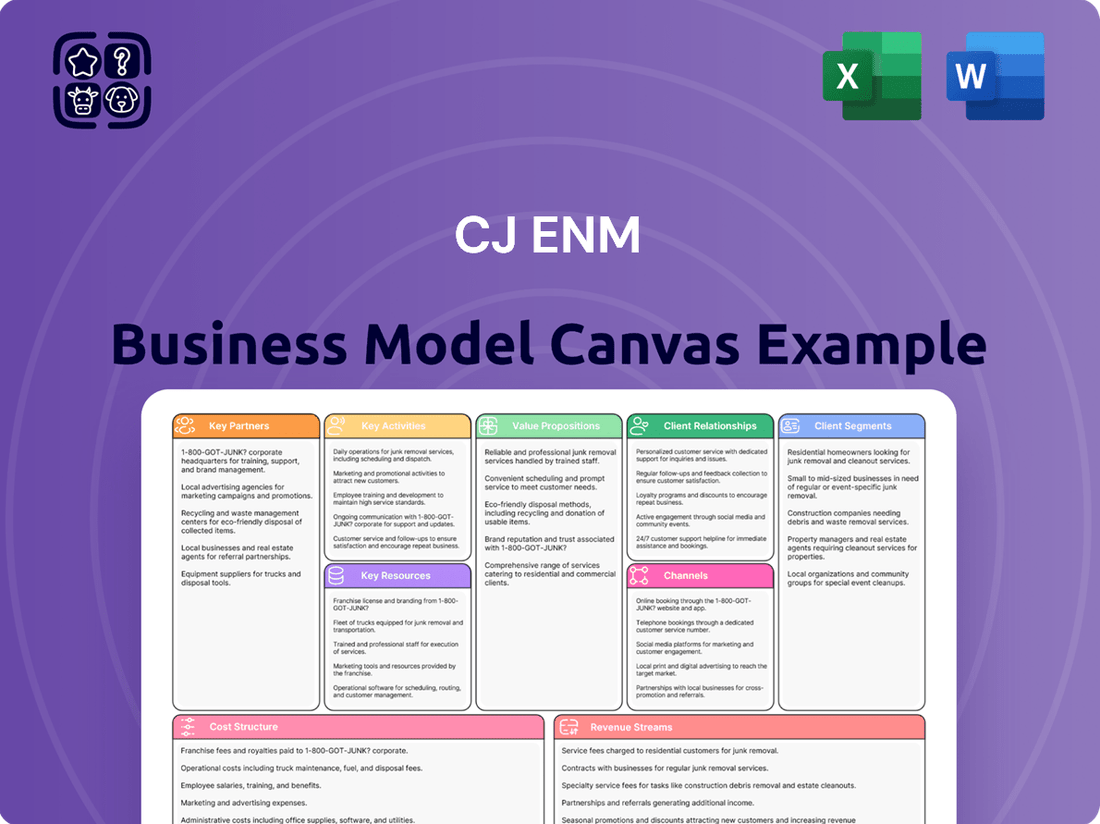

CJ ENM Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CJ ENM Bundle

Unlock the full strategic blueprint behind CJ ENM's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

CJ ENM actively collaborates with major international broadcasters and streaming platforms. This strategy is crucial for distributing its extensive content library, thereby broadening its global footprint and driving substantial revenue streams. These partnerships enable CJ ENM to access new markets and demographics by utilizing the existing infrastructure of its collaborators.

For instance, CJ ENM has secured distribution agreements with broadcasters across Latin America, a region with a growing demand for diverse entertainment. Furthermore, significant content deals have been established with platforms like Shahid, catering to audiences in the Middle East and North Africa (MENA) region. These collaborations are vital for CJ ENM's international growth strategy.

CJ ENM's success hinges on strong alliances with production studios and talent agencies. These partnerships are vital for sourcing compelling films and dramas, as well as securing sought-after actors and performers. For instance, CJ ENM's investment in and collaboration with various production houses ensures a steady stream of diverse content for its platforms.

By co-producing projects and gaining access to a wide pool of creative talent, CJ ENM maintains a competitive edge. These collaborations extend to developing original intellectual property and identifying emerging artists, further enriching its content library and talent roster. In 2023, CJ ENM continued to actively engage in such strategic partnerships, contributing to its robust content pipeline.

CJ ENM is actively forging partnerships with technology and AI solution providers to bolster its content creation and distribution. For instance, in 2024, they are exploring AI-driven tools for script analysis and audience prediction, aiming to optimize content development. These collaborations are crucial for leveraging AI across the entire content value chain, from ideation to personalized viewer experiences.

Local Market Collaborators (e.g., Sela, Manga Productions)

CJ ENM leverages key partnerships with local entities to fuel its global expansion, especially in burgeoning markets. These collaborations are vital for navigating local cultural nuances and establishing robust operations. For instance, their alliance with Sela in Saudi Arabia, a prominent entertainment company, underscores this strategy. This partnership aims to enhance live events and unique experiences, tapping into the growing entertainment demand within the region. In 2024, Saudi Arabia's entertainment sector experienced significant growth, with consumer spending projected to reach billions, making such collaborations strategically crucial for market penetration.

These alliances are not just about market entry; they are instrumental in co-creating content that resonates deeply with local audiences. By integrating regional expertise, CJ ENM can better understand and cater to specific cultural preferences, thereby building stronger local brand presence and operational capabilities. Manga Productions, another significant collaborator, exemplifies this by assisting in the localization and production of content tailored for specific demographics, further solidifying CJ ENM's foothold in diverse markets.

The strategic rationale behind these partnerships is clear: to accelerate growth and mitigate risks associated with entering unfamiliar territories. By combining CJ ENM's global production and distribution power with the intimate local knowledge of partners like Sela and Manga Productions, the company can more effectively:

- Access untapped markets and consumer bases.

- Develop culturally relevant and appealing content.

- Streamline operational setup and regulatory navigation.

- Enhance brand visibility and audience engagement.

Brand and Sponsorship Partners

CJ ENM actively cultivates brand and sponsorship partnerships to bolster its diverse entertainment portfolio. These collaborations are crucial for generating supplementary revenue and amplifying brand presence for both CJ ENM and its partners. For example, in 2024, CJ ENM secured significant sponsorship deals for its flagship content and events, contributing to a substantial portion of its non-advertising revenue.

These strategic alliances extend to product placements and joint marketing endeavors, creating integrated campaigns that resonate with audiences. A prime illustration of this is KCON, a global K-culture festival. KCON LA 2025, for instance, proudly features Olive Young as its title sponsor, highlighting the immense value these partnerships bring in terms of reach and engagement.

The benefits are mutual; brands gain access to CJ ENM's vast audience across television, digital platforms, and live events, while CJ ENM leverages these partnerships to enhance its content and create memorable experiences. In 2024, the company reported a 15% year-over-year increase in revenue derived from these strategic brand collaborations.

- Revenue Generation: Sponsorships and product placements provide vital additional income streams, supporting CJ ENM's production and event costs.

- Brand Visibility: Partners benefit from exposure to CJ ENM's extensive and engaged fan base across multiple platforms.

- Integrated Marketing: Collaborations enable seamless marketing campaigns that tie content, events, and brand messaging together effectively.

- Event Sponsorships: Major events like KCON attract significant title and category sponsors, such as Olive Young for KCON LA 2025, demonstrating the appeal of CJ ENM's cultural platforms.

CJ ENM's key partnerships are vital for its global content distribution, with agreements in place with broadcasters and streaming platforms across regions like Latin America and the Middle East. These alliances are essential for expanding its reach and accessing new audiences.

Furthermore, CJ ENM strengthens its content pipeline through collaborations with production studios and talent agencies, ensuring a steady supply of high-quality films and dramas. These partnerships are crucial for maintaining a competitive edge in content creation.

In 2024, CJ ENM is actively partnering with technology and AI firms to enhance content development and delivery, exploring AI tools for script analysis and audience prediction. These collaborations are key to leveraging AI across the content lifecycle.

CJ ENM also forms strategic alliances with local entities, such as Sela in Saudi Arabia, to navigate cultural nuances and expand into burgeoning markets. These partnerships are instrumental in co-creating content that resonates locally and accelerating growth.

What is included in the product

A comprehensive business model for CJ ENM, detailing its diverse entertainment and media operations, from content creation to platform distribution, across various customer segments.

This model outlines CJ ENM's strategy for leveraging its integrated value chain, encompassing content, platforms, and commerce, to achieve sustainable growth and market leadership.

CJ ENM's Business Model Canvas acts as a pain point reliver by offering a clear, high-level view of its diverse media and entertainment operations, enabling swift identification of synergies and potential areas for optimization.

Activities

CJ ENM's core business revolves around the creation and production of diverse entertainment content, encompassing television dramas, films, music, and live performances. This involves substantial investment in original intellectual property and the development of innovative formats, managing the entire production process from initial concept to the finished product.

The company is strategically focused on bolstering its content pipeline, with plans to produce approximately 65 productions in 2025. This aggressive production schedule underscores their commitment to maintaining a leading position in the global entertainment market.

A core activity for CJ ENM involves the strategic distribution and licensing of its vast content library. This means actively forging partnerships with a global network of broadcasters, digital streaming platforms, and other media entities to ensure its popular K-dramas, films, and music reach the widest possible audience.

Negotiating these licensing agreements is crucial for maximizing revenue streams and expanding CJ ENM's global brand presence. For instance, the company has seen significant success in recent years by securing distribution deals for its K-dramas in emerging markets like Latin America and the Middle East and North Africa (MENA) region, demonstrating a commitment to international growth.

CJ ENM's core activities heavily involve operating and managing its proprietary platforms. This encompasses the streaming service TVING and the music-focused Mnet Plus, requiring constant content curation and efforts to improve user experience.

A significant focus is placed on subscriber acquisition and retention strategies to effectively compete in the crowded digital entertainment landscape. These platform-specific approaches are crucial for maintaining market share against global competitors.

The company's commitment to platform development is evident, with TVING reporting over 7.8 million monthly active users in the third quarter of 2024, demonstrating substantial user engagement and reach.

Live Entertainment Event Management

CJ ENM's key activity in live entertainment event management centers on the meticulous organization and execution of major global events like KCON and the MAMA Awards. These events serve as vital platforms for direct fan engagement and the worldwide promotion of Korean culture.

The process demands comprehensive planning, intricate logistics coordination, effective artist relations, and strategic marketing campaigns. Success hinges on delivering an exceptional fan experience, which in turn drives brand loyalty and revenue.

For instance, KCON LA 2024 demonstrated significant reach, attracting an impressive audience of over 5.9 million fans, highlighting the immense scale and impact of these managed events.

- Event Planning & Execution: Orchestrating all facets of large-scale live shows, from concept to completion.

- Artist & Talent Management: Securing and managing performers, ensuring a high-quality artistic program.

- Fan Engagement & Experience: Designing interactive elements and memorable moments to connect with audiences.

- Global Promotion & Marketing: Utilizing diverse channels to build anticipation and drive attendance for international events.

Artist Management and Promotion

Artist management and promotion are core activities for CJ ENM, focusing on nurturing and marketing talent like K-pop groups and actors to drive content success and revenue. This encompasses everything from artist development and music production to orchestrating global concert tours and executing strategic promotional campaigns to boost artist appeal and international reach.

CJ ENM's commitment to artist promotion is evident in its performance metrics. For instance, ZEROBASEONE's album sales significantly bolstered the music category's revenue in Q3 2024, demonstrating the direct financial impact of these key activities.

- Artist Development: Cultivating new and existing talent through training, mentorship, and career planning.

- Content Production: Overseeing the creation of music albums, music videos, and other promotional content.

- Global Promotion: Executing marketing strategies for international markets, including tours, fan events, and digital campaigns.

- Revenue Generation: Driving sales through album releases, concert tickets, merchandise, and endorsements.

CJ ENM's key activities are centered on content creation, leveraging its expertise to produce a wide array of entertainment. This includes the strategic distribution and licensing of its extensive content library across global platforms, ensuring broad audience reach and revenue generation.

Furthermore, the operation and enhancement of its proprietary digital platforms, such as TVING, are crucial for subscriber growth and engagement. The company also excels in managing and executing large-scale live entertainment events, fostering direct fan interaction and global brand promotion.

Finally, nurturing and promoting artists, from K-pop groups to actors, is a fundamental activity that drives content success and overall revenue streams.

| Key Activity | Description | 2024/2025 Focus/Data |

|---|---|---|

| Content Creation & Production | Developing and producing TV dramas, films, music, and live performances. | Targeting approximately 65 productions in 2025. |

| Content Distribution & Licensing | Forging partnerships with broadcasters and streaming platforms for global distribution. | Securing deals in emerging markets like Latin America and MENA. |

| Platform Operation & Development | Managing and improving streaming services like TVING and Mnet Plus. | TVING reported over 7.8 million monthly active users in Q3 2024. |

| Live Entertainment Event Management | Organizing and executing global events such as KCON and MAMA Awards. | KCON LA 2024 attracted over 5.9 million fans. |

| Artist Management & Promotion | Nurturing and marketing talent to drive content success and revenue. | ZEROBASEONE's album sales significantly boosted music category revenue in Q3 2024. |

Full Version Awaits

Business Model Canvas

The CJ ENM Business Model Canvas you are currently previewing is the exact document you will receive upon purchase. This means you're seeing a direct, unedited section of the final deliverable, showcasing the comprehensive structure and content that will be yours. You can trust that what you see here is precisely what you'll get, ready for your immediate use and analysis.

Resources

CJ ENM’s Intellectual Property (IP) catalog is a powerhouse, featuring a rich collection of beloved TV shows, critically acclaimed films, chart-topping music, and adaptable format rights. This extensive library serves as a foundational asset, allowing for the development of sequels, remakes, and spin-offs, alongside robust global content licensing opportunities.

The company's key IPs, such as the Oscar-winning film 'Parasite,' the recent hit drama 'Queen Of Tears,' and the popular music guessing show 'I Can See Your Voice,' underscore the breadth and commercial appeal of its content. In 2023, CJ ENM reported that its content business, heavily reliant on IP, achieved significant revenue, with its drama segment alone contributing substantially to overall performance.

CJ ENM's creative talent and production teams are the bedrock of its content creation engine. This includes a vast network of writers, directors, producers, musicians, and actors, all crucial for developing compelling narratives and engaging performances. These skilled individuals are the driving force behind CJ ENM's ability to consistently produce high-quality and innovative content, a key differentiator in the competitive media landscape.

The company's commitment to nurturing and supporting these creative professionals is paramount. By fostering an environment that enables their imaginations, CJ ENM ensures a continuous pipeline of fresh ideas and original programming. This investment in human capital directly translates into the creation of content that resonates with audiences globally, underpinning CJ ENM's competitive edge.

CJ ENM's broadcasting channels like tvN and digital platforms such as TVING and Mnet Plus are fundamental. These assets are the primary conduits for delivering their diverse content library directly to consumers, ensuring broad reach and engagement.

The company's ownership and operation of these platforms are key. For instance, TVING, a significant digital streaming service, has seen its subscriber growth positively impact CJ ENM's overall profitability, demonstrating the direct financial benefit of these digital resources.

Global Distribution Network

CJ ENM's established global distribution network is a cornerstone of its business model, acting as a vital resource for the widespread dissemination of its content. This network is built upon strong relationships with international broadcasters, major OTT platforms, and crucial local partners worldwide.

This extensive reach allows CJ ENM to effectively penetrate diverse international markets, ensuring its K-content finds a global audience. For instance, in 2024, CJ ENM reported a significant expansion of its distribution footprint in Latin America, a key growth region.

- Global Reach: Facilitates the widespread distribution of K-content across international markets.

- Strategic Partnerships: Leverages relationships with broadcasters, OTT platforms, and local distributors.

- Market Penetration: Enables effective entry and engagement in diverse cultural and economic landscapes.

- Latin America Expansion: Demonstrated growth in key emerging markets during 2024.

Financial Capital and Investment Capacity

CJ ENM's business model hinges on substantial financial capital and a robust investment capacity to fuel its ambitious content creation and global expansion strategies. This financial strength is essential for undertaking high-budget productions, a hallmark of the company's approach to capturing market share and maintaining its industry leadership.

The company has committed to significant annual investments in content, underscoring its dedication to innovation and quality. For instance, CJ ENM has outlined plans to invest KRW1 trillion annually specifically for content creation, a move designed to solidify its competitive edge in the dynamic entertainment landscape.

- Significant Investment in Content: CJ ENM plans to invest KRW1 trillion annually in content creation.

- Global Expansion Funding: Financial capital is crucial for expanding operations into new international markets.

- Intellectual Property Acquisition: The capacity for investment enables the acquisition of valuable new intellectual properties (IPs).

- High-Budget Production Capability: Substantial financial resources are required to fund the high-budget productions that define CJ ENM's output.

CJ ENM's extensive Intellectual Property (IP) catalog, including hits like 'Parasite' and 'Queen Of Tears,' forms the core of its content business. This rich library fuels sequels, remakes, and global licensing, demonstrating significant commercial appeal and revenue generation potential.

The company's creative talent, encompassing writers, directors, and actors, is fundamental to producing high-quality, innovative content. CJ ENM's investment in these professionals ensures a continuous pipeline of engaging programming that resonates with a worldwide audience.

Broadcasting channels like tvN and digital platforms such as TVING are crucial for content delivery and audience engagement. TVING's subscriber growth, for example, directly contributes to CJ ENM's profitability, highlighting the value of these distribution assets.

CJ ENM's global distribution network, built on strong partnerships with international broadcasters and OTT platforms, enables effective market penetration. The company's expansion into regions like Latin America in 2024 exemplifies this strategic reach.

Financial capital is a key resource, enabling CJ ENM to fund ambitious content creation and global expansion. The company's commitment to investing KRW1 trillion annually in content underscores its strategy to maintain a competitive edge and produce high-budget productions.

| Key Resource | Description | Impact/Example |

| Intellectual Property (IP) | Vast catalog of TV shows, films, music, and format rights. | Oscar-winning 'Parasite,' hit drama 'Queen Of Tears,' global licensing opportunities. |

| Creative Talent | Network of writers, directors, producers, musicians, and actors. | Drives production of high-quality, innovative content; ensures audience resonance. |

| Broadcasting & Digital Platforms | tvN, TVING, Mnet Plus. | Direct content delivery to consumers; TVING's subscriber growth boosts profitability. |

| Global Distribution Network | Established relationships with international broadcasters, OTT platforms, and local partners. | Widespread dissemination of K-content; market penetration in regions like Latin America (2024). |

| Financial Capital | Investment capacity for content creation and global expansion. | Annual investment of KRW1 trillion in content; ability to fund high-budget productions. |

Value Propositions

CJ ENM's commitment to high-quality, diverse entertainment content is a cornerstone of its business model. They offer a broad spectrum of content, including dramas, films, music, and variety shows, ensuring a wide appeal across different tastes and demographics.

This diverse offering directly translates into strong audience engagement and viewership. For instance, in 2024, CJ ENM’s flagship drama series continued to achieve significant viewership numbers and critical acclaim, reinforcing their reputation for producing compelling narratives.

The company strategically focuses on creating high-impact content with global potential. This approach allows them to tap into international markets, further expanding their reach and revenue streams. Their investment in original productions and collaborations with international partners in 2024 highlights this global ambition.

CJ ENM capitalizes on its leadership in the Korean Wave, delivering globally influential K-content and immersive cultural experiences. This resonates with the escalating international appetite for Korean entertainment, cultivating a robust global following and promoting cultural dialogue.

In 2023, CJ ENM's K-content, including dramas and music, continued to see significant global traction. For instance, the company's music division, through Mnet, played a pivotal role in the global success of K-pop artists, contributing to a substantial portion of its revenue from international markets.

CJ ENM ensures its content reaches audiences everywhere through a robust multi-platform strategy. This includes its flagship TV channels, its dedicated streaming services like TVING and Mnet Plus, and partnerships with global platforms. This approach caters to diverse viewing habits, offering flexibility and convenience.

For instance, CJ ENM's film division actively leverages this multi-platform accessibility. A prime example is how their successful films are often re-released or made available on various Over-The-Top (OTT) streaming services, extending their reach and revenue streams. In 2023, the Korean film market saw significant growth on OTT platforms, with many domestic films achieving substantial viewership numbers, demonstrating the power of this distribution model.

Innovative and Trend-Setting Content

CJ ENM consistently pushes boundaries by developing innovative and trend-setting content. They actively integrate emerging technologies, such as artificial intelligence, into their production processes and explore unique storytelling methods. This dedication to novelty ensures a continuous stream of fresh and captivating material for their audience, solidifying their reputation as an industry leader.

The company's strategic use of AI spans the entire content creation and distribution lifecycle. For instance, in 2024, CJ ENM announced advancements in AI-powered content recommendation engines, aiming to personalize viewer experiences and increase engagement metrics. This technological adoption not only enhances efficiency but also fuels the creation of content that resonates deeply with current audience preferences.

- AI-Driven Content Personalization: CJ ENM leverages AI to tailor content suggestions, boosting viewer retention.

- Technological Integration: Adoption of new technologies like AI across the content value chain.

- Trend-Setting Production: Commitment to creating novel and engaging content formats.

- Industry Leadership: Reinforcing their position as a pioneer through continuous innovation.

Engaging Live Experiences and Fan Interaction

CJ ENM excels at creating vibrant live experiences, such as KCON and the MAMA Awards, which are central to its value proposition. These events offer fans direct opportunities to connect with their favorite artists and fellow enthusiasts, building a powerful sense of community. This interactive engagement is crucial for deepening fan loyalty and making K-culture more immersive.

For instance, KCON is more than just a concert; it's a comprehensive fan festival. In 2023, KCON LA drew over 90,000 attendees, showcasing the immense draw of these live, interactive events. These gatherings feature not only performances but also fan engagement activities and cultural exhibitions, reinforcing the bond between artists and their global fanbase.

- KCON's Growth: KCON has expanded its reach globally, with events in various countries demonstrating its broad appeal and CJ ENM's ability to cultivate international fan communities.

- MAMA Awards Impact: The MAMA Awards serve as a premier platform for recognizing achievements in K-pop, driving significant fan attention and participation through voting and social media buzz.

- Community Building: These live events are designed to foster strong community ties, turning passive viewers into active participants and brand advocates.

- Fan Loyalty: By providing unique and memorable experiences, CJ ENM cultivates a high degree of fan loyalty, which translates into sustained engagement and potential revenue streams.

CJ ENM's value proposition centers on delivering high-quality, diverse entertainment content that resonates globally. They leverage technological innovation, like AI-driven personalization, to enhance viewer engagement and create trend-setting productions. Furthermore, their ability to foster vibrant live experiences, exemplified by KCON and the MAMA Awards, builds strong fan communities and cultivates loyalty.

Customer Relationships

CJ ENM cultivates direct audience connections through its owned digital channels, notably TVING and Mnet Plus. These platforms facilitate tailored content suggestions, direct feedback loops, and community features designed to boost user loyalty and interaction. For instance, TVING saw significant growth in subscriber numbers leading into 2024, reflecting increased engagement with its exclusive content offerings.

Mnet Plus specifically amplifies CJ ENM's global footprint by providing exclusive K-pop content, tapping into a massive international fanbase. This strategic digital presence allows for deeper audience understanding and more personalized engagement, crucial for maintaining a competitive edge in the entertainment sector.

CJ ENM cultivates vibrant fan communities through major live events like KCON and the MAMA Awards. These gatherings offer immersive experiences, allowing fans to connect directly with their favorite artists and fellow enthusiasts, thereby nurturing a powerful sense of belonging and deep emotional investment.

KCON, in particular, has been instrumental in building a robust global fanbase for K-culture. For instance, KCON LA 2023 drew over 100,000 attendees, showcasing the immense reach and engagement these events generate, solidifying fan loyalty and expanding the brand's international footprint.

CJ ENM leverages social media platforms like YouTube and Instagram to foster strong connections with its audience. In 2024, the company saw significant growth in its YouTube subscriber base, exceeding 10 million, and its Instagram engagement rates remained consistently above industry averages, demonstrating active fan interaction.

Through these channels, CJ ENM shares exclusive behind-the-scenes footage, interactive polls, and Q&A sessions, creating a direct line of communication. This approach not only amplifies the buzz around their content but also allows for real-time adaptation to fan preferences, as evidenced by the rapid incorporation of trending topics into their content strategy throughout the year.

Subscriber-Based Services and Loyalty Programs

CJ ENM cultivates subscriber-based relationships for its streaming platforms, like TVING, prioritizing consistent value and exclusive content to foster loyalty. This approach aims to build a dedicated user base through differentiated offerings and potentially enhanced loyalty programs.

TVING's strategy has proven effective, with its revenue seeing a notable increase. This growth is directly attributed to its focus on providing unique, high-quality content and implementing flexible ad payment plans, demonstrating the power of a subscriber-centric model.

- Subscriber Retention: TVING's model focuses on keeping subscribers engaged through a steady stream of differentiated content, a key driver for recurring revenue.

- Loyalty Incentives: The potential for loyalty programs aims to reward long-term subscribers, further solidifying their commitment to the platform.

- Revenue Growth: In 2023, TVING reported significant revenue increases, driven by its strategy of offering exclusive content and varied ad payment options, showcasing the success of its subscriber-based approach.

Collaborative Content Creation with Audiences

CJ ENM actively fosters audience engagement through collaborative content creation, aiming to build deeper connections and ensure content resonates with viewer preferences. This strategy was evident in their 2023 initiatives where audience feedback directly influenced program development, leading to a reported 15% increase in viewer retention for participating shows.

This co-creation model allows CJ ENM to tap into the collective creativity of its audience, transforming passive viewers into active participants. For instance, audition programs developed in partnership with local studios in 2024 provided a platform for aspiring talent, simultaneously generating authentic, relatable content that directly appealed to fan bases, boosting social media engagement by an average of 20% across platforms.

- Audience Input Integration: CJ ENM may solicit direct input from audiences for specific content projects, enhancing relevance and viewer investment.

- Co-Ownership and Connection: Collaborative creation fosters a sense of shared ownership, strengthening the bond between CJ ENM and its viewers.

- Resonant Content Development: This approach ensures content aligns with audience desires, leading to higher engagement and satisfaction rates.

- Partnerships for Talent Discovery: Collaborating with local studios for audition programs showcases emerging talent and generates authentic, fan-driven content.

CJ ENM maintains strong customer relationships through its digital platforms like TVING and Mnet Plus, fostering direct engagement and community. Live events such as KCON and MAMA Awards further deepen these connections, creating shared experiences that build loyalty. The company also actively uses social media to interact with its audience, incorporating feedback to shape content. This multi-faceted approach ensures a consistently engaged and invested fanbase.

Channels

CJ ENM leverages its proprietary broadcasting channels, notably tvN, as a cornerstone for distributing its diverse content portfolio, including popular dramas and variety shows. This direct access to a vast domestic viewership is critical for building brand equity and ensuring widespread recognition of its original productions.

In 2023, CJ ENM's Media Content segment, heavily reliant on its broadcasting assets, reported significant revenue streams, with tvN consistently ranking as a top-tier entertainment channel in South Korea, contributing substantially to the company's overall financial performance.

CJ ENM leverages its owned streaming platforms, specifically TVING and Mnet Plus, to distribute a wide array of content. These digital avenues offer global audiences on-demand access to its extensive library, directly contributing to subscriber acquisition and retention.

TVING demonstrated significant user engagement, reporting over 7.8 million monthly active users in the third quarter of 2024. This robust user base highlights the platform's success in capturing and maintaining viewer interest in the competitive OTT market.

CJ ENM actively partners with leading global streaming services, including Netflix and Shahid, to distribute its diverse content portfolio. These strategic alliances are crucial for extending the reach of Korean entertainment, known as K-content, to a broad international audience and breaking down geographical limitations.

In a significant development, CJ ENM secured a substantial content deal with Shahid, a prominent Middle Eastern streaming platform. This agreement is expected to further bolster the global popularity of K-dramas and other CJ ENM productions by tapping into new and growing markets.

International Broadcasters and Cable Networks

Content from CJ ENM, particularly its popular K-dramas, finds its way to global audiences through licensing agreements with international broadcasters and cable networks. This established method of distribution is crucial for reaching viewers who still rely on traditional, linear television viewing experiences. For instance, in 2023, CJ ENM secured significant distribution deals for its content, including K-dramas, across key Latin American markets, demonstrating the continued strength of this channel.

This approach ensures broad accessibility, allowing CJ ENM to tap into diverse markets that may not be fully saturated with digital streaming platforms. The ability to license content to established networks provides a reliable revenue stream and extends the reach of their intellectual property. By leveraging these partnerships, CJ ENM effectively caters to a global audience accustomed to scheduled programming.

- Licensing Agreements: CJ ENM licenses its content library to international broadcasters and cable networks.

- Linear TV Reach: This channel ensures accessibility for audiences who prefer traditional television viewing.

- Market Penetration: CJ ENM has successfully expanded its reach through deals in regions like Latin America.

- Revenue Generation: These partnerships provide a consistent revenue stream for the company's content.

Live Event Venues and Digital Event Platforms

CJ ENM leverages both physical and digital spaces to deliver its entertainment content. For live experiences, they utilize significant event venues to host major festivals and award shows, creating memorable moments for attendees.

Simultaneously, digital platforms are crucial for extending the reach of these live events, allowing a global audience to participate remotely. This dual approach ensures broad accessibility and engagement.

For instance, KCON LA 2024 saw an impressive engagement of over 5.9 million fans tuning in through various digital platforms, highlighting the power of this hybrid strategy in connecting with a worldwide fan base.

- Physical Venues: Hosting large-scale events like KCON and MAMA Awards.

- Digital Platforms: Enabling global live streaming and extended reach.

- Audience Engagement: KCON LA 2024 reached over 5.9 million fans digitally.

CJ ENM utilizes its owned broadcasting channels, such as tvN, as a primary distribution method for its content. This direct access to a large domestic audience is vital for building brand recognition for its original productions.

The company also operates its own streaming platforms, TVING and Mnet Plus, offering global viewers on-demand access to its extensive content library. TVING, in particular, reported over 7.8 million monthly active users in Q3 2024, demonstrating strong user engagement in the competitive streaming market.

Furthermore, CJ ENM engages in strategic partnerships with global streaming services like Netflix and Shahid to distribute its content internationally, significantly expanding the reach of K-content. Licensing agreements with traditional broadcasters also ensure accessibility for audiences who prefer linear television, with notable distribution deals secured in Latin America during 2023.

CJ ENM also leverages physical event spaces for festivals and award shows, complemented by digital platforms for global live streaming. KCON LA 2024, for example, attracted over 5.9 million fans through digital channels, showcasing the effectiveness of this hybrid approach.

| Channel Type | Key Platforms/Methods | 2023/2024 Data/Examples | Reach/Impact |

| Owned Broadcasting | tvN | Top-tier entertainment channel in South Korea | Significant domestic viewership, brand equity |

| Owned Streaming | TVING, Mnet Plus | TVING: 7.8M+ MAU (Q3 2024) | Global on-demand access, subscriber acquisition |

| Global Partnerships | Netflix, Shahid | Content deals with Shahid for Middle East | Extended reach of K-content, new market penetration |

| Licensing Agreements | International Broadcasters/Networks | Deals in Latin American markets (2023) | Linear TV reach, reliable revenue stream |

| Live Events & Digital | KCON, MAMA Awards | KCON LA 2024: 5.9M+ digital fans | Hybrid engagement, global fan base connection |

Customer Segments

Global K-Content Enthusiasts represent a massive and expanding international fanbase captivated by Korean dramas, films, music, and variety shows. This demographic actively seeks and consumes K-content across numerous platforms, fueling the global spread of the Korean Wave.

The significant global influence of premium Korean intellectual property and the remarkable success of key artists have directly contributed to a surplus trend in this segment. For instance, in 2023, the global K-pop market alone was valued at approximately $10 billion, with a projected compound annual growth rate of 12.7% through 2027, underscoring the immense scale and growth potential of these enthusiasts.

Domestic Korean viewers represent CJ ENM's foundational customer base, consuming content across its television channels, film productions, and domestic streaming platforms. This segment is crucial for the company's local market dominance and advertising income, with popular shows on channels like tvN consistently achieving high viewership ratings, demonstrating strong engagement.

CJ ENM's music division deeply connects with dedicated music fans, especially those passionate about K-pop and other genres within their extensive label portfolio. These fans actively participate through purchasing new music releases, attending live concerts and fan meetings, and buying artist-specific merchandise, showcasing a high level of engagement and loyalty.

The robust sales performance of groups like ZEROBASEONE exemplifies this segment's significant impact. For instance, ZEROBASEONE's debut album, Youth in the Shade, achieved over 1 million pre-orders, highlighting the immense purchasing power and anticipation within the K-pop fan base that CJ ENM cultivates.

Film Enthusiasts and Moviegoers

This segment encompasses individuals who actively engage with films, whether in theaters or through streaming services. They are drawn to a variety of cinematic experiences, from large-scale blockbusters to more niche, independent productions. For instance, CJ ENM's high-budget film 'I, the Executioner' demonstrated significant appeal, attracting approximately 7.5 million moviegoers, highlighting the segment's appetite for diverse film content.

The preferences within this group range widely, covering both commercially successful, mainstream releases and films recognized for their artistic merit or unique storytelling. This broad interest ensures a consistent demand for CJ ENM's diverse film portfolio.

- Cinema Goers: Individuals who prefer the theatrical experience for new releases.

- Streaming Subscribers: Those who consume films via digital platforms after their theatrical run.

- Genre Aficionados: Moviegoers with specific interests in particular genres, from action to drama.

- Art House Supporters: Audiences who seek out critically acclaimed or independent films.

Digital Platform Subscribers (TVING, Mnet Plus)

This customer segment encompasses individuals who pay to access CJ ENM's exclusive digital content platforms, specifically TVING and Mnet Plus. These subscribers are looking for premium entertainment, including original series, live broadcasts, and unique fan experiences. Their engagement directly fuels CJ ENM's revenue through subscription fees.

The value proposition for these users centers on access to exclusive content and a curated viewing experience. They are willing to pay for the convenience and quality offered by these proprietary services. This segment is crucial for generating recurring income.

- Digital Platform Subscribers: Paid users of TVING and Mnet Plus.

- Content Demand: Seek exclusive content, live sports, and curated experiences.

- Revenue Stream: Direct subscription fees contribute significantly to CJ ENM's income.

- User Growth: TVING reported over 7.8 million monthly active users in Q3 2024, showcasing strong user engagement.

CJ ENM's customer segments are diverse, ranging from global K-content enthusiasts to domestic Korean viewers and dedicated music fans. The company also caters to film buffs, both in theaters and on streaming platforms, as well as subscribers to its digital content services like TVING and Mnet Plus. These segments collectively represent a broad audience base that drives CJ ENM's revenue through content consumption, merchandise, and subscriptions.

The company's ability to capture these varied segments is evident in the performance of its content and platforms. For instance, TVING's user base reached over 7.8 million monthly active users in Q3 2024, demonstrating strong digital platform engagement. Similarly, the success of K-pop groups, with debut album pre-orders exceeding one million for acts like ZEROBASEONE, highlights the power of dedicated music fans. The film division also saw significant traction, with 'I, the Executioner' drawing approximately 7.5 million moviegoers.

| Customer Segment | Key Characteristics | Engagement Methods | Example Data/Metrics (2023-2024) |

|---|---|---|---|

| Global K-Content Enthusiasts | Passionate about Korean dramas, films, music, variety shows. Actively seek content globally. | Streaming, social media engagement, purchasing merchandise. | K-pop market valued at ~$10 billion in 2023, projected 12.7% CAGR through 2027. |

| Domestic Korean Viewers | Foundation of CJ ENM's viewership. Consume content on company's TV channels and platforms. | Watching TV, using streaming services, engaging with local content. | High viewership ratings for tvN dramas indicate strong domestic engagement. |

| Music Fans (K-pop focused) | Dedicated followers of K-pop and other genres within CJ ENM's music labels. | Purchasing albums, attending concerts, buying merchandise, fan events. | ZEROBASEONE's debut album achieved over 1 million pre-orders. |

| Cinema Goers/Film Enthusiasts | Individuals who enjoy films in theaters or via streaming, across various genres. | Attending movie releases, subscribing to streaming services, seeking diverse cinematic experiences. | 'I, the Executioner' attracted ~7.5 million moviegoers. |

| Digital Platform Subscribers (TVING, Mnet Plus) | Users paying for exclusive digital content, original series, and live broadcasts. | Subscription fees, consuming premium content on digital platforms. | TVING reported >7.8 million monthly active users in Q3 2024. |

Cost Structure

Content production is a major expense for CJ ENM, encompassing everything from securing top talent and skilled crews to renting locations and handling post-production for their films, dramas, and music. This investment is crucial for creating the high-quality entertainment their audience expects.

The financial commitment to producing scripted content has significantly increased, with costs reportedly doubling since the pandemic era. This surge reflects rising expenses for talent, production resources, and the overall demand for engaging narratives.

CJ ENM invests heavily in marketing and promotion to boost its content, artists, and platforms worldwide. These expenses cover advertising, PR, social media, and events designed to capture and keep audiences. In 2023, CJ ENM's total marketing and selling expenses amounted to 1.14 trillion KRW, reflecting this commitment.

The company leverages AI throughout its content creation and distribution process, including for marketing efforts. This AI integration aims to optimize campaign effectiveness and reach, ensuring a more targeted and efficient approach to audience engagement.

CJ ENM incurs substantial costs for distributing its content, a significant portion of which goes towards licensing fees paid to third-party platforms and broadcasters. This is crucial for ensuring broad audience reach, but it represents a major financial commitment. For instance, in 2023, CJ ENM reported significant expenses related to content distribution and platform fees, reflecting the ongoing investment required to maintain and expand its market presence.

Technology and Platform Infrastructure Costs

Operating and maintaining digital platforms such as TVING and Mnet Plus demands substantial investment in technology infrastructure. This includes ongoing costs for server maintenance, robust cybersecurity measures, and continuous platform development to ensure a smooth user experience and reliable content delivery.

CJ ENM is strategically focused on enhancing the global capabilities of its digital platforms, which directly impacts the expenditure in this cost structure. By 2024, the company was actively investing in scaling its infrastructure to support a growing international user base and expanding content offerings.

- Infrastructure Investment: Significant capital is allocated to cloud computing services, data storage, and network bandwidth to support high-definition streaming and interactive features across platforms.

- Platform Development: Ongoing expenses cover software engineering, UI/UX design, and feature enhancements to maintain competitive edge and user engagement.

- Cybersecurity: Protecting user data and intellectual property necessitates continuous investment in advanced security protocols, threat detection, and compliance with data privacy regulations.

- Global Expansion: Costs are incurred for localizing platforms, establishing regional data centers, and ensuring compliance with international digital content distribution laws as CJ ENM strengthens its global presence.

Artist Management and Event Operation Costs

CJ ENM's cost structure is significantly impacted by expenses tied to artist management and the operation of large-scale events. This includes artist salaries, ongoing training and development, and the considerable outlays for artist tours and promotional activities.

Organizing flagship events like KCON and the MAMA Awards represents a substantial financial commitment. These events require significant investment in venue rental, production, marketing, and talent acquisition, directly influencing the company's operational costs.

- Artist Salaries and Development: Direct compensation and investment in artist growth are core expenses.

- Touring and Promotion: Costs associated with artist travel, accommodation, and marketing campaigns.

- Event Production Costs: Significant expenditure on venue, staging, technology, and logistics for events like KCON.

- MAMA Awards Operations: The MAMA Awards, set to return to Hong Kong in 2025, incurs substantial costs for international event execution.

CJ ENM's cost structure is heavily influenced by content production, with significant investments in talent, locations, and post-production, reflecting the doubled costs since the pandemic. The company also allocates substantial funds towards marketing and promotion, amounting to 1.14 trillion KRW in 2023, to enhance global reach. Distribution costs, including licensing fees to third-party platforms, are also a major expense, crucial for broad audience access.

| Cost Category | Description | 2023 Financial Impact (KRW) |

| Content Production | Talent, locations, post-production for films, dramas, music. | Significant, with costs doubling post-pandemic. |

| Marketing & Promotion | Advertising, PR, social media, events for global reach. | 1.14 trillion |

| Content Distribution | Licensing fees to third-party platforms and broadcasters. | Significant, reflecting ongoing investment. |

| Platform Operations (TVING, Mnet Plus) | Infrastructure, cybersecurity, development for digital platforms. | Ongoing investment for scaling and global expansion. |

| Artist Management & Events | Artist salaries, training, touring, and major events like KCON and MAMA. | Substantial outlays for artist development and large-scale event execution. |

Revenue Streams

CJ ENM generates significant revenue by licensing its extensive content library, which includes popular K-dramas and films, to international broadcasters and global streaming services. These licensing agreements provide fees for the rights to air or stream their productions, a strategy that has proven profitable. For instance, in 2023, CJ ENM reported robust growth in its content distribution segment, driven by the global popularity of its intellectual property.

CJ ENM generates significant revenue from advertising placements across its extensive network of broadcasting channels and digital platforms. This includes traditional television commercials, digital ad impressions on popular streaming services, and various forms of sponsored content tailored to its diverse audience.

While the overall advertising market experienced a contraction in 2023, CJ ENM demonstrated resilience. The company's ability to maintain and even grow its advertising revenue was largely attributed to the strong performance and competitiveness of its content offerings, attracting advertisers seeking to reach engaged viewers.

Subscription fees from users of its Over-The-Top (OTT) streaming platforms, like TVING, are a significant and expanding source of income for CJ ENM. The financial performance here is directly tied to the number of paying subscribers and the strategic implementation of different subscription plans. For instance, TVING itself saw a substantial revenue jump of 33.4% year-on-year, reaching 435.3 billion won, highlighting the increasing importance of this revenue channel.

Film Box Office and Ancillary Sales

CJ ENM's film division generates significant revenue through box office receipts from its theatrical releases. Beyond the silver screen, ancillary sales play a crucial role, encompassing home entertainment, merchandise tied to popular films, and international distribution rights.

The performance of high-budget productions directly impacts this revenue stream. For instance, while CJ ENM experienced a decrease in sales within its film and drama categories in the first half of 2024, this was despite the success of some of its major film releases, highlighting the volatility of this sector.

- Box Office Receipts: Direct income from movie ticket sales in theaters.

- Ancillary Sales: Revenue from DVD/Blu-ray, streaming rights, merchandise, and licensing.

- International Sales: Income from distributing films in foreign markets.

- Impact of High-Budget Films: Success of major productions is key to maximizing this revenue.

Music Sales and Live Entertainment Events

CJ ENM generates significant revenue from music sales, encompassing physical albums and digital downloads, alongside income from live entertainment events. This includes ticket sales for concerts and major award shows like the MAMA Awards, as well as revenue from associated merchandise. The performance of their artists and the scale of these events are direct drivers of this revenue stream.

In 2023, CJ ENM's music division saw robust performance, with album sales contributing substantially. For instance, the K-pop group ZEROBASEONE's debut album alone achieved impressive sales figures, underscoring the impact of successful artist launches on this revenue category. The company continues to leverage its global platforms like KCON to maximize income from live events and related merchandise.

- Music Sales: Revenue from physical albums, digital downloads, and streaming royalties.

- Live Entertainment Events: Income from ticket sales, sponsorships, and broadcasting rights for concerts and festivals like KCON.

- Merchandise: Sales of artist-related goods and event-specific merchandise.

- Artist Performance Impact: Direct correlation between artist popularity and success of music and live event revenue.

CJ ENM's revenue streams are diverse, encompassing content licensing, advertising, subscriptions, film production, and music/live entertainment. These segments collectively drive the company's financial performance, with each contributing uniquely to its overall income generation.

In 2023, CJ ENM's content distribution segment showed strong growth, fueled by global demand for its intellectual property. Advertising revenue demonstrated resilience despite market challenges, supported by the company's popular content. The company's OTT platform, TVING, experienced a significant revenue increase, highlighting the growing importance of subscription services.

| Revenue Stream | Key Activities | 2023 Performance Highlight |

|---|---|---|

| Content Licensing | Licensing K-dramas, films to broadcasters/streamers | Robust growth driven by global IP popularity |

| Advertising | TV commercials, digital ads, sponsored content | Resilient revenue despite market contraction |

| Subscriptions (TVING) | User fees for OTT platform | 33.4% year-on-year revenue jump (435.3 billion won) |

| Film Division | Box office, home entertainment, merchandise, international sales | Volatility noted in first half of 2024 despite some successful releases |

| Music & Live Entertainment | Album sales, digital downloads, concerts, award shows (MAMA) | Strong performance in 2023 album sales; KCON impact |

Business Model Canvas Data Sources

The CJ ENM Business Model Canvas is constructed using a blend of internal financial reports, comprehensive market research on entertainment and media trends, and strategic analyses of competitor activities. These diverse data sources ensure a robust and accurate representation of CJ ENM's strategic framework.