CJ ENM Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CJ ENM Bundle

CJ ENM navigates a dynamic entertainment landscape, facing intense rivalry from established players and emerging digital platforms. Understanding the bargaining power of buyers and the constant threat of substitutes is crucial for their sustained success.

The complete report reveals the real forces shaping CJ ENM’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of top-tier talent, including actors, directors, musicians, and writers, is substantial for CJ ENM. Their unique creative input and existing fan followings mean they can command significant fees, directly impacting production budgets. For instance, in 2024, top K-pop artists and lead actors in major K-dramas often secure multi-million dollar contracts, reflecting their global appeal and the intense competition to secure their involvement.

Production studios and intellectual property (IP) holders can wield considerable bargaining power over CJ ENM. While CJ ENM has its own production capabilities, it also relies on external studios and the acquisition of IP to fuel its content pipeline. Suppliers of unique or highly sought-after content, particularly for niche genres or globally recognized franchises, can command higher fees or more favorable terms. For instance, a successful K-drama IP holder could leverage the proven market demand to negotiate a larger share of revenue or exclusive distribution rights.

Suppliers of specialized broadcasting equipment, streaming technology, and digital infrastructure hold moderate bargaining power over CJ ENM. While multiple vendors exist, the significant investment required for new systems and the integration challenges create substantial switching costs for a company like CJ ENM, which operates extensive platforms such as TVING.

This reliance on advanced, often proprietary, technology means that providers of cutting-edge solutions can exert influence. For instance, CJ ENM's exploration of AI technology for production and distribution highlights a dependence on specialized tech providers, who can leverage their unique offerings to negotiate terms. As of 2024, the global market for media infrastructure technology is highly competitive but also characterized by high R&D costs for suppliers, allowing them to command premium pricing for innovative solutions.

Distribution Platform Partners

Major global streaming platforms, such as Amazon Prime Video, are significant buyers of CJ ENM's content for worldwide distribution. This makes them powerful players due to their substantial purchasing volume.

CJ ENM's strategic partnerships with these platforms are crucial for expanding its global reach and facilitating K-content exports. These collaborations are essential for maximizing the audience and financial success of its productions.

- Key Platforms: Major buyers include Amazon Prime Video, Netflix, and Disney+, which are actively seeking diverse content.

- Content Licensing Deals: In 2023, the global streaming market saw continued robust demand for Korean content, with licensing deals contributing significantly to CJ ENM's revenue streams. Specific figures for individual deals are often confidential, but the overall trend indicates strong buyer interest.

- Global Reach vs. Dependence: While these platforms offer unparalleled global reach, CJ ENM's reliance on them for broad distribution can shift bargaining power towards the platforms, especially for exclusive content rights.

Marketing and Advertising Service Providers

Marketing and advertising service providers hold moderate bargaining power over CJ ENM. The industry is fragmented with numerous agencies and digital platforms, meaning CJ ENM can often find competitive pricing and tailored solutions. For instance, in 2024, the global digital advertising market was projected to reach over $700 billion, indicating a vast supply of service providers.

However, the necessity of effective marketing for content visibility in a crowded entertainment market, especially in South Korea where CJ ENM operates, grants these providers some leverage. Successful campaigns are vital for CJ ENM's content to gain traction and reach its target demographics. Specialized agencies offering data-driven insights and creative excellence can command higher fees.

- Fragmented Market: Numerous agencies and platforms offer marketing and advertising services, increasing CJ ENM's options.

- Industry Growth: The global digital advertising market's significant size in 2024 (projected over $700 billion) reflects a competitive supply landscape.

- Content Visibility Needs: CJ ENM's reliance on effective marketing to cut through entertainment clutter gives service providers some influence.

- Specialized Expertise: Agencies with proven track records in driving engagement and ROI can negotiate more favorable terms.

The bargaining power of suppliers for CJ ENM is generally moderate, with some exceptions. While CJ ENM benefits from a diverse range of suppliers for various operational needs, including talent, production, and technology, certain key suppliers can exert significant influence. This is particularly true for specialized creative talent and critical technology providers where alternatives are limited or switching costs are high.

In 2024, the demand for premium content creators and intellectual property (IP) remained high, allowing these suppliers to negotiate favorable terms. For instance, securing top-tier actors or exclusive rights to popular webtoons or novels often involves substantial upfront payments and revenue-sharing agreements, directly impacting CJ ENM's production budgets and profitability.

Technology suppliers for advanced broadcasting and streaming infrastructure also hold considerable sway. The integration of new systems, such as AI-driven content recommendation engines or high-definition broadcasting equipment, requires significant investment and expertise, creating high switching costs for CJ ENM. This dependence on specialized, often proprietary, technology allows these providers to command premium pricing and influence contract terms, as seen with CJ ENM's ongoing investment in its TVING platform.

| Supplier Category | Bargaining Power | Key Factors | 2024 Impact/Data |

|---|---|---|---|

| Creative Talent (Actors, Directors, Writers) | High | Unique skills, fan following, limited supply of top-tier talent | Multi-million dollar contracts for lead talent in major productions. |

| IP Holders (K-drama, Webtoon, Music) | High | Proven market demand, exclusive rights, potential for global franchises | Negotiation for larger revenue shares and exclusive distribution rights for successful IPs. |

| Technology Providers (Broadcasting, Streaming, AI) | Moderate to High | High R&D costs, proprietary technology, integration complexity, switching costs | Premium pricing for innovative solutions; essential for platform development (e.g., TVING). |

| Marketing & Advertising Services | Moderate | Fragmented market, but essential for content visibility | Global digital advertising market projected over $700 billion in 2024, indicating competitive supply. |

What is included in the product

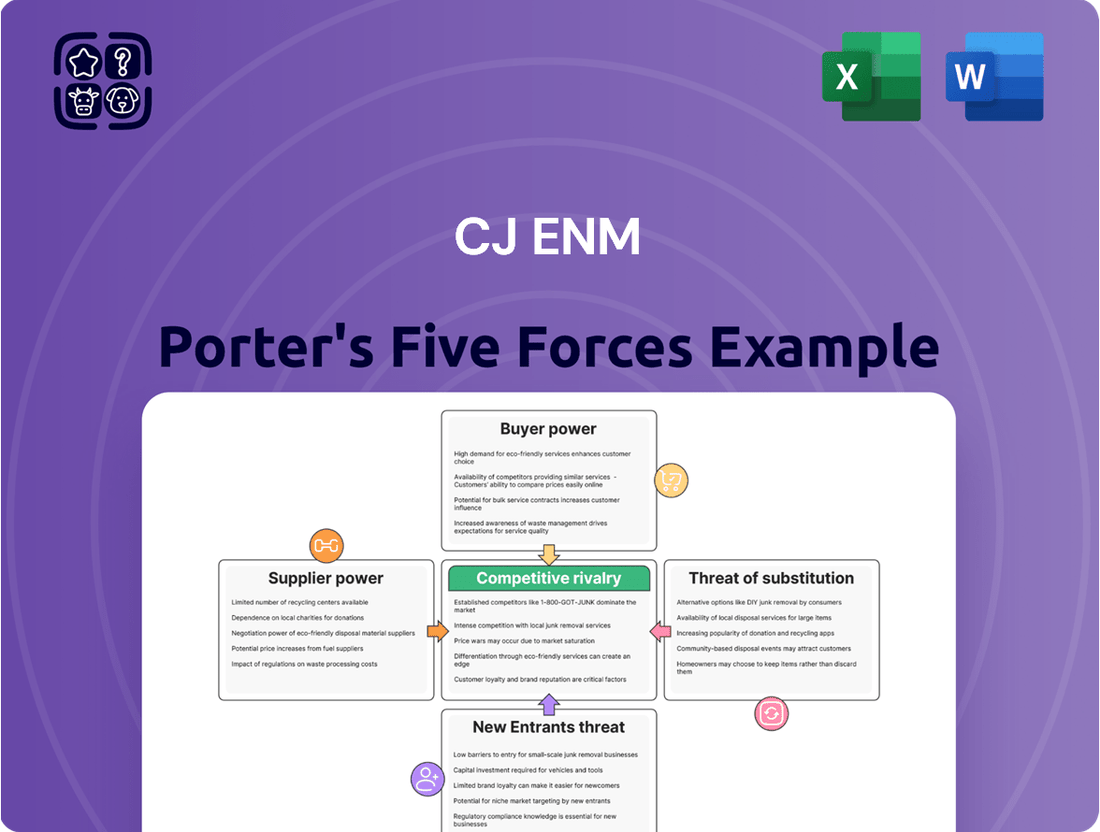

This analysis of CJ ENM's competitive landscape meticulously examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes.

Instantly identify and mitigate competitive threats with a dynamic CJ ENM Porter's Five Forces model, allowing for proactive strategy adjustments.

Customers Bargaining Power

Individual viewers and subscribers hold significant bargaining power. The sheer volume of entertainment choices available, from rival streaming services to traditional broadcast channels, means consumers can easily shift their attention and spending. For instance, in 2023, the global streaming market saw intense competition, with numerous platforms vying for subscriber loyalty.

Switching between these entertainment providers is typically effortless and inexpensive. This low barrier to entry for consumers means companies like CJ ENM, with its streaming service TVING, must constantly innovate and offer unique content to keep viewers engaged. The ability for viewers to readily cancel subscriptions and explore alternatives directly impacts revenue streams and market share.

Advertisers wield significant bargaining power over broadcasting platforms like CJ ENM, particularly given the ongoing contraction in the traditional advertising market. In 2023, the global advertising market experienced a slowdown, with some projections indicating modest growth for 2024, but the shift towards digital remains a dominant trend.

While CJ ENM saw a rise in TVING users, its overall media platform content revenue is still susceptible to the advertising market's dynamics. Advertisers can leverage this by demanding better rates or shifting budgets to more cost-effective channels.

The proliferation of digital and mobile platforms provides advertisers with a vast array of alternatives to reach consumers. This increased choice directly enhances their ability to negotiate terms and pressure traditional broadcasters like CJ ENM for more favorable advertising packages.

Global streaming giants like Amazon Prime Video represent a significant customer base for CJ ENM's content. These platforms, with their millions of subscribers worldwide, possess considerable bargaining power due to their consistent demand for diverse and exclusive content, particularly the highly sought-after K-content. This demand allows them to negotiate favorable terms for content acquisition.

The sheer scale of global distribution offered by these streaming services provides them with substantial leverage. CJ ENM strategically partners with these platforms to expand its content's reach internationally, effectively using these relationships to boost its global business and accelerate content exports. For instance, CJ ENM's drama 'Queen of Tears' achieved significant global viewership on Netflix in 2024, demonstrating the power of these distribution partnerships.

Live Entertainment Attendees

Live entertainment attendees, particularly fans of global phenomena like K-pop, wield considerable bargaining power. Their decision to purchase tickets and engage with events directly fuels revenue, making their willingness to pay a critical factor in success. For instance, CJ ENM's KCON events rely heavily on fan enthusiasm and spending. In 2023, KCON LA alone saw tens of thousands of attendees, demonstrating the scale of fan engagement that translates into significant purchasing power.

Organizers must constantly innovate to capture and retain this audience. While the K-pop market is robust, with projections indicating continued growth, the sheer variety of entertainment options available means that fan loyalty is not guaranteed. This necessitates offering compelling, unique experiences that justify the cost and time commitment for attendees. The market's expansion, however, is tied to the ability to consistently deliver high-value content that resonates with a discerning global fanbase.

- Fan Loyalty is Paramount: The success of live events like KCON hinges on the dedicated global fanbase's willingness to attend and spend.

- Demand for Unique Experiences: High production costs and numerous entertainment choices compel organizers to offer distinctive events to attract attendees.

- Market Growth Potential: The K-pop events sector is expected to expand, but sustained fan engagement is crucial for this growth.

- Revenue Driver: Attendee spending on tickets, merchandise, and related activities directly impacts the financial viability of live entertainment productions.

Film Audiences

The bargaining power of film audiences remains significant, especially given the ongoing challenges and gradual recovery of the theatrical market. In 2023, global box office revenue reached approximately $32 billion, a notable increase from previous years but still below pre-pandemic levels, indicating audience selectivity.

Audiences are increasingly discerning, and a film's success hinges on its perceived value and appeal. Lukewarm reviews can directly impact a film's box office performance, leading to a contraction in the investment market as studios and distributors become more cautious. For instance, films with strong critical reception and positive word-of-mouth tend to perform better, demonstrating the direct correlation between audience perception and financial outcomes.

- Audience Selectivity: Filmgoers are more selective, prioritizing films that offer a compelling experience, contributing to the $32 billion global box office in 2023.

- Impact of Reviews: Negative or lukewarm reviews can significantly deter audiences, impacting a film's financial viability and investor confidence.

- Value Perception: The perceived value of a movie ticket, considering the cost and the quality of the cinematic experience, directly influences attendance.

- Market Recovery: While the theatrical market is recovering, audience return rates are still being closely watched, underscoring their power to shape industry trends.

Consumers, whether as individual viewers or as part of larger entities like global streaming platforms, possess substantial bargaining power. This is amplified by the vast array of entertainment options available and the ease with which consumers can switch providers. For instance, CJ ENM's TVING faces stiff competition from numerous global and local streaming services, forcing it to continuously offer compelling content to retain subscribers. This power is evident in how easily consumers can cancel subscriptions, directly impacting revenue and market share.

Advertisers also exert significant influence, especially in a shifting media landscape. With the continued growth of digital and mobile platforms, advertisers have more choices and can negotiate for better rates or redirect their budgets. This pressure is felt by traditional broadcasting arms of companies like CJ ENM. The global advertising market, while showing signs of growth, is increasingly favoring digital channels, giving advertisers more leverage.

Global streaming giants that license CJ ENM's content, such as Netflix and Amazon Prime Video, wield considerable power due to their massive subscriber bases and consistent demand for content, particularly K-content. Their scale allows them to negotiate favorable acquisition terms, as seen with the global success of CJ ENM's drama 'Queen of Tears' on Netflix in 2024. This symbiotic relationship highlights how distribution partners can leverage demand to their advantage.

Fans of live events, particularly in the K-pop sector, hold significant sway. Their willingness to purchase tickets and merchandise directly fuels revenue for events like CJ ENM's KCON. The success of these events, such as KCON LA in 2023 attracting tens of thousands, demonstrates the substantial purchasing power of dedicated fanbases. This necessitates continuous innovation in event offerings to maintain engagement and justify costs against a backdrop of growing entertainment choices.

Full Version Awaits

CJ ENM Porter's Five Forces Analysis

This preview showcases the complete CJ ENM Porter's Five Forces Analysis, offering a deep dive into the competitive landscape of the entertainment and media industry. You are viewing the exact, professionally formatted document that will be delivered instantly upon purchase, ensuring you receive all the insights without any alterations or missing sections.

Rivalry Among Competitors

CJ ENM navigates a highly competitive landscape within the domestic Korean entertainment sector, with rivals like HYBE, SM Entertainment, and YG Entertainment vying intensely for talent and market dominance, especially in the booming K-pop industry. This rivalry is further amplified by a reported stagnation in K-pop sales and exports during 2024, forcing companies to innovate and secure top-tier artists to maintain their competitive edge.

Global streaming powerhouses like Netflix, Disney+, and Amazon Prime Video are intensely vying for Korean content, directly challenging CJ ENM's local OTT service, TVING. These giants are not just acquiring Korean shows but are also investing heavily in their production and global distribution, creating a fierce battle for subscriber attention and content exclusivity.

This intense competition forces CJ ENM and TVING to adapt their content production and distribution strategies to stand out. For instance, Netflix reported over 270 million paid memberships globally as of the first quarter of 2024, highlighting the sheer scale of competition TVING faces in securing and retaining viewers.

Traditional broadcasting networks remain significant competitors for CJ ENM, even with the rise of digital media. These networks compete directly for advertising dollars and audience attention, impacting the overall revenue potential for linear television. For instance, in 2024, the global advertising market saw shifts, with digital advertising continuing its growth, but linear TV advertising still represented a substantial portion, creating a competitive landscape where all players vie for a share.

CJ ENM's own popular channels, such as tvN, operate within this competitive environment. The broader challenge for all linear broadcasters, including CJ ENM's traditional networks, is the ongoing contraction in the advertising market. This contraction means less overall revenue is available, intensifying the rivalry as each network strives to capture a larger piece of a shrinking pie.

Film Production and Distribution Companies

Competitive rivalry within the film production and distribution sector is intense, with numerous Korean and international studios vying for market share. This dynamic is particularly evident in the South Korean market, which has faced headwinds. For instance, in 2023, the total number of admissions in Korean cinemas saw a slight decrease compared to 2022, indicating a challenging environment for attracting audiences.

The landscape is further complicated by rising production expenses and a noticeable dip in box office returns for mid-budget films. This situation forces companies like CJ ENM to compete fiercely for successful releases that can capture audience attention and generate significant revenue. The pressure to deliver hit films is constant, making differentiation and strategic marketing paramount.

- Intense Competition: Numerous Korean and global film studios and distributors actively compete for audience attention and market share.

- Rising Costs: Production budgets continue to climb, squeezing profit margins and intensifying the need for successful film performance.

- Box Office Challenges: Mid-budget films have struggled at the box office, creating a more challenging environment for all players to achieve consistent profitability.

- Market Dynamics: The South Korean film market, a key territory for CJ ENM, experienced a slight decline in cinema admissions in 2023, underscoring the competitive pressures.

Digital Content and Social Media Platforms

The competitive rivalry within digital content and social media platforms is intense, directly impacting companies like CJ ENM. The proliferation of user-generated content (UGC) platforms such as YouTube and TikTok means audiences have access to a vast and often free alternative to professionally produced media. This shift challenges traditional content providers by fragmenting attention and leisure time. For instance, by the end of 2023, TikTok reported over 1 billion monthly active users globally, demonstrating its significant pull on consumer engagement.

These platforms not only offer diverse content but also foster direct engagement between creators and audiences, bypassing traditional media gatekeepers. This dynamic alters how content is discovered, consumed, and monetized. In 2024, the advertising spend on social media platforms continues to grow, with digital advertising expected to reach over $600 billion globally, underscoring the economic power these platforms wield and the competitive pressure they exert on traditional media companies seeking advertising revenue.

- User-Generated Content Dominance: Platforms like YouTube and TikTok, with billions of users, offer a constant stream of diverse and often free content, directly competing for audience attention.

- Fragmented Leisure Time: The rise of short-form video and social media apps significantly disrupts traditional media consumption habits, making it harder for established players to retain viewers.

- Advertising Revenue Shift: A substantial portion of advertising budgets is migrating to digital and social platforms, intensifying competition for marketing dollars that previously supported traditional media.

- Creator Economy Growth: The increasing viability of the creator economy incentivizes talent to bypass traditional studios and networks, directly engaging with audiences on digital platforms.

CJ ENM faces intense rivalry from domestic entertainment giants like HYBE and SM Entertainment, particularly in the K-pop sector, where securing top talent is crucial amidst reported 2024 sales stagnation. Global streaming services such as Netflix and Disney+ are aggressively acquiring and producing Korean content, directly challenging CJ ENM's own streaming platform, TVING, and competing for subscriber attention. Traditional broadcasters also remain strong competitors, vying for advertising revenue in a market where digital advertising continues to grow, impacting linear TV's share. The film industry presents further challenges, with numerous studios competing in a market that saw a slight dip in cinema admissions in 2023, compounded by rising production costs and weaker performance from mid-budget films.

| Competitor Type | Key Players | Impact on CJ ENM | 2024 Context/Data |

|---|---|---|---|

| Domestic Entertainment | HYBE, SM Entertainment, YG Entertainment | Competition for K-pop talent and market share | Reported stagnation in K-pop sales and exports |

| Global Streaming Services | Netflix, Disney+, Amazon Prime Video | Competition for Korean content acquisition and subscribers for TVING | Netflix had over 270 million global paid memberships (Q1 2024) |

| Traditional Broadcasting | Major Korean TV networks | Competition for advertising revenue and audience attention | Global digital ad spend expected to exceed $600 billion; linear TV ad market facing contraction |

| Film Studios | Korean and international film companies | Competition for box office success and market share | South Korean cinema admissions saw a slight decrease in 2023; mid-budget films facing challenges |

SSubstitutes Threaten

The threat of substitutes for CJ ENM's traditional broadcasting and content businesses is significant, primarily from Over-The-Top (OTT) streaming services. Global giants like Netflix and Disney+, along with strong local players such as Wavve, offer extensive libraries of on-demand content, directly competing for viewer attention and subscription revenue. These platforms often provide compelling value propositions through competitive pricing and exclusive original content, making them attractive alternatives to CJ ENM's offerings.

CJ ENM's own streaming service, TVING, actively participates in this competitive landscape, aiming to differentiate itself through unique and high-quality content. As of early 2024, the Korean OTT market continues to grow, with significant investment in original productions by all major players. This intense competition from substitutes puts pressure on CJ ENM to innovate and maintain subscriber loyalty by offering compelling, exclusive programming that can’t be found elsewhere.

Social media platforms and user-generated content (UGC) present a substantial threat by capturing considerable consumer leisure time. Platforms like YouTube and TikTok offer an abundance of free entertainment, ranging from short videos to vlogs and live streams, effectively drawing audience attention away from professionally produced content such as films, dramas, and music.

This shift in consumption habits is evident in the growing dominance of short-form video. In 2023, TikTok reported over 1 billion monthly active users globally, with its average watch time per user per day often exceeding an hour, directly competing for the same audience CJ ENM targets with its traditional media offerings.

The rise of esports and video gaming presents a significant threat of substitutes for CJ ENM's traditional media offerings. These digital entertainment forms provide highly immersive and interactive experiences that increasingly compete for consumers' leisure time and disposable income, especially among younger demographics. For instance, the global esports market was projected to reach over $1.8 billion in 2024, demonstrating its substantial economic footprint and appeal.

Live Events and Experiences (Non-CJ ENM)

The threat of substitutes for CJ ENM's live events and experiences is significant, as consumers have a plethora of alternative leisure activities. Other forms of live entertainment, such as concerts by different artists, major sporting events, and diverse theatrical performances not affiliated with CJ ENM, directly compete for audience attention and disposable income. For instance, the global live music industry, excluding ticket sales, generated an estimated $30 billion in 2023, showcasing the vast market for similar entertainment options.

Consumers are not limited to CJ ENM's specific offerings; they can opt for a wide array of out-of-home experiences. This includes everything from local festivals and community events to international travel and even high-quality home entertainment systems that offer immersive viewing. The sheer volume of choices means that if CJ ENM's events are perceived as too expensive, inconvenient, or lacking in appeal, consumers will readily shift their spending to these substitutes, impacting attendance and overall engagement.

- Broader Entertainment Landscape: Consumers can choose from a vast array of live events beyond CJ ENM's portfolio, including concerts from other promoters, major league sporting events, and diverse theatrical productions.

- Alternative Leisure Spending: Disposable income allocated for entertainment can easily be diverted to other out-of-home activities like dining, travel, or even significant investments in home entertainment systems.

- Competitive Pricing and Value Perception: The availability of numerous substitutes forces CJ ENM to remain competitive in pricing and consistently deliver high perceived value to retain its audience.

Traditional Forms of Entertainment

While digital platforms dominate, traditional entertainment forms like reading books or listening to the radio still compete for consumer leisure time. These enduring activities satisfy the fundamental need for entertainment, albeit through different mediums. For instance, global book sales saw a steady increase, with the U.S. market alone generating approximately $26 billion in 2023, indicating continued consumer engagement.

The threat of substitutes extends to various non-digital leisure activities. People can choose to engage in hobbies, outdoor pursuits, or social gatherings instead of consuming CJ ENM's content. This broad spectrum of alternatives means CJ ENM must consistently deliver high-quality, engaging programming to capture and retain audience attention.

- Reading: Global book sales reached significant figures, demonstrating a persistent demand for this traditional form of entertainment.

- Radio: Despite the rise of digital audio, radio continues to maintain a substantial listener base across many demographics.

- Other Leisure Activities: Hobbies, social events, and outdoor recreation offer alternative ways for consumers to spend their free time, diverting attention from screen-based content.

The threat of substitutes for CJ ENM is substantial, with digital platforms like Netflix and Disney+ offering compelling alternatives to traditional broadcasting and content. These OTT services, along with local players like TVING, compete directly for viewer attention and subscription revenue, often with exclusive original content. Furthermore, user-generated content platforms such as YouTube and TikTok capture significant leisure time, especially with the growing popularity of short-form video. In 2023, TikTok alone boasted over 1 billion monthly active users globally, with many spending over an hour daily on the platform.

The rise of interactive entertainment like esports and video gaming also presents a strong substitute, particularly for younger demographics. The global esports market was projected to exceed $1.8 billion in 2024, highlighting its growing appeal and economic significance. Even traditional forms of entertainment, such as reading books, continue to compete, with the U.S. book market generating approximately $26 billion in 2023.

| Substitute Category | Key Players/Examples | Impact on CJ ENM | Supporting Data (Approximate) |

|---|---|---|---|

| OTT Streaming Services | Netflix, Disney+, Wavve, TVING | Direct competition for viewers and subscriptions; pressure on content exclusivity. | Global OTT market revenue projected to reach over $100 billion in 2024. |

| User-Generated Content (UGC) Platforms | YouTube, TikTok | Captures significant leisure time, especially short-form video consumption. | TikTok: >1 billion monthly active users globally (2023). |

| Interactive Digital Entertainment | Esports, Video Gaming | Appeals strongly to younger demographics, competing for leisure time and spending. | Global Esports Market: Projected to exceed $1.8 billion (2024). |

| Traditional Media & Leisure | Books, Radio, Hobbies, Social Events | Still compete for consumer attention and disposable income. | U.S. Book Market Revenue: Approx. $26 billion (2023). |

Entrants Threaten

The entertainment and media sector demands significant upfront capital for creating content, building robust technology, and establishing global distribution networks. This high financial requirement acts as a substantial barrier for potential newcomers. For instance, CJ ENM’s commitment to investing KRW 1 trillion (approximately $750 million USD as of 2024) annually in content underscores the immense financial resources needed to stay competitive in this landscape.

CJ ENM benefits from robust brand loyalty, cultivated through years of delivering popular content across broadcasting, film, and music. This deep connection with consumers makes it challenging for newcomers to gain traction. For instance, their K-pop powerhouse, CJ ENM Music, boasts artists who consistently top charts, a testament to their established fan base.

The company's extensive intellectual property library, encompassing beloved dramas and films, represents a significant barrier to entry. New companies would need substantial investment to acquire or develop a comparable catalog of engaging content. CJ ENM's strategic global IP expansion further strengthens this advantage, making it difficult for new players to compete on a similar scale.

For new players entering the media and entertainment space, replicating CJ ENM's intricate distribution networks presents a significant hurdle. This includes securing slots on established TV networks, negotiating with major streaming services, and gaining access to cinema chains, all of which require substantial capital and established relationships. CJ ENM's existing global partnerships, such as those with Amazon Prime Video, alongside its robust domestic infrastructure, create a high barrier to entry.

Talent Acquisition and Management

Attracting and retaining top-tier creative and performing talent is a significant hurdle for new entrants in the entertainment sector, especially within the fiercely competitive K-pop and K-drama markets. Established companies like CJ ENM possess strong brand recognition and offer lucrative opportunities, making it difficult for newcomers to lure away proven artists and creators. This talent war drives up labor costs and can limit the innovation potential of emerging players.

The cost of securing and keeping skilled professionals is substantial. For instance, in 2023, the global entertainment and media industry saw significant investment in talent development and acquisition, with major studios and agencies competing for limited pools of highly sought-after individuals. New entrants must therefore allocate considerable resources to compete for this essential input, potentially impacting their profitability and growth trajectory.

- High Competition for Talent: Established players have existing relationships and resources that make it hard for new entrants to attract top artists.

- Cost of Acquisition: Securing skilled creative and performing talent is expensive, increasing operational costs for new companies.

- K-Pop and K-Drama Focus: The intense demand for talent in these popular genres exacerbates the challenge for new entrants.

Regulatory Hurdles and Licensing Requirements

The media and entertainment sector faces substantial regulatory hurdles and licensing demands, especially concerning broadcasting and content dissemination. For instance, in South Korea, where CJ ENM operates, obtaining broadcasting licenses can involve lengthy approval processes and significant capital investment, as seen with the stringent requirements for new terrestrial broadcasters. These complexities, including content standards and intellectual property rights management, create a high barrier for aspiring entrants, demanding considerable legal expertise and financial resources to comply.

New entrants must also contend with the intricate web of international regulations for content distribution, particularly for digital platforms. CJ ENM, with its global reach, navigates varied compliance landscapes, from data privacy laws like GDPR to local content quotas in different markets. Successfully entering and operating within these diverse regulatory environments requires substantial upfront investment in legal counsel and compliance infrastructure, effectively deterring many potential competitors.

- Regulatory Complexity: The media and entertainment industry is heavily regulated, with specific licensing and compliance requirements for broadcasting, content creation, and distribution.

- Cost of Compliance: New entrants face significant costs associated with obtaining necessary licenses, adhering to content standards, and managing intellectual property rights.

- Legal Expertise: Navigating these complex legal frameworks demands specialized legal knowledge and ongoing investment in compliance, which can be a major deterrent for smaller or less-resourced companies.

- International Variations: For global players like CJ ENM, dealing with differing regulations across multiple countries, including data privacy and content quotas, adds another layer of complexity and cost to market entry.

The threat of new entrants for CJ ENM is relatively low due to the substantial capital required for content production and distribution, estimated at KRW 1 trillion annually by CJ ENM in 2024. Established brand loyalty, a rich intellectual property library, and complex global distribution networks further erect significant barriers. Additionally, the intense competition for top talent, exemplified by the high investment in talent acquisition across the industry in 2023, and stringent regulatory and licensing demands, particularly in key markets like South Korea, solidify CJ ENM's competitive position.

| Barrier Type | Description | Impact on New Entrants | CJ ENM's Advantage |

|---|---|---|---|

| Capital Requirements | High upfront investment in content, technology, and distribution. | Deters new players due to financial scale needed. | Annual content investment of KRW 1 trillion (approx. $750 million USD in 2024). |

| Brand Loyalty & IP | Established consumer trust and extensive content catalog. | Difficult for newcomers to gain market share and recognition. | Strong fan bases for K-pop artists and popular drama/film IPs. |

| Distribution Networks | Securing access to TV, streaming, and cinema platforms. | Requires significant capital and established relationships. | Existing global partnerships (e.g., Amazon Prime Video) and domestic infrastructure. |

| Talent Acquisition | Attracting and retaining skilled creative and performing artists. | High labor costs and competition for proven talent. | Brand recognition and lucrative opportunities for artists. |

| Regulatory Landscape | Navigating broadcasting licenses, content standards, and international laws. | Demands legal expertise and significant compliance investment. | Experience in complying with varied global and domestic regulations. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for CJ ENM is built upon a foundation of comprehensive data, including CJ ENM's annual reports and investor relations materials, alongside industry-specific market research from firms like Statista and IBISWorld.