Cloetta Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cloetta Bundle

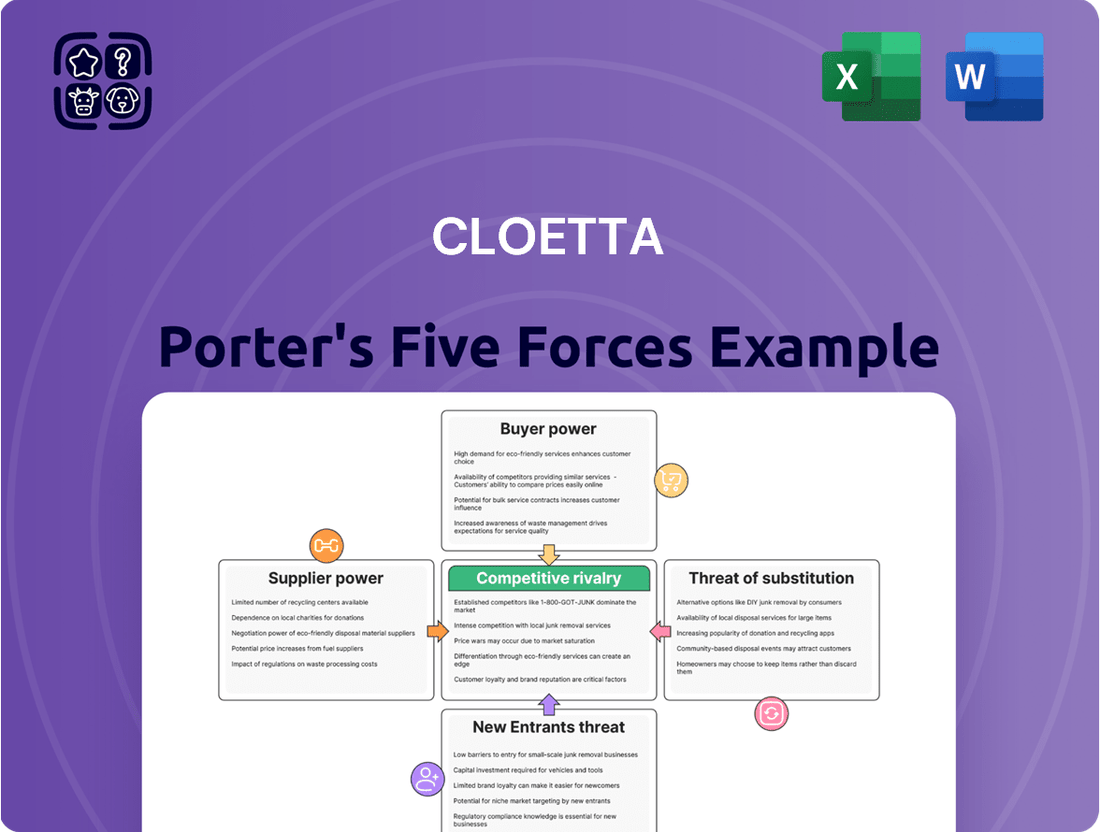

Cloetta's competitive landscape is shaped by a complex interplay of forces, from the bargaining power of its suppliers and buyers to the ever-present threat of new entrants and substitutes. Understanding these dynamics is crucial for navigating the confectionery market.

The complete report reveals the real forces shaping Cloetta’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Cloetta's reliance on a concentrated supplier base for key ingredients like cocoa and sugar significantly impacts supplier power. For instance, the global cocoa market, dominated by a few major producing regions, can lead to price volatility and supply constraints, as seen in recent market trends where cocoa prices reached record highs in early 2024, impacting confectionery manufacturers worldwide.

The uniqueness of certain flavorings or specialized ingredients also plays a crucial role. If Cloetta sources proprietary flavor compounds or specific fruit extracts from a single or very few suppliers, these suppliers gain considerable leverage. This is particularly relevant in the competitive confectionery market where differentiated product offerings are key, and the inability to source a specific ingredient can halt production or force costly substitutions.

Global supply chain complexities, including geopolitical factors and trade policies, can further amplify supplier bargaining power. For example, disruptions in West Africa, a primary cocoa-producing region, can have ripple effects across the entire industry, limiting options for companies like Cloetta and strengthening the position of suppliers who can guarantee consistent delivery.

Cloetta faces considerable switching costs when changing suppliers for key ingredients like sugar or cocoa, or for specialized packaging. These costs can include significant investments in retooling manufacturing equipment to accommodate new material specifications, the lengthy process of re-certifying ingredients to meet food safety and quality standards, and the administrative burden of renegotiating complex supply contracts. For example, a change in a primary sweetener might require recalibrating mixing machinery, a process that could take weeks and incur substantial engineering fees.

The threat of forward integration by Cloetta's suppliers is a significant factor in their bargaining power. If suppliers, particularly those providing specialized ingredients or advanced processing technology, possess the necessary capabilities and see a profitable opportunity, they could enter the confectionery market directly. This would transform them from suppliers into competitors, directly challenging Cloetta's market position.

Importance of Supplier's Input to Cloetta's Product Quality

The bargaining power of suppliers significantly impacts Cloetta's operational costs and product quality. For instance, key ingredients like cocoa, sugar, and dairy are fundamental to confectionery products. If these suppliers are few or their products are highly specialized, they can command higher prices, directly affecting Cloetta's profitability. In 2023, the cost of raw materials, particularly sugar and cocoa, saw notable increases, putting pressure on confectionery manufacturers like Cloetta.

Cloetta's reliance on specific, high-quality ingredients for its premium brands, such as Läkerol or Kex, amplifies supplier leverage. If a particular supplier provides a unique flavor compound or a specially processed ingredient that is difficult to substitute, that supplier holds considerable power. This can lead to less favorable contract terms for Cloetta, potentially impacting its ability to maintain competitive pricing or margins.

- Ingredient Criticality: Certain ingredients are vital for Cloetta's product identity and taste profiles.

- Supplier Concentration: A limited number of suppliers for essential raw materials can increase their bargaining power.

- Input Quality Impact: The quality of supplier inputs directly influences the perceived quality and brand reputation of Cloetta's confectionery.

- Cost Pass-Through: Suppliers with strong leverage may be able to pass on their own cost increases to Cloetta, affecting profitability.

Availability of Substitute Inputs

The availability of substitute inputs significantly impacts the bargaining power of Cloetta's suppliers. If Cloetta can easily switch to alternative raw materials or components without impacting product quality or consumer appeal, suppliers have less leverage. For instance, if cocoa bean prices surge, Cloetta's ability to source from different regions or even explore alternative flavor profiles would reduce the bargaining power of its primary cocoa suppliers.

In 2024, the confectionery industry faces fluctuating commodity prices, particularly for sugar and cocoa. For example, global cocoa prices reached record highs in early 2024, increasing by over 60% year-on-year. This volatility highlights the importance for Cloetta to identify and cultivate relationships with suppliers offering diverse sourcing options or to explore the feasibility of using alternative sweeteners or flavorings that are less susceptible to such price shocks. The presence of readily available and comparable substitutes for key ingredients like sugar, fats, and flavorings directly weakens the negotiation position of those specific suppliers.

- Impact of Substitutes: If Cloetta can source comparable ingredients from multiple suppliers or utilize alternative inputs, the bargaining power of any single supplier is reduced.

- Commodity Price Sensitivity: Fluctuations in prices for key inputs like cocoa and sugar, as seen in 2024 with cocoa prices surging over 60% year-on-year, underscore the need for ingredient flexibility.

- Quality and Perception: The ability to substitute without compromising product quality or consumer perception is crucial; readily available, high-quality substitutes diminish supplier leverage.

Cloetta's bargaining power with suppliers is significantly influenced by the concentration of its supplier base for critical ingredients like cocoa and sugar. The global cocoa market, for instance, saw prices surge by over 60% year-on-year in early 2024, reaching record highs. This concentration means suppliers of such essential commodities can exert considerable influence over pricing and supply terms.

The criticality of certain ingredients and the potential for supplier forward integration also bolster supplier power. If a supplier provides a unique flavoring or a specialized processing technology, and has the capacity to enter the confectionery market itself, it gains substantial leverage over Cloetta.

Conversely, the availability of viable substitutes for key inputs directly weakens supplier bargaining power. Cloetta's ability to source alternative sweeteners or flavorings, or to switch between different cocoa-producing regions without compromising product quality, can mitigate price increases and supply disruptions.

| Factor | Impact on Cloetta | Example/Data Point |

|---|---|---|

| Supplier Concentration (Cocoa) | Increases supplier leverage and price volatility | Cocoa prices rose over 60% YoY in early 2024 |

| Ingredient Uniqueness | Strengthens power of niche suppliers | Proprietary flavor compounds or specialized fruit extracts |

| Switching Costs | Deters Cloetta from changing suppliers | Retooling machinery, re-certifying ingredients |

| Availability of Substitutes | Reduces supplier leverage | Ability to use alternative sweeteners or source from different regions |

What is included in the product

This analysis dissects Cloetta's competitive environment by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the confectionery market.

Instantly identify and address competitive threats with a comprehensive yet digestible overview of Cloetta's industry landscape.

Customers Bargaining Power

Cloetta's customer base is notably concentrated, with a few dominant retail chains in key markets like the Nordic region, Netherlands, and Italy wielding significant bargaining power. For instance, in 2023, major grocery retailers in these regions collectively represented a substantial portion of Cloetta's total revenue, giving them considerable leverage to negotiate pricing and favorable terms. This concentration means that if these large customers demand lower prices or better payment conditions, Cloetta has limited options but to comply to maintain sales volume.

The bargaining power of customers, particularly retailers, is significantly influenced by the sheer volume of substitute confectionery products available. Retailers can easily switch to competing brands if Cloetta's pricing or terms become unfavorable. This is because the market is flooded with numerous chocolate, sugar confectionery, and pastille brands, offering a wide range of alternatives.

In 2024, the confectionery market remained highly competitive, with many global and local players vying for shelf space. For instance, major retailers in Sweden, Cloetta's primary market, have access to a vast selection of products from companies like Mondelez, Mars, and Nestlé, alongside smaller, niche producers. This abundance of choice directly limits Cloetta's ability to dictate terms or raise prices without risking a shift in purchasing to a competitor.

Cloetta's major customers, such as large supermarket chains and distributors, often possess significant market data, including sales figures and competitor pricing. This information asymmetry allows them to negotiate more aggressively, understanding consumer preferences and market trends to their advantage. For instance, if a key retailer has access to detailed sales data for Cloetta's confectionery products compared to rivals, they can leverage this insight to demand lower prices or better promotional terms, potentially squeezing Cloetta's profit margins.

Threat of Backward Integration by Customers

Large retail customers, such as major supermarket chains, possess the potential to develop their own private-label confectionery brands. This capability directly challenges Cloetta's market position by offering consumers similar products under the retailer's own banner.

If these retailers have the necessary infrastructure and financial incentive to produce their own chocolate and candy, their bargaining power against Cloetta is significantly amplified. This threat compels Cloetta to maintain competitive pricing and favorable terms to retain shelf space and customer loyalty.

- Retailer Private Label Growth: In 2024, private label penetration in the European confectionery market continued to rise, with some categories seeing growth rates exceeding branded products, indicating a growing capacity and willingness of retailers to produce their own brands.

- Impact on Margins: The threat of backward integration can exert downward pressure on Cloetta's gross margins, as retailers may use their private label offerings as leverage in negotiations for branded product placement and pricing.

- Competitive Landscape: Retailers investing in private label production can shift market share, forcing established players like Cloetta to innovate and differentiate their offerings beyond price alone.

Price Sensitivity and Product Differentiation

Cloetta's customers can exhibit varying degrees of price sensitivity. For instance, in the broader confectionery market, basic chocolate bars or candies might be viewed as more commoditized, leading to higher price sensitivity among consumers. However, Cloetta's investment in brands like Kexchoklad and Marabou, which possess significant brand equity and a history of perceived quality, can reduce this sensitivity. These established brands offer a degree of differentiation that allows Cloetta to command a premium over generic alternatives.

The degree of product differentiation plays a crucial role in mitigating customer bargaining power. When Cloetta's products are perceived as unique, perhaps due to specific flavors, ingredients, or packaging, customers are less likely to switch to competitors solely based on price. For example, seasonal or limited-edition offerings often leverage this differentiation. In 2024, the confectionery market continues to see consumers seeking both value and distinctive experiences, meaning strong brand loyalty is a key defense against price-driven purchasing.

- Price Sensitivity: High for basic confectionery, lower for differentiated, branded products.

- Brand Differentiation: Strong brands like Kexchoklad and Marabou reduce customer reliance on price alone.

- Market Perception: Commodities face intense price pressure; unique offerings build loyalty.

- 2024 Trend: Consumers balance value with unique product experiences, favoring established brands with perceived quality.

Cloetta's bargaining power with customers is significantly shaped by retailer concentration and the availability of substitutes. Major grocery chains in key markets like the Nordics and Netherlands hold substantial sway due to their volume purchasing. In 2023, these large retailers accounted for a significant portion of Cloetta's revenue, enabling them to negotiate favorable pricing and terms. The abundance of alternative confectionery brands means retailers can easily switch suppliers if Cloetta's offers are not competitive, limiting Cloetta's pricing flexibility.

Furthermore, retailers' access to sales data and their potential to develop private-label brands amplify their bargaining power. By understanding consumer preferences and market trends, retailers can negotiate more aggressively for branded products. The rise of private label penetration in Europe, with some categories growing faster than branded products in 2024, underscores this threat, potentially pressuring Cloetta's profit margins and necessitating continuous innovation and differentiation.

| Factor | Impact on Cloetta | 2023/2024 Relevance |

|---|---|---|

| Customer Concentration | High leverage for large retailers | Major grocery chains in key markets drive significant revenue. |

| Availability of Substitutes | Limits pricing power | Numerous competing brands allow easy switching by retailers. |

| Retailer Data Access | Enables aggressive negotiation | Market insights used to secure better terms. |

| Private Label Threat | Potential margin pressure | Growing private label market in Europe in 2024. |

Full Version Awaits

Cloetta Porter's Five Forces Analysis

This preview displays the complete Cloetta Porter's Five Forces Analysis, offering a comprehensive examination of the competitive landscape. The document you see here is the exact, professionally formatted file you will receive immediately upon purchase, ensuring transparency and immediate usability. You can confidently rely on this preview as it represents the full, ready-to-use analysis that will be instantly accessible after your transaction.

Rivalry Among Competitors

Cloetta operates in a confectionery market teeming with a vast number of competitors. This includes global behemoths like Mars Wrigley and Nestlé, alongside robust regional players and specialized niche brands focusing on everything from chocolate to sugar confectionery and pastilles.

The sheer diversity of these players, each with unique product portfolios and market strategies, creates a highly dynamic and competitive landscape. For instance, in 2024, the global confectionery market was valued at approximately USD 230 billion, a testament to the scale and intensity of competition.

This crowded environment intensifies rivalry, forcing companies like Cloetta to constantly innovate and defend their market share. The pressure on pricing and profitability is significant, as consumers have a wide array of choices across different brands and product categories.

The confectionery market, particularly in mature European regions where Cloetta primarily operates, often exhibits a slow growth rate. For instance, the European confectionery market saw a modest growth of around 1.5% in 2023, indicating a relatively mature landscape.

In such environments, intense competition for market share becomes a defining characteristic. Companies like Cloetta face a scenario where gains are often at the expense of rivals, potentially triggering price wars and heightened promotional activities to capture consumer attention and loyalty.

Cloetta's product differentiation strategy is crucial in mitigating competitive rivalry. While many confectionery products can be seen as similar, Cloetta has focused on specific niches and heritage brands, such as Kexchoklad and Malaco, which have cultivated strong consumer recognition and loyalty. For instance, in 2023, Cloetta reported that its branded products continued to perform well, indicating that consumers value the specific attributes and experiences associated with these brands, thereby reducing the inclination to switch based solely on price.

High Fixed Costs and Exit Barriers

The confectionery industry, including players like Cloetta, often involves substantial fixed costs. These include investments in large-scale manufacturing plants, sophisticated machinery, and significant marketing budgets for brand building. For instance, establishing a modern confectionery production line can easily run into tens of millions of euros. These high initial outlays mean companies must operate at high capacity to spread the costs, which can lead to intense competition and price wars if demand falters.

When demand weakens, companies with high fixed costs are pressured to continue production to cover their overheads. This can result in an oversupply in the market, driving down prices and squeezing profit margins for everyone. In 2023, the global confectionery market experienced price pressures due to rising raw material costs and a more cautious consumer spending environment, exacerbating the impact of fixed costs.

Furthermore, significant exit barriers can lock companies into the industry, intensifying rivalry. These barriers might include specialized production equipment that is difficult to repurpose, long-term supply contracts, or substantial brand equity that would be lost upon exiting. Companies are therefore reluctant to leave the market, even when profitability is low, contributing to sustained competitive pressure.

- High Fixed Costs: Confectionery manufacturing requires significant capital investment in production facilities and marketing, often running into millions of euros per facility.

- Production Pressure: High fixed costs incentivize companies to maintain high production volumes, potentially leading to oversupply and price erosion, especially during economic downturns.

- Exit Barriers: Specialized assets and long-term commitments make exiting the industry difficult, thus prolonging intense competition among existing players.

- Market Dynamics: In 2023, the confectionery sector faced price pressures due to increased raw material costs and shifts in consumer spending, highlighting the impact of fixed costs in a challenging market.

Switching Costs for Consumers

In the confectionery sector, switching costs for consumers are typically very low. This means that shoppers can easily choose a different brand of sweets or chocolates on their next purchase without facing significant hurdles or expenses. For instance, a consumer might opt for a Mars bar one day and a Cadbury bar the next with no penalty.

This low barrier to switching places considerable pressure on companies like Cloetta. They must constantly innovate and differentiate their products to retain customer loyalty. Competition often centers on factors like:

- Product Taste and Quality: Offering superior or unique flavors is crucial.

- Price Competitiveness: Promotions and pricing strategies play a significant role.

- Novelty and Innovation: Introducing new products or limited editions can attract attention.

In 2023, the global confectionery market was valued at approximately $230 billion, highlighting the intense competition where brand loyalty can be fluid. Companies that fail to keep pace with consumer preferences or offer compelling value risk losing market share rapidly due to these low switching costs.

Competitive rivalry within the confectionery market is fierce, driven by a multitude of global, regional, and niche players. This intense competition is further fueled by high fixed costs in manufacturing and marketing, creating pressure to maintain production volumes and potentially leading to price wars. Low consumer switching costs mean brand loyalty can be fickle, compelling companies like Cloetta to continuously innovate and differentiate to retain market share.

| Factor | Impact on Cloetta | 2023/2024 Data/Context |

|---|---|---|

| Number of Competitors | High | Global confectionery market valued at ~USD 230 billion in 2023, with numerous established and emerging brands. |

| Product Differentiation | Crucial for market share defense | Cloetta's heritage brands like Kexchoklad and Malaco show strong consumer recognition, aiding loyalty. |

| Pricing Pressure | Significant due to low switching costs and high fixed costs | The market experienced price pressures in 2023 due to rising raw material costs and cautious consumer spending. |

| Market Growth Rate | Slow in mature regions | European confectionery market saw ~1.5% growth in 2023, intensifying competition for existing share. |

SSubstitutes Threaten

Consumers have a vast array of snack options beyond confectionery, including savory snacks like chips and pretzels, baked goods such as cookies and pastries, and chilled treats like ice cream. Even healthier alternatives like fresh fruit, yogurt, and nuts compete for consumer attention during snack times. For instance, in 2024, the global savory snacks market was projected to reach over $190 billion, demonstrating a significant appetite for non-confectionery options.

The threat intensifies when these substitutes offer a more appealing price-performance ratio. If consumers perceive that they can achieve similar levels of satisfaction, novelty, or even perceived health benefits from alternatives at a lower cost, they are more likely to switch. This price sensitivity is particularly relevant in economic climates where discretionary spending might be curtailed, making value a primary driver for purchasing decisions.

The increasing consumer demand for healthier alternatives presents a significant threat of substitutes for traditional confectionery. As more people prioritize well-being, they are actively seeking out snacks like nuts, seeds, and protein bars, which are perceived as more nutritious. For instance, the global healthy snacks market was valued at approximately $113.5 billion in 2023 and is projected to grow substantially, indicating a clear shift away from sugar-laden treats.

This trend forces companies like Cloetta to consider how their product offerings stack up against these emerging substitutes. If Cloetta’s portfolio remains heavily focused on sugary confectionery, it risks losing market share to brands that cater to the growing health-conscious consumer base. Adapting by introducing or expanding healthier product lines is crucial to counter this threat.

The ease with which consumers can switch to substitute products significantly impacts Cloetta's market position. For chocolate and candy, switching costs are practically non-existent. A consumer can effortlessly choose a different brand, a different type of snack, or even a healthy alternative with minimal effort or financial outlay. This low barrier to switching means Cloetta faces constant pressure to maintain consumer loyalty and product appeal.

In 2024, the confectionery market continues to see a rise in health-conscious alternatives, from fruit-based snacks to protein bars, all readily available and often competitively priced. For instance, the global healthy snacks market was projected to reach over $130 billion by 2024, demonstrating a clear consumer shift towards options perceived as healthier. This readily available array of substitutes means Cloetta must continually innovate and offer compelling value propositions, whether through unique flavors, premium ingredients, or engaging brand experiences, to retain its customer base.

Perceived Value and Benefits of Substitutes

The confectionery market faces a significant threat from substitutes that offer distinct advantages beyond simple indulgence. For instance, the burgeoning health and wellness trend has propelled products like protein bars and functional snacks, which promise satiety and nutritional benefits, directly competing with traditional candy. In 2024, the global healthy snacks market was valued at over $120 billion, demonstrating a strong consumer shift towards options perceived as more beneficial.

Savory snacks also present a compelling alternative, catering to different taste preferences and occasions. A study in early 2025 indicated that 45% of consumers reach for savory options when seeking a mid-afternoon pick-me-up, a segment that historically might have been dominated by sweet treats. This indicates that the perceived value of substitutes is often tied to fulfilling specific needs or cravings that confectionery may not adequately address.

- Health and Nutrition: Products like protein bars offer tangible health benefits, appealing to a growing health-conscious consumer base.

- Satiety and Fullness: Substitutes such as savory snacks or meal replacement bars can provide a greater sense of fullness, addressing hunger more effectively than many confectionery items.

- Occasion-Based Appeal: Different substitutes cater to various consumption occasions, from post-workout recovery (protein bars) to on-the-go convenience (savory snacks).

- Dietary Restrictions: The rise of gluten-free, vegan, and low-sugar alternatives in the broader snack category provides options for consumers with specific dietary needs, a space where traditional confectionery is often limited.

Technological Advancements in Alternative Product Development

Technological advancements are a significant threat of substitutes for confectionery companies like Cloetta. Innovations in food technology are constantly creating new, appealing alternatives that could draw consumers away from traditional sweets. For instance, the rise of sophisticated plant-based alternatives, functional foods offering health benefits alongside taste, and novel healthy snack options are all potential disruptors.

These emerging product categories can challenge established consumption patterns by catering to evolving consumer preferences for health and wellness. By the end of 2024, the global plant-based food market is projected to reach over $70 billion, indicating a strong consumer shift towards these alternatives.

- Healthy Snacks: Innovations in snack formulation, like baked instead of fried options and those with reduced sugar and artificial ingredients, are gaining traction.

- Plant-Based Alternatives: The market for plant-based confectionery, offering dairy-free and vegan options, is expanding rapidly, driven by ethical and health concerns.

- Functional Foods: Confectionery incorporating functional ingredients like probiotics, vitamins, or adaptogens could attract consumers seeking added health benefits.

- Disruptive Technologies: Advancements in 3D food printing and precision fermentation could lead to entirely new confectionery experiences and ingredients, further challenging traditional products.

The threat of substitutes for confectionery remains high as consumers increasingly seek alternatives that align with evolving lifestyle and health preferences. Products offering perceived health benefits, greater satiety, or catering to specific dietary needs directly challenge traditional candy and chocolate. For example, the global healthy snacks market was projected to exceed $130 billion in 2024, a clear indicator of this shift.

These substitutes are readily available and often competitively priced, with switching costs for consumers being minimal. This forces companies like Cloetta to continuously innovate and provide compelling value propositions to retain customer loyalty. The ease of switching means that market share can be easily eroded by alternatives that better meet consumer demands for wellness or specific occasions.

| Substitute Category | 2024 Market Projection (USD Billion) | Key Differentiators |

| Healthy Snacks | > $130 | Nutritional benefits, lower sugar, natural ingredients |

| Savory Snacks | > $190 | Taste variety, satiety, different consumption occasions |

| Plant-Based Alternatives | > $70 | Ethical concerns, dietary restrictions, perceived health benefits |

Entrants Threaten

The confectionery industry demands substantial upfront capital, a significant hurdle for aspiring competitors. Establishing modern manufacturing facilities, acquiring specialized machinery, and building a robust distribution network can easily run into hundreds of millions of euros. For instance, setting up a new, fully automated production line for a single product category could cost upwards of €50 million, not including the ongoing investment in raw material sourcing and logistics.

These high capital requirements act as a formidable barrier, effectively deterring many potential new entrants from challenging established players like Cloetta. The sheer financial commitment needed to achieve economies of scale and match existing operational efficiencies makes market entry exceptionally difficult without considerable backing.

Cloetta benefits from strong brand loyalty built over years, making it difficult for new entrants to capture consumer attention and market share. For instance, brands like Kexchoklad and Läkerol have a deep-rooted presence in their respective markets. Newcomers face significant hurdles in replicating this established trust and recognition, which is crucial in the confectionery sector.

Accessing established retail distribution channels presents another substantial barrier. Cloetta's strong relationships with major retailers across the Nordics, Netherlands, and Italy mean that new entrants find it incredibly challenging and expensive to secure prime shelf space. This limited access directly impacts a new company's ability to reach consumers and compete effectively.

Cloetta, like many established confectionery players, benefits from significant economies of scale. These advantages in production, raw material procurement, and marketing spend create a substantial cost barrier for potential new entrants. For instance, in 2024, major players in the European confectionery market often operate production facilities with much lower per-unit costs compared to smaller operations, simply due to higher output volumes. This cost efficiency makes it challenging for newcomers to compete on price without absorbing significant losses initially.

Access to Raw Materials and Specialized Inputs

New entrants often struggle to secure consistent and affordable access to key raw materials like cocoa and sugar. These commodities are subject to volatile global prices, and established players benefit from long-term supply agreements and bulk purchasing power, creating a significant barrier. For instance, in 2023, cocoa prices saw substantial increases, impacting production costs for confectionery companies.

Replicating the preferential pricing and established supplier relationships enjoyed by incumbents is a formidable challenge for newcomers. This can lead to higher initial input costs, diminishing a new entrant's competitive edge from the outset.

- High Commodity Price Volatility: Global cocoa prices, for example, experienced a significant surge in early 2024, reaching record highs due to supply concerns in West Africa.

- Supplier Relationships: Major confectionery manufacturers often have multi-year contracts with key suppliers, ensuring stable supply and potentially better pricing than new entrants can negotiate.

- Economies of Scale in Procurement: Established companies benefit from purchasing raw materials in much larger volumes, leading to lower per-unit costs compared to smaller, new entrants.

- Quality Control and Traceability: Ensuring consistent quality and traceability of raw materials, especially for premium products, requires established networks and rigorous processes that are difficult for new players to quickly build.

Regulatory Hurdles and Food Safety Standards

The threat of new entrants for Cloetta is significantly impacted by the complex regulatory landscape within the confectionery industry. New players must contend with stringent food safety standards, detailed labeling requirements, and import/export regulations across various operating regions. For instance, in the European Union, the General Food Law (Regulation (EC) No 178/2002) sets a high bar for food safety, requiring rigorous traceability and risk assessment for all food businesses.

Navigating these requirements demands substantial investment in compliance, quality control, and certification processes. Obtaining necessary approvals and certifications can be time-consuming and costly, creating a considerable barrier for aspiring competitors. In 2024, the European Food Safety Authority (EFSA) continued to emphasize strict adherence to novel food regulations and allergen labeling, further complicating market entry for those not already established.

- Stringent Food Safety: Compliance with EU General Food Law and national food safety agencies is paramount.

- Labeling Complexity: Adherence to detailed ingredient, nutritional, and allergen labeling laws adds significant cost.

- Certification Requirements: Obtaining certifications like HACCP or ISO 22000 is often necessary, increasing time and expense.

- Import/Export Regulations: Navigating customs and differing food standards across countries presents a logistical and financial challenge.

The threat of new entrants into the confectionery market, including for Cloetta, is generally low due to several significant barriers. High capital requirements for manufacturing and distribution, coupled with established brand loyalty and strong retailer relationships, make market entry challenging. Furthermore, economies of scale in procurement and production, along with complex regulatory compliance, further deter new players.

In 2024, the European confectionery market continued to be dominated by a few large players, indicating that overcoming these entry barriers remains a substantial undertaking. For example, the cost to establish a new, fully automated production line for a single product category can exceed €50 million, a figure that excludes ongoing operational investments.

New entrants also face difficulties in securing favorable raw material contracts, as established companies like Cloetta benefit from bulk purchasing power and long-term supplier agreements. This disparity in procurement costs, exacerbated by price volatility in commodities like cocoa, which saw significant increases in early 2024, puts newcomers at a distinct disadvantage.

The established distribution networks and shelf space secured by companies like Cloetta represent another formidable hurdle. Gaining access to prime retail locations across key markets such as the Nordics, Netherlands, and Italy requires substantial investment and negotiation power that new entrants typically lack.

| Barrier Type | Description | Estimated Cost/Challenge | Impact on New Entrants | Cloetta's Advantage |

| Capital Requirements | Setting up manufacturing, machinery, distribution | €50M+ for a single production line | High barrier to entry | Established infrastructure, economies of scale |

| Brand Loyalty | Consumer trust and recognition | Difficult to replicate established brands like Kexchoklad | Challenges in market penetration | Deep-rooted brand equity and recognition |

| Distribution Access | Securing shelf space with retailers | Expensive and time-consuming | Limited consumer reach | Strong existing retail relationships |

| Economies of Scale | Lower per-unit costs due to high volume | New entrants struggle to match cost efficiencies | Price competitiveness issues | Cost advantages in production and procurement |

| Raw Material Access | Securing consistent and affordable supply | Volatile commodity prices (e.g., cocoa surge in 2024) | Higher initial input costs | Long-term supply agreements, bulk purchasing |

| Regulatory Compliance | Food safety, labeling, certifications | Significant investment in quality control and approvals | Time-consuming and costly | Established compliance processes and expertise |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Cloetta is built upon a robust foundation of publicly available information, including the company's annual reports, investor presentations, and press releases. We also incorporate data from reputable industry research firms and market intelligence platforms to capture broader market trends and competitive dynamics.