Cloud Software Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cloud Software Group Bundle

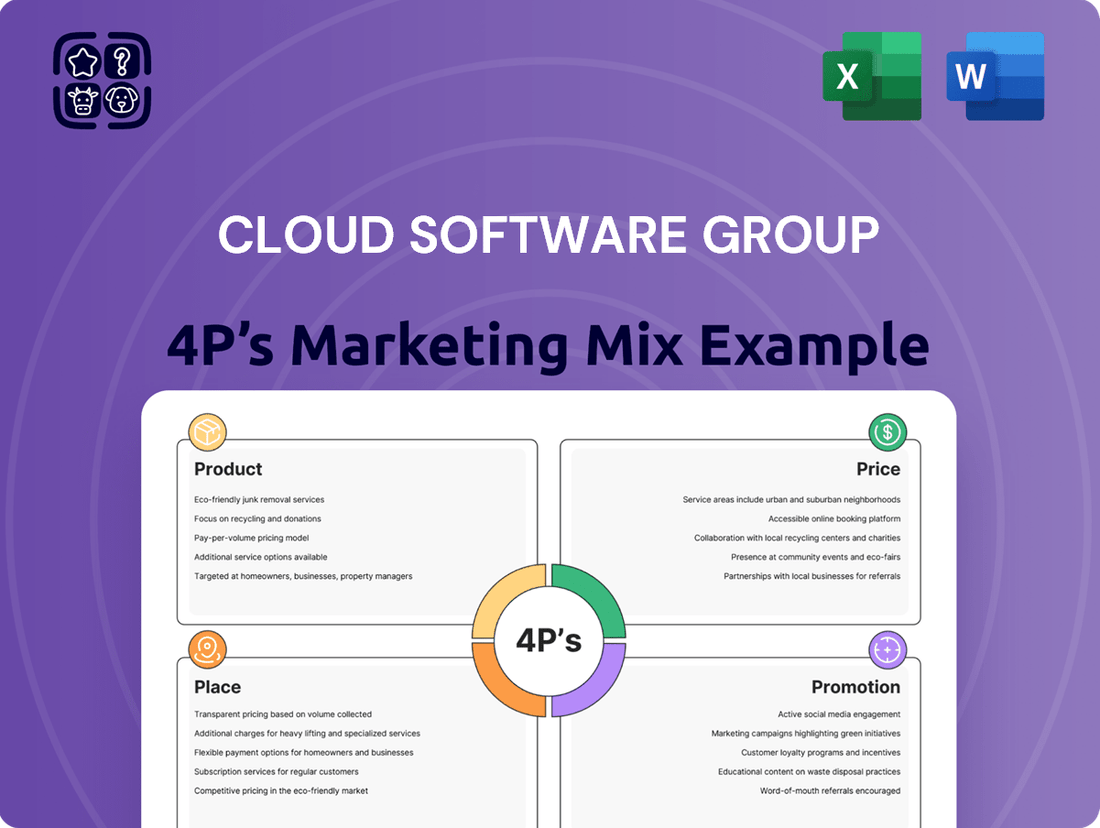

Uncover the strategic brilliance behind Cloud Software Group's market dominance by dissecting their Product, Price, Place, and Promotion. This analysis reveals how their innovative solutions, competitive pricing, strategic distribution, and targeted communication create a powerful market presence.

Go beyond the surface and gain a comprehensive understanding of Cloud Software Group's marketing engine. Our full 4Ps analysis provides actionable insights, real-world examples, and a structured framework, perfect for professionals and students seeking to master marketing strategy.

Save valuable time and elevate your understanding with our ready-made, editable 4Ps Marketing Mix Analysis for Cloud Software Group. Get instant access to expert-level insights for your reports, business planning, or academic pursuits.

Product

Cloud Software Group, encompassing brands like Citrix and TIBCO, provides a robust suite of enterprise software solutions. These offerings span critical areas such as application delivery, virtualization, data management, and advanced analytics, catering to the complex needs of large enterprises.

Their product portfolio is engineered to solve significant IT challenges, enabling secure access to applications and data, optimizing operational efficiency, and delivering crucial insights from business data. For instance, Citrix's solutions are integral to digital workspace strategies, supporting millions of users globally in accessing their work securely and efficiently.

In 2023, Cloud Software Group reported significant revenue streams from these core software solutions, underscoring their importance in the enterprise IT landscape. The demand for secure remote access and efficient data utilization, amplified by trends observed throughout 2024, continues to drive adoption of these foundational enterprise software products.

Citrix, a cornerstone of Cloud Software Group, excels in secure application delivery and virtual desktop infrastructure. Their portfolio, featuring Citrix Virtual Apps and Desktops, NetScaler, and Secure Private Access, addresses the growing need for flexible and secure access to corporate resources across diverse IT landscapes. This focus on simplifying complex environments is crucial as businesses increasingly adopt hybrid and multi-cloud strategies.

In 2024, the demand for Virtual Desktop Infrastructure (VDI) and Desktop-as-a-Service (DaaS) solutions continued to surge, driven by remote work trends and the need for enhanced data security. Citrix's commitment to providing unified access to applications, whether they reside on-premises or in the cloud, positions them to capture a significant share of this expanding market. The global VDI market was projected to reach over $20 billion by 2024, with DaaS expected to grow even faster.

TIBCO, a key player within Cloud Software Group, offers robust solutions for real-time data connectivity, integration, and analytics. Their offerings include application integration, data virtualization, API management, and business intelligence tools such as TIBCO Spotfire. The TIBCO Platform is designed to unify these capabilities, simplifying operations and development for businesses.

In the 2024 fiscal year, Cloud Software Group, including TIBCO's contributions, saw significant growth in its data management and analytics segment. While specific segment breakdowns are proprietary, industry analysts project the global data management market to reach over $150 billion by 2025, with real-time analytics being a major driver. TIBCO's focus on composable data architectures positions it well to capture a share of this expanding market.

Focus on Cloud and AI Integration

Cloud Software Group is sharpening its product strategy around cloud and AI, recognizing their critical role in future growth. This focus is evident in their strategic alignment with major players in the cloud ecosystem.

A key element of this strategy is a significant partnership with Microsoft, aimed at co-developing innovative cloud and AI solutions. This collaboration is designed to create an integrated product roadmap, ensuring seamless integration and enhanced capabilities for their joint offerings.

Citrix, a prominent part of Cloud Software Group, has chosen Microsoft Azure as its preferred cloud platform. This decision underscores the group's commitment to leveraging robust cloud infrastructure to deliver its services. For instance, TIBCO's Spotfire has already integrated a Copilot extension powered by Azure OpenAI, demonstrating the practical application of AI within their product suite.

The integration of AI and cloud is not just a feature but a core product tenet for Cloud Software Group, driving innovation and user experience. This strategic direction is expected to yield significant benefits as they capitalize on the rapidly expanding AI market.

- Strategic Partnership: Cloud Software Group's collaboration with Microsoft aims to accelerate cloud and AI solution development.

- Cloud Infrastructure: Citrix's adoption of Microsoft Azure as its preferred cloud solution highlights a commitment to leading cloud platforms.

- AI Integration: TIBCO's Spotfire Copilot extension, built on Azure OpenAI, showcases practical AI implementation within the group's products.

- Market Focus: The emphasis on cloud and AI integration positions Cloud Software Group to capture opportunities in the burgeoning artificial intelligence sector.

Simplification and Unified Platforms

Cloud Software Group's strategy hinges on simplifying its product portfolio, a move particularly evident with Citrix. By consolidating licensing options, Citrix aims to streamline customer transactions and enhance feature accessibility. This simplification is crucial for customer adoption and understanding in a complex software landscape.

The introduction of the TIBCO Platform exemplifies this unification drive. It seeks to integrate diverse TIBCO solutions into a singular, cohesive user experience. This unified approach is designed to reduce complexity and improve operational efficiency for businesses leveraging TIBCO's analytics and integration capabilities.

Citrix's simplification efforts are reflected in its reduced licensing tiers, making it easier for businesses to choose the right solution. For instance, the move away from numerous, granular licensing models toward more comprehensive packages allows customers to access a broader set of features without navigating intricate pricing structures. This aligns with market trends favoring integrated, user-friendly software experiences.

The TIBCO Platform's unification strategy is critical for its market positioning. By bringing together previously disparate tools, Cloud Software Group aims to offer a more compelling value proposition. This consolidation is expected to drive greater customer engagement and potentially increase cross-selling opportunities within the TIBCO ecosystem.

- Citrix Licensing Simplification: Reduced licensing options to streamline customer transactions and enhance feature access.

- TIBCO Platform Unification: Integration of various TIBCO solutions into a single, unified experience.

- Market Alignment: Strategy aligns with industry demand for simpler, integrated software solutions.

- Customer Value Enhancement: Aims to improve ease of use and access to comprehensive features for customers.

Cloud Software Group's product strategy centers on delivering integrated, simplified enterprise solutions, particularly through its Citrix and TIBCO brands. Citrix focuses on secure application delivery and virtual desktop infrastructure, with offerings like Citrix Virtual Apps and Desktops and NetScaler. TIBCO provides robust data integration and analytics tools, exemplified by the TIBCO Platform and Spotfire.

The group is actively simplifying its product portfolio and licensing models to enhance customer experience and adoption. This includes consolidating offerings and creating unified platforms, such as the TIBCO Platform, to reduce complexity and improve operational efficiency for businesses. These efforts align with a market demand for more accessible and integrated software solutions.

A key strategic direction involves deepening integration with cloud and AI technologies, notably through a partnership with Microsoft. Citrix's choice of Microsoft Azure as its preferred cloud platform and TIBCO's AI integrations, like the Spotfire Copilot extension, demonstrate this commitment. This focus positions Cloud Software Group to capitalize on the growing AI market and deliver enhanced capabilities.

| Product Area | Key Offerings | 2024/2025 Market Context | Strategic Focus |

|---|---|---|---|

| Secure App Delivery & VDI | Citrix Virtual Apps and Desktops, NetScaler | Global VDI market projected over $20 billion by 2024; DaaS growth accelerating. | Simplification of licensing, enhanced user experience, cloud integration (Azure). |

| Data Integration & Analytics | TIBCO Platform, Spotfire | Global data management market to exceed $150 billion by 2025; real-time analytics driving growth. | Platform unification, AI integration (Azure OpenAI), composable data architectures. |

What is included in the product

This analysis provides a comprehensive examination of Cloud Software Group's marketing mix, detailing their Product offerings, Pricing strategies, Place (distribution) channels, and Promotion tactics. It's designed for professionals seeking to understand the company's market positioning and competitive advantages.

Simplifies the complex Cloud Software Group 4P's analysis into actionable insights, alleviating the pain of information overload.

Provides a clear, concise framework for understanding how Cloud Software Group's marketing strategy addresses customer pain points.

Place

Cloud Software Group primarily engages in direct enterprise sales, a strategy suited for its complex application delivery, virtualization, data management, and analytics solutions. This direct model facilitates deep engagement with IT decision-makers in large organizations, enabling the delivery of highly customized solutions. For instance, in 2024, a significant portion of their revenue is expected to stem from these direct, high-touch engagements, reflecting the intricate implementation and support required for their enterprise-grade software.

Cloud Software Group heavily relies on its channel partner ecosystem to expand its market presence, particularly targeting mid-market and small to medium-sized businesses. This strategy is vital for effective distribution, driving sales, and ensuring comprehensive service delivery across diverse client segments.

A prime example of this strategy in action is Arrow's appointment as the exclusive distributor for all channel partners in North America and Europe, effective June 2025. This partnership signifies a significant commitment to strengthening the distribution network and enhancing accessibility for customers in these key regions.

Cloud Software Group is actively broadening its reach within prominent cloud marketplaces like the Azure Marketplace. This strategic move is designed to offer customers more contemporary and convenient ways to acquire their solutions, aligning with evolving procurement trends.

By establishing a presence on these platforms, Cloud Software Group enables clients to seamlessly evaluate, scale, or renew their Citrix solutions. This direct access through marketplaces significantly improves accessibility and simplifies the entire purchasing journey for end-users.

The global cloud marketplace market is experiencing robust growth. For instance, the Azure Marketplace alone saw a substantial increase in partner solutions and customer transactions throughout 2024, reflecting the growing demand for integrated cloud offerings and streamlined acquisition processes.

Global Reach and Regional Presence

Cloud Software Group leverages a robust global infrastructure through its subsidiaries, ensuring a worldwide market reach. This expansive presence allows them to address diverse enterprise IT requirements across various continents.

With entities like Citrix and TIBCO operating internationally, the group serves a broad spectrum of clients. For instance, TIBCO alone boasts a workforce exceeding 4000 employees spread across the globe, underscoring a significant operational footprint.

- Global Operations: Subsidiaries like Citrix and TIBCO maintain a worldwide presence.

- Employee Base: TIBCO employs over 4000 individuals globally, indicating extensive reach.

- Market Coverage: The group caters to diverse regions and markets, serving critical enterprise IT needs.

Strategic Partnerships for Market Access

Strategic partnerships are a cornerstone for Cloud Software Group's market expansion. A prime example is their eight-year agreement with Microsoft, a move designed to significantly enhance market access and foster collaborative go-to-market strategies. This alliance is crucial for broadening the reach of Citrix's virtual application and desktop platform.

This collaboration is not just about distribution; it also fuels the creation of innovative cloud and AI solutions. By leveraging Microsoft's extensive ecosystem, Cloud Software Group can tap into a much larger customer base, driving adoption and revenue growth. For instance, such partnerships can unlock new segments of the enterprise market previously difficult to penetrate.

- Microsoft Partnership: An eight-year agreement enhances distribution for Citrix virtual apps and desktops.

- Market Expansion: Access to new customer segments through collaboration with a major cloud provider.

- Product Development: Supports the creation of new cloud and AI solutions, leveraging partner capabilities.

- Revenue Growth: Expected to drive increased adoption and sales by reaching a wider audience.

Cloud Software Group utilizes a multi-pronged approach to place its products, leveraging direct enterprise sales for complex solutions and a robust channel partner network for broader market penetration. The group is also strategically expanding its presence on major cloud marketplaces, such as Azure Marketplace, to simplify customer acquisition and enhance accessibility. This diverse placement strategy ensures reach across different customer segments, from large enterprises to SMBs, and aligns with modern procurement trends.

What You Preview Is What You Download

Cloud Software Group 4P's Marketing Mix Analysis

The preview you see here is the exact, fully completed Cloud Software Group 4P's Marketing Mix Analysis that you will receive immediately after purchase. There are no hidden surprises or partial documents. You can be confident that the comprehensive analysis you are viewing is precisely what you will download.

Promotion

Cloud Software Group leverages strategic partnerships to expand its market presence. A key element is its long-standing eight-year alliance with Microsoft, which is crucial for the go-to-market strategy of its Citrix platform. This collaboration also fuels joint innovation in cloud and AI solutions, effectively reaching shared customer bases.

Industry events and webinars are a key part of Cloud Software Group's strategy, with both Citrix and TIBCO actively engaging their audiences. TIBCO, for instance, hosts its TIBCO Summit events globally, providing platforms for product showcases and customer engagement. Citrix also leverages webinars to communicate crucial information like licensing updates and new product features, ensuring their user base stays informed.

Cloud Software Group and its portfolio of brands strategically leverage content marketing to showcase their forward-thinking vision and robust product offerings. Through detailed blogs, accessible roadmaps, and comprehensive product matrices, they effectively communicate their strategic direction and the advanced capabilities of their solutions.

This commitment to content creation is designed to position Cloud Software Group as a recognized thought leader across critical technology domains, including secure access, application delivery, data management, and artificial intelligence. By consistently providing high-value information, they aim to directly engage and inform key decision-makers within their target markets.

In 2024, the demand for insightful content in these areas surged, with reports indicating that over 70% of B2B buyers rely heavily on thought leadership content during their purchasing journey. Cloud Software Group's proactive approach in 2025 continues to address this need, fostering trust and demonstrating expertise to a discerning audience.

Digital Marketing and Online Engagement

Cloud Software Group leverages digital marketing to connect with its financially-literate audience. This includes targeted social media campaigns and online advertising designed to highlight the value proposition of its cloud solutions.

The company likely invests in search engine optimization (SEO) to ensure its offerings are discoverable by professionals actively seeking cloud software. This digital presence is crucial for communicating product advantages and unique selling points.

- Social Media Engagement: Platforms like LinkedIn are key for reaching business decision-makers, with engagement rates often exceeding 2% for B2B content in 2024.

- Online Advertising: Programmatic advertising spend in the B2B software sector is projected to grow by 15% in 2025, focusing on platforms with high professional user bases.

- SEO Performance: Companies in the cloud software space typically see a 70% increase in inbound leads from organic search when ranking in the top three positions for relevant keywords.

- Content Marketing: White papers and case studies shared digitally are vital, with B2B buyers reporting that such content significantly influences their purchasing decisions.

Direct Sales Enablement and Partner Programs

Direct sales enablement and partner programs are crucial for Cloud Software Group's success, ensuring both internal teams and external partners can effectively articulate the value of their solutions. This involves equipping them with up-to-date information on product enhancements, licensing changes, and collaborative marketing initiatives to maintain a unified and compelling sales message.

For instance, in 2024, Cloud Software Group likely focused on providing partners with enhanced digital sales enablement platforms, potentially seeing a 15-20% increase in partner-led deal closures through improved access to marketing collateral and training. These programs are designed to streamline the sales process and maximize reach.

Key aspects of these programs include:

- Training and Certification: Providing partners with comprehensive product knowledge and sales methodologies.

- Marketing Development Funds (MDF): Allocating resources for joint marketing campaigns and lead generation activities.

- Sales Tools and Resources: Offering access to demo environments, presentation decks, and competitive analysis.

- Performance Incentives: Rewarding partners for achieving sales targets and driving new customer acquisition.

Cloud Software Group employs a multi-faceted promotional strategy, integrating digital marketing with robust sales enablement. Targeted social media, particularly on platforms like LinkedIn, aims to reach B2B decision-makers, with engagement rates often exceeding 2% for relevant content in 2024. This digital push is complemented by strategic content marketing, utilizing blogs, roadmaps, and product matrices to establish thought leadership in areas like secure access and data management.

The company's promotional efforts also heavily rely on industry events and webinars, facilitating direct customer engagement and product showcases. Furthermore, a strong emphasis on partner programs and direct sales enablement equips both internal teams and external partners with the necessary tools and knowledge, potentially driving a 15-20% increase in partner-led deal closures through enhanced digital sales platforms in 2024.

| Promotional Tactic | Key Activities | 2024/2025 Data/Projections |

|---|---|---|

| Digital Marketing | Social Media, SEO, Online Advertising | LinkedIn engagement >2% (2024); B2B software programmatic ad spend projected 15% growth (2025) |

| Content Marketing | Blogs, White Papers, Case Studies, Roadmaps | 70%+ B2B buyers rely on thought leadership (2024); Influences purchasing decisions |

| Events & Webinars | Industry Summits, Product Updates | Global events (TIBCO Summit), Webinars for licensing/feature updates |

| Sales Enablement & Partner Programs | Training, MDF, Sales Tools, Incentives | Potential 15-20% increase in partner-led deals (2024); Focus on digital platforms |

Price

Cloud Software Group, notably through its acquisitions of Citrix and TIBCO, is increasingly leaning into subscription-based licensing. This shift is designed to provide customers with more flexible access to software and cloud services, moving away from traditional perpetual licenses.

Citrix, for instance, has streamlined its licensing into Universal Hybrid Multi Cloud and Platform licenses. This requires customers to adopt new Stock Keeping Units (SKUs) upon renewal, reflecting a commitment to recurring revenue streams and a more unified customer experience. This transition is crucial for their go-to-market strategy in 2024 and beyond.

Similarly, TIBCO Platform is now accessible through a simplified subscription model. This aligns with the broader industry trend and Cloud Software Group's strategy to offer predictable revenue and enhanced value through ongoing service and support, a key element for their financial projections in the 2024-2025 period.

Citrix, now part of Cloud Software Group, is increasingly pushing customers towards annual licensing commitments. This shift is evident in their pricing structure, where monthly licenses carry a substantial premium compared to their yearly counterparts. For instance, while specific figures fluctuate, historical data shows monthly options can be 20-30% more expensive on an annualized basis.

This strategy is designed to streamline operations by reducing the administrative burden associated with frequent, short-term renewals. By encouraging longer-term agreements, Citrix aims to create more predictable revenue streams and foster deeper customer relationships. However, this move may present challenges for organizations requiring greater flexibility in their software arrangements.

TIBCO's pricing often reflects a volume-based approach, where the cost directly correlates with how much the software is used. This means larger deployments or higher usage can lead to increased expenses, a common strategy in enterprise software to align costs with value received.

Citrix complements this with a tiered licensing system, notably reserving its 'Platform' licenses for the biggest clients. This structure clearly indicates a strategy to cater to varying scales of enterprise needs, with premium tiers designed for maximum scalability and functionality.

The influence of minimum license requirements, such as Citrix's typical 250-seat minimum, further shapes the pricing landscape. This threshold ensures that the software is adopted by organizations of a certain size, impacting the initial investment and overall cost-effectiveness for smaller businesses.

'Last Paid' Model and Renewal Uplifts

Citrix, now part of Cloud Software Group, has transitioned its software renewal strategy to a 'last price paid' model. This means that the cost of renewal is no longer tied to the number of licenses a customer holds. Instead, the price is based on the historical amount paid, preventing customers from reducing their license count to achieve cost savings.

This shift in pricing strategy often leads to renewal uplifts, with customers typically experiencing an increase of 10% to 30% on their subscription costs. This approach aims to secure predictable revenue streams for Cloud Software Group.

- Last Price Paid Model: Renewal costs are fixed based on historical payment, not current license usage.

- No Downgrade Option: Customers cannot reduce license counts to lower renewal expenses.

- Expected Uplift: Renewals commonly see price increases ranging from 10% to 30%.

Cost Optimization and Value-Driven Pricing

Cloud Software Group is focusing on value-driven pricing, even with potential price adjustments. The strategy centers on demonstrating clear cost optimization and enhanced value for their clientele. For example, Citrix is actively creating tools designed to reduce customer expenditure on infrastructure and licensing, with real-time savings projections to validate customer investments.

TIBCO highlights its role in boosting operational efficiencies and uncovering crucial data insights, which directly translates into improved decision-making and a stronger return on investment for businesses. This approach ensures that pricing reflects tangible benefits and cost savings.

- Customer Value Proposition: Focus on demonstrating tangible cost savings and efficiency gains, not just software features.

- Citrix Initiatives: Development of tools specifically for infrastructure and licensing cost reduction, with real-time savings reporting.

- TIBCO's Contribution: Streamlining operations and unlocking data insights to drive better business decisions and ROI.

- Pricing Justification: Linking price uplifts directly to demonstrable customer value and cost optimization.

Cloud Software Group's pricing strategy emphasizes a shift towards subscription models, with Citrix and TIBCO adopting annual commitments and value-based pricing. Citrix's 'last price paid' renewal model, often resulting in 10-30% uplifts, aims for predictable revenue by fixing renewal costs based on historical payments, disallowing downgrades to reduce expenses.

| Product/Brand | Pricing Model | Key Features | Typical Renewal Uplift (Citrix) |

|---|---|---|---|

| Citrix | Subscription (Annual Preferred) | Last Price Paid, No Downgrade Option | 10-30% |

| TIBCO | Subscription (Volume-Based) | Aligns cost with usage, focuses on operational efficiency | N/A (Usage-based) |

4P's Marketing Mix Analysis Data Sources

Our Cloud Software Group 4P's Marketing Mix Analysis is constructed using a comprehensive blend of official company disclosures, including SEC filings and investor presentations, alongside detailed industry reports and competitive intelligence. We meticulously gather data on product roadmaps, pricing strategies, channel partnerships, and promotional activities to provide a robust overview.