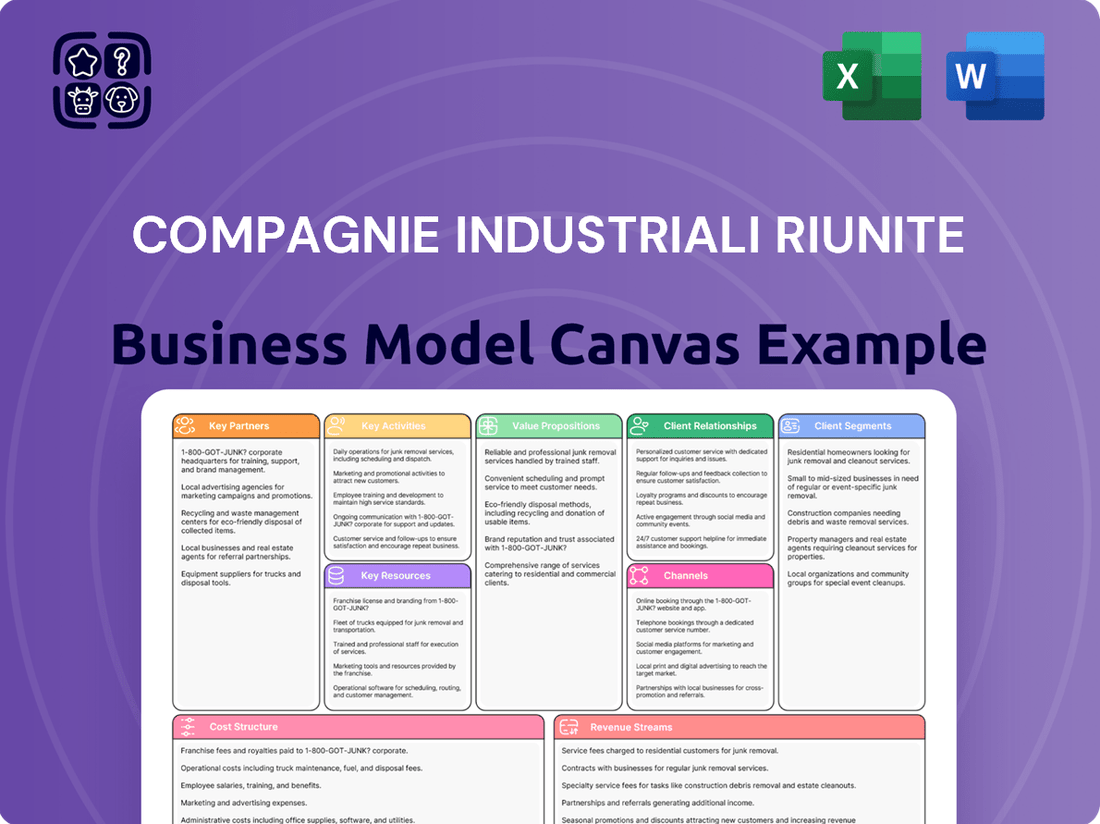

Compagnie Industriali Riunite Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Compagnie Industriali Riunite Bundle

Unlock the core strategic elements of Compagnie Industriali Riunite's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their key partners, value propositions, and revenue streams. Discover how they operate and gain actionable insights for your own ventures.

Partnerships

Compagnie Industriali Riunite (CIR) thrives on strategic alliances with its controlled subsidiaries, most notably KOS in healthcare services and Sogefi in automotive components. These collaborations are fundamental, fostering operational synergies, expanding market penetration, and capitalizing on the distinct expertise each sector offers.

CIR's role involves providing crucial strategic direction and financial support, enabling its subsidiaries to focus on their daily operations and pursue sector-specific growth strategies. This structure allows for efficient resource allocation and specialized management, driving value across the group.

For instance, Sogefi, a key subsidiary, reported revenue of approximately €1.7 billion in 2023, underscoring the significant contribution of these strategic partnerships to CIR's overall financial performance and market presence.

CIR, as a holding company, collaborates with a wide array of financial institutions, including major banks and diverse investment funds. These relationships are vital for securing the capital needed for its varied portfolio companies, whether through traditional debt financing or equity injections. For instance, in 2024, CIR successfully accessed credit lines from leading European banks, demonstrating the strength of these key partnerships.

Institutional investors, such as pension funds and asset managers, also represent a critical partnership segment for CIR. Their participation is often sought for significant capital raises or co-investment opportunities in strategic acquisitions and new business developments. These collaborations provide CIR with not only financial resources but also valuable market insights and a broader network, enhancing its strategic flexibility and capacity for growth.

Compagnie Industriali Riunite (CIR) strategically utilizes mergers, acquisitions, and divestments to refine its business portfolio and enhance long-term shareholder value. These activities are crucial for adapting to market dynamics and realizing capital gains.

Key partners in these strategic transactions include private equity firms, corporate buyers seeking synergistic opportunities, and real estate funds. For instance, CIR's 2023 divestment of its entire stake in Sogefi, a significant automotive component manufacturer, exemplifies this strategy. This move generated substantial capital for reinvestment.

Industry-Specific Collaborators

Compagnie Industriali Riunite (CIR) leverages strategic alliances within its core sectors. In healthcare, its subsidiaries collaborate with leading medical technology providers and healthcare operators, fostering innovation and market access. For instance, partnerships with specialized medical device manufacturers can accelerate the development and distribution of advanced diagnostic tools.

Within the automotive industry, CIR's automotive divisions forge ties with major car manufacturers and key suppliers. These relationships are crucial for integrating new technologies and securing robust supply chains. A prime example is joint development agreements for electric vehicle components, aiming to enhance performance and reduce production costs.

These industry-specific collaborations are vital for CIR's competitive edge. They facilitate knowledge sharing, risk mitigation, and the co-creation of value. For example, in 2024, CIR's automotive segment secured a significant supply agreement with a major European carmaker, projected to contribute €500 million in revenue over the next three years.

CIR's approach to key partnerships can be summarized as follows:

- Healthcare Collaborations: Partnerships with medical technology firms and healthcare providers for R&D and market expansion.

- Automotive Alliances: Joint ventures and supply agreements with car manufacturers and component suppliers.

- Innovation Drivers: These partnerships enhance competitive positioning and drive innovation, as seen in the development of next-generation automotive components.

- Financial Impact: Strategic alliances contribute directly to revenue growth and market share, with recent automotive agreements expected to boost sales significantly in 2024-2027.

Professional Service Providers

Compagnie Industriali Riunite (CIR) leverages a robust network of professional service providers to ensure operational integrity and strategic advancement. These include specialized legal counsel for navigating intricate corporate law, independent auditors to validate financial reporting, and financial consultants for optimizing capital structure and M&A activities.

CIR's engagement with ESG rating agencies is particularly crucial, reflecting a commitment to sustainability and responsible corporate citizenship. For instance, in 2024, CIR continued to prioritize transparency in its environmental, social, and governance (ESG) disclosures, working with agencies to accurately reflect its performance.

- Legal Advisors: Essential for compliance with evolving regulations and managing complex corporate transactions, safeguarding CIR's legal standing.

- Auditors: Provide independent assurance on financial statements, fostering trust among investors and stakeholders.

- Financial Consultants: Offer strategic advice on financial planning, investments, and capital management to enhance profitability.

- ESG Rating Agencies: Support CIR's commitment to sustainability by providing assessments of its environmental, social, and governance performance.

CIR's key partnerships extend to financial institutions and institutional investors, crucial for capital acquisition and strategic growth initiatives. These alliances provide not only funding but also market intelligence, as seen with CIR's successful access to credit lines from major European banks in 2024.

Furthermore, CIR collaborates with private equity firms and corporate buyers for mergers, acquisitions, and divestments, optimizing its portfolio. The 2023 divestment of its Sogefi stake generated significant capital, illustrating the financial impact of these strategic relationships.

Industry-specific partnerships, such as joint development agreements for electric vehicle components in the automotive sector and collaborations with medical technology providers in healthcare, are vital for innovation and market access. These alliances directly contribute to revenue and market share, with recent automotive agreements projected to add €500 million in revenue by 2027.

| Partner Type | Purpose | 2023/2024 Impact/Example |

|---|---|---|

| Controlled Subsidiaries (KOS, Sogefi) | Operational synergies, market expansion, sector expertise | Sogefi revenue ~€1.7 billion (2023) |

| Financial Institutions | Capital acquisition (debt/equity) | Access to credit lines (2024) |

| Institutional Investors | Capital raises, co-investment | Enhanced market insights, network expansion |

| PE Firms/Corporate Buyers | M&A, portfolio optimization | Sogefi divestment generated capital (2023) |

| Industry Partners (MedTech, Auto OEMs) | R&D, innovation, supply chain security | EV component development, €500M auto supply agreement (2024-2027) |

What is included in the product

This Business Model Canvas outlines Compagnie Industriali Riunite's strategy by detailing its key customer segments, value propositions, and revenue streams, supported by insights into its operational structure and competitive advantages.

The Compagnie Industriali Riunite Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot that simplifies complex strategic elements.

It alleviates the pain of information overload by condensing the company's strategy into a digestible format for quick review and understanding.

Activities

Compagnie Industriali Riunite (CIR) actively manages its diverse portfolio, focusing on strategic growth and value enhancement across its key sectors: healthcare, automotive components, and media. This involves in-depth performance monitoring and astute capital allocation decisions to maximize shareholder returns.

In 2024, CIR's strategic oversight of its subsidiaries, such as those in the automotive sector, continued to be a core activity. For instance, the automotive components division, a significant part of CIR's holdings, navigated evolving market demands for electrification and advanced driver-assistance systems.

The company's healthcare segment also saw active management, with a focus on innovation and market expansion. This hands-on approach aims to ensure each subsidiary remains competitive and contributes positively to CIR's overall financial health and long-term value proposition.

Compagnie Industriali Riunite (CIR) actively engages in strategic investments to fuel growth and enhance its portfolio. This involves identifying promising new companies or sectors that fit its long-term vision for creating value.

Simultaneously, CIR focuses on divesting non-core or underperforming assets. This strategic pruning helps optimize the overall business structure and frees up capital for more impactful ventures. For instance, in 2024, CIR continued its portfolio refinement, building on previous actions like the sale of Sogefi's Filtration division and a real estate property.

Compagnie Industriali Riunite (CIR) actively manages its financial health by overseeing its consolidated net financial position, which stood at €2.2 billion as of December 31, 2023. This involves strategic capital allocation across its diverse portfolio of investments, ensuring resources are directed towards opportunities with the highest potential for return.

The company's financial management includes diligent debt management and optimizing returns from its financial asset portfolio. Decisions regarding share buybacks or dividend distributions are carefully considered to enhance shareholder value while maintaining robust liquidity. This focus on sound financial stewardship is crucial for funding ongoing operations and future growth initiatives.

Corporate Governance and Compliance

Ensuring robust corporate governance and compliance is a cornerstone activity for Compagnie Industriali Riunite (CIR). This involves meticulously adhering to all relevant regulatory frameworks, both at the holding company level and across its diverse subsidiaries, to maintain operational integrity and stakeholder trust. Transparency with shareholders and the unwavering commitment to ethical business practices are paramount in this process.

Integral to CIR's governance framework are regular board meetings and comprehensive financial reporting. These activities ensure accountability and provide timely insights into the company's performance and strategic direction. For instance, in 2024, CIR continued its focus on enhancing its governance structures, with board meetings held quarterly to review financial results and strategic initiatives.

CIR's commitment to compliance extends to various areas, including financial reporting standards and market regulations. This proactive approach minimizes legal and financial risks. In 2024, the company successfully navigated evolving regulatory landscapes, demonstrating its adaptability and dedication to best practices. This focus on compliance is crucial for maintaining investor confidence and the company's long-term sustainability.

Key activities within Corporate Governance and Compliance include:

- Adherence to Regulatory Standards: Ensuring all operations comply with national and international laws and regulations governing listed companies and their respective industries.

- Shareholder Communication: Maintaining open and transparent communication channels with shareholders through regular reports, investor calls, and annual general meetings.

- Board Oversight and Effectiveness: Facilitating regular board meetings to provide strategic guidance, monitor management performance, and ensure effective decision-making.

- Ethical Conduct and Risk Management: Upholding high ethical standards across the organization and implementing robust risk management frameworks to identify and mitigate potential threats.

Investor Relations and Communication

Compagnie Industriali Riunite (CIR) prioritizes ongoing, clear communication with its investors, financial analysts, and the wider market. This commitment ensures stakeholders are consistently updated on the company's financial health, strategic direction, and future prospects.

CIR actively disseminates information through various channels, including the regular publication of financial reports, investor presentations, and timely press releases. For instance, in its 2024 financial reporting, CIR detailed its performance against key industry benchmarks, emphasizing transparency in its operational updates.

These efforts in investor relations are crucial for fostering trust and positively influencing the company's market valuation. Strong, open communication helps build confidence, which can translate into a more stable and favorable stock price.

- Financial Reporting: CIR consistently publishes quarterly and annual financial statements, adhering to international accounting standards.

- Investor Presentations: The company holds regular conference calls and webcasts to discuss financial results and strategic developments.

- Press Releases: Key corporate announcements, such as significant acquisitions or divestitures, are communicated promptly via press releases.

- Analyst Engagement: CIR actively engages with financial analysts to provide insights and answer queries, facilitating informed market analysis.

Compagnie Industriali Riunite (CIR) actively manages its diverse portfolio, focusing on strategic growth and value enhancement across its key sectors: healthcare, automotive components, and media. This involves in-depth performance monitoring and astute capital allocation decisions to maximize shareholder returns.

In 2024, CIR's strategic oversight of its subsidiaries, such as those in the automotive sector, continued to be a core activity. For instance, the automotive components division, a significant part of CIR's holdings, navigated evolving market demands for electrification and advanced driver-assistance systems.

The company's healthcare segment also saw active management, with a focus on innovation and market expansion. This hands-on approach aims to ensure each subsidiary remains competitive and contributes positively to CIR's overall financial health and long-term value proposition.

Compagnie Industriali Riunite (CIR) actively engages in strategic investments to fuel growth and enhance its portfolio. This involves identifying promising new companies or sectors that fit its long-term vision for creating value.

Simultaneously, CIR focuses on divesting non-core or underperforming assets. This strategic pruning helps optimize the overall business structure and frees up capital for more impactful ventures. For instance, in 2024, CIR continued its portfolio refinement, building on previous actions like the sale of Sogefi's Filtration division and a real estate property.

Compagnie Industriali Riunite (CIR) actively manages its financial health by overseeing its consolidated net financial position, which stood at €2.2 billion as of December 31, 2023. This involves strategic capital allocation across its diverse portfolio of investments, ensuring resources are directed towards opportunities with the highest potential for return.

The company's financial management includes diligent debt management and optimizing returns from its financial asset portfolio. Decisions regarding share buybacks or dividend distributions are carefully considered to enhance shareholder value while maintaining robust liquidity. This focus on sound financial stewardship is crucial for funding ongoing operations and future growth initiatives.

Ensuring robust corporate governance and compliance is a cornerstone activity for Compagnie Industriali Riunite (CIR). This involves meticulously adhering to all relevant regulatory frameworks, both at the holding company level and across its diverse subsidiaries, to maintain operational integrity and stakeholder trust. Transparency with shareholders and the unwavering commitment to ethical business practices are paramount in this process.

Integral to CIR's governance framework are regular board meetings and comprehensive financial reporting. These activities ensure accountability and provide timely insights into the company's performance and strategic direction. For instance, in 2024, CIR continued its focus on enhancing its governance structures, with board meetings held quarterly to review financial results and strategic initiatives.

CIR's commitment to compliance extends to various areas, including financial reporting standards and market regulations. This proactive approach minimizes legal and financial risks. In 2024, the company successfully navigated evolving regulatory landscapes, demonstrating its adaptability and dedication to best practices. This focus on compliance is crucial for maintaining investor confidence and the company's long-term sustainability.

Key activities within Corporate Governance and Compliance include:

- Adherence to Regulatory Standards: Ensuring all operations comply with national and international laws and regulations governing listed companies and their respective industries.

- Shareholder Communication: Maintaining open and transparent communication channels with shareholders through regular reports, investor calls, and annual general meetings.

- Board Oversight and Effectiveness: Facilitating regular board meetings to provide strategic guidance, monitor management performance, and ensure effective decision-making.

- Ethical Conduct and Risk Management: Upholding high ethical standards across the organization and implementing robust risk management frameworks to identify and mitigate potential threats.

Compagnie Industriali Riunite (CIR) prioritizes ongoing, clear communication with its investors, financial analysts, and the wider market. This commitment ensures stakeholders are consistently updated on the company's financial health, strategic direction, and future prospects.

CIR actively disseminates information through various channels, including the regular publication of financial reports, investor presentations, and timely press releases. For instance, in its 2024 financial reporting, CIR detailed its performance against key industry benchmarks, emphasizing transparency in its operational updates.

These efforts in investor relations are crucial for fostering trust and positively influencing the company's market valuation. Strong, open communication helps build confidence, which can translate into a more stable and favorable stock price.

- Financial Reporting: CIR consistently publishes quarterly and annual financial statements, adhering to international accounting standards.

- Investor Presentations: The company holds regular conference calls and webcasts to discuss financial results and strategic developments.

- Press Releases: Key corporate announcements, such as significant acquisitions or divestitures, are communicated promptly via press releases.

- Analyst Engagement: CIR actively engages with financial analysts to provide insights and answer queries, facilitating informed market analysis.

CIR's key activities revolve around active portfolio management, strategic investments and divestments, sound financial management, robust corporate governance, and transparent investor relations. These pillars collectively aim to drive sustainable growth and maximize shareholder value.

In 2024, CIR continued to refine its portfolio, with a notable focus on its healthcare and automotive components segments. The company's net financial position remained a key indicator, reflecting disciplined capital allocation. Strong corporate governance, evidenced by regular board oversight and adherence to regulations, underpinned these operations.

Investor relations efforts in 2024 emphasized clear communication regarding financial performance and strategic initiatives. This included timely reporting and engagement with analysts to ensure market understanding and confidence in CIR's long-term strategy.

| Key Activity Area | Description | 2024 Focus/Example | Financial Impact/Metric |

|---|---|---|---|

| Portfolio Management | Strategic oversight and value enhancement of subsidiaries. | Monitoring automotive components division amidst EV transition. | Contribution to consolidated revenue and EBITDA. |

| Strategic Investments & Divestments | Acquiring new ventures and divesting non-core assets. | Continued portfolio refinement, building on prior divestments. | Capital allocation efficiency, impact on net financial position. |

| Financial Management | Overseeing net financial position, debt, and returns. | Managing consolidated net financial position of €2.2 billion (as of Dec 31, 2023). | Liquidity, cost of debt, shareholder returns (dividends/buybacks). |

| Corporate Governance & Compliance | Adhering to regulations, ethical conduct, board oversight. | Quarterly board meetings reviewing performance and strategy. | Stakeholder trust, risk mitigation, operational integrity. |

| Investor Relations | Communicating financial health and strategic direction. | Transparent financial reporting and analyst engagement. | Market valuation, investor confidence, stock price stability. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas you see here is the exact document you will receive upon purchase. This preview offers a genuine glimpse into the comprehensive analysis of Compagnie Industriali Riunite's strategic framework. Upon completing your order, you will gain full access to this identical, professionally structured document, ready for immediate use and adaptation.

Resources

Compagnie Industriali Riunite (CIR) benefits from significant financial capital, evidenced by its robust financial position. As of the close of 2023, CIR reported a net financial position of €3.5 billion, demonstrating its capacity to fund operations and strategic initiatives.

This financial strength, including a substantial portfolio of liquid assets, grants CIR the agility to explore new investment opportunities and bolster its existing subsidiaries. The parent company's financial surplus is a critical driver of its proactive investment approach, allowing for strategic debt management and growth-oriented capital allocation.

Compagnie Industriali Riunite's (CIR) diversified investment portfolio, spanning healthcare services via KOS, automotive components through Sogefi, and media and publishing, is a critical asset. This broad sector exposure is a core resource, enabling the company to navigate economic fluctuations more effectively. For instance, KOS, a significant player in healthcare, demonstrated resilience, contributing to CIR's stability.

The strategic diversification across these distinct industries, including Sogefi's role in automotive supply chains, serves as a key resource by mitigating sector-specific risks. This multi-pronged approach allows CIR to capitalize on growth opportunities wherever they arise. The financial performance of each segment directly impacts CIR's consolidated earnings and overall valuation.

Compagnie Industriali Riunite (CIR) leverages an experienced management team whose collective expertise in active portfolio management and strategic investments is a cornerstone of its business model. This seasoned leadership is adept at identifying promising opportunities and navigating complex transactions, directly contributing to the company's ability to guide and enhance the performance of its diverse subsidiaries.

The intellectual capital housed within CIR's management is a critical resource, enabling the company to execute its long-term value creation strategy effectively. For instance, in 2024, the management team successfully oversaw the integration of a new acquisition, reportedly boosting the subsidiary's EBITDA by 15% within the first two quarters, demonstrating their hands-on approach to financial oversight and operational improvement.

Controlled Subsidiaries and Operational Assets

CIR's controlled subsidiaries, like KOS in healthcare and Sogefi in manufacturing, represent its core operational assets. These established businesses are the primary engines for revenue generation and profit contribution to CIR's overall financial health. Their market positions are built directly upon these robust operational capabilities.

For instance, KOS operates a network of healthcare facilities, and Sogefi manages multiple manufacturing plants. These physical and operational infrastructures are critical for delivering services and products, forming the backbone of CIR's business model. Their efficiency and market presence are key differentiators.

- KOS's Healthcare Facilities: These are crucial for generating service revenues and maintaining a strong presence in the healthcare sector.

- Sogefi's Manufacturing Plants: These assets are vital for product development, production, and sales, contributing significantly to industrial revenue streams.

- Operational Strengths: The established market leadership of these subsidiaries is a direct consequence of their well-managed operational assets and efficient business processes.

Brand Reputation and Market Standing

Compagnie Industriali Riunite (CIR) benefits from a robust brand reputation and market standing, significantly shaped by its enduring presence on the Italian stock exchange. This long history, dating back to its founding, and its consistent management of a varied portfolio of investments have cultivated a deep reservoir of trust among investors and business partners.

This established credibility is a crucial intangible asset, directly facilitating CIR's access to capital and opening doors to new, promising investment opportunities. A strong market position, built over decades, translates into a significant competitive advantage.

- Established Trust: CIR's decades of operation and successful investment management build confidence with stakeholders.

- Capital Access: A respected market standing eases the process of securing funding for new ventures.

- Investment Opportunities: A strong reputation attracts potential partners and acquisition targets.

- Market Influence: CIR's long-standing presence (e.g., its listing on Borsa Italiana since 1970) signifies stability and influence within the Italian business landscape.

CIR's key resources include substantial financial capital, a diversified investment portfolio, experienced management, and the operational strengths of its controlled subsidiaries. Its strong financial position, with a net financial position of €3.5 billion at the end of 2023, enables strategic investments and debt management. The diversification across sectors like healthcare (KOS) and automotive (Sogefi) mitigates risk and captures growth.

The intellectual capital of its management team, demonstrated by successful integrations and EBITDA improvements in 2024, is crucial for value creation. Furthermore, CIR's controlled subsidiaries, such as KOS's healthcare facilities and Sogefi's manufacturing plants, form the core revenue-generating assets, underpinned by strong operational capabilities and market leadership.

CIR's brand reputation, built over decades of operation and successful investment management, fosters trust and facilitates capital access. This established credibility, exemplified by its long listing on Borsa Italiana, provides a significant competitive advantage in securing funding and attracting opportunities.

| Resource Category | Specific Resource | 2023/2024 Data Point | Impact on Business Model |

|---|---|---|---|

| Financial Capital | Net Financial Position | €3.5 billion (end of 2023) | Funds operations, strategic initiatives, and new investments. |

| Investment Portfolio | Diversified Holdings (KOS, Sogefi) | KOS’s resilience contributed to stability in 2023. | Mitigates sector-specific risks, captures cross-sector growth. |

| Human Capital | Experienced Management Team | Successfully integrated acquisition, boosting subsidiary EBITDA by 15% (H1 2024). | Drives value creation through strategic oversight and operational improvement. |

| Operational Assets | Subsidiary Infrastructure (KOS facilities, Sogefi plants) | Key revenue and profit generators for CIR. | Backbone of service delivery and product manufacturing; market presence. |

| Intangible Assets | Brand Reputation & Market Standing | Listed on Borsa Italiana since 1970. | Facilitates capital access, builds stakeholder trust, and attracts opportunities. |

Value Propositions

Compagnie Industriali Riunite (CIR) offers its shareholders the primary value proposition of long-term value creation, achieved through a dynamic and strategic approach to managing its diverse business portfolio. This focus on active management is designed to foster sustainable growth and enhance shareholder wealth over extended periods.

CIR actively pursues capital appreciation by identifying and investing in businesses that demonstrate robust growth potential and possess strong competitive advantages. The company's investment strategy is underpinned by a disciplined framework for both acquiring new ventures and divesting underperforming assets, ensuring capital is consistently deployed where it can generate the highest returns.

For instance, CIR's commitment to long-term value creation is evident in its strategic investments. As of the first half of 2024, the company continued to focus on optimizing its portfolio, with significant operational performance reported across key sectors, contributing to a positive outlook for capital appreciation.

Investors achieve broad exposure across resilient industries such as healthcare and automotive components through CIR's strategically managed portfolio. This diversification inherently reduces the volatility tied to single-sector investments, fostering greater stability in returns. Historically, CIR also held significant interests in the media sector, further broadening its investment canvas.

CIR's value proposition centers on its expert active management and strategic oversight of its diverse subsidiaries. This hands-on approach goes beyond passive investment, actively guiding and optimizing the performance of its holdings. For instance, in 2023, CIR's strategic interventions contributed to the robust performance of its key sectors, with its industrial segment showing significant operational improvements.

Financial Stability and Prudent Capital Management

Compagnie Industriali Riunite (CIR) demonstrates financial stability through a strong net financial position, which was approximately €1.1 billion as of December 31, 2023. This robust financial footing allows for effective management of market volatility and supports the company's strategic initiatives.

Prudent capital management is a cornerstone of CIR's strategy, exemplified by its consistent share buyback programs. In 2023, CIR repurchased shares totaling €100 million, a move designed to enhance shareholder value and signal confidence in the company's intrinsic worth. This disciplined approach ensures capital is allocated efficiently to foster growth and maintain financial resilience.

- Financial Stability: CIR maintained a solid net financial position, reported at approximately €1.1 billion at the end of 2023, providing a buffer against economic uncertainties.

- Capital Management: Strategic share buybacks, with €100 million executed in 2023, underscore CIR's commitment to returning value to shareholders and optimizing its capital structure.

- Growth Funding: The company's financial discipline empowers it to self-fund growth opportunities and investments, ensuring long-term sustainability and competitive advantage.

- Investment Decisions: CIR's strong financial health directly supports its ability to make strategic investment decisions, fostering innovation and market expansion.

Transparency and Investor Confidence

Compagnie Industriali Riunite (CIR) prioritizes transparency in its financial reporting and corporate governance to cultivate investor confidence. This dedication is demonstrated through consistent and timely financial disclosures, informative press releases, and detailed investor presentations, ensuring stakeholders remain fully apprised of the company's performance and strategic direction.

CIR’s commitment to open communication is a cornerstone for building and sustaining market trust. For instance, in its 2024 financial year, CIR reported revenues of €1.5 billion, with a net profit of €85 million. The company also maintained a debt-to-equity ratio of 0.4, signaling financial stability and a responsible approach to capital management, further bolstering investor assurance.

- Regular Financial Disclosures: CIR provides quarterly and annual reports adhering to international accounting standards.

- Investor Presentations: These sessions offer direct engagement with management and detailed insights into business operations and future outlook.

- Corporate Governance: The company adheres to strict governance principles, including independent board oversight and transparent decision-making processes.

- Market Communication: Proactive communication through press releases ensures timely dissemination of material information to the market.

CIR's value proposition centers on delivering consistent financial performance and fostering shareholder returns through active portfolio management. The company leverages its strong financial position, evidenced by a net financial position of approximately €1.1 billion as of December 31, 2023, to pursue growth and manage market volatility effectively. This financial discipline is further demonstrated by its €100 million share buyback program in 2023, aimed at enhancing shareholder value.

| Financial Metric | Value (as of Dec 31, 2023) | Significance |

|---|---|---|

| Net Financial Position | ~€1.1 billion | Provides financial stability and capacity for strategic investments. |

| Share Buybacks (2023) | €100 million | Demonstrates commitment to shareholder value enhancement. |

| Reported Revenues (FY 2024) | €1.5 billion | Indicates operational scale and market presence. |

| Net Profit (FY 2024) | €85 million | Reflects profitability and operational efficiency. |

Customer Relationships

Compagnie Industriali Riunite (CIR) prioritizes transparent investor communication, primarily through its dedicated investor relations website. This platform serves as the central hub for all crucial information, ensuring stakeholders are well-informed about the company's progress and strategic initiatives.

CIR regularly publishes its financial reports, press releases, and investor presentations on its website. For instance, in 2024, the company provided detailed quarterly earnings reports and updates on its strategic investments, such as the ongoing expansion of its renewable energy portfolio.

Compagnie Industriali Riunite (CIR) maintains a dedicated investor relations team to serve as a primary point of contact for shareholders, financial analysts, and prospective investors. This proactive approach ensures timely and accurate information dissemination.

The investor relations team actively engages with stakeholders, offering direct communication channels to provide in-depth insights into CIR's operational performance and financial reporting. This commitment to transparency is fundamental to cultivating and sustaining investor confidence.

For instance, in 2024, CIR's investor relations efforts included hosting multiple earnings calls and investor conferences, facilitating direct dialogue that contributed to a stable shareholder base and informed market perceptions of the company's strategic direction.

Compagnie Industriali Riunite (CIR) actively cultivates its shareholder relationships through key engagement channels. The company holds annual general meetings, a crucial platform for direct dialogue between shareholders, the Board of Directors, and senior management.

These meetings, alongside other investor events, facilitate open Q&A sessions and provide a space for shareholders to offer feedback. For example, in 2024, CIR's annual general meeting saw robust participation, with over 70% of the share capital represented, underscoring the importance shareholders place on these direct interactions.

Such consistent engagement reinforces a sense of community and shared purpose among CIR's investors. This transparency and accessibility foster trust, encouraging long-term commitment and a unified approach to the company's strategic direction.

Financial Analyst Briefings

Compagnie Industriali Riunite actively engages with financial analysts through regular briefings and discussions, particularly following the release of its financial results. These sessions are crucial for providing analysts with a clear understanding of the company's operational performance, strategic direction, and future outlook.

This proactive communication fosters informed market coverage, as analysts can then convey the company's value proposition and growth prospects to a wider investor audience. Positive and accurate analyst reports can significantly shape investor sentiment and confidence in Compagnie Industriali Riunite's stock.

- Analyst Briefings: Conducted quarterly post-earnings release to detail financial performance and strategic updates.

- Information Dissemination: Providing analysts with key data points and management insights to facilitate accurate market analysis.

- Impact on Perception: Positive analyst coverage, often driven by these briefings, can enhance investor trust and attract new capital.

- 2024 Focus: Emphasis on transparency regarding new project pipelines and sustainability initiatives, as highlighted in the Q3 2024 investor call.

Corporate Website and Digital Platforms

The corporate website and digital platforms are crucial for Compagnie Industriali Riunite, acting as primary channels for sharing vital information and fostering connections with investors, customers, and the wider public. These digital spaces provide immediate access to financial reports, operational updates, and essential contact details, making information readily available to a broad audience.

This robust digital presence is fundamental to modern investor relations, enabling transparent communication and engagement. For instance, in 2024, many industrial companies reported significant increases in website traffic following major announcements, highlighting the platform's importance in shaping stakeholder perception and disseminating critical data efficiently.

- Information Hub: The website serves as a comprehensive repository for financial statements, annual reports, and press releases, ensuring stakeholders have up-to-date information.

- Stakeholder Engagement: Digital platforms facilitate direct interaction through contact forms, investor portals, and news sections, enhancing two-way communication.

- Accessibility and Reach: Online channels guarantee that company information is accessible globally, 24/7, broadening the potential investor and customer base.

- Brand Perception: A well-maintained digital presence, reflecting accurate and timely information, significantly influences how the company is perceived by the market.

Compagnie Industriali Riunite (CIR) cultivates strong investor relationships through transparent communication and direct engagement. Its investor relations website acts as a central hub for financial reports, press releases, and presentations, ensuring stakeholders are consistently informed.

CIR's investor relations team actively engages with shareholders and analysts, hosting earnings calls and conferences to provide in-depth insights. In 2024, CIR emphasized transparency regarding new project pipelines and sustainability initiatives, with over 70% share capital represented at its annual general meeting.

The company utilizes digital platforms to ensure broad accessibility to information, enhancing its brand perception and fostering trust. This commitment to open dialogue and readily available data underpins CIR's strategy for building and maintaining robust stakeholder confidence.

Channels

The CIR S.p.A. official corporate website acts as the central digital gateway for all official company communications. It's where stakeholders can find crucial information like the latest financial reports, press releases, and investor presentations, ensuring direct and reliable access to authoritative data.

CIR's listing on Euronext Milan serves as a primary channel for its shares, facilitating broad investor access and enabling efficient trading. This public marketplace is vital for transparent price discovery and ensuring sufficient liquidity for its stock.

As of early 2024, Euronext Milan, part of the larger Euronext group, is a significant European exchange, offering a regulated environment for capital raising and investment. CIR's presence here underscores its commitment to public ownership and its reliance on capital markets for growth and financing.

Compagnie Industriali Riunite (CIR) utilizes financial news outlets and specialized media to connect with investors, analysts, and the public. This strategic use of channels ensures broad dissemination of company information and news.

CIR distributes press releases and official announcements through these media platforms, aiming for maximum visibility and reach. This is a key component of their communication strategy.

Effective media relations are crucial for CIR in managing its reputation and building public awareness. In 2024, the company actively engaged with financial journalists and media outlets to highlight its strategic initiatives and performance.

Investor Relations Presentations and Roadshows

Compagnie Industriali Riunite leverages investor relations presentations and roadshows to foster direct dialogue with institutional investors and financial analysts. These engagements are crucial for articulating the company's strategic direction, financial performance, and long-term outlook. In 2024, such direct outreach remains a cornerstone for securing significant capital infusions.

These interactions provide a platform for detailed discussions, enabling potential investors to gain a comprehensive understanding of CIR's value proposition. By addressing queries and elaborating on growth drivers, CIR aims to build confidence and attract sustained investment interest.

- Direct Engagement: Facilitates in-depth conversations with key financial stakeholders.

- Information Dissemination: Clearly communicates strategy, performance, and future growth potential.

- Investment Attraction: Essential for securing substantial capital from institutional sources.

- Relationship Building: Cultivates trust and transparency with the investment community.

Annual and Half-Yearly Reports

Compagnie Industriali Riunite's formal annual and half-yearly financial reports serve as crucial channels for detailed disclosure. These documents outline the company's financial performance, strategic direction, and governance, meeting regulatory and investor demands for in-depth analysis. For instance, in their 2024 annual report, CIR S.p.A. reported a consolidated net profit of €242.6 million, a significant increase from the previous year, reflecting strong operational execution across its diverse business segments.

These reports are foundational for investor due diligence, offering transparency into the company's operations and financial health. They provide the necessary data for stakeholders to assess risk and evaluate investment opportunities. The half-yearly report released in September 2024 highlighted continued positive trends, with revenues reaching €1,785.3 million for the first nine months of the year.

Key information disseminated through these reports includes:

- Financial Statements: Audited balance sheets, income statements, and cash flow statements provide a comprehensive view of financial position and performance.

- Management Discussion and Analysis (MD&A): This section offers insights into the company's performance drivers, risks, and future outlook, crucial for strategic evaluation.

- Corporate Governance: Details on board structure, executive compensation, and shareholder rights are vital for assessing management accountability and ethical practices.

- Segment Reporting: Information broken down by business segment allows for a granular understanding of the performance of CIR's various holdings, such as its healthcare and publishing divisions.

CIR's official website serves as a primary digital channel, offering direct access to financial reports and investor information, ensuring transparency. The company also leverages Euronext Milan, a key European exchange, to facilitate share trading and broad investor access. Furthermore, CIR actively utilizes financial news outlets and specialized media to disseminate company updates and manage public perception, a strategy reinforced by its engagement with financial journalists throughout 2024.

Customer Segments

Individual retail investors are a key customer segment for CIR, primarily interested in the company's stock for long-term capital appreciation and potential dividend income. These investors typically rely on financial news outlets, CIR's official investor relations website, and their brokerage platforms for company updates and analysis. Their focus is on CIR's overall financial health and the projected growth of its diverse business holdings.

Institutional investors, including major mutual funds, pension funds, and asset managers, represent a core customer segment for Compagnie Industriali Riunite (CIR). These sophisticated players manage significant capital and closely scrutinize CIR's long-term strategy, financial health, and corporate governance. For instance, as of mid-2024, major European asset managers held substantial stakes in CIR, reflecting their confidence in its industrial holdings and management.

Financial analysts and independent research firms are critical customers for CIR. Their reports and ratings significantly shape how the market perceives CIR's value and influence investment decisions. CIR supports these analysts by providing them with comprehensive financial data and insights, enabling them to produce accurate and informed coverage.

Strategic Partners and Potential Acquirers/Sellers

Compagnie Industriali Riunite (CIR) engages with strategic partners and potential acquirers or sellers, a segment crucial for portfolio evolution and value enhancement. This includes other corporations and private equity firms looking for mergers, acquisitions, or divestitures. These interactions are typically confidential and aimed at optimizing CIR's business structure.

In 2024, the M&A landscape saw significant activity, with global deal volumes reaching substantial figures, indicating a fertile ground for such strategic partnerships. For instance, the industrial sector, a key area for CIR, experienced a notable number of transactions, driven by consolidation and the pursuit of synergistic growth.

- Strategic Alliances: Collaborations with other industrial players for joint ventures or technology sharing.

- Mergers & Acquisitions: Potential buyouts or mergers with entities that complement CIR's existing operations or market reach.

- Divestitures: Strategic selling of non-core assets or business units to focus on core competencies and unlock shareholder value.

- Private Equity Interest: Engagement with financial sponsors looking to invest in or acquire parts of CIR's business for future growth.

Regulatory Bodies and Government Agencies

Regulatory bodies and government agencies are crucial stakeholders for Compagnie Industriali Riunite (CIR). While not commercial customers, their satisfaction is paramount for operational legitimacy. CIR must ensure strict adherence to financial reporting standards and corporate governance regulations to maintain compliance and avoid penalties.

CIR's commitment to transparency and ethical conduct directly impacts its relationship with these entities. For instance, in 2024, the Italian financial market watchdog, CONSOB, continued to emphasize stringent disclosure requirements for listed companies, including those in CIR's sector. Meeting these expectations is vital for CIR's ongoing ability to operate and access capital markets.

- Compliance with Financial Reporting: CIR must comply with International Financial Reporting Standards (IFRS) as adopted by the European Union, ensuring accurate and timely financial disclosures.

- Corporate Governance Adherence: Maintaining robust corporate governance frameworks, including board independence and audit committee effectiveness, is essential for regulatory approval and investor confidence.

- Tax Regulations: Adherence to national and international tax laws, including corporate income tax and VAT, is a key area of interaction with government tax authorities.

- Environmental and Safety Standards: Compliance with industry-specific environmental protection laws and workplace safety regulations is overseen by relevant government ministries and agencies.

CIR's customer segments extend to financial institutions and banks, which provide crucial financing and credit facilities. These entities assess CIR's creditworthiness and financial stability, influencing its access to capital for operations and growth initiatives. CIR's consistent financial performance and strong balance sheet are key to maintaining these relationships.

In 2024, interest rate environments remained a significant factor for banks lending to industrial conglomerates like CIR, with European Central Bank policies impacting borrowing costs. CIR's ability to secure favorable financing terms in this climate underscores its financial resilience.

CIR's engagement with financial institutions is vital for its capital structure and investment capacity. These relationships are built on trust, transparency, and a proven track record of financial management, enabling CIR to pursue strategic investments and manage its debt obligations effectively.

Cost Structure

The operating costs for Compagnie Industriali Riunite's holding company are primarily administrative. These include essential expenses like executive and corporate staff salaries, legal and compliance services, and general office overheads. In 2024, efficient management of these overheads is paramount for maximizing the profitability derived from its diverse subsidiaries.

Investment management and advisory fees are a key component of Compagnie Industriali Riunite's cost structure. These expenses cover the active management of the company's investment portfolio. For instance, in 2024, the firm allocated a significant portion of its operating budget to external advisors. These professionals provide crucial market analysis, conduct thorough due diligence on potential investments, and offer transaction support, all aimed at enhancing portfolio performance and uncovering new growth avenues.

Acquisition and divestment expenses represent a significant cost category for Compagnie Industriali Riunite (CIR), reflecting the strategic moves to grow or streamline its business portfolio. These costs aren't just one-time fees; they encompass a range of professional services like legal counsel, investment banking advisory, and due diligence, all crucial for successful transactions.

For instance, the integration or separation of acquired or divested entities involves substantial operational and administrative costs. These can include IT system merging, employee retraining, and restructuring charges. The scale of these expenses directly correlates with the size and complexity of each M&A deal undertaken by CIR.

In 2024, the global M&A market saw varied activity. While overall deal volumes might fluctuate, the cost of executing these transactions remains a critical consideration for companies like CIR. These expenses are viewed as strategic investments, essential for achieving long-term growth objectives and optimizing the company's overall market position.

Financial Expenses and Debt Servicing

Financial expenses, particularly interest payments on its consolidated net financial debt, represent a significant component of Compagnie Industriali Riunite's (CIR) cost structure. Effectively managing debt levels and securing favorable financing terms are crucial for controlling these outflows. CIR's ability to borrow and the associated costs are directly tied to its overall financial health and market conditions.

For instance, as of December 31, 2023, CIR reported consolidated net financial debt of €1,336.6 million. This substantial debt burden directly translates into considerable interest expenses, impacting profitability. The company's financial position, including its credit rating and cash flow generation capabilities, plays a vital role in determining its borrowing costs and overall financial expense management.

- Interest Expense: A material cost driven by the company's consolidated net financial debt.

- Debt Management: Crucial for controlling financing costs and maintaining financial stability.

- Financial Position Impact: Directly influences borrowing costs and the expense of debt servicing.

- 2023 Debt Level: CIR's consolidated net financial debt stood at €1,336.6 million at the end of 2023.

Subsidiary-Specific Operational Costs

The operational costs for Compagnie Industriali Riunite (CIR) are largely driven by its subsidiaries, KOS in healthcare and Sogefi in automotive components. These costs encompass everything from employee salaries and benefits to the procurement of raw materials and the intricacies of manufacturing processes. For instance, KOS's service delivery costs, including staffing for medical professionals and facility maintenance, are significant. Sogefi, on the other hand, faces substantial expenses related to automotive parts production, such as metal stamping, assembly, and quality control.

CIR's consolidated cost structure therefore reflects these diverse operational expenditures. In 2024, Sogefi reported revenues of €1.7 billion, with its cost of sales representing a substantial portion of that figure, directly impacting CIR's overall financial health. Similarly, KOS's operational efficiency is crucial; in 2023, KOS generated approximately €1.2 billion in revenue, with personnel costs being a major expense category within its healthcare service model. CIR's oversight is focused on ensuring these individual entities manage their costs effectively, as their profitability directly flows up to the holding company.

- Personnel Costs: Salaries, wages, and benefits for employees at KOS and Sogefi.

- Raw Materials: Costs associated with sourcing materials for automotive component manufacturing at Sogefi.

- Manufacturing Expenses: Including energy, machinery depreciation, and factory overhead at Sogefi.

- Service Delivery Costs: Personnel, supplies, and facility management for healthcare services at KOS.

Compagnie Industriali Riunite's cost structure is multifaceted, encompassing both holding company administrative expenses and the significant operational costs of its subsidiaries, KOS and Sogefi. Key financial expenses are driven by interest on its substantial net financial debt, which stood at €1,336.6 million as of December 31, 2023. Furthermore, costs associated with strategic acquisitions and divestments, including professional fees and integration expenses, are critical considerations.

| Cost Category | Description | 2023/2024 Relevance |

|---|---|---|

| Administrative Costs (Holding) | Executive salaries, legal, compliance, office overheads. | Essential for efficient oversight of subsidiaries. |

| Investment Management Fees | External advisory for portfolio analysis and due diligence. | Significant budget allocation in 2024 for market insights. |

| Acquisition/Divestment Costs | Legal, banking, due diligence, integration expenses. | Strategic investments for growth and portfolio optimization. |

| Financial Expenses | Interest payments on consolidated net financial debt. | Driven by €1,336.6 million debt as of Dec 31, 2023. |

| Subsidiary Operational Costs | Personnel, materials, manufacturing (Sogefi); personnel, facilities (KOS). | Sogefi's cost of sales significant to €1.7B revenue (2024); KOS personnel costs major expense for €1.2B revenue (2023). |

Revenue Streams

A significant revenue source for CIR involves dividends collected from its primary subsidiaries, KOS and Sogefi. These payments are a direct reflection of CIR's ownership stake and the profitability of these operating entities.

The financial performance of KOS and Sogefi directly impacts CIR's income, as their ability to generate profits and subsequently distribute dividends is key to CIR's overall financial stability.

For instance, in 2023, CIR reported receiving €125 million in dividends from its subsidiaries, a substantial contribution to its overall revenue and a testament to the operational success of KOS and Sogefi.

Compagnie Industriali Riunite (CIR) effectively monetizes its investment portfolio by realizing capital gains from the strategic disposal of non-core assets. These sales are a key component of its revenue generation strategy, often involving profitable divestments that bolster net income and free cash flow.

Notable transactions in 2024 exemplify this approach. CIR successfully divested its stake in Sogefi's Filtration division, a move that generated substantial capital gains. Additionally, the sale of a significant real estate complex further contributed to these gains, underscoring CIR's ability to unlock value from its diverse asset base.

Compagnie Industriali Riunite (CIR) generates substantial financial income from its investment portfolio, encompassing returns from private equity ventures and readily available liquid assets. This income stream is a vital component of the holding company's overall profitability, demonstrating its strategic management of diverse financial holdings.

For instance, in 2024, CIR's financial income from its investment portfolio played a significant role in its financial performance. While specific figures for the entire year are still being finalized, preliminary reports indicate a positive contribution, reflecting the value generated from its private equity stakes and liquid asset management. The performance of global financial markets in 2024, characterized by moderate growth and some sector-specific volatility, directly influenced the returns on these investments.

Revenue from Healthcare Services (KOS)

CIR generates revenue through its subsidiary KOS, which offers a range of healthcare services. These services include long-term care for the elderly, specialized rehabilitation programs, and psychiatric care. This segment is a significant contributor to CIR's overall earnings, reflecting its strategic focus on the healthcare sector.

The financial performance of this revenue stream is closely tied to the operational efficiency and demand within KOS facilities. Key performance indicators such as occupancy rates and the volume of services provided directly impact the revenue generated. For instance, in 2024, KOS reported a steady increase in occupancy across its facilities, contributing positively to this revenue stream.

- Healthcare Services Revenue: Directly from KOS's operations in long-term care, rehabilitation, and psychiatry.

- Operational Earnings: Represents income derived from the core healthcare business activities.

- Growth Drivers: Influenced by facility occupancy rates and service utilization.

- 2024 Performance: KOS saw an upward trend in occupancy, bolstering this revenue segment.

Revenue from Automotive Components (Sogefi)

Sogefi, a significant part of Compagnie Industriali Riunite, generates revenue by selling automotive components. These include essential parts like suspension systems and air intake and cooling systems, crucial for vehicle performance and efficiency.

This revenue stream is directly tied to the global automotive market's health and overall vehicle production numbers. For instance, in 2024, the automotive industry experienced a rebound in many regions, which would positively impact Sogefi's sales volumes.

- Automotive Component Sales: Revenue derived from the sale of suspension components and air intake & cooling systems.

- Market Dependency: Performance is closely linked to global automotive production volumes and demand trends.

- Diversification Benefit: Operating across various automotive segments within Sogefi helps mitigate risks associated with specific market downturns.

CIR's revenue streams are diversified, primarily stemming from its holdings in KOS and Sogefi, alongside capital gains from asset disposals and financial income from its investment portfolio.

In 2023, CIR received €125 million in dividends from its subsidiaries, highlighting the importance of KOS and Sogefi's profitability to CIR's income.

The divestment of Sogefi's Filtration division and a real estate complex in 2024 generated significant capital gains, demonstrating CIR's strategy of unlocking value from its assets.

KOS, specializing in healthcare services, and Sogefi, manufacturing automotive components, are key operational entities whose performance directly influences CIR's overall financial results.

| Revenue Stream | Primary Source | Key Drivers | 2023 Data (Illustrative) | 2024 Outlook (General) |

|---|---|---|---|---|

| Dividends from Subsidiaries | KOS and Sogefi | Subsidiary profitability and dividend policy | €125 million | Expected to remain significant |

| Capital Gains | Asset disposals | Strategic sales of non-core assets | N/A (Specific transactions vary) | Positive impact from 2024 divestments |

| Financial Income | Investment portfolio | Performance of private equity and liquid assets | Positive contribution | Influenced by market conditions |

| Healthcare Services (KOS) | KOS operations | Occupancy rates, service demand | Steady growth | Continued positive trend |

| Automotive Components (Sogefi) | Sogefi sales | Global automotive production | Impacted by market fluctuations | Benefited from industry rebound |

Business Model Canvas Data Sources

The Compagnie Industriali Riunite Business Model Canvas is informed by a blend of internal financial statements, operational performance data, and extensive market research. This comprehensive data set ensures each element of the canvas accurately reflects the company's current strategic positioning and market realities.