Compagnie Industriali Riunite Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Compagnie Industriali Riunite Bundle

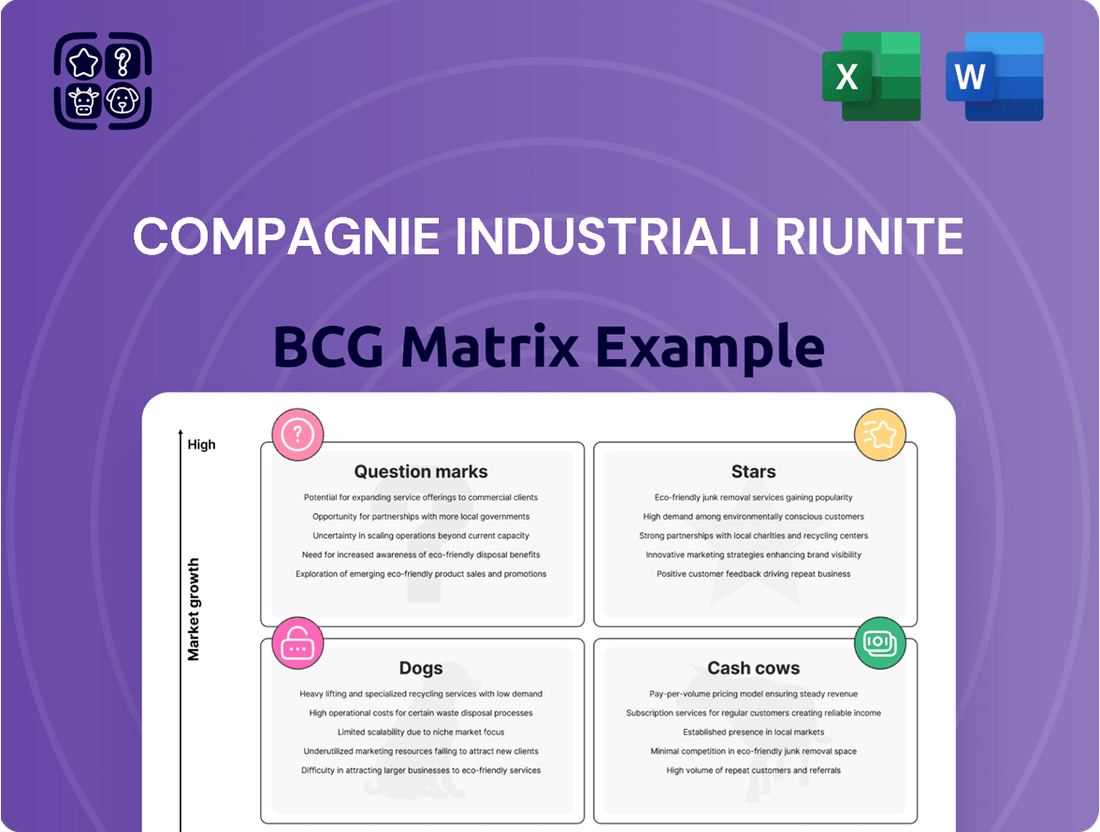

Curious about Compagnie Industriali Riunite's strategic positioning? This glimpse into their BCG Matrix reveals the foundational insights into their product portfolio's market share and growth potential. Understanding their current standing across Stars, Cash Cows, Dogs, and Question Marks is crucial for any investor or competitor.

Don't miss out on the full strategic picture; purchase the complete BCG Matrix report to unlock detailed quadrant analysis, actionable recommendations, and a clear roadmap for informed investment decisions. Gain the competitive edge you need to navigate Compagnie Industriali Riunite's market landscape with confidence.

Stars

KOS Group, Compagnie Industriali Riunite's healthcare arm, stands out as a Star in the BCG Matrix. It's a dominant player in Italian Long Term Care and is making significant strides in the German nursing home market. The healthcare sector saw a robust 6.2% revenue jump in 2024, and KOS is forecasting even stronger performance in 2025, driven by higher occupancy rates and favorable tariff adjustments.

This strategic expansion, coupled with KOS's established leadership, solidifies its Star status. Continued investment is crucial to fully leverage the growth opportunities in both the Italian and German markets, ensuring KOS maintains its competitive edge and capitalizes on the sector's upward trajectory.

Sogefi, a key player within Compagnie Industriali Riunite (CIR), is making significant strides in the e-mobility sector. The company is actively boosting its market share through strategic investments in research and development and targeted business acquisitions focused on electric vehicle components. This proactive approach aligns with the broader global automotive components market, which is experiencing robust growth, largely fueled by the accelerating transition to electric vehicles and the increasing demand for specialized EV parts.

The e-mobility segment within Sogefi is well-positioned to be a Star in the BCG Matrix. This classification is supported by the segment's operation within a rapidly expanding market, driven by technological advancements and evolving consumer preferences. For instance, the global electric vehicle market alone was valued at over $380 billion in 2023 and is projected to reach over $1.5 trillion by 2030, indicating substantial growth potential. Sogefi's commitment to new technologies in this space, including advanced battery thermal management systems and lightweight EV components, underscores its potential for high growth and market leadership.

Maintaining this Star status, however, requires continued and substantial investment. Sogefi must allocate significant capital to further its R&D efforts, enhance its production capabilities for e-mobility solutions, and potentially pursue further strategic acquisitions to solidify its competitive advantage. This investment is crucial to capitalize on the market's expansion and to fend off emerging competitors in the dynamic EV component landscape.

Compagnie Industriali Riunite (CIR) strategically focuses its acquisition efforts on core sectors with high growth potential, aiming to bolster the development of KOS and Sogefi. While specific recent acquisitions fitting this exact description aren't publicly detailed as growth investments, any significant expansion into growing markets would align with this strategy.

Such strategic moves would necessitate considerable investment in marketing and integration to cement market leadership and ensure sustained profitability. For example, if KOS were to acquire a leading European player in its aesthetic medicine market, it would likely represent a significant capital outlay, potentially exceeding hundreds of millions of euros, to capture a larger share of a market projected to grow at a compound annual growth rate of over 10% in the coming years.

International Expansion of Healthcare Operations

KOS Group's expansion into German nursing homes represents a significant international push, positioning it as a high-growth entity within the long-term care sector. This strategic move into a key European market, which saw its elderly population grow by approximately 1.5% annually in recent years, aims to capture a larger market share beyond its Italian base.

The company anticipates substantial investment to build and scale its operations in Germany, reflecting the high capital requirements typical for establishing a strong presence in new international healthcare markets. This investment is crucial for solidifying KOS Group's leadership position and achieving its ambitious growth targets.

- Geographic Diversification: Entry into the German nursing home market.

- Market Growth: Tapping into a growing elderly population and demand for long-term care.

- Investment Needs: Significant capital outlay required for international footprint development.

- Strategic Goal: Solidifying leadership beyond Italy and increasing market share.

Investment in Advanced Automotive Technologies

Sogefi's strategic focus on advanced automotive technologies, particularly in e-mobility, positions it as a key player in a rapidly transforming industry. The company's dedication to research and development, coupled with strategic business acquisitions in this sector, underscores its commitment to future growth. This investment aligns with the automotive industry's significant shift towards electrification and autonomous driving, areas projected to experience substantial market expansion.

The e-mobility segment, including components for electric vehicles and related systems, represents a high-growth potential area for Sogefi. For instance, the global electric vehicle market was valued at approximately $380 billion in 2023 and is projected to reach over $1.5 trillion by 2030, indicating a compound annual growth rate of around 18%. Sogefi's proactive investment in these cutting-edge technologies is therefore essential for securing and expanding its market share in this dynamic landscape.

- R&D Investment: Sogefi has consistently allocated resources to innovation in e-mobility components.

- Acquisition Strategy: Targeted acquisitions bolster Sogefi's capabilities in advanced automotive technologies.

- Market Trends: The automotive industry's pivot to electrification and autonomy fuels demand for these technologies.

- Growth Potential: E-mobility components are identified as high-growth areas within the automotive sector.

KOS Group and Sogefi, both key entities within Compagnie Industriali Riunite, are positioned as Stars in the BCG Matrix due to their strong performance in high-growth markets. KOS is excelling in the healthcare sector, particularly in Italian Long Term Care and expanding into Germany, while Sogefi is a leader in the rapidly growing e-mobility components market.

Their Star status is underpinned by significant market expansion and strategic investments in innovation and new territories. For example, the global electric vehicle market is projected for substantial growth, and KOS's healthcare segment saw a 6.2% revenue increase in 2024.

Continued substantial investment is vital for both KOS and Sogefi to maintain their competitive edge and capitalize on these expanding markets. This includes enhancing production, pursuing further R&D, and potentially strategic acquisitions to solidify their leadership positions.

| Business Unit | Market Position | Growth Rate | BCG Category | Strategic Implication |

|---|---|---|---|---|

| KOS Group (Healthcare) | Dominant in Italian LTC, expanding in Germany | High (Healthcare sector grew 6.2% in 2024) | Star | Continued investment to maintain leadership and capitalize on growth. |

| Sogefi (E-mobility Components) | Key player in EV components | Very High (Global EV market projected to exceed $1.5T by 2030) | Star | Sustained R&D and potential acquisitions to secure market share. |

What is included in the product

Highlights which of Compagnie Industriali Riunite's business units to invest in, hold, or divest based on market share and growth.

Clear, actionable insights from the Compagnie Industriali Riunite BCG Matrix, simplifying complex portfolio decisions.

Cash Cows

KOS Group's established presence in the Italian long-term care sector, primarily through its 'Anni Azzurri' brand, positions it as a significant cash cow within the Compagnie Industriali Riunite BCG Matrix. This mature market leadership, coupled with the healthcare sector's projected 6.2% revenue increase in 2024, underscores KOS's strong and consistent cash generation capabilities.

The company's deep-rooted presence and substantial market share in Italy mean it can reliably generate stable profits with minimal need for extensive marketing or investment. This allows KOS to serve as a vital source of funds for other business units within the larger conglomerate.

Sogefi's core automotive components business, encompassing suspensions and air intake & cooling systems, functions as a cash cow within the Compagnie Industriali Riunite portfolio. This segment benefits from established leadership positions in key geographic markets, underscoring its maturity and stable revenue generation.

Despite a reported revenue decrease of 2.1% in 2024, reaching €1.3 billion, the inherent strength of these mature product lines, characterized by high profit margins, ensures consistent cash flow. This financial robustness allows Sogefi's core business to effectively fund other strategic initiatives and investments for the broader group.

CIR's liquid assets and private equity investments are a significant component of its financial strategy, acting as a key cash cow. The company actively manages this diversified portfolio to achieve optimal risk-return profiles.

As of the close of 2024, CIR reported a positive net financial position of €341.3 million. This substantial liquidity underscores the strength and availability of its liquid assets, ready for deployment.

These managed assets not only generate valuable financial income but also provide readily accessible capital. This financial flexibility allows CIR to pursue strategic investment opportunities, reinforcing their role as a reliable source of funds.

Dividends from Subsidiaries

Dividends from subsidiaries, such as those from KOS and Sogefi, are a crucial component of Compagnie Industriali Riunite's (CIR) financial structure. In 2024, CIR's parent company reported a profit of €105.8 million, with a substantial €82 million of that figure stemming directly from dividends received from its subsidiaries. This highlights the significant cash-generating ability of these established entities.

These consistent dividend inflows act as a stable and predictable source of cash for CIR. This reliable income stream is vital for funding the holding company's ongoing operations and exploring new investment opportunities. It provides CIR with a degree of financial flexibility, reducing its reliance on the performance of its less mature or newer investments.

The role of these dividend-paying subsidiaries within CIR's BCG Matrix can be viewed as "Cash Cows." Their maturity and strong profitability generate surplus cash that can be reinvested elsewhere within the group, supporting growth initiatives or other business units.

- 2024 Profit: €105.8 million for CIR's parent company.

- Dividends Received: €82 million in 2024, primarily from subsidiaries.

- Key Subsidiaries: KOS and Sogefi are significant contributors to dividend income.

- Financial Impact: Provides stable cash flow, supporting operations and new ventures.

Real Estate Divestments for Capital Gain

Compagnie Industriali Riunite (CIR) has effectively leveraged its real estate holdings as a significant source of capital. A prime example is the June 2024 sale of a Milanese real estate complex, which yielded a substantial capital gain of €18.8 million.

This strategic divestment highlights CIR's capacity to extract value from mature or non-core assets, effectively acting as a cash cow. Such one-time events, when strategically executed, provide crucial liquidity that can be reinvested in growth areas or used to strengthen the company's financial standing.

- June 2024: Sale of Milan real estate complex.

- €18.8 million capital gain realized.

- Demonstrates ability to monetize existing assets.

- Provides significant cash injection for strategic deployment.

Compagnie Industriali Riunite (CIR) benefits from its mature subsidiaries, KOS and Sogefi, which operate in stable markets and generate consistent profits. These entities, functioning as cash cows, provide a reliable stream of dividends, with €82 million of CIR's €105.8 million profit in 2024 originating from such distributions.

CIR's liquid assets and private equity portfolio also contribute significantly, bolstered by a positive net financial position of €341.3 million reported at the end of 2024. Furthermore, strategic asset sales, like the June 2024 Milan real estate divestment yielding an €18.8 million capital gain, underscore CIR's ability to monetize existing assets for capital generation.

| CIR Financial Performance (2024) | Amount (€ million) | Source |

|---|---|---|

| Parent Company Profit | 105.8 | Overall Group Operations |

| Dividends Received from Subsidiaries | 82.0 | KOS, Sogefi, and other dividend-paying entities |

| Net Financial Position | 341.3 | Liquidity and Financial Assets |

| Real Estate Capital Gain (June 2024) | 18.8 | Milan property sale |

Delivered as Shown

Compagnie Industriali Riunite BCG Matrix

The Compagnie Industriali Riunite BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, free from watermarks or demo content, is ready for immediate strategic application. You'll gain access to the complete, professionally designed BCG Matrix, enabling informed decision-making for Compagnie Industriali Riunite's portfolio. This is not a sample; it's the final, ready-to-use report for your business planning needs.

Dogs

Compagnie Industriali Riunite (CIR) divested its remaining 5% stake in GEDI Gruppo Editoriale in June 2024. This move strongly suggests that CIR viewed its media and publishing assets, represented by GEDI, as a low-growth, low-market share business. Such characteristics align with the 'Dog' quadrant in a BCG Matrix analysis, indicating an area that consumes resources without generating significant returns.

The strategic decision to exit the GEDI stake reflects CIR's effort to streamline its portfolio and reallocate capital. By selling off this segment, CIR likely aims to focus on core or higher-potential growth areas, thereby improving overall business performance and shareholder value. This divestment underscores a proactive approach to portfolio management in response to market dynamics.

Compagnie Industriali Riunite's divestment of its Milan real estate property in June 2024 for €38.0 million highlights a strategic shift away from non-core assets. This sale, which resulted in a capital gain, signals that these properties were not actively supporting the company's primary business objectives or market expansion efforts.

The decision to sell these real estate holdings suggests they were considered underperforming or non-strategic within the broader portfolio. By divesting these assets, Compagnie Industriali Riunite is likely aiming to streamline its balance sheet and reallocate capital towards more growth-oriented ventures, thereby optimizing its overall asset utilization.

Within Compagnie Industriali Riunite's (CIR) automotive segment, Sogefi's legacy product lines present a classic case for the BCG matrix's question mark or dog categories. These are components not directly supporting the burgeoning e-mobility trend or operating in mature, shrinking segments of the internal combustion engine market. For instance, while Sogefi reported a solid 2023 with consolidated revenues reaching €1.7 billion, specific legacy filter or suspension components might be facing headwinds.

These underperforming legacy products likely exhibit low market growth and potentially declining market share, a hallmark of the dog quadrant. As of early 2024, the automotive industry's significant shift towards electric vehicles means that components solely designed for traditional powertrains are increasingly vulnerable. CIR's strategy would be to limit further capital infusion into these products, focusing instead on divesting or phasing them out to reallocate resources to more promising areas.

Any Remaining Small, Non-Core Investments

Compagnie Industriali Riunite (CIR), as a diversified holding company, might retain certain smaller, non-core investments. These are assets outside its main focus areas like healthcare and automotive components that haven't demonstrated significant growth or market traction.

If these minor holdings consume valuable resources without delivering substantial returns or strategic benefits, they would be classified as Dogs in the BCG Matrix. CIR's strategy would likely involve divesting these assets or reducing their operational impact to streamline its portfolio.

- Divestment Strategy: CIR may actively seek buyers for non-core assets that underperform.

- Resource Reallocation: Funds and management attention currently tied to these smaller investments could be redirected to core, high-growth sectors.

- Portfolio Optimization: Identifying and exiting these Dog investments is crucial for enhancing overall company efficiency and profitability.

- Market Performance: For instance, if a small technology venture held by CIR in 2023 generated only €5 million in revenue against a €20 million investment, it would clearly be a candidate for divestment.

Inefficient or Outdated Operational Processes

Inefficient or outdated operational processes within Compagnie Industriali Riunite's subsidiaries, while not direct products, can act as significant drags, similar to "Dogs" in a BCG matrix. These processes might include manual data entry in logistics, legacy manufacturing equipment, or unoptimized supply chain management, all consuming valuable resources without generating substantial competitive advantage or high returns.

For instance, a subsidiary relying on paper-based inventory tracking in 2024 might experience higher error rates and slower fulfillment times compared to competitors using real-time digital systems. This inefficiency directly impacts profitability by increasing operational costs and potentially leading to lost sales due to stockouts or delays. CIR's stated commitment to operational excellence and digital transformation in their 2024 reports highlights a strategic imperative to identify and phase out such underperforming processes.

- Resource Drain: Outdated processes can lead to increased labor costs, higher error rates, and longer cycle times, directly reducing profitability.

- Competitive Disadvantage: Inefficient operations prevent subsidiaries from matching the speed, cost-effectiveness, or quality of competitors with modern systems.

- Strategic Focus: CIR's emphasis on improving efficiency suggests a proactive approach to eliminating these "Dog" like operational elements to free up capital and management attention for growth areas.

Compagnie Industriali Riunite (CIR) has strategically divested assets like its stake in GEDI Gruppo Editoriale and a Milan real estate property in 2024. These moves indicate a classification of these ventures as 'Dogs' within the BCG Matrix, characterized by low growth and market share, consuming resources without substantial returns.

CIR's automotive segment, particularly legacy product lines within Sogefi, also exhibits 'Dog' characteristics. These components for internal combustion engines face declining demand due to the industry's shift towards e-mobility, as evidenced by Sogefi's €1.7 billion revenue in 2023, where specific legacy parts likely underperformed.

CIR's approach to these 'Dog' assets involves limiting further investment, focusing on divestment or phasing out to reallocate capital and management attention to more promising, high-growth sectors within its portfolio.

Inefficient operational processes, such as manual data entry or legacy manufacturing equipment, also function as 'Dogs' by draining resources. CIR's 2024 reports highlight a commitment to digital transformation to eliminate these inefficiencies and enhance overall profitability.

| Asset/Segment | BCG Classification | Rationale | 2024 Action/Observation |

| GEDI Gruppo Editoriale | Dog | Low growth, low market share in media sector | Divested remaining 5% stake in June 2024 |

| Milan Real Estate | Dog | Non-core, underperforming asset | Sold for €38.0 million in June 2024 |

| Sogefi Legacy Components | Dog | Declining demand in automotive shift to EVs | Focus on phasing out or divesting |

| Inefficient Processes | Dog | Resource drain, operational drag | Strategic imperative to eliminate via digital transformation |

Question Marks

New ventures by Compagnie Industriali Riunite (CIR) or its subsidiary KOS into emerging healthcare technologies like advanced diagnostics or personalized medicine would likely be classified as Question Marks in the BCG Matrix. These innovative sectors offer substantial growth prospects but currently represent a small market share for CIR/KOS due to their early stage of development and the significant capital needed to build a strong foothold.

Sogefi's strategic pivot towards e-mobility, marked by increased R&D and acquisitions, positions it favorably. However, within this broader 'Star' category, certain early-stage e-mobility product lines are still navigating market penetration. These nascent offerings are in a high-growth sector but require substantial investment to establish a dominant market share.

As a holding company, Compagnie Industriali Riunite (CIR) may consider diversifying into emerging sectors like renewable energy or advanced materials. Initial, small-scale investments in these high-growth, less familiar markets, where CIR currently holds minimal market share or expertise, would be classified as question marks in a BCG matrix. These ventures would necessitate thorough due diligence and potentially significant capital commitments to assess their long-term potential and competitive positioning.

Digital Transformation Initiatives in Media/Publishing (Post-GEDI)

If Compagnie Industriali Riunite (CIR) were to re-enter the media and publishing sector with a focus on purely digital, high-growth segments, these initiatives would likely be classified as Stars within a BCG Matrix framework. This is due to the inherent high growth potential of niche digital content platforms and AI-driven news analytics, despite the intense competition and substantial investment required to establish a strong market presence.

The digital media landscape is a dynamic arena. For instance, the global digital advertising market was projected to reach over $600 billion in 2024, signaling robust growth. However, success in this space demands continuous innovation and adaptation to evolving consumer behaviors and technological advancements, such as the increasing reliance on AI for content personalization and data analysis.

- Niche Digital Content Platforms: Focusing on underserved audiences or specialized interests can yield high engagement and monetization opportunities.

- AI-Driven News Analytics: Leveraging artificial intelligence for sentiment analysis, trend prediction, and personalized content delivery offers a competitive edge.

- Subscription Models: Implementing tiered subscription services for premium content and exclusive insights can create recurring revenue streams.

- Data Monetization: Utilizing anonymized user data for targeted advertising and market research, while adhering to privacy regulations, can be a significant revenue driver.

Geographical Expansion into High-Growth, Untapped Markets

Compagnie Industriali Riunite (CIR) could strategically expand its KOS healthcare services beyond Italy and Germany into emerging markets with high demand for long-term care and other healthcare solutions. This expansion would position KOS as a potential star in the BCG matrix, albeit initially a question mark due to its nascent presence in these new territories. For instance, exploring opportunities in Southeast Asia or parts of Eastern Europe, where aging populations and increasing healthcare spending are significant trends, presents a compelling growth avenue.

Such geographical ventures, while promising substantial long-term growth, would commence with a low market share, necessitating considerable investment. CIR would need to allocate significant capital for establishing local infrastructure, executing targeted marketing campaigns, and forging strategic partnerships with local entities to navigate regulatory landscapes and build brand recognition. For example, in 2024, the global long-term care market was valued at approximately $1.2 trillion, with projected growth driven by demographic shifts, underscoring the potential for new entrants.

- Market Entry Strategy: Focus on acquiring or partnering with established local healthcare providers to accelerate market penetration and leverage existing infrastructure and customer bases.

- Investment Requirements: Substantial capital will be needed for market research, regulatory compliance, facility development, technology integration, and talent acquisition in new regions.

- Growth Potential: High-growth markets often exhibit double-digit annual growth rates in healthcare services, offering significant upside for early movers like KOS.

- Risk Mitigation: Diversifying investments across multiple new markets can help mitigate risks associated with any single region's economic or political instability.

Question Marks for Compagnie Industriali Riunite (CIR) represent new business ventures or product lines in high-growth industries where the company currently holds a small market share. These initiatives, such as investments in nascent digital health platforms or early-stage renewable energy technologies, require significant capital investment to develop and capture market potential. The success of these Question Marks hinges on strategic execution and the ability to convert them into Stars.

BCG Matrix Data Sources

Our Compagnie Industriali Riunite BCG Matrix is built upon a foundation of robust financial disclosures, comprehensive market research, and strategic industry analysis to provide actionable insights.