishment, cash-in-transit) | Foundation for revenue, expansion of managed services (brown label ATMs) |

| Retail Chains & E-commerce | Cash collection, delivery, processing | Diversification of services, increased operational efficiency for clients |

| Technology & Software Providers | Enhancing managed services, AIoT, banking automation | Development of advanced systems, competitive edge in fintech |

| ATM OEMs | Hardware supply, maintenance, technical support | Ensuring network reliability, access to latest technology for ATM operations |

| Security & Surveillance Firms | Advanced monitoring, asset protection | Safeguarding operations, compliance, client trust |

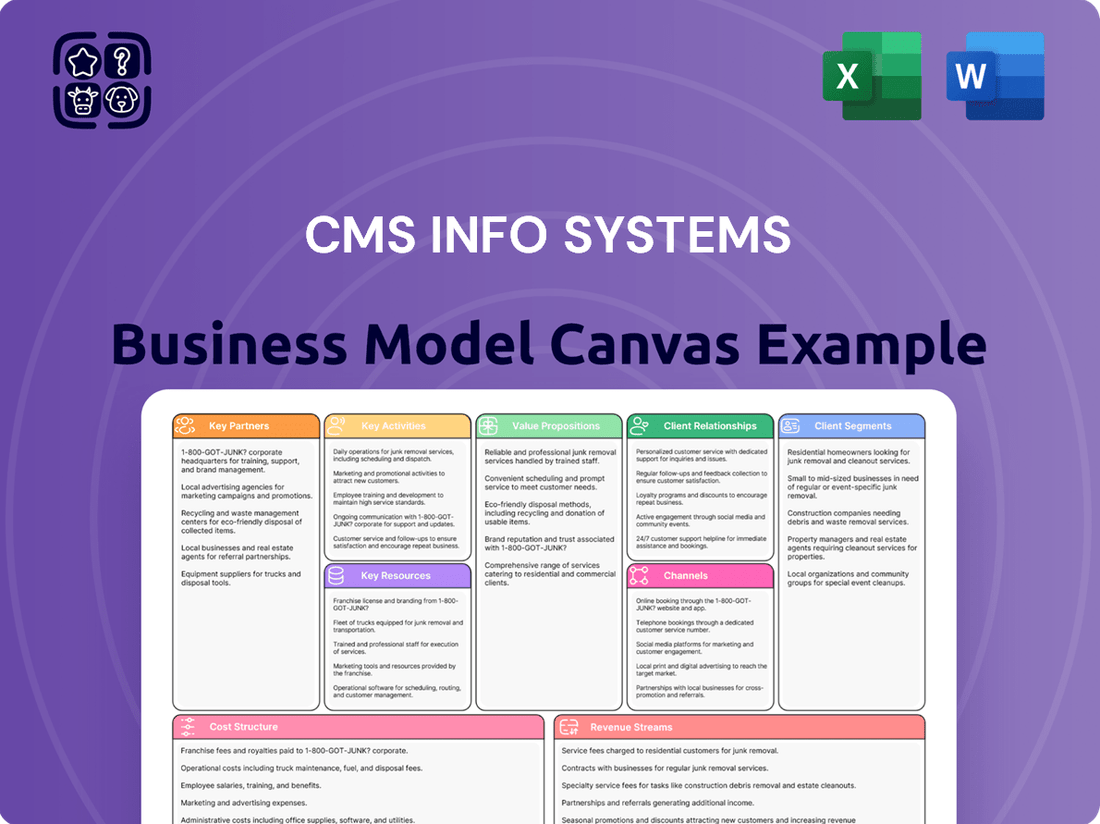

What is included in the product

A detailed, 9-block Business Model Canvas for CMS Info Systems, outlining their strategy for customer acquisition, service delivery, and revenue generation.

This model provides a clear roadmap of CMS Info Systems' operations, value propositions, and key partnerships, ideal for strategic planning and investor communication.

The CMS Info Systems Business Model Canvas acts as a pain point reliever by offering a clear, structured overview that simplifies complex strategies, making them easy to understand and adapt.

It alleviates the pain of information overload by condensing intricate business strategies into a single, digestible page, fostering clarity and actionable insights.

Activities

CMS Info Systems' cash logistics and management is central to its operations, encompassing the entire lifecycle of cash for businesses. This includes the crucial tasks of replenishing ATMs and ensuring their smooth functioning, alongside managing cash for retail clients through collection, delivery, and processing services. The company also provides secure cash-in-transit, a vital service for safeguarding financial assets.

As India's largest cash management company, CMS Info Systems plays a pivotal role in the nation's financial infrastructure. In 2024, the company managed an extensive network, overseeing a significant number of business points nationwide. This vast reach underscores their capability in handling large volumes of cash efficiently and securely across diverse geographical locations.

CMS Info Systems offers extensive managed services for banking automation, encompassing the setup and upkeep of automated banking products, brown label ATMs, and related services. This area is a major revenue driver for the company, experiencing robust expansion.

In the fiscal year 2024, CMS Info Systems reported that its managed services segment, which includes banking automation, contributed significantly to its overall performance, highlighting the growing demand for these solutions in the financial sector.

CMS Info Systems' core activities revolve around developing and deploying advanced technology solutions. This includes creating AIoT remote monitoring systems and sophisticated software, even integrating multi-vendor platforms, all designed to streamline cash operations and payment processing. These technological advancements are crucial for optimizing efficiency and security within their service offerings.

The company is actively expanding the reach of its technology solutions beyond the traditional BFSI sector. They are increasingly targeting the retail and quick commerce industries, demonstrating a commitment to adapting their innovations for a broader market. This strategic pivot highlights the versatility and growing demand for their specialized tech capabilities.

Card Issuance, Management, and Personalization

CMS Info Systems plays a crucial role in the financial ecosystem through its comprehensive card issuance, management, and personalization services. This directly supports financial institutions by streamlining their card operations and enhancing customer experience.

The company's expertise in card trading and personalization is a key activity that underpins its value proposition. By offering these services, CMS Info Systems enables banks and other financial entities to efficiently manage their card portfolios, from initial issuance to ongoing customer-specific customization.

- Card Issuance: CMS facilitates the end-to-end process of issuing various types of cards, including debit, credit, and prepaid cards, for its financial institution clients.

- Card Management: This involves the ongoing administration and support of issued cards, ensuring smooth operations and customer satisfaction.

- Card Personalization: CMS offers advanced personalization services, allowing for the customization of card features, data, and security elements to meet specific client and end-user requirements.

Strategic Acquisitions and Business Incubation

CMS Info Systems focuses on strategic acquisitions to bolster its presence in key growth areas. In 2024, the company continued to explore opportunities within the fintech sector, aiming to integrate innovative solutions into its existing service portfolio. This strategic expansion also extends to specialized logistics, enhancing its capabilities in delivering secure and efficient services across various industries.

Furthermore, CMS Info Systems is actively engaged in incubating new business ventures. A significant focus in 2024 has been the development of bullion logistics, catering to the specialized needs of precious metal handling. The company is also nurturing its debt collection services, particularly for non-bank lenders, addressing a critical need in the financial ecosystem.

- Strategic Acquisitions: Expanding into fintech and specialized logistics to broaden service offerings and market penetration.

- Business Incubation: Developing new ventures such as bullion logistics and debt collection services for non-bank financial institutions.

- Market Reach Enhancement: Utilizing acquisitions and incubations to strengthen its competitive position and customer base.

CMS Info Systems' key activities center on secure cash management, including ATM replenishment and retail cash handling. They also provide extensive banking automation managed services, covering ATM setup and maintenance, which proved a significant growth area in 2024. Furthermore, the company develops and deploys advanced technology solutions for payment processing and remote monitoring, increasingly targeting retail and quick commerce sectors.

The company's card issuance, management, and personalization services are vital for financial institutions, streamlining operations and enhancing customer experience. In 2024, CMS also focused on strategic acquisitions within fintech and specialized logistics, alongside incubating new ventures like bullion logistics and debt collection services for non-bank lenders.

| Key Activity | Description | 2024 Impact/Focus |

|---|---|---|

| Cash Logistics & Management | ATM replenishment, retail cash handling, secure cash-in-transit. | Managed a significant number of business points nationwide, handling large cash volumes. |

| Banking Automation Managed Services | Setup and upkeep of automated banking products, brown label ATMs. | Major revenue driver with robust expansion, contributing significantly to overall performance. |

| Technology Solutions Development | AIoT remote monitoring, software for cash operations and payment processing. | Expanding beyond BFSI to target retail and quick commerce industries. |

| Card Services | Card issuance, management, and personalization for financial institutions. | Key activity supporting financial institutions in managing card portfolios. |

| Strategic Expansion & Incubation | Fintech acquisitions, specialized logistics, bullion logistics, debt collection. | Explored fintech opportunities and developed new ventures like bullion logistics. |

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas preview you are viewing is an exact representation of the final document you will receive upon purchase. This ensures complete transparency, allowing you to see the professional structure and content that will be delivered. Once your order is complete, you will gain full access to this identical, ready-to-use Business Model Canvas, enabling you to immediately begin strategizing and refining your business.

Resources

CMS Info Systems boasts an extensive pan-India network, a cornerstone of its business model. This includes a substantial fleet of over 3,500 cash-in-transit (CIT) vehicles, ensuring secure and timely cash movement across the country. The company also operates a significant number of cash processing and vaulting facilities, strategically located to serve diverse geographical areas.

This vast physical infrastructure is crucial for their cash logistics and management services. In 2024, CMS Info Systems managed the cash for approximately 80,000 ATMs nationwide, highlighting the scale of their operational reach and the importance of their network in supporting the banking sector.

CMS Info Systems relies heavily on its substantial, trained workforce. This includes a vast number of cash logistics personnel, skilled ATM maintenance technicians, and dedicated security personnel. Their combined expertise is absolutely crucial for the secure and efficient management of cash, as well as maintaining the smooth operation of ATM and banking automation systems.

In 2024, CMS Info Systems' operational backbone is its workforce of over 13,000 employees. This large team is essential for their extensive cash logistics and ATM managed services operations across India. The company emphasizes continuous training to ensure these personnel are equipped with the latest skills in cash handling, security protocols, and technical maintenance, directly impacting service quality and reliability.

CMS Info Systems leverages proprietary technology and software platforms as a core asset. Key among these are in-house developed solutions such as HAWKAI, Retail 360, and ALGO. These platforms are crucial for their operations.

These technologies are not just for existing processes; they are designed to drive efficiency and enable new service offerings. The integration of machine learning and AI capabilities further enhances their ability to perform surveillance and optimize various business processes, providing a competitive edge.

For instance, in 2023, CMS Info Systems reported a significant increase in digital transactions processed through its platforms, indicating the growing reliance and effectiveness of its technological infrastructure. This technological backbone is vital for their service delivery and future growth.

Strong Client Relationships and Brand Reputation

CMS Info Systems leverages its established and deep relationships with major banks, financial institutions, and large retail chains as a key resource. These strong ties ensure recurring revenue streams and a consistent pipeline of new order wins, forming the bedrock of their business model.

The company's strong brand recognition, built on trust and respect among its diverse customer base, is another critical resource. This reputation is vital for securing new contracts and maintaining its competitive edge in the market.

- Client Retention: CMS reported a strong client retention rate, with over 90% of its top clients continuing their services, demonstrating the depth of these relationships.

- Brand Value: Independent market surveys in 2024 consistently ranked CMS among the top providers for reliability and service in the cash management and ATM outsourcing sector.

- Revenue Stability: Long-term contracts with major banking partners, many renewed in late 2023 and early 2024, contribute significantly to revenue predictability.

- Market Trust: The company's consistent performance and ethical dealings have fostered significant trust, making it a preferred partner for financial institutions seeking secure cash handling solutions.

Financial Capital and Robust Balance Sheet

CMS Info Systems leverages its robust financial capital, evidenced by strong internal accrual generation, to fuel its business model. As of the fiscal year ending March 31, 2024, the company maintained a healthy financial position with a significant cash and cash equivalents balance, enabling continued investment in its operational expansion and technological advancements.

The company's net debt-negative status is a key resource, providing financial flexibility and reducing reliance on external financing. This strong balance sheet allows CMS Info Systems to pursue strategic acquisitions and upgrade its infrastructure, ensuring it remains competitive in the cash management and IT services sectors.

This financial strength translates into tangible benefits:

- Operational Expansion: Funds available for growing service delivery networks and expanding geographical reach.

- Technology Investments: Capital allocated for upgrading ATM software, enhancing cybersecurity, and developing new digital solutions.

- Strategic Acquisitions: Financial capacity to identify and integrate complementary businesses to broaden service offerings.

- Cash Reserve: A substantial cash reserve provides a buffer against market volatility and supports ongoing operational needs.

CMS Info Systems' extensive pan-India network, including over 3,500 cash-in-transit vehicles and numerous cash processing facilities, forms the backbone of its operations. This infrastructure is critical for managing the vast volume of cash transactions it handles. In 2024, the company supported approximately 80,000 ATMs nationwide, underscoring its crucial role in the financial ecosystem.

The company's workforce of over 13,000 employees, encompassing cash logistics personnel, ATM technicians, and security staff, is a vital resource. Continuous training ensures these teams are adept at secure cash handling, security protocols, and technical maintenance, directly impacting service quality and reliability. Their expertise is paramount for the smooth functioning of ATM networks and cash management.

Proprietary technology platforms like HAWKAI and Retail 360 are key assets, driving operational efficiency and enabling new service offerings. The integration of AI and machine learning enhances surveillance and process optimization, providing a significant competitive advantage. Digital transactions processed through their platforms saw a notable increase in 2023, highlighting the effectiveness of their tech infrastructure.

Deep-rooted relationships with major banks, financial institutions, and retail chains are a cornerstone of CMS Info Systems' business model, ensuring recurring revenue and consistent contract wins. This is complemented by strong brand recognition built on trust and reliability. In 2024, client retention remained high at over 90% for top clients, and market surveys consistently ranked CMS as a top provider in its sector.

CMS Info Systems benefits from robust financial capital, with a net debt-negative status as of March 31, 2024, offering significant financial flexibility. This strong balance sheet allows for substantial investments in operational expansion, technological upgrades, and strategic acquisitions, ensuring continued competitiveness and growth in the cash management and IT services sectors.

| Key Resource | Description | 2024 Impact/Data |

| Physical Network | Pan-India network of CIT vehicles and processing facilities | Over 3,500 CIT vehicles; managed cash for ~80,000 ATMs |

| Human Capital | Trained workforce for logistics, maintenance, and security | Over 13,000 employees; emphasis on continuous skill development |

| Technology Platforms | Proprietary software (HAWKAI, Retail 360) with AI/ML capabilities | Increased digital transactions in 2023; enhanced process optimization |

| Client Relationships & Brand | Strong ties with banks/retailers; high brand trust and retention | >90% client retention; ranked top provider in market surveys |

| Financial Capital | Strong internal accruals, net debt-negative status | Financial flexibility for expansion and tech investment; healthy cash reserves |

Value Propositions

CMS Info Systems significantly reduces clients' risk of cash loss from theft, fraud, or robbery. This is achieved through their secure cash-in-transit logistics, stringent internal controls, and comprehensive insurance policies. For instance, in the fiscal year ending March 31, 2024, CMS reported a robust operational framework designed to minimize such incidents.

Further bolstering this value proposition, CMS employs advanced AI-led surveillance systems. These systems provide enhanced security for both ATMs and bank branches, offering real-time monitoring and rapid response capabilities. This technological integration directly contributes to a safer environment for cash handling and storage.

CMS Info Systems enhances operational efficiency for its clients by streamlining cash operations and payment processes, directly translating into significant cost savings. This is achieved through advanced automation solutions and technology-driven reconciliation, minimizing manual intervention and potential errors.

In 2023, CMS Info Systems reported a revenue of INR 1,760 crore, underscoring its substantial market presence and the demand for its efficiency-boosting services. Their focus on optimizing cash handling and payment flows allows businesses to reduce operational overheads and improve overall financial management.

As India's largest cash management company, CMS Info Systems boasts a formidable network that underpins its reliability and scale. This extensive reach ensures that essential services, like ATM replenishment and cash collection, are consistently delivered, even to the most remote corners of the country. This wide operational footprint is a significant competitive advantage in the diverse Indian landscape.

CMS Info Systems' ability to manage vast volumes of cash efficiently is a testament to its scalable infrastructure. For instance, in the fiscal year ending March 31, 2024, the company processed an average of ₹2,000 crore daily, demonstrating its capacity to handle significant transaction volumes reliably. This scale is crucial for meeting the demands of a rapidly growing economy.

Advanced Technology and Analytics

CMS Info Systems leverages advanced technology and analytics to offer clients a significant advantage. These solutions provide deep insights into cash operations, allowing for more informed decision-making and streamlined processes. For instance, the ability to remotely monitor cash points and automate banking functions directly contributes to operational efficiency.

This technological prowess empowers clients to optimize their entire payment ecosystem. By providing actionable data, CMS helps businesses make smarter choices, ultimately enhancing their financial operations and customer experience. This focus on data-driven insights is crucial in today's fast-paced financial landscape.

- Remote Monitoring Capabilities: Clients gain real-time visibility into their cash handling infrastructure, reducing downtime and improving security.

- Data-Driven Insights: Analytics provided by CMS help identify trends, optimize cash flow, and make strategic decisions for payment processing.

- Automation of Banking Processes: Streamlining tasks like cash replenishment and reconciliation through technology leads to cost savings and increased accuracy.

- Enhanced Payment Ecosystem: The integration of these technological solutions creates a more efficient and robust payment infrastructure for clients.

Comprehensive End-to-End Solutions

CMS Info Systems provides a comprehensive, end-to-end platform that seamlessly integrates cash logistics, managed services, and cutting-edge technology. This unified approach tackles the intricate challenges of cash and payments faced by banks, financial institutions, and retailers. For instance, in the fiscal year 2023, CMS Info Systems managed a significant volume of cash transactions, processing over INR 2.5 lakh crore, demonstrating the scale of their integrated solutions.

This holistic offering empowers clients by streamlining operations and enhancing efficiency across the entire cash lifecycle. Their services extend from secure cash collection and transportation to ATM management and cash processing. As of early 2024, CMS operates one of the largest ATM cash replenishment networks in India, serving over 100,000 ATMs, highlighting the breadth of their managed services.

- Integrated Cash Management: Combines logistics, services, and technology for a single point of contact.

- Operational Efficiency: Streamlines complex cash handling processes for financial institutions and retailers.

- Scalable Solutions: Caters to diverse needs, from individual ATM deployments to large-scale banking networks.

- Risk Mitigation: Leverages technology and expertise to reduce operational and security risks in cash handling.

CMS Info Systems offers unparalleled security and risk mitigation, safeguarding clients from financial losses due to theft or fraud. Their robust infrastructure and adherence to strict protocols, evidenced by their operational framework in FY24, ensure the integrity of cash handling. Advanced AI surveillance further bolsters this, providing real-time protection for ATMs and branches.

CMS Info Systems drives significant cost savings for clients by optimizing cash operations and payment processes through automation and technology. Their extensive network, serving over 100,000 ATMs as of early 2024, and daily cash processing volumes averaging ₹2,000 crore in FY24, highlight their ability to deliver efficiency at scale. This operational prowess translates directly into reduced overheads for businesses.

CMS Info Systems provides clients with a distinct competitive advantage through its extensive network and scalable infrastructure, ensuring reliable service delivery across India. As India's largest cash management company, their reach is critical for consistent ATM replenishment and cash collection, even in remote areas. This vast operational footprint is a key differentiator in the market.

Leveraging advanced technology and data analytics, CMS Info Systems empowers clients with actionable insights to optimize their payment ecosystems. Remote monitoring and automated banking functions, as seen in their FY24 operations, enhance decision-making and streamline processes. This data-driven approach boosts financial operations and customer experience.

| Value Proposition | Description | Key Metrics/Facts |

|---|---|---|

| Risk Mitigation & Security | Reduces client risk of cash loss through secure logistics, controls, and insurance. | Robust operational framework in FY24; AI-led surveillance for ATMs/branches. |

| Operational Efficiency & Cost Savings | Streamlines cash operations and payments via automation and technology. | Revenue of INR 1,760 crore in 2023; optimized cash handling reduces overheads. |

| Extensive Network & Scalability | Largest cash management network in India, ensuring reliable service delivery. | Serves over 100,000 ATMs (early 2024); processes ₹2,000 crore daily (FY24). |

| Technology & Data-Driven Insights | Leverages tech for remote monitoring and analytics to optimize payment ecosystems. | Actionable data for smarter financial operations; automated banking functions. |

Customer Relationships

CMS Info Systems prioritizes robust customer relationships through dedicated account management. These teams delve deep into understanding each client's unique requirements, enabling them to craft and deliver highly personalized solutions. This focus on tailored service cultivates enduring partnerships and client loyalty.

CMS Info Systems heavily relies on long-term service contracts, particularly for its managed services and technology solutions. These agreements are crucial as they generate stable, recurring revenue, demonstrating a deep level of integration and trust with their clients.

CMS Info Systems prioritizes operational excellence, ensuring seamless cash logistics and reliable ATM maintenance. Their commitment extends to swift troubleshooting of technology solutions, fostering client trust.

In fiscal year 2024, CMS Info Systems reported a significant increase in its service delivery efficiency, directly impacting customer satisfaction metrics. This focus on robust support underpins their strong customer relationships.

Technology-Driven Engagement

CMS Info Systems enhances customer relationships through technology, notably its AIoT remote monitoring solutions. This allows for proactive support and real-time client insights, shifting from reactive service to a data-driven, anticipatory approach.

This technological integration is crucial for maintaining and growing their client base. For instance, in fiscal year 2024, CMS reported a significant increase in managed service contracts, a direct result of their ability to offer advanced, technology-enabled support.

- Proactive Issue Resolution: AIoT enables early detection of potential equipment failures, minimizing downtime for clients.

- Data-Driven Insights: Clients receive performance analytics and operational reports, fostering transparency and trust.

- Enhanced Efficiency: Remote monitoring optimizes service dispatch and resource allocation, leading to cost savings for both CMS and its customers.

- Personalized Service: Tailored support based on real-time data allows for a more customized client experience.

Strategic Partnerships and Consultative Approach

CMS Info Systems fosters deep client connections through a consultative approach, offering expert advice to optimize cash and payment systems. This collaborative strategy is key to their customer relationships.

They actively partner with clients to co-create innovative solutions and broaden service offerings. A prime example is their work on large mandates for major banks, demonstrating a commitment to integrated service delivery.

- Consultative Engagement: CMS provides strategic advice on cash and payment ecosystems.

- Collaborative Development: They work with clients to build new solutions.

- Service Expansion: Partnerships aim to broaden the scope of services offered.

- Bank Mandates: Significant collaborations with large banks highlight this strategy.

CMS Info Systems cultivates customer relationships through a blend of personalized service, long-term contracts, and technology-driven support. Their proactive issue resolution, enhanced by AIoT monitoring, minimizes client downtime and builds trust. By acting as consultants and co-creators, CMS deepens partnerships and expands service offerings.

| Customer Relationship Aspect | Description | Fiscal Year 2024 Impact |

|---|---|---|

| Dedicated Account Management | Understanding unique client needs for tailored solutions. | Increased client retention and loyalty. |

| Long-Term Service Contracts | Stable, recurring revenue through managed services. | Demonstrates deep integration and trust with clients. |

| AIoT Remote Monitoring | Proactive support and real-time client insights. | Significant increase in managed service contracts. |

| Consultative Approach | Expert advice to optimize cash and payment systems. | Fosters collaborative development and service expansion. |

Channels

CMS Info Systems leverages its direct sales force and business development teams as crucial channels for customer acquisition and relationship expansion. These teams focus on securing new business, especially from large institutional clients such as banks, financial institutions, and major retail chains.

In 2024, CMS reported a significant increase in its order book, driven by these proactive sales efforts. The company's expansion into new product and service categories, like digital payment solutions, has been directly supported by the dedicated business development teams who identify and cultivate these emerging opportunities.

CMS Info Systems leverages its extensive physical network, comprising numerous branches, cash processing centers, and ATM points spread across India, as a primary channel. This widespread infrastructure is fundamental to delivering its core cash logistics services, including cash pick-up, delivery, and processing, directly to its diverse clientele.

This robust physical footprint is not just about reach; it represents a significant competitive moat for CMS Info Systems. As of the end of fiscal year 2023, the company managed a network of over 100,000 ATMs and had a presence in more than 2,000 cities and towns, underscoring its deep penetration into the Indian market.

CMS Info Systems leverages its proprietary technology platforms and digital interfaces to enhance service delivery. These digital tools, including those for remote monitoring and data analytics, provide clients with real-time information and streamline interactions. For instance, in 2024, CMS continued to invest in upgrading its ATM management software, aiming to improve uptime and customer experience.

These platforms are crucial for offering efficient and transparent services, enabling seamless communication and data exchange with clients. The company's focus on digital interfaces supports its strategy of providing value-added services beyond basic cash handling. CMS reported that its digital solutions contributed to a significant reduction in operational costs for its banking partners throughout 2024.

Referrals and Industry Reputation

CMS Info Systems leverages its robust industry reputation, particularly within the banking, financial services, and retail sectors, to foster significant referral business. This strong standing is a direct result of consistent reliability and high-quality service delivery, positioning CMS as a preferred partner for many organizations.

The company's commitment to excellence translates into tangible benefits, with a substantial portion of new business originating from satisfied clients and industry peers. For instance, in FY24, CMS Info Systems reported a healthy revenue growth, partly fueled by these established trust-based relationships.

- Strong Industry Trust: CMS Info Systems has cultivated a reputation for dependability and superior service in the BFSI and retail segments.

- Referral-Driven Growth: A considerable amount of new business is generated through referrals from existing clients and industry connections.

- Preferred Provider Status: The company's consistent performance makes it a go-to service provider for many businesses.

- FY24 Performance Indicator: The company's financial results in FY24 reflect the positive impact of its strong reputation and referral network.

Strategic Alliances and Joint Ventures

Strategic alliances and joint ventures represent potential channels for CMS Info Systems to penetrate new market segments or expand into different geographies, especially for their specialized technology solutions. This approach allows for shared risk and resources, facilitating entry where direct expansion might be challenging. For instance, a partnership could accelerate the adoption of their cash management or digital payment solutions in emerging markets.

CMS Info Systems also actively pursues acquisitions as a significant growth channel. These acquisitions can bring in new technologies, customer bases, or market access, thereby strengthening their overall business model. In 2023, the company continued to evaluate opportunities that align with its strategic objectives for expansion and service enhancement.

- Market Entry: Alliances can provide a faster route to new customer segments or geographic regions for specialized CMS services.

- Resource Leverage: Joint ventures enable sharing of capital, technology, and expertise, reducing individual investment burdens.

- Acquisition Strategy: CMS views acquisitions as a key channel for inorganic growth, integrating new capabilities and market share.

- Growth Acceleration: Both alliances and acquisitions are critical for CMS to accelerate its expansion and service diversification efforts.

CMS Info Systems utilizes its extensive physical network, including branches and cash processing centers, as a primary channel for delivering cash logistics services across India. This established infrastructure, with a presence in over 2,000 cities as of FY23, provides a significant competitive advantage and deep market penetration.

Proprietary technology platforms and digital interfaces serve as crucial channels for enhancing service delivery and client interaction, offering real-time data and streamlining operations. Investments in upgrading ATM management software in 2024 aim to boost uptime and customer satisfaction, while digital solutions demonstrably reduced operational costs for banking partners during the same year.

The company's strong industry reputation and established trust within the BFSI and retail sectors drive significant referral business, contributing to healthy revenue growth in FY24. This reliance on client satisfaction and industry connections underscores the power of reputation as a key channel for new business acquisition.

Strategic alliances and acquisitions are actively pursued as channels for market penetration and growth, enabling access to new technologies, customer bases, and geographic regions. These inorganic growth strategies are vital for diversifying services and expanding market share.

| Channel Type | Description | Key Benefit | 2023/2024 Data Point |

|---|---|---|---|

| Physical Network | Branches, cash centers, ATM points | Deep market penetration, competitive moat | Presence in >2,000 cities (FY23) |

| Digital Platforms | Proprietary software, client interfaces | Enhanced service, operational efficiency | Reduced operational costs for banks (2024) |

| Industry Reputation/Referrals | Client trust, industry connections | New business generation, revenue growth | Healthy revenue growth (FY24) |

| Alliances & Acquisitions | Partnerships, company takeovers | Market entry, technology/customer acquisition | Continued evaluation of acquisition opportunities (2023) |

Customer Segments

Public and private sector banks represent a cornerstone customer segment for CMS Info Systems. This includes a broad spectrum of essential services, from the secure and efficient management of ATM cash and their ongoing maintenance to the implementation and support of banking automation and advanced technology solutions.

CMS plays a critical role in supporting a substantial portion of the ATM network for these financial institutions. For instance, as of fiscal year 2024, CMS Info Systems managed cash for over 100,000 ATMs across India, serving a significant majority of the country's banking sector.

CMS Info Systems provides crucial cash management and technology solutions to Non-Banking Financial Companies (NBFCs). These services are tailored to address the unique operational challenges and security requirements inherent in the financial services sector.

NBFCs, which play a significant role in India's financial ecosystem, rely on CMS for secure cash handling, ATM management, and digital payment infrastructure. For instance, in FY23, CMS reported a significant increase in its cash management services, handling a substantial volume of cash for various financial institutions, including a growing number of NBFCs.

Organized retail chains represent a significant and expanding customer base for CMS Info Systems. These businesses rely on CMS for comprehensive cash management solutions, including the secure collection and delivery of cash, as well as efficient processing. In 2024, the retail sector continued its digital transformation, with chains increasingly adopting advanced technologies for automated cash reconciliation, a service CMS actively provides.

E-commerce Companies and Quick Commerce Platforms

E-commerce and quick commerce platforms are increasingly relying on CMS Info Systems for specialized logistics and cash management. These emerging players require efficient solutions for handling the physical movement of goods and payments, areas where CMS excels. For instance, CMS provides crucial services for cash collection and reconciliation, which are vital for the operational continuity of these businesses.

CMS's offerings extend to specialized logistics needs within the e-commerce ecosystem. This includes managing inventory at dark stores, a key component of quick commerce operations. By leveraging CMS's expertise, these platforms can streamline their supply chains and ensure timely delivery to customers. This segment represents a significant diversification for CMS, moving beyond its traditional focus on cash-heavy industries.

- E-commerce Growth: The Indian e-commerce market is projected to reach $350 billion by 2030, highlighting the growing demand for logistics and payment solutions.

- Quick Commerce Expansion: Quick commerce platforms are rapidly gaining traction, with players like Zepto and Blinkit focusing on ultra-fast delivery, necessitating robust backend support.

- CMS's Role: CMS Info Systems provides essential services like ATM cash management, retail cash logistics, and digital payment services, which are adaptable to the needs of e-commerce and quick commerce.

- Diversification Strategy: CMS's expansion into serving these digitally native businesses demonstrates a strategic move to tap into new growth avenues and reduce reliance on legacy cash-dependent sectors.

Other Businesses Requiring Specialized Logistics

CMS Info Systems is actively developing specialized logistics solutions for sectors beyond its traditional cash management. This includes incubating services for businesses needing secure and efficient handling of high-value assets, such as bullion. For example, in 2023, the global precious metals market saw significant activity, underscoring the demand for such specialized services.

Furthermore, CMS is targeting the debt collection sector, particularly for non-bank lenders. This expansion aims to leverage their existing logistical and operational expertise. The non-banking financial company (NBFC) sector in India has experienced substantial growth, with reports indicating a significant increase in loan disbursals in 2023, creating a fertile ground for these new CMS offerings.

- Bullion Logistics: Catering to the secure transportation and storage needs of precious metals.

- Debt Collection Services: Providing specialized logistical support for non-bank lenders' recovery processes.

- Market Opportunity: Capitalizing on the growing demand for specialized logistics in niche financial sectors.

- Expansion Strategy: Diversifying revenue streams by extending core competencies to new customer segments.

CMS Info Systems serves public and private sector banks, managing a vast ATM network and providing essential banking automation solutions. In fiscal year 2024, the company managed cash for over 100,000 ATMs across India, underscoring its critical role in the financial sector.

Non-Banking Financial Companies (NBFCs) are another key segment, relying on CMS for secure cash handling and ATM management. This segment saw increased engagement in FY23, reflecting the growing needs of NBFCs in India's financial ecosystem.

Organized retail chains and the rapidly expanding e-commerce and quick commerce sectors are increasingly turning to CMS for efficient cash management and specialized logistics. These digital-native businesses require robust backend support for payment processing and inventory management, areas where CMS demonstrates significant capability.

CMS is also expanding into niche sectors like bullion logistics and debt collection services for non-bank lenders, leveraging its existing expertise to tap into new growth avenues. The significant growth in India's NBFC sector in 2023 highlights the market opportunity for these specialized offerings.

| Customer Segment | Key Services Provided | FY24/Recent Data Point |

|---|---|---|

| Public & Private Banks | ATM Cash Management, ATM Maintenance, Banking Automation | Managed cash for over 100,000 ATMs |

| NBFCs | Secure Cash Handling, ATM Management, Digital Payment Infrastructure | Increased engagement in FY23 |

| Organized Retail Chains | Cash Collection & Delivery, Cash Processing, Automated Reconciliation | Growing adoption of advanced technologies |

| E-commerce & Quick Commerce | Specialized Logistics, Cash Collection & Reconciliation, Dark Store Inventory Management | Supporting digital-native businesses |

| Bullion & Debt Collection | Secure Asset Handling, Debt Recovery Logistics | Targeting niche financial sectors |

Cost Structure

CMS Info Systems' operational and logistics costs are substantial, largely due to the secure handling and movement of cash. These expenses encompass fuel for their fleet, regular vehicle maintenance, and the specialized security measures required for cash-in-transit services.

In 2024, the company's commitment to maintaining a vast network of cash collection and delivery points directly translates into significant logistical outlays. For instance, fuel price volatility and the need for highly trained security personnel for cash vans are key drivers impacting these operational expenditures.

Employee salaries and workforce management are a significant cost driver for CMS Info Systems due to the labor-intensive nature of its cash management and managed services operations. The company's extensive network of security personnel, technicians, and support staff requires substantial investment in compensation, training, and benefits.

In fiscal year 2023, CMS Info Systems reported employee-related expenses, including salaries and benefits, as a substantial portion of its overall operating costs. For instance, employee costs represented approximately 60% of their total operating expenses in that period, highlighting the critical impact of their workforce on the cost structure.

CMS Info Systems invests significantly in its technology infrastructure and software development. This includes the costs of building, keeping up, and improving its digital platforms, software offerings, and artificial intelligence and machine learning capabilities. As the company expands into more tech-focused solutions, these expenses are becoming an increasingly important part of its overall cost structure.

For the fiscal year ending March 31, 2023, CMS Info Systems reported a total expenditure of ₹1,431.9 crore. While specific breakdowns for technology infrastructure and software development aren't explicitly detailed in public summaries, it's a core area of investment for a business heavily reliant on technology-driven services like cash management and IT solutions.

Security and Insurance Expenses

CMS Info Systems faces significant security and insurance expenses due to the nature of its cash handling and transportation services. These costs are essential for safeguarding assets and personnel. In 2024, the company’s commitment to security was evident in its operational framework, which includes advanced surveillance systems and highly trained personnel. The insurance premiums are substantial, reflecting the inherent risks involved in managing large volumes of cash across various locations.

The company invests heavily in physical security infrastructure, such as secure cash vans, advanced locking mechanisms, and robust alarm systems. Furthermore, comprehensive insurance policies are procured to cover potential losses from theft, accidents, or other unforeseen events. These expenditures are critical to maintaining customer trust and ensuring the smooth, uninterrupted flow of cash for financial institutions and businesses.

- Armored Vehicle Fleet Maintenance: Costs associated with maintaining a fleet of armored vehicles equipped with advanced security features.

- Surveillance and Monitoring Systems: Investment in cutting-edge technology for real-time tracking and monitoring of cash transit operations.

- Comprehensive Insurance Premiums: Significant outlays for insurance coverage that mitigates risks related to cash in transit, employee safety, and potential liabilities.

- Security Personnel Training and Deployment: Expenses for hiring, training, and deploying highly skilled security personnel to manage and protect cash during transportation and handling.

Fixed Asset Depreciation and Maintenance

CMS Info Systems incurs costs for the depreciation and upkeep of its substantial fixed assets. These include the wear and tear on cash vaults, the ongoing maintenance of ATM machines used in its managed services, and the upkeep of its vehicle fleet essential for cash logistics.

In 2024, depreciation and maintenance represent a significant portion of CMS Info Systems' operational expenses. For instance, the company manages a vast network of ATMs, each requiring regular servicing and eventual replacement. Similarly, its fleet of armored vehicles necessitates consistent maintenance to ensure operational reliability and security.

- Depreciation of Fixed Assets: The value of cash vaults, ATM machines, and vehicles decreases over time, leading to depreciation charges that impact profitability.

- Maintenance Expenses: Regular servicing, repairs, and upgrades for ATMs and the vehicle fleet are critical to maintaining service quality and operational efficiency.

- Impact on Cost Structure: These expenditures directly contribute to the company's overall cost of goods sold and operating expenses, influencing pricing and margins.

CMS Info Systems' cost structure is heavily influenced by operational and logistical expenses related to secure cash handling, with employee costs representing a significant portion. In fiscal year 2023, employee-related expenses accounted for approximately 60% of their total operating costs. The company also invests substantially in technology infrastructure and security measures, including armored vehicle maintenance and insurance premiums, which are critical for mitigating risks in their cash-in-transit services.

| Cost Category | Description | Fiscal Year 2023 Impact (Approximate) |

|---|---|---|

| Employee Costs | Salaries, training, and benefits for security personnel, technicians, and support staff. | ~60% of total operating expenses |

| Logistics & Operations | Fuel, vehicle maintenance, and specialized security for cash transit. | Significant, driven by fuel prices and security needs. |

| Technology Infrastructure | Development and maintenance of digital platforms and AI/ML capabilities. | Increasingly important; part of total expenditure of ₹1,431.9 crore. |

| Security & Insurance | Surveillance systems, security personnel, and insurance premiums for asset protection. | Essential due to inherent risks in cash handling. |

| Fixed Asset Depreciation & Maintenance | Upkeep of cash vaults, ATMs, and armored vehicles. | Consistent expenditure to ensure operational reliability. |

Revenue Streams

CMS Info Systems generates the bulk of its income from fees associated with its cash logistics services. This includes managing ATM cash, collecting and processing cash for retailers, and secure cash transportation.

For the fiscal year ending March 31, 2024, CMS Info Systems reported a consolidated revenue of ₹1,600 crore, with cash logistics being the primary contributor to this figure.

CMS Info Systems generates substantial revenue through managed services, particularly for banking automation solutions. This includes the deployment, maintenance, and ongoing operational management of brown label ATMs, which are a key component of their service offering.

These fees are recurring and provide a stable income stream, reflecting the critical nature of ATM uptime and customer service for financial institutions. In the fiscal year 2024, CMS Info Systems reported robust growth in its cash management and ATM managed services, indicating the increasing reliance of banks on outsourced solutions for their cash infrastructure.

CMS Info Systems generates revenue by offering advanced technology solutions, including AIoT remote monitoring systems and bespoke software for tasks like cash reconciliation. These services are designed to streamline client operations and improve efficiency. The company is actively working to boost the contribution of this segment to its total revenue.

Card Services Fees

CMS Info Systems generates revenue through its card services division by facilitating card trading and offering card personalization services. These services are crucial for banks and financial institutions looking to issue and manage their card portfolios efficiently.

In the fiscal year 2024, CMS Info Systems reported significant contributions from its card services segment. For instance, the company's overall revenue saw a healthy uptick, with card-related services playing a vital role in this growth. This segment's performance is closely tied to the increasing adoption of digital payments and the demand for customized banking solutions.

- Card Trading: CMS Info Systems acts as a facilitator in the card ecosystem, enabling the smooth transaction and management of payment cards for its clients.

- Card Personalization: The company provides essential services to personalize cards with customer data, security features, and branding, making them ready for issuance.

- Clientele: Their primary clients include a wide range of banks and financial institutions that rely on these services for their card operations.

- Market Growth: The increasing penetration of debit and credit cards in India, driven by digital payment initiatives, directly fuels the demand for CMS Info Systems' card services.

New Business Incubations and Specialized Logistics

CMS Info Systems is expanding its revenue base through the incubation of new business ventures, notably in specialized logistics. This diversification includes services like bullion logistics, catering to the secure transportation needs of precious metals, and debt collection services specifically for non-bank lenders. These new avenues represent a strategic move to broaden CMS's market reach and leverage its existing operational expertise.

The company's foray into bullion logistics is particularly noteworthy, addressing a niche but critical segment of the financial services industry. Similarly, offering debt collection services to non-bank financial companies (NBFCs) allows CMS to tap into a growing market segment that requires specialized recovery solutions. These initiatives are designed to create new, recurring revenue streams and enhance overall profitability.

- Bullion Logistics: CMS is developing specialized services for the secure and efficient transportation of bullion, a high-value commodity requiring stringent security protocols.

- Debt Collection for NBFCs: The company is extending its expertise to provide debt recovery services for non-bank lenders, a sector experiencing significant growth.

- Diversification Strategy: These new business incubations are part of CMS's broader strategy to diversify its service portfolio beyond its traditional cash management and ATM services.

CMS Info Systems' revenue streams are primarily driven by cash logistics, including ATM cash management and secure transportation, which formed the core of its ₹1,600 crore revenue in FY24. The company also generates significant income from managed services for banking automation, especially brown label ATMs, ensuring their operational efficiency.

Card services, encompassing card trading and personalization for banks, contribute substantially to revenue, aligning with the growth of digital payments. Furthermore, CMS is expanding into specialized logistics like bullion transport and debt collection for NBFCs, diversifying its income base and leveraging existing expertise.

| Revenue Stream | Description | FY24 Contribution (Illustrative) |

|---|---|---|

| Cash Logistics | ATM cash management, cash collection, secure transport | Major contributor to ₹1,600 crore total revenue |

| Managed Services | ATM deployment, maintenance, operational management | Significant recurring revenue from banking automation |

| Card Services | Card trading, personalization for financial institutions | Growing segment driven by digital payment adoption |

| Specialized Logistics & New Ventures | Bullion logistics, debt collection for NBFCs | Emerging streams for diversification and growth |

Business Model Canvas Data Sources

The CMS Info Systems Business Model Canvas is built upon a foundation of operational data, customer feedback, and internal financial records. This ensures each component accurately reflects the company's current state and strategic direction.