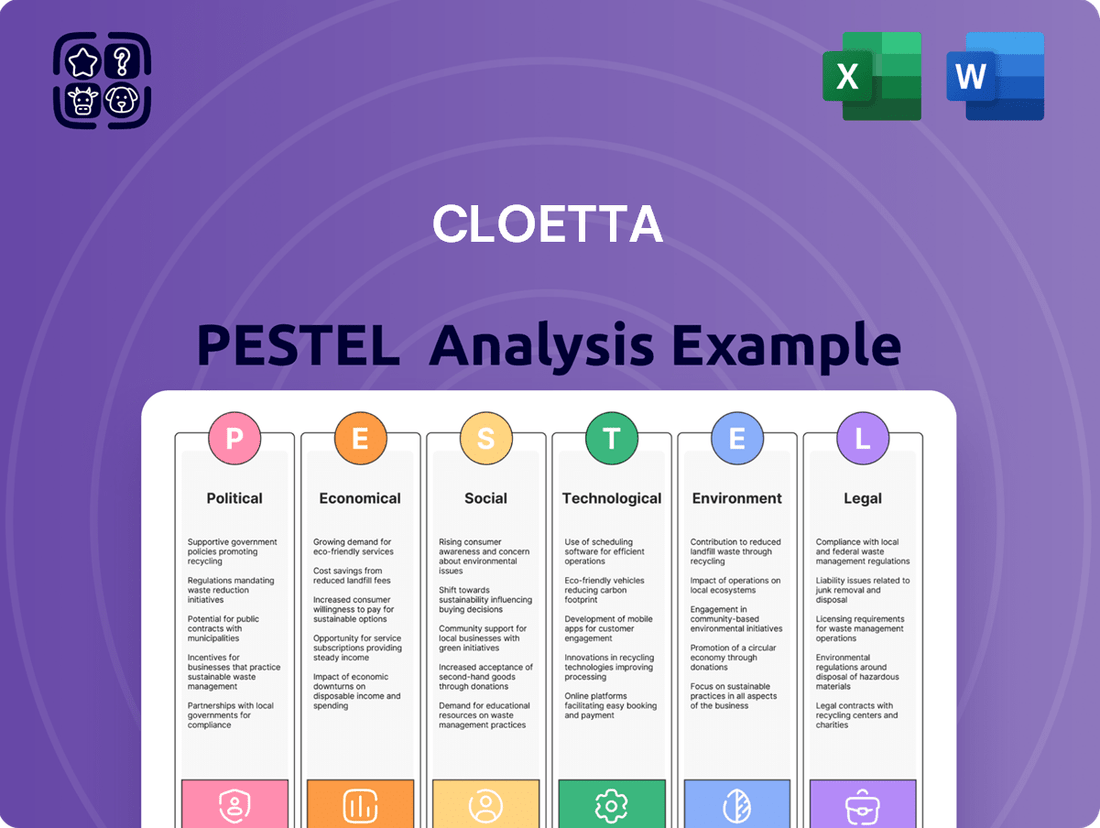

Cloetta PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cloetta Bundle

Unlock the secrets behind Cloetta's market position with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and evolving social trends are shaping the confectionery giant's future. Gain a strategic advantage by identifying opportunities and mitigating risks. Download the full PESTLE analysis now for actionable intelligence to inform your business decisions.

Political factors

Governmental bodies in Cloetta's key markets, including the Nordic region, the Netherlands, and Italy, are progressively enforcing more stringent food labeling regulations. These evolving rules often mandate detailed nutritional information, clear allergen declarations, and precise origin labeling for ingredients.

These stricter regulations directly impact how Cloetta communicates its product information to consumers, potentially necessitating significant adjustments in packaging design, ingredient sourcing strategies, and overall product development processes to ensure compliance. For instance, the EU's Farm to Fork strategy, aiming for a more sustainable food system, will likely influence future labeling requirements across member states where Cloetta operates.

Changes in international trade policies and tariffs, particularly between the EU and key global markets, directly influence Cloetta's raw material procurement costs and the efficiency of its product distribution. For instance, the EU's trade relationship with countries like the United Kingdom, following Brexit, has introduced new customs procedures and potential tariffs that could impact supply chain expenses.

Fluctuations in trade agreements or the imposition of new import/export duties can significantly affect Cloetta's profitability. In 2024, ongoing discussions around potential EU tariffs on certain confectionery ingredients or finished goods from non-EU nations highlight the sensitivity of the sector to these policy shifts. Such changes can disrupt the company's global distribution network, necessitating adjustments to pricing and sourcing strategies to maintain competitive margins.

Cloetta's core markets, including Sweden, Norway, Denmark, the Netherlands, and Italy, generally exhibit robust political stability, which fosters a predictable economic climate for consumer spending on confectionery. For instance, Sweden, a key market, consistently ranks high in global governance indicators, suggesting a low risk of political disruption impacting business operations.

However, any significant geopolitical tensions or unexpected domestic political shifts in these regions, such as changes in trade policies or consumer protection regulations, could introduce volatility. For example, a sudden imposition of new tariffs on imported ingredients or finished goods could directly affect Cloetta's cost structure and profitability.

Public Health Policies on Sugar Consumption

Governments worldwide are stepping up efforts to curb sugar intake, directly affecting companies like Cloetta. For instance, the UK's sugar tax, introduced in 2018, has already prompted many beverage manufacturers to reformulate their products to avoid higher levies. This trend is expected to continue and broaden to other food categories.

These public health initiatives, including potential marketing bans on high-sugar items and stricter labeling requirements, pose a significant challenge. Cloetta may need to invest in research and development to create healthier alternatives or adapt its product portfolio to align with evolving regulatory landscapes and consumer demand for reduced sugar options. In 2023, Cloetta reported that 14% of its net sales were from sugar-free products, highlighting an ongoing shift.

The impact of these policies can be substantial:

- Reduced Sales Volume: Stricter regulations could limit the appeal and availability of certain confectionery products, potentially leading to lower sales.

- Increased Operational Costs: Reformulating products to meet new sugar guidelines or complying with marketing restrictions can incur significant R&D and production expenses.

- Shifting Consumer Preferences: Growing health consciousness, amplified by public health campaigns, is driving consumers towards lower-sugar alternatives, forcing companies to adapt their offerings.

- Market Access Limitations: Non-compliance with sugar-related policies in key markets could restrict Cloetta's ability to sell its products, impacting its global reach.

Food Safety Standards and Enforcement

Cloetta operates within a landscape where food safety standards are paramount. Regulatory bodies across its key markets, including Sweden, Norway, Denmark, Finland, and the Netherlands, maintain stringent requirements for product safety and quality. For instance, the European Food Safety Authority (EFSA) plays a significant role in setting and enforcing these standards across EU member states, which impacts Cloetta's operations.

Any tightening of these regulations or increased enforcement could require substantial capital expenditure. This might involve upgrading manufacturing facilities, enhancing traceability systems, and expanding quality assurance teams. Such investments directly affect operational costs and could influence Cloetta's profitability. For example, in 2024, the EU continued its focus on reducing contaminants in food products, a trend that likely necessitates ongoing vigilance and potential process adjustments for confectionery manufacturers like Cloetta.

- Stringent Regulations: Cloetta must adhere to evolving food safety regulations across its operating countries, influenced by bodies like EFSA.

- Compliance Costs: Increased scrutiny or new standards can lead to higher operational expenses for production, quality control, and compliance.

- Brand Reputation: Maintaining high food safety standards is critical for preserving consumer trust and Cloetta's brand image.

- Market Access: Non-compliance with food safety laws can result in product recalls, market access restrictions, and significant financial penalties.

Political stability in Cloetta's core markets like Sweden and the Netherlands generally supports consistent business operations. However, shifts in trade policies, such as those post-Brexit impacting the UK, can influence raw material costs and distribution efficiency. For instance, the EU's ongoing trade discussions in 2024 highlight the sector's sensitivity to import/export duties, potentially affecting Cloetta's margins and global supply chain.

Governments are increasingly focused on public health, leading to stricter regulations on sugar content and marketing of confectionery products. Initiatives like sugar taxes, already present in some European countries, and potential marketing bans directly challenge companies like Cloetta. In 2023, Cloetta noted that 14% of its net sales came from sugar-free products, reflecting an adaptation to this trend.

Stringent food safety and labeling regulations, enforced by bodies like EFSA, are critical. In 2024, the EU's continued focus on reducing contaminants necessitates ongoing vigilance and potential process adjustments for manufacturers. Non-compliance can lead to recalls, market restrictions, and significant financial penalties, impacting brand reputation and profitability.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Cloetta, covering Political, Economic, Social, Technological, Environmental, and Legal aspects.

It offers actionable insights for strategic decision-making, identifying potential threats and opportunities shaped by current market dynamics and future trends.

A clear, actionable PESTLE analysis for Cloetta serves as a pain point reliever by providing a structured framework to anticipate and mitigate external challenges, ensuring strategic agility and market resilience.

Economic factors

Rising inflation significantly impacts Cloetta's operational costs, particularly for key ingredients like sugar and cocoa. For instance, global sugar prices saw substantial increases in early 2024, with benchmark prices reaching multi-year highs due to supply concerns in major producing regions. This directly translates to higher input costs for confectionery manufacturers like Cloetta.

The challenge for Cloetta lies in absorbing or mitigating these escalating raw material expenses. Failing to pass these costs onto consumers through price adjustments could compress profit margins. In 2024, many food and beverage companies, including those in the confectionery sector, reported margin pressures stemming from persistent inflation in commodity prices and energy.

Consumer purchasing power is a key driver for Cloetta, as confectionery is often considered a discretionary purchase. In 2024, while inflation showed signs of moderating in many European economies, including those where Cloetta operates, the impact on real disposable income varied. For instance, Sweden, a core market, experienced a slight uptick in real wages towards the end of 2024, potentially boosting spending on non-essential goods.

However, economic uncertainties persist. The Netherlands, another significant market, faced ongoing concerns about consumer confidence in early 2025, which could temper demand for premium or impulse confectionery items. Similarly, Italy's economic recovery, while present, continued to be uneven, impacting the disposable income available for treats.

Disposable income levels directly correlate with the volume and value of confectionery sales. As of late 2024, average disposable income in the Nordic countries remained relatively high, providing a stable base for Cloetta's products. Yet, any significant economic slowdown in 2025 could quickly translate into reduced consumer spending on items like chocolate and sweets, impacting Cloetta's revenue streams.

Cloetta's international operations mean exchange rate volatility is a significant economic factor. For example, if the Euro strengthens considerably against currencies where Cloetta sources raw materials, those imports become cheaper, potentially boosting profit margins on products manufactured within the Eurozone. However, a stronger Euro also makes Cloetta's products more expensive for consumers in countries using weaker currencies, potentially dampening export sales.

Considering the 2024-2025 period, the Euro has shown some resilience, but global economic uncertainties and varying inflation rates across regions continue to create significant exchange rate swings. For instance, the Euro to Swedish Krona (SEK) exchange rate, important for Cloetta given its Swedish origins and significant presence there, has seen fluctuations. A sustained stronger Euro could reduce the cost of goods sold for imported ingredients, but conversely, it might negatively impact the competitiveness of Cloetta's exports to markets like the UK or the US, where currencies may weaken against the Euro.

Competition and Pricing Pressures

The confectionery sector is intensely competitive, featuring a broad array of both regional and global brands vying for consumer attention. Cloetta navigates this landscape by addressing persistent pricing pressures from rivals, necessitating astute pricing strategies and compelling value propositions to retain its market share and profitability without diluting its brand image.

These competitive dynamics often lead to promotional activities and price adjustments across the industry. For instance, in 2024, the European confectionery market saw increased promotional spending as brands sought to capture consumer spending amidst economic uncertainties, directly impacting profit margins for companies like Cloetta.

- Intense Market Competition: Numerous local and international players operate within the confectionery market.

- Pricing Pressures: Competitors' pricing strategies force Cloetta to make strategic decisions to maintain market share.

- Value Proposition: Cloetta must balance competitive pricing with maintaining its brand perception and profitability.

- 2024 Market Trends: Increased promotional activities observed in the European market in 2024 impacted profit margins across the sector.

Interest Rates and Access to Capital

Changes in interest rates directly impact Cloetta's cost of capital. For instance, as of early 2024, the European Central Bank's (ECB) key interest rates remained at elevated levels, making borrowing more expensive for companies like Cloetta looking to finance expansion or R&D projects. This can put pressure on margins and potentially slow down strategic growth initiatives.

Higher borrowing costs can deter investment in new facilities or acquisitions, forcing a re-evaluation of capital expenditure plans. For example, if Cloetta was considering a significant investment in a new production line in 2024, a higher interest rate environment would increase the overall cost of that investment, potentially impacting its financial viability and the company's ability to access capital for such ventures.

- Impact on Borrowing Costs: Elevated interest rates increase the cost for Cloetta to secure loans for expansion or operational upgrades.

- Investment Decisions: Higher rates can make capital-intensive growth projects less attractive, potentially delaying or scaling back strategic plans.

- Access to Capital: The overall cost and availability of capital for Cloetta are directly influenced by prevailing interest rate policies, such as those set by the ECB.

Rising inflation continues to be a significant economic headwind for Cloetta, impacting raw material costs like sugar and cocoa. For example, global sugar prices experienced a notable surge in early 2024, reaching multi-year highs due to supply chain disruptions. This directly translates to increased input expenses for confectionery producers.

Consumer purchasing power remains a critical factor, as confectionery is often a discretionary item. While inflation began to moderate in several key European markets for Cloetta in 2024, the impact on real disposable income varied. For instance, Sweden, a core market, saw a slight increase in real wages by year-end, potentially bolstering spending on non-essential goods.

Exchange rate volatility poses another economic challenge for Cloetta's international operations. A stronger Euro, for example, could make imported raw materials cheaper, benefiting margins for products manufactured within the Eurozone. However, it also makes Cloetta's products more expensive for consumers in countries with weaker currencies, potentially impacting export sales.

Interest rates directly affect Cloetta's cost of capital. Elevated rates, such as those maintained by the European Central Bank in early 2024, increase borrowing costs, potentially slowing down strategic growth initiatives and impacting profitability.

Preview the Actual Deliverable

Cloetta PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Cloetta PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the confectionery company. Understand the external forces shaping Cloetta's strategic landscape.

Sociological factors

Consumers are increasingly prioritizing health, leading to a significant shift towards reduced sugar consumption. This trend is particularly pronounced in major European markets where Cloetta operates, with many consumers actively seeking out healthier snack options. For instance, a 2024 survey indicated that over 60% of consumers in Sweden reported actively trying to reduce their sugar intake.

Cloetta must adapt its product offerings to align with these evolving health perceptions. This could involve reformulating existing products to lower sugar content or introducing new product lines that cater to the demand for healthier alternatives, such as sugar-free confectionery or products with natural sweeteners. By doing so, Cloetta can maintain market relevance and capture a larger share of the health-conscious consumer segment.

The increasing prevalence of on-the-go lifestyles fuels a robust demand for convenient snacking options. This trend, evident in the global convenience food market projected to reach over $1.2 trillion by 2027, offers Cloetta a significant opportunity to innovate with accessible, single-serving confectionery. By focusing on easily portable packaging and portion-controlled treats, Cloetta can effectively cater to consumers seeking quick and satisfying indulgence throughout their busy days.

Consumers are increasingly prioritizing ethical consumption, with a growing demand for transparency in ingredient sourcing and labor practices. For instance, a 2024 survey indicated that over 60% of European consumers consider sustainability a key factor when purchasing confectionery. Cloetta's proactive approach to responsible sourcing, such as its participation in the World Cocoa Foundation and its efforts to ensure fair wages for farmers, directly addresses this trend.

This heightened awareness of environmental sustainability in manufacturing also plays a crucial role. Consumers are looking for brands that minimize their ecological footprint, from packaging to production processes. Cloetta's investments in energy-efficient factories and its commitment to reducing plastic packaging, with targets set for 2025, resonate with this segment of the market, potentially boosting brand loyalty and market share.

Cultural Preferences and Local Tastes

Cloetta's strategy thrives on recognizing that confectionery preferences are deeply rooted in local culture. For instance, their strong presence in the Nordic region, the Netherlands, and Italy isn't accidental; it's built on a foundation of understanding and adapting to unique national tastes. This means more than just selling candy; it's about offering products that resonate with established traditions and flavor profiles in each market.

For example, Cloetta's success in the Netherlands is partly due to its popular licorice products, a flavor profile that holds significant cultural weight there. Similarly, in Italy, the company likely focuses on offerings that align with the Italian appreciation for richer, perhaps more fruit-forward or chocolate-centric, confectionery experiences. This granular approach to product development, informed by deep cultural insights, is key to gaining consumer acceptance and achieving robust market penetration.

- Nordic Region: Emphasis on specific flavors and product formats popular in countries like Sweden and Norway.

- Netherlands: Strong demand for licorice-based confectionery, a significant cultural preference.

- Italy: Focus on offerings aligning with Italian tastes, potentially including chocolate and fruit-flavored items.

Impact of Digitalization and Social Media on Consumer Behavior

The pervasive influence of digital platforms and social media profoundly shapes consumer behavior within the confectionery market. Trends emerge rapidly, brand perception is molded through online interactions, and purchasing decisions are increasingly swayed by digital touchpoints. For instance, by early 2024, over 60% of global internet users actively engaged with social media, creating a direct channel for confectionery brands to connect with their audience.

Cloetta must strategically harness digital marketing and foster online engagement to cultivate robust brand loyalty, successfully introduce new products, and adeptly manage customer feedback. This digital presence allows for real-time interaction and sentiment analysis, crucial for adapting to evolving consumer preferences in the fast-paced confectionery sector.

- Digital Influence: Social media platforms like Instagram and TikTok are key drivers of confectionery trends, with user-generated content and influencer marketing significantly impacting purchase decisions.

- Brand Perception: Online reviews and social media sentiment directly influence how consumers perceive confectionery brands, making proactive reputation management essential.

- E-commerce Growth: The rise of online grocery shopping and direct-to-consumer channels, accelerated by digital adoption, presents significant opportunities for confectionery sales.

- Data-Driven Marketing: Leveraging data analytics from digital interactions allows Cloetta to personalize marketing campaigns and understand consumer preferences more effectively.

Societal shifts toward health-consciousness are reshaping confectionery consumption, with a notable increase in demand for lower-sugar options. This trend is particularly strong in key European markets where Cloetta operates, as evidenced by a 2024 survey showing over 60% of Swedish consumers actively reducing sugar intake. Furthermore, busy lifestyles drive demand for convenient, on-the-go snacks, a market segment projected to exceed $1.2 trillion globally by 2027, presenting opportunities for single-serving, portable confectionery items.

Technological factors

Advancements in automation and robotics are poised to significantly boost efficiency and cut labor expenses within Cloetta's confectionery manufacturing and distribution networks. By integrating automated systems, from the initial ingredient blending stages right through to final packaging, Cloetta can expect to see increased production volumes, more uniform product quality, and greater overall operational flexibility.

For instance, the global industrial robotics market, valued at approximately $50 billion in 2023, is projected to grow substantially, with many confectionery manufacturers adopting these technologies to stay competitive. This trend suggests that Cloetta's investment in automation could yield tangible benefits in terms of reduced per-unit production costs and faster order fulfillment times, crucial in the fast-moving consumer goods sector.

Ongoing advancements in food science are a significant technological factor for Cloetta. Innovations in areas like sugar substitutes and natural flavorings present opportunities to create novel confectionery products and enhance existing ones. For instance, the development of stevia and monk fruit extracts allows for reduced sugar content while maintaining palatability, catering to the growing health-conscious consumer base.

Furthermore, the integration of functional ingredients, such as those offering digestive benefits or added vitamins, can differentiate Cloetta's offerings in a competitive market. Research into plant-based ingredients and alternative proteins also opens doors for developing vegan and allergen-friendly confectionery lines, aligning with evolving dietary trends. In 2024, the global sugar substitutes market was valued at approximately $9.5 billion, with a projected compound annual growth rate of over 6% through 2030, highlighting the substantial market potential for sugar-reduced products.

Cloetta's ability to leverage data analytics and artificial intelligence is crucial for understanding evolving consumer tastes. By analyzing vast datasets on purchasing habits and market shifts, the company can identify emerging trends, such as the growing demand for healthier snack options or specific flavor profiles. For example, in 2024, the global market for health and wellness snacks was projected to reach over $200 billion, a significant indicator of consumer preference shifts that data analytics can help Cloetta tap into.

These advanced analytical tools allow for highly targeted product development and personalized marketing. Imagine tailoring promotions based on individual purchase histories or developing new confectionery items that directly address identified consumer needs. This data-driven approach can optimize inventory management, reducing waste and ensuring popular products are readily available, thereby enhancing customer satisfaction and driving sales efficiency throughout 2025.

E-commerce and Digital Sales Platforms

The surge in e-commerce platforms demands Cloetta maintain a robust digital storefront and agile online distribution. By 2025, global e-commerce sales are projected to reach $7.4 trillion, highlighting the critical need for companies like Cloetta to invest in seamless online experiences. This includes user-friendly websites, secure payment gateways, and dependable logistics to effectively serve the growing online consumer base.

Cloetta's strategic focus on digital channels is essential for capturing market share in the evolving retail landscape. The company's investment in its own direct-to-consumer (DTC) channels and partnerships with major online retailers are key components of this strategy. For instance, during Q1 2024, Cloetta reported a notable increase in online sales, reflecting the success of its digital initiatives.

- E-commerce Growth: Global e-commerce sales are expected to hit $7.4 trillion by 2025.

- Digital Presence: Cloetta must prioritize user-friendly websites and secure payment systems.

- Logistics: Reliable online order fulfillment is crucial for customer satisfaction.

- DTC Investment: Direct-to-consumer channels are a growing focus for confectionery brands.

Packaging Innovation and Shelf-Life Extension

Technological advancements in packaging are crucial for Cloetta. Innovations in materials and techniques can significantly extend product shelf-life, a key factor in the confectionery market where freshness is paramount. This directly impacts waste reduction and can improve the overall appeal of Cloetta's products to consumers.

For instance, the development of advanced barrier films in 2024 has shown promise in maintaining the quality of chocolate and other sensitive confectionery items for longer periods. Smart packaging, which might include indicators for temperature or freshness, is also emerging as a differentiator. Companies that adopt these technologies can gain a competitive edge and better align with growing consumer demand for sustainable and transparent product information.

Cloetta's focus on innovation in this area could lead to several benefits:

- Extended Shelf-Life: Reducing spoilage and allowing for wider distribution.

- Waste Reduction: Contributing to sustainability goals and cost savings.

- Enhanced Consumer Appeal: Through improved product quality and innovative packaging designs.

- Competitive Advantage: Differentiating products in a crowded market, especially with sustainable or smart packaging solutions.

Technological advancements are reshaping the confectionery landscape for Cloetta. Automation in manufacturing, driven by a global industrial robotics market nearing $50 billion in 2023, promises increased efficiency and reduced labor costs. Innovations in food science, such as the use of natural sugar substitutes, are key as the global market for these ingredients was valued at approximately $9.5 billion in 2024 and is projected for strong growth.

Leveraging data analytics and AI allows Cloetta to understand consumer preferences, particularly in the burgeoning health and wellness snack market, which was projected to exceed $200 billion in 2024. Furthermore, the critical growth of e-commerce, with global sales anticipated to reach $7.4 trillion by 2025, necessitates a strong digital presence and efficient online logistics for Cloetta. Packaging technology, including advanced barrier films, is also vital for extending shelf-life and reducing waste.

| Technological Factor | Impact on Cloetta | Relevant Data (2023-2025) |

|---|---|---|

| Automation & Robotics | Increased manufacturing efficiency, reduced labor costs | Global industrial robotics market: ~$50 billion (2023) |

| Food Science Innovations | New product development (e.g., reduced sugar), enhanced appeal | Global sugar substitutes market: ~$9.5 billion (2024) |

| Data Analytics & AI | Consumer trend identification, targeted marketing | Health & wellness snacks market: >$200 billion projected (2024) |

| E-commerce & Digital Platforms | Expanded market reach, direct-to-consumer opportunities | Global e-commerce sales: ~$7.4 trillion projected (2025) |

| Packaging Technology | Extended shelf-life, waste reduction, improved product quality | Advancements in barrier films and smart packaging |

Legal factors

Cloetta must navigate a complex web of food additive regulations across its markets, impacting everything from colorings to preservatives. These rules are not static; they evolve, demanding constant vigilance and adaptation. For instance, the European Food Safety Authority (EFSA) regularly reviews and updates acceptable daily intakes (ADIs) for various additives, which directly influences product formulations.

Failure to comply can lead to significant legal penalties and damage to brand reputation. In 2023, several food manufacturers faced recalls and fines due to undeclared or non-compliant additives. Cloetta's commitment to product safety necessitates rigorous adherence to these evolving legal frameworks, often requiring costly reformulations or adjustments to its supply chain to source compliant ingredients.

Advertising and marketing of confectionery products, including those from Cloetta, face stringent legal scrutiny, particularly regarding health claims and child-directed promotions. Regulations in key markets, such as the EU and UK, mandate truthful and non-misleading advertising, with specific rules against exploiting children's credulity. For instance, the UK's Advertising Standards Authority (ASA) actively monitors and enforces rules against unhealthy food advertising to children, impacting how companies like Cloetta can promote their products.

Cloetta navigates a complex web of labor laws across its operating countries, impacting everything from minimum wage requirements to workplace safety standards. For instance, in Sweden, the Employment Protection Act (LAS) provides significant employee protections, while Germany's Works Constitution Act establishes works councils with co-determination rights. Failure to adhere to these varied regulations, which can include specific rules on working hours, overtime pay, and employee benefits, poses substantial legal and financial risks, potentially leading to fines or operational disruptions.

Intellectual Property Rights and Brand Protection

Intellectual property rights are fundamental to Cloetta's success, protecting its diverse range of beloved brands and unique product recipes. The company actively manages its trademarks and patents to combat counterfeiting and unauthorized usage, thereby preserving its brand value and competitive edge in the confectionery market. In 2024, Cloetta continued its vigilance, with ongoing efforts to defend its intellectual assets against infringements, a critical component of its brand protection strategy.

Safeguarding its intellectual property ensures that Cloetta maintains control over its product innovations and brand identity. This legal framework is essential for preventing market dilution and maintaining consumer trust. For instance, the company's commitment to IP protection is evident in its proactive stance against any attempts to replicate its popular products or utilize its established brand names without authorization.

Cloetta's robust intellectual property portfolio, encompassing trademarks for brands like Kexchoklad and Läkerol, is a significant asset. The company's legal team works diligently to monitor global markets for potential violations. This proactive approach is vital, especially as the company expands into new territories where brand recognition and product integrity must be rigorously upheld. The ongoing legal landscape for intellectual property, particularly concerning digital and international brand protection, remains a key focus for the company in 2024 and into 2025.

Data Privacy and GDPR Compliance

Cloetta, like all businesses operating in Europe, must navigate the complex landscape of data privacy regulations, with the General Data Protection Regulation (GDPR) being a prime example. The increasing digitalization of its operations and the collection of consumer data necessitate strict adherence to these rules. Failure to comply can lead to substantial fines; for instance, in 2023, the European Data Protection Board reported that fines issued under GDPR exceeded €1.5 billion across all sectors.

Protecting customer and employee data is not just a legal obligation but a critical component of maintaining consumer trust and brand reputation. Cloetta's commitment to transparent data handling practices and the implementation of robust cybersecurity measures are therefore legal imperatives. These efforts are crucial to avoid significant penalties and safeguard sensitive information, especially as cyber threats continue to evolve.

- GDPR Fines: In 2023, GDPR fines collectively surpassed €1.5 billion across Europe, highlighting the financial risks of non-compliance.

- Data Protection: Legal requirements mandate the protection of both customer and employee personal data.

- Cybersecurity Investment: Robust cybersecurity measures are essential to prevent data breaches and associated legal liabilities.

- Transparency: Clear and transparent data handling policies are legally required and build consumer trust.

Cloetta must adhere to stringent food safety and labeling laws across its operating regions, ensuring product integrity and consumer information accuracy. These regulations cover everything from ingredient disclosure to allergen warnings, with non-compliance risking product recalls and substantial fines. For example, the EU's General Food Law (Regulation (EC) No 178/2002) sets out the fundamental principles of food law, including traceability and risk analysis, which Cloetta must integrate into its operations.

Advertising standards are also a key legal consideration, particularly concerning health claims and promotions targeting children. Regulations in markets like the UK, enforced by bodies such as the Advertising Standards Authority (ASA), prohibit misleading advertising and restrict the marketing of high-sugar products to younger audiences. This necessitates careful crafting of marketing campaigns to align with legal requirements and maintain brand integrity.

Intellectual property laws are crucial for safeguarding Cloetta's brands and product innovations, with trademarks for popular products like Kexchoklad and Läkerol requiring continuous legal protection. The company actively monitors markets for infringements to prevent counterfeiting and unauthorized use, a vital strategy for maintaining brand value and competitive advantage, especially as it expands internationally.

Data privacy regulations, most notably the GDPR in Europe, impose strict requirements on how Cloetta handles customer and employee data. The company must ensure transparent data processing and implement robust cybersecurity measures to prevent breaches and avoid significant penalties. In 2023, GDPR fines across various sectors exceeded €1.5 billion, underscoring the financial risks associated with data protection failures.

Environmental factors

Climate change poses significant threats to Cloetta's supply chain, with extreme weather events increasingly impacting the availability and cost of crucial agricultural inputs like cocoa and sugar. For example, the 2023 cocoa harvest in West Africa, a primary sourcing region for many confectionery companies, faced challenges due to unseasonal rainfall and disease outbreaks, leading to price volatility.

Cloetta must proactively assess these climate-related risks and integrate resilience into its sourcing strategies. This involves diversifying suppliers, exploring alternative raw material sources, and potentially investing in climate-resilient agricultural practices to ensure consistent production and mitigate disruptions.

Water scarcity is a growing global challenge, and its availability directly affects manufacturing, particularly for companies like Cloetta operating in diverse regions or sourcing ingredients internationally. Ensuring efficient water management within its own facilities is crucial, and Cloetta also needs to scrutinize the water footprint of its agricultural suppliers.

For instance, the European Environment Agency reported in 2023 that a significant portion of European river basins experienced water stress. This highlights the need for Cloetta to invest in water-saving technologies and explore water recycling initiatives across its production sites to mitigate operational risks and environmental impact.

Cloetta faces increasing pressure from consumers and regulators to minimize packaging waste, especially plastics. This trend is accelerating globally, with many regions implementing or strengthening bans on single-use plastics and introducing extended producer responsibility schemes. For instance, the European Union's Packaging and Packaging Waste Regulation aims to increase recycling rates and reduce overall packaging waste by 2030, directly impacting companies like Cloetta.

To address this, Cloetta is investing in developing more sustainable packaging. This includes exploring recyclable materials, biodegradable options, and reducing the overall amount of packaging used. A key focus for 2024 and 2025 will be on enhancing the recyclability of their confectionery wrappers and ensuring compliance with evolving environmental standards, which is vital for maintaining brand reputation and market access.

Energy Consumption and Carbon Footprint

Cloetta's confectionery production is inherently energy-intensive, directly impacting its carbon footprint. The company is under increasing pressure from stakeholders and regulators to curb its energy usage and transition towards more sustainable power sources. This shift is crucial for meeting global climate targets and also offers a pathway to lower operational expenses.

To address these environmental concerns, Cloetta is focusing on several key areas:

- Energy Efficiency Initiatives: Implementing advanced technologies and optimizing manufacturing processes to reduce overall energy consumption.

- Renewable Energy Sourcing: Increasing the proportion of electricity sourced from renewable resources like wind and solar power.

- Carbon Footprint Reduction Targets: Setting and working towards specific, measurable goals for reducing greenhouse gas emissions across its value chain.

- Supply Chain Engagement: Collaborating with suppliers to encourage sustainable practices and reduce the environmental impact of raw material sourcing and transportation.

In 2023, Cloetta reported a reduction in its Scope 1 and 2 greenhouse gas emissions by 10.6% compared to its 2022 baseline, demonstrating progress in its sustainability efforts. The company aims to further decrease these emissions in the coming years, aligning with the European Union’s climate objectives.

Biodiversity Loss and Sustainable Sourcing

Biodiversity loss, especially from agricultural practices, poses a significant challenge for companies like Cloetta that rely on raw materials such as cocoa. Unsustainable farming methods can degrade ecosystems, impacting the very resources essential for future production. For instance, reports in 2024 highlight that over 1 million species are now threatened with extinction, a stark reminder of the environmental pressures.

Cloetta's commitment to sustainable sourcing is therefore crucial for both environmental stewardship and business continuity. By promoting farming practices that protect biodiversity, the company can ensure a more resilient supply chain. This also resonates with an increasing consumer base in 2024-2025 that prioritizes ethically sourced and environmentally conscious products, driving demand for transparency in ingredient origins.

- Cocoa farming is a major contributor to deforestation in West Africa, impacting critical habitats.

- Sustainable agriculture initiatives aim to restore degraded land and protect local wildlife.

- Consumer surveys in 2024 indicate a strong preference for brands demonstrating clear environmental commitments.

- Supply chain resilience is directly linked to the health of the ecosystems where ingredients are grown.

Cloetta's environmental strategy is increasingly focused on reducing its carbon footprint and improving energy efficiency. The company reported a 10.6% reduction in Scope 1 and 2 greenhouse gas emissions in 2023 compared to 2022, demonstrating tangible progress. Efforts in 2024 and 2025 will concentrate on expanding renewable energy sourcing and optimizing manufacturing processes to further lower energy consumption.

Addressing packaging waste is a critical environmental concern, with the EU's Packaging and Packaging Waste Regulation setting ambitious recycling targets for 2030. Cloetta is investing in developing more recyclable and reduced packaging solutions for its confectionery products, aiming to meet these evolving standards and consumer expectations for sustainability.

Water scarcity and biodiversity loss are also significant environmental factors impacting Cloetta's supply chain. The company is scrutinizing its water footprint and promoting sustainable agricultural practices to protect ecosystems and ensure the long-term availability of key ingredients like cocoa, a sector where deforestation remains a concern.

| Environmental Factor | Impact on Cloetta | Key Initiatives (2023-2025) | Data/Targets |

|---|---|---|---|

| Climate Change & Extreme Weather | Disruptions to cocoa and sugar supply, price volatility | Supply chain diversification, climate-resilient agriculture investment | 2023 cocoa harvest challenges in West Africa |

| Water Scarcity | Manufacturing process risks, supplier water footprint | Water-saving technologies, water recycling in facilities | European river basins experiencing water stress (2023) |

| Packaging Waste | Regulatory pressure, consumer demand for reduced waste | Developing recyclable/biodegradable packaging, reducing material usage | EU Packaging and Packaging Waste Regulation targets |

| Energy Consumption & Carbon Footprint | Operational costs, regulatory compliance, stakeholder pressure | Energy efficiency, renewable energy sourcing, emissions reduction targets | 10.6% Scope 1 & 2 GHG emission reduction (2023 vs 2022) |

| Biodiversity Loss | Threats to raw material sourcing (e.g., cocoa) | Promoting sustainable farming, protecting ecosystems | Over 1 million species threatened with extinction (2024) |

PESTLE Analysis Data Sources

Our Cloetta PESTLE Analysis is grounded in comprehensive data from official government publications, reputable market research firms, and leading economic institutions. We meticulously gather insights on political stability, economic forecasts, technological advancements, environmental regulations, and socio-cultural trends to ensure a robust understanding of the external landscape.