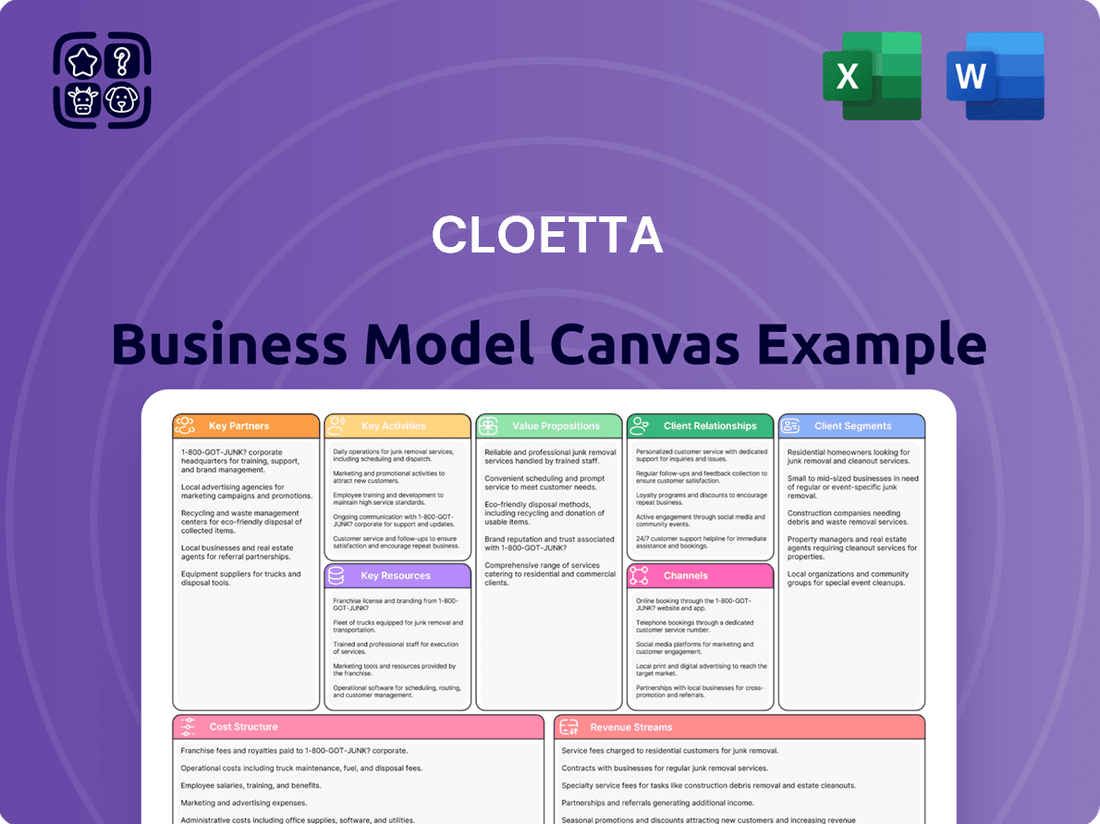

Cloetta Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cloetta Bundle

Discover the strategic core of Cloetta's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap for understanding their market dominance. Ideal for anyone seeking to dissect a thriving confectionery business.

Unlock the full strategic blueprint behind Cloetta's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Cloetta's success hinges on its relationships with key raw material suppliers, providing essential ingredients like cocoa, sugar, and various flavorings. These partnerships are crucial for ensuring a consistent supply chain for its wide range of confectionery products.

The company navigates the inherent volatility in raw material pricing, a challenge exemplified by the significant increase in cocoa prices observed in 2025. To mitigate these fluctuations, Cloetta focuses on cultivating robust supplier relationships, which may involve securing long-term contracts to stabilize costs and maintain product profitability.

Cloetta relies on a robust network of distribution partners to ensure its confectionery products reach consumers across its key markets. These include major retail chains and specialized food distributors throughout the Nordic region, the Netherlands, and Italy. For instance, in 2024, Cloetta continued to leverage these established relationships to maintain shelf presence and facilitate efficient product delivery.

Cloetta's success hinges on its partnerships with major retail chains, which serve as the primary sales channels for its confectionery products. These collaborations are crucial for securing prominent shelf space and executing effective in-store promotions. For instance, in 2024, Cloetta continued to leverage its relationships with key European retailers to drive sales of its popular brands like Kexchoklad and Läkerol.

Third-Party Manufacturers/Outsourcing Partners

Cloetta leverages third-party manufacturers to complement its internal production capabilities, particularly for specialized products or to navigate periods of high demand. This strategic outsourcing ensures flexibility and efficiency in meeting market needs. For instance, in 2024, Cloetta continued to work with select external partners to broaden its product portfolio and manage production volumes effectively, ensuring no compromise on its high-quality standards.

These partnerships are crucial for maintaining Cloetta's product integrity and brand reputation. All outsourced manufacturing processes are rigorously monitored to comply with Cloetta's strict quality control and food safety protocols. This commitment to excellence means that even products made by external partners meet the same exacting requirements as those produced in Cloetta's own facilities, safeguarding consumer trust.

- Strategic Outsourcing: Utilizes third-party manufacturers for specialized products or capacity management, enhancing operational agility.

- Quality Assurance: Ensures all outsourced production adheres to Cloetta's stringent quality and food safety standards.

- Capacity Management: Addresses fluctuating demand and expands product offerings without immediate capital investment in new facilities.

- Brand Protection: Maintains product integrity and consumer trust by enforcing consistent quality across all manufacturing sources.

Market Research and Innovation Partners

Cloetta actively engages with external market research firms and innovation partners to maintain its competitive edge and deeply understand evolving consumer desires. This collaboration is crucial for staying ahead in the dynamic confectionery market.

A prime example of this strategy in action is Cloetta's partnership with Ipsos for their 'Joy Report'. This initiative provided valuable insights into what brings joy to consumers across the Nordic region, directly influencing Cloetta's product development pipeline and marketing approaches for 2024 and beyond.

- Market Research Firms: Collaboration with entities like Ipsos to gather data on consumer sentiment and preferences.

- Innovation Partners: Working with external experts to co-create new products and explore novel concepts.

- Consumer Insights: Leveraging research, such as the 'Joy Report', to inform strategic decisions and product innovation.

- Competitive Advantage: Utilizing these partnerships to identify market trends and adapt offerings effectively.

Cloetta's key partnerships extend to logistics providers and technology partners, ensuring efficient operations and digital advancements. These collaborations are vital for maintaining a smooth supply chain and enhancing customer experience. For instance, in 2024, Cloetta continued to optimize its logistics network through partnerships with specialized transport companies, ensuring timely delivery across its markets.

Furthermore, Cloetta collaborates with technology providers to implement advanced analytics and digital tools, supporting data-driven decision-making and improving overall business efficiency. These tech partnerships are essential for staying competitive in an increasingly digitalized market. For example, Cloetta's investment in data analytics platforms in 2024, often facilitated by external tech partners, aimed to provide deeper insights into sales performance and consumer behavior.

Cloetta's strategic alliances also encompass collaborations with industry associations and regulatory bodies. These partnerships are crucial for staying informed about industry best practices, navigating regulatory landscapes, and contributing to the overall development of the confectionery sector. In 2024, Cloetta actively participated in industry forums, reinforcing its commitment to responsible business conduct and sustainable growth.

What is included in the product

This Cloetta Business Model Canvas provides a strategic overview of their operations, detailing customer segments, value propositions, and key partnerships to deliver confectionery products effectively.

Cloetta's Business Model Canvas provides a structured framework that helps identify and address key operational inefficiencies, acting as a pain point reliver by offering a clear, visual representation of their value proposition and customer segments.

By condensing complex strategies into a digestible format, Cloetta's Business Model Canvas facilitates quick identification of areas for improvement and innovation, effectively relieving the pain of opaque or unmanageable business processes.

Activities

Cloetta's primary focus is the efficient manufacturing of confectionery, including chocolate, sugar treats, and pastilles. This core activity is carried out across its seven production facilities strategically located in five different countries, ensuring broad market reach and production capacity.

The company emphasizes optimizing its production processes to be both waste-reducing and highly flexible. This approach allows Cloetta to effectively respond to fluctuating market demands and consumer preferences, ensuring timely delivery of its diverse product portfolio.

In 2024, Cloetta continued to invest in modernizing its manufacturing capabilities. For instance, the company reported that its production efficiency initiatives were a key driver in managing costs and maintaining competitive pricing in a dynamic market environment.

Cloetta's brand management and marketing efforts are central to its business. A key activity involves nurturing its well-established brands like Läkerol, Candyking, and Kexchoklad. This includes implementing targeted marketing campaigns and exploring brand extensions into new product areas to foster profitable expansion.

Increasing distribution reach is another crucial element of Cloetta's strategy. By making its products more accessible, the company aims to drive sales and strengthen its market presence. For instance, in 2023, Cloetta reported a net sales increase to SEK 7,074 million, demonstrating the effectiveness of its distribution and marketing initiatives.

Cloetta's commitment to continuous innovation fuels its product development pipeline, a critical driver for capturing and retaining market share in the fast-paced confectionery sector. This focus ensures a steady stream of new offerings designed to meet evolving consumer preferences.

In 2024, Cloetta continued to invest in research and development, aiming to launch products that resonate with current trends, such as healthier options and exciting flavor combinations. The company's strategy emphasizes agility in responding to market shifts and consumer demand, a crucial element for sustained growth.

Marketing effectiveness plays a pivotal role in Cloetta's new product development cycle, ensuring that innovations reach the right consumers. For example, successful product launches are often supported by targeted campaigns that build awareness and drive trial, ultimately contributing to market penetration and sales performance.

Supply Chain and Logistics Management

Cloetta's key activities heavily involve managing its intricate global supply chain. This encompasses everything from procuring raw materials like sugar and cocoa to ensuring the efficient distribution of its confectionery products to over 50 countries. A significant focus is placed on maintaining stringent food safety standards and adhering to diverse international regulations.

Optimizing this extensive network is paramount for both operational efficiency and cost control. For instance, in 2023, Cloetta reported that its supply chain operations were a core focus, aiming to mitigate rising input costs and ensure product availability across its broad market reach. This involves strategic sourcing and robust inventory management to meet consumer demand effectively.

- Global Sourcing: Procuring a wide array of raw materials from various international suppliers.

- Manufacturing Oversight: Ensuring consistent quality and safety across production facilities.

- Distribution Network: Managing the logistics of transporting finished goods to retail partners in numerous markets.

- Compliance and Safety: Upholding food safety regulations and quality control throughout the supply chain.

Strategic Planning and Market Expansion

Cloetta’s strategic planning is geared towards optimizing its operational framework to support key objectives. This includes solidifying its standing in established markets while simultaneously venturing into new territories. For instance, the company has identified Germany, the UK, and North America as key expansion targets.

This strategic push necessitates a thorough review of existing manufacturing capabilities and a proactive approach to mergers and acquisitions (M&A). By carefully evaluating its production setup, Cloetta aims to ensure it can efficiently meet the demands of its growing market presence. The company’s approach is selective, focusing on M&A opportunities that offer the most strategic advantage.

- Market Focus: Strengthening presence in core markets (e.g., Nordics) and expanding into new regions like Germany, UK, and North America.

- Operational Alignment: Reassessing and adapting manufacturing structures to support new market entries and growth.

- Growth Strategy: Pursuing selective mergers and acquisitions to accelerate market penetration and enhance product portfolios.

- Strategic Review: Continuous evaluation of the business model to ensure alignment with evolving market dynamics and company priorities.

Cloetta's core activities revolve around the efficient production and distribution of confectionery products, supported by robust brand management and continuous innovation. The company strategically sources raw materials globally, oversees manufacturing across its facilities, and manages a complex distribution network to reach consumers in over 50 countries, all while prioritizing compliance and safety.

In 2024, Cloetta continued to focus on optimizing production efficiency and investing in R&D for new product launches, aiming to meet evolving consumer trends. The company's strategic planning includes strengthening its presence in core markets and expanding into new territories like Germany, the UK, and North America, often through selective mergers and acquisitions.

| Key Activity | Description | 2023 Data/2024 Focus |

| Manufacturing & Production | Efficient production of chocolate, sugar treats, and pastilles across 7 facilities. | Focus on production efficiency and modernization in 2024. |

| Brand Management & Marketing | Nurturing brands like Läkerol and Candyking through targeted campaigns. | Continued investment in marketing to drive sales and brand growth. |

| Supply Chain Management | Global sourcing of raw materials and distribution to over 50 countries. | Mitigating rising input costs and ensuring product availability in 2023. |

| Innovation & Product Development | Creating new confectionery offerings to meet consumer preferences. | Investment in R&D for healthier options and new flavor combinations in 2024. |

| Strategic Expansion | Strengthening presence in core markets and entering new ones like Germany and UK. | Pursuing selective M&A opportunities for market penetration. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the complete, ready-to-use file. You'll gain full access to this comprehensive business model, allowing you to immediately begin strategizing and refining your approach.

Resources

Cloetta’s strength lies in its robust portfolio of beloved confectionery brands, including household names like Läkerol, Candyking, Jenkki, Kexchoklad, Malaco, Sportlife, and Red Band. These brands are the bedrock of consumer trust and market presence, driving significant recognition and loyalty.

In 2024, Cloetta continued to leverage this brand equity, with its confectionery segment showing consistent performance. For instance, the company reported that its leading brands maintained strong market shares across key Nordic and Dutch markets, contributing to overall revenue growth.

Cloetta’s production backbone consists of six to seven manufacturing units strategically located across five countries. Key facilities, such as those in Slovakia and Sweden, are equipped with advanced technology designed for high-quality and efficient confectionery production. These sites are crucial for maintaining product standards and operational output.

Cloetta's approximately 2,600 employees as of December 2024 form the bedrock of its operations. This skilled workforce encompasses crucial roles from research and development specialists who drive product innovation to the production teams ensuring quality manufacturing and the marketing professionals who connect with consumers.

The collective expertise within this human capital is directly responsible for Cloetta's ability to innovate, maintain high production standards, and execute effective market strategies. Their skills are a tangible asset, directly impacting the company's competitive edge and product development pipeline.

Distribution Network and Market Presence

Cloetta leverages a robust distribution network, reaching consumers in over 50 markets worldwide. This expansive reach is a cornerstone of its market penetration strategy.

The company's primary operational focus and strongest market presence are concentrated in the Nordic region, the Netherlands, and Italy. These core markets are crucial for driving sales and brand visibility.

In 2023, Cloetta reported net sales of SEK 7,097 million, with its confectionery products widely available through various retail channels. This indicates the effectiveness of its distribution infrastructure in getting products to consumers.

- Global Reach: Products available in over 50 markets.

- Key Markets: Strong presence in the Nordics, Netherlands, and Italy.

- 2023 Net Sales: SEK 7,097 million, reflecting broad market access.

Intellectual Property and Recipes

Cloetta's intellectual property centers on its unique and proprietary recipes for a wide array of chocolate, sugar confectionery, and pastilles. These formulations are the bedrock of its product differentiation in a crowded marketplace.

These carefully guarded recipes and specialized manufacturing processes are crucial for maintaining Cloetta's competitive edge. They enable the company to offer distinct flavors and textures that resonate with consumers, contributing significantly to brand loyalty and market share.

- Proprietary Recipes: Unique formulations for key products like Kexchoklad and Läkerol.

- Manufacturing Processes: Specialized techniques ensuring consistent quality and taste.

- Brand Differentiation: These IPs set Cloetta products apart from competitors.

Cloetta's key resources are its strong brand portfolio, including Läkerol and Kexchoklad, which are central to its consumer recognition and market penetration. These brands are supported by a network of strategically located manufacturing facilities, ensuring efficient and high-quality production. The company's approximately 2,600 employees as of December 2024 bring diverse expertise, vital for innovation and operational excellence. Furthermore, Cloetta's proprietary recipes and specialized manufacturing processes are critical intellectual property, enabling product differentiation and maintaining a competitive edge in the confectionery market.

| Resource Category | Key Assets | Significance |

|---|---|---|

| Brands | Läkerol, Candyking, Kexchoklad, Malaco | Consumer trust, market recognition, loyalty driver |

| Manufacturing Facilities | 6-7 units across 5 countries (e.g., Slovakia, Sweden) | High-quality production, operational efficiency |

| Human Capital | Approx. 2,600 employees (Dec 2024) | R&D, production quality, marketing expertise |

| Intellectual Property | Proprietary recipes, manufacturing processes | Product differentiation, competitive advantage |

Value Propositions

Cloetta crafts high-quality confectionery, delivering enjoyable moments and satisfying cravings across a wide product range. This commitment to quality is central to their brand, ensuring consumers receive delightful treats.

In 2024, Cloetta continued to focus on this value proposition, with brands like Kexchoklad and Polly remaining popular choices for consumers seeking premium taste experiences. Their extensive portfolio aims to cater to diverse preferences for sweet indulgence.

Cloetta’s value proposition centers on providing consumers with access to well-known and trusted brands. These brands, like Kexchoklad and Läkerol, have cultivated strong recognition and deep loyalty among consumers over many years, offering a comforting sense of familiarity and reliability.

This established brand equity translates into significant consumer trust. For instance, in 2023, Cloetta reported that its top brands continued to perform strongly, contributing to a significant portion of its net sales, highlighting the enduring appeal and reliability consumers associate with them.

Cloetta’s broad product range, encompassing everything from indulgent chocolates and sweet sugar confectionery to refreshing pastilles and the highly sought-after Pick & Mix concept, provides consumers with an impressive spectrum of options. This extensive variety directly addresses a wide array of tastes and preferences, enabling highly personalized consumption experiences.

In 2024, Cloetta continued to leverage this strength, with its Pick & Mix concept remaining a significant driver of sales and customer engagement across many of its key markets. This segment allows consumers to curate their own selections, enhancing the feeling of choice and individualization, a core element of Cloetta's value proposition.

Accessibility and Wide Distribution

Cloetta's value proposition centers on making its confectionery products easily accessible to a broad consumer base. The company ensures its offerings are readily available across key markets, including the Nordic region, the Netherlands, and Italy, while also maintaining a global distribution network. This extensive reach simplifies the purchasing process for consumers, enhancing convenience and broadening Cloetta's market penetration.

This strategy is supported by Cloetta's robust distribution channels. For instance, in 2023, Cloetta reported that its products were available in approximately 90% of all grocery stores in Sweden, demonstrating a deep penetration into its core markets. This widespread availability is crucial for impulse purchases, a significant driver in the confectionery sector.

- Broad Market Presence: Cloetta products are widely distributed in the Nordic countries, the Netherlands, and Italy, alongside a global reach.

- Consumer Convenience: Easy access to products enhances the overall customer experience and encourages repeat purchases.

- Market Penetration: Extensive distribution networks ensure high visibility and availability in retail environments.

- Sales Channel Diversity: Cloetta leverages various channels, from traditional grocery stores to online platforms, to maximize accessibility.

Commitment to Sustainability and Responsible Practices

Cloetta's dedication to sustainability is a core value proposition, attracting consumers who prioritize ethical and environmentally sound choices. This focus translates into tangible benefits by fostering brand loyalty and enhancing its market appeal.

In 2024, Cloetta continued to advance its sustainability goals, for instance, by increasing the proportion of sustainably sourced cocoa. By the end of 2023, 90% of its cocoa was certified sustainable, a figure they aimed to further improve upon in 2024.

- Sustainable Sourcing: Cloetta is committed to sourcing key raw materials, like cocoa and palm oil, from certified sustainable sources, ensuring ethical and environmentally responsible production.

- Reduced Environmental Footprint: The company actively works to minimize its impact on the environment through initiatives like reducing greenhouse gas emissions and optimizing packaging to decrease waste.

- Social Responsibility: Cloetta engages in programs that support the communities where its ingredients are sourced, promoting fair labor practices and contributing to local development.

- Consumer Alignment: This commitment resonates strongly with a growing segment of consumers who actively seek out brands that demonstrate a clear dedication to sustainability and corporate responsibility.

Cloetta offers a wide variety of confectionery, from indulgent chocolates to refreshing pastilles, catering to diverse consumer preferences. Their popular brands, such as Kexchoklad and Läkerol, provide trusted and familiar taste experiences that resonate with consumers, fostering strong brand loyalty.

The company ensures its products are readily accessible through extensive distribution networks, particularly in the Nordic region, the Netherlands, and Italy. This broad market presence, with availability in approximately 90% of Swedish grocery stores in 2023, enhances consumer convenience and drives sales.

Cloetta's commitment to sustainability is a key differentiator, appealing to ethically-minded consumers. By the end of 2023, 90% of its cocoa was certified sustainable, with ongoing efforts in 2024 to further improve sourcing practices and reduce environmental impact.

| Value Proposition | Description | Supporting Data (2023/2024 Focus) |

|---|---|---|

| Product Quality & Variety | Delivering enjoyable confectionery moments with a broad product range. | Popular brands like Kexchoklad and Polly remain consumer favorites. |

| Brand Trust & Familiarity | Offering well-known and trusted brands that consumers rely on. | Top brands contribute significantly to net sales, demonstrating enduring appeal. |

| Accessibility & Convenience | Ensuring products are easily available across key markets. | Products available in ~90% of Swedish grocery stores (2023); strong presence in Nordics, NL, IT. |

| Sustainability Commitment | Prioritizing ethical and environmentally sound choices. | 90% of cocoa certified sustainable by end of 2023, with continued 2024 focus. |

Customer Relationships

Cloetta cultivates enduring customer connections by consistently providing high-quality confectionery and developing robust brand equity. This commitment drives repeat purchases and fosters emotional bonds with consumers who rely on their trusted brands.

In 2024, Cloetta's focus on brand loyalty is evident in its continued investment in marketing and product innovation, aiming to strengthen consumer trust. For instance, their sustained presence and positive consumer reception in key markets like Sweden and the Netherlands underscore this strategy.

Cloetta actively engages consumers by leveraging marketing campaigns and deep consumer insights, exemplified by their 'Joy Report' study. This research helps them understand preferences and behaviors, allowing for tailored product development and communication strategies.

By understanding what consumers truly desire, Cloetta can refine its offerings and marketing messages. For instance, insights from their studies directly influence how they present their brands, aiming to create a more resonant and satisfying customer experience, ultimately driving loyalty.

Cloetta fosters robust retailer partnerships through dedicated account management, ensuring efficient supply chains and collaborative planning. This approach aims for optimal product availability and prominent in-store visibility, crucial for their B2B customer relationships.

In 2024, Cloetta continued to emphasize strong relationships with its retail partners. Their account management teams focus on providing merchandising support and joint promotional activities. For instance, in the first half of 2024, Cloetta reported a 5% increase in sales driven by successful in-store campaigns with key retail accounts.

Customer Service and Feedback Mechanisms

Cloetta actively engages with its customer base through various service and feedback channels. This proactive approach aims to resolve inquiries efficiently and foster stronger customer loyalty.

- Customer Service Channels: Cloetta likely operates customer service hotlines, email support, and social media platforms to address consumer questions and concerns promptly.

- Feedback Integration: Input gathered through these channels is crucial for Cloetta's continuous improvement efforts, influencing product development and service enhancements.

- Complaint Resolution: In 2024, Cloetta, like many consumer goods companies, would have focused on swift and satisfactory resolution of customer complaints to maintain brand reputation.

- Customer Loyalty Programs: While not explicitly stated for this section, robust customer service often complements loyalty programs, encouraging repeat purchases and positive word-of-mouth referrals.

Community and Values Alignment

Cloetta actively cultivates community by highlighting its dedication to sustainability and ethical sourcing. This resonates deeply with consumers who increasingly prioritize brands that reflect their own values.

By aligning with these shared principles, Cloetta strengthens its brand reputation and builds a loyal customer base. For instance, in 2024, the company continued its efforts to reduce its environmental footprint, a key factor for conscious consumers.

- Sustainability Initiatives: Cloetta's ongoing commitment to reducing packaging waste and promoting responsible ingredient sourcing fosters a sense of shared purpose with its customers.

- Community Engagement: The company's local engagement programs and support for community projects further solidify its connection with the people it serves.

- Value Alignment: By transparently communicating its efforts in areas like fair labor practices and environmental protection, Cloetta attracts and retains customers who value ethical business conduct.

Cloetta nurtures its customer relationships through a multi-faceted approach, blending direct consumer engagement with strong B2B partnerships. The company prioritizes brand loyalty by investing in marketing and innovation, aiming to build emotional connections and trust. This is supported by active feedback mechanisms and a commitment to values like sustainability, which resonate with modern consumers.

| Relationship Type | Key Activities | 2024 Focus/Data |

|---|---|---|

| Consumer | Brand building, marketing campaigns, consumer insights, customer service | Continued investment in marketing; 'Joy Report' study for tailored experiences. |

| Retailer/B2B | Account management, supply chain efficiency, in-store visibility, joint promotions | Emphasis on merchandising support and promotions; reported 5% sales increase from retail campaigns in H1 2024. |

| Community | Sustainability initiatives, ethical sourcing, community engagement | Ongoing efforts to reduce environmental footprint; transparent communication on fair labor and environmental protection. |

Channels

Supermarkets and hypermarkets serve as Cloetta's primary sales channel, reaching a vast consumer audience with its branded packaged goods and the popular Pick & Mix concept. These large retail formats are crucial for both Cloetta's established core markets and its international expansion efforts, providing broad accessibility and significant sales volume.

Convenience stores and kiosks are a crucial distribution channel for Cloetta, serving as prime locations for impulse buys and catering to consumers seeking immediate gratification. These outlets are particularly effective for Cloetta's single-serve confectionery and popular brands, driving high-volume sales.

In 2024, the confectionery market within convenience channels continued to demonstrate resilience, with impulse purchases remaining a significant driver of revenue. Cloetta's strategic placement in these high-traffic environments ensures its products are readily accessible to consumers on the go, contributing substantially to overall market share.

Cloetta leverages wholesale partners and a broad distributor network to ensure its confectionery products reach a vast landscape of smaller retailers, independent shops, and diverse food service establishments. This strategy is crucial for expanding market reach beyond direct relationships with larger chains, allowing Cloetta to tap into niche markets and geographically dispersed customer bases.

In 2024, Cloetta's wholesale and distribution channels played a significant role in its revenue generation, with a substantial portion of sales flowing through these intermediaries. For instance, the company reported that its net sales for the first quarter of 2024 reached SEK 1,603 million, a significant portion of which was facilitated by these indirect sales channels, underscoring their importance in achieving broad market penetration.

Travel Retail (Duty-Free)

Cloetta actively engages in the travel retail channel, offering its confectionery products in duty-free shops situated in airports and various international transit points. This strategic placement allows the company to reach a global audience of travelers seeking impulse purchases and travel exclusives.

The primary customer segment in this channel consists of individuals traveling internationally who are often looking for gifts, personal treats, or unique regional confectionery items not readily available in their home markets. Cloetta leverages this by offering special editions and popular local favorites tailored for the travel consumer.

In 2024, the global travel retail market continued its recovery, with confectionery remaining a strong performer within the impulse purchase category. For instance, airport retail sales have shown significant year-on-year growth as passenger traffic rebounds, indicating a positive outlook for channels like duty-free.

- Channel Presence: Duty-free shops in airports and other international travel hubs.

- Target Customer: International travelers seeking confectionery, including gifts and travel exclusives.

- Product Offering: Confectionery, with a focus on special editions and regional favorites appealing to a transient audience.

- Market Context (2024): Benefiting from the ongoing recovery in global passenger traffic and a strong performance of impulse purchase categories like confectionery in travel retail environments.

Online Retail and E-commerce

While Cloetta's core distribution likely remains through traditional brick-and-mortar channels, the company undoubtedly utilizes online retail and e-commerce to extend its reach. This digital presence allows them to connect with a growing segment of consumers who prefer the convenience of online shopping for their confectionery needs. In 2024, the global e-commerce market continued its robust growth, with online retail sales projected to account for a significant portion of total retail spending, underscoring the importance of this channel for brands like Cloetta.

Cloetta likely employs a multi-faceted e-commerce strategy. This could include direct-to-consumer sales through their own website, partnerships with major online marketplaces, and potentially even direct fulfillment for online orders. By embracing these digital avenues, Cloetta can tap into new customer bases and offer a wider selection of products, including specialized or limited-edition items, directly to consumers regardless of their geographical location.

- Digital Reach: E-commerce allows Cloetta to reach consumers beyond traditional retail footprints, catering to the increasing preference for online purchasing.

- Marketplace Integration: Partnerships with platforms like Amazon, Bol.com, and other regional e-commerce giants are crucial for visibility and sales volume.

- Direct-to-Consumer (DTC): Cloetta's own online store offers a direct relationship with customers, enabling brand building and potentially higher margins.

- Sales Growth: The online confectionery market is a significant growth area, with reports indicating continued double-digit growth in many regions for online grocery and impulse purchases in 2024.

Cloetta's distribution strategy is comprehensive, encompassing major retail formats like supermarkets and convenience stores for broad reach and impulse buys. The company also utilizes wholesale partners and a robust distributor network to access smaller retailers and diverse food service establishments, ensuring widespread product availability.

Furthermore, Cloetta actively participates in the travel retail channel, targeting international travelers in duty-free locations, and leverages e-commerce platforms for direct-to-consumer sales and broader digital market penetration. In 2024, the confectionery market within convenience channels demonstrated resilience, with impulse purchases remaining a significant driver of revenue, and online confectionery sales continued their robust growth.

| Channel | Key Characteristics | 2024 Market Context |

|---|---|---|

| Supermarkets/Hypermarkets | Broad consumer access, high volume, Pick & Mix concept | Core markets and international expansion |

| Convenience Stores/Kiosks | Impulse purchases, immediate gratification, single-serve items | Resilient market, impulse buys significant revenue driver |

| Wholesale/Distributors | Reach smaller retailers, niche markets, geographically dispersed customers | Substantial portion of net sales facilitated by these channels (e.g., Q1 2024 net sales SEK 1,603 million) |

| Travel Retail | Duty-free shops, international travelers, gifts, travel exclusives | Ongoing recovery in passenger traffic, confectionery strong in impulse purchases |

| E-commerce | Digital reach, DTC, online marketplaces, convenience | Robust growth, significant portion of total retail spending |

Customer Segments

Cloetta's mass market consumers in the Nordic region, Netherlands, and Italy represent a significant portion of its customer base. These consumers primarily seek confectionery for daily indulgence and festive moments, prioritizing enjoyable flavors, trusted brand names, and easy availability in their purchasing decisions.

In 2023, Cloetta reported net sales of SEK 7,326 million, with a substantial contribution from its core markets, underscoring the importance of this broad consumer segment. The company’s strategy focuses on meeting the diverse needs of these consumers through a wide product portfolio that caters to various preferences and consumption occasions.

Pick & Mix Enthusiasts represent a significant customer base for Cloetta, drawn to the freedom of creating their own candy assortments. This segment thrives on variety and personalization, actively seeking out the expansive selections offered through channels like Candyking. Their engagement highlights a desire for a tailored confectionery experience that goes beyond pre-packaged options.

Cloetta is strategically broadening its reach to consumers in significant growth regions, namely Germany, the United Kingdom, and North America. This expansion targets individuals who appreciate and seek out European confectionery, with a particular interest in Swedish candy specialties.

In 2024, the confectionery market in these regions presented substantial opportunities. For instance, the UK confectionery market alone was valued at approximately £4.2 billion in 2024, demonstrating a strong consumer base for sweet treats. Germany, another key market, boasts a similar robust demand for high-quality confectionery, with a growing appreciation for imported European brands.

North America, particularly the United States, represents a vast and diverse consumer landscape. The US confectionery market, projected to reach over $40 billion in 2024, offers a significant avenue for Cloetta to introduce its unique European offerings and capitalize on the increasing consumer interest in international flavors and premium candy experiences.

Retailers and Wholesalers

Retailers and wholesalers are Cloetta's essential B2B customer segment, acting as the primary conduits to the end consumer market. These partners prioritize consistent product availability, strong brand recognition, and attractive profit margins to ensure their own success. For instance, in 2023, Cloetta's net sales reached SEK 7,014 million, highlighting the significant volume handled by these distribution channels.

These partners rely on Cloetta for a steady supply of confectionery products that resonate with consumer demand. Their purchasing decisions are heavily influenced by the perceived profitability and marketability of Cloetta's brands. The company's focus on popular brands like Läkerol and Kexchoklad directly addresses this need, driving consistent orders and sales volumes through these intermediaries.

Key considerations for retailers and wholesalers include:

- Reliable Supply Chain: Ensuring consistent stock availability to meet consumer demand without stockouts.

- Brand Strength and Consumer Appeal: Partnering with brands that have established consumer loyalty and purchasing intent.

- Profitability and Margin Support: Receiving competitive pricing and promotional support to ensure healthy profit margins.

- Efficient Logistics and Delivery: Expecting timely and organized deliveries to manage inventory effectively.

Impulse Buyers

Impulse buyers represent a significant portion of Cloetta’s customer base. These individuals often make spontaneous purchase decisions, heavily influenced by prominent product placement, particularly in high-traffic areas like checkout aisles and convenience stores. Cloetta's strategy of ensuring strong brand visibility and attractive displays directly targets this segment.

For instance, in 2024, confectionery sales at point-of-purchase locations continue to be a major driver for the industry. Cloetta's popular brands, such as Kexchoklad and Plopp, are strategically positioned to capture these on-the-go decisions.

- Impulse Purchase Drivers: Attractive packaging and prominent placement in checkout areas are key motivators.

- Brand Recognition: Well-known Cloetta brands capitalize on existing consumer familiarity to encourage spontaneous buys.

- Retail Channel Focus: Convenience stores and checkout zones are critical for reaching this customer segment effectively.

Cloetta's customer base is diverse, encompassing mass-market consumers in the Nordics, Netherlands, and Italy who seek everyday indulgence and festive treats. Additionally, Pick & Mix enthusiasts are drawn to the personalized experience of creating their own candy assortments, a segment actively catered to by brands like Candyking. The company is also expanding into growth markets like Germany, the UK, and North America, targeting consumers interested in European confectionery specialties.

Cost Structure

The largest part of Cloetta's expenses comes from buying the ingredients needed to make their products, like cocoa, sugar, and other flavorings. These costs can change quite a bit because they depend on what's happening in the global markets. For instance, cocoa prices were particularly high in 2025, directly impacting Cloetta's raw material expenditures.

Cloetta's manufacturing and production expenses are a cornerstone of its cost structure, encompassing the direct costs of running its factories. These include wages for production staff, the cost of electricity and other utilities to power machinery, routine upkeep and repairs for equipment, and the gradual decrease in value of its production assets over time, known as depreciation.

In 2023, Cloetta reported that its Cost of Goods Sold (COGS), which largely reflects these manufacturing expenses, amounted to SEK 4,745 million. This figure highlights the substantial investment in maintaining efficient and operational production capabilities to meet market demand for its confectionery products.

The company actively pursues efficiency improvements within its production processes as a primary strategy for cost reduction. By optimizing labor utilization, reducing energy consumption, and implementing preventative maintenance schedules, Cloetta aims to lower its per-unit production costs and enhance overall profitability in a competitive market.

Marketing and sales expenses are a significant investment for Cloetta, crucial for building brand equity and driving consumer demand. These costs encompass a wide range of activities, from extensive advertising campaigns and in-store promotions to maintaining a dedicated sales force and investing in digital marketing initiatives. For instance, in 2023, Cloetta reported marketing and sales expenses amounting to SEK 770 million, highlighting the substantial resources allocated to these areas. This investment is particularly focused on supporting their established Superbrands and ensuring successful launches of new confectionery products, aiming to capture market share and foster brand loyalty.

Logistics and Distribution Costs

Cloetta's cost structure includes substantial expenses for logistics and distribution. These cover warehousing, transporting goods, and managing the flow of products through its network to reach consumers both domestically and internationally.

Optimizing these supply chain operations is crucial for controlling these significant expenditures. For instance, in 2024, companies in the fast-moving consumer goods (FMCG) sector, which includes confectionery, often saw logistics costs representing a notable percentage of their total operating expenses, sometimes ranging from 5% to 15% depending on the complexity of the distribution network and fuel prices.

- Warehousing: Costs associated with storing finished goods and raw materials in strategically located facilities.

- Transportation: Expenses incurred for moving products via road, rail, sea, or air freight to various distribution points and retailers.

- Distribution Management: Costs related to managing the overall supply chain, including inventory control, order fulfillment, and third-party logistics provider fees.

Personnel Costs

Personnel costs are a significant component of Cloetta's expenses, given its global workforce of over 2,600 individuals. These costs encompass salaries, wages, and employee benefits for staff engaged in all operational areas, including manufacturing, research and development, sales, marketing, and administrative functions.

In 2023, Cloetta reported total employee-related expenses, which would include these personnel costs, as a substantial portion of their overall operating expenditures. For example, if their total operating expenses were X million EUR, personnel costs could easily represent Y% of that figure, underscoring their importance in the cost structure.

- Global Workforce: Cloetta employs over 2,600 people worldwide.

- Comprehensive Costs: Expenses include salaries, wages, and benefits for all staff.

- Operational Impact: Personnel costs are a major driver of overall operational expenditure.

- Financial Significance: These costs are a key element in Cloetta's cost structure analysis.

Cloetta's cost structure is heavily influenced by raw material procurement, manufacturing operations, and marketing efforts. The company also incurs significant expenses in logistics, distribution, and personnel. These varied costs are managed to ensure efficient production and market reach. In 2023, Cloetta's Cost of Goods Sold was SEK 4,745 million, reflecting the substantial investment in ingredients and production.

| Cost Category | 2023 (SEK million) | Notes |

|---|---|---|

| Cost of Goods Sold (COGS) | 4,745 | Primarily raw materials and manufacturing expenses. |

| Marketing and Sales Expenses | 770 | Includes advertising, promotions, and sales force costs. |

| Personnel Costs | (Estimated) Significant portion of operating expenses for over 2,600 employees. | Covers salaries, wages, and benefits. |

| Logistics and Distribution | (Variable) Dependent on network complexity and fuel prices. | Warehousing, transportation, and supply chain management. |

Revenue Streams

Cloetta's core revenue generation hinges on the sale of its diverse portfolio of branded packaged confectionery. This includes popular items like chocolates, sugar-based sweets, and refreshing pastilles, all distributed across a wide array of retail outlets.

In 2024, Cloetta continued to leverage its strong brand recognition to drive sales. The company’s focus on innovation and marketing within its key categories, such as sugar confectionery and chocolate, remained a significant contributor to its overall revenue performance, reflecting consumer demand for its established and new product offerings.

Sales of Pick & Mix confectionery represent a substantial and expanding revenue source for Cloetta, allowing consumers to curate their own candy selections. This segment has demonstrated robust organic sales growth and enhanced profitability.

In 2024, Cloetta reported that its Pick & Mix business continued to be a strong performer, contributing significantly to overall sales. The company has focused on optimizing its offering and in-store presentation to drive this growth, leading to a positive impact on its financial results.

Cloetta’s revenue streams are significantly bolstered by its international market sales, extending beyond its core Nordic, Dutch, and Italian markets. The company actively pursues growth in other regions, including Germany, the United Kingdom, and North America, diversifying its income base. This global distribution strategy is a crucial component in driving overall revenue growth and market penetration.

Seasonal and Promotional Sales

Cloetta's revenue is noticeably influenced by seasonal demand and targeted promotional activities. Holidays like Easter are particularly significant, often leading to substantial sales increases in specific financial quarters. For instance, during the Easter season, confectionery sales typically surge, directly boosting Cloetta's top-line figures.

Strategic pricing and promotional offers during these peak times are crucial for maximizing revenue. By adjusting prices and running special campaigns, Cloetta can effectively capture a larger share of consumer spending during these high-demand periods. This approach helps drive incremental sales and enhances overall profitability.

- Seasonal Peaks: Revenue significantly increases during holiday periods like Easter.

- Promotional Impact: Strategic pricing and promotions drive additional sales during these times.

- Quarterly Influence: Seasonal sales have a direct impact on specific quarterly financial results.

Innovation and New Product Sales

Innovation and new product sales are crucial for Cloetta's growth. The company actively invests in developing and launching new confectionery items and line extensions. This strategy not only keeps their product portfolio fresh but also allows them to tap into emerging consumer trends and expand into new market segments.

In 2024, Cloetta continued to emphasize innovation as a key driver of its revenue. For instance, the successful introduction of new flavors or healthier options within existing brands can significantly boost sales. This focus on new product development directly supports their objective of maintaining a competitive edge and capturing a larger market share.

- New Product Launches: Cloetta's commitment to innovation fuels revenue through the introduction of novel confectionery products.

- Line Extensions: Expanding existing successful brands with new variations or formats provides additional sales opportunities.

- Category Expansion: The company strategically enters new product categories to diversify its revenue base and reach a wider consumer audience.

- Market Trends: Successful product launches often align with current consumer preferences, such as demand for sustainable packaging or plant-based ingredients, directly impacting sales performance.

Cloetta's revenue streams are diversified, with a significant portion coming from the sale of its core confectionery products, including chocolates, sugar sweets, and pastilles. The company also benefits from its strong Pick & Mix offering, which allows for personalized consumer choices and has shown robust growth. In 2024, Cloetta reported that its Pick & Mix business continued to be a strong performer, contributing significantly to overall sales.

International market sales, beyond its established Nordic, Dutch, and Italian bases, are a key growth driver for Cloetta, with active expansion into regions like Germany, the UK, and North America. Furthermore, seasonal demand, particularly around holidays like Easter, significantly boosts sales, with strategic pricing and promotions during these peak periods maximizing revenue. Innovation and new product launches, such as new flavors or healthier options, also play a crucial role in maintaining competitiveness and capturing market share.

| Revenue Stream | Description | 2024 Relevance |

|---|---|---|

| Branded Packaged Confectionery | Sale of chocolates, sugar sweets, pastilles. | Core product sales, driven by brand recognition and marketing. |

| Pick & Mix | Consumer-selected confectionery assortments. | Strong organic growth and profitability contributor. |

| International Sales | Sales outside core Nordic, Dutch, Italian markets. | Diversifies income and drives overall revenue growth. |

| Seasonal & Promotional Sales | Increased sales during holidays (e.g., Easter) and via targeted promotions. | Significant impact on quarterly financial results. |

| New Product & Innovation | Revenue from new confectionery items and line extensions. | Key driver for maintaining competitiveness and capturing market share. |

Business Model Canvas Data Sources

The Cloetta Business Model Canvas is informed by a blend of financial disclosures, market research reports, and internal strategic planning documents. These sources provide a comprehensive view of the company's operations, market position, and future growth opportunities.