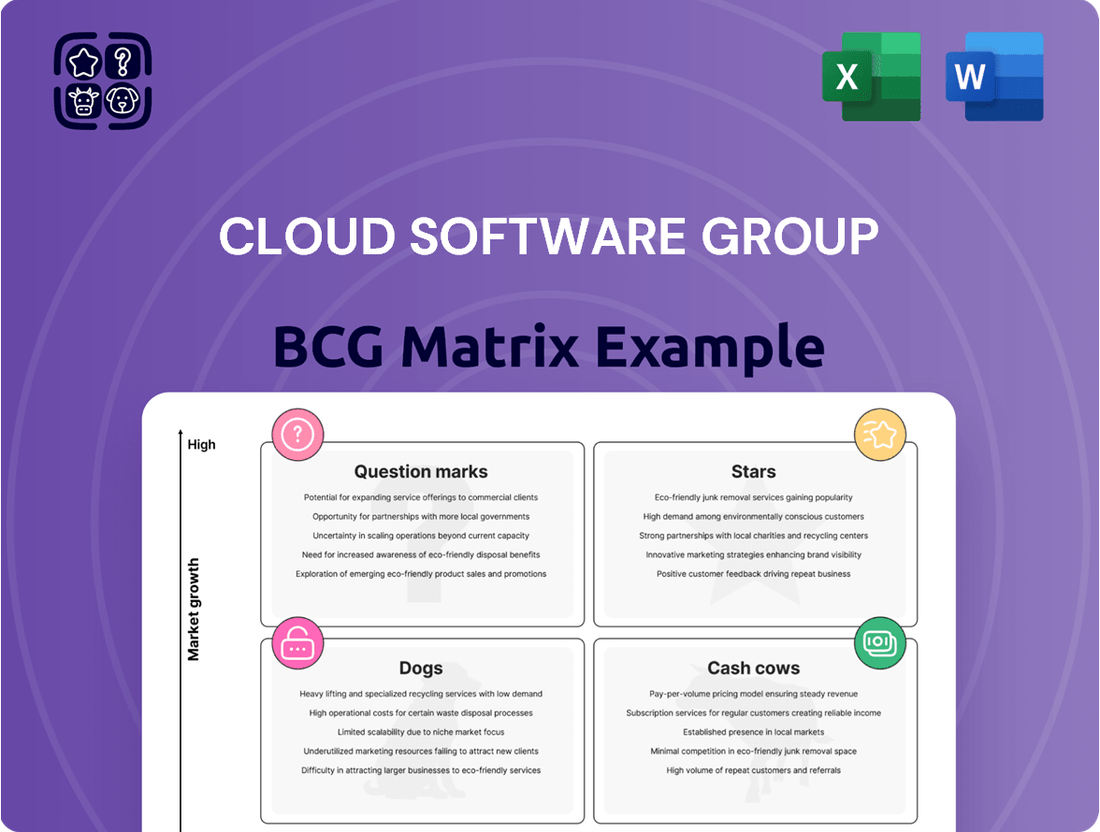

Cloud Software Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cloud Software Group Bundle

Curious about where Cloud Software Group's products fit in the market? This BCG Matrix preview offers a glimpse into their potential as Stars, Cash Cows, Dogs, or Question Marks. For a comprehensive understanding and actionable strategies, purchase the full report to unlock detailed quadrant analysis and data-driven insights.

Stars

Citrix DaaS solutions are situated in a rapidly expanding market, with the Desktop as a Service sector showing robust growth. This strong market position, combined with Citrix's leadership status alongside competitors like Microsoft and Broadcom, places it favorably.

The company's strategic eight-year partnership with Microsoft is a significant advantage, cementing Citrix as a preferred Azure partner for enterprise DaaS deployments. This collaboration is crucial for its continued success in the cloud software space.

The market for Secure Access Service Edge (SASE), encompassing secure access and Zero Trust, is booming. It's expected to grow from $2.4 billion in 2024 to $3.02 billion in 2025, showing a strong 25.7% compound annual growth rate. Citrix is making significant investments here, with their 2024 plans prioritizing zero trust security and secure app delivery.

Citrix's commitment is evident in their 2024 roadmap, which includes advanced features like post-quantum cryptography for NetScaler. This proactive approach aims to tackle the ever-changing landscape of cybersecurity threats, ensuring robust protection for their users.

TIBCO Data Fabric Solutions operates within the burgeoning global data fabric market, a sector experiencing significant expansion. Estimates place the market's value at USD 2.29 billion in 2024, with projections indicating a climb to USD 12.91 billion by 2032, reflecting a robust compound annual growth rate (CAGR) of 21.20%.

This growth is fueled by the escalating complexity of data landscapes and the critical demand for immediate, actionable insights across industries. TIBCO's established presence positions it to capitalize on these market dynamics, addressing the core challenges of data integration and accessibility.

TIBCO Real-time Analytics Capabilities

TIBCO's emphasis on real-time data processing and event-driven architectures positions it strongly within the high-growth data analytics market. Businesses today require instant data insights to make agile decisions and adapt swiftly to market shifts. TIBCO's platform is engineered to provide these critical real-time capabilities, allowing companies to leverage data as it's generated.

The demand for real-time analytics is soaring. By 2024, the global big data and business analytics market was projected to reach over $370 billion, with a significant portion driven by the need for immediate insights. TIBCO's solutions directly address this by enabling organizations to process and act on data as it flows, rather than relying on batch processing.

- Real-time Data Processing: TIBCO's platform excels at handling high-velocity data streams, crucial for industries like finance and telecommunications.

- Event-Driven Architecture: This design allows applications to react instantly to events, facilitating automated responses and proactive decision-making.

- Mission-Critical Insights: TIBCO's capabilities are built for demanding environments where immediate, accurate data is essential for operations.

- Capitalizing on Data Creation: The platform empowers businesses to extract value from data the moment it is created, offering a competitive edge.

NetScaler for Cloud-Native Application Delivery

NetScaler, now part of Cloud Software Group, is positioned as a star in the BCG matrix due to its strategic integration within the broader Citrix ecosystem, particularly for cloud-native and hybrid application delivery. This mature market is seeing renewed growth driven by the increasing complexity of modern IT infrastructures.

The product vision for NetScaler emphasizes high-performance delivery, robust security features, and end-to-end observability. These capabilities are critical for managing and securing distributed applications prevalent in cloud-native architectures. For example, in 2024, the global Application Delivery Controller market was valued at approximately $4.5 billion, with cloud-native solutions showing significant year-over-year growth.

- Focus on Cloud-Native: NetScaler's adaptation to cloud-native environments addresses a key market trend.

- Enhanced Security: Comprehensive security is a major draw for businesses migrating to or operating in the cloud.

- Observability: End-to-end visibility is crucial for troubleshooting and optimizing performance in complex distributed systems.

- Market Growth: The increasing adoption of hybrid and multi-cloud strategies fuels demand for integrated ADCs like NetScaler.

NetScaler, as part of Cloud Software Group, is a star due to its strong market position and growth potential, especially in cloud-native and hybrid application delivery. The market for Application Delivery Controllers (ADCs), where NetScaler operates, is substantial and growing, with cloud-native solutions showing particularly strong momentum. In 2024, the global ADC market was valued around $4.5 billion, and NetScaler's focus on enhanced security and observability in distributed systems aligns perfectly with current IT demands.

NetScaler's strategic importance is amplified by its integration within the broader Citrix ecosystem, supporting complex IT infrastructures. Its product vision, emphasizing high performance and comprehensive security, directly addresses the needs of modern cloud environments. This makes it a key player in a market that values integrated solutions for managing and securing applications across diverse platforms.

| Product | Market Position | Growth Potential | Key Strengths |

| NetScaler | Star | High | Cloud-native focus, enhanced security, observability, integration |

What is included in the product

Strategic evaluation of Cloud Software Group's portfolio by market share and growth.

The Cloud Software Group BCG Matrix offers a clear, one-page overview to identify and prioritize business units, alleviating the pain of strategic uncertainty.

Cash Cows

Citrix Virtual Apps and Desktops (On-Premises) represents a strong Cash Cow within the Cloud Software Group's portfolio. As of 2025, over 11,511 global companies rely on this robust virtualization solution, underscoring its substantial installed base and continued relevance.

Despite the market's maturity, these on-premises deployments are vital for the established IT infrastructures of numerous large enterprises, ensuring consistent revenue generation. The strategic emphasis remains on optimizing these existing solutions for cost-effectiveness and continued operational efficiency.

TIBCO's core data integration platforms, like TIBCO BusinessWorks, are long-standing stalwarts in the enterprise software market. These solutions are crucial for global businesses needing to connect disparate systems efficiently, acting as reliable middleware. Their mission-critical nature ensures consistent cash flow as they underpin complex operational environments.

Citrix Workspace App, as a significant player in the virtualization platform market, commands a 14.52% share as of 2025, serving more than 54,683 customers. This broad customer base highlights its established presence and consistent value proposition in end-user computing environments.

The app's extensive adoption translates into a reliable revenue stream for the Cloud Software Group. Its role as a foundational element in many organizations' digital workspaces solidifies its position as a cash cow, generating predictable income due to its ongoing utility and integration into daily business operations.

NetScaler (Traditional ADC Deployments)

NetScaler, a stalwart in the application delivery controller (ADC) space, continues to be a significant revenue generator for Cloud Software Group. Its traditional deployments, particularly within on-premises data centers, cater to a mature market segment where its robust security and performance features are highly valued. This established presence translates into consistent and predictable cash flow.

The company's leadership in enterprise application delivery is underscored by its ability to provide secure access and optimize application performance, even in complex traditional IT environments. While the growth trajectory in this segment might be more measured compared to cloud-native solutions, the sheer volume of existing deployments ensures a steady income stream. For 2024, the ADC market, which NetScaler heavily participates in, was projected to see continued stability, with some reports indicating modest growth driven by security and performance needs in hybrid cloud setups.

- NetScaler's traditional ADC deployments are a mature business segment.

- These solutions provide reliable revenue streams through established on-premises installations.

- The market for traditional ADCs remains stable, supported by ongoing security and performance demands.

- Investment in this area is focused on maintaining market share rather than aggressive expansion.

Citrix Endpoint Management

Citrix Endpoint Management, now part of the Cloud Software Group, functions as a Cash Cow within the BCG Matrix. Its core strength lies in providing secure and flexible work solutions through robust management of endpoints and stringent data safety measures. This mature offering consistently addresses a fundamental enterprise requirement for device and application security, contributing to stable revenue streams.

The continued demand for secure remote work environments, especially following the widespread adoption of hybrid models, underpins its Cash Cow status. As of early 2024, the global endpoint security market is projected to reach significant valuations, with companies like Citrix holding established positions.

- Stable Revenue: Citrix Endpoint Management generates consistent income due to its established market presence and ongoing enterprise need for device and application security.

- Mature Offering: The solution is well-developed, meeting a persistent demand for secure and flexible work environments.

- Market Position: It maintains a strong foothold in the endpoint security and management sector, a critical component of modern IT infrastructure.

- Contribution to Cloud Software Group: As a Cash Cow, it provides the financial resources to invest in other, higher-growth potential products within the Cloud Software Group portfolio.

Citrix Virtual Apps and Desktops (On-Premises) and TIBCO BusinessWorks represent established Cash Cows for Cloud Software Group. These mature products benefit from substantial existing customer bases, providing consistent and predictable revenue streams.

Citrix Workspace App and NetScaler's traditional ADC deployments also fall into this category, leveraging their strong market positions and the ongoing need for secure application delivery and end-user computing solutions.

Citrix Endpoint Management further solidifies the Cash Cow segment by addressing the persistent enterprise demand for robust device and application security in hybrid work environments.

These products are vital for generating the financial resources needed to invest in the company's Stars and Question Marks.

| Product | BCG Category | Key Characteristics | 2025 Data/Relevance |

|---|---|---|---|

| Citrix Virtual Apps and Desktops (On-Premises) | Cash Cow | High installed base, mature market, stable revenue | Over 11,511 global companies rely on it. |

| TIBCO BusinessWorks | Cash Cow | Mission-critical for data integration, reliable middleware | Underpins complex operational environments for global businesses. |

| Citrix Workspace App | Cash Cow | Significant market share, broad customer base | 14.52% share, serving over 54,683 customers. |

| NetScaler (Traditional ADC) | Cash Cow | Mature market, strong security/performance features | Stable market segment, projected modest growth in 2024 for ADCs. |

| Citrix Endpoint Management | Cash Cow | Addresses endpoint security needs, stable income | Strong position in the global endpoint security market. |

Delivered as Shown

Cloud Software Group BCG Matrix

The Cloud Software Group BCG Matrix preview you are currently viewing is precisely the final, unwatermarked document you will receive upon purchase. This means you're getting the complete, professionally formatted analysis ready for immediate strategic application, with no demo content or hidden surprises. Rest assured, the file is identical to what will be delivered, ensuring you can confidently assess its value for your business planning and decision-making processes.

Dogs

TIBCO Spotfire, a data visualization tool, occupies a modest 0.32% of the data visualization market as of early 2024. This places it considerably behind market leaders such as Microsoft Power BI and Tableau Software, which command much larger shares.

While Spotfire is integrated into Cloud Software Group's broader analytics offerings, its standalone presence in the data visualization segment is notably constrained. This limited market penetration, especially within a dynamic and expanding sector, strongly suggests its classification as a 'Dog' within the BCG matrix.

Citrix XenServer, now under the Cloud Software Group, holds a minimal share in the overall hypervisor market. Its historical focus was on supporting Citrix's own software solutions, not on directly challenging dominant players like VMware and Microsoft. This niche strategy, while effective for specific use cases, has resulted in a limited footprint compared to market leaders.

Despite efforts to re-engage with the broader hypervisor landscape, XenServer's current low market penetration firmly places it in the 'Dog' category of the BCG Matrix for this segment. The established dominance of competitors makes a significant market share reclaim a substantial challenge.

The primary utility of Citrix XenServer remains largely confined to environments already heavily invested in Citrix products. In 2024, its competitive positioning against hypervisors like VMware vSphere and Microsoft Hyper-V, which command significant market share, underscores its status as a niche player with limited mainstream appeal.

Within the Cloud Software Group's portfolio, legacy on-premises offerings represent a segment with limited cloud transition. These products, often built on older architectures, may not fully leverage cloud-native capabilities or align with the group's overarching platform strategy.

While these legacy systems continue to serve a customer base, their growth prospects are likely constrained. In 2024, for instance, many established on-premises software providers saw single-digit or even flat revenue growth compared to the double-digit expansion of cloud-native solutions. This can lead to a disproportionate allocation of resources, such as maintenance and support staff, relative to their strategic contribution.

Effectively managing these "cash cows" or "dogs" in the BCG matrix is paramount. This involves a strategic decision on whether to divest, sunset, or invest minimally to maintain a loyal customer base, thereby freeing up capital and talent for more promising cloud-based initiatives.

Niche, Less-Integrated Acquired Products

Niche, less-integrated acquired products within the Cloud Software Group's portfolio, particularly those with limited market share and growth prospects, can become dogs if they don't align with the core strategy. For instance, a specialized data analytics tool acquired in 2023 that doesn't mesh with the company's broader application delivery or virtualization offerings might struggle to gain traction. Such products often require substantial investment to revitalize or may be candidates for divestiture to streamline the portfolio.

These products, lacking synergy with the main business lines, could see their market share stagnate or decline. For example, a niche product acquired for $50 million that only contributes $5 million in revenue and shows no significant growth trajectory by 2024 would be a prime candidate for the dog quadrant. The decision to invest further or divest hinges on the potential for future integration and market impact.

- Limited Market Share: Products with less than a 5% market share in their specific niche, especially if that niche itself is small, fall into this category.

- Low Growth Potential: Forecasted annual growth rates below 3% for these niche products indicate a lack of market expansion.

- Integration Challenges: If an acquired product requires more than 20% of its revenue in ongoing integration costs without clear benefits to core offerings, it signals a problem.

- Divestiture Consideration: Products consistently showing negative ROI or requiring disproportionate management attention compared to their revenue contribution are prime candidates for divestiture.

Products with Declining Customer Adoption

Products with declining customer adoption within Cloud Software Group, specifically referencing legacy offerings from Citrix and TIBCO, are those experiencing a steady drop in new customer acquisition and a decrease in renewal rates. These products, while still holding some existing customer revenue, lack a clear strategy for future growth or revitalization. For instance, certain older versions of Citrix's on-premises virtualization solutions might fit this description as organizations increasingly shift to cloud-native alternatives. Similarly, some niche TIBCO integration platforms, particularly those not updated to support modern API-driven architectures, could be seeing reduced uptake.

These declining products are often characterized by a shrinking market share and a lack of competitive differentiation in the current technology landscape. For example, if a particular TIBCO integration suite saw its market share decrease by 15% year-over-year in 2023 due to its inability to easily connect with newer SaaS applications, it would exemplify this category. The focus for these offerings is typically on managing existing revenue streams while planning for a gradual wind-down or strategic divestment rather than investing in further development.

- Legacy Citrix Virtual Apps and Desktops versions: Older on-premises deployments that are not being upgraded to cloud-based or hybrid solutions.

- Specific TIBCO integration products: Platforms that have not kept pace with cloud-native integration patterns and API management.

- Reduced R&D investment: Companies in this situation often see a significant drop in research and development spending allocated to these specific product lines.

- Phased exit strategy: The typical approach involves a plan to sunset these products over a defined period, focusing on customer migration to newer, more viable offerings.

Products identified as "Dogs" within the Cloud Software Group's portfolio exhibit low market share and minimal growth potential. Examples include legacy Citrix XenServer, which holds a negligible share in the competitive hypervisor market, and certain TIBCO integration products that haven't adapted to modern cloud-native architectures. These offerings often require significant resources for maintenance relative to their strategic contribution.

The strategic approach for these "Dog" products typically involves careful consideration for divestiture, sunsetting, or minimal investment to sustain existing customer bases. This allows for the reallocation of capital and talent towards more promising cloud-based initiatives within the group's portfolio. For instance, a niche acquired product with stagnant revenue by 2024, contributing only 10% of its acquisition cost, would be a prime candidate for this strategy.

By classifying products like older versions of Citrix Virtual Apps and Desktops and specific TIBCO integration suites as "Dogs," Cloud Software Group can make informed decisions. These products face declining customer adoption and reduced market relevance, often due to a lack of competitive differentiation or integration challenges. For example, a TIBCO suite experiencing a 15% year-over-year market share decrease in 2023 due to poor SaaS connectivity exemplifies this classification.

Managing these low-performing assets is crucial for optimizing resource allocation. Products with less than a 5% market share and projected growth below 3% annually, or those with integration costs exceeding 20% of revenue without clear strategic benefits, are typically candidates for divestiture. This proactive management ensures focus remains on high-growth, strategic areas.

Question Marks

Cloud Software Group's substantial $1.65 billion investment in Microsoft cloud and generative AI, including the development of Spotfire Copilot, positions them to tap into a rapidly expanding market. This strategic move aims to create new AI-driven solutions, but these offerings are currently in their early stages with minimal market share in the overall AI sector.

Cloud Software Group's strategic acquisitions, such as Strong Network, are aimed at bolstering its cloud development environment offerings. While the overall cloud development market is experiencing robust growth, these newly integrated solutions are likely to start with a low market share in 2024.

Significant investment in areas like integration, marketing, and sales will be crucial for these solutions to capture substantial market share. This investment is necessary to elevate them from their initial Dog or Question Mark positions towards becoming Stars within the BCG matrix.

Emerging solutions from strategic partnerships, like the eight-year collaboration between Cloud Software Group and Microsoft, represent potential Stars in the BCG matrix. This alliance focuses on developing new cloud and AI solutions, integrating product roadmaps to foster innovation.

These joint ventures, while backed by significant resources and expertise from both entities, are often in their nascent stages of development or market entry. Their high growth potential is undeniable, but their ability to capture substantial market share remains a future determinant.

Advanced Automation Offerings

The market for advanced automation solutions, especially those powered by artificial intelligence and machine learning, is experiencing robust growth. For instance, the global AI market was projected to reach over $500 billion in 2024, with automation being a significant driver.

Cloud Software Group's strategic focus on streamlining IT operations and enhancing efficiency through automation likely translates into advanced offerings in this domain. These solutions aim to automate complex tasks, optimize resource allocation, and improve overall business processes.

These advanced automation products, while tapping into a high-growth market segment, may currently possess a relatively nascent market share. Significant investment in research, development, and market penetration will be crucial for scaling these offerings and capturing a larger portion of the expanding automation landscape.

- Market Growth: The global automation market is expected to grow at a CAGR of over 15% from 2024 to 2030, driven by AI and machine learning adoption.

- Cloud Software Group's Role: Enhancing IT operations and efficiency through AI-powered automation tools.

- Investment Needs: Substantial investment required for scaling and market presence due to the emerging nature of some advanced offerings.

- AI in Automation: AI and machine learning are key enablers for sophisticated automation, handling complex decision-making and predictive capabilities.

Specialized Vertical Solutions in Early Adoption

Cloud Software Group may focus on creating highly specialized software for industries in the nascent stages of cloud adoption. These niche solutions target emerging, high-growth sectors but currently hold a minimal market share.

Significant investment in marketing and sales is crucial to capture these nascent markets. For instance, the global market for AI-powered cloud solutions, a likely area for such specialization, was projected to reach $10.4 billion in 2024, indicating substantial growth potential.

- Niche Focus: Developing tailored cloud solutions for emerging industry verticals.

- Low Market Share: Starting with a small footprint in these specialized sectors.

- High Growth Potential: Targeting industries on the cusp of significant cloud adoption.

- Investment Needs: Requiring substantial marketing and sales resources to gain traction.

Question Marks in Cloud Software Group's portfolio represent new ventures or products with high growth potential but currently low market share. These often stem from strategic investments in emerging technologies like generative AI, as seen with Spotfire Copilot, or from recent acquisitions like Strong Network.

These offerings require substantial investment in development, marketing, and sales to transition from their nascent stage to market leadership. Without this dedicated support, they risk remaining in the Question Mark quadrant or even declining.

The success of these Question Marks hinges on their ability to capture market share in rapidly evolving sectors, such as the projected over $500 billion global AI market in 2024, where automation is a key driver.

Cloud Software Group's strategic partnerships, like the eight-year collaboration with Microsoft, also fall into this category, aiming to innovate in cloud and AI solutions with significant future potential but an uncertain immediate market impact.

| Product/Initiative | Market Growth Potential | Current Market Share | Strategic Focus | Investment Requirement |

|---|---|---|---|---|

| Spotfire Copilot (Generative AI) | Very High (AI market > $500B in 2024) | Low (Nascent) | AI-driven solutions | High (R&D, marketing) |

| Strong Network (Cloud Dev Environment) | High (Cloud market growth) | Low (New acquisition) | Cloud development offerings | High (Integration, sales) |

| Advanced Automation Solutions | Very High (Automation CAGR > 15% 2024-2030) | Low to Moderate | IT operations efficiency | High (R&D, market penetration) |

| Niche Industry Cloud Solutions | High (Emerging sectors) | Very Low | Specialized cloud adoption | High (Marketing, sales) |

BCG Matrix Data Sources

Our Cloud Software Group BCG Matrix leverages comprehensive data from financial reports, market research, and industry analysis to provide a clear strategic overview.