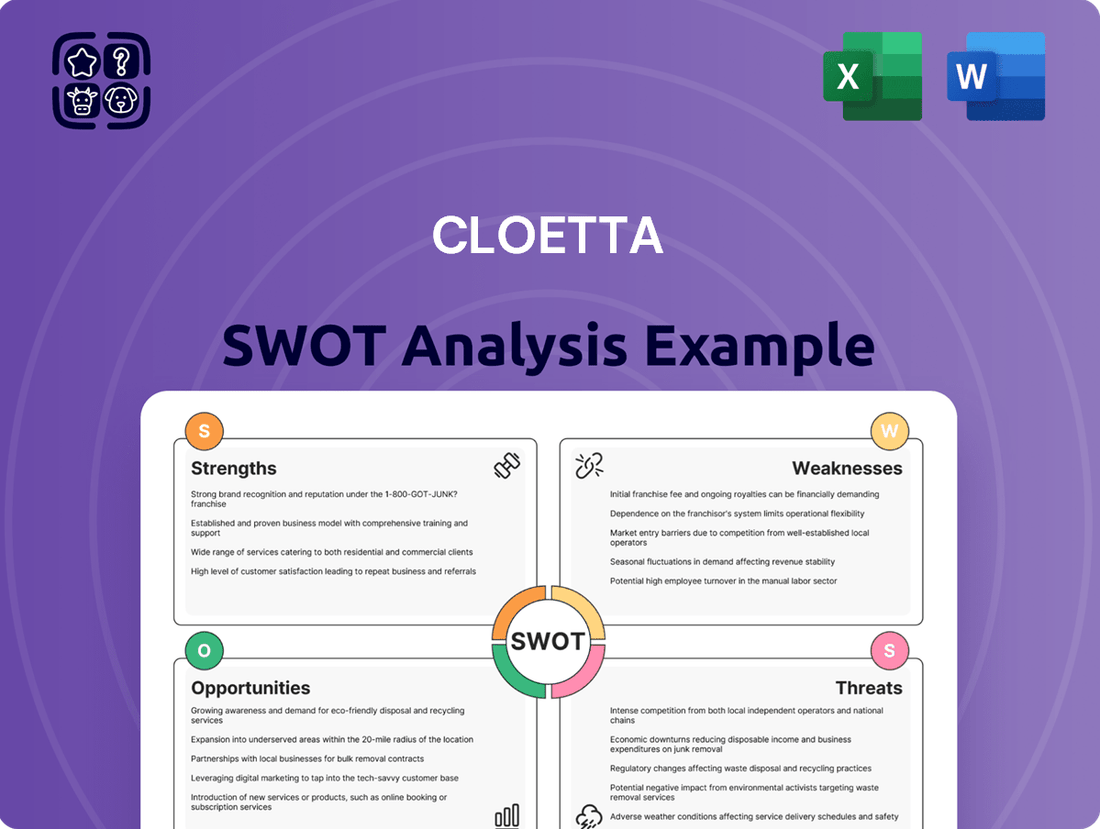

Cloetta SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cloetta Bundle

Cloetta's journey is marked by strong brand recognition and a solid European presence, but also faces challenges in evolving consumer preferences and intense competition. Understanding these dynamics is crucial for navigating the confectionery market.

Want the full story behind Cloetta's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Cloetta's strength lies in its portfolio of iconic brands, which are highly recognized and cherished by consumers. These brands span multiple confectionery segments, including chocolate, sugar confectionery, and pastilles, demonstrating broad market appeal.

These well-established brands are a significant driver of the company's success, accounting for more than 50% of Cloetta's total revenue. This highlights strong consumer loyalty and brand equity in its primary operating regions.

Cloetta is a dominant force in the confectionery sector across Northern Europe, securing leading market positions in Sweden, Finland, the Netherlands, Denmark, and Norway. This strong regional presence is a significant asset, offering stability and a competitive edge in these well-established markets.

Cloetta operates in the confectionery market, a sector known for its non-cyclical nature. This means that even during economic downturns or periods of geopolitical instability, consumers tend to maintain their spending on treats. This inherent stability provides Cloetta with a degree of resilience, allowing for more consistent revenue streams compared to businesses in more volatile industries.

For instance, during the first half of 2024, Cloetta reported a net sales growth of 6% in local currencies, underscoring the continued consumer demand for their products despite a challenging macroeconomic environment. This demonstrates the company's ability to weather economic fluctuations, a direct benefit of its non-cyclical market positioning.

Consistent Profitability and Sales Growth

Cloetta has shown remarkable financial resilience, consistently delivering strong sales growth and profitability. For the full year 2024, the company reported net sales of SEK 8.6 billion, a testament to its effective market strategies and product appeal.

This upward trend continued into early 2025, with positive reports for Q1 and Q2 2025, indicating sustained momentum. The company's operational efficiency is further highlighted by an impressive 10.6% operating profit margin in 2024, underscoring its ability to translate sales into tangible profits.

- Consistent Net Sales Growth: SEK 8.6 billion in 2024.

- Improved Profitability: Strong performance reported in Q4 2024, Q1 2025, and Q2 2025.

- Healthy Operating Margin: Achieved a 10.6% operating profit margin in 2024.

Commitment to Sustainability and ESG Initiatives

Cloetta's dedication to sustainability and Environmental, Social, and Governance (ESG) initiatives is a significant strength. The company's 'Sustainability Report for 2024' and its new agenda, 'A Sweeter Future,' underscore this commitment.

By joining the Science Based Targets initiative and aiming for a 46% reduction in its carbon footprint by 2030, Cloetta is demonstrating a forward-thinking approach to environmental responsibility. This proactive stance not only bolsters its brand image but also resonates with an increasingly eco-conscious consumer base, positioning the company favorably in the market.

- Commitment to Science Based Targets initiative

- Ambition to reduce carbon footprint by 46% by 2030

- Enhanced brand reputation through ESG focus

- Alignment with growing consumer preferences for sustainability

Cloetta's robust portfolio of well-loved brands, including Läkerol and Kexchoklad, forms a core strength, driving over 50% of its revenue and fostering strong consumer loyalty. This brand equity is particularly potent in Northern Europe, where Cloetta holds leading market positions in key countries like Sweden and Finland.

The company benefits from operating in the non-cyclical confectionery market, which provides a degree of economic resilience. This stability was evident in its performance through early 2025, with continued positive sales trends reported for Q1 and Q2 2025, building on the 6% net sales growth in local currencies seen in the first half of 2024.

Cloetta's financial performance in 2024 was strong, with net sales reaching SEK 8.6 billion and an operating profit margin of 10.6%, indicating effective operational management and market penetration.

Furthermore, Cloetta's proactive commitment to sustainability, as outlined in its 2024 ESG initiatives and the 'A Sweeter Future' agenda, enhances its brand reputation and aligns with growing consumer demand for environmentally responsible products. The company's participation in the Science Based Targets initiative, aiming for a 46% carbon footprint reduction by 2030, underscores this forward-looking strategy.

| Metric | 2024 Data | Early 2025 Data |

|---|---|---|

| Net Sales | SEK 8.6 billion | Positive growth trend (Q1 & Q2 2025) |

| Operating Profit Margin | 10.6% | Sustained profitability |

| Brand Revenue Contribution | > 50% | Continued strong performance |

What is included in the product

Analyzes Cloetta’s competitive position through key internal and external factors, highlighting both its strengths and weaknesses alongside market opportunities and potential threats.

Offers a clear breakdown of Cloetta's market position, highlighting opportunities to leverage strengths and address weaknesses in a competitive confectionery landscape.

Weaknesses

Cloetta's profitability is susceptible to swings in the cost of key ingredients. For instance, cocoa prices reached record highs in early 2024, directly squeezing margins on their chocolate confectionery. While sugar prices have eased somewhat, the broader ingredient cost landscape remains unpredictable, demanding agile cost control and strategic price adjustments to maintain financial health.

Cloetta's reliance on its core markets, which generated 81% of its revenue in 2023, presents a notable weakness. This concentration makes the company particularly vulnerable to economic slowdowns, changing consumer tastes, or increased competition within these specific regions.

Cloetta's branded packaged product volumes, a crucial segment, saw a dip in Q4 2024, specifically within its chocolate offerings. This decline, despite overall sales growth, points to potential consumer resistance to price adjustments or intensified competition impacting unit sales in this core category.

One-Time Costs from Organizational Restructuring

Cloetta's strategic reorganization, involving up to 100 job reductions across Europe, presents a significant short-term financial challenge. These restructuring efforts are projected to result in one-time costs ranging from SEK 60 million to SEK 70 million, anticipated in the second quarter of 2025. While these measures are designed to enhance long-term operational efficiency, the immediate financial impact could dampen near-term profitability.

The SEK 60-70 million in one-time costs directly affects Cloetta's bottom line in Q2 2025. This expenditure, though strategic, will temporarily reduce earnings per share and potentially impact key financial ratios, requiring careful management and clear communication to stakeholders regarding the expected pay-off from these restructuring activities.

- Estimated one-time costs: SEK 60-70 million.

- Timing of costs: Expected in Q2 2025.

- Impact: Reduction in immediate profitability due to restructuring.

Intense Competitive Landscape

The global confectionery market is a crowded arena, with giants like Mars and Nestlé, alongside robust regional contenders, constantly battling for consumer attention and shelf space. Cloetta, despite its strong position in the Nordics, must constantly push for new product development and unique branding to stand out. This intense rivalry means that even minor missteps in product launches or marketing can lead to significant market share erosion.

Cloetta's reliance on its established brands, while a strength, also presents a challenge in a market that craves novelty. The company needs to ensure its core products remain relevant while also successfully introducing new confectionery experiences. For instance, while specific 2024/2025 market share data for Cloetta against all global competitors isn't readily available in a consolidated view, industry reports consistently highlight the dominance of major players. The global confectionery market was valued at approximately USD 223.7 billion in 2023 and is projected to reach USD 290.4 billion by 2030, indicating substantial growth but also fierce competition for every percentage point.

- Intense Rivalry: Cloetta operates within a global confectionery market dominated by large multinational corporations and strong regional players.

- Innovation Pressure: Continuous need to innovate and differentiate products is crucial to maintain market share against competitors.

- Brand Reliance: While strong, reliance on established brands requires ongoing investment to prevent market share loss to newer, trendier offerings.

- Market Share Dynamics: The need to secure and grow market share in a highly fragmented and competitive landscape remains a significant challenge.

Cloetta's profitability is vulnerable to fluctuations in the cost of key ingredients like cocoa and sugar, as seen with record cocoa prices in early 2024 impacting margins. Its significant reliance on core markets, accounting for 81% of 2023 revenue, makes it susceptible to regional economic downturns and competitive pressures. Furthermore, a recent dip in branded packaged product volumes for chocolate in Q4 2024 suggests potential consumer pushback against price increases or heightened competition in this crucial segment.

| Weakness | Description | Impact |

| Ingredient Cost Volatility | Sensitivity to rising costs of cocoa, sugar, etc. | Squeezed profit margins, potential price increases. |

| Market Concentration | 81% of 2023 revenue from core markets. | Vulnerability to regional economic slowdowns and competition. |

| Volume Decline in Key Segment | Dip in branded packaged product volumes (chocolate) in Q4 2024. | Indicates potential consumer resistance or competitive pressure on unit sales. |

| Restructuring Costs | SEK 60-70 million in one-time costs in Q2 2025. | Temporary reduction in near-term profitability and EPS. |

Preview Before You Purchase

Cloetta SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase. This ensures transparency and guarantees you get the complete, professionally structured report without any surprises.

You’re viewing a live preview of the actual Cloetta SWOT analysis file. The complete, in-depth version becomes available immediately after checkout, allowing you to utilize the full report.

This is a real excerpt from the complete Cloetta SWOT analysis. Once purchased, you’ll receive the full, editable version, ready for your strategic planning needs.

Opportunities

Cloetta is actively pursuing expansion into high-growth markets, notably Germany and the UK, which represent Europe's largest confectionery retail sectors. This strategic move aims to tap into a broader consumer base and diversify revenue streams beyond its established Nordic presence.

The company is capitalizing on the increasing global appeal of Swedish candy, evidenced by its launch of pilot concepts in the United States. This initiative directly addresses the growing consumer interest in unique and international confectionery offerings, potentially opening significant new revenue channels.

Consumers are increasingly seeking confectionery products that offer health benefits, such as lower sugar content, plant-based ingredients, and added functional attributes. This shift in preference presents a significant opportunity for Cloetta.

Cloetta's existing sustainability strategy already prioritizes the development of natural, vegan, sugar-less, and sugar-free confectionery options. This proactive approach positions the company well to capitalize on the growing demand for healthier treats. For instance, in 2023, the global market for sugar-free confectionery was valued at approximately $20 billion and is projected to grow significantly in the coming years, reflecting this strong consumer trend.

Cloetta's commitment to innovation is a key opportunity. They are focusing on accelerating new product development, exploring adventurous flavors, and offering personalized confectionery experiences. This aligns with their updated strategy to drive profitable growth through marketing and innovation, directly addressing changing consumer tastes.

Leveraging E-commerce and Digital Sales Channels

The confectionery sector's strong e-commerce growth offers Cloetta a prime opportunity to broaden its consumer base and boost sales via digital channels. This trend reflects a significant shift in how consumers shop for treats.

Cloetta can capitalize on this by enhancing its direct-to-consumer (DTC) offerings and optimizing its presence on major online retail platforms. For instance, online sales in the European confectionery market saw a substantial increase, with some reports indicating double-digit year-over-year growth in the digital channel during 2024.

- Expanded Market Reach: E-commerce allows Cloetta to transcend geographical limitations, reaching a wider customer demographic.

- Enhanced Consumer Engagement: Digital platforms facilitate direct interaction, enabling personalized marketing and loyalty programs.

- Data-Driven Insights: Online sales provide valuable data on consumer preferences and purchasing habits, informing product development and marketing strategies.

- Increased Sales Volume: Leveraging online marketplaces and a robust DTC strategy can significantly contribute to overall revenue growth.

Potential for Strategic Mergers and Acquisitions (M&A)

Cloetta's strategic roadmap highlights selective mergers and acquisitions as a key lever for strengthening its operational framework and accelerating expansion. This suggests a deliberate approach to integrating external businesses to bolster market share or diversify its product offerings.

The company's focus on M&A aligns with industry trends where consolidation can unlock synergies and create competitive advantages. For instance, in the confectionery sector, strategic acquisitions have historically been used to gain access to new geographies or specialized product lines. Cloetta's proactive stance in 2024 and 2025 will likely involve identifying targets that complement its existing strengths and offer clear pathways to value creation.

- Market Consolidation: Pursuing acquisitions to increase market share in core regions.

- Portfolio Expansion: Acquiring brands or product categories that broaden customer appeal.

- Synergy Realization: Targeting M&A deals that offer cost savings and operational efficiencies.

- Geographic Reach: Expanding into new markets through strategic partnerships or outright purchases.

Cloetta is strategically expanding into key European markets like Germany and the UK, aiming to capture larger market shares and diversify its revenue beyond the Nordic region. The company is also exploring international growth, with pilot programs in the United States to leverage the global demand for unique confectionery experiences.

The increasing consumer preference for healthier options, such as sugar-free, plant-based, and functional confectionery, presents a significant opportunity for Cloetta. This aligns with their existing sustainability focus on developing natural and vegan products, tapping into a market segment that was valued at around $20 billion in 2023.

Cloetta's commitment to innovation, including exploring new flavors and personalized offerings, directly addresses evolving consumer tastes. Furthermore, the robust growth of e-commerce in the confectionery sector, with European online sales showing double-digit growth in 2024, provides a channel to expand reach and enhance consumer engagement through direct-to-consumer strategies.

Selective mergers and acquisitions are also a key part of Cloetta's strategy to strengthen its market position and expand its portfolio. This approach is common in the industry for achieving synergies and competitive advantages, with Cloetta likely to pursue targets in 2024-2025 that complement its existing business.

| Opportunity Area | Description | Market Relevance |

|---|---|---|

| Market Expansion | Entry into Germany and UK, pilot programs in the US. | Access to larger consumer bases and new revenue streams. |

| Health & Wellness Trends | Focus on sugar-free, plant-based, and functional confectionery. | Capitalizes on growing consumer demand for healthier treats. |

| E-commerce Growth | Enhancing DTC and online platform presence. | Broadens reach, improves engagement, and drives sales. |

| Mergers & Acquisitions | Strategic acquisitions to strengthen market share and portfolio. | Leverages industry consolidation for synergies and competitive edge. |

Threats

The confectionery sector, including companies like Cloetta, is facing a persistent challenge with historically elevated cocoa prices. This sustained cost pressure directly impacts the profitability of chocolate-centric products, forcing strategic adjustments in pricing and potentially necessitating a shift towards alternative ingredients.

As of early 2024, cocoa futures have reached record highs, with benchmarks trading significantly above previous years. For instance, cocoa futures on the ICE exchange surpassed $6,000 per metric ton in early 2024, a substantial increase from levels seen in prior years. This economic reality translates to higher input costs for Cloetta, potentially squeezing profit margins if these costs cannot be fully passed on to consumers.

The increasing global emphasis on health and wellness, particularly concerning sugar consumption and 'ultra-processed' foods, poses a significant long-term challenge to confectionery sales. For instance, a 2024 report indicated that over 60% of consumers globally are actively seeking healthier food options, directly impacting traditional candy markets.

Cloetta needs to proactively evolve its product portfolio to align with these shifting consumer preferences and ensure continued market relevance. Failure to adapt could lead to declining sales as consumers opt for perceived healthier alternatives.

The global confectionery market is a crowded space, with major players like Mars Wrigley and Nestlé constantly vying for consumer attention alongside nimble local brands. This intense rivalry means Cloetta must consistently invest in new product development and robust marketing campaigns to stand out and avoid losing ground. For instance, in 2023, the global confectionery market was valued at approximately $113.4 billion, with projections indicating continued growth, but also highlighting the fierce competition for market share within this expanding sector.

Supply Chain Disruptions and Geopolitical Instability

The confectionery sector, including companies like Cloetta, faces significant risks from global supply chain vulnerabilities. Fluctuations in the availability and price of essential raw materials such as sugar, cocoa, and palm oil can directly impact production costs and profit margins. For instance, a 2024 report highlighted that cocoa prices reached record highs, driven by adverse weather conditions in West Africa and disease affecting crops, a trend that continued into early 2025, directly squeezing manufacturers' input costs.

Geopolitical tensions further amplify these supply chain challenges. Trade disputes, regional conflicts, and shifts in international relations can disrupt established distribution channels and increase logistical expenses. The ongoing instability in certain key agricultural regions, coupled with evolving trade policies, creates an unpredictable operating environment for companies reliant on global sourcing and export markets.

- Ingredient Price Volatility: Cocoa prices, a key input for confectionery, saw an unprecedented surge in late 2024 and early 2025, impacting the cost structure of manufacturers.

- Logistical Hurdles: Increased shipping costs and potential port congestion, exacerbated by geopolitical events in 2024, continue to pose a threat to timely delivery of both raw materials and finished goods.

- Regulatory Changes: Evolving trade agreements and import/export regulations in major markets can create unforeseen barriers and compliance costs.

Consumer Price Sensitivity and Economic Pressures

Rising inflation and ongoing economic pressures in key markets are making consumers more cautious about their spending. This heightened price sensitivity could lead them to cut back on non-essential items like confectionery or opt for cheaper alternatives, directly impacting Cloetta's sales volumes.

For instance, in early 2024, inflation rates in several European countries where Cloetta operates remained elevated, impacting household purchasing power. This trend necessitates careful consideration of pricing strategies and promotional activities to maintain competitiveness without alienating price-conscious consumers.

- Increased Price Sensitivity: Consumers are actively seeking better value for their money, potentially leading to a decline in premium product sales.

- Shift to Private Labels: Retailers' own-brand confectionery offerings may gain traction as consumers look for lower-priced options.

- Impact on Sales Volume: A prolonged period of economic strain could result in reduced overall demand for confectionery products.

- Need for Strategic Adjustments: Cloetta may need to adapt its product portfolio, pricing, and marketing to address these evolving consumer behaviors.

Persistent high cocoa prices, reaching record highs in early 2024 and continuing into early 2025, directly threaten Cloetta's profitability, forcing potential price increases or ingredient adjustments.

Intensifying competition from global and local players, within a market valued at over $113 billion in 2023, demands continuous innovation and marketing investment to maintain market share.

Growing consumer focus on health and wellness, with over 60% of consumers seeking healthier options in 2024, challenges traditional confectionery sales, requiring portfolio evolution.

SWOT Analysis Data Sources

This Cloetta SWOT analysis is built upon a robust foundation of data, encompassing their official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded and actionable assessment.