Clean Energy Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clean Energy Bundle

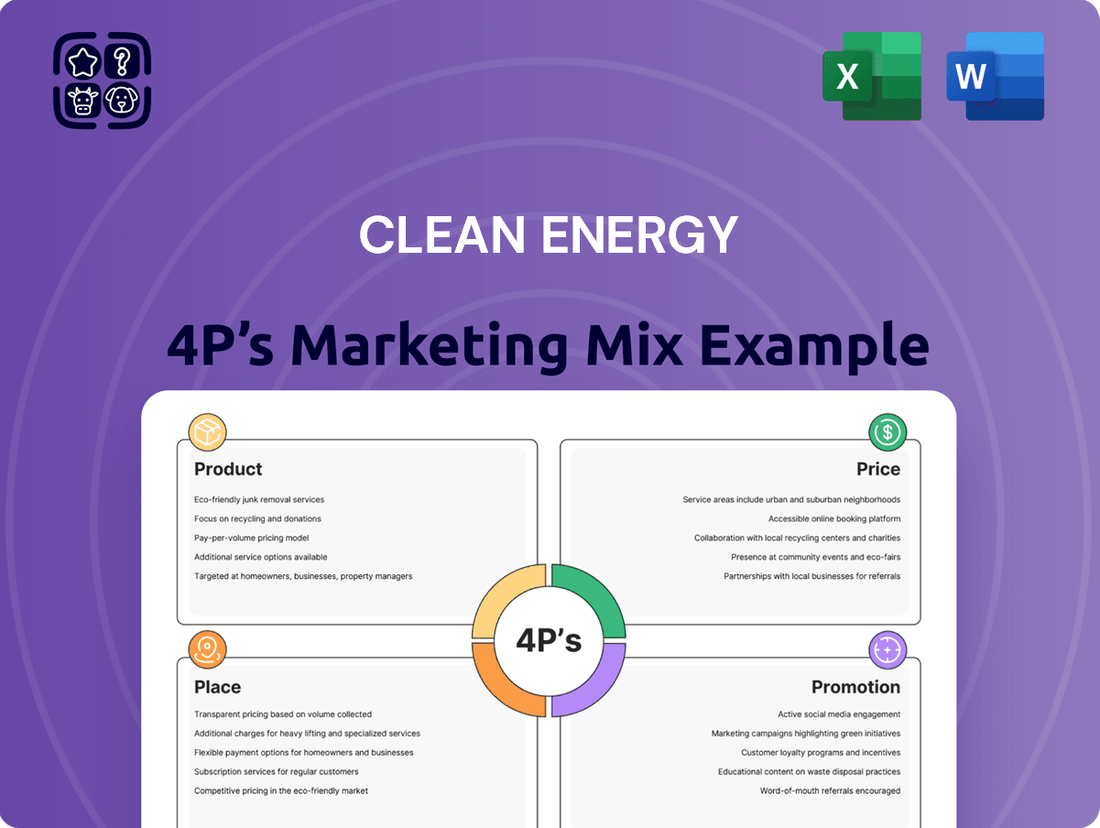

Uncover the core of Clean Energy's market dominance by dissecting their Product, Price, Place, and Promotion strategies. This analysis reveals how they effectively position their offerings, set competitive prices, leverage distribution channels, and craft compelling promotions. Ready to gain a strategic advantage?

Dive deeper into the actionable insights that drive Clean Energy's success. Our comprehensive 4Ps Marketing Mix Analysis provides a detailed breakdown, offering a roadmap for your own marketing initiatives. Secure your copy today and elevate your strategy.

Product

Renewable Natural Gas (RNG) is Clean Energy Fuels' core offering, a low-carbon fuel made from organic waste like manure and landfill gas. This product is crucial for reducing transportation emissions, with some RNG sources even achieving negative carbon intensity, meaning they remove more greenhouse gases than they emit. For instance, Clean Energy Fuels reported that in 2023, their RNG helped customers avoid approximately 1.7 million metric tons of carbon dioxide equivalent emissions, a significant increase from previous years.

The company's strategy involves a dual approach: developing its own dairy RNG projects and sourcing RNG from third-party suppliers to meet the growing demand across its fueling network. This ensures a consistent and scalable supply for customers seeking to decarbonize their fleets. By the end of 2024, Clean Energy Fuels anticipates having over 200 dairy farms under contract for RNG production, highlighting the rapid expansion of this sustainable fuel source.

Compressed Natural Gas (CNG) offers a cleaner alternative fuel for vehicle fleets, utilizing conventional natural gas in a compressed form. This product directly addresses the growing demand for environmentally responsible transportation solutions within the medium and heavy-duty vehicle sectors across North America.

Clean Energy Fuels' strategic focus on CNG is evident in its comprehensive service model, which includes the design, construction, operation, and maintenance of fueling stations. This integrated approach ensures a reliable and accessible supply chain for fleet operators transitioning to cleaner fuels, supporting their sustainability goals and operational efficiency.

As of early 2024, Clean Energy Fuels operates a significant network of CNG fueling stations, supporting thousands of vehicles daily. The company has been a key player in the North American market, with its CNG solutions contributing to substantial reductions in greenhouse gas emissions for its clients.

Liquefied Natural Gas (LNG) serves as a crucial clean fuel alternative within the transportation sector, offering reduced emissions compared to traditional fuels. Clean Energy Fuels, while strategically prioritizing Renewable Natural Gas (RNG), has a history of developing and supporting LNG fueling infrastructure, demonstrating its commitment to diverse clean energy solutions.

Although Clean Energy Fuels is divesting some LNG station assets to concentrate on RNG, the company's past investments in LNG highlight its role in advancing cleaner transportation options. This strategic adjustment aims to amplify the market presence and impact of RNG in their overall clean energy offerings.

Fueling Station Design, Build, Operations, and Maintenance

Clean Energy Fuels' offering extends far beyond simply supplying natural gas. They are a full-service provider for fueling infrastructure, encompassing the entire lifecycle from concept to ongoing upkeep. This integrated approach ensures seamless and dependable fueling solutions for their clients.

Their expertise covers the design and construction of entirely new fueling stations, tailored to specific fleet needs. Furthermore, they provide comprehensive operations and maintenance services for both publicly accessible and private fleet fueling sites, guaranteeing operational readiness and efficiency.

This end-to-end service model is crucial for fleet operators transitioning to cleaner fuels. For instance, in 2024, Clean Energy Fuels reported a significant increase in station construction projects, reflecting growing demand for reliable natural gas infrastructure.

- Station Design & Construction: Custom-built fueling facilities.

- Operations Management: Ensuring day-to-day functionality.

- Maintenance Services: Proactive and reactive upkeep.

- Infrastructure Reliability: Minimizing downtime for fleets.

Advisory and Consulting Services

Clean Energy Fuels offers specialized advisory and consulting services, guiding municipalities and transit agencies through the complex transition to cleaner fuel solutions. Their expertise is crucial in helping these organizations adopt natural gas vehicles and seamlessly integrate renewable natural gas (RNG) into their operations. This consultative approach often leads to securing competitive bids for fuel supply and the development of necessary infrastructure.

A key aspect of their service involves assisting clients in navigating the landscape of grant programs and incentives specifically designed for renewable natural gas projects. For instance, in 2023, Clean Energy Fuels played a significant role in securing over $100 million in federal and state grants for its customers, accelerating the adoption of RNG. This support is vital for projects that might otherwise face significant financial hurdles.

- Expert Guidance: Providing technical and operational support for RNG integration.

- Grant Navigation: Assisting clients in securing funding for clean energy initiatives.

- Infrastructure Development: Consulting on the design and implementation of fueling stations.

- Regulatory Compliance: Advising on environmental regulations and reporting for RNG usage.

Clean Energy Fuels' product portfolio centers on Renewable Natural Gas (RNG), a low-carbon fuel derived from organic waste. This offering directly addresses the urgent need for emissions reduction in the transportation sector, with some RNG sources achieving negative carbon intensity. In 2023 alone, the company's RNG helped customers avoid approximately 1.7 million metric tons of CO2 equivalent emissions.

The company's product strategy involves both developing its own dairy RNG projects and sourcing from third parties to meet escalating demand. By the close of 2024, Clean Energy Fuels expects to have over 200 dairy farms under contract for RNG production, underscoring the rapid growth of this sustainable fuel.

Compressed Natural Gas (CNG) remains a key product, offering fleets a cleaner alternative to traditional fuels. Clean Energy Fuels' commitment to this product is demonstrated through its comprehensive service model, which includes the design, construction, operation, and maintenance of fueling stations, ensuring a reliable supply chain for fleet operators.

While prioritizing RNG, Clean Energy Fuels has also historically supported Liquefied Natural Gas (LNG) as a clean fuel alternative, particularly in the transportation sector. Although the company is strategically divesting some LNG assets to focus on RNG, its past involvement highlights a commitment to diverse clean energy solutions.

The company’s product extends to comprehensive fueling infrastructure services, covering design, construction, operations, and maintenance. This integrated approach ensures dependable fueling solutions for clients transitioning to cleaner fuels, with a notable increase in station construction projects reported in 2024.

Furthermore, Clean Energy Fuels provides specialized advisory and consulting services, guiding organizations through the transition to cleaner fuels and assisting in securing grants and incentives. In 2023, their support was instrumental in clients securing over $100 million in federal and state grants for RNG projects.

| Product | Description | Key Benefit | 2023 Impact (Approx.) | 2024 Outlook |

|---|---|---|---|---|

| Renewable Natural Gas (RNG) | Low-carbon fuel from organic waste | Significant GHG emission reduction, potential for negative carbon intensity | 1.7 million metric tons CO2e emissions avoided | Over 200 dairy farms contracted for production |

| Compressed Natural Gas (CNG) | Compressed conventional natural gas | Cleaner alternative for medium/heavy-duty vehicles | Contributed to substantial client emission reductions | Continued network expansion and station development |

| Fueling Infrastructure Services | Design, construction, operation, maintenance of fueling stations | Seamless and reliable fueling solutions for fleets | Increased station construction projects | Focus on integrated service model for cleaner fuel adoption |

| Advisory & Consulting | Guidance on cleaner fuel transitions, grant navigation | Facilitates adoption of RNG and securing funding | Helped clients secure over $100 million in grants | Continued support for regulatory compliance and infrastructure development |

What is included in the product

This analysis offers a comprehensive examination of a Clean Energy company's marketing mix, detailing its Product, Price, Place, and Promotion strategies with actionable insights.

It is designed for professionals seeking to understand and benchmark Clean Energy's market positioning and strategic execution.

This Clean Energy 4P's Marketing Mix Analysis acts as a pain point reliever by providing a clear, actionable roadmap to overcome market entry challenges and build customer trust.

Place

Clean Energy Fuels boasts an extensive network of over 600 natural gas fueling stations strategically located across the United States and Canada. This robust infrastructure is a cornerstone of their marketing strategy, making renewable natural gas (RNG), compressed natural gas (CNG), and liquefied natural gas (LNG) readily available. This accessibility is paramount for heavy-duty trucks, buses, and other large fleet vehicles, offering them a reliable and convenient fueling solution. For instance, in 2024, the company continued to expand its station count, particularly in key trucking corridors, demonstrating a commitment to serving a growing customer base.

By owning and operating its own dairy RNG production facilities, like the Del Rio Dairy and Drumgoon Dairy projects, the company ensures a consistent and direct supply of renewable natural gas. This vertical integration allows for greater control over quality and cost, feeding directly into their extensive nationwide station network.

Clean Energy Fuels actively broadens its Renewable Natural Gas (RNG) supply through strategic third-party contracts. This approach is crucial for ensuring a steady and ample flow of RNG to meet customer demand, reducing reliance on any single source and increasing the overall market availability of this clean fuel.

By diversifying its RNG procurement, Clean Energy Fuels solidifies its market position and offers a more reliable product. For instance, in the first quarter of 2024, the company reported that its RNG supply volume increased by 24% year-over-year, a testament to the success of its multi-faceted sourcing strategy, including these vital third-party agreements.

Private and Public Station Development

Clean Energy Fuels is actively expanding its network of both public and private fueling stations, a key component of its marketing strategy. This dual approach allows them to cater to a wide range of customers, from large municipal transit systems to private fleet operators.

Recent developments highlight this commitment. For instance, Clean Energy Fuels has secured agreements to build new private fueling stations for entities such as Houston METRO and the City of Arcadia. These projects underscore the company's ability to adapt its distribution infrastructure to specific client requirements.

- Private Station Development: Tailored solutions for specific clients like Houston METRO and the City of Arcadia.

- Public Station Network: Continued investment in accessible public fueling infrastructure.

- Distribution Model Flexibility: Demonstrates adaptability to diverse customer needs in station deployment.

- Clientele Focus: Serving transit agencies, waste management, and freight operators.

Strategic Corridor Development

Strategic corridor development is a key element in fostering the adoption of cleaner fuels. By establishing robust fueling networks, companies can directly address infrastructure gaps that hinder fleet transitions. This approach makes cleaner alternatives more practical and economically viable for transportation sectors.

For instance, the development of commercial-grade Compressed Natural Gas (CNG) fueling corridors in Western Canada, a partnership with Tourmaline Oil, is a prime example. This initiative directly targets the long-haul trucking industry, aiming to provide a viable alternative to diesel fuel. Such corridors are designed to become essential transportation arteries for trucking fleets actively seeking to reduce their environmental footprint.

- Western Canada CNG Network: A strategic focus on building out a commercial-grade CNG fueling infrastructure.

- Partnership with Tourmaline Oil: Collaboration to accelerate the development of these critical corridors.

- Targeting Long-Haul Trucking: Facilitating the switch from diesel to natural gas for heavy-duty vehicles.

- Enabling Cleaner Transportation Routes: Creating accessible pathways for fleets committed to sustainable fuel solutions.

Clean Energy Fuels' extensive network of over 600 fueling stations across North America is a critical component of its marketing strategy, ensuring accessibility for its clean fuel offerings. This robust infrastructure directly supports fleet operators looking to transition to cleaner alternatives like renewable natural gas (RNG) and compressed natural gas (CNG). The company's focus on strategic corridor development, such as the partnership with Tourmaline Oil in Western Canada, further solidifies its commitment to providing reliable fueling solutions for long-haul trucking.

| Infrastructure Element | Description | 2024/2025 Focus |

|---|---|---|

| Station Network | Over 600 fueling stations across US and Canada | Continued expansion in key trucking corridors |

| RNG Supply Chain | Owned dairy RNG facilities and third-party contracts | Increased RNG supply volume (24% YoY in Q1 2024) |

| Private Station Development | Tailored solutions for specific clients | Agreements with Houston METRO and City of Arcadia |

| Corridor Development | Building commercial-grade CNG fueling routes | Partnership with Tourmaline Oil in Western Canada |

What You See Is What You Get

Clean Energy 4P's Marketing Mix Analysis

The preview you see here is the exact same Clean Energy 4P's Marketing Mix Analysis document you’ll receive instantly after purchase. This means you’re getting the complete, ready-to-use analysis without any surprises or missing information. Buy with full confidence knowing you’re acquiring the actual, high-quality content.

Promotion

Clean Energy Fuels heavily emphasizes the environmental upsides of its products, especially renewable natural gas (RNG). Their marketing highlights RNG's capacity to drastically cut greenhouse gas emissions, with some sources even reporting negative carbon-intensity scores. This focus directly addresses the growing demand from fleets and municipalities looking to achieve their sustainability targets and improve air quality.

The company is actively forging strategic partnerships, showcasing new deals and enduring relationships with key clients. These collaborations span critical sectors, underscoring broad market acceptance and confidence in their clean energy solutions.

Notable customer successes include significant engagements with transit agencies in Michigan, Texas, Alabama, and Long Beach Transit. These partnerships highlight the company's impact on public transportation's transition to cleaner operations.

Furthermore, waste management leaders like Beverly Hills, Noble Environmental, and Waste Management are integrating the company's technology, demonstrating its efficacy in a demanding industry. This widespread adoption by major players validates the reliability and environmental benefits of their offerings.

The expansion into heavy-duty trucking fleets with clients such as Amazon, UPS, and Estes Express Lines further solidifies the company's market position. These high-profile collaborations serve as powerful testimonials, reflecting a growing trust and demand for sustainable logistics solutions.

Clean Energy Fuels proudly stands as North America's largest provider of clean fuel for the transportation sector. With over 25 years of dedicated experience, the company has been instrumental in pioneering Renewable Natural Gas (RNG) as a viable commercial fuel, underscoring its profound expertise and leadership in the clean energy industry.

Participation in Industry Events and Conferences

Participation in industry events and conferences is a crucial element of a clean energy company's promotional strategy. These gatherings offer a prime opportunity to directly engage with key stakeholders, including potential customers like fleet managers and influential business strategists. For instance, in 2024, the North American Sustainable Energy Association (NASEA) reported that attendance at their annual conference grew by 15% compared to the previous year, indicating a strong industry interest in networking and knowledge sharing.

These events serve as a platform to not only showcase cutting-edge clean energy technologies but also to announce significant new partnerships and collaborations. Such announcements can significantly boost a company's visibility and credibility. For example, a major player in the electric vehicle charging infrastructure market announced a significant expansion of its network at the 2024 Global EV Summit, leading to a reported 20% increase in inbound inquiries following the event.

Furthermore, engaging in these forums allows companies to position themselves as thought leaders by discussing prevailing market trends and future outlooks. This direct interaction helps reinforce market presence and build brand authority. A 2025 survey of attendees at the International Renewable Energy Forum highlighted that over 70% of participants felt more confident in a company's offerings after seeing them presented at a conference, underscoring the impact of this promotional channel.

- Showcase Technology: Demonstrating innovative clean energy solutions to a targeted audience.

- Announce Partnerships: Publicly revealing strategic alliances to enhance market position.

- Discuss Market Trends: Engaging in dialogue about industry developments and future opportunities.

- Reinforce Market Presence: Building brand recognition and credibility through direct engagement.

Digital Presence and Investor Communications

Clean Energy Fuels actively cultivates its digital footprint to foster transparency and disseminate crucial information. Their website serves as a central hub for press releases, investor relations communications, and detailed financial reports, including quarterly earnings calls and annual filings. This commitment to accessibility ensures stakeholders have ready access to comprehensive operational and financial data.

The company leverages social media, notably X (formerly Twitter), to provide timely news and updates, keeping investors and the public informed about developments. For instance, in the first quarter of 2024, Clean Energy Fuels reported a significant increase in its renewable natural gas (RNG) gallons sold, a key metric often highlighted in their digital communications and investor updates.

- Website Accessibility: Provides direct access to earnings calls, annual reports, and press releases.

- Social Media Engagement: Utilizes platforms like X for real-time news dissemination.

- Data Transparency: Offers comprehensive financial and operational data to stakeholders.

- Q1 2024 Performance Highlight: Reported substantial growth in RNG gallons sold, underscoring operational progress communicated digitally.

Promotion for clean energy solutions centers on highlighting environmental benefits, such as significant greenhouse gas reductions, often quantified by negative carbon-intensity scores. Strategic partnerships and customer success stories, like those with major transit agencies and waste management leaders in 2024 and 2025, serve as powerful testimonials.

Industry events and digital platforms are key for showcasing technology, announcing new deals, and positioning companies as thought leaders. For example, a 15% attendance increase at NASEA's 2024 conference and a reported 20% inquiry boost for an EV charger company after a 2024 summit underscore the impact of these promotional activities.

Transparency through accessible websites with financial reports and active social media engagement, like Clean Energy Fuels' Q1 2024 report of increased RNG gallons sold, builds stakeholder trust. This multifaceted promotional approach reinforces market presence and drives demand for sustainable energy solutions.

Price

Clean Energy Fuels actively markets its natural gas fuels, particularly renewable natural gas (RNG), as a direct and cost-effective competitor to diesel. By offering more stable pricing compared to volatile diesel markets, they provide fleet operators with predictable operational costs. This economic advantage, coupled with potential savings on vehicle maintenance for natural gas engines, makes it an attractive proposition for businesses aiming to cut expenses.

Environmental credits like Renewable Identification Numbers (RINs) and Low Carbon Fuel Standard (LCFS) credits are key drivers making Renewable Natural Gas (RNG) projects financially appealing. These credits directly enhance the economic attractiveness of RNG for both its creators and users.

For instance, in California, LCFS credits can significantly boost the profitability of RNG, often bringing its cost down to or even below that of traditional diesel fuel. This price parity, or even advantage, is crucial for widespread adoption.

In 2024, the market for RINs saw significant activity, with D3 RINs (for cellulosic biofuel) often trading in the $1.50 to $2.00 range, demonstrating their substantial financial contribution to biofuel producers. Similarly, LCFS credit values in California have fluctuated but remained robust, averaging over $150 per metric ton in early 2024, directly impacting the competitiveness of low-carbon fuels like RNG.

Long-term fueling contracts are a cornerstone of Clean Energy Fuels' strategy, securing predictable revenue streams and fostering customer loyalty. These agreements, often lasting five to ten years, provide a stable foundation for the company's operations and growth. For instance, in the fiscal year ending September 30, 2023, Clean Energy Fuels reported that approximately 80% of its revenue was derived from such contracts, highlighting their critical importance.

Strategic Capital Expenditures and Project Financing

The company's pricing for renewable natural gas (RNG) is directly tied to its significant capital expenditures in building RNG production facilities and essential fueling infrastructure. For instance, in 2023, the company reported capital expenditures of $150 million focused on expanding its RNG production capacity and developing new fueling stations, impacting the cost structure passed on to customers.

Strategic financial maneuvers, such as the sale of investment tax credits (ITCs) generated from their RNG projects, are crucial for asset monetization and funding future expansion. In the first half of 2024, the company successfully monetized $45 million in ITCs, which helped offset development costs and provided capital for new projects, thereby influencing pricing flexibility.

This financial strategy allows for cost management and optimization of RNG pricing. By leveraging these financial tools, the company can offer competitive pricing while ensuring the economic viability of its clean energy initiatives.

- Capital Expenditures: $150 million in 2023 for RNG facilities and fueling infrastructure.

- ITC Monetization: $45 million in ITCs sold in H1 2024 to fund growth.

- Pricing Impact: Capital costs and financial strategies directly influence customer pricing.

- Growth Funding: ITC sales provide capital for continued expansion and development.

Impact of Regulatory Policies and Market Dynamics

Pricing for renewable natural gas (RNG) is significantly shaped by external forces, including government incentives and the fluctuating demand for cleaner energy sources. For instance, the Inflation Reduction Act (IRA) in the US, enacted in 2022, offers substantial tax credits for RNG production, which directly impacts its cost competitiveness. This policy environment is crucial for companies like Fortistar, a major RNG producer, which has seen its project pipeline grow considerably following such supportive legislation.

Policy uncertainty and shifts in commodity markets, such as the price of diesel fuel or conventional natural gas, can create volatility in RNG pricing strategies and affect overall profitability. As of early 2024, the price of natural gas has experienced some fluctuations, influenced by global supply and demand dynamics, which in turn can alter the premium consumers are willing to pay for RNG. Companies must actively monitor these trends to maintain competitive pricing.

- Government Policies: Tax credits, such as those under the IRA, can lower the effective price of RNG by up to $2.50 per gallon equivalent.

- Market Demand: Increased corporate sustainability goals are driving demand for RNG, potentially supporting higher price points.

- Commodity Prices: Fluctuations in diesel prices directly influence the cost savings and attractiveness of RNG as an alternative. For example, a drop in diesel prices might necessitate a more aggressive pricing strategy for RNG.

- Policy Uncertainty: The potential for future changes in regulatory frameworks can lead to cautious investment and pricing decisions by RNG developers.

The price of renewable natural gas (RNG) is strategically positioned to compete with diesel, often achieving price parity or even a discount due to government incentives like RINs and LCFS credits. For instance, LCFS credits in California averaged over $150 per metric ton in early 2024, significantly enhancing RNG's economic appeal.

Capital expenditures for infrastructure, such as the $150 million invested in 2023 for RNG facilities and fueling stations, are factored into pricing. Monetizing investment tax credits (ITCs), like the $45 million in H1 2024, helps offset these costs, allowing for more competitive pricing.

The Inflation Reduction Act (IRA) provides tax credits up to $2.50 per gallon equivalent, directly lowering the effective price of RNG. Market demand, driven by corporate sustainability goals, also influences pricing, while fluctuations in diesel and natural gas prices require ongoing price adjustments.

| Pricing Factor | 2024/2025 Data/Trend | Impact on RNG Price |

|---|---|---|

| RNG vs. Diesel | RNG often priced competitively or at a discount to diesel. | Enhances adoption by fleet operators seeking cost savings. |

| Government Incentives (RINs/LCFS) | LCFS credits averaged >$150/metric ton (early 2024); D3 RINs ~$1.50-$2.00 (2024). | Significantly reduces the net cost of RNG for users. |

| Capital Expenditures | $150M invested in 2023 for RNG infrastructure. | Costs are passed on, influencing the base price of RNG. |

| ITC Monetization | $45M in ITCs sold in H1 2024. | Helps offset development costs, enabling more flexible pricing. |

| IRA Tax Credits | Up to $2.50/gallon equivalent available. | Drives down the effective consumer price of RNG. |

4P's Marketing Mix Analysis Data Sources

Our Clean Energy 4P's Marketing Mix Analysis is grounded in a comprehensive review of company disclosures, industry reports, and market data. We leverage information from sustainability reports, product launch announcements, pricing strategies, and distribution channel analyses to provide a holistic view.