CJ ENM Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CJ ENM Bundle

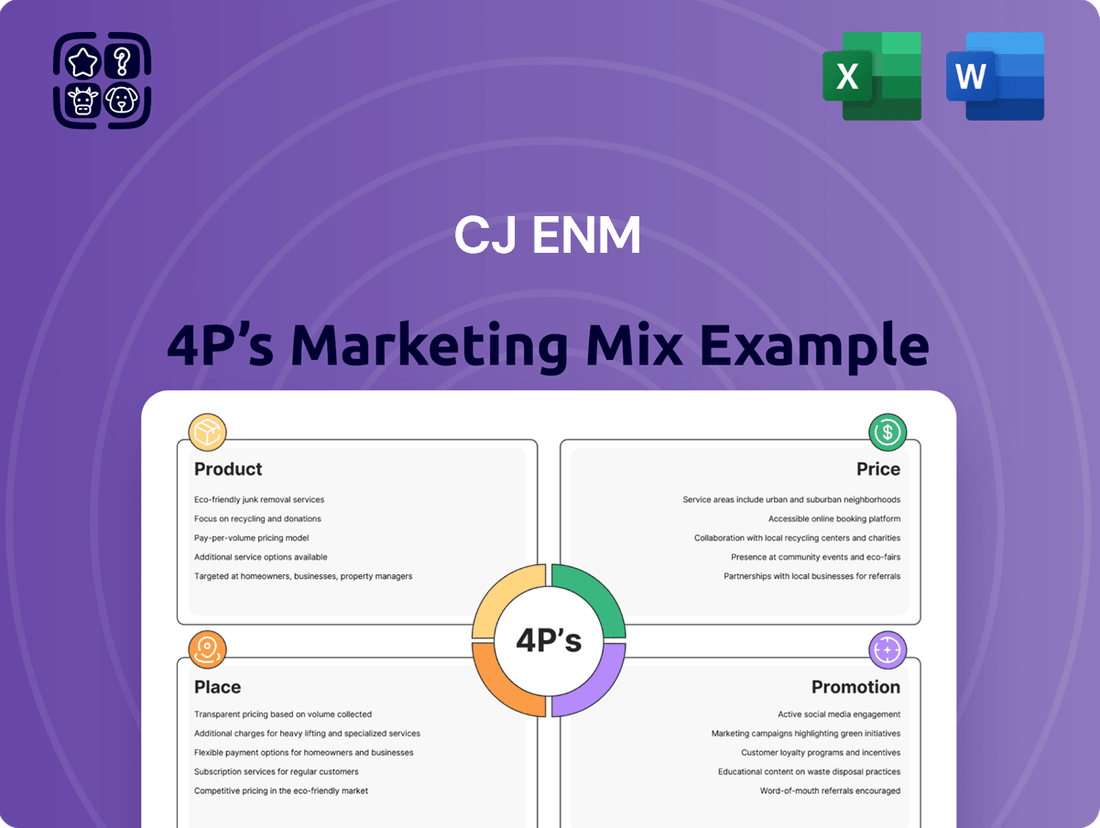

Uncover the strategic brilliance behind CJ ENM's market dominance by dissecting their Product, Price, Place, and Promotion. This analysis reveals how their diverse content portfolio, competitive pricing, expansive distribution, and impactful promotional campaigns create a powerful marketing synergy. Ready to gain a competitive edge?

Dive deeper into CJ ENM's marketing mastery with a comprehensive 4Ps analysis. Understand their product innovation, pricing strategies, channel reach, and promotional effectiveness to unlock actionable insights for your own business. Get the full, editable report now!

Product

CJ ENM boasts a broad spectrum of entertainment offerings, encompassing everything from popular TV dramas and films to music and live performances. This extensive content mix is designed to attract a wide range of viewers, appealing to diverse tastes and age groups.

The company's strategic focus on content expansion is evident in its significant investment plans. For 2025, CJ ENM has earmarked over 65 new dramas and entertainment shows, underscoring a dedication to delivering fresh and captivating programming to its audience.

CJ ENM is strategically enhancing its global K-content Intellectual Property (IP) development, a key component of its product strategy. This involves creating international co-productions and adapting successful Korean formats for diverse markets. For instance, CJ ENM is actively pursuing opportunities to globalize hits like 'It's Okay to Not Be Okay' and 'Happiness' through various international adaptations, demonstrating a commitment to expanding its content's worldwide footprint.

CJ ENM is aggressively expanding its music business globally, launching new international labels and production studios to foster connections between Korean and overseas artists. This strategy aims to leverage its established K-pop expertise for broader market penetration.

The company's commitment to global audiences is evident in projects like 'World of Street Woman Fighter' and the upcoming 'Boys Planet 2', which are designed to capture international viewership and engagement. These initiatives underscore CJ ENM's ambition to solidify its position as a major player in the worldwide music scene.

In 2023, CJ ENM's music division reported significant growth, contributing to the company's overall revenue with a focus on its global entertainment IP. This expansion is supported by substantial investments in content production and artist development, anticipating continued strong performance in the international music market through 2025.

Digital Platform Original Content

CJ ENM's product strategy heavily features its digital platforms, with TVING serving as a cornerstone for original content. This includes a robust library of new series and exclusive sports broadcasts, catering to a broad audience. As of early 2024, TVING continued its expansion, aiming to solidify its position in the competitive streaming market.

Mnet Plus is another crucial digital offering, specifically targeting the global K-pop fandom. This platform fosters fan engagement through exclusive content, interactive features, and integrated global commerce, creating a comprehensive ecosystem for fans. The platform's growth is directly tied to the increasing global demand for K-pop culture.

- TVING's Original Content: CJ ENM is investing significantly in producing exclusive series and acquiring rights to popular sports, differentiating TVING from competitors.

- Mnet Plus for K-pop Fandom: This platform leverages K-pop's global appeal by offering unique fan experiences and e-commerce opportunities.

- Digital Platform Growth: The focus on these digital avenues reflects a broader industry trend towards direct-to-consumer engagement and content monetization.

Focus on Asian and Asian American Storytelling

CJ ENM's 'First Light StoryHouse' label is a key part of its Product strategy, specifically focusing on Asian and Asian American storytelling. This initiative directly supports the creation of film and scripted TV projects spearheaded by creators from these backgrounds.

The goal is to elevate underrepresented voices and narratives, ensuring their stories find a global audience. This strategic focus aims to build a sustainable business model that provides ongoing support for these creators and their projects. For instance, CJ ENM's investment in diverse content aligns with the growing global demand for authentic storytelling, a trend projected to continue its upward trajectory in the coming years.

- Product Focus: Amplifying Asian and Asian American narratives through film and scripted TV.

- Key Initiative: 'First Light StoryHouse' label supports creator-led projects.

- Strategic Aim: Global resonance for underrepresented stories and sustainable business growth.

- Market Relevance: Capitalizes on increasing global appetite for diverse and authentic content.

CJ ENM's product strategy centers on a diverse and expanding content portfolio, from dramas and films to music and live events, aiming to capture a wide audience. The company is heavily investing in global K-content IP development, including international co-productions and format adaptations, to broaden its reach.

Digital platforms like TVING and Mnet Plus are crucial for direct-to-consumer engagement, offering exclusive original content and K-pop fan experiences. CJ ENM's commitment to diverse storytelling is exemplified by its 'First Light StoryHouse' label, dedicated to Asian and Asian American narratives.

| Product Area | Key Initiatives | 2024/2025 Focus | Growth Driver |

|---|---|---|---|

| Content Production | Dramas, Films, Entertainment Shows | 65+ new dramas/shows planned for 2025 | Global appeal of K-content |

| Global IP Development | Co-productions, Format Adaptations | Expanding successful Korean formats internationally | Increasing demand for localized content |

| Digital Platforms | TVING (Originals, Sports), Mnet Plus (K-pop fandom) | Strengthening streaming presence, fan engagement | Direct-to-consumer monetization |

| Music Business | International Labels, Production Studios | Leveraging K-pop expertise for global market penetration | Growth in global music consumption |

What is included in the product

This analysis offers a comprehensive breakdown of CJ ENM's marketing strategies, examining their Product offerings, Pricing tactics, Place (distribution) channels, and Promotion efforts to understand their market positioning and competitive advantage.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of overwhelming data for quick decision-making.

Provides a clear, concise overview of CJ ENM's 4Ps, resolving the challenge of communicating intricate marketing plans to diverse teams.

Place

CJ ENM leverages a diverse array of distribution channels to maximize content accessibility worldwide. This includes its proprietary television networks, such as the popular tvN, alongside its robust film production studios and influential music labels.

This multi-platform strategy is key to achieving broad market penetration and effectively serving varied consumer habits, encompassing both traditional broadcast methods and the rapidly growing digital streaming sector. For instance, CJ ENM's content is readily available on platforms like TVING, its own streaming service, which saw a significant increase in subscribers in 2024, reflecting the growing demand for integrated digital content experiences.

CJ ENM has strategically leveraged global streaming partnerships to broaden its content's reach. A prime example is its multi-year deal with Amazon Prime Video, securing exclusive streaming rights for CJ ENM titles across more than 240 countries and territories, a move that dramatically amplifies its international distribution capabilities. This aligns with the growing trend of content providers seeking direct access to vast global audiences through major streaming services.

CJ ENM is significantly boosting its digital presence by investing in platforms like TVING and Mnet Plus, positioning them as global centers for K-content and K-pop. This strategic move aims to deepen fan connections through interactive features and exclusive content.

The company is targeting substantial subscriber increases in crucial international markets, including Japan, Southeast Asia, and the United States. For instance, TVING reported a notable increase in paid subscribers in 2024, driven by exclusive original content, demonstrating the effectiveness of their digital enhancement strategy.

International Market Entry and Local Partnerships

CJ ENM is strategically expanding its global reach by focusing on key international markets such as Japan, Southeast Asia, and the United States. This expansion is heavily reliant on establishing robust local partnerships to navigate diverse consumer preferences and regulatory landscapes.

The company is actively seeking new growth avenues in emerging markets like India and the Middle East, recognizing the escalating demand for Korean content in these regions. This diversification of its distribution network is crucial for long-term market penetration and revenue growth.

- Japan Market Focus: CJ ENM has seen significant success in Japan, with K-drama and K-pop continuing to drive strong viewership and fan engagement.

- Southeast Asian Expansion: In 2023, CJ ENM reported substantial growth in its Southeast Asian operations, driven by local content co-productions and platform partnerships.

- U.S. Market Penetration: The U.S. market remains a priority, with CJ ENM leveraging its studio capabilities and content library to secure distribution deals with major American broadcasters and streaming services.

- Emerging Market Exploration: CJ ENM is actively assessing the potential of markets like India and the Middle East, where the popularity of Korean entertainment has surged, indicated by a reported 25% year-over-year increase in content consumption in these regions during 2024.

Live Entertainment Global Reach

CJ ENM's live entertainment division actively engages global audiences through flagship events like KCON and the MAMA Awards. These experiences are crucial for showcasing K-pop and broader Korean culture, solidifying CJ ENM's international footprint. The company leverages these large-scale events, amplified by digital broadcasts, to create immersive fan experiences worldwide.

These events are significant revenue drivers and brand builders for CJ ENM. For instance, KCON 2023, held in multiple locations, saw attendance figures in the tens of thousands, with strong digital engagement across its broadcast platforms. The MAMA Awards consistently draw millions of online viewers, demonstrating the global appetite for K-pop content delivered through live spectacles.

- KCON 2023 attendance: Over 280,000 attendees across its global stops.

- MAMA Awards viewership: Reached over 190 million viewers globally in recent years through various streaming platforms.

- Digital reach: CJ ENM's live events are complemented by extensive social media campaigns and online streaming, significantly broadening their audience beyond physical attendees.

CJ ENM's place strategy focuses on making its content easily accessible through a variety of channels. This includes its own TV networks like tvN, film studios, and music labels, as well as digital platforms such as TVING. They've also secured major global streaming partnerships, like the one with Amazon Prime Video, to reach over 240 countries.

The company is actively expanding its presence in key international markets, including Japan, Southeast Asia, and the U.S., and is exploring opportunities in emerging markets like India and the Middle East where Korean content demand is rising. Live events like KCON and the MAMA Awards further solidify its global reach, drawing massive audiences both in person and online.

| Distribution Channel | Key Platforms/Initiatives | 2024/2025 Focus/Data |

|---|---|---|

| Proprietary Networks | tvN, Film Studios, Music Labels | Continued investment in original programming for domestic and international appeal. |

| Digital Streaming | TVING, Mnet Plus | Targeting significant subscriber growth in key international markets; TVING saw notable paid subscriber increases in 2024. |

| Global Streaming Partnerships | Amazon Prime Video (multi-year deal) | Exclusive streaming rights for CJ ENM titles in over 240 countries, expanding global content accessibility. |

| Live Entertainment | KCON, MAMA Awards | Leveraging digital broadcasts to enhance fan experiences; KCON 2023 saw over 280,000 attendees globally. |

Preview the Actual Deliverable

CJ ENM 4P's Marketing Mix Analysis

The preview you see here is the actual, complete CJ ENM 4P's Marketing Mix Analysis document you’ll receive instantly after purchase. There are no hidden pages or missing sections; what you see is exactly what you get. This ensures full transparency and immediate usability for your strategic planning.

Promotion

CJ ENM is making significant waves by announcing an extensive content lineup, aiming to build substantial buzz. For 2025 alone, they're set to release over 65 new dramas and entertainment shows, a clear indicator of their aggressive content strategy.

These announcements are strategically designed to highlight key themes and showcase prominent projects, often featuring A-list talent. This approach is crucial for capturing audience attention and driving anticipated viewership for their upcoming releases.

CJ ENM actively utilizes high-profile events, such as the anticipated 'Mnext: Worlds of Mnet Since 2025', to unveil its forward-looking global music business strategies and upcoming initiatives. These gatherings are crucial for showcasing new global labels, production studios, and strategic partnerships, aiming to generate significant buzz within the industry and among fans.

These events act as powerful promotional tools, providing a platform to not only announce but also to deeply engage stakeholders with CJ ENM's vision for the global music landscape. For instance, the company's 2024 financial reports indicate a substantial investment in global expansion, with a projected 15% increase in international market revenue by 2025, underscoring the importance of these strategic announcements.

CJ ENM leverages strategic partnerships with global streaming giants like Amazon Prime Video to significantly expand its promotional reach. These collaborations allow CJ ENM to showcase its diverse content library to a vast international audience, moving beyond traditional broadcast limitations.

The company's focus on exclusive streaming deals, such as those with Amazon Prime Video for K-dramas and films, directly translates into enhanced promotion. For instance, in 2023, CJ ENM reported a substantial increase in overseas content sales, partly driven by these platform partnerships, which provide a dedicated channel for marketing and distribution.

Furthermore, the commitment to offering content with multiple subtitles and dubbing languages in 2024 and projected for 2025 dramatically boosts accessibility and promotional effectiveness. This multilingual approach ensures that CJ ENM's productions resonate with a broader demographic, maximizing engagement and viewership across different global markets.

K-Culture Events and Festivals

CJ ENM leverages K-Culture events and festivals, notably KCON and the MAMA Awards, as cornerstones of its promotional strategy. These events serve as massive global showcases for K-pop and broader Korean cultural content, fostering direct fan engagement and artist interaction.

KCON, for instance, has seen significant growth, with KCON LA 2023 attracting over 140,000 attendees and billions of social media impressions, underscoring its reach. Similarly, the MAMA Awards consistently draw millions of viewers across various platforms, solidifying CJ ENM's position in promoting Korean entertainment on a global scale.

- KCON's Global Reach: KCON events in 2023 alone saw participation from over 100 K-pop artists and attracted millions of fans both in-person and virtually, generating substantial buzz and media coverage.

- MAMA Awards' Impact: The MAMA Awards, held in Tokyo in 2023, garnered significant attention, with viewership numbers reaching tens of millions globally, highlighting its influence in the K-pop awards landscape.

- Digital Engagement: CJ ENM's promotional events are amplified through robust digital strategies, with live streaming and online content from KCON and MAMA Awards accumulating billions of views and interactions, extending their promotional impact far beyond physical attendance.

Cross-Platform Synergy and Digital Engagement

CJ ENM is actively fostering cross-platform synergy to boost its market presence. This involves strategically promoting content across its diverse media ecosystem, encompassing traditional TV broadcasts, its own streaming platforms, and popular social media channels. By leveraging this integrated approach, CJ ENM aims to maximize content reach and audience engagement. For instance, in 2023, CJ ENM reported a significant increase in digital ad revenue, reaching approximately ₩1.5 trillion, reflecting the growing importance of its digital footprint.

Digital platforms are central to CJ ENM's fan engagement strategy, with services like Mnet Plus serving as crucial hubs. These platforms are designed to facilitate direct interaction between artists and their fans, offering exclusive content and interactive features. This not only strengthens fan loyalty but also acts as a powerful, organic promotional engine for CJ ENM's various entertainment offerings. By Q1 2024, Mnet Plus reported over 5 million active users globally, demonstrating its success in building a dedicated community.

- Cross-Platform Promotion: Content is strategically amplified across CJ ENM's TV channels, streaming services, and social media to enhance visibility and audience reach.

- Digital Platform Enhancement: Services like Mnet Plus are continuously improved to foster fan communication and provide exclusive, interactive experiences.

- Direct Promotional Tools: Enhanced digital platforms act as direct marketing channels, driving engagement and promoting CJ ENM's content and artists.

- Revenue Growth: CJ ENM's digital advertising revenue saw a substantial rise, reaching around ₩1.5 trillion in 2023, underscoring the effectiveness of its digital strategy.

CJ ENM's promotional strategy is multifaceted, leveraging a vast content pipeline with over 65 new dramas and shows planned for 2025 to generate significant buzz. High-profile events like 'Mnext: Worlds of Mnet Since 2025' showcase global music strategies and new ventures, aiming to capture industry and fan attention.

Strategic partnerships with global streaming services, such as Amazon Prime Video, are key to expanding promotional reach and offering content with multilingual support, enhancing accessibility. CJ ENM's digital advertising revenue reached approximately ₩1.5 trillion in 2023, highlighting the success of its digital-first approach.

CJ ENM actively utilizes major K-Culture events like KCON and the MAMA Awards for promotion, with KCON LA 2023 attracting over 140,000 attendees and the MAMA Awards drawing tens of millions of viewers globally. These events foster direct fan engagement and amplify promotional impact through extensive digital and social media coverage, with billions of views generated.

Digital platforms, including Mnet Plus which reported over 5 million active users by Q1 2024, are crucial for direct fan interaction and organic promotion. This cross-platform synergy across TV, streaming, and social media maximizes content reach and audience engagement.

| Promotional Tactic | Key Event/Platform | 2023/2024 Data Point | Projected 2025 Impact |

|---|---|---|---|

| Content Pipeline Announcement | CJ ENM Content Lineup | 65+ new dramas/shows planned for 2025 | Increased viewership anticipation |

| Global Strategy Showcase | Mnext: Worlds of Mnet Since 2025 | Unveiling new global music initiatives | Strengthened global market presence |

| Streaming Partnerships | Amazon Prime Video | Increased overseas content sales | Expanded international audience reach |

| Cultural Events | KCON, MAMA Awards | KCON LA 2023: 140k+ attendees; MAMA Awards viewership in tens of millions | Continued global brand awareness and fan engagement |

| Digital Engagement | Mnet Plus | 5M+ active users (Q1 2024) | Enhanced fan loyalty and organic promotion |

Price

CJ ENM's content investment strategy is a cornerstone of its marketing mix, with a significant annual commitment exceeding 1 trillion KRW (roughly $750 million) dedicated to film and drama production. This substantial financial backing underscores the company's belief in the power of premium content to drive growth and global appeal.

This aggressive investment not only fuels the creation of high-quality productions but also serves to elevate CJ ENM's standing in the competitive international entertainment landscape. It implicitly establishes benchmarks for production expenditures and the inherent market value of compelling content in today's media environment.

CJ ENM's streaming service, TVING, utilizes a dual revenue stream, combining subscription fees with an advertising-supported video-on-demand (AVOD) model. This approach allows them to cater to a wider audience, offering flexibility in how users access content and manage costs.

As of early 2024, TVING reported a significant increase in paid subscribers, exceeding 5 million users, highlighting the appeal of their tiered subscription options. The AVOD tier, introduced to capture price-sensitive consumers, further broadens their market reach.

CJ ENM actively monetizes its vast content library through long-term global licensing and distribution agreements with major streaming platforms like Amazon Prime Video and Netflix. These deals, often spanning multiple years, are crucial for revenue generation, demonstrating the significant international market value of CJ ENM's intellectual property. For instance, the success of K-dramas like Crash Landing on You, distributed through such partnerships, highlights the revenue potential of these content rights.

Live Event Ticket Sales and Sponsorships

CJ ENM's live entertainment events, such as the MAMA Awards and KCON, generate significant revenue through a dual approach of ticket sales and strategic sponsorships. This pricing strategy is carefully calibrated to capture the high demand for authentic K-pop fan experiences and the star power of the featured artists. For instance, KCON 2022 in Los Angeles generated an estimated $30 million in economic impact for the region, showcasing the substantial financial reach of these events.

Sponsorships play a crucial role in bolstering the financial success of these live events. Brands like Olive Young, a prominent South Korean health and beauty retailer, have partnered with CJ ENM, demonstrating the value proposition for companies looking to connect with the highly engaged K-pop fanbase. These partnerships not only provide vital funding but also enhance the overall event experience for attendees.

Key revenue drivers for CJ ENM's live events include:

- Ticket Sales: Pricing reflects demand for K-pop experiences and artist caliber.

- Sponsorships: Partnerships with brands like Olive Young contribute to financial viability.

- Ancillary Revenue: Merchandise sales and other on-site activations further boost income.

- Global Reach: Events like KCON attract international audiences, increasing ticket and sponsorship potential.

Diversified Revenue Streams

CJ ENM’s revenue diversification extends beyond its core content production and distribution. A key area of growth is its mobile live commerce segment, which has demonstrated robust performance.

In 2023, CJ ENM's live commerce business, particularly through its CJ ONSTYLE platform, saw a significant increase in transaction volume. This segment is increasingly contributing to the company's overall profit, showcasing its potential as a substantial revenue driver. For instance, CJ ONSTYLE's mobile sales in the first half of 2024 continued to show positive trends, with a notable year-over-year increase in mobile transaction value.

- Mobile Live Commerce Growth: CJ ENM's live commerce operations, primarily through CJ ONSTYLE, have experienced substantial transaction volume increases.

- Profit Contribution: This segment is becoming a more significant contributor to CJ ENM's overall profit, enhancing financial stability.

- Diversification Strategy: The expansion into live commerce provides CJ ENM with additional monetization avenues beyond traditional media and entertainment models.

- Market Position: CJ ONSTYLE is recognized as a leading player in the South Korean live commerce market, leveraging its established brand and customer base.

CJ ENM's pricing strategy is multifaceted, reflecting the diverse revenue streams across its business segments. For its content, pricing is influenced by licensing agreements with global platforms, where the perceived value of K-dramas and films dictates multi-year deal values, as seen with major distribution partners.

TVING employs a tiered subscription model, with pricing structured to attract a broad user base, complemented by an advertising-supported tier to capture price-sensitive consumers. This dual approach aims to maximize subscriber acquisition and retention, with paid subscribers exceeding 5 million as of early 2024.

Live events like KCON and MAMA Awards utilize dynamic pricing for tickets, reflecting demand and artist popularity, alongside premium sponsorship packages. For instance, KCON 2022 in Los Angeles saw significant economic impact, underscoring the value proposition for sponsors seeking access to engaged fan bases.

CJ ENM's live commerce segment, CJ ONSTYLE, leverages competitive pricing on a wide array of products, driving substantial transaction volumes. Mobile sales on CJ ONSTYLE in the first half of 2024 continued to show positive year-over-year growth in transaction value.

| Segment | Pricing Strategy | Key Data Point |

|---|---|---|

| Content Licensing | Value-based international licensing | Multi-year deals with global platforms |

| TVING Streaming | Tiered subscriptions & AVOD | Over 5 million paid subscribers (early 2024) |

| Live Events (KCON, MAMA) | Demand-driven ticket pricing & Sponsorships | KCON 2022 LA economic impact ~$30 million |

| Live Commerce (CJ ONSTYLE) | Competitive product pricing | Positive year-over-year growth in mobile transaction value (H1 2024) |

4P's Marketing Mix Analysis Data Sources

Our CJ ENM 4P's Marketing Mix Analysis is constructed using a comprehensive blend of official company disclosures, including investor relations materials and press releases, alongside robust industry reports and competitive intelligence. This ensures our insights into their product portfolio, pricing strategies, distribution channels, and promotional activities are grounded in verifiable data.