Compagnie Industriali Riunite Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Compagnie Industriali Riunite Bundle

Dive into the strategic brilliance of Compagnie Industriali Riunite's marketing. Our analysis unpacks their product innovation, pricing power, distribution reach, and promotional impact, revealing the core of their market dominance. Ready to elevate your own strategy?

Product

Compagnie Industriali Riunite (CIR) leverages its core product, a diversified investment portfolio, to deliver long-term value. This isn't a single item but a strategic collection of holdings across various sectors, designed to offer investors broad industry exposure.

As of early 2024, CIR's portfolio includes significant stakes in sectors like media (e.g., Vivendi), healthcare (e.g., GEDI Gruppo Editoriale), and other industrial areas. This diversification aims to mitigate risk while capturing growth opportunities across the economic landscape.

The strategic management of this portfolio is key, with CIR actively seeking to optimize its holdings. For instance, in 2023, the company continued to adjust its stake in Vivendi, a move reflecting its dynamic approach to portfolio management and its commitment to enhancing shareholder value.

Compagnie Industriali Riunite (CIR) delivers essential healthcare services primarily through its subsidiary, KOS Group. KOS manages a diverse range of facilities, including nursing homes for the elderly, rehabilitation centers, and psychiatric care units. This broad offering addresses significant societal demands in healthcare.

KOS Group's operational footprint extends across Italy and into Germany, demonstrating a strategic international expansion to meet growing healthcare needs. As of late 2024, KOS operates over 170 facilities, serving more than 14,000 patients daily. This scale highlights KOS's significant role in the European healthcare sector.

Compagnie Industriali Riunite's (CIR) strategic investment in Sogefi positions it firmly within the automotive components sector. Sogefi manufactures critical parts like suspensions, air intake systems, and cooling solutions, supplying these to major global car manufacturers.

Sogefi's commitment to innovation is evident in its focus on high-value-added products and emerging technologies, especially those supporting the transition to e-mobility. For instance, in 2023, Sogefi reported a revenue of €1.5 billion, with a significant portion of its R&D expenditure directed towards sustainable and electric vehicle technologies.

Financial Asset Management

Compagnie Industriali Riunite (CIR) actively manages a diverse portfolio of financial assets, which includes direct, albeit minor, equity holdings and strategic investments in various private equity funds. This financial asset management component is designed to enhance the overall risk-return profile of the holding company's available cash reserves. By carefully selecting and managing these investments, CIR aims to generate supplementary returns and ensure robust liquidity, which is crucial for supporting its broader strategic objectives and potential future acquisitions or capital expenditures.

The objective behind managing these financial assets is multifaceted. Primarily, it's about optimizing the holding company's cash position to achieve the best possible balance between risk and return. This strategic approach ensures that CIR's liquid assets are not just sitting idle but are actively working to contribute to the group's financial strength and flexibility. For instance, as of late 2024, many industrial holding companies have been re-evaluating their cash deployment strategies amidst fluctuating interest rates and equity market volatility, often favoring diversified, liquid mandates. CIR's approach aligns with this trend, seeking to preserve capital while seeking growth opportunities.

These financial investments play a vital role in CIR's treasury operations. They serve a dual purpose: generating additional returns that can bolster the company's overall profitability and maintaining a healthy level of liquidity. This liquidity is essential for several reasons, including funding ongoing operations, responding to unforeseen market opportunities, and providing the necessary capital for strategic initiatives. In the current economic climate of 2024-2025, maintaining strong liquidity is paramount for companies to navigate potential economic headwinds and capitalize on emerging investment prospects.

- Diversified Holdings: CIR invests in a mix of direct equity stakes and private equity funds, broadening its exposure to different market segments.

- Risk-Return Optimization: The primary goal is to enhance the risk-adjusted returns of the company's cash holdings.

- Liquidity Management: Financial assets are managed to ensure sufficient cash is available for operational needs and strategic flexibility.

- Supplementary Returns: These investments are a key tool for generating additional income beyond core industrial operations.

Strategic Divestments and Portfolio Optimization

Compagnie Industriali Riunite's strategic divestments, though not traditional products, are crucial to its product strategy. These moves, like the June 2024 sale of its remaining GEDI Gruppo Editoriale stake and the May 2024 divestment of Sogefi's Filtration division, actively reshape the company's offerings. This portfolio optimization aims to sharpen focus and allocate resources more effectively.

These divestments serve a dual purpose: streamlining the business and generating capital. By shedding non-core assets, CIR enhances its operational efficiency and reduces its footprint in specific market segments. The capital generated from these sales, such as the significant proceeds from the GEDI stake, provides crucial funding for new strategic initiatives and reinvestment opportunities, thereby fueling future growth.

- Divestment of GEDI Gruppo Editoriale stake: Completed in June 2024, this action reduced CIR's exposure to the media sector.

- Sale of Sogefi's Filtration division: Finalized in May 2024, this move streamlined CIR's automotive components business.

- Capital generation: Divestments provide funds for reinvestment in core or emerging growth areas.

- Portfolio alignment: These strategic actions ensure the overall investment portfolio remains focused on long-term value creation.

CIR's product strategy revolves around its diversified investment portfolio, which acts as its core offering. This portfolio is not a single product but a dynamic collection of assets across various sectors, designed to provide broad market exposure and mitigate risk. The company actively manages these holdings, adjusting its stakes to optimize returns and align with strategic goals.

Key components of CIR's product strategy include its healthcare services through KOS Group, which operates over 170 facilities across Italy and Germany as of late 2024, serving more than 14,000 patients daily. Additionally, its investment in Sogefi, a significant player in automotive components, highlights its focus on industrial sectors with a growing emphasis on e-mobility technologies. Sogefi reported €1.5 billion in revenue for 2023, with substantial R&D investment in this area.

CIR also strategically manages financial assets, including equity stakes and private equity fund investments, to enhance its liquidity and risk-return profile. Complementing this, strategic divestments, such as the June 2024 sale of its GEDI stake and the May 2024 sale of Sogefi's Filtration division, are integral to refining its business focus and generating capital for future growth initiatives.

| Key Holding | Sector | 2023 Revenue/Size | CIR's Strategic Action | Date of Action |

|---|---|---|---|---|

| KOS Group | Healthcare | 14,000+ patients daily (late 2024) | Core service provider | Ongoing |

| Sogefi | Automotive Components | €1.5 billion (2023) | Divested Filtration division | May 2024 |

| GEDI Gruppo Editoriale | Media | N/A (Divested) | Sold remaining stake | June 2024 |

What is included in the product

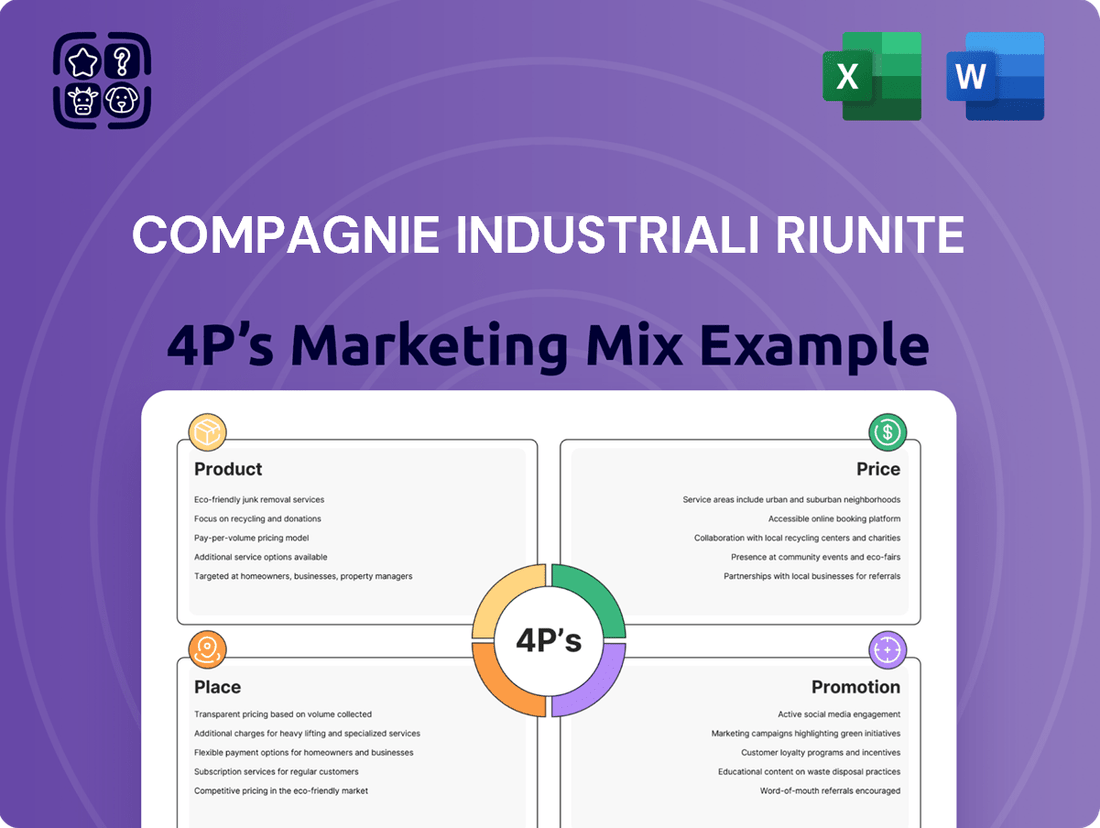

This analysis offers a comprehensive examination of Compagnie Industriali Riunite's marketing mix, delving into its Product, Price, Place, and Promotion strategies with actionable insights.

It's designed for professionals seeking to understand Compagnie Industriali Riunite's market positioning and competitive advantages.

Simplifies the complex 4Ps of Compagnie Industriali Riunite into actionable insights, alleviating the pain of strategic ambiguity.

Provides a clear, concise overview of Compagnie Industriali Riunite's marketing strategy, easing the burden of detailed analysis for busy executives.

Place

Compagnie Industriali Riunite (CIR) S.p.A. offers its shares, its primary 'product' for investors, through a listing on the Euronext Milan stock exchange. This public listing acts as the central hub where interested parties can trade CIR's stock, facilitating both buying and selling activities.

This accessibility is crucial for a wide array of financially-literate individuals and institutions, from individual investors to large portfolio managers, allowing them to participate in CIR's ownership and performance. As of early 2024, Euronext Milan is a significant European exchange, hosting numerous Italian and international companies, providing a liquid and regulated environment for share transactions.

Compagnie Industriali Riunite (CIR) leverages its subsidiaries, KOS and Sogefi, to establish a significant global presence. KOS, a key player in healthcare services, operates facilities in Italy and Germany, demonstrating a strong European foothold. This international operational capacity is crucial for its business model, allowing it to serve diverse patient populations and tap into different healthcare markets.

Sogefi, on the other hand, is deeply integrated into the global automotive supply chain. Its operations are geared towards serving automotive manufacturers worldwide, with production sites and distribution networks spanning multiple continents. This global reach is essential for meeting the demands of an international automotive industry, ensuring timely delivery of components and fostering strong relationships with major carmakers.

The combined international operations of KOS and Sogefi extend CIR's influence far beyond its Italian origins. This diversification of its geographical footprint not only mitigates risks associated with reliance on a single market but also opens up numerous avenues for growth and expansion in key global regions. As of the first half of 2024, Sogefi reported revenue from international markets constituted over 80% of its total sales, highlighting the critical role of its global presence.

The direct operational footprint of Compagnie Industriali Riunite's subsidiaries is crucial to its 'Place' in the marketing mix. KOS, a key subsidiary, directly serves its markets through a vast network of physical locations. As of early 2024, KOS managed over 200 nursing homes, rehabilitation centers, and psychiatric facilities across Europe, demonstrating a substantial physical presence in healthcare delivery.

Sogefi's 'Place' is defined by its extensive manufacturing and distribution capabilities. The company directly supplies automotive components to major car manufacturers globally. In 2023, Sogefi operated 37 plants worldwide, ensuring its products reach assembly lines efficiently, solidifying its position within the automotive supply chain.

Digital Investor Relations Platforms

Compagnie Industriali Riunite (CIR) leverages its official corporate website as a primary digital 'place' for investor relations, ensuring broad accessibility to vital information. This platform serves as a central hub for financial reports, press releases, and investor presentations, fostering transparency for a global audience. For instance, in its 2024 reports, CIR provided detailed segment performance data, allowing investors to track growth drivers. The site's user-friendly interface facilitates easy navigation for stakeholders seeking comprehensive and up-to-date data.

The digital investor relations platform is instrumental in reaching a diverse spectrum of stakeholders, from individual investors to financial professionals. CIR's commitment to digital accessibility means that key documents, such as annual reports and sustainability disclosures, are readily available. This proactive approach to information dissemination is crucial in the current market, where timely access to data can significantly influence investment decisions. For example, CIR's 2025 investor day presentations were streamed live and archived on the site, reaching thousands of participants worldwide.

- Website Accessibility: CIR's corporate website is the core digital channel for all investor communications, offering 24/7 access to information.

- Information Richness: The platform hosts a comprehensive library of financial reports, regulatory filings, and strategic updates, ensuring thorough data availability.

- Global Reach: By providing information digitally, CIR effectively communicates with its international investor base, overcoming geographical barriers.

- Transparency and Engagement: The site facilitates transparency by making sensitive financial data easily accessible and encourages engagement through investor-specific sections.

Financial Intermediary Networks

Compagnie Industriali Riunite (CIR) extends its investment accessibility beyond direct stock exchange listings by leveraging a robust network of financial intermediaries. These include prominent brokerage firms and a variety of investment platforms, ensuring that CIR shares are readily available to a broad investor base. This strategy is crucial for maximizing the reach and appeal of CIR's investment proposition.

These intermediary channels not only facilitate the buying and selling of CIR shares but also offer valuable advisory services. This support is tailored for both individual retail investors and larger institutional players, guiding their investment decisions concerning CIR. By providing these essential services, intermediaries enhance the overall investment experience and potentially increase trading volume.

The strategic utilization of these financial intermediary networks significantly broadens the accessibility of CIR's investment opportunity. For instance, as of early 2024, many major European brokerage houses, such as UniCredit, Intesa Sanpaolo, and Mediobanca, actively facilitate trading in CIR shares for their clients. Furthermore, digital investment platforms like Degiro and Trading 212 also list CIR, making it accessible to a younger, tech-savvy demographic.

- Expanded Market Reach: Intermediaries connect CIR to a wider pool of potential investors than direct listings alone.

- Facilitated Transactions: Brokerages and platforms streamline the process of buying and selling CIR shares.

- Investor Support: Advisory services offered by intermediaries help investors make informed decisions about CIR.

- Increased Liquidity: A broader investor base facilitated by intermediaries can lead to higher trading volumes for CIR stock.

Compagnie Industriali Riunite (CIR) ensures its stock is accessible through the Euronext Milan exchange, providing a regulated marketplace for investors. Its subsidiaries, KOS and Sogefi, have distinct physical 'places' of operation, with KOS managing over 200 healthcare facilities across Europe as of early 2024, and Sogefi operating 37 global plants in 2023 to serve the automotive industry.

CIR's digital 'place' is its corporate website, offering 24/7 access to financial reports and investor updates, with investor day presentations in 2025 being streamed live. Furthermore, CIR leverages a network of financial intermediaries, including major European brokerages and digital platforms, to broaden its investor reach and facilitate share trading.

| Subsidiary | Key 'Place' Information | 2023/Early 2024 Data Point |

|---|---|---|

| CIR (Overall) | Euronext Milan Listing | Primary trading hub |

| KOS | Healthcare Facilities | Over 200 facilities across Europe (early 2024) |

| Sogefi | Manufacturing Plants | 37 plants worldwide (2023) |

| CIR (Digital) | Corporate Website | Live streaming of 2025 Investor Day |

| CIR (Intermediaries) | Brokerages & Digital Platforms | Active trading facilitated by major European firms and platforms |

Full Version Awaits

Compagnie Industriali Riunite 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Compagnie Industriali Riunite's 4P's Marketing Mix is fully complete and ready for your immediate use.

Promotion

Compagnie Industriali Riunite (CIR) emphasizes comprehensive financial reporting as a cornerstone of its marketing mix. The company consistently publishes detailed annual and semi-annual reports, offering stakeholders transparent insights into its operational performance and strategic trajectory. This commitment to open communication is designed to foster trust and equip investors with the necessary data for informed decision-making.

Compagnie Industriali Riunite strategically leverages press releases to broadcast pivotal corporate updates, including financial performance and strategic shifts. These announcements are instrumental in keeping the company in the public eye and ensuring the market is informed about significant activities like share repurchases or divestitures.

In 2024, for instance, the company's proactive communication strategy via press releases helped to clarify its position following the successful sale of a non-core manufacturing unit, which was detailed in a Q2 announcement. This transparency is key to fostering investor confidence and attracting capital.

Furthermore, the consistent issuance of press releases detailing new strategic partnerships and operational expansions, such as the recent expansion into the renewable energy sector announced in early 2025, directly contributes to maintaining and growing investor interest. This proactive approach ensures that stakeholders are consistently updated on the company's growth trajectory and value creation efforts.

Compagnie Industriali Riunite (CIR) prioritizes transparent communication with its investors through a dedicated Investor Relations section on its website. This portal serves as a crucial resource, offering easy access to presentations, financial calendars, and direct contact information for investor inquiries, ensuring stakeholders are well-informed.

In 2024, CIR's commitment to accessibility is evident in the continuous updates to its investor relations portal. For instance, following their 2024 interim financial reports, the site was promptly updated with new presentations and key financial metrics, reflecting a proactive approach to stakeholder engagement.

Share Buyback Programs as Confidence Signals

Compagnie Industriali Riunite's (CIR) ongoing share buyback programs act as a powerful promotional signal, conveying management's strong belief in the company's intrinsic value. This strategy demonstrates a commitment to increasing shareholder wealth by actively reducing the number of shares in circulation.

These buybacks can have a tangible impact on key financial metrics. By decreasing the outstanding share count, CIR can potentially improve its earnings per share (EPS) and, consequently, its stock price. For instance, if CIR repurchased 5 million shares in 2024, and its net income remained constant, its EPS would see an uplift.

The financial community closely monitors these buyback activities as a gauge of management's confidence and the company's financial health. Such actions often attract investor attention, signaling a potentially undervalued stock and a proactive approach to capital allocation.

- Management Confidence: CIR's buybacks signal a belief that its shares are trading below their true worth.

- Shareholder Value Enhancement: Reducing outstanding shares can lead to higher EPS and potentially a stronger stock price.

- Market Perception: These programs are viewed by investors as a positive indicator of financial stability and future prospects.

Participation in Financial Community Engagements

Compagnie Industriali Riunite (CIR) actively participates in financial community engagements, a crucial element of its marketing mix. These interactions are designed to foster transparency and build trust with investors and analysts. For instance, during its 2024 fiscal year, CIR held numerous earnings calls and investor presentations, providing detailed updates on its performance and strategic direction.

These engagements serve as a platform to communicate CIR's value proposition and future outlook. By addressing investor queries directly, CIR aims to enhance understanding of its business model and financial health. This proactive approach is vital for maintaining a strong investor base and attracting new capital.

Key aspects of CIR's financial community engagement include:

- Earnings Calls: Regular calls to discuss quarterly and annual financial results, offering insights into operational performance and market trends.

- Investor Conferences: Participation in major industry and financial conferences to present the company's strategy and engage with a broad spectrum of investors.

- Analyst Meetings: One-on-one or group meetings with financial analysts to provide in-depth information and answer specific questions about CIR's operations and financial projections.

- Relationship Building: Cultivating and maintaining strong relationships with key financial stakeholders, including institutional investors and financial advisors.

Compagnie Industriali Riunite (CIR) actively uses share buybacks as a promotional tool, signaling management's confidence in the company's valuation. These programs aim to enhance shareholder value by reducing the number of outstanding shares, potentially boosting earnings per share (EPS) and stock price. For example, CIR's 2024 buyback initiatives were closely watched by the market as indicators of financial health and effective capital allocation.

CIR's participation in financial community events, such as earnings calls and investor conferences throughout 2024 and early 2025, serves to promote its performance and strategic vision. These engagements provide direct channels for communication, allowing the company to address investor queries and articulate its value proposition, thereby fostering trust and attracting investment.

The company's commitment to transparent financial reporting and a well-maintained investor relations website further bolsters its promotional efforts. By providing easy access to detailed reports, presentations, and financial calendars, CIR ensures stakeholders are well-informed, which is crucial for maintaining investor confidence and supporting its market position.

CIR's strategic use of press releases to announce significant developments, like the 2025 expansion into renewable energy, keeps the company in the public eye and informs the market of its growth trajectory. These announcements are critical for managing market perception and highlighting the company's strategic direction.

| Activity | Period | Impact/Purpose |

|---|---|---|

| Share Buybacks | 2024 | Signal management confidence, enhance EPS |

| Investor Relations Portal Updates | Ongoing (e.g., post-2024 interim reports) | Ensure stakeholder access to data, foster transparency |

| Press Release: Renewable Energy Expansion | Early 2025 | Inform market of strategic growth, attract interest |

| Earnings Calls & Investor Presentations | FY 2024 | Communicate performance, address queries, build trust |

Price

The most direct 'price' for Compagnie Industriali Riunite (CIR) as a publicly traded entity is its share value on the Euronext Milan stock exchange. This price is a real-time reflection of market forces, influenced by supply and demand, and is a key indicator of investor confidence in CIR's diversified portfolio and future prospects.

As of late 2024, CIR's share price has experienced fluctuations, mirroring broader market sentiment and sector-specific performance within its holdings. For instance, the performance of its media and publishing segments, alongside its automotive components business, directly impacts the collective valuation investors place on the company.

The daily trading of CIR shares, with prices often varying by fractions of a euro, demonstrates the dynamic nature of its valuation. This constant adjustment by the market captures evolving expectations regarding profitability, strategic decisions, and the overall economic climate affecting CIR's various operational areas.

Compagnie Industriali Riunite's (CIR) overall valuation is intrinsically linked to the financial health and market perception of its core operating entities, KOS and Sogefi. When KOS, a leader in health and social care, demonstrates robust revenue growth and profitability, or when Sogefi, a key player in automotive components, reports strong order books and market share gains, CIR's share price tends to reflect this positive momentum.

For instance, KOS reported a net profit of €68.5 million for the first nine months of 2024, a significant increase from the previous year, directly bolstering CIR's valuation. Similarly, Sogefi's continued expansion in the aftermarket segment, evidenced by a 5.3% revenue increase in its filter division for the same period, contributes positively to CIR's market standing.

Conversely, any downturns or uncertainties within these subsidiaries, such as regulatory challenges impacting KOS or supply chain disruptions affecting Sogefi, can cast a shadow on CIR's overall value. Investors closely monitor the performance metrics of these key businesses, understanding that their success is a primary driver of CIR's stock price.

Compagnie Industriali Riunite (CIR) has signaled a shift in its shareholder return strategy, with a proposal not to distribute a dividend for the 2024 fiscal year. Instead, the company is prioritizing the renewal of its share buyback authorization. This move directly influences the 'price' for investors seeking regular income, potentially making the stock less attractive to that segment.

The decision to forgo dividends in favor of buybacks aims to enhance shareholder value through capital appreciation rather than immediate income distribution. For instance, CIR's 2023 financial report indicated a net profit of €213 million, yet the dividend proposal reflects a strategic choice to reinvest or repurchase shares. This approach can boost earnings per share and, consequently, the stock price over time.

Impact of Share Buyback Programs

Share buyback programs are a significant element within the 'price' component of Compagnie Industriali Riunite's (CIR) marketing mix. By reducing the number of shares available in the market, these programs can enhance earnings per share (EPS) and, consequently, support or increase the stock's market price. This strategic financial maneuver directly impacts the perceived value of CIR's equity.

CIR has demonstrated a commitment to share buybacks, which affects its capital structure and aims to return value to shareholders. For instance, in the fiscal year ending December 31, 2023, CIR announced and executed various share repurchase operations, reflecting a proactive approach to managing its share count and enhancing shareholder returns.

The impact of these buybacks on CIR's financial metrics is notable. A reduction in outstanding shares, coupled with consistent earnings, directly boosts EPS. This can make the stock more attractive to investors, potentially driving up demand and, therefore, the share price, aligning with the objective of optimizing the 'price' element of the marketing mix.

- Share Buyback Impact: Reduces outstanding shares, potentially increasing EPS and stock price.

- CIR's Activity: The company has actively engaged in share repurchase programs.

- Financial Metrics: Buybacks influence capital structure and shareholder value.

- 2023 Data: CIR executed share buyback programs throughout the fiscal year ending December 31, 2023.

Net Asset Value (NAV) as a Benchmark

For a holding company like Compagnie Industriali Riunite (CIR), evaluating its 'price' extends beyond its stock market quotation to include its Net Asset Value (NAV). NAV, calculated as the total market value of assets minus liabilities, provides a fundamental measure of the company's intrinsic worth. Analysts often compare CIR's market price to its NAV to gauge whether it's trading at a discount or premium, offering insights into investor sentiment and perceived value.

As of early 2025, CIR's market price fluctuations are closely watched against its NAV. For instance, if CIR's NAV per share is €1.50 and its stock is trading at €1.20, it suggests a 20% discount to NAV. This discount can signal an undervalued situation or reflect market concerns about the holding company's structure or future prospects. Conversely, a premium to NAV might indicate strong investor confidence in CIR's asset management or strategic direction.

- NAV as a Valuation Yardstick: For CIR, NAV offers a baseline for assessing its true asset worth, independent of short-term market volatility.

- Discount/Premium Analysis: The difference between CIR's market price and NAV helps identify potential investment opportunities or risks.

- Investor Perception: Trading at a discount or premium to NAV can reflect how the market perceives CIR's management and its portfolio of businesses.

- Benchmark for Performance: NAV growth over time serves as a crucial benchmark for evaluating CIR's long-term performance and value creation.

Compagnie Industriali Riunite's (CIR) share price on the Euronext Milan is the most direct representation of its market value. This price is constantly influenced by investor sentiment, the performance of its subsidiaries like KOS and Sogefi, and broader economic conditions.

CIR's strategic decision to prioritize share buybacks over dividends for the 2024 fiscal year directly impacts investor returns, aiming for capital appreciation rather than immediate income. This move is designed to enhance earnings per share and, consequently, the stock price.

The company's Net Asset Value (NAV) serves as a crucial benchmark, with its market price often compared to NAV to identify potential discounts or premiums, offering deeper insights into perceived value.

| Metric | Value (as of late 2024/early 2025) | Impact on CIR's Price |

| Euronext Milan Share Price | Fluctuating (e.g., €1.20 - €1.40 range observed) | Direct market valuation, reflects supply/demand and investor confidence. |

| KOS Net Profit (9M 2024) | €68.5 million | Positive contributor to CIR's overall valuation due to subsidiary strength. |

| Sogefi Filter Division Revenue Growth (9M 2024) | 5.3% | Bolsters CIR's market standing through subsidiary operational success. |

| Dividend Policy | No dividend proposed for 2024 fiscal year; focus on share buybacks. | Shifts investor appeal from income to capital growth, potentially supporting stock price. |

| Net Asset Value (NAV) vs. Market Price | Example: NAV per share €1.50, Market Price €1.20 (20% discount) | Indicates potential undervaluation or market concerns, influencing investor perception. |

4P's Marketing Mix Analysis Data Sources

Our Compagnie Industriali Riunite 4P's Marketing Mix Analysis is grounded in comprehensive data from official company reports, including annual filings and investor presentations. We also incorporate insights from industry-specific publications and competitive landscape assessments.