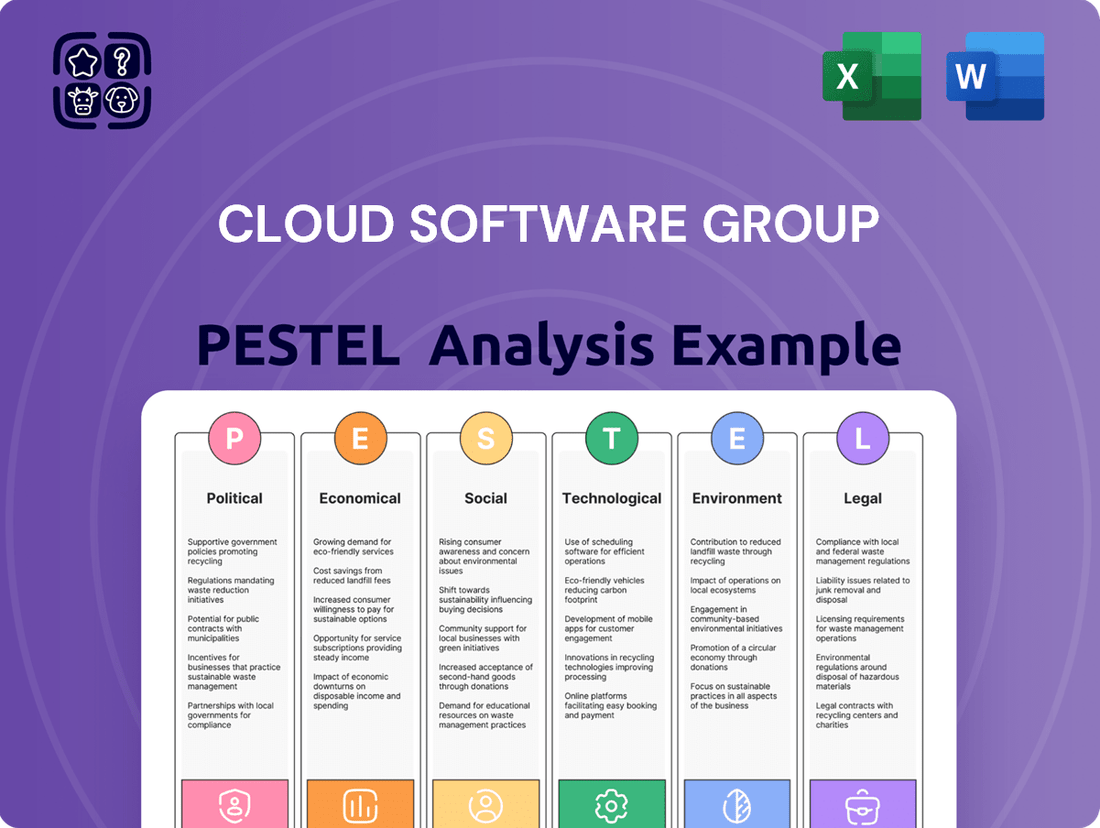

Cloud Software Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cloud Software Group Bundle

Understand how political shifts, economic volatility, and evolving social trends are shaping Cloud Software Group's operational landscape. This comprehensive PESTLE analysis provides the critical external intelligence you need to anticipate challenges and capitalize on opportunities. Download the full version now for actionable insights to inform your strategic planning.

Political factors

Governments worldwide are tightening their grip on cloud services, focusing on data sovereignty, international data movement, and cybersecurity. For Cloud Software Group, with its Citrix and TIBCO products, this means a complex web of rules to follow across different countries, affecting how they operate and sell.

These evolving regulations can significantly shape product design, where data centers are built, and ultimately, the cost of doing business. For instance, GDPR in Europe, enacted in 2018, has set a precedent for data privacy that many other regions are now emulating, impacting how companies like Cloud Software Group handle customer data.

Global geopolitical tensions and evolving international trade policies present a significant variable for Cloud Software Group. For instance, the ongoing trade disputes between major economies, such as those involving the United States and China, can lead to increased tariffs on hardware components or software services, impacting cost structures and market access. These shifts directly influence Cloud Software Group's ability to seamlessly operate and pursue growth opportunities across diverse international markets.

Trade barriers and restrictions on technology exports or imports are a direct concern. If certain countries impose limitations on the transfer of advanced software or cloud infrastructure, it could disrupt Cloud Software Group's supply chains and directly hinder sales in those specific regions. The company's extensive global customer base and its strategically distributed operational footprint mean it is inherently exposed to these broader political and economic dynamics.

National governments are increasingly prioritizing cybersecurity, viewing it as a critical component of national security. This heightened focus translates into more stringent regulations for protecting essential services and mandatory reporting of security breaches. For Cloud Software Group, this means their secure application delivery and data management tools are directly shaped by these developing government policies.

Compliance with these national cybersecurity frameworks is no longer just a regulatory hurdle; it's becoming a key differentiator in the market. Companies like Cloud Software Group that can demonstrably meet these standards will find it easier to secure contracts with government agencies and large enterprises operating in highly regulated sectors.

In 2024, for instance, the US government continued to emphasize cybersecurity, with initiatives like the National Cybersecurity Strategy aiming to bolster defenses against state-sponsored cyber threats. Similarly, the EU's NIS2 Directive, which came into effect in January 2023 and is being implemented throughout 2024 and 2025, imposes stricter cybersecurity requirements on a wider range of organizations, directly impacting cloud software providers that serve European clients.

Government IT Spending Priorities

Government IT spending priorities significantly shape the landscape for Cloud Software Group. In 2024, many governments worldwide continued to prioritize digital transformation, with significant investments flowing into cloud infrastructure and data analytics to improve public services and operational efficiency. For instance, the US federal government's IT modernization efforts, including a focus on cloud adoption, are projected to see continued robust spending through 2025, creating substantial opportunities for vendors like Cloud Software Group.

Shifts in budget allocations directly impact the demand for enterprise solutions. As public sector organizations increasingly embrace cloud adoption and virtualization, Cloud Software Group can leverage these trends. The company's ability to align its offerings with these modernization goals is crucial for securing government contracts. For example, the European Union's digital agenda continues to drive significant IT spending, with a strong emphasis on secure cloud solutions and data management, areas where Cloud Software Group has a vested interest.

Key areas of government IT investment in 2024-2025 include:

- Cloud Infrastructure: Governments are investing heavily in migrating legacy systems to cloud platforms for scalability and cost-efficiency.

- Cybersecurity: With increasing digital threats, a substantial portion of IT budgets is allocated to enhancing cybersecurity measures, often integrated with cloud solutions.

- Data Analytics and AI: Modernizing data management and leveraging analytics for better decision-making are key government IT priorities.

- Digital Services Delivery: Enhancing citizen-facing digital platforms and improving the efficiency of public service delivery through technology.

Antitrust and Competition Policies

Antitrust and competition policies are increasingly shaping the technology landscape, directly impacting companies like Cloud Software Group. Regulators worldwide are intensifying their scrutiny of large tech mergers and instances of market dominance. This trend could significantly influence Cloud Software Group's ability to pursue strategic acquisitions and maintain its market position, especially following its acquisition of Citrix and TIBCO. For instance, the European Union's Digital Markets Act (DMA), which came into effect in March 2024, imposes strict rules on gatekeeper platforms, potentially affecting how large software providers operate and compete.

Policies designed to promote greater competition could alter the strategic integration of Cloud Software Group's acquired entities, such as Citrix and TIBCO, and influence its expansion into new market segments. The ongoing antitrust investigations into major cloud providers by the U.S. Department of Justice and Federal Trade Commission, for example, signal a heightened focus on market concentration. This regulatory environment demands that Cloud Software Group meticulously assess its market impact and competitive strategies to ensure compliance and sustained growth.

- Increased Global Antitrust Scrutiny: Regulators in the US and EU have been actively investigating and challenging technology mergers, with significant fines imposed for anti-competitive practices.

- Impact on M&A: Cloud Software Group's acquisition strategies, including those involving Citrix and TIBCO, face heightened review, potentially leading to delays or divestiture requirements.

- Fostering Competition: New legislation and enforcement actions aim to level the playing field, which may influence Cloud Software Group's pricing, bundling, and partnership strategies.

- Market Dominance Concerns: The company must navigate concerns around market concentration, particularly as it integrates and scales its portfolio companies.

Governments globally are increasingly focused on national security and economic stability, influencing technology policies. This includes stringent cybersecurity mandates and a push for domestic technological capabilities, directly impacting how cloud software providers like Cloud Software Group operate and innovate. For instance, the US government's continued emphasis on cybersecurity in 2024, with initiatives like the National Cybersecurity Strategy, sets a precedent for stricter regulations that Cloud Software Group must adhere to. Similarly, the EU's NIS2 Directive, actively being implemented through 2024 and 2025, expands cybersecurity requirements for a broader range of organizations, affecting Cloud Software Group's European client base.

Government IT spending remains a significant driver for Cloud Software Group, with digital transformation initiatives continuing through 2024-2025. Key investment areas include cloud infrastructure, cybersecurity, and data analytics, creating substantial opportunities for companies that align with these priorities. For example, the US federal government's ongoing IT modernization efforts, including cloud adoption, are projected for robust spending, benefiting vendors like Cloud Software Group.

Antitrust and competition regulations are intensifying, particularly impacting large technology firms and M&A activities. New legislation like the EU's Digital Markets Act (DMA), effective March 2024, imposes strict rules on gatekeepers, potentially affecting Cloud Software Group's market strategies and integration of acquired entities like Citrix and TIBCO. This heightened scrutiny necessitates careful navigation of market concentration concerns and competitive practices.

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors influencing the Cloud Software Group, examining Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key opportunities and threats within the current market landscape.

A clear, actionable PESTLE analysis for Cloud Software Group that highlights key external factors impacting the business, enabling proactive strategy adjustments and risk mitigation.

Economic factors

Global economic growth significantly impacts Cloud Software Group's revenue, as enterprise IT spending is directly tied to economic health. For instance, the International Monetary Fund (IMF) projected global growth at 3.2% for 2024, a slight slowdown from 2023, indicating a cautious but still expanding economic environment that generally supports IT investments.

However, recession risks remain a concern. Persistent inflation and geopolitical tensions could dampen business confidence and lead to reduced IT budgets. A slowdown in major economies, like the Eurozone which saw very modest growth projections for 2024, could directly affect Cloud Software Group's sales pipelines in those regions.

The cyclical nature of IT spending means Cloud Software Group is inherently sensitive to these macroeconomic shifts. If a significant downturn occurs, companies often defer or cancel software upgrades, directly impacting the demand for Cloud Software Group's services and products.

Rising inflation in 2024 and projected into 2025 presents a significant challenge for Cloud Software Group. Increased costs for essential resources like electricity for data centers and skilled labor in software development directly impact operational expenses. For instance, the US Consumer Price Index (CPI) saw a notable increase in early 2024, indicating broader inflationary pressures that would likely translate to higher input costs for the company.

Concurrently, the prevailing interest rate environment, with central banks maintaining or cautiously lowering rates throughout 2024 and into 2025, affects borrowing costs. Higher rates make it more expensive for Cloud Software Group to finance new projects or acquisitions, and similarly, enterprise clients may face increased borrowing costs for their own IT investments. This can lead to delayed or scaled-back adoption of cloud software solutions, impacting the company's revenue growth and profitability.

Currency exchange rate volatility presents a significant economic factor for Cloud Software Group. As a global entity, fluctuations between the US dollar and other currencies directly impact its international revenue and expenses. For instance, if the Euro strengthens against the dollar, European sales revenue translates into fewer dollars, potentially affecting profitability.

In 2024, major currency pairs like EUR/USD and USD/JPY have experienced notable swings. For example, the EUR/USD rate has seen movements of over 2% within short periods, directly influencing the dollar value of Cloud Software Group's European operations. This necessitates robust hedging strategies to mitigate potential losses from adverse currency movements.

A stronger US dollar, conversely, can make Cloud Software Group's software and services more expensive for international clients, potentially dampening demand. Conversely, a weaker dollar could boost the appeal of US-based offerings to foreign buyers. Managing this dynamic is vital for maintaining competitive pricing and consistent financial performance across its global markets.

Enterprise IT Spending Trends

Enterprise IT spending is seeing significant growth, fueled by the persistent move to cloud environments and the widespread adoption of hybrid work. This trend directly benefits companies like Cloud Software Group, as organizations are prioritizing investments in scalable and flexible software solutions to support these evolving operational models. For instance, Gartner projected worldwide enterprise IT spending to reach $5.1 trillion in 2024, an increase from $4.9 trillion in 2023, highlighting the robust demand for technology services.

However, this increased spending also means heightened competition for IT budgets. Cloud Software Group must clearly articulate the return on investment (ROI) and the cost efficiencies its offerings provide to stand out. A recent survey by Deloitte indicated that 70% of CIOs are focused on optimizing IT costs while simultaneously driving digital transformation, underscoring the need for demonstrable value.

Understanding nuanced industry spending patterns is crucial for strategic targeting. For example, the financial services sector is expected to increase its IT spending by 8.7% in 2024, according to IDC, with a strong focus on cloud infrastructure and cybersecurity. Conversely, other sectors might have different priorities, necessitating tailored approaches.

- Cloud Adoption Growth: Worldwide enterprise IT spending forecast to reach $5.1 trillion in 2024.

- Hybrid Work Impact: Increased demand for collaboration and remote access software solutions.

- Cost Optimization Focus: 70% of CIOs prioritize IT cost optimization alongside digital transformation.

- Industry Variations: Financial services IT spending projected to grow by 8.7% in 2024.

Competitive Pricing Pressures

The enterprise software landscape is intensely competitive, with many providers offering comparable or overlapping solutions. This fierce rivalry often translates into significant pricing pressures for companies like Cloud Software Group, necessitating a delicate balance between offering competitive rates and preserving robust profit margins.

The ongoing commoditization of specific cloud services and virtualization technologies further exacerbates these pricing challenges. For instance, by mid-2024, the average cost for basic cloud storage had seen a notable decline, forcing vendors to differentiate through value-added services rather than solely on price.

This environment demands continuous innovation to maintain market share and profitability. Cloud Software Group must consistently enhance its offerings, perhaps by integrating advanced AI capabilities or specialized industry solutions, to justify pricing and avoid being undercut by competitors offering more standardized, lower-cost alternatives.

- Intense Competition: The enterprise software market features a crowded field of vendors, driving down prices.

- Pricing Dilemma: Cloud Software Group must compete on price while safeguarding profit margins.

- Commoditization Impact: Basic cloud services and virtualization tools are becoming commodities, intensifying price wars.

- Innovation Imperative: Continuous development of unique features and services is crucial for differentiation and pricing power.

Global economic conditions significantly influence Cloud Software Group's performance, with projected global growth of 3.2% for 2024 by the IMF indicating a generally supportive, albeit slower, economic climate for IT investments. However, persistent inflation, as evidenced by the US CPI increases in early 2024, raises operational costs for data centers and talent acquisition, while interest rate policies in 2024-2025 impact borrowing costs for both the company and its clients, potentially delaying software adoption.

Currency fluctuations also play a critical role, with notable swings in major pairs like EUR/USD in 2024 directly affecting the dollar value of international revenue. For instance, a stronger US dollar can make Cloud Software Group's offerings more expensive for overseas customers, impacting demand. This necessitates careful management of currency risks to maintain stable financial results across its global operations.

| Economic Factor | 2024/2025 Outlook | Impact on Cloud Software Group |

|---|---|---|

| Global Economic Growth | Projected 3.2% in 2024 (IMF) | Generally supports IT spending, but slowdowns in key regions can reduce sales pipelines. |

| Inflation | Persistent, impacting operational costs (e.g., US CPI increases) | Increases expenses for data centers, talent, and potentially necessitates price adjustments. |

| Interest Rates | Cautiously stable to slowly declining | Affects borrowing costs for expansion and client IT investments, potentially slowing adoption. |

| Currency Exchange Rates | Volatile (e.g., EUR/USD swings) | Impacts international revenue translation and competitiveness of pricing. |

Preview the Actual Deliverable

Cloud Software Group PESTLE Analysis

The preview shown here is the exact Cloud Software Group PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive report delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Cloud Software Group, providing valuable strategic insights.

Sociological factors

The widespread adoption of remote and hybrid work, accelerated by events in 2020 and continuing through 2024, has dramatically boosted the need for secure, flexible application delivery. Citrix, a key part of Cloud Software Group, is well-positioned as demand for virtual desktop infrastructure (VDI) and secure remote access solutions continues to grow. For instance, Gartner projected worldwide IT spending on end-user computing to reach $77 billion in 2024, with a significant portion allocated to solutions enabling distributed workforces.

End-users, whether they are employees accessing internal tools or customers interacting with a company's services, now demand digital experiences that are not just functional but also intuitive and exceptionally performant. This expectation spans across all devices and applications they encounter. For Cloud Software Group, whose offerings often revolve around application delivery and virtualization, prioritizing this seamless user experience is paramount for successful adoption within client enterprises.

A failure to deliver a smooth and user-friendly interface can have tangible negative consequences. It can directly translate into reduced employee productivity as they struggle with clunky software, and it can foster resistance to adopting new technologies altogether. For instance, a recent survey indicated that 70% of employees report frustration with poorly designed business software, directly impacting their efficiency.

The growing complexity of enterprise software necessitates a workforce proficient in digital tools. A 2024 report indicated that 60% of businesses struggle with digital skill gaps, particularly in cloud management and data analytics, directly impacting the adoption of advanced cloud solutions.

These skill deficits can create significant hurdles for companies looking to leverage Cloud Software Group's advanced platforms. For instance, a lack of cybersecurity expertise can deter organizations from migrating sensitive data to the cloud, a core offering.

Cloud Software Group may need to invest in robust training programs and accessible support to bridge these skill gaps. By empowering users, the company can foster wider adoption and ensure clients maximize the value of their software investments.

Data-Driven Decision-Making Culture

There's a significant societal and business push towards using data to guide strategic choices across all sectors. This trend is evident in the increasing adoption of analytics platforms, with the global big data and business analytics market projected to reach $374.4 billion by 2027, according to Statista.

Cloud Software Group, through TIBCO's offerings, directly addresses this by providing tools that help businesses unlock valuable insights from their extensive data. This cultural evolution fuels a robust demand for sophisticated data management and analytics solutions.

Key aspects of this data-driven decision-making culture include:

- Increased reliance on analytics: Businesses are increasingly moving from gut feelings to data-backed strategies.

- Demand for actionable insights: The focus is on extracting practical information that can drive immediate business improvements.

- Growth in data literacy: There's a broader societal understanding and expectation for data to be used transparently and effectively.

Talent Acquisition and Retention in Tech

Cloud Software Group faces intense competition for skilled tech professionals, especially in high-demand areas like cloud, cybersecurity, and data science. This talent war directly impacts the company's capacity for innovation and maintaining its market edge. For instance, a 2024 report indicated that the average salary for cloud engineers in major tech hubs increased by 15% year-over-year, highlighting the rising cost of acquiring top talent.

Attracting and keeping the best engineers, developers, and sales experts is paramount for Cloud Software Group's success. These individuals drive product development and customer acquisition, directly influencing the company's growth trajectory. A recent survey of tech employees revealed that 60% prioritize company culture and opportunities for professional growth over salary alone when considering a new role.

Key factors influencing talent acquisition and retention at Cloud Software Group include its company culture, competitive compensation packages, and robust career development programs. These elements are crucial differentiators in a crowded market. In 2025, companies with strong employee referral programs, which often stem from positive company culture, reported a 25% higher retention rate for new hires.

- Talent Scarcity: Fierce competition for cloud, cybersecurity, and data science expertise.

- Innovation Driver: Top talent is essential for product development and market leadership.

- Retention Factors: Company culture, compensation, and career advancement are critical.

- Market Trends: Rising salaries and employee focus on culture and growth impact hiring.

Societal shifts toward digital-first interactions and the increasing expectation for seamless user experiences directly influence the demand for Cloud Software Group's solutions. As remote and hybrid work models solidify, exemplified by a projected 30% of the global workforce operating remotely by 2025, the need for accessible and intuitive application delivery platforms becomes paramount.

The growing emphasis on data-driven decision-making fuels demand for Cloud Software Group's analytics and data management tools. Businesses are actively seeking to leverage insights, with the global business analytics market expected to grow to $111 billion in 2024, according to IDC. This cultural shift necessitates sophisticated platforms that can process and interpret vast datasets.

A significant challenge for Cloud Software Group and its clients is the pervasive digital skills gap. Reports from 2024 indicate that over 60% of businesses struggle to find employees with adequate cloud and data analytics expertise, directly impacting the adoption and effective utilization of advanced software solutions.

The intense competition for skilled technology professionals, particularly in cloud engineering and cybersecurity, presents a critical factor. The average salary for cloud engineers saw a 15% increase in 2024 alone, underscoring the high cost and difficulty in attracting and retaining the talent essential for innovation and market competitiveness.

Technological factors

The relentless pace of cloud computing evolution, marked by a growing preference for hybrid and multi-cloud architectures, significantly shapes Cloud Software Group's strategic direction and product development. Companies are increasingly looking for solutions that offer flexibility and avoid vendor lock-in.

Cloud Software Group's ability to innovate in virtualization, application delivery, and data management is paramount. These advancements are crucial for ensuring seamless integration and interoperability across these complex, distributed cloud environments. For instance, by Q3 2024, over 80% of enterprises surveyed by Flexera were utilizing a hybrid or multi-cloud strategy.

Maintaining a leading edge in cloud infrastructure trends is not just beneficial but essential for Cloud Software Group's continued market relevance and competitive advantage. This requires ongoing investment in research and development to anticipate and address the evolving needs of businesses operating in diverse cloud ecosystems.

The pervasive integration of AI and ML into enterprise software presents a significant opportunity for Cloud Software Group to elevate its product suite. For instance, by 2024, the global AI market was projected to reach $200 billion, highlighting the immense potential for AI-driven enhancements in areas like security analytics and IT operations automation.

Cloud Software Group can leverage AI and ML to automate IT operations, optimize application performance, and unlock deeper data insights, thereby offering more value to its customers. This strategic adoption of AI/ML within its core products, such as those inherited from Citrix and TIBCO, can create a distinct competitive advantage and open up new avenues for revenue generation.

The cybersecurity threat landscape is a dynamic battlefield, with attackers constantly refining their tactics. For Cloud Software Group, this means their security solutions must be in perpetual motion, adapting to new vulnerabilities and attack vectors. The increasing sophistication of threats like ransomware and advanced persistent threats (APTs) demands that their application delivery and virtualization platforms offer not just protection, but also proactive threat detection and rapid response mechanisms to safeguard customer data and operations.

Big Data Analytics and Real-time Processing

The sheer volume of data generated globally continues to skyrocket, with projections indicating a compound annual growth rate (CAGR) of over 20% for data creation through 2025. This explosion necessitates robust big data analytics capabilities. Cloud Software Group, through TIBCO, is positioned to capitalize on this trend by providing solutions that facilitate the efficient storage, processing, and real-time analysis of these vast datasets, enabling enterprises to derive actionable insights.

The demand for immediate data processing is no longer a niche requirement but a core business imperative. Companies are increasingly relying on real-time analytics to inform critical decisions, from fraud detection to personalized customer experiences. Cloud Software Group's investment in technologies that support low-latency processing is therefore vital for clients seeking to maintain a competitive edge in a fast-paced market.

- Data Growth: Global data creation is expected to reach 181 zettabytes by 2025, a significant increase from 64.2 zettabytes in 2020.

- Real-time Demand: Over 60% of organizations are increasing their investment in real-time analytics capabilities to improve business outcomes.

- Value Extraction: Companies leveraging advanced data analytics are 5-6% more profitable than their peers.

Pace of Technological Obsolescence and Innovation Cycles

The cloud software industry moves at lightning speed. Innovation cycles are short, meaning technologies can become outdated very quickly. This rapid pace of change means Cloud Software Group needs to continuously invest in research and development. Staying ahead requires not just updating current offerings but also creating entirely new solutions to meet evolving market demands.

Failure to keep up with these innovation cycles can be costly. Agile competitors can quickly introduce superior products, potentially eroding Cloud Software Group's market share. For instance, in 2024, companies that delayed adopting AI-powered features in their cloud platforms saw a noticeable dip in customer acquisition compared to those who integrated them early.

- Rapid Innovation: The technology sector, especially cloud software, sees new advancements monthly, not annually.

- Product Lifecycles: Key software features can have lifecycles of 18-24 months before needing significant upgrades or replacements.

- R&D Investment: Leading cloud providers typically allocate 15-20% of their revenue to R&D to combat obsolescence.

- Market Share Impact: A lag of even six months in adopting new technologies like advanced cybersecurity or AI integration can result in a 5-10% loss of potential new business.

The rapid advancement of Artificial Intelligence and Machine Learning is a significant technological factor, offering Cloud Software Group opportunities to enhance its products. By 2024, the global AI market was projected to exceed $200 billion, underscoring the potential for AI-driven improvements in areas like security and IT operations automation.

The increasing adoption of hybrid and multi-cloud strategies, with over 80% of enterprises using them by Q3 2024, necessitates flexible solutions that prevent vendor lock-in. Cloud Software Group's ability to innovate in virtualization and data management is crucial for seamless integration in these distributed environments.

| Technology Trend | Impact on Cloud Software Group | Supporting Data (2024/2025) |

|---|---|---|

| AI/ML Integration | Enhance product offerings, automate IT operations, improve security analytics. | Global AI market projected to exceed $200 billion in 2024. |

| Hybrid/Multi-Cloud Adoption | Demand for flexible, interoperable solutions; need for advanced virtualization and data management. | Over 80% of enterprises utilize hybrid/multi-cloud (Q3 2024). |

| Cybersecurity Threats | Need for advanced, adaptive security solutions in virtualization and application delivery platforms. | Cybersecurity spending expected to reach $300 billion globally by 2025. |

Legal factors

Global data privacy regulations, such as the EU's GDPR and California's CCPA, are increasingly stringent, dictating how personal data can be handled. Cloud Software Group must ensure its platforms facilitate customer compliance with these evolving legal landscapes, which include requirements for data minimization and user consent.

Failure to adhere to these data privacy laws can lead to substantial financial penalties; for instance, GDPR fines can reach up to 4% of a company's annual global turnover or €20 million, whichever is higher. This necessitates robust data governance features within Cloud Software Group's offerings to mitigate risks and protect customer trust.

Software licensing models are a cornerstone of Cloud Software Group's legal landscape. The company navigates various models, from subscription-based services to perpetual licenses, each with specific legal implications regarding usage rights and revenue recognition. Ensuring these agreements are clear and compliant is paramount.

Protecting intellectual property (IP) is critical. Cloud Software Group invests heavily in safeguarding its proprietary code and innovations through patents and copyrights. This focus is essential in a competitive market where IP theft can significantly impact market position and profitability.

The risk of patent infringement is a constant legal challenge. Cloud Software Group must remain vigilant, conducting thorough due diligence to ensure its products do not violate existing patents held by competitors or other entities. Navigating these complexities requires ongoing legal counsel and robust internal processes.

Cloud Software Group's enterprise clients, particularly those in finance, healthcare, and government, face rigorous compliance demands. For instance, the healthcare sector's adherence to HIPAA regulations, which mandate strict patient data privacy and security, directly impacts the design and functionality of cloud software. Similarly, financial institutions must comply with SOX and PCI DSS, requiring robust audit trails and data protection measures.

Antitrust and Competition Law Scrutiny

Cloud Software Group, as a major enterprise software provider, is subject to rigorous antitrust and competition law oversight. Regulators worldwide, including the US Department of Justice and the European Commission, actively monitor market concentration and business practices. For instance, in 2024, the FTC continued its focus on tech mergers, and the EU's Digital Markets Act (DMA) imposes specific obligations on large online platforms, which could impact software distribution and interoperability.

Any significant mergers, acquisitions, or strategic partnerships undertaken by Cloud Software Group could face intense scrutiny from competition authorities. These bodies assess whether such actions could stifle innovation, limit consumer choice, or create unfair advantages. For example, a hypothetical acquisition of a smaller cloud analytics firm by Cloud Software Group in 2025 would likely trigger a detailed review to ensure it doesn't unduly harm competition in that niche market.

Navigating these complex legal frameworks is crucial for Cloud Software Group's sustained growth and market position. Proactive compliance and a commitment to fair competition are essential to avoid costly legal battles, regulatory sanctions, and reputational damage. The company's ability to adapt to evolving regulatory landscapes, such as increased data privacy enforcement impacting software development and deployment, directly influences its operational freedom and market access.

Key considerations for Cloud Software Group include:

- Merger Control: Ensuring proposed acquisitions comply with thresholds and do not create anti-competitive market structures, as seen in ongoing reviews of major tech sector deals globally in 2024-2025.

- Abuse of Dominance: Avoiding practices that leverage market power to disadvantage competitors, such as unfair pricing or exclusive bundling of services.

- Interoperability and Data Access: Complying with regulations like the DMA that mandate greater openness and data sharing to foster competition.

- Regulatory Compliance Costs: Allocating resources to legal teams and compliance programs to stay abreast of and adhere to diverse international antitrust regulations.

Cybersecurity Laws and Incident Reporting

Governments worldwide are intensifying their focus on cybersecurity, with new legislation frequently introduced to set minimum security standards and mandate the reporting of data breaches. For instance, the EU's NIS2 Directive, fully in effect from October 2024, significantly expands the scope of cybersecurity requirements for critical infrastructure and digital services, impacting cloud providers and their clients. Cloud Software Group's offerings must therefore not only meet these evolving legal mandates but also actively assist customers in fulfilling their compliance and data integrity obligations.

The global regulatory environment for cyber resilience is becoming increasingly stringent. By July 2025, many jurisdictions will have updated or implemented comprehensive data protection and breach notification laws. These regulations often include specific timelines for reporting incidents, such as the 72-hour window post-awareness for breaches affecting personal data under the GDPR. Cloud Software Group's ability to provide auditable logs and secure data handling processes becomes a key differentiator, enabling clients to navigate this complex legal terrain.

- Increased Regulatory Scrutiny: Expect continued growth in cybersecurity legislation globally, impacting cloud service providers and their customers.

- Mandatory Breach Notifications: Laws like GDPR and CCPA require timely reporting of data breaches, making robust incident response capabilities crucial.

- Data Integrity and Compliance: Cloud Software Group's solutions must ensure data integrity to help clients meet their legal reporting obligations and avoid penalties.

- Evolving Legal Landscape: The pace of regulatory change necessitates continuous adaptation and investment in compliance by cloud software vendors.

Cloud Software Group navigates a complex web of intellectual property laws, requiring robust protection of its proprietary code through patents and copyrights. The constant threat of patent infringement necessitates diligent oversight to avoid legal disputes and safeguard market position.

Antitrust and competition laws are increasingly shaping the cloud software landscape. Regulations like the EU's Digital Markets Act (DMA) are imposing new obligations on large tech firms, impacting how software is distributed and ensuring greater market openness. Cloud Software Group must ensure its practices, including potential mergers and acquisitions, do not create anti-competitive market structures, a focus for global regulators throughout 2024 and into 2025.

Cybersecurity legislation is rapidly evolving, with directives like the EU's NIS2, effective from October 2024, setting higher security standards and mandating breach reporting. Cloud Software Group's solutions must facilitate client compliance with these stringent cybersecurity mandates, including adherence to data breach notification timelines, such as the 72-hour window under GDPR.

Environmental factors

Data centers, the backbone of cloud software delivery, are massive energy consumers. Their operation is critical, but it also contributes substantially to global carbon footprints. For Cloud Software Group, this means a direct responsibility for the energy used by its own infrastructure and indirectly for the energy consumed by customers running its software.

The push for sustainability is intensifying, with a growing demand for cloud providers and software companies to demonstrate environmental responsibility. This pressure is particularly acute in 2024 and 2025, as regulatory bodies and investor expectations align on reducing carbon emissions. For instance, by 2025, many cloud providers are aiming for 100% renewable energy sourcing for their data centers, a trend that will directly impact companies like Cloud Software Group.

Optimizing software for energy efficiency is no longer a niche concern; it's a strategic imperative. This involves developing code that requires less processing power and memory, thereby reducing the energy needed to run applications. As of early 2025, studies indicate that inefficient software can increase a data center’s energy consumption by up to 30%, highlighting the significant potential for improvement.

While Cloud Software Group is primarily a software provider, its solutions are deployed on extensive hardware infrastructure, meaning the company has an indirect role in the generation of electronic waste (e-waste). Growing global awareness means there's intense focus on the entire lifespan of IT equipment, from its creation to its end-of-life disposal. For instance, the global e-waste generated reached an estimated 62 million metric tons in 2020, a figure projected to climb significantly in the coming years, underscoring the environmental impact of the tech sector.

Cloud Software Group can mitigate its environmental footprint by actively engaging with hardware partners to encourage sustainable manufacturing and by championing efficient hardware utilization among its clients. This approach not only addresses environmental concerns but can also lead to cost savings through extended hardware lifespans and reduced energy consumption. Companies are increasingly prioritizing vendors with strong environmental, social, and governance (ESG) credentials, making responsible e-waste management a strategic imperative.

Investor and consumer demand for robust corporate sustainability and transparent ESG reporting is intensifying. For Cloud Software Group, this means clearly outlining environmental policies and setting concrete targets to reduce its operational footprint, aiming for a more sustainable IT ecosystem. This focus directly influences brand perception and attractiveness to investors, with ESG funds increasingly influencing capital allocation decisions.

Demand for Green IT Solutions

The growing demand for green IT solutions is a significant environmental factor for Cloud Software Group. Enterprises are actively looking for ways to shrink their environmental impact, particularly by making their IT operations more energy-efficient. This trend is not just a niche concern; it's becoming a mainstream business imperative.

Cloud Software Group can capitalize on this by clearly demonstrating how its core technologies, such as virtualization, advanced application delivery, and smart data management, directly translate into tangible resource optimization and reduced energy consumption for its clients. Highlighting these benefits can be a key differentiator in a competitive market.

The market for these eco-friendly IT solutions is experiencing substantial growth. For instance, the global green IT market was valued at approximately $22.7 billion in 2023 and is projected to reach $67.8 billion by 2030, growing at a compound annual growth rate of 16.9% during that period. This indicates a strong and expanding opportunity for companies like Cloud Software Group that can provide effective green IT solutions.

- Growing Market Value: The global green IT market is expanding rapidly, projected to grow from $22.7 billion in 2023 to $67.8 billion by 2030.

- Key Growth Driver: Enterprises are increasingly prioritizing IT solutions that reduce their environmental footprint and optimize energy usage.

- Competitive Advantage: Cloud Software Group can leverage its virtualization and data management technologies to offer clients significant resource efficiency gains.

- Client Benefits: Solutions that enhance resource efficiency directly contribute to lower energy consumption, a critical goal for many businesses.

Climate Change Adaptation and Resilience

The physical impacts of climate change, like severe weather events, pose a direct threat to Cloud Software Group's data center operations and the supply chains for its IT hardware. For instance, a 2024 report indicated a 15% increase in major weather-related disruptions affecting critical infrastructure globally compared to the previous year.

Cloud Software Group must integrate climate resilience into its core operational strategies. This includes robust disaster recovery plans and strategically diversifying its infrastructure geographically to mitigate risks associated with localized climate impacts.

Ensuring business continuity in the face of a changing climate is paramount. By 2025, it's projected that companies with proactive climate adaptation strategies will experience 20% less downtime during extreme weather events than those without.

Key considerations for Cloud Software Group include:

- Geographic Diversification: Spreading data centers across regions with lower climate risk profiles.

- Infrastructure Hardening: Investing in data center designs that can withstand extreme temperatures and flooding.

- Supply Chain Risk Assessment: Evaluating suppliers' climate resilience and developing alternative sourcing strategies.

- Energy Efficiency: Reducing the carbon footprint of operations, which also lowers vulnerability to energy price volatility driven by climate events.

The increasing focus on environmental sustainability is a major driver for Cloud Software Group, pushing for greener IT solutions. Enterprises are actively seeking ways to reduce their carbon footprint, making energy-efficient software a key differentiator. The global green IT market is projected to grow significantly, reaching an estimated $67.8 billion by 2030, up from $22.7 billion in 2023.

Cloud Software Group can leverage its technologies like virtualization and advanced data management to demonstrate tangible resource optimization and energy savings for clients. This aligns with the growing demand for eco-friendly IT, offering a competitive edge in a market prioritizing sustainability.

The physical impacts of climate change, such as extreme weather events, directly threaten data center operations and IT hardware supply chains. Reports from 2024 show a 15% rise in major weather-related disruptions affecting critical infrastructure globally, highlighting the need for resilience.

Integrating climate resilience into operations, including disaster recovery and geographic diversification of infrastructure, is crucial for business continuity. By 2025, companies with proactive climate adaptation strategies are expected to experience 20% less downtime during extreme weather compared to those without.

| Environmental Factor | Impact on Cloud Software Group | Data/Trend (2024-2025 Focus) |

| Energy Consumption & Carbon Footprint | Data centers are significant energy consumers; software efficiency impacts overall footprint. | Aim for 100% renewable energy sourcing for data centers by 2025. Inefficient software can increase data center energy use by up to 30%. |

| Electronic Waste (E-waste) | Indirect role in e-waste through hardware deployment and lifecycle. | Global e-waste reached 62 million metric tons in 2020, a figure projected to increase. |

| Green IT Demand | Opportunity to provide energy-efficient solutions. | Global green IT market valued at $22.7 billion (2023), projected to reach $67.8 billion by 2030 (16.9% CAGR). |

| Climate Change Impacts | Threats to infrastructure and supply chains from extreme weather. | 15% increase in major weather-related disruptions affecting critical infrastructure globally (2024 report). Companies with climate adaptation strategies expected to have 20% less downtime by 2025. |

PESTLE Analysis Data Sources

Our Cloud Software Group PESTLE Analysis is meticulously constructed using data from reputable industry analysts, government reports on technology adoption, and economic forecasts from leading financial institutions. This ensures a comprehensive understanding of the external factors impacting the cloud software landscape.