CJ ENM Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CJ ENM Bundle

Curious about CJ ENM's strategic positioning? This glimpse into their BCG Matrix reveals the potential powerhouses and emerging players within their diverse portfolio. Understand which segments are driving growth and which might require a closer look.

Don't miss out on the full picture! Purchase the complete CJ ENM BCG Matrix to unlock detailed quadrant analysis, actionable insights into their market share and growth rates, and a clear roadmap for optimizing their product investments.

Gain the competitive edge by diving into the full report, which provides a comprehensive breakdown of CJ ENM's Stars, Cash Cows, Dogs, and Question Marks, empowering you to make informed strategic decisions.

Stars

CJ ENM's KCON and MAMA AWARDS are pivotal in its global K-Pop strategy, serving as major fan and artist gatherings. These events are crucial for expanding K-Pop's reach and cementing CJ ENM's status as a global music IP leader.

KCON, in particular, has seen immense success, with over 1.99 million attendees globally across 14 regions in 13 years. The 2024 KCON LA event alone attracted an impressive 5.9 million fans, highlighting the massive and growing demand for live K-Pop experiences.

Tving, CJ ENM's streaming service, is a shining star in the company's portfolio. In 2024, it experienced remarkable growth, with revenue jumping 33.4% to 435.3 billion won. This strong performance is further evidenced by its monthly active users exceeding 7.8 million in the third quarter of 2024.

CJ ENM has ambitious plans for Tving, aiming to capture 15 million subscribers by 2027. A key part of this strategy involves aggressive global expansion, targeting markets such as Japan, Southeast Asia, and the United States to solidify its position as a leading international streaming platform.

CJ ENM is significantly boosting its content production, earmarking over 1.5 trillion Korean Won for 2025, its most substantial investment to date. This push is geared towards creating globally appealing content, moving beyond K-Pop and fostering international collaborations.

The company's strategic focus on expanding its intellectual property (IP) portfolio is designed to tap into burgeoning markets. By diversifying distribution channels, CJ ENM aims to capture demand in key growth regions like India, South America, and the Middle East.

Fifth Season Global Studio Content

Fifth Season, CJ ENM's global premium studio, is a significant player in the company's portfolio. Its operations have stabilized, contributing to a notable revenue increase.

The film and drama sector, bolstered by Fifth Season's output, experienced a 56.1% revenue surge in 2024. This growth highlights the studio's effectiveness in content creation and distribution.

- Fifth Season's Stabilized Operations: The studio's operational stability is a key factor in its positive financial impact.

- Revenue Growth Driver: Fifth Season significantly contributed to the 56.1% increase in CJ ENM's film and drama sector revenue in 2024.

- Representative Content: The studio is producing high-profile dramas such as 'Chief of War' and 'Nine Perfect Strangers' Season 2, demonstrating its capacity for successful content sales and distribution.

- Global Growth Focus: Fifth Season's emphasis on international projects positions it as a crucial element for CJ ENM's global expansion strategy.

New Global Music Labels

CJ ENM is strategically expanding its global music footprint with plans for a new global label in 2025. This follows the success of existing ventures like WAKEONE and LAPONE ENTERTAINMENT in Japan.

The company aims to leverage its proven training system to connect global artists with a worldwide fanbase. This expansion is a key part of CJ ENM's 2025 global music business roadmap.

This initiative is designed to strengthen CJ ENM's position in the dynamic global music market. By fostering international talent, they anticipate a significant increase in market share.

- Global Label Launch: Targeting 2025, building on WAKEONE and LAPONE ENTERTAINMENT's success.

- Artist-Fan Connection: Utilizing established training systems to bridge global artists and audiences.

- Market Expansion: Aiming to solidify CJ ENM's presence and market share in the international music industry.

CJ ENM's film and drama sector, significantly boosted by Fifth Season, demonstrated robust growth in 2024, with revenue surging by 56.1%. This performance highlights Fifth Season's crucial role as a revenue driver and its contribution to the company's overall success in content creation and distribution.

Fifth Season's operational stability is a cornerstone of its positive financial impact, allowing it to effectively produce and distribute high-profile content. Dramas like 'Chief of War' and 'Nine Perfect Strangers' Season 2 exemplify its capability in generating successful sales and distribution streams.

The studio's strategic focus on international projects positions it as a vital component of CJ ENM's global expansion strategy. This global growth focus is key to leveraging its content across diverse international markets.

CJ ENM's K-Pop events, KCON and MAMA AWARDS, are pivotal for its global strategy, attracting millions of fans and solidifying its leadership in music IP. KCON LA 2024 alone drew 5.9 million attendees, showcasing the immense demand for live K-Pop experiences.

Tving, CJ ENM's streaming service, is a standout performer, with revenue climbing 33.4% to 435.3 billion won in 2024 and monthly active users exceeding 7.8 million in Q3 2024. The company aims for 15 million subscribers by 2027 through aggressive global expansion.

CJ ENM is set to launch a new global music label in 2025, building on the success of WAKEONE and LAPONE ENTERTAINMENT. This initiative aims to strengthen its market share by connecting global artists with worldwide fanbases.

| Business Unit | Key Event/Product | 2024 Performance Highlight | Strategic Goal | Global Impact |

|---|---|---|---|---|

| Content (Film & Drama) | Fifth Season Studio | 56.1% revenue surge in 2024 | Global content creation & distribution | Key for international market penetration |

| Content (Music/Events) | KCON & MAMA AWARDS | KCON LA 2024: 5.9 million attendees | Global K-Pop IP leadership | Expanding K-Pop's global reach |

| Digital Platform | Tving | Revenue up 33.4% (435.3B KRW); 7.8M+ MAU (Q3 2024) | 15M subscribers by 2027 | Targeting Japan, SEA, US |

| Global Music | New Global Label | Planned for 2025 | Strengthen global market position | Leveraging training systems for global artists |

What is included in the product

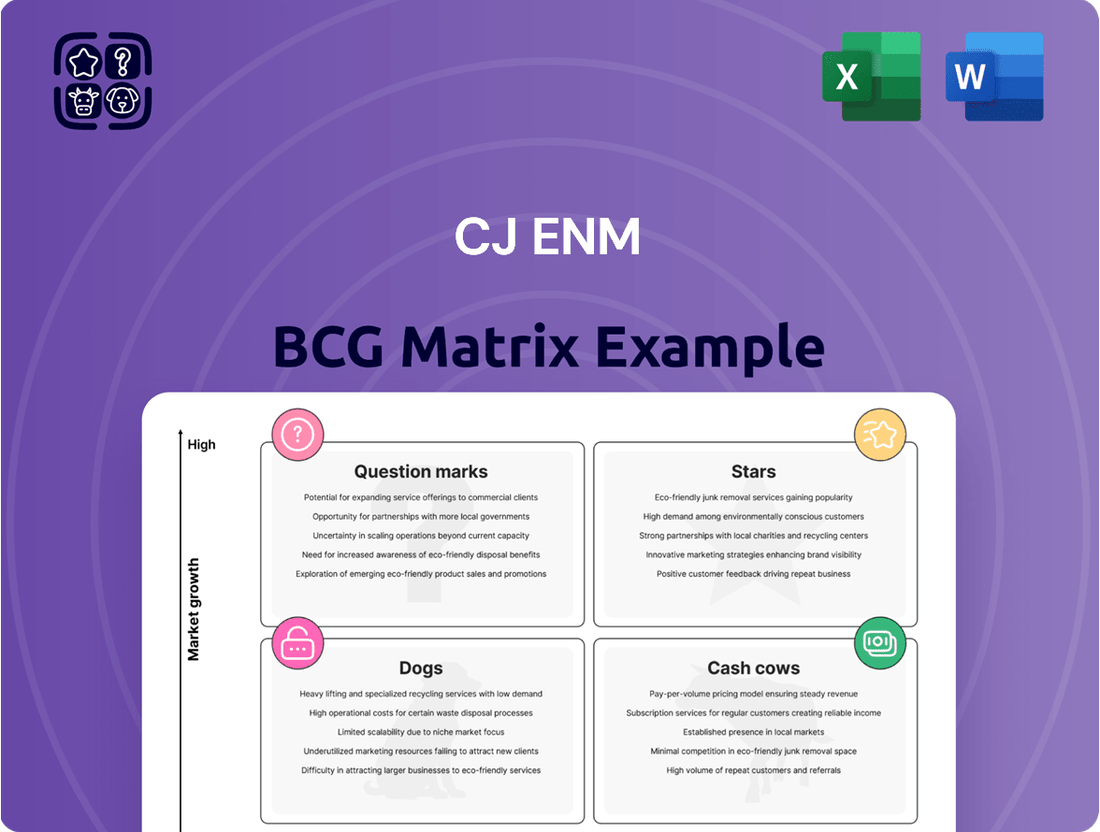

This BCG Matrix overview details CJ ENM's portfolio, identifying Stars for growth, Cash Cows for funding, Question Marks for potential, and Dogs for divestment.

A clear CJ ENM BCG Matrix overview pinpoints underperforming units, easing the pain of resource misallocation.

Cash Cows

tvN, CJ ENM's premier cable channel, solidified its status as the leading K-content provider in 2024. It achieved this through consistently strong viewership and critical recognition for its dramas.

The channel's success was significantly boosted by popular shows such as 'Marry My Husband,' 'Queen of Tears,' and 'Lovely Runner.' These hits directly contributed to an 8.8% surge in CJ ENM's media division sales for the year.

Even with a challenging advertising market, tvN's robust content slate guarantees dependable revenue streams. This resilience highlights the enduring appeal and marketability of its programming.

CJ ENM's established music labels and artists, including WAKEONE and LAPONE ENTERTAINMENT, are significant cash cows, consistently delivering strong revenue streams. The music division saw a healthy 3.8% year-over-year sales growth in 2024, hitting 702.1 billion won.

This financial performance is largely driven by the immense popularity and sales success of artists such as ZEROBASEONE, underscoring the mature and reliable nature of these assets within CJ ENM's portfolio.

The commerce business, specifically mobile live commerce, is a significant Cash Cow for CJ ENM. In 2024, this sector achieved impressive annual revenues of 1.4514 trillion won and an operating profit of 83.2 billion won. This performance underscores its role as a stable financial contributor.

Mobile live commerce experienced a remarkable surge in transaction volume, growing by 96% year-on-year. This substantial increase directly fueled the segment's profit growth, highlighting its increasing importance and effectiveness within CJ ENM's portfolio.

This high-margin, scalable business model ensures consistent financial stability for CJ ENM. The robust performance of mobile live commerce demonstrates its capacity to generate reliable profits, making it a dependable pillar of the company's financial health.

Traditional Broadcasting Services

Traditional Broadcasting Services, encompassing channels like tvN, OCN, and CH CGV, represent a significant Cash Cow for CJ ENM within its Media Platform segment. These services generate a stable, foundational revenue stream primarily from content licensing and advertising sales. Despite a challenging advertising market in 2024, the enduring infrastructure and loyal viewership base continue to provide consistent, predictable cash flow, even with modest growth prospects.

This segment's strength lies in its broad reach and deeply entrenched audience. In 2023, the Korean broadcasting advertising market saw a slight decline, but CJ ENM's flagship channels maintained strong viewership, contributing significantly to overall revenue. For instance, tvN consistently ranks among the top-performing channels in Korea, attracting substantial advertising investment due to its high-quality content and engaged demographic.

- Established Infrastructure: CJ ENM's broadcasting arm benefits from decades of investment in production facilities and distribution networks.

- Loyal Viewership: Channels like tvN boast a strong, consistent audience, making them attractive for advertisers.

- Consistent Revenue: Despite market headwinds, advertising and content sales provide a reliable cash flow.

- Market Position: In 2024, CJ ENM's broadcasting segment remained a key contributor to the company's financial stability.

Existing Content Library Distribution

CJ ENM's extensive content library, encompassing a wide array of genres and formats, functions as a significant cash cow. This valuable intellectual property generates consistent revenue through ongoing distribution agreements and licensing opportunities.

The company strategically pursues cross-platform synergies to amplify the reach and profitability of its existing content assets. This ongoing monetization of successful past productions provides a stable and predictable contribution to CJ ENM's overall earnings.

- CJ ENM's content library includes popular K-drama series and films, which are continuously licensed to global streaming platforms.

- In 2023, CJ ENM reported robust performance in its Content business division, driven by strong IP monetization.

- The company's focus on leveraging its back catalog ensures a steady revenue stream, supporting its investment in new content development.

CJ ENM's music labels and artists represent a stable Cash Cow, consistently generating significant revenue. In 2024, the music division achieved 702.1 billion won in sales, a 3.8% increase year-over-year, with artists like ZEROBASEONE leading the charge.

The mobile live commerce sector also proved to be a strong Cash Cow, recording 1.4514 trillion won in annual revenue and 83.2 billion won in operating profit for 2024. This segment's remarkable 96% year-on-year transaction volume growth underscores its increasing financial importance.

CJ ENM's traditional broadcasting services, including tvN, continue to be a reliable Cash Cow. Despite market challenges in 2024, these channels maintain strong viewership and attract advertising, providing a consistent revenue stream through content licensing and ad sales.

The company's extensive content library acts as another Cash Cow, with ongoing licensing and distribution agreements for popular K-dramas and films ensuring a steady revenue flow. This strategic monetization of intellectual property supports overall earnings and new content investment.

| Business Segment | 2024 Revenue (KRW) | 2024 Operating Profit (KRW) | Key Drivers |

|---|---|---|---|

| Music | 702.1 billion | N/A | Artist popularity (ZEROBASEONE), consistent sales |

| Mobile Live Commerce | 1.4514 trillion | 83.2 billion | High transaction volume growth (96% YoY) |

| Traditional Broadcasting | N/A (Significant contributor) | N/A | Advertising sales, content licensing, loyal viewership |

| Content Library | N/A (Steady contribution) | N/A | IP monetization, global distribution |

Preview = Final Product

CJ ENM BCG Matrix

The CJ ENM BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis is ready for immediate use, offering strategic insights into CJ ENM's business units without any watermarks or demo content. You'll gain access to a professionally designed report, perfect for informing your business planning and presentations.

Dogs

The traditional TV advertising market is facing a steep downturn, with Q1 2025 revenue plummeting by almost 50% compared to three years earlier. This sharp decline, driven by challenging economic factors and fierce competition, has directly impacted CJ ENM's media platform sector, pushing it into an operating loss. This segment is characterized as a declining market with limited growth potential, presenting a significant hurdle for sustained profitability.

Underperforming film productions within CJ ENM's portfolio can be viewed as cash traps. Despite some box office hits, the broader theatrical market is still finding its footing post-pandemic, with mid-tier films particularly challenged. This has directly impacted CJ ENM's film and drama sector, which saw a significant 22.9% drop in sales and incurred an operating loss in the third quarter of 2024.

CJ ENM's scripted content, encompassing films and dramas, experienced a significant downturn in overseas distribution revenue, dropping 13.8% year-on-year in the first quarter of 2025. This decline signals potential challenges in international market penetration or a fading appeal of existing content libraries. The reduced income from these distribution channels directly impacts the segment's profitability, contributing to operating losses.

Niche or Less Popular Cable Channels

While tvN dominates CJ ENM's cable channel portfolio, other networks like OCN and CH CGV may find themselves in the Dogs quadrant. These channels, once popular, are now facing declining viewership and advertising income in a highly competitive and fragmented media market. Their market share is likely small, with little prospect for significant growth, potentially consuming valuable resources without delivering substantial returns.

The continued existence of these niche channels might be driven by a strategy of maintaining a broad media offering rather than immediate profit generation. For example, OCN, historically known for its movie and drama content, has seen its audience shift to streaming platforms. CH CGV, focused on film, also contends with direct-to-consumer movie releases and changing viewing habits.

- Low Viewership: Channels like OCN and CH CGV may be experiencing a decline in average viewership, impacting their attractiveness to advertisers.

- Decreasing Ad Revenue: As viewership falls, so does the revenue generated from advertising slots, making these channels less profitable.

- Resource Drain: Maintaining these channels requires ongoing investment in content acquisition and production, which may not yield commensurate returns given their market position.

- Portfolio Diversification: Their presence might serve a strategic purpose in CJ ENM's overall media ecosystem, even if they are not high-revenue generators.

Non-Mobile E-commerce Segments

While CJ ENM's mobile live commerce is a vibrant growth engine, other e-commerce segments might be facing headwinds. These traditional areas, if not generating substantial revenue or profit relative to their operational demands, could be categorized as 'dogs' within the BCG matrix.

For instance, in 2023, while CJ ENM's commerce division reported robust growth, it's crucial to examine the performance of its non-mobile segments. If these segments, such as general online retail or specific product categories not driven by live streaming, show minimal year-over-year revenue increases or declining market share, they would fit the 'dog' profile. This classification suggests they consume resources without offering significant returns, potentially hindering overall portfolio efficiency.

- Stagnant Revenue Growth: Non-mobile e-commerce segments may exhibit single-digit or even flat revenue growth, contrasting sharply with the double-digit expansion seen in live commerce.

- Low Profitability: These segments might have high operational costs associated with inventory management, marketing, and platform maintenance, leading to low or negative profit margins.

- Declining Market Share: In a competitive landscape, if these traditional channels are losing ground to more innovative or mobile-first approaches, their market share will shrink, indicating a 'dog' status.

- Resource Drain: Continued investment in underperforming non-mobile segments can divert capital and attention away from more promising growth areas like mobile live commerce.

CJ ENM's older, less popular cable channels, such as OCN and CH CGV, are likely candidates for the Dogs quadrant. These channels face declining viewership and advertising revenue in a fragmented media landscape, with limited prospects for significant growth. Their continued operation might serve a strategic purpose in maintaining a broad media offering, even if they consume resources without substantial returns.

Certain traditional e-commerce segments within CJ ENM, distinct from its successful mobile live commerce, could also be classified as Dogs. These areas may exhibit stagnant revenue growth and low profitability due to high operational costs and declining market share. Continued investment in these underperforming segments can divert capital from more promising growth areas.

| CJ ENM Segment | Market Growth | Relative Market Share | BCG Classification |

|---|---|---|---|

| Older Cable Channels (e.g., OCN, CH CGV) | Low | Low | Dog |

| Traditional E-commerce (non-mobile) | Low | Low | Dog |

Question Marks

CJ ENM is investing heavily in AI for content production, aiming for greater efficiency and creative breakthroughs. This positions AI as a potential star in their portfolio, given the technology's rapid growth and transformative impact on media industries.

While the potential is immense, AI's direct contribution to CJ ENM's market share and profitability is still in its early stages. The company is in a phase of development and adoption, meaning the exact returns are not yet fully realized, making it a question mark for now.

CJ ENM is actively pursuing expansion into emerging markets like India, South America, and the Middle East, recognizing their substantial growth potential for Korean entertainment. These regions represent key opportunities for CJ ENM to broaden its global footprint and diversify its revenue streams beyond established markets.

In these developing territories, CJ ENM's current market penetration is likely modest, positioning them as question marks within the BCG matrix. This implies a need for strategic investment to build brand awareness and establish a strong presence, transforming potential into tangible market share.

Significant investment in content localization, including dubbing and subtitling in local languages, alongside building robust distribution networks, will be crucial. For instance, the global streaming market in emerging economies is projected to grow significantly, with India alone expected to see its digital video market reach $12.5 billion by 2025, according to Statista, presenting a compelling case for CJ ENM's strategic focus.

First Light StoryHouse, launched in July 2025 by CJ ENM, is positioned as a 'Question Mark' in the BCG Matrix. This new label aims to elevate Asian and Asian American narratives globally through film and scripted television.

The initiative taps into a rising global appetite for diverse storytelling, but its current market share is minimal. This necessitates significant upfront investment in content development and co-production to build brand recognition and capture market share.

New Genres and Formats for Content Diversification

CJ ENM is actively exploring new content avenues to broaden its appeal and capture emerging market trends. This includes venturing into experimental genres like lifestyle survival shows and innovative drama formats. These initiatives aim to attract younger demographics and capitalize on evolving viewer preferences.

These novel content types represent CJ ENM's "question marks" in the BCG matrix. While they hold significant promise for future growth, their current market penetration is minimal. Success for these projects will be determined by their ability to resonate with audiences and achieve critical acclaim in a competitive landscape.

- New Genres: Lifestyle survival shows and experimental drama structures are key diversifications.

- Audience Attraction: These formats are designed to capture new and younger audience segments.

- Market Position: Currently low market share, indicating a question mark status.

- Growth Potential: High potential hinges on successful audience adoption and critical reception.

Specific New Artist Debuts and Global Collaborations

CJ ENM's focus on new artist debuts and global collaborations highlights a strategic push into high-growth areas within the music industry. These initiatives are crucial for capturing emerging market trends and diversifying revenue beyond established acts.

The global music market is dynamic, with new artists and cross-border collaborations increasingly driving engagement. For instance, K-pop's continued global expansion, exemplified by groups like NewJeans which debuted in 2022 and quickly achieved significant international success, underscores the potential of well-executed new artist launches.

- New Artist Investment: CJ ENM likely allocates substantial marketing budgets to nurture emerging talent, aiming to replicate the success of artists who have garnered millions of streams and chart positions globally.

- Global Collaboration Impact: International partnerships, such as those involving Western artists collaborating with Korean acts, have proven effective in expanding fan bases and increasing global market share.

- Revenue Diversification: The success of these new ventures is vital for building future revenue streams in a competitive landscape where established artists' revenue can fluctuate.

CJ ENM's AI content production initiatives and expansion into emerging markets are prime examples of their "Question Marks." These ventures require significant investment and are in the early stages of development, meaning their future market share and profitability are uncertain but hold substantial growth potential.

First Light StoryHouse, focused on elevating Asian narratives, and the exploration of experimental content formats like lifestyle survival shows also fall into this category. Their success hinges on audience reception and market penetration, making them areas of strategic focus for future growth.

The company's investment in new artist debuts and global music collaborations also represents a "Question Mark." While K-pop's global success, like that of NewJeans, demonstrates the potential, these new ventures need time and resources to establish a significant market presence and revenue stream.

| Initiative | Category | Current Status | Potential | Investment Focus |

| AI Content Production | Question Mark | Early stage, adoption phase | High efficiency, creative breakthroughs | Development, R&D |

| Emerging Market Expansion | Question Mark | Modest penetration | Broaden global footprint, diversify revenue | Localization, distribution networks |

| First Light StoryHouse | Question Mark | New venture, minimal market share | Global platform for Asian narratives | Content development, co-productions |

| Experimental Content Formats | Question Mark | Low market penetration | Attract younger demographics, evolving viewer preferences | Audience resonance, critical acclaim |

| New Artist Debuts & Global Music Collabs | Question Mark | Nurturing talent, building presence | Expand fan bases, increase global market share | Marketing budgets, international partnerships |

BCG Matrix Data Sources

Our CJ ENM BCG Matrix is built on a robust foundation of internal financial data, market research reports, and competitive analysis. This comprehensive approach ensures accurate assessment of market share and growth potential.