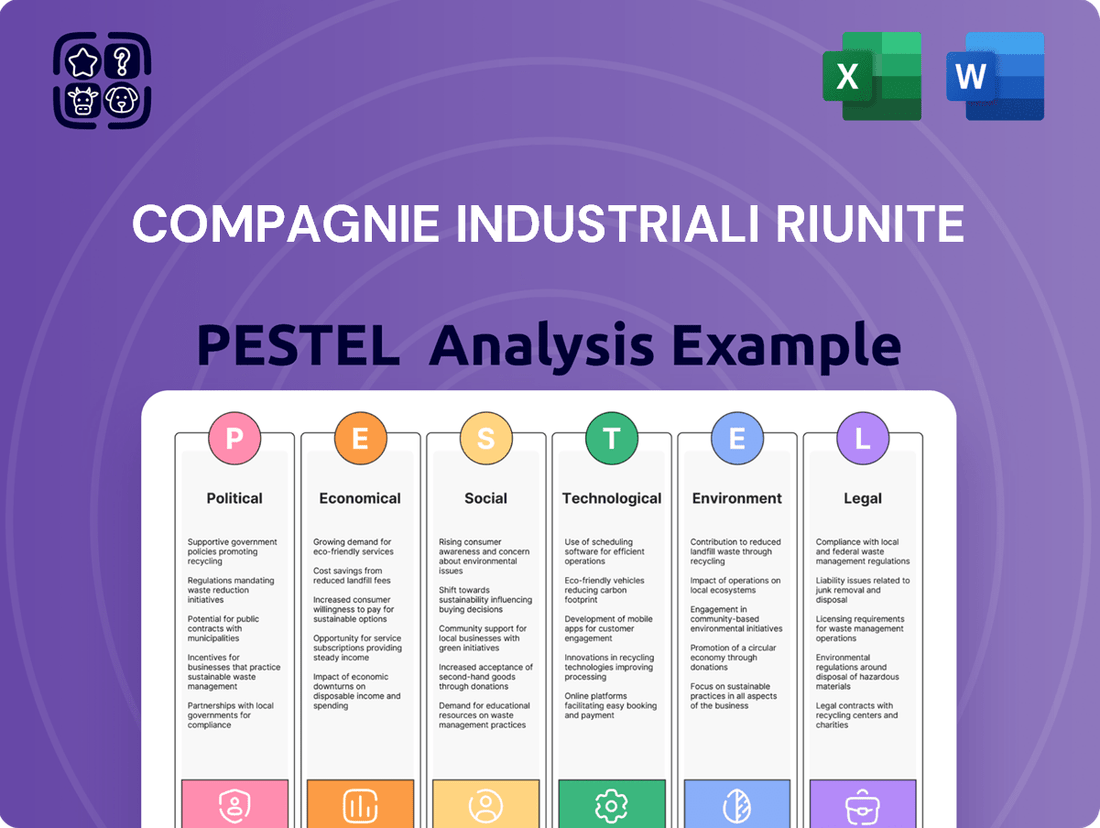

Compagnie Industriali Riunite PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Compagnie Industriali Riunite Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Compagnie Industriali Riunite's trajectory. Our meticulously researched PESTEL analysis provides actionable intelligence to navigate market complexities and identify strategic opportunities. Don't get left behind; gain a competitive edge by downloading the full version now and arming yourself with essential insights.

Political factors

The Italian government's commitment to healthcare is evident in its budget allocations. For 2024, an extra €3 billion is designated for the National Health Fund, with further increases to €4 billion in 2025 and €4.2 billion in 2026. This ensures health expenditure remains at a robust 6.4% of GDP for both 2024 and 2025.

These policy shifts, including reforms to the Italian Medicines Agency (AIFA), are designed to boost the profitability of the Italian healthcare sector and streamline access to medicines and pharmaceutical services. For CIR's KOS Group, this translates into a more favorable operating environment, with enhanced public funding supporting growth and stability in its healthcare services.

The European Union's tightening CO2 emission standards for new passenger cars are a significant political factor. By 2025, the aim is a 15% reduction from 2021 levels, targeting an average of 93.6 g/km. Failure to comply incurs substantial fines, with manufacturers facing €95 per gram of CO2 over the limit for each vehicle sold.

For CIR's automotive components subsidiary, Sogefi, these regulations mandate a strategic shift. The company must prioritize the development of components for zero and low-emission vehicles (ZLEVs). This adaptation is crucial as automakers race to meet these stringent environmental targets and avoid costly penalties.

The ongoing global trade disputes and the imposition of tariffs by various nations, including the United States, present a notable risk to the automotive sector. For companies like Compagnie Industriali Riunite, with significant operations in key markets like Europe and North America, this can translate to potential revenue pressures.

Escalating trade tensions can disrupt supply chains, increase the cost of raw materials, and dampen overall market demand for automotive components. For instance, the automotive industry in 2024 continues to navigate the complexities of these trade policies, with analysts predicting potential impacts on production volumes and pricing strategies across major manufacturing hubs.

National Recovery and Resilience Plan (NRRP)

Italy's National Recovery and Resilience Plan (NRRP), backed by over €200 billion in EU funding, is designed to fast-track digital and green initiatives alongside crucial reforms. While this ambitious plan holds the potential to invigorate economic growth, there have been observed delays in the efficient absorption of these funds. Consequently, the bulk of the anticipated economic stimulus is now projected to materialize in the 2025-2026 period.

For Compagnie Industriali Riunite (CIR), with its strategically diversified investment portfolio, the effective execution of the NRRP is paramount. Successful implementation could cultivate a more supportive economic landscape for CIR through enhanced infrastructure development and a more robust overall economic recovery.

- NRRP Funding: Over €200 billion from EU funds allocated to Italy.

- Key Objectives: Accelerating digital and green transitions, implementing reforms.

- Stimulus Timeline: Most economic stimulus expected between 2025 and 2026 due to absorption delays.

- CIR Impact: Potential for a favorable economic environment through infrastructure and recovery.

Political Stability and Government Spending

Italy's political landscape presents a mixed outlook for businesses like CIR. While the government has signaled a commitment to fiscal responsibility, aiming to reduce the public deficit, the nation's substantial public debt remains a persistent concern. This high debt level can create vulnerabilities, potentially leading to policy shifts or economic headwinds that could impact business operations.

The government's proposed 2025 budget reflects a strategy to bolster the economy, with notable tax cuts and reductions in social security contributions. These measures are specifically designed to enhance consumer purchasing power, which could translate into increased demand for the products and services offered by CIR's diverse portfolio of companies. For instance, tax relief could boost disposable income, directly benefiting sectors like consumer goods or media.

The effectiveness and longevity of these government policies are crucial. Political stability plays a significant role in shaping the predictability of the business environment. Consistent and well-executed fiscal management, coupled with policies that genuinely stimulate sustained economic growth, will be key determinants of CIR's success. Conversely, any resurgence of political instability or missteps in managing public finances could introduce considerable risk.

- Italy's public debt stood at approximately 144.4% of GDP at the end of 2023, a figure that underscores the fiscal challenges the government aims to address.

- The 2025 budget proposal targets a deficit reduction, though specific targets are subject to ongoing parliamentary debate and European Union fiscal rules.

- Tax cuts in the 2025 budget are expected to provide households with an estimated €10 billion in relief, aiming to stimulate consumption.

- The stability of coalition governments in Italy has historically been a factor influencing the pace and direction of economic reforms.

The Italian government's focus on fiscal prudence, exemplified by its 2025 budget proposals including tax cuts, aims to boost consumer spending and economic activity. However, Italy's substantial public debt, around 144.4% of GDP in late 2023, remains a persistent vulnerability that could influence future policy decisions and economic stability.

The effective absorption and implementation of the EU-funded National Recovery and Resilience Plan (NRRP) are critical for Italy's economic trajectory, with significant stimulus anticipated between 2025 and 2026. Political stability will be key to ensuring consistent policy execution and fostering a predictable business environment for companies like CIR.

Stricter EU CO2 emission standards for vehicles, mandating a 15% reduction by 2025, necessitate strategic adaptation within the automotive sector. For CIR's subsidiary Sogefi, this means prioritizing components for zero and low-emission vehicles to avoid penalties and align with market demands.

| Political Factor | Description | Impact on CIR | Data Point/Year |

| Fiscal Policy & Debt | Government efforts to reduce deficit via 2025 budget, but high public debt persists. | Potential for increased consumer spending due to tax cuts; risk from debt vulnerabilities. | Public debt ~144.4% of GDP (end 2023); 2025 budget proposes tax relief of ~€10 billion. |

| EU Regulations (Environment) | Stricter CO2 emission standards for new cars. | Requires automotive component suppliers (Sogefi) to focus on ZLEV components. | 15% CO2 reduction target by 2025 from 2021 levels. |

| National Recovery Plan (NRRP) | EU-funded plan for digital/green initiatives and reforms. | Potential economic stimulus and improved infrastructure if funds are absorbed efficiently. | Most stimulus expected 2025-2026 due to absorption delays. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Compagnie Industriali Riunite, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and actionable strategies to navigate industry challenges and capitalize on emerging opportunities for Compagnie Industriali Riunite.

This PESTLE analysis for Compagnie Industriali Riunite offers a clear, summarized version of external factors, simplifying strategic discussions and risk assessment for leadership.

Economic factors

Italy faced negative real wage growth in 2023, with inflation running higher than wage increases. However, forecasts for 2024 and 2025 suggest a reversal, as inflation is expected to ease and new wage agreements will likely factor in previous price hikes. For instance, the Italian national institute of statistics, ISTAT, reported that inflation in 2023 averaged 5.9%, while nominal wage growth was around 3%.

This persistent inflation erodes consumer purchasing power, potentially dampening demand for goods and services, particularly in sectors sensitive to discretionary spending like media and automotive. Companies must navigate this environment by carefully managing their operational costs and adjusting pricing strategies to maintain margins.

For a diversified entity like Compagnie Industriali Riunite (CIR), this economic backdrop necessitates a strategic approach. The ability to effectively manage costs and implement appropriate pricing models will be key to preserving profitability, especially as the company anticipates a recovery in real wages in the coming years.

Italy's Gross Domestic Product (GDP) is anticipated to grow by 0.7% in 2024, with expectations for a stronger rebound to 1.2% in 2025. This growth is largely supported by investments channeled through the national recovery and resilience plan.

Despite demonstrating resilience, the Italian economic landscape faces potential headwinds. Factors such as ongoing US tariffs and the pace at which European Union funds are absorbed could moderate the immediate growth trajectory.

A stable or expanding GDP typically signifies a favorable market environment for Compagnie Industriali Riunite (CIR). This is particularly relevant for its healthcare services and automotive components divisions, sectors that are notably influenced by broader economic cycles.

Rising interest rates and tighter financial conditions in Italy are dampening consumer spending and business investment. This trend, observed throughout 2024, makes borrowing more expensive for companies like CIR, directly impacting their ability to fund new projects or manage existing debt. While Italian banks saw profit increases in early 2024, any significant economic downturn could still create ripple effects across the EU.

Automotive Market Trends

The global automotive market faces headwinds, with production expected to dip in 2024 and continue its decline through 2025. This downturn is particularly pronounced in Europe and North America, critical regions for component suppliers like Sogefi.

Several factors are contributing to this contraction. Ongoing geopolitical tensions, including military conflicts and the specter of escalating trade wars, create significant uncertainty. Additionally, evolving green deal regulations, while aiming for sustainability, can also introduce compliance challenges and impact production costs and timelines.

In response to these challenging market dynamics, Sogefi has projected a mid-single-digit revenue decrease for 2025. This forecast underscores the imperative for the company to implement strategic adjustments to navigate the downturn and safeguard its profitability.

- Projected Global Automotive Production Decline: Expected decrease in 2024 and 2025.

- Regional Impact: Greater decreases anticipated in Europe and North America, key Sogefi markets.

- Influencing Factors: Military conflicts, potential trade wars, and green deal regulation uncertainties.

- Sogefi's Revenue Outlook: Anticipates a mid-single-digit revenue decline for 2025.

Healthcare Expenditure and Investment

Italy's healthcare expenditure is projected for substantial growth, with the national healthcare budget slated to rise from €135 billion in 2024 to an estimated €142 billion by 2026. This expansion directly benefits CIR's KOS Group, a key player in the healthcare sector. The increased funding targets critical areas such as innovative pharmaceuticals, antimicrobial resistance strategies, and crucial infrastructure upgrades in community health services, telemedicine, and digital health solutions.

This upward trend in public healthcare investment creates a favorable economic climate for KOS Group. The government's commitment to modernizing healthcare infrastructure and embracing digital advancements, including telemedicine, presents significant opportunities for KOS to expand its service offerings and invest in new technologies.

- Increased Public Spending: Italy's healthcare budget is expected to grow from €135 billion in 2024 to €142 billion by 2026.

- Focus on Innovation: Government investment prioritizes innovative medicines and digital transformation within the healthcare sector.

- Community and Digital Health: Significant funds are allocated to community care, telemedicine, and digitalization initiatives.

- Opportunity for KOS Group: These trends provide a positive economic environment and new avenues for investment and service development for CIR's KOS Group.

Italy's economy is showing signs of recovery, with GDP growth projected at 0.7% for 2024 and an anticipated acceleration to 1.2% in 2025, largely fueled by national recovery plan investments. While inflation eased to an average of 5.9% in 2023, real wage growth is expected to pick up, boosting consumer spending power. However, rising interest rates in 2024 are making borrowing more expensive, potentially impacting business investment and debt management for companies like CIR.

The automotive sector faces a challenging outlook, with global production expected to decline in 2024 and continue through 2025, particularly in Europe and North America. Geopolitical tensions and evolving green deal regulations add to market uncertainty, leading Sogefi to forecast a mid-single-digit revenue decrease for 2025.

Conversely, Italy's healthcare sector presents a positive growth trajectory, with the national healthcare budget set to increase from €135 billion in 2024 to an estimated €142 billion by 2026. This expansion, focused on innovation, digital health, and community services, offers significant opportunities for CIR's KOS Group.

| Economic Indicator | 2023 (Actual) | 2024 (Projected) | 2025 (Projected) |

|---|---|---|---|

| Italian GDP Growth | (Not specified) | 0.7% | 1.2% |

| Italian Inflation (Avg) | 5.9% | (Not specified) | (Not specified) |

| Italian Healthcare Budget | (Not specified) | €135 billion | €142 billion (by 2026) |

| Global Automotive Production | (Not specified) | Decline | Continued Decline |

Preview Before You Purchase

Compagnie Industriali Riunite PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Compagnie Industriali Riunite covers political, economic, social, technological, legal, and environmental factors impacting the company.

Sociological factors

Italy's demographic landscape is characterized by a rapidly aging population, a trend that significantly amplifies the need for healthcare services. This includes a heightened demand for long-term care, rehabilitation facilities, and specialized elderly care homes. For instance, by the end of 2023, individuals aged 65 and over constituted approximately 24.1% of Italy's total population, a figure projected to rise further.

Companies like KOS Group, which strategically focuses on these specific healthcare segments, are favorably positioned to capitalize on this demographic shift. The increasing societal emphasis on enhancing the quality of life for senior citizens further bolsters the demand for advanced and specialized healthcare solutions tailored to their needs.

Societal emphasis on health and wellness is a significant driver for companies like Compagnie Industriali Riunite. This growing consciousness impacts demand for healthcare services and products, potentially boosting KOS Group's rehabilitation and outpatient clinics. For instance, in Italy, the healthcare spending per capita reached approximately $3,600 in 2023, reflecting this increased focus.

Furthermore, this health-aware trend influences media consumption. GEDI Gruppo Editoriale, for example, may see shifts in audience engagement with health and lifestyle content, requiring strategic adjustments to their editorial offerings to align with public interests.

Digital media consumption is reshaping how people access information and entertainment, directly affecting industries like publishing. CIR's media arm, GEDI Gruppo Editoriale, recognizes this, investing in areas like podcasts and specialized content hubs to meet changing user habits. For instance, in 2024, digital advertising revenue for news publishers in Italy was projected to grow, but the struggle to effectively monetize this digital content while keeping audiences engaged against a backdrop of intense competition and shifting viewing patterns remains a significant hurdle.

Workforce Dynamics and Skills Gap

The availability of skilled labor in specialized sectors, particularly healthcare and advanced manufacturing such as automotive components, directly influences Compagnie Industriali Riunite's operational efficiency and growth potential. For instance, a shortage of qualified technicians in automotive component production could slow down manufacturing output.

Attracting and retaining talent in rapidly evolving fields like digital media, robotics, and telemedicine is paramount for CIR's technological advancement and the effective delivery of its services. In 2024, the demand for robotics engineers in Italy saw a significant increase, with job postings rising by an estimated 15% compared to the previous year, highlighting a competitive talent market.

Societal attitudes toward education and career choices play a crucial role in shaping the future talent pipeline for these critical industries. Growing interest in STEM fields among younger generations, evidenced by a 10% rise in university enrollments for engineering programs in Italy between 2023 and 2024, bodes well for CIR's long-term recruitment efforts.

- Skilled Labor Impact: Shortages in automotive component manufacturing expertise can constrain production capacity for CIR.

- Talent Acquisition Focus: CIR must prioritize attracting professionals in digital media, robotics, and telemedicine for innovation.

- Talent Market Trends: A 15% year-over-year increase in robotics engineer job openings in Italy (2024) indicates a competitive landscape.

- Educational Influence: A 10% increase in Italian engineering university enrollments (2023-2024) suggests a strengthening talent pool for CIR's technical needs.

Consumer Preferences in Automotive Sector

Consumer preferences in the automotive sector are significantly shifting towards sustainability. Growing environmental awareness, coupled with increasing regulatory pressures, is fueling a strong demand for electric vehicles (EVs) and other low-emission alternatives. This trend directly impacts component suppliers like Sogefi, necessitating adaptation in their product development to cater to these evolving market needs.

By 2024, global EV sales are projected to exceed 15 million units, a substantial increase from previous years. This surge underscores the urgency for automotive manufacturers and their supply chains to invest in and produce components for these greener technologies. Sogefi's strategic focus on developing filtration and engine system components compatible with EVs and hybrid powertrains is crucial for maintaining market relevance and capturing growth opportunities in this dynamic segment.

- EV Market Growth: Global EV sales are expected to reach approximately 17 million units in 2025, indicating a sustained upward trajectory.

- Consumer Demand for Sustainability: Surveys in 2024 show that over 60% of new car buyers consider environmental impact when making a purchase decision.

- Regulatory Push: Many governments have set targets for phasing out internal combustion engine vehicles, further accelerating the adoption of EVs and low-emission technologies.

- Sogefi's Adaptation: The company's investment in lightweight materials and advanced filtration systems for EVs positions it to benefit from this market transformation.

Societal attitudes towards health and sustainability are increasingly influencing consumer choices and corporate strategies. For Compagnie Industriali Riunite (CIR), this means a growing demand for eco-friendly products and services, particularly within its automotive components division, Sogefi. For example, in 2024, over 60% of new car buyers in Europe indicated that environmental impact was a key factor in their purchasing decisions.

This shift also impacts the media sector, where GEDI Gruppo Editoriale must adapt its content to reflect public interest in health and wellness. CIR's healthcare arm, KOS Group, benefits directly from the aging Italian population, with individuals over 65 representing approximately 24.1% of the population in late 2023, a demographic that requires specialized care services.

The demand for skilled labor in sectors like automotive components and digital media is crucial for CIR's operational success. Italy saw a 15% rise in job postings for robotics engineers in 2024, highlighting a competitive talent market that CIR must navigate to secure necessary expertise.

The evolving consumer preferences toward electric vehicles (EVs) are a significant factor for Sogefi. With global EV sales projected to exceed 15 million units by the end of 2024, Sogefi's focus on developing components for EVs and hybrid powertrains is vital for its future growth and market relevance.

| Sociological Factor | Impact on CIR | Relevant Data (2023-2025) |

| Aging Population | Increased demand for healthcare services (KOS Group) | 24.1% of Italy's population aged 65+ (late 2023) |

| Health & Wellness Focus | Demand for specialized healthcare products/services; content shifts (GEDI) | Italy's healthcare spending per capita ~$3,600 (2023) |

| Sustainability Concerns | Demand for EV components (Sogefi) | 60%+ of new car buyers consider environmental impact (2024) |

| Digital Media Consumption | Content strategy adjustments (GEDI) | Projected growth in digital advertising revenue for Italian news publishers (2024) |

| Skilled Labor Demand | Operational efficiency and growth potential | 15% increase in robotics engineer job postings in Italy (2024) |

Technological factors

The healthcare industry is rapidly adopting digital solutions, with substantial growth in telemedicine, electronic health records, and robotic assistance. For instance, global spending on health IT is projected to reach over $150 billion by 2025, highlighting this trend.

Compagnie Industriali Riunite, through its KOS Group, is strategically channeling investments into these advanced technologies. This includes enhancing digital platforms for patient interaction and clinical workflow optimization, reflecting a commitment to innovation.

These technological advancements are designed to boost operational efficiency and personalize patient care. Furthermore, this digital push aligns with Italy's National Recovery and Resilience Plan, which prioritizes digital infrastructure development across key sectors, including healthcare.

Technological advancements in materials science are significantly impacting automotive components. The development of lighter yet stronger materials, like advanced composites, is a key trend. These innovations are vital for improving vehicle safety, passenger comfort, and fuel efficiency, particularly for the burgeoning electric vehicle (EV) market. For instance, the increasing adoption of lightweight materials in EVs can directly translate to extended range.

Sogefi, operating within this dynamic automotive components sector, faces the imperative to innovate. The company must adapt its product offerings to integrate these cutting-edge materials and technologies. This continuous innovation is essential for maintaining competitiveness and adhering to increasingly stringent industry standards and consumer expectations for performance and sustainability.

Technological advancements, particularly in AI and automation, are reshaping the media and publishing landscape. Companies like GEDI Gruppo Editoriale can harness these tools for more efficient content creation, personalized reader experiences, and optimized distribution channels. For instance, AI can analyze vast datasets to predict trending topics and tailor content delivery, potentially boosting engagement metrics.

The adoption of AI in media is not just about efficiency; it’s about deeper audience understanding and engagement. In 2024, many publishers are investing in AI-powered recommendation engines and personalized news feeds. GEDI could explore these avenues to enhance user retention and create more targeted advertising opportunities, a key driver for revenue in the digital publishing space.

Cybersecurity and Data Privacy

Cybersecurity and data privacy are critical for Compagnie Industriali Riunite (CIR) and its subsidiaries, especially those in healthcare and media. These sectors handle highly sensitive information, making them prime targets for cyber threats. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the significant financial risks involved.

CIR's healthcare subsidiaries, dealing with patient health information (PHI), must comply with stringent regulations like GDPR and HIPAA. A data breach could lead to substantial fines, reputational damage, and loss of patient trust. In 2023, the average cost of a data breach in the healthcare sector was $4.82 million, underscoring the financial imperative for robust security.

Similarly, CIR's media operations, which collect subscriber data and personal preferences, face risks related to privacy violations. Maintaining user confidence is key to subscriber retention and growth. The increasing sophistication of cyberattacks necessitates continuous investment in advanced security technologies and employee training to mitigate these evolving threats.

- Data Breach Costs: The healthcare industry faced an average data breach cost of $4.82 million in 2023.

- Global Cybercrime Threat: Cybercrime costs are estimated to reach $10.5 trillion annually by 2025.

- Regulatory Compliance: Adherence to regulations like GDPR and HIPAA is crucial for protecting sensitive data.

- Investment Necessity: Ongoing investment in cybersecurity infrastructure and training is vital for mitigating risks.

Telecommunications Infrastructure Development

The ongoing expansion of 5G networks is a significant technological driver for businesses like Compagnie Industriali Riunite (CIR). This advanced infrastructure is essential for enabling new digital services, from remote healthcare solutions to sophisticated in-car connectivity and high-definition content delivery. As CIR increasingly integrates digital components into its operations and offerings, robust and rapid telecommunications will be fundamental to ensuring smooth service delivery and expanding market reach.

The global 5G market is projected to see substantial growth. For instance, by the end of 2024, it's estimated that over 1.5 billion 5G connections will be active worldwide, with this number expected to climb significantly in the coming years. This widespread adoption directly impacts CIR's ability to leverage digital technologies.

- 5G Deployment: Continued investment in 5G infrastructure globally, aiming for wider coverage and increased speeds.

- IoT Enablement: Enhanced capabilities for the Internet of Things (IoT), supporting connected devices and data transmission crucial for industrial applications.

- Digital Service Growth: The infrastructure supports the expansion of digital services, including cloud computing, advanced analytics, and immersive digital experiences, all of which can benefit CIR.

Technological advancements are profoundly influencing Compagnie Industriali Riunite's (CIR) diverse operations. Its healthcare segment, KOS Group, is embracing digital health solutions, including telemedicine and AI-driven diagnostics, to enhance patient care and operational efficiency. This aligns with global health IT spending projected to exceed $150 billion by 2025.

In the automotive sector, Sogefi is adapting to innovations in lightweight materials and advanced manufacturing processes. The automotive industry's push for electric vehicles (EVs) necessitates the integration of new materials to improve performance and range, a trend that Sogefi must actively engage with to remain competitive.

CIR's media arm, GEDI Gruppo Editoriale, is leveraging AI and automation for content creation, personalization, and distribution. The increasing adoption of AI in media, with publishers investing in AI-powered recommendation engines in 2024, offers opportunities for enhanced reader engagement and targeted advertising.

The company must also prioritize cybersecurity, given the escalating threat landscape. With global cybercrime costs projected to reach $10.5 trillion annually by 2025, and the healthcare sector facing average data breach costs of $4.82 million in 2023, robust security measures are paramount for protecting sensitive data and maintaining trust.

Furthermore, the expansion of 5G networks is a critical technological enabler, supporting CIR's digital service growth and IoT capabilities. With over 1.5 billion 5G connections expected globally by the end of 2024, this infrastructure is vital for the company's future operations.

Legal factors

The Italian healthcare system operates under a robust legal structure, with recent legislative changes significantly influencing how healthcare budgets are distributed and how the Italian Medicines Agency (AIFA) is reorganized. These reforms are key to understanding the operating environment.

For KOS Group, adherence to both national and regional healthcare laws is paramount. This includes regulations concerning how drugs are evaluated, the processes for reimbursement, and the standards for accrediting healthcare facilities. Staying compliant is not optional; it's fundamental to their business.

Potential shifts in these regulations could directly impact KOS Group's day-to-day operations, the types of services they can offer, and the financial strategies they employ. For instance, a change in drug pricing policies could alter revenue streams.

The European Union's updated CO2 emission performance standards for new cars and vans, commencing in 2025, place considerable legal duties on automotive manufacturers, impacting component suppliers like Sogefi. Non-compliance with these regulations, which aim for an average fleet emission reduction of 55% by 2030 compared to 2021 levels, can result in substantial financial penalties. Sogefi's strategic imperative is to develop and supply components that enable manufacturers to achieve these ambitious targets, particularly in the realm of zero-emission vehicle technology.

Compagnie Industriali Riunite (CIR) and its diverse subsidiaries navigate a complex web of competition laws across various sectors. These regulations, including those from the European Union, scrutinize mergers, acquisitions, and any shifts in market dominance to prevent monopolistic behavior.

For instance, in 2024, the European Commission continued its active enforcement of competition rules, investigating several sectors where market concentration could potentially harm consumers. CIR's strategic planning must therefore account for these legal frameworks, ensuring all expansion and investment activities align with antitrust guidelines.

Labor Laws and Employment Regulations

Compagnie Industriali Riunite (CIR), operating in Italy and abroad, navigates a complex web of labor laws. These regulations, covering everything from employment contracts and working conditions to collective bargaining, directly influence CIR's operational costs and human resource strategies. For instance, Italy's labor market reforms, such as those aimed at increasing flexibility in hiring and firing, can significantly alter a company's ability to manage its workforce effectively. Failure to comply with these diverse legal frameworks can lead to substantial fines and legal challenges, impacting the company's reputation and financial stability.

The dynamic nature of labor legislation means CIR must remain vigilant. For example, recent discussions and potential updates to EU directives on worker rights or national minimum wage adjustments in key operating countries could introduce new compliance burdens or cost increases. In 2023, Italy saw ongoing debates around the minimum wage and the regulation of platform work, underscoring the evolving landscape. Staying abreast of these changes is crucial for maintaining a compliant and motivated workforce, thereby mitigating risks and ensuring smooth business operations across all subsidiaries.

Key aspects of labor laws impacting CIR include:

- Employment Contracts: Adherence to various contract types (permanent, fixed-term, apprenticeship) and their specific legal requirements in each jurisdiction.

- Working Conditions: Compliance with regulations on working hours, health and safety standards, and employee benefits, which can vary significantly by country.

- Collective Bargaining: Engagement with trade unions and adherence to agreements that dictate wages, benefits, and working practices, a significant factor in Italy's industrial relations.

- Dismissal Procedures: Following strict legal protocols for employee termination to avoid unfair dismissal claims, which can be costly and time-consuming.

Data Protection and Privacy Laws (GDPR)

Data protection and privacy laws, particularly the General Data Protection Regulation (GDPR), are paramount for companies like GEDI Gruppo Editoriale, given their extensive digital operations, and KOS Group, due to the sensitive patient data they manage. Non-compliance carries substantial risks, including hefty fines and significant reputational harm. For instance, GDPR fines can reach up to €20 million or 4% of annual global turnover, whichever is greater. This mandates rigorous data security protocols, transparent data handling procedures, and consistent audits to maintain compliance. In 2024, the European Union continued to emphasize enforcement, with numerous companies facing scrutiny over their data practices.

The implications of GDPR extend to how these companies collect, process, store, and share personal information. For GEDI, this means ensuring subscriber data and website user activity are handled with utmost care and transparency. KOS Group must prioritize patient confidentiality and data integrity, adhering to strict guidelines for health records.

- GDPR Fines: Penalties can amount to 4% of global annual revenue or €20 million, whichever is higher.

- Data Breach Reporting: Companies must report significant data breaches to supervisory authorities within 72 hours of becoming aware of them.

- Consent Management: Obtaining explicit and informed consent for data processing is a core requirement.

- Data Subject Rights: Individuals have rights to access, rectify, erase, and restrict the processing of their personal data.

Compagnie Industriali Riunite (CIR) operates within a legal framework that mandates adherence to competition laws, particularly concerning market dominance and anti-competitive practices. The European Union's ongoing enforcement in 2024, targeting sectors with high market concentration, underscores the need for CIR to ensure all strategic moves, including mergers and acquisitions, comply with antitrust regulations to avoid significant penalties and legal challenges.

Environmental factors

The increasing global and European focus on climate change is a significant environmental factor. This trend directly fuels demand for products and services that are environmentally conscious. For companies like Sogefi, a key player in automotive components and part of the CIR group, this translates into a heightened need to innovate. They are under pressure to develop components that actively reduce vehicle emissions, contributing to lower environmental impact.

Furthermore, this emphasis on sustainability extends to manufacturing processes. Sogefi faces expectations to adopt more eco-friendly production methods, minimizing waste and resource consumption. This environmental shift also impacts CIR's broader investment strategy, potentially steering capital towards green investments and companies that adhere to strong Environmental, Social, and Governance (ESG) criteria. For instance, in 2024, the European Union continued to strengthen its Green Deal objectives, aiming for climate neutrality by 2050, which will undoubtedly influence industrial supply chains and investment priorities.

The availability and cost of critical raw materials, such as steel, aluminum, and increasingly, lithium and cobalt for electric vehicle batteries, directly impact automotive component manufacturers like Sogefi. For instance, the average price of lithium carbonate surged by over 400% between early 2021 and late 2022, driven by soaring demand and supply constraints, a trend that continued to affect battery production costs into 2023 and 2024.

Environmental regulations, including those related to emissions standards and the sourcing of sustainable materials, can add complexity and cost to raw material procurement. Geopolitical instability, as seen in regions rich in mineral resources, further exacerbates supply chain risks and price volatility for essential metals used in vehicle manufacturing.

Sogefi's strategy to mitigate these environmental factor-driven risks involves securing diversified sourcing channels for key metals and investing in technologies that promote more efficient material utilization and recycling, aiming to stabilize production costs amidst fluctuating global commodity markets.

Industrial operations, particularly in automotive component manufacturing, inherently generate waste and emissions, posing a significant environmental challenge for companies like Sogefi. For instance, in 2024, the automotive sector globally faced increasing scrutiny over its carbon footprint, with stricter emission standards being implemented across major markets.

Compliance with evolving environmental regulations concerning waste management, air quality, and water pollution is absolutely critical for Sogefi's operational continuity and reputation. Failure to adhere to these standards, such as the EU's Waste Framework Directive or national air quality standards, can result in substantial fines and operational disruptions.

To navigate these environmental factors, Sogefi must focus on implementing sustainable manufacturing practices and investing in advanced pollution control technologies. This proactive approach is not only necessary to meet regulatory requirements but also to demonstrate a commitment to environmental responsibility, which is increasingly valued by investors and consumers alike.

Energy Consumption and Renewable Energy Adoption

Energy costs represent a critical environmental factor for Compagnie Industriali Riunite (CIR). The ongoing global emphasis on sustainability and the transition to cleaner energy sources directly impacts operational expenditures and strategic planning. For CIR, with its varied industrial activities, managing energy consumption efficiently and investigating renewable energy solutions are key to both cost optimization and improving its environmental footprint. This strategic alignment supports broader European Union objectives for energy independence and decarbonization, particularly in light of rising fossil fuel prices and stricter environmental regulations anticipated through 2025.

The push towards renewable energy adoption is accelerating across Europe. For instance, by the end of 2024, renewable energy sources were projected to account for over 40% of the EU's gross final energy consumption, a significant increase from previous years. CIR's commitment to integrating more renewable energy into its operations, such as solar or wind power for its manufacturing facilities, could lead to substantial savings on energy bills. Furthermore, this proactive approach can bolster the company's brand image and appeal to environmentally conscious investors and customers.

- Energy Cost Volatility: Fluctuations in global energy prices, particularly for natural gas and electricity, directly affect CIR's manufacturing and operational costs.

- Renewable Energy Targets: European Union directives aim for increased renewable energy penetration, creating opportunities and potential mandates for companies like CIR to adopt cleaner energy sources.

- Operational Efficiency Gains: Investing in energy-efficient technologies and processes can reduce CIR's overall energy consumption, leading to lower operating expenses and a reduced carbon footprint.

- Market Demand for Sustainability: Growing consumer and business preference for sustainably produced goods and services incentivizes CIR to enhance its environmental performance, including its energy sourcing.

Environmental Impact of Healthcare Facilities

Healthcare facilities, including those operated by KOS Group, significantly impact the environment through waste generation, energy consumption, and water usage. For instance, the healthcare sector in Italy, a key market for KOS, generated an estimated 1.3 million tons of waste in 2023, with a substantial portion being medical waste requiring specialized disposal.

Adopting sustainable facility management is crucial for KOS Group to lessen its environmental footprint. This involves implementing advanced waste segregation and recycling programs, which can reduce landfill waste by up to 30% in similar organizations. Furthermore, investing in energy-efficient technologies, such as LED lighting and smart HVAC systems, can decrease energy consumption by 15-25% annually.

The adoption of green building standards in new constructions or renovations can also play a vital role. For example, facilities designed to LEED (Leadership in Energy and Environmental Design) standards often report lower operational costs and improved environmental performance. KOS Group's commitment to these practices aligns with broader European Union directives aiming to reduce carbon emissions and promote circular economy principles within the healthcare industry.

- Waste Management: In 2023, the Italian healthcare sector produced approximately 1.3 million tons of waste, highlighting the need for efficient disposal and recycling strategies.

- Energy Efficiency: Implementing energy-saving measures can lead to a reduction in energy consumption by 15-25% in healthcare facilities.

- Water Conservation: Sustainable water management practices can reduce water usage by an estimated 10-20% in large institutions.

- Green Building: Adherence to green building standards can lower operational expenses and environmental impact, contributing to long-term sustainability goals.

The increasing global focus on climate change and sustainability is a significant environmental factor shaping industries. This trend drives demand for eco-friendly products and services, pressuring companies like Sogefi to innovate in emission-reducing components. For CIR, it influences investment towards green initiatives, aligning with EU Green Deal objectives targeting climate neutrality by 2050.

The availability and cost of raw materials, such as lithium for EV batteries, directly impact automotive component manufacturers. For example, lithium carbonate prices saw over a 400% surge between early 2021 and late 2022, affecting production costs into 2024. Environmental regulations on emissions and sustainable sourcing add complexity to procurement, with geopolitical instability further risking supply chains.

Industrial operations, particularly in automotive manufacturing, inherently generate waste and emissions. In 2024, the automotive sector faced scrutiny over its carbon footprint, with stricter emission standards implemented globally. Compliance with regulations on waste, air, and water quality is critical, with non-compliance leading to fines and disruptions.

Energy costs are a critical environmental factor for CIR. The transition to cleaner energy sources impacts operational expenditures. Managing energy consumption efficiently and adopting renewables are key for cost optimization and reducing CIR's environmental footprint, supporting EU energy independence goals and decarbonization efforts, especially with anticipated rising fossil fuel prices and stricter regulations by 2025.

| Environmental Factor | Impact on CIR Group | Example/Data Point (2024/2025 Focus) |

|---|---|---|

| Climate Change & Sustainability Focus | Drives demand for eco-friendly products; influences investment strategy towards ESG. | EU Green Deal objectives for climate neutrality by 2050 continue to shape industrial supply chains. |

| Raw Material Availability & Cost | Affects manufacturing costs for automotive components (e.g., lithium for batteries). | Lithium carbonate prices experienced significant volatility, impacting battery production costs into 2024. |

| Emissions & Waste Management | Requires compliance with evolving regulations; necessitates sustainable manufacturing practices. | Automotive sector faces global scrutiny on carbon footprint with stricter emission standards in major markets. |

| Energy Costs & Renewable Energy | Impacts operational expenditures; drives adoption of cleaner energy sources for cost optimization. | Renewable energy sources projected to account for over 40% of EU's gross final energy consumption by end of 2024. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Compagnie Industriali Riunite is built on a comprehensive review of official government publications, reports from international financial institutions, and leading industry analysis firms. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.