Cloud Software Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cloud Software Group Bundle

Cloud Software Group's robust product portfolio and strategic acquisitions present significant strengths, but market saturation and evolving customer needs pose notable challenges. Understanding these dynamics is crucial for any stakeholder looking to navigate the competitive software landscape.

Want the full story behind Cloud Software Group's market position, including detailed insights into their competitive advantages and potential threats? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Cloud Software Group boasts a highly diversified product suite, encompassing essential enterprise solutions like application delivery, virtualization, data management, and analytics. This breadth is anchored by strong brands such as Citrix and TIBCO, which are critical for numerous IT functions.

The established market presence is undeniable, with Citrix alone serving over 400,000 clients globally. This includes an impressive 99% of Fortune 100 and 98% of Fortune 500 companies, highlighting significant brand recognition and deep penetration in key markets like virtualization and networking.

This extensive client base and product diversification inherently reduce the company's vulnerability to downturns in any single market segment or product line, creating a more resilient business model.

Cloud Software Group has solidified its market standing through key strategic alliances, most notably an eight-year partnership with Microsoft inked in April 2024. This significant collaboration includes a $1.65 billion investment by Cloud Software Group into Microsoft's cloud and generative AI technologies, positioning Microsoft Azure as its primary cloud platform.

This deep integration with Microsoft is vital for advancing Cloud Software Group's cloud solutions and accelerating AI-driven innovation. It directly supports the increasing enterprise demand for hybrid and multi-cloud environments, enhancing their go-to-market approach.

Cloud Software Group's strategic emphasis on hybrid cloud solutions directly addresses a significant market trend, with an estimated 90% of enterprises expected to utilize hybrid cloud environments by 2024. This alignment ensures their offerings are relevant to a broad customer base navigating complex cloud strategies.

The company's proactive integration of generative AI, exemplified by the Spotfire Copilot powered by Microsoft Azure OpenAI, enhances user productivity and data analysis capabilities. This focus on AI innovation is crucial as AI is projected to be a primary driver of growth in cloud infrastructure services.

Strong Customer Base and Industry Recognition

Cloud Software Group benefits significantly from Citrix's established and loyal customer base, which includes a substantial number of Fortune 100 and Fortune 500 companies. This deep penetration across major enterprises demonstrates the trust and consistent value delivered by their offerings.

The company's solutions exhibit strong customer retention, a testament to their reliability and effectiveness in diverse industry settings. This widespread adoption fuels recurring revenue streams and provides a stable foundation for growth.

Further solidifying its market position, Citrix was recognized as a Leader in the 2024 Gartner Magic Quadrant for Desktop as a Service. This acknowledgment by a leading industry analyst highlights Cloud Software Group's ongoing innovation and leadership in the critical DaaS sector.

- Loyal Customer Base: Citrix serves a significant portion of Fortune 100 and Fortune 500 companies.

- Industry Recognition: Named a Leader in the 2024 Gartner Magic Quadrant for Desktop as a Service.

- High Retention: Demonstrates strong customer stickiness and reliance on their solutions.

- Broad Adoption: Widespread use across various industries signifies solution versatility and value.

Commitment to Innovation and Product Roadmaps

Cloud Software Group, via its subsidiaries Citrix and TIBCO, shows a strong dedication to innovation, consistently improving its products and aligning development roadmaps. TIBCO's recent launch of a unified platform exemplifies this, designed to streamline solution deployment and speed up digital transformation efforts for clients.

This forward-thinking approach is backed by significant investment in research and development, with a particular focus on emerging technologies like artificial intelligence and cloud-native architectures. These investments are crucial for addressing changing customer demands and staying ahead in the competitive software market.

- TIBCO's Unified Platform: Simplifies deployment and accelerates digital initiatives.

- R&D Focus: Emphasis on AI and cloud-native solutions to meet market evolution.

- Subsidiary Strength: Leveraging Citrix and TIBCO for integrated innovation.

Cloud Software Group leverages a deeply entrenched and loyal customer base, particularly through its Citrix subsidiary, which boasts an impressive client roster including 99% of Fortune 100 and 98% of Fortune 500 companies. This significant market penetration underscores the reliability and essential nature of their solutions for critical IT functions. Furthermore, Citrix's recognition as a Leader in the 2024 Gartner Magic Quadrant for Desktop as a Service highlights their continued innovation and leadership in a key sector. The company also demonstrates strong customer retention, indicating the enduring value and effectiveness of its offerings across diverse industries, which contributes to stable, recurring revenue streams.

What is included in the product

Delivers a strategic overview of Cloud Software Group’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address Cloud Software Group's strategic challenges.

Weaknesses

Cloud Software Group's reliance on its established legacy products presents a notable weakness. The company faces significant hurdles in migrating these mature offerings to modern, cloud-native architectures. This transition demands considerable investment in re-engineering, which could slow down the adoption of new cloud services for some of its existing customer base.

Cloud Software Group operates in highly competitive markets. In application delivery and virtualization, for instance, Citrix faces significant pressure from giants like Microsoft and VMware. This intense rivalry can drive down prices and potentially shrink market share in key areas.

Furthermore, TIBCO's data integration and analytics segments are crowded with numerous competitors. This crowded landscape necessitates continuous innovation and aggressive market strategies to maintain a competitive edge and capture market opportunities.

Cloud Software Group's structure as a holding company presents integration challenges post-acquisition. Merging diverse enterprise software businesses, such as Citrix and TIBCO, necessitates significant effort to ensure product interoperability and a cohesive customer experience. This complexity can strain resources and impact the speed of realizing synergies.

The integration process extends beyond technology to encompass human capital and operational streamlining. Effectively managing employee synergies and harmonizing business processes across newly acquired entities requires careful planning and execution to avoid disruptions. For instance, in 2024, many tech acquisitions faced delays in realizing projected cost savings due to these integration hurdles.

Potential for Vendor Lock-in Concerns

While Cloud Software Group's strategic alliances, like its collaboration with Microsoft, unlock substantial advantages, they simultaneously introduce the potential for heightened reliance on a singular major cloud provider. This dependence can foster vendor lock-in concerns for certain clients, potentially curtailing their future adaptability and negotiation leverage.

Many enterprises are actively pursuing multi-cloud strategies to counter this very risk, aiming to distribute their workloads across various providers. For instance, a 2024 Gartner survey indicated that over 70% of organizations are adopting a multi-cloud approach to enhance resilience and avoid vendor dependency.

- Increased Dependency: Strategic partnerships, while beneficial, can create an over-reliance on a single cloud ecosystem.

- Vendor Lock-in: This reliance may restrict customer flexibility and bargaining power over time.

- Multi-Cloud Trend: The growing adoption of multi-cloud strategies by businesses highlights a desire to mitigate such risks.

Impact of Layoffs on Employee Morale and Innovation Pace

Cloud Software Group's recent global layoffs, including significant workforce reductions in early 2025, while aimed at fiscal discipline, present a notable weakness. These actions can significantly dampen employee morale across the remaining workforce, fostering uncertainty and potentially reducing overall productivity. For instance, reports from late 2024 indicated a general trend of declining employee engagement in the tech sector following widespread restructuring.

The departure of employees, particularly those with deep institutional knowledge, poses a risk to Cloud Software Group's operational continuity and future development. This loss can create knowledge gaps, making it harder to onboard new talent or maintain existing projects efficiently. Such disruptions can directly impact the speed at which new features are developed or existing products are improved.

Furthermore, the pace of innovation may decelerate as a consequence of these workforce adjustments. When key personnel involved in research and development or strategic planning are let go, the company's capacity to explore new technological frontiers or adapt to market changes can be compromised. This is a common concern in the software industry, where retaining specialized talent is crucial for maintaining a competitive edge.

The impact on innovation is particularly concerning given the dynamic nature of the cloud software market. Companies that fail to innovate rapidly risk falling behind competitors. The potential for a slowdown in new product releases or feature enhancements due to talent attrition is a direct threat to Cloud Software Group's market position.

Cloud Software Group's reliance on legacy products creates a significant hurdle in migrating to modern cloud architectures, potentially slowing adoption. Intense competition from tech giants like Microsoft and VMware in application delivery and virtualization markets pressures pricing and market share.

The company's holding company structure complicates integration post-acquisition, straining resources and impacting synergy realization. Workforce reductions in early 2025, while fiscally motivated, risk decreased morale and productivity, alongside potential knowledge gaps from departing employees.

| Weakness Category | Specific Challenge | Impact | Supporting Data/Trend |

|---|---|---|---|

| Product Portfolio | Legacy product migration | Slower cloud service adoption, re-engineering costs | N/A (Qualitative assessment) |

| Market Position | Intense competition (Citrix, TIBCO) | Price pressure, potential market share erosion | Citrix faces significant rivalry from Microsoft and VMware. |

| Integration Complexity | Post-acquisition integration (Citrix, TIBCO) | Interoperability issues, strained resources, delayed synergies | Tech acquisitions in 2024 faced integration delays impacting cost savings. |

| Human Capital | Recent layoffs (early 2025) | Reduced morale, productivity loss, knowledge gaps, slower innovation | Late 2024 reports showed declining employee engagement in tech post-restructuring. |

What You See Is What You Get

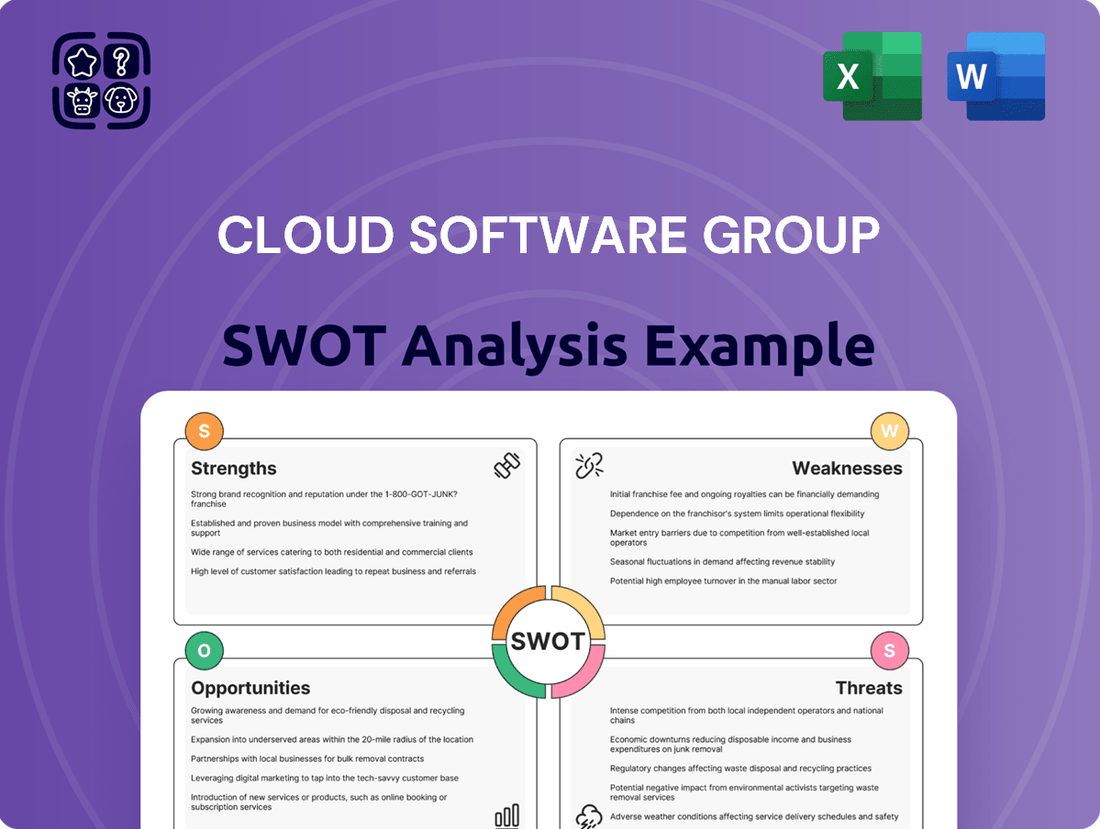

Cloud Software Group SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details Cloud Software Group's Strengths, Weaknesses, Opportunities, and Threats, offering a comprehensive overview to inform your strategic decisions.

Opportunities

The widespread enterprise adoption of hybrid and multi-cloud strategies is a key opportunity. Projections indicated that by 2024, a substantial 90% of enterprises would be utilizing hybrid or multi-cloud setups. Cloud Software Group's expertise in providing secure access and operational efficiency across these varied infrastructures directly addresses this growing market need.

This strategic alignment allows Cloud Software Group to broaden its product portfolio and solidify its position in the dynamic cloud services sector. The increasing complexity of enterprise IT environments fuels the demand for integrated solutions that can manage diverse cloud deployments effectively.

The accelerating adoption of artificial intelligence, especially generative AI, across various industries presents a significant growth avenue for Cloud Software Group. This trend is fueled by businesses seeking to automate tasks and gain deeper insights from their data.

Cloud Software Group is strategically positioned to capitalize on this opportunity through its integration of AI into its core offerings. For instance, the development of Spotfire Copilot and the utilization of Microsoft Azure OpenAI services directly address the escalating enterprise demand for AI-enhanced analytics and productivity solutions.

The broader data management and analytics market, which is increasingly shaped by AI advancements, is experiencing robust expansion. Projections indicate continued strong growth in this sector, with AI being a primary driver, creating a fertile ground for Cloud Software Group's AI-powered solutions.

The global data management and analytics market is booming, expected to reach $264.4 billion by 2027, a significant jump from previous years. Cloud Software Group, via its TIBCO subsidiary, is well-positioned to capitalize on this, given its established expertise in data integration and advanced analytics solutions.

This escalating demand for data-driven decision-making, further amplified by the integration of artificial intelligence and machine learning, presents a prime opportunity for Cloud Software Group to broaden its product portfolio and capture a larger share of this expanding market.

Strategic Acquisitions and Partnerships

Cloud Software Group has a history of strategic acquisitions, notably deviceTrust and Strong Network, to enhance its security and cloud offerings. This approach, combined with strengthening key alliances like the one with Microsoft, presents a significant opportunity to speed up product innovation and broaden market penetration. Such collaborations can unlock integrated solutions and create new avenues for reaching customers.

Continuing to leverage acquisitions and partnerships offers a clear path for growth. For instance, by integrating new technologies acquired or developed through partnerships, Cloud Software Group can create more comprehensive and attractive solutions for its clients. This strategic M&A and alliance activity in 2024 and into 2025 will be crucial for staying ahead in the competitive cloud software landscape.

- Acquisition of deviceTrust: Strengthened security and endpoint management capabilities.

- Acquisition of Strong Network: Bolstered cloud development and network security.

- Microsoft Partnership: Deepened integration and co-selling opportunities.

- Future M&A: Potential to acquire complementary technologies or expand into new verticals.

Leveraging Digital Transformation and Remote Work Trends

The persistent shift towards digital transformation and the enduring popularity of remote and hybrid work models are significant tailwinds for Cloud Software Group. These trends directly fuel the need for robust solutions that facilitate secure application delivery and desktop virtualization. For instance, a 2024 Gartner report indicated that over 70% of organizations are expected to continue offering remote work options, underscoring the sustained demand for technologies that support this paradigm.

Cloud Software Group, through its Citrix offerings, is well-positioned to capitalize on this. Their virtual application and desktop platforms are designed to provide secure, seamless access to essential business tools and data from any location. This alignment with market needs presents a continuous opportunity for growth and reinforces the company's relevance in the evolving IT landscape.

Key aspects of this opportunity include:

- Increased adoption of VDI and DaaS: The demand for Virtual Desktop Infrastructure (VDI) and Desktop-as-a-Service (DaaS) solutions is projected to rise significantly, with market research firms predicting double-digit growth rates through 2025.

- Enhanced cybersecurity needs: As workforces become more distributed, the imperative for secure access to sensitive data intensifies, directly benefiting solutions that offer centralized control and security.

- Improved employee productivity and flexibility: Organizations are increasingly recognizing the productivity gains and employee satisfaction associated with flexible work arrangements, driving investment in the underlying technology.

The increasing demand for AI-driven analytics and data management solutions presents a significant growth opportunity for Cloud Software Group. With businesses actively seeking to leverage AI for automation and deeper insights, the company's integrated AI offerings, such as Spotfire Copilot, are well-positioned to meet this need. The broader data management and analytics market, projected to reach substantial figures by 2027, is a fertile ground for Cloud Software Group's AI-powered solutions.

Threats

The overwhelming market dominance of hyperscale cloud providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, collectively holding over 65% of the global cloud infrastructure market in early 2024, presents a significant challenge. These providers are aggressively expanding their service portfolios, often integrating advanced capabilities like AI and machine learning directly into their platforms.

This relentless expansion by hyperscalers directly threatens Cloud Software Group's market position by offering increasingly comprehensive solutions that can absorb or replicate niche functionalities. For instance, AWS's broad suite of data management tools and Azure's AI services are continually enhanced, potentially diminishing the unique value proposition of specialized cloud software offerings and intensifying pricing pressures.

The relentless pace of technological change, particularly in areas like artificial intelligence and advanced cloud infrastructure, poses a significant threat. Companies like Cloud Software Group must constantly invest in R&D to integrate these innovations, a challenge amplified by the fact that global IT spending on AI is projected to reach $200 billion in 2024, according to Gartner.

Staying ahead of agile startups and established tech giants who are quickly embedding new technologies into their offerings requires continuous product evolution. For instance, Microsoft’s Azure AI services and Google Cloud’s AI platform are rapidly expanding their capabilities, setting a high bar for competitors. Failure to adapt risks losing market share and becoming irrelevant in a rapidly shifting landscape.

Cloud Software Group, operating in enterprise software, faces substantial cybersecurity risks. Its application delivery and data management solutions are prime targets for cyberattacks. In 2024, the average cost of a data breach reached $4.73 million globally, a figure that underscores the financial implications of security failures.

Furthermore, non-compliance with data privacy regulations like GDPR and CCPA poses a significant threat. Fines for GDPR violations can reach up to 4% of global annual revenue or €20 million, whichever is higher, impacting customer trust and incurring substantial financial penalties.

Economic Downturns and IT Spending Fluctuations

Global economic uncertainties, particularly in 2024 and early 2025, pose a significant threat to Cloud Software Group. Businesses facing recessionary pressures often slash IT budgets, leading to postponed software upgrades or outright cancellations of new cloud solution implementations. This directly impacts revenue streams for software providers like Cloud Software Group.

While the enterprise software market is expected to see continued growth, economic headwinds could dampen this trajectory. For instance, Gartner projected worldwide IT spending to reach $5.1 trillion in 2024, an increase of 6.8% from 2023, but this growth is sensitive to economic performance. A slowdown could mean Cloud Software Group experiences slower-than-anticipated revenue growth or even a contraction in certain segments.

- Reduced IT Budgets: Companies may cut spending on non-essential software, impacting Cloud Software Group's sales pipeline.

- Delayed Decision-Making: Economic uncertainty leads to longer sales cycles as businesses become more cautious with investments.

- Shift to Cost Optimization: Customers might favor solutions with lower upfront costs or prioritize essential functionalities over broader suites, affecting Cloud Software Group's pricing and product strategy.

Talent Acquisition and Retention Challenges

The intensely competitive technology landscape presents a significant hurdle for Cloud Software Group in attracting and keeping skilled professionals, especially in crucial domains such as cloud architecture, AI development, and cybersecurity. This difficulty is amplified by a general skills gap prevalent in the IT services sector concerning cloud technologies.

Furthermore, Cloud Software Group's recent workforce reductions may worsen these talent acquisition and retention issues. Such actions can create apprehension among potential hires and existing employees, potentially hindering the recruitment and retention of the specialized expertise essential for driving innovation and achieving sustained growth.

For instance, in 2024, reports indicated that the demand for cloud computing skills outstripped supply by a considerable margin, with some surveys showing over 70% of organizations struggling to find qualified cloud talent. This market dynamic makes it even more critical for companies like Cloud Software Group to address internal perceptions and external market signals effectively to maintain a competitive edge in talent.

The impact of these challenges can be seen in:

- Increased recruitment costs and longer hiring cycles for specialized roles.

- Potential delays in product development and innovation due to a lack of critical skills.

- Higher employee turnover rates, leading to loss of institutional knowledge and increased training expenses.

- Difficulty in scaling operations to meet market demand without adequate staffing.

The dominance of hyperscale cloud providers like AWS, Azure, and Google Cloud, which held over 65% of the market in early 2024, poses a significant threat by offering integrated services that can replicate niche functionalities, thereby intensifying pricing pressure.

Rapid technological advancements, especially in AI, necessitate continuous R&D investment, a challenge amplified by the projected $200 billion global IT spending on AI in 2024, requiring companies like Cloud Software Group to constantly adapt to stay competitive against agile competitors.

Cybersecurity risks are substantial, with the average cost of a data breach reaching $4.73 million globally in 2024, and non-compliance with data privacy regulations like GDPR can result in fines up to 4% of global annual revenue, impacting trust and finances.

Economic uncertainties in 2024-2025 may lead businesses to cut IT budgets, delaying software upgrades and impacting Cloud Software Group's revenue, despite a projected 6.8% increase in worldwide IT spending to $5.1 trillion for 2024, which remains sensitive to economic performance.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from the company's official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-informed strategic overview.