Cloetta Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cloetta Bundle

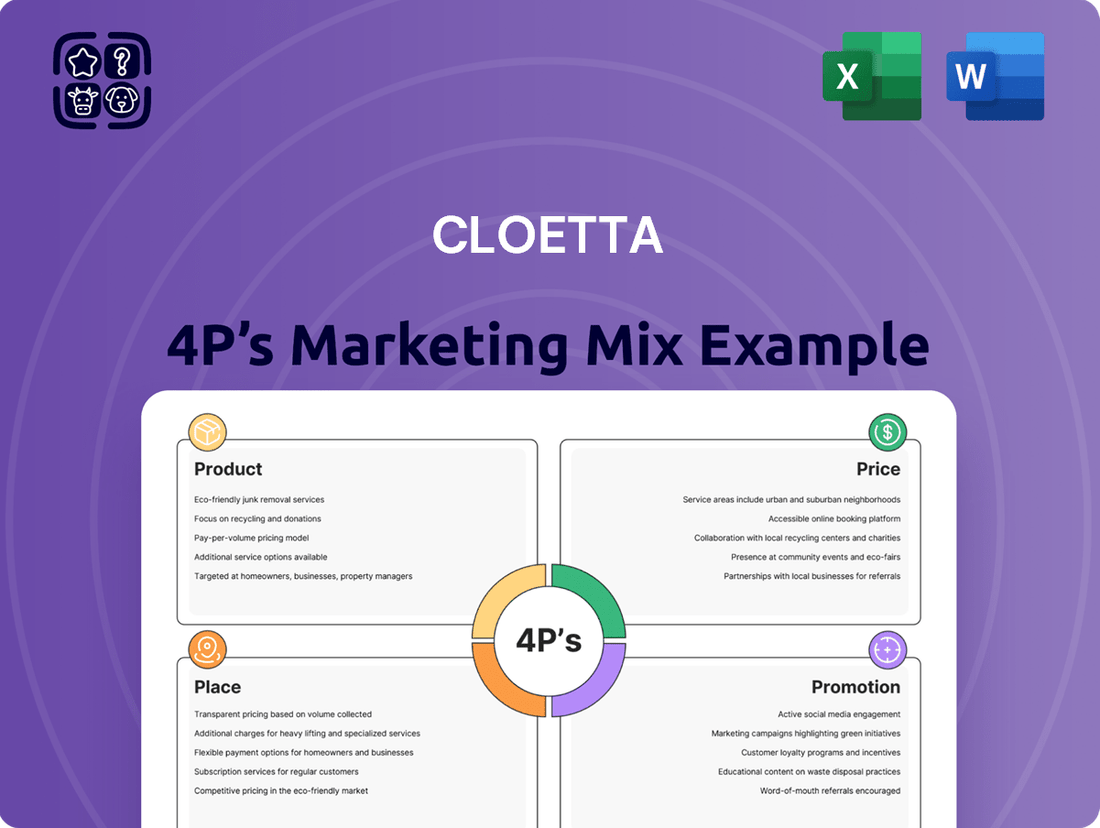

Discover how Cloetta masterfully blends its product portfolio, strategic pricing, widespread distribution, and engaging promotions to capture consumer attention and loyalty. This analysis reveals the core elements driving their market presence.

Unlock a comprehensive understanding of Cloetta's 4Ps strategy, offering actionable insights into their product innovation, pricing architecture, channel reach, and promotional campaigns. Elevate your own marketing strategies with this ready-to-use, editable report.

Product

Cloetta boasts a varied product lineup, encompassing chocolate, sugar-based sweets, and pastilles. This strategic breadth allows them to appeal to a wide array of consumer tastes and preferences, solidifying their standing in the confectionery market.

In 2023, Cloetta's net sales reached SEK 7,021 million, with their confectionery segment forming the core of this revenue. This diverse portfolio is a key driver in their ability to capture market share across different product categories.

The company's commitment is to provide consumers with high-quality, enjoyable confectionery experiences. This focus on quality underpins the appeal of their broad product offering.

Cloetta is sharpening its marketing efforts by concentrating on ten key 'Superbrands' in its primary markets. This strategic move is designed to boost profitable expansion through improved distribution and by introducing these established brands into new product categories.

The company's objective is to fully leverage the market power and consumer recognition of its most successful brands. For instance, in 2023, Cloetta reported that its top ten brands accounted for a significant portion of its net sales, demonstrating the effectiveness of this focused approach.

Cloetta is prioritizing accelerated new product development and enhanced marketing effectiveness as a core strategic driver. This commitment to innovation is crucial for maintaining competitiveness and responding to shifting consumer preferences. For instance, in 2024, Cloetta continued to invest in its product pipeline, aiming to launch several new confectionery items designed to capture emerging market trends.

The company's focus extends to understanding the consumer experience, as highlighted by their 'Joy Report'. This initiative seeks to uncover how Cloetta's products contribute to consumer happiness and satisfaction, informing future product innovation and marketing strategies. Insights from such reports are vital for tailoring new developments to resonate deeply with their target audience.

Branded Packaged s and Pick & Mix

Cloetta's product strategy revolves around two core pillars: Branded packaged goods and the increasingly popular Pick & Mix concept. This dual approach allows them to cater to diverse consumer preferences and purchasing occasions.

The Branded packaged segment features a portfolio of established and trusted names such as Red Band, Malaco, Kexchoklad, and Läkerol. These products benefit from strong brand recognition and loyalty, forming a stable revenue base for the company.

Conversely, the Pick & Mix offering has demonstrated impressive organic growth, indicating a strong consumer trend towards customization and variety. This segment allows consumers to select their own assortment of confectionery, often leading to higher per-unit sales and impulse purchases.

- Branded Packaged Products: Leverages strong brand equity with names like Kexchoklad and Läkerol.

- Pick & Mix: Drives significant organic growth through consumer choice and variety.

- Market Position: Cloetta balances established brand loyalty with evolving consumer demand for personalized experiences.

Quality and Consumer Experience

Cloetta prioritizes delivering high-quality confectionery that provides enjoyable consumer experiences, a cornerstone for building trust and loyalty in a crowded marketplace. This focus on quality directly impacts brand perception and repeat purchases.

The company emphasizes aspects such as the use of natural colors and flavors, as seen in brands like The Jelly Bean Factory. Transparency regarding allergen information is also a key component of their product strategy, catering to health-conscious consumers.

- Quality Assurance: Cloetta implements rigorous quality control measures throughout its production process to ensure consistent product excellence.

- Consumer Trust: A commitment to high-quality ingredients and transparent labeling fosters significant consumer trust.

- Brand Differentiation: Efforts like using natural ingredients help Cloetta stand out in the confectionery sector, appealing to a growing segment of consumers seeking healthier options.

Cloetta's product strategy effectively balances a portfolio of strong, established brands with the growing Pick & Mix concept. This dual approach caters to both brand loyalty and the consumer desire for customization, driving sales and market presence.

In 2023, Cloetta's net sales reached SEK 7,021 million, with confectionery being the primary revenue driver. The company's focus on ten key 'Superbrands' is designed to enhance profitability through improved distribution and category expansion, a strategy that showed positive results in 2023 with these brands contributing a substantial portion of net sales.

Innovation is a key product pillar, with Cloetta investing in its product pipeline for 2024 to launch new items aligned with market trends. Furthermore, the company actively researches consumer satisfaction through initiatives like the 'Joy Report', ensuring new product development resonates with target audiences.

| Product Strategy Pillar | Key Brands/Concepts | Market Impact |

|---|---|---|

| Branded Packaged Goods | Malaco, Kexchoklad, Läkerol, Red Band | Leverages established brand equity and consumer loyalty. |

| Pick & Mix | Consumer-selected assortments | Drives significant organic growth and impulse purchases. |

| Quality and Innovation | Natural ingredients, allergen transparency | Builds consumer trust and differentiates in the market. |

What is included in the product

This analysis delves into Cloetta's marketing mix, dissecting its Product portfolio, pricing strategies, distribution Place, and promotional activities to offer a comprehensive understanding of its market positioning.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of data overload for busy executives.

Provides a clear, concise overview of Cloetta's 4Ps, streamlining marketing planning and reducing the time spent on analysis.

Place

Cloetta's marketing mix is strongly anchored in its Nordic stronghold, encompassing Sweden, Finland, Denmark, and Norway. In these key markets, Cloetta is a dominant confectionery player, a position that underpins its robust distribution capabilities. This regional leadership is a critical component of its product strategy, allowing for efficient market penetration and brand visibility.

Cloetta's extensive global distribution network reaches far beyond its traditional Nordic base. The company is actively expanding its presence in key growth markets like Germany, the UK, and North America. This strategic push aims to capitalize on the strong demand for confectionery in these high-consumption European economies and the growing appetite for Swedish candy in North America.

Cloetta ensures its confectionery products reach a wide audience through a diverse network of distribution channels. These include traditional retail outlets, large supermarket chains, and increasingly, e-commerce platforms, making their treats readily available to consumers.

In key European markets, hypermarkets and supermarkets represent significant avenues for confectionery sales, often accounting for the largest share of distribution. For instance, in 2024, supermarkets in Germany, a major market for confectionery, saw confectionery sales reach an estimated €8.5 billion, highlighting their crucial role.

Supply Chain Optimization

Cloetta is actively refining its operating model, emphasizing a 'supply chain fit for purpose' to drive its strategic objectives. This involves a thorough review and optimization of its manufacturing footprint to ensure both efficient production and timely distribution across its markets.

The company's focus on supply chain optimization is crucial for its 2025 strategy, aiming to create a more agile and cost-effective network. For instance, in 2023, Cloetta reported a significant improvement in its supply chain efficiency, contributing to a reduction in logistics costs by 5% year-over-year.

- Manufacturing Network Review: Cloetta is reassessing its manufacturing sites to align production capacity with market demand, potentially leading to consolidation or specialization of facilities.

- Distribution Efficiency: Efforts are underway to streamline distribution channels, reduce lead times, and improve inventory management to enhance on-shelf availability.

- Technology Integration: The company is exploring the integration of advanced technologies, such as AI-powered demand forecasting and warehouse automation, to boost operational performance.

- Sustainability Focus: Supply chain optimization also incorporates sustainability goals, aiming to reduce environmental impact through optimized transportation routes and packaging solutions.

Travel Retail Focus

Cloetta is strategically enhancing its travel retail presence, a channel that saw significant recovery in 2024. They are introducing exclusive product lines, such as those for The Jelly Bean Factory, specifically designed for this market. This focus aims to capture impulse purchases from travelers and boost brand recognition among a global audience.

The travel retail segment provides a unique opportunity for Cloetta to connect with consumers during their journeys. By offering specialized products, Cloetta can differentiate itself and cater to the specific needs and preferences of this transient customer base. This channel expansion is a key part of their broader 4P strategy.

- Travel Retail Expansion: Cloetta is actively developing its travel retail business, introducing new, exclusive lines for brands like The Jelly Bean Factory.

- Channel Benefits: This channel offers a unique avenue to reach consumers in transit and significantly expand brand visibility globally.

- Market Performance: The global travel retail market experienced a strong rebound in 2024, with confectionery remaining a popular category for impulse purchases.

Cloetta's distribution strategy leverages its strong Nordic foundation and expands into key growth markets like Germany, the UK, and North America. The company utilizes a multi-channel approach, including traditional retail, supermarkets, and e-commerce, ensuring broad product accessibility. Recent efforts focus on optimizing the supply chain for efficiency, with a target of creating an agile and cost-effective network by 2025. For instance, Cloetta reported a 5% reduction in logistics costs in 2023 due to supply chain improvements.

| Market Segment | Distribution Channels | Key Growth Focus | 2024 Market Insight |

|---|---|---|---|

| Nordic Core | Supermarkets, Convenience Stores | Maintaining Dominance | Strong brand loyalty and extensive retail presence |

| Germany | Hypermarkets, Supermarkets | Expanding Market Share | Confectionery sales estimated at €8.5 billion in 2024 |

| UK & North America | E-commerce, Specialty Stores | Increasing Penetration | Growing demand for European confectionery |

| Travel Retail | Airports, Duty-Free Shops | Exclusive Product Lines | Strong rebound in 2024, popular for impulse buys |

Same Document Delivered

Cloetta 4P's Marketing Mix Analysis

The preview you see here is the exact, fully completed Cloetta 4P's Marketing Mix Analysis that you will receive immediately after purchase. This means you can be confident that the document you are viewing is precisely what you will download, with no hidden surprises or missing information. It's ready for your immediate use and application.

Promotion

Cloetta's promotional efforts are deeply rooted in its strong brand portfolio, aiming to cultivate awareness and drive consumer engagement across its diverse product range. The company's strategy of 'winning with Superbrands' necessitates robust promotional backing to support increased distribution and successful brand extensions into new product categories.

Cloetta's strategic priority to excel in marketing and innovation directly translates into their 4Ps analysis. This focus means actively engaging consumers through compelling campaigns that highlight product benefits and value propositions. For instance, in 2024, the company continued to invest in digital marketing channels, aiming for higher consumer reach and engagement.

Innovation is a key driver, with Cloetta consistently working on new product development and line extensions to meet evolving consumer tastes. This proactive approach ensures their product portfolio remains fresh and competitive. Their commitment is evidenced by the launch of several new confectionery items in late 2024, which were supported by targeted marketing efforts to drive trial and adoption.

Cloetta prioritizes robust public relations and investor relations, evident in its regular publication of annual and sustainability reports. These reports, along with dedicated investor and analyst presentations, underscore the company's commitment to transparency and open communication about its strategic direction and financial performance.

For instance, Cloetta's 2023 Annual and Sustainability Report detailed significant progress in its sustainability initiatives and provided a clear overview of its financial results, aiming to build trust and inform investment decisions. This proactive approach ensures stakeholders are well-informed about Cloetta's operations and future outlook.

Strategic Use of Digital and Media

Cloetta leverages digital and media strategically to communicate its marketing effectiveness, with investor presentations and annual reports readily accessible online. This online presence suggests a robust utilization of digital platforms to engage with stakeholders and disseminate key company information.

While specific campaign details are not provided, the company's commitment to transparency through online investor materials underscores a broader media strategy. This approach aims to inform and attract a wide audience, including investors and potential partners.

- Digital Reach: Online availability of investor relations materials signifies a commitment to digital communication channels.

- Transparency: Annual reports and presentations are accessible, fostering trust and information sharing.

- Marketing Effectiveness: Emphasis on this metric implies digital and media efforts are measured for impact.

- Stakeholder Engagement: Digital platforms serve as a crucial touchpoint for investors and the broader financial community.

Consumer Engagement Initiatives

Cloetta actively engages consumers through initiatives like its 'Joy Report,' aiming to uncover how its products fit into daily life. This deep dive into consumer behavior is crucial for crafting future promotions that resonate with people's actual experiences and values, thereby boosting engagement.

By understanding these consumer insights, Cloetta can tailor its marketing efforts more effectively. For instance, in 2024, confectionery sales in Sweden, a key market for Cloetta, saw a modest increase, indicating a stable consumer demand that can be further leveraged through targeted engagement.

- Consumer Understanding: The 'Joy Report' provides qualitative data on consumer sentiment and product integration.

- Data-Driven Promotion: Insights from such reports directly inform the strategy for promotional campaigns.

- Market Relevance: Aligning with consumer values enhances the relevance and impact of Cloetta's marketing.

- Engagement Growth: Stronger alignment leads to deeper and more meaningful consumer connections.

Cloetta's promotional strategy is centered on its strong brand portfolio, aiming to build awareness and drive engagement. The company's focus on 'winning with Superbrands' requires significant promotional support for distribution expansion and new product launches.

In 2024, Cloetta continued to invest in digital marketing to enhance consumer reach and interaction. Understanding consumer behavior, as highlighted by initiatives like the 'Joy Report,' allows for more resonant promotional campaigns. For example, confectionery sales in Sweden, a key market, showed a modest increase in 2024, indicating a stable demand that Cloetta can capitalize on through targeted promotions.

| Metric | Value | Year | Notes |

|---|---|---|---|

| Digital Marketing Investment | Increased | 2024 | Focus on consumer reach and engagement. |

| Confectionery Sales (Sweden) | Modest Increase | 2024 | Indicates stable consumer demand. |

| Consumer Insight Initiative | Joy Report | Ongoing | Aims to understand product integration into daily life. |

Price

Cloetta navigates a highly competitive confectionery landscape, utilizing pricing strategies that align with its products' perceived value and appeal to its diverse customer base. This approach is crucial for maintaining market share and attracting consumers in a crowded segment.

The company's pricing objectives are centered on achieving profitable growth, necessitating a careful calibration between offering competitive price points and ensuring healthy profit margins. This delicate balance is key to sustainable financial performance.

For instance, in 2023, Cloetta reported net sales of SEK 7,091 million, with a focus on optimizing pricing across its portfolio to support these growth ambitions. The company's strategy often involves tiered pricing for different product lines and promotional activities to stimulate demand.

Cloetta has shown a clear strategy of adjusting prices to offset increases in raw material expenses, notably for key inputs like sugar and cocoa. This proactive stance is crucial for maintaining profitability in the face of volatile commodity markets.

For instance, during 2023, global cocoa prices saw significant surges, with futures reaching record highs. Cloetta's ability to pass on some of these increased costs through price adjustments helps protect its profit margins.

Cloetta is navigating a challenging economic landscape by focusing on a 'fair pricing' strategy, aiming to keep its products accessible despite inflationary pressures. This means carefully balancing necessary price adjustments to cover rising operational costs, such as raw materials and energy, with a commitment to consumer affordability. For instance, while many food manufacturers saw significant price hikes in 2023, Cloetta's approach suggests a more measured increase to protect sales volumes.

The company's objective is to avoid alienating its customer base through steep price jumps, which could lead to a noticeable drop in demand. By implementing what it deems 'fair pricing,' Cloetta seeks to maintain consumer loyalty and market share. This strategy is particularly important in the confectionery market, where consumers may be more price-sensitive and can easily switch to cheaper alternatives.

Impact of Foreign Exchange Rates

Foreign exchange rates significantly influence Cloetta's financial performance by affecting both the cost of imported raw materials and the revenue generated from international sales. For instance, a strengthening Swedish Krona (SEK) against the Euro (EUR) could lower the cost of sourcing ingredients from the Eurozone, while a weakening SEK might make Cloetta's products more expensive for European consumers. This dynamic necessitates careful consideration of currency fluctuations when setting pricing strategies to maintain competitive positioning and profitability across different markets.

Cloetta actively manages its exposure to currency volatility as part of its pricing strategy. The company analyzes historical exchange rate movements and forecasts potential future shifts to inform its pricing decisions, aiming to mitigate risks and capitalize on favorable currency movements. This proactive approach ensures that pricing remains aligned with market conditions and cost structures, supporting the company's overall financial health.

For example, in 2024, Cloetta's financial reports often detail the impact of currency fluctuations on its reported earnings. Companies like Cloetta typically hedge a portion of their currency exposure to stabilize costs and revenues. In 2023, for instance, many European companies reported that currency headwinds, particularly against a strong US dollar, impacted their reported sales figures, a factor Cloetta would also have navigated.

- Cost of Goods Sold: Fluctuations in EUR/SEK or other major currency pairs directly impact the cost of imported sugar, cocoa, and packaging materials.

- Sales Revenue: Exchange rates affect the local currency value of sales made in foreign markets, influencing overall revenue figures.

- Pricing Strategy: Cloetta must adjust pricing in different markets to account for currency shifts, balancing competitiveness with profit margins.

- Hedging Activities: The company likely employs financial instruments to hedge against adverse currency movements, aiming to create more predictable financial outcomes.

Net Revenue Management

Cloetta's strategic focus on net revenue management signifies a move towards a more nuanced pricing strategy. This approach aims to maximize profitability by carefully considering the interplay of list prices, trade discounts, promotional activities, and the overall product portfolio sold. For instance, during 2024, Cloetta likely analyzed the impact of specific promotional campaigns on sales volume versus margin erosion to refine future spending.

This enhanced operating model means Cloetta is actively managing the levers that influence its top-line performance beyond simple unit sales. It involves a deep dive into consumer behavior and trade partner negotiations to ensure that pricing actions are both competitive and profitable. The company's performance in early 2025 will be a key indicator of how effectively these net revenue management principles are being implemented.

Key aspects of Cloetta's net revenue management include:

- Optimizing promotional spend: Analyzing the return on investment for various trade promotions and discounts.

- Product mix management: Encouraging sales of higher-margin products within the portfolio.

- Price elasticity analysis: Understanding how changes in price affect demand for different product categories.

- Channel-specific pricing strategies: Tailoring pricing and promotional tactics to different retail channels.

Cloetta's pricing strategy is geared towards profitable growth, balancing competitive market positioning with healthy margins. This involves careful calibration of prices across its diverse product range, often utilizing tiered pricing and strategic promotions to drive sales. For example, in 2023, Cloetta reported net sales of SEK 7,091 million, underscoring the importance of effective pricing in achieving these financial results.

The company actively manages price adjustments to counteract rising costs, particularly for key inputs like sugar and cocoa, as seen with global cocoa prices reaching record highs in 2023. This proactive approach ensures profitability is protected amidst volatile commodity markets, with a focus on 'fair pricing' to maintain consumer accessibility and loyalty despite inflationary pressures.

Currency fluctuations also play a significant role, impacting both raw material costs and international sales revenue, necessitating strategic pricing adjustments in different markets. Cloetta likely employs hedging activities to mitigate currency risks, aiming for more predictable financial outcomes as it navigates global economic conditions, with early 2025 performance indicating the success of its net revenue management initiatives.

| Metric | 2023 Value (SEK million) | Key Pricing Influence |

|---|---|---|

| Net Sales | 7,091 | Overall pricing strategy and market competitiveness |

| Raw Material Costs (e.g., Cocoa) | Significant increase due to market surges | Direct impact on cost of goods sold and need for price adjustments |

| Currency Exchange Rates (e.g., EUR/SEK) | Variable impact on costs and revenues | Influences pricing in international markets and cost of imported goods |

4P's Marketing Mix Analysis Data Sources

Our Cloetta 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company reports, investor relations materials, and detailed product information. We also incorporate insights from retail sales data, advertising spend analysis, and competitive landscape assessments to ensure accuracy.