CJ ENM SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CJ ENM Bundle

CJ ENM boasts a powerful brand portfolio and a strong presence in the global entertainment market, but faces intense competition and evolving consumer preferences. Understanding these dynamics is crucial for any strategic player.

Want the full story behind CJ ENM's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

CJ ENM boasts a remarkably diverse entertainment portfolio, spanning broadcasting, film, music, and live events. This broad operational scope creates a robust, diversified revenue base, significantly reducing the risk of over-dependence on any single market segment.

The company's strategic advantage lies in its ability to leverage synergies across these varied content types, facilitating cross-promotional opportunities. Key business segments contributing to this strength include its media content division, online and home shopping services, extensive film and drama production capabilities, and its significant music production and distribution operations.

CJ ENM stands as a dominant player in the global Korean Wave, consistently producing and distributing highly popular K-content that resonates with audiences worldwide. This leadership is a significant strength, fueling the company's international expansion and brand recognition.

The company's strategic emphasis on bolstering its global business operations and enhancing platform competitiveness, specifically for K-content, has been a key driver of its impressive growth trajectory. This focus allows CJ ENM to effectively capitalize on the increasing international demand for Korean entertainment.

CJ ENM's KCON, an annual K-POP Fan & Artist Festival, exemplifies this global reach, drawing millions of dedicated fans from over 170 countries. The success of KCON underscores CJ ENM's ability to cultivate and engage a massive international fanbase, solidifying its position as a leader in the K-culture ecosystem.

CJ ENM boasts a formidable capability in content production, evident in its ownership of highly successful intellectual property (IP) like the tvN channel and original series for its streaming platform, Tving. This robust IP portfolio is a significant strength, attracting and retaining viewers.

The company's dedication to content creation is underscored by its substantial annual investment, which reached 1 trillion Korean won in 2023, marking it as the largest such investment in South Korea. This financial commitment is strategically directed towards bolstering the film industry and securing top-tier creative talent, solidifying CJ ENM's position as a leader in content innovation and production.

Growth of Streaming Platform (Tving)

CJ ENM's online video service, Tving, has shown impressive expansion, significantly boosting the company's financial performance. This growth is a key strength, particularly in its contribution to a recent profit turnaround for CJ ENM.

Tving's revenue saw a substantial 33.4% increase year-on-year. This surge was fueled by a combination of unique content offerings and the successful rollout of advertising-supported subscription tiers.

The platform's user base is rapidly expanding, with monthly active users reaching over 7.8 million by the third quarter of 2024. This rapid user acquisition positions Tving as a strong competitor, quickly closing the gap with established global streaming giants.

- Subscriber Growth: Tving's subscriber numbers are on a strong upward trajectory.

- Revenue Increase: A 33.4% year-on-year revenue jump highlights Tving's commercial success.

- User Engagement: Exceeding 7.8 million monthly active users in Q3 2024 demonstrates significant platform appeal.

- Competitive Positioning: Tving is rapidly gaining ground on major global streaming services.

Strategic Global Expansion Initiatives

CJ ENM is actively broadening its international footprint through significant strategic moves. A key initiative includes the creation of a new global music label, alongside a specialized label, First Light StoryHouse, designed to champion content from Asian creators.

The company is also making inroads into new territories, notably establishing a subsidiary in Saudi Arabia to tap into the Middle East and North Africa (MENA) market. These ventures are crucial for diversifying how CJ ENM distributes its content and for forging stronger global collaborations. For instance, CJ ENM's K-Culture ventures are projected to see continued growth, with the global K-pop market alone valued at over $10 billion in 2023, a figure expected to rise.

- Global Music Label Launch: A new entity to expand CJ ENM's reach in the international music scene.

- First Light StoryHouse: A dedicated label focusing on Asian creator content, fostering diverse storytelling.

- MENA Expansion: Entry into the Middle Eastern and North African markets via a Saudi Arabian subsidiary.

- Diversified Distribution: Aiming to broaden content access and create new revenue streams globally.

CJ ENM's diverse entertainment portfolio, encompassing broadcasting, film, music, and live events, creates a robust, diversified revenue stream. This broad operational scope significantly reduces reliance on any single market segment.

The company excels at leveraging cross-promotional synergies across its content types, enhancing its market position. Its dominance in the global Korean Wave, consistently producing popular K-content, fuels international expansion and brand recognition.

CJ ENM's substantial annual investment in content creation, reaching 1 trillion Korean won in 2023, underscores its commitment to innovation and talent acquisition, solidifying its leadership in the industry.

What is included in the product

Delivers a strategic overview of CJ ENM’s internal and external business factors, highlighting its strengths in content creation and market position, while also identifying weaknesses in diversification and opportunities in global expansion.

Offers a clear, actionable framework to identify and address CJ ENM's strategic challenges and opportunities.

Weaknesses

Despite an overall profit improvement for CJ ENM, specific entertainment areas like film and drama are experiencing difficulties. This has resulted in lower revenues and operating losses in these segments. For instance, the script content division saw its revenue drop by 13.8% in the first quarter of 2025 compared to the previous year, and it also reported an operating loss.

Furthermore, the financial performance of its American content production company, Fifth Season, negatively affected CJ ENM's net loss in 2024. This was primarily due to delays in delivering content, highlighting a specific area of operational weakness that needs addressing.

CJ ENM's media platform segment faces a significant weakness due to its vulnerability to advertising market contractions. This sector, heavily reliant on TV advertising, has seen its revenue impacted by a slowdown in ad spending, exacerbated by challenging economic conditions. For instance, in the first half of 2023, the advertising market experienced a downturn, directly affecting media companies like CJ ENM.

The decline in advertising revenue is further compounded by shifts in viewership patterns. A temporary surge in news program viewership, while beneficial for news outlets, often diverts advertising budgets away from entertainment and other content categories that CJ ENM's platforms specialize in. This dynamic, even with strong content, directly translates to reduced revenue and can lead to operating losses within the media division, as observed in recent financial reports.

CJ ENM faces a significant challenge with its production costs, especially for scripted content, which have reportedly doubled since the pandemic. This surge is largely driven by increased actor fees, making it a substantial financial hurdle for the company.

To navigate this, CJ ENM is actively exploring more efficient budgeting practices, drawing inspiration from the film industry's cost management strategies. The goal is to ensure financial viability while continuing to produce high-quality content.

Overall Net Loss in Fiscal Year 2024

Despite a return to operating profit in fiscal year 2024, CJ ENM recorded a consolidated net loss. This was primarily driven by the underperformance of certain subsidiaries and the impact of one-off expenses.

The company's financial results for the year ended December 31, 2024, revealed a net loss, underscoring persistent financial vulnerabilities. While operational improvements are a positive sign, the overall net loss points to areas requiring significant financial restructuring and strategic adjustments.

- Consolidated Net Loss: CJ ENM reported a net loss for the full fiscal year 2024.

- Subsidiary Performance: Underperforming subsidiaries contributed significantly to the net loss.

- One-off Costs: Non-recurring expenses also impacted the bottom line.

- Financial Strengthening Needed: The 2024 net loss highlights the necessity for financial improvements in the upcoming periods.

Intense Competition in Streaming and Content Market

CJ ENM faces a formidable challenge in the global streaming arena, where giants like Netflix and Disney+ command significant market share and subscriber bases. This intense competition requires constant innovation and substantial investment to stand out.

The streaming market is incredibly crowded, making it difficult for CJ ENM to consistently attract and keep subscribers engaged. This dynamic necessitates a continuous focus on producing high-quality, differentiated content that resonates with a global audience.

- Market Saturation: The global OTT market is projected to reach over $220 billion by 2027, indicating intense competition for consumer attention and subscription dollars.

- Content Arms Race: Major players are investing billions in original content, with Netflix alone budgeting around $17 billion for content in 2023, forcing CJ ENM to match or exceed these efforts.

- Subscriber Churn: High competition leads to increased subscriber churn, as consumers can easily switch between platforms, demanding consistent value proposition from CJ ENM.

To thrive, CJ ENM must not only produce compelling original series and films but also invest in platform technology and user experience to retain its subscriber base amidst this fierce competition.

CJ ENM's scripted content division experienced a notable revenue decline of 13.8% in Q1 2025 year-over-year, alongside an operating loss, indicating struggles in this key area. Additionally, the company's US production arm, Fifth Season, contributed to a net loss in 2024 due to content delivery delays.

The media platform segment is vulnerable to advertising market downturns, as seen in the first half of 2023 when ad spending slowed, impacting revenue. This is further complicated by shifting viewership, where increased news consumption can divert ad budgets from CJ ENM's entertainment focus.

Production costs for scripted content have surged, reportedly doubling since the pandemic largely due to higher actor fees, presenting a significant financial challenge. Despite returning to operating profit in FY2024, CJ ENM reported a consolidated net loss for the year, driven by underperforming subsidiaries and one-off expenses, highlighting a need for financial restructuring.

What You See Is What You Get

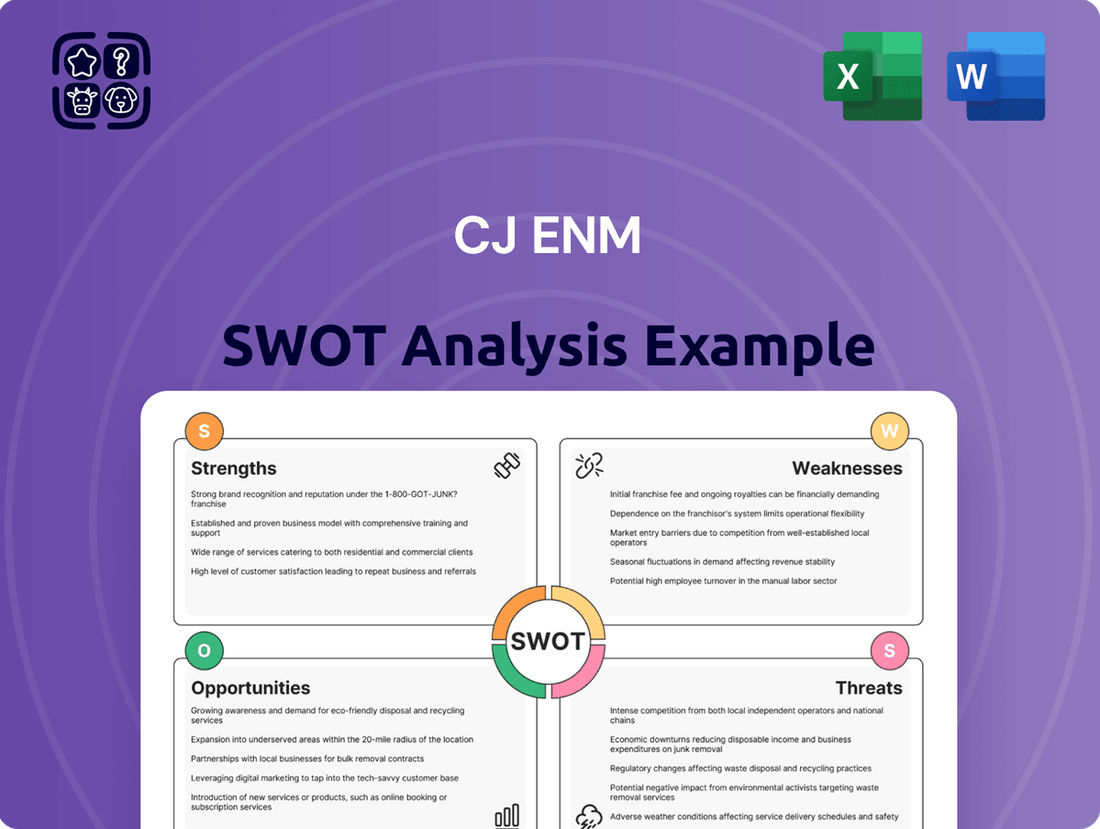

CJ ENM SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You'll get the complete CJ ENM SWOT analysis, detailing its Strengths, Weaknesses, Opportunities, and Threats, with no hidden surprises.

Opportunities

The global surge in Korean entertainment, often called K-content, is a massive opportunity for CJ ENM. Think about how popular K-dramas and K-pop have become worldwide; this trend is only getting stronger. In 2024, the global K-culture market was estimated to be worth over $10 billion, showing a clear demand for this type of content.

CJ ENM is smart to focus on this. They are actively working to get their shows and music into new markets. Regions like India, South America, and the Middle East are showing particularly high interest in K-content. This expansion into new territories, driven by a global appetite for Korean culture, is a key driver for CJ ENM’s international growth strategy.

CJ ENM is actively incorporating AI into its content creation, aiming to boost planning and creativity. This move supports their 'ONLY ONE IP' strategy by streamlining production and identifying valuable intellectual property.

By utilizing AI, CJ ENM can more efficiently generate content, pinpoint emerging IP opportunities, and conduct deeper market analysis. For instance, in 2024, the company reported significant investment in AI research and development, with a portion earmarked for content production enhancements, signaling a strong commitment to this technological integration.

CJ ENM is actively expanding its global footprint, aiming to tap into new revenue streams and reduce reliance on existing markets. A key initiative is the establishment of a Saudi Arabian subsidiary, signaling a strong commitment to the MENA region's burgeoning entertainment sector. This move is designed to leverage local infrastructure and cater to regional demand, enhancing the company's competitive edge.

The company also identifies significant growth potential in markets where Korean content's popularity is still developing, such as India. By introducing its diverse content portfolio to these regions, CJ ENM seeks to cultivate new fan bases and establish early market leadership. This diversification strategy is crucial for long-term sustainable growth and mitigating risks associated with market saturation or shifts in consumer preferences.

Growth and Enhancement of Digital Platforms

CJ ENM's digital platforms, such as Tving and Mnet Plus, present a substantial opportunity for growth and enhancement. Tving, in particular, has demonstrated strong revenue growth, a trend expected to continue with its focus on unique content and innovative advertising models. This digital expansion is a key area where CJ ENM can solidify its market position.

Further investment in original content and enhanced fan engagement features across these digital channels is crucial. By doing so, CJ ENM can not only boost digital revenue streams but also capture a larger share of the digital market. This strategy is vital for staying competitive in the evolving media landscape.

- Tving's Revenue Growth: Driven by exclusive content and new ad formats, Tving's revenue saw a significant uplift, indicating strong potential for digital revenue expansion.

- Platform Enhancement: Continued development of Tving, Mnet Plus, and mobile live commerce with original content and improved fan interaction will drive user acquisition and retention.

- Market Share Expansion: Strengthening digital platforms is key to increasing CJ ENM's overall market share in the competitive digital entertainment sector.

Strategic Partnerships and IP Co-Development

CJ ENM’s strategic partnerships and intellectual property (IP) co-development are key growth drivers. By forming alliances with global players, the company can tap into new creative resources and distribution channels, significantly broadening its market presence. For instance, collaborations like the one with Amazon Prime Video for K-content distribution demonstrate a clear strategy to leverage external expertise and reach.

These ventures are designed not just to expand content offerings but also to build a robust, sustainable business model. Initiatives such as First Light StoryHouse, aimed at promoting Asian storytellers, underscore CJ ENM's commitment to cultivating diverse talent and IP. Such co-development efforts can lead to unique, globally appealing content, strengthening the company's competitive edge in the international entertainment landscape.

The financial impact of these partnerships is substantial. For example, CJ ENM’s content, often produced through these collaborations, has seen significant global traction. In 2023, the company reported strong performance in its media division, partly fueled by the success of its globally distributed dramas and films, indicating the financial viability of its partnership strategy.

- Global Reach Expansion: Partnerships provide access to new territories and audiences, increasing the potential for content monetization.

- IP Diversification: Co-developing IP with partners allows CJ ENM to build a broader and more varied content library.

- Risk Mitigation: Sharing development and production costs with partners can reduce financial risk and improve capital efficiency.

- Innovation Catalyst: Collaborations foster cross-pollination of ideas, driving innovation in storytelling and production techniques.

CJ ENM is strategically leveraging the immense global popularity of K-content, a market valued at over $10 billion in 2024, to expand its reach into promising new regions like India and the Middle East. The company's commitment to integrating AI into content creation, evidenced by significant R&D investments in 2024, aims to enhance efficiency and identify valuable intellectual property, supporting its 'ONLY ONE IP' strategy. Furthermore, CJ ENM is fortifying its digital platforms like Tving, which has shown strong revenue growth, and pursuing strategic global partnerships to diversify its content library and distribution channels, thereby mitigating risks and fostering innovation.

| Opportunity | Description | 2024/2025 Data Point |

| K-Content Global Surge | Capitalizing on the worldwide demand for Korean entertainment. | Global K-culture market estimated over $10 billion in 2024. |

| AI Integration | Enhancing content creation, planning, and IP identification. | Significant investment in AI R&D for content production in 2024. |

| Digital Platform Growth | Expanding revenue and market share through platforms like Tving. | Tving showing strong revenue growth with focus on exclusive content and new ad models. |

| Strategic Partnerships | Accessing new markets, creative resources, and distribution channels. | Collaborations with global players like Amazon Prime Video for K-content distribution. |

Threats

CJ ENM operates in a hyper-competitive global entertainment landscape, facing formidable rivals like Netflix, Disney+, and Amazon Prime Video, which boast extensive content libraries and significant subscriber bases. This intense competition, especially in the burgeoning Over-The-Top (OTT) streaming sector, puts constant pressure on CJ ENM to secure exclusive, high-quality content and attract/retain viewers. For instance, global streaming services collectively invested over $100 billion in content in 2023, a figure CJ ENM must contend with to maintain market share.

The entertainment sector, especially media platforms like those CJ ENM operates, is quite sensitive to shifts in the advertising market. Economic slowdowns can lead to companies cutting back on ad spending, directly impacting revenue streams.

For CJ ENM, a prolonged slump in the TV advertising market, perhaps triggered by worsening economic conditions globally, could significantly reduce its earnings. This vulnerability is a persistent concern.

For instance, global advertising spending growth forecasts for 2024 have been revised downwards by some analysts due to persistent inflation and geopolitical instability, suggesting a challenging environment for media companies like CJ ENM.

Finding a rapid fix for declining ad revenue appears difficult, meaning CJ ENM will likely face this challenge for the foreseeable future as it navigates economic uncertainties.

The escalating costs of creating content, from talent fees to production crew salaries, are a persistent threat to CJ ENM's profitability. For instance, during 2023, the average cost for a prime-time drama production in South Korea saw an increase of approximately 15-20% compared to the previous year, driven by demand for experienced personnel and higher quality standards.

While CJ ENM actively seeks ways to mitigate these rising expenditures, they continue to represent a substantial financial challenge. This pressure can potentially limit the company's ability to invest in a broad slate of new projects or maintain the ambitious scale of its current productions if not managed efficiently.

Performance Volatility of Subsidiaries

The financial performance of CJ ENM's subsidiaries, particularly those in content production like Fifth Season, introduces significant volatility to the company's consolidated results. Delays in content delivery from Fifth Season, for instance, were a contributing factor to CJ ENM reporting a net loss in 2024, highlighting the direct impact of these units on overall profitability.

The success or setbacks experienced by individual business units can create unpredictable swings in the company's earnings. This dependency means that challenges in one area, such as production timelines or market reception for content from Fifth Season, can disproportionately affect CJ ENM's bottom line.

- Subsidiary Performance Impact: Fifth Season's production delays led to a net loss for CJ ENM in 2024.

- Earnings Volatility: Individual business unit struggles can cause unpredictable fluctuations in consolidated earnings.

- Content Delivery Risk: The timing and success of content releases from subsidiaries directly influence CJ ENM's financial outcomes.

Evolving Consumer Preferences and Market Saturation

The global entertainment landscape is dynamic, with consumer preferences shifting rapidly. For CJ ENM, this presents a significant threat, especially as the streaming and content market becomes increasingly saturated. For instance, in 2023, the global video streaming market was valued at over $220 billion, with projections indicating continued growth, but also intense competition for viewer attention. This means CJ ENM needs to be exceptionally agile in its content creation and distribution strategies to stay relevant and avoid what's often called subscription fatigue, where consumers feel overwhelmed by the number of services they subscribe to.

Market saturation means that simply producing content is no longer enough. CJ ENM faces the challenge of differentiating itself in a crowded marketplace. This requires constant innovation and a deep understanding of audience desires. Failure to consistently deliver compelling, diverse, and culturally resonant content risks a decline in viewership, impacting subscription numbers and overall market share. The company must actively invest in understanding emerging trends and audience segments to maintain its competitive edge.

Key challenges include:

- Rapidly shifting consumer tastes: Audiences are increasingly seeking novel and niche content, making long-term content planning more difficult.

- Intensified competition: The proliferation of streaming services, both global giants and local players, means CJ ENM competes for limited viewer time and disposable income. In 2024, major streaming platforms are expected to spend billions on original content, further intensifying this competition.

- Subscription fatigue: Consumers are becoming more selective about their subscriptions, prioritizing services that offer unique value and consistent quality, posing a risk to subscriber retention.

CJ ENM faces significant threats from intense global competition, particularly from streaming giants like Netflix and Disney+, which are heavily investing in content. This makes it challenging to secure exclusive rights and retain subscribers in a market where global streaming services invested over $100 billion in content in 2023.

Rising content production costs, with South Korean drama production costs increasing by 15-20% in 2023, directly impact profitability. Furthermore, the company's reliance on subsidiaries like Fifth Season introduces earnings volatility, as evidenced by Fifth Season's production delays contributing to CJ ENM's net loss in 2024. The dynamic nature of consumer preferences and market saturation also demand constant innovation to avoid declining viewership and maintain market share amidst growing competition.

| Threat Category | Specific Threat | Impact on CJ ENM | Supporting Data/Context |

| Competition | Intense Global Streaming Competition | Pressure on content acquisition and subscriber retention | Global streaming services invested >$100B in content in 2023. |

| Costs | Escalating Content Production Costs | Reduced profitability and investment capacity | South Korean drama production costs up 15-20% in 2023. |

| Operational Risk | Subsidiary Performance Volatility | Unpredictable earnings fluctuations | Fifth Season delays contributed to CJ ENM's 2024 net loss. |

| Market Dynamics | Shifting Consumer Tastes & Market Saturation | Risk of declining viewership and market share | Over $220B global video streaming market in 2023, high competition for attention. |

SWOT Analysis Data Sources

This CJ ENM SWOT analysis is built upon a robust foundation of data, including the company's official financial statements, comprehensive market research reports, and expert industry analysis to provide a well-rounded perspective.