Clean Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clean Energy Bundle

Understand the strategic positioning of clean energy initiatives with our insightful BCG Matrix preview. See where solar, wind, and other technologies fall as Stars, Cash Cows, Dogs, or Question Marks in the current market. Purchase the full BCG Matrix for a comprehensive breakdown and actionable strategies to navigate the dynamic clean energy landscape.

Stars

Clean Energy Fuels is a prominent player in the rapidly expanding renewable natural gas (RNG) sector. The company's focus on dairy and other livestock waste-to-RNG projects, coupled with strategic alliances, places it advantageously within this burgeoning market. This strategic positioning is crucial as the global RNG market is expected to reach $24.23 billion by 2031, growing at an 8.1% compound annual growth rate from 2024.

Clean Energy Fuels boasts an impressive network of over 600 natural gas fueling stations throughout North America. This extensive infrastructure is a significant asset for fleets looking to adopt cleaner fuels like renewable natural gas (RNG) and conventional natural gas. It directly supports the growth of these cleaner alternatives.

The sheer scale of this fueling station network provides a substantial competitive advantage, enabling Clean Energy Fuels to maintain a high market share in the alternative fuel infrastructure sector. This widespread presence is key to facilitating the transition for heavy-duty vehicles to cleaner energy solutions.

Clean Energy Fuels has solidified its market position through strategic partnerships and customer agreements, securing significant renewable natural gas (RNG) supply deals. Major clients like Amazon and UPS, along with large transit agencies, underscore the strong market acceptance and predictable revenue generated by these long-term contracts.

These robust customer relationships, exemplified by a joint venture with energy giant BP, not only reinforce Clean Energy Fuels' leadership in the clean fuel sector but also establish a dependable foundation for sustained expansion. For instance, in 2023, the company announced an agreement to supply RNG to Amazon for its fleet in California, highlighting the tangible impact of these strategic alliances.

Pioneering Role in RNG as a Vehicle Fuel

Clean Energy Fuels has established itself as a pioneer in the U.S. market for renewable natural gas (RNG) as a vehicle fuel. The company currently leads North America in providing this cleaner alternative, leveraging its early entry and ongoing technological advancements. This significant market share and established expertise create a formidable barrier to entry for potential competitors in the expanding RNG sector.

Their pioneering role translates into tangible market dominance. As of early 2024, Clean Energy Fuels operates over 600 fueling stations across the United States, serving a growing fleet of vehicles powered by RNG. This infrastructure represents a substantial first-mover advantage that is difficult for new entrants to quickly overcome.

- Market Leadership: Clean Energy Fuels is North America's largest provider of RNG as a vehicle fuel, demonstrating significant market penetration.

- First-Mover Advantage: Their early investment and development in the RNG sector have created a strong competitive moat.

- Infrastructure Dominance: The company's extensive network of fueling stations provides a critical advantage in serving the growing demand for RNG.

- Innovation Focus: Continued investment in technology and supply chain development solidifies their position in a rapidly evolving market.

Positive Policy and Regulatory Environment for RNG

A positive policy and regulatory environment is a significant tailwind for Renewable Natural Gas (RNG). Favorable government policies, including tax incentives and ambitious renewable energy targets across North America, are directly fueling the demand for RNG. For instance, the Inflation Reduction Act (IRA) in the United States offers production tax credits for clean fuels, making RNG projects more economically viable.

These regulatory tailwinds create a supportive ecosystem for companies like Clean Energy Fuels, enabling sustained growth and profitability, particularly within the burgeoning clean transportation sector. The company's business model is further bolstered by environmental credits such as Renewable Identification Numbers (RINs) and Low Carbon Fuel Standard (LCFS) credits, which represent a crucial revenue stream.

- Government support: Policies like the IRA provide substantial tax credits for RNG production, enhancing project economics.

- Renewable energy targets: Increasing mandates for renewable fuels across North America directly drive RNG demand.

- Environmental credits: Revenue from RINs and LCFS credits significantly contributes to profitability and market competitiveness.

Stars in the BCG matrix represent high-growth, high-market-share business segments. For Clean Energy Fuels, its pioneering role and dominant market share in the RNG vehicle fuel sector firmly place it in the Star category. This is supported by the rapidly expanding RNG market, projected to reach $24.23 billion by 2031, and the company's extensive fueling infrastructure, boasting over 600 stations across North America. Their strategic partnerships with major clients like Amazon and UPS further solidify this position, indicating strong demand and future growth potential in this segment.

| Metric | Value (as of early 2024) | Significance |

|---|---|---|

| North American RNG Stations | Over 600 | Largest network, key infrastructure advantage |

| Projected RNG Market Growth (2024-2031) | 8.1% CAGR | Indicates a high-growth market |

| Key Partnerships | Amazon, UPS, BP | Demonstrates strong customer adoption and revenue security |

| Market Position | North America's largest RNG vehicle fuel provider | High market share, indicative of a Star |

What is included in the product

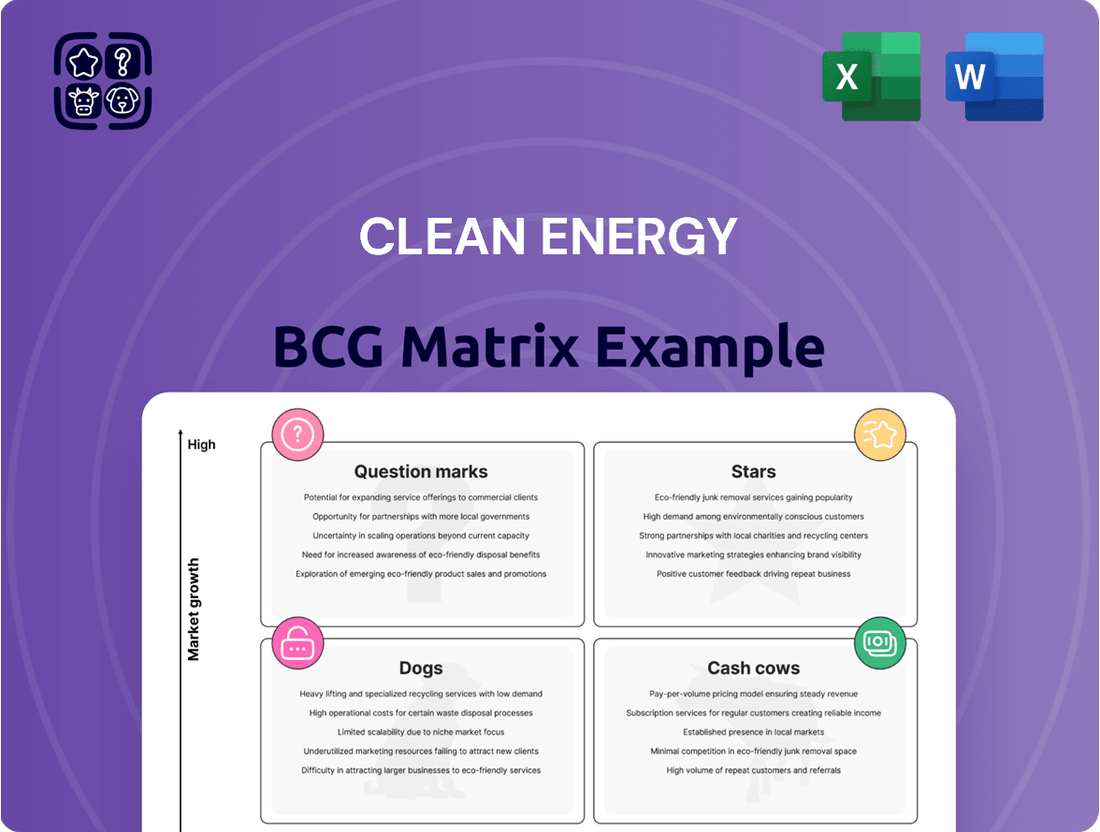

The Clean Energy BCG Matrix categorizes clean energy technologies by market growth and relative market share.

It guides strategic decisions on investing in Stars, milking Cash Cows, developing Question Marks, and divesting Dogs.

The Clean Energy BCG Matrix provides a clear visual guide to portfolio strategy, alleviating the pain of resource allocation uncertainty.

Cash Cows

Clean Energy Fuels' established business of supplying conventional compressed natural gas (CNG) and liquefied natural gas (LNG) to vehicle fleets represents a mature market with a high market share.

While the growth rate for conventional natural gas might be lower compared to renewable natural gas (RNG), it generates consistent cash flow due to its widespread adoption and existing infrastructure.

This segment provides a stable revenue foundation for the company, as evidenced by its significant contribution to overall sales, even as the company invests in newer, higher-growth areas.

Operations and Maintenance (O&M) services for fueling stations represent a classic Cash Cow within the Clean Energy BCG Matrix. This segment generates consistent, predictable income by servicing both the company's own network and external clients, capitalizing on the essential nature of keeping these facilities running smoothly.

The profitability of O&M services is bolstered by their specialized requirements and the critical uptime demands of fueling infrastructure, leading to high-profit margins. For instance, in 2024, the global market for energy infrastructure maintenance was projected to reach over $150 billion, with O&M services for fueling stations forming a significant, stable portion of this. This segment efficiently utilizes existing operational expertise and infrastructure, maximizing returns on invested capital.

Clean Energy Fuels boasts a substantial existing customer base, especially among transit agencies and waste management firms, often solidified by long-term agreements. This translates to predictable demand and consistent revenue streams, characterizing a stable, profitable, yet low-growth segment.

For instance, in 2024, the company continued to leverage its strong relationships, with a significant portion of its revenue derived from these established, long-term contracts. This stability reduces the necessity for extensive marketing efforts, allowing for efficient resource allocation.

Revenue from Environmental Credits (RINs, LCFS)

Clean Energy Fuels generates a notable portion of its income from environmental credits like Renewable Identification Numbers (RINs) and Low Carbon Fuel Standard (LCFS) credits. These are earned through its renewable natural gas (RNG) sales.

Although the market prices for these credits can fluctuate, they offer a substantial revenue stream with relatively low associated costs, especially considering the volume of RNG sold. In 2024, the demand for these credits remained robust, driven by regulatory mandates and corporate sustainability goals.

- Environmental Credit Revenue: A key driver for Clean Energy Fuels, stemming from RNG production and sales.

- RINs and LCFS: Specific types of environmental credits that contribute significantly to revenue.

- Price Volatility: While prices can change, these credits represent a valuable, low-cost revenue source.

- 2024 Market Trends: Continued strong demand for credits supported by regulatory and ESG initiatives.

Legacy LNG Production Facilities

Legacy LNG Production Facilities are the established cash cows for the company, providing a consistent and reliable fuel supply. While the LNG market for transportation is more mature than the burgeoning RNG sector, these facilities are mature assets that consistently generate revenue and contribute significantly to the company's overall cash flow. Their established position means they require minimal new investment to maintain their market share and revenue generation.

These facilities are critical for the company's financial stability.

- Established Revenue Stream: Legacy LNG plants consistently generate revenue, acting as a stable financial bedrock for the company.

- Lower Investment Needs: Unlike growth-oriented segments, these facilities require less capital for promotion or expansion, allowing for efficient cash generation.

- Contribution to Overall Supply: They ensure a steady supply of fuel, supporting other business operations and customer commitments.

The company's legacy compressed natural gas (CNG) and liquefied natural gas (LNG) supply business serves as a prime example of a Cash Cow. This segment benefits from a well-established customer base, particularly in the transportation sector, and existing, robust distribution infrastructure.

Despite lower growth prospects compared to newer ventures like renewable natural gas, these operations consistently generate substantial profits with minimal reinvestment needs. In 2024, the demand for natural gas as a transportation fuel remained significant, underpinning the stable cash flow from these mature operations.

This segment's strength lies in its predictable revenue streams, often secured through long-term contracts, allowing Clean Energy Fuels to allocate capital towards higher-growth opportunities.

| Business Segment | BCG Matrix Category | Key Characteristics | 2024 Financial Insight |

|---|---|---|---|

| Conventional CNG/LNG Supply | Cash Cow | High market share, mature market, stable demand, existing infrastructure | Consistent revenue generation, low capital expenditure requirements |

| Operations & Maintenance (O&M) Services | Cash Cow | Essential services, high-profit margins, specialized expertise, critical uptime demands | Significant contribution to overall profitability, stable income stream |

| Environmental Credit Revenue (RINs/LCFS) | Cash Cow | Low associated costs, substantial revenue, driven by regulatory mandates | Strong market demand in 2024, supporting profitability |

What You’re Viewing Is Included

Clean Energy BCG Matrix

The Clean Energy BCG Matrix preview you see is the definitive document you will receive upon purchase, offering a complete and unwatermarked strategic analysis. This comprehensive report is meticulously designed, providing actionable insights into the clean energy market's growth and relative market share for immediate business planning. You are viewing the exact, professionally formatted BCG Matrix that will be yours to download and utilize without any alterations or demo content. This preview ensures transparency, confirming that the full, ready-to-use document is precisely what you will acquire, empowering your decision-making in the dynamic clean energy sector.

Dogs

Underperforming CNG/LNG stations in declining markets are categorized as Dogs in the Clean Energy BCG Matrix. These facilities, often older or poorly situated, cater to fleets in regions where natural gas demand is shrinking or where rival energy sources have become more popular. For instance, in 2024, several such stations reported operating at a loss, failing to cover their costs due to reduced vehicle usage and increased competition from electric charging infrastructure.

These Dog assets represent a drain on capital, offering minimal growth potential and potentially generating ongoing losses. The company’s financial reports for 2024 highlighted accelerated depreciation charges related to the decommissioning of specific LNG station assets, a clear indicator of their strategic reassessment of these underperforming units. This move reflects a broader industry trend of divesting from less viable fossil fuel-based infrastructure.

Small-scale, non-strategic conventional natural gas supply contracts often involve customers with low volume or low-margin needs in regions exhibiting limited growth prospects. These agreements can demand a significant administrative overhead relative to the minimal financial returns generated, prompting consideration for reduction or termination to reallocate resources towards more advantageous business areas.

For instance, in 2024, the average administrative cost per contract for such small-scale agreements could easily exceed the profit margin, particularly if the contract volume is below 1,000 MMBtu annually. Companies might find that these contracts represent less than 1% of their total revenue but consume upwards of 5% of their administrative resources, highlighting an inefficient allocation of capital and personnel.

Outdated fueling technology or equipment falls into the Dogs category within the Clean Energy BCG Matrix. These are assets like older gasoline pumps or early-generation hydrogen fueling stations that are becoming less efficient and more costly to maintain. For instance, a fueling station still relying on older diesel pumps might face increasing regulatory scrutiny and higher operational expenses compared to newer, cleaner alternatives.

Investing in expensive upgrades for these aging assets often doesn't make financial sense. Their market share potential is typically low, especially as the clean energy sector rapidly evolves with newer, more competitive technologies. Consider that the global market for electric vehicle charging infrastructure alone was projected to reach over $100 billion by 2027, dwarfing the potential growth for legacy fueling systems.

Furthermore, these outdated assets may be subject to accelerated depreciation schedules. This means their book value decreases more rapidly, reflecting their diminishing economic utility. This financial reality further discourages significant capital investment, pushing them firmly into the Dogs quadrant where divestment or minimal maintenance is often the most prudent strategy.

Investments in Non-Core or Unsuccessful Diversification Efforts

Investments in non-core or unsuccessful diversification efforts, such as past ventures into emerging battery storage technologies that did not achieve projected scalability or profitability, could be categorized as Dogs within the Clean Energy BCG Matrix. These initiatives represent capital allocated to areas that have failed to gain significant market traction, resulting in minimal returns and limited strategic value. For instance, a hypothetical investment of $50 million in a novel hydrogen fuel cell component that faced insurmountable manufacturing challenges in 2023 would fit this description, diverting resources from the company's core focus on Renewable Natural Gas (RNG).

The company's strategic priority remains firmly rooted in the RNG sector, evidenced by its substantial capital allocation towards expanding RNG production facilities and natural gas transportation infrastructure. Any prior or current investments outside of these core competencies that have demonstrated poor performance, such as a small-scale solar panel manufacturing pilot program that ceased operations in early 2024 due to intense market competition and low margins, are considered Dogs. These ventures, while perhaps initially promising, have not materialized into significant revenue streams or strategic advantages.

- Past investments in ancillary clean energy technologies that failed to achieve commercial viability.

- Minimal market share or revenue generation from diversified, non-core ventures.

- Capital tied up in projects with low or negative return on investment, hindering core business growth.

High-Cost, Low-Volume Conventional Natural Gas Supply Sources

High-cost, low-volume conventional natural gas supply sources represent a significant challenge within the Clean Energy BCG Matrix. These agreements, often characterized by inflexible terms and escalating prices, can severely impact profitability. For instance, if Clean Energy Fuels were to hold contracts for natural gas sourced from mature, declining basins, these would likely fall into this category.

Such arrangements are particularly problematic when they coincide with regional demand contraction. In 2024, several natural gas-producing regions experienced shifts in demand due to increased renewable energy integration and energy efficiency measures. Contracts with high unit costs, coupled with low offtake volumes, directly diminish the margin per unit sold.

- Erosion of Profit Margins: High procurement costs for these legacy contracts directly reduce the profitability of each unit of natural gas sold, especially in markets with limited pricing power.

- Lack of Strategic Growth: Low-volume commitments offer minimal opportunity for scaling operations or capturing market share, failing to contribute to the company's strategic objectives.

- Capital Inefficiency: Maintaining these contracts ties up capital and resources that could be better allocated to higher-growth, more profitable clean energy ventures.

- Divestiture Consideration: Contracts exhibiting these characteristics are prime candidates for renegotiation or divestiture to streamline operations and focus on more advantageous supply agreements.

Dogs in the Clean Energy BCG Matrix represent business units or assets with low market share in low-growth markets. These are often characterized by underperforming infrastructure, outdated technology, or unsuccessful diversification efforts that consume resources without generating significant returns. For example, in 2024, investments in niche, unproven clean energy technologies that failed to gain traction, such as a small-scale algae biofuel pilot project, would be classified as Dogs.

These assets typically require divestment or minimal investment to avoid further capital drain. Their low growth potential and market share make them liabilities rather than strategic assets. A 2024 analysis of a company's portfolio might reveal that a segment focused on legacy solar panel manufacturing, facing intense competition and declining margins, contributed less than 0.5% of total revenue while absorbing 3% of operational overhead, clearly marking it as a Dog.

The strategic approach for Dogs is usually to exit the market or harvest remaining value. This could involve selling off underperforming assets or discontinuing unprofitable product lines. For instance, a company might decide to sell off a fleet of older, less efficient CNG refueling stations in a region where electric vehicle adoption is rapidly increasing, as seen in several markets during 2024 where such stations reported negative cash flow.

The financial implications of holding Dog assets are significant, often leading to reduced profitability and inefficient capital allocation. Companies must actively identify and manage these units to reallocate resources to more promising areas like Stars or Cash Cows. In 2024, companies with significant exposure to these Dog categories often saw a dip in their overall return on assets, as capital remained tied up in these low-performing ventures.

Question Marks

Clean Energy Fuels is actively investing in hydrogen fueling infrastructure, with specific initiatives to design and construct new hydrogen stations. This strategic move targets the burgeoning heavy-duty transportation sector, a segment poised for significant growth.

The hydrogen fuel market for heavy-duty vehicles is characterized by its high-growth potential, yet it currently holds a minimal market share. Key uncertainties surrounding cost-competitiveness, the pace of widespread adoption, and the long-term sustainability of the technology create a complex investment landscape.

This presents a classic high-risk, high-reward scenario. Significant capital outlay is necessary to establish a strong market presence and overcome the existing adoption hurdles. For instance, in 2024, the global hydrogen fuel cell market for commercial vehicles was projected to reach approximately $3.5 billion, with substantial growth expected in the coming years, underscoring the potential but also the competitive intensity.

Clean Energy Fuels is strategically exploring the integration of Renewable Natural Gas (RNG) to power electric vehicle (EV) charging infrastructure. This move targets the rapidly expanding EV market, a sector projected for substantial growth in the coming years. For instance, global EV sales are expected to surpass 20 million units in 2024, indicating a massive demand for charging solutions.

However, in this specific niche of RNG-powered EV charging, Clean Energy Fuels currently holds a minimal market share. This presents both a challenge and a significant opportunity for the company to establish a strong foothold.

This venture into RNG for EV charging is a nascent area for Clean Energy Fuels, necessitating considerable investment in new technologies and the development of robust infrastructure. The company needs to ascertain the technical feasibility and market acceptance of this innovative approach, which is crucial for its long-term viability and potential for widespread adoption.

The introduction of the Cummins X15N 15-liter natural gas engine represents a significant opportunity for Clean Energy Fuels in the heavy-duty trucking sector, offering extended range capabilities. While the engine's compatibility with Renewable Natural Gas (RNG) is a key advantage, its adoption rate and the subsequent impact on fuel sales are still in early stages, positioning it as a 'Question Mark' within the Clean Energy BCG Matrix.

For widespread fleet adoption of the X15N, substantial investment in marketing efforts and the expansion of fueling infrastructure will be crucial. This strategic support is necessary to overcome potential barriers and capitalize on the engine's potential to drive increased RNG consumption.

Expansion into New Geographical Markets for RNG

Expanding Renewable Natural Gas (RNG) operations into new international or underserved domestic markets presents a classic 'Question Mark' scenario within the Clean Energy BCG Matrix. While Clean Energy Fuels has a strong North American presence, these new territories offer significant growth potential, estimated to reach USD 28.5 billion globally by 2030, according to some projections.

However, these ventures demand considerable upfront capital for infrastructure development and navigating unfamiliar regulatory environments. Market adoption rates and the intensity of the competitive landscape remain uncertain, making rapid penetration crucial for success.

- High Growth Potential: Untapped international and domestic markets offer substantial demand for RNG, driven by decarbonization mandates and corporate sustainability goals.

- Substantial Upfront Investment: Establishing new distribution networks, securing feedstock agreements, and complying with diverse regulations require significant capital outlay.

- Uncertain Market Adoption: Consumer and industry acceptance, alongside the development of supportive policies, can vary greatly, impacting revenue streams.

- Competitive Landscape: Entering markets with established energy providers or emerging RNG competitors necessitates a strong differentiation strategy.

New RNG Production Technologies Beyond Dairy Waste

Exploring new organic waste feedstocks and advanced anaerobic digestion (AD) technologies for renewable natural gas (RNG) production beyond dairy operations positions a company in a high-growth, albeit currently low-market-share, segment. This strategic pivot taps into diverse waste streams, potentially unlocking new revenue avenues and enhancing sustainability credentials.

These emerging technologies promise greater efficiency and novel supply sources, but they carry inherent development risks and demand substantial capital investment for scaling. For instance, while dairy waste has been a primary feedstock, exploring sources like food processing waste or municipal solid waste (MSW) could significantly expand RNG production capacity. In 2023, the U.S. RNG market was valued at approximately $2.5 billion, with significant growth projected, driven by policy incentives and corporate sustainability goals.

- Expanding Feedstock Diversity: Moving beyond dairy to include food waste, agricultural residues, and landfill gas offers broader supply chains and reduced reliance on a single sector.

- Technological Advancements: Investing in enhanced AD processes, such as co-digestion or pre-treatment technologies, can boost methane yields and feedstock compatibility.

- Market Potential: The global RNG market is forecast to reach over $70 billion by 2030, indicating substantial growth opportunities for companies diversifying their production methods.

- Investment Considerations: While promising, these ventures require careful risk assessment due to technology maturation and feedstock logistics, with capital expenditures for new facilities potentially running into tens of millions of dollars.

Question Marks in the Clean Energy BCG Matrix represent ventures with high growth potential but currently low market share, demanding significant investment and strategic focus. These opportunities, while promising, carry inherent risks due to market uncertainties and the need for technological or infrastructural development. Success hinges on careful market analysis and substantial capital allocation to overcome adoption barriers and establish a competitive edge.

The Cummins X15N engine's integration into heavy-duty trucking, while offering extended range with RNG, is a prime example of a Question Mark. Its adoption rate and impact on RNG fuel sales are still in nascent stages, requiring substantial marketing and infrastructure expansion to realize its full potential. Similarly, expanding RNG operations into new international or underserved domestic markets, despite significant global growth projections for RNG, necessitates considerable upfront capital and navigating unfamiliar regulatory landscapes, making market adoption rates a key uncertainty.

Exploring diverse organic waste feedstocks and advanced anaerobic digestion technologies for RNG production beyond traditional dairy operations also falls into the Question Mark category. While these innovations promise greater efficiency and new revenue streams, they involve development risks and significant capital investment for scaling. The U.S. RNG market's growth, projected to be substantial, underscores the opportunity, but the success of these ventures depends on technology maturation and effective feedstock logistics.

| Initiative | Market Growth Potential | Current Market Share | Key Considerations | Estimated Investment Needs (Illustrative) |

| Cummins X15N Engine Adoption | High (Heavy-duty trucking sector) | Low | Fleet adoption rate, infrastructure expansion, marketing | Significant |

| RNG Expansion (New Markets) | High (Global RNG market projected >$70B by 2030) | Low (in new territories) | Infrastructure development, regulatory navigation, market acceptance | Substantial upfront capital |

| Diversified Feedstock RNG Production | High (U.S. RNG market valued ~$2.5B in 2023) | Low (for new feedstocks/tech) | Technology scaling, feedstock logistics, capital expenditure for new facilities | Tens of millions of dollars per facility |

BCG Matrix Data Sources

Our Clean Energy BCG Matrix leverages a blend of industry reports, market share data, and government statistics to provide a comprehensive view of the sector's landscape.