Cipla PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cipla Bundle

Navigate the complex external forces shaping Cipla's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and evolving social trends present both challenges and opportunities for the pharmaceutical giant. Gain actionable intelligence to refine your own market strategies and anticipate future industry dynamics. Download the full PESTLE analysis now and unlock critical insights for informed decision-making.

Political factors

Government healthcare policies are a critical factor for pharmaceutical companies like Cipla. Regulations around drug pricing, such as India's Drug Price Control Orders, directly affect revenue streams. For instance, in 2024, the National Pharmaceutical Pricing Authority (NPPA) continued to monitor and cap prices for essential medicines, impacting the profitability of certain Cipla products.

Initiatives aimed at increasing drug accessibility, like government-backed generic drug programs, can boost sales volumes but may compress profit margins. Cipla's focus on affordable medicines positions it well to benefit from these programs, but it requires careful management of production costs. Public health campaigns and disease eradication programs also create demand for specific Cipla offerings.

The pharmaceutical industry, including Cipla, operates under a complex web of regulations. Bodies like the US Food and Drug Administration (USFDA) and India's Central Drugs Standard Control Organisation (CDSCO) dictate everything from drug approvals and manufacturing quality to pricing and market access.

Recent USFDA inspections of Cipla's manufacturing sites in 2024 have underscored the critical importance of adhering to Good Manufacturing Practices (GMP). For instance, observations from these inspections can lead to import alerts or warning letters, directly impacting Cipla's ability to supply its products to key markets like the United States, which is crucial for revenue generation.

Geopolitical shifts and evolving trade policies, including the impact of tariffs on Active Pharmaceutical Ingredients (APIs) originating from countries like China, directly influence global supply chain dynamics and manufacturing expenses for pharmaceutical giants such as Cipla. For instance, the United States' imposition of tariffs on certain Chinese APIs in recent years has created cost pressures and necessitated strategic adjustments within the industry.

Cipla's proactive approach to diversifying its manufacturing footprint, which includes leveraging its production capabilities in China to serve the US market, serves as a critical risk mitigation strategy against these trade-related uncertainties. This diversification aims to ensure a more resilient and cost-effective supply chain, particularly in light of potential trade disputes or policy changes.

Intellectual Property Rights and Patent Laws

Changes in patent laws and intellectual property rights significantly impact pharmaceutical companies like Cipla. For instance, India's Patent (Amendment) Rules 2024 are shaping how new drugs are developed and how long they maintain market exclusivity. This directly affects Cipla's strategy in both developing innovative treatments and competing in the generics market.

Cipla's strong presence in the generics sector means it must closely track evolving patent regulations to safeguard its existing product portfolio and to continue fostering innovation. Understanding these legal shifts is crucial for maintaining a competitive edge and ensuring continued access to affordable medicines.

- Patent Landscape: India's Patent (Amendment) Rules 2024 introduce new guidelines that could alter the timelines for patent approvals and oppositions.

- Market Exclusivity: Stricter enforcement or changes in data exclusivity provisions can impact the profitability and market entry of both innovator and generic drugs.

- Cipla's Strategy: Monitoring these changes helps Cipla protect its intellectual property and plan for future product launches in a dynamic regulatory environment.

- Innovation vs. Generics: The balance between incentivizing new drug discovery through patents and ensuring access to affordable generics remains a key consideration for policymakers and companies like Cipla.

Political Stability and Corruption

Political stability in Cipla's key operating regions, particularly India and emerging markets, directly impacts its operational continuity and investment climate. For instance, India's consistent economic policies and commitment to healthcare reforms in 2024 provide a generally stable environment.

Efforts to enhance ethical pharmaceutical marketing practices, such as the ongoing implementation and potential updates to the Uniform Code of Pharmaceutical Marketing Practices (UCPMP) in India, are vital. These initiatives aim to curb unethical practices and promote fair competition, influencing Cipla's marketing strategies and regulatory compliance.

- Market Integrity: Robust anti-corruption measures and transparent regulatory frameworks foster trust and a level playing field for pharmaceutical companies like Cipla.

- Ease of Doing Business: Stable political environments reduce operational risks and facilitate smoother market entry and expansion.

- Regulatory Compliance: Adherence to evolving marketing codes, like the UCPMP, ensures Cipla maintains ethical standards and avoids potential penalties.

- Investment Climate: Political stability attracts foreign and domestic investment, crucial for Cipla's growth and R&D funding.

Government healthcare policies continue to shape Cipla's operational landscape, with a focus on drug pricing and accessibility. In 2024, India's National Pharmaceutical Pricing Authority (NPPA) maintained its oversight on essential medicine prices, directly impacting Cipla's revenue for specific products. Simultaneously, government initiatives promoting generic drugs, while boosting volume, necessitate stringent cost management to maintain profitability.

Regulatory adherence remains paramount, with bodies like the USFDA and CDSCO setting stringent standards for drug approval and manufacturing. Cipla's 2024 USFDA inspections highlighted the critical need for Good Manufacturing Practices compliance, as any adverse findings could lead to import restrictions impacting its significant US market presence.

Geopolitical factors, including trade policies and tariffs on Active Pharmaceutical Ingredients (APIs), influence Cipla's supply chain costs. For instance, tariffs on Chinese APIs in recent years have prompted Cipla to diversify its manufacturing base, enhancing supply chain resilience.

Evolving patent laws, such as India's Patent (Amendment) Rules 2024, directly affect Cipla's intellectual property strategy and market exclusivity for both innovative and generic products. The company actively monitors these changes to protect its portfolio and plan future market entries.

What is included in the product

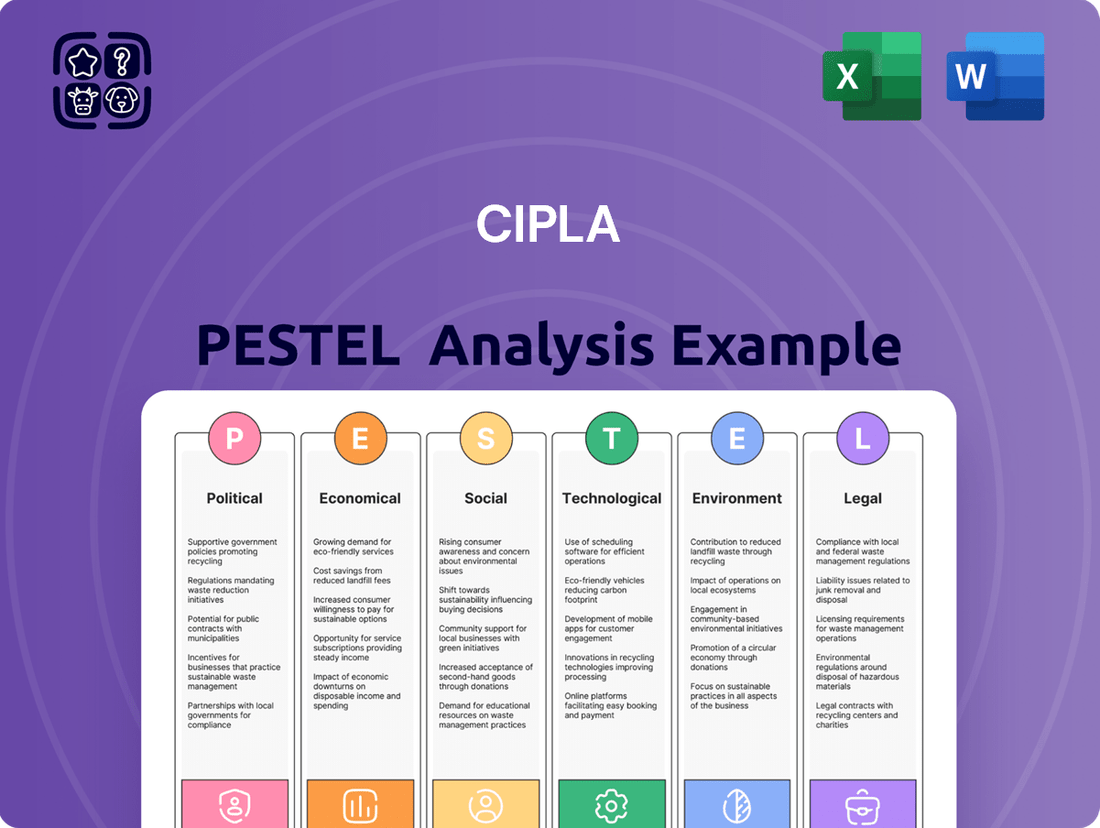

This PESTLE analysis of Cipla delves into the impact of political, economic, social, technological, environmental, and legal factors on its operations.

It provides a comprehensive understanding of the external landscape, highlighting potential challenges and strategic advantages for Cipla's future growth.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear roadmap to navigate Cipla's external landscape and mitigate potential challenges.

Economic factors

The overall health of global and domestic economies significantly influences healthcare spending, patient affordability, and government healthcare budgets. Economic downturns can lead to reduced discretionary spending on healthcare, impacting pharmaceutical companies like Cipla.

Cipla's performance demonstrates resilience, with strong domestic sales and revenue growth reported in Q1 FY25-26, suggesting its ability to navigate global economic uncertainties. This domestic strength provides a buffer against international economic volatility.

Healthcare expenditure globally is on an upward trajectory, with a significant emphasis on making medicines more affordable. This trend directly benefits Cipla, whose core strategy revolves around providing cost-effective generic pharmaceuticals. The global pharmaceutical market is expected to expand considerably, reaching an estimated USD 3.03 trillion by 2034, underscoring the persistent demand for accessible and budget-friendly treatments.

Cipla's global operations mean it's directly impacted by currency exchange rate fluctuations. For instance, a stronger Indian Rupee against currencies like the US Dollar or Euro can reduce the Rupee value of its foreign earnings, affecting top-line revenue when consolidated. Conversely, a weaker Rupee can make imported raw materials more expensive, increasing production costs.

In 2024, the Indian Rupee has shown volatility, trading around 83 against the US Dollar for much of the year. This stability, while seemingly positive, still presents a risk if the Rupee were to strengthen significantly, impacting Cipla's reported international revenue. Managing these currency exposures through hedging strategies is crucial for Cipla to protect its profit margins.

Inflation and Cost of Raw Materials

Inflationary pressures have a direct impact on Cipla's operational costs. For instance, the global average inflation rate hovered around 5.9% in 2023, a slight decrease from 2022's 8.7%, but still elevated. This can translate to higher prices for Active Pharmaceutical Ingredients (APIs) and other essential raw materials, potentially squeezing Cipla's profit margins.

To counter these rising costs, Cipla's focus on efficient supply chain management and diversifying its sourcing strategies becomes paramount. By securing raw materials from multiple geographical locations and optimizing logistics, the company can better absorb price shocks and maintain production stability.

- API Cost Volatility: Global supply chain disruptions and geopolitical factors have contributed to significant price fluctuations in key APIs throughout 2023 and into early 2024, directly affecting pharmaceutical manufacturers like Cipla.

- Logistics Expenses: Increased fuel prices and shipping costs, exacerbated by inflationary trends, add to the overall cost of bringing raw materials to manufacturing facilities.

- Sourcing Diversification: Cipla's strategy to broaden its supplier base, including exploring domestic sourcing options in India, aims to mitigate reliance on single-source suppliers and reduce vulnerability to international price hikes.

Competition and Pricing Pressures in Generics

The generic drug market, especially in the United States, is intensely competitive. This environment creates significant pricing pressures, which can directly impact Cipla's revenue and overall profitability. For instance, reports from late 2023 and early 2024 indicate that the US generics sector continues to grapple with declining prices, particularly for products that previously offered higher margins.

Cipla's own US generics business has been experiencing these headwinds. The company has noted that pricing pressures on its key, higher-margin products are a persistent challenge, affecting its financial performance in this crucial market. This situation necessitates a strategic focus on efficiency and product portfolio management to mitigate the impact of these market dynamics.

- Intense Competition: The US generic drug market is characterized by a large number of players, leading to aggressive pricing strategies.

- Margin Erosion: Pricing pressures are particularly acute on established, high-volume generic drugs, squeezing profit margins for companies like Cipla.

- Revenue Impact: Declining prices for key products directly translate to lower revenue generation for Cipla's US generics segment.

- Strategic Adjustments: Cipla must continually adapt its strategy to navigate these pricing challenges, potentially through cost optimization or focusing on niche generic segments.

Global economic trends, including inflation and interest rates, directly influence Cipla's operational costs and revenue streams. For example, the International Monetary Fund projected global growth to be around 3.2% in 2024, a slight uptick from 2023, but still indicating a cautious economic environment. This backdrop affects consumer spending on healthcare and government budget allocations for pharmaceuticals.

Currency fluctuations, particularly the Indian Rupee against major currencies like the US Dollar, significantly impact Cipla's international earnings and the cost of imported raw materials. In early 2024, the INR remained relatively stable around 83 per USD, but any strengthening could reduce the Rupee value of Cipla's export revenues, while a weakening INR increases the cost of imported Active Pharmaceutical Ingredients (APIs).

The competitive landscape, especially in the US generics market, continues to exert downward pressure on drug prices. Reports from late 2023 and early 2024 highlight ongoing price erosion for established generic products, directly impacting Cipla's profitability in this key market and necessitating a focus on operational efficiency and portfolio management.

| Economic Factor | Impact on Cipla | Data Point (2023-2024) |

|---|---|---|

| Global Economic Growth | Influences healthcare spending and affordability. | Projected Global Growth: 3.2% (IMF, 2024) |

| Currency Exchange Rates (INR/USD) | Affects export revenue and raw material costs. | INR ~83/USD (Early 2024) |

| Inflation | Increases operational costs (APIs, logistics). | Global Average Inflation: ~5.9% (2023) |

| US Generics Market Pricing | Creates pricing pressure and margin erosion. | Continued price erosion on established generics (Late 2023/Early 2024) |

Preview Before You Purchase

Cipla PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This detailed Cipla PESTLE analysis covers political, economic, social, technological, legal, and environmental factors impacting the company, offering a comprehensive strategic overview.

Sociological factors

The world's population is getting older, and with that comes a greater need for healthcare. By 2050, the UN projects that one in six people globally will be over 65. This demographic shift directly fuels the demand for pharmaceuticals, particularly for managing chronic conditions.

Chronic diseases like heart disease, diabetes, and respiratory illnesses are on the rise. In 2024, estimates suggest over 150 million people in India alone live with chronic diseases, a number expected to grow. Cipla's focus on respiratory, cardiovascular, and oncology treatments positions it well to meet this increasing demand.

Growing health awareness across India is significantly reshaping consumer choices and healthcare demands. This heightened consciousness about well-being, coupled with evolving lifestyles, is driving a greater need for preventative care and treatments for lifestyle-related ailments.

The rise of conditions such as obesity, diabetes, and cardiovascular diseases, directly linked to changing dietary habits and reduced physical activity, presents both challenges and opportunities for pharmaceutical companies. For instance, the Indian market for weight management drugs is projected to grow substantially, with estimates suggesting it could reach over $300 million by 2027.

Cipla's strategic entry into the weight management segment in India, launching products like "Ciplox-OZ" for obesity, directly addresses these emerging societal health needs. This move demonstrates a keen understanding of how shifts in public health awareness and lifestyle patterns create demand for specific pharmaceutical solutions, positioning Cipla to capitalize on these trends.

Societal access to healthcare services and the robustness of medical infrastructure, especially in developing economies, significantly influence the market penetration and uptake of pharmaceutical goods. Cipla's dedication to enhancing global medicine accessibility directly addresses this crucial societal requirement.

In 2024, India, a key market for Cipla, continued to grapple with disparities in healthcare access. While urban centers boast advanced medical facilities, rural areas often face shortages of doctors and essential medicines. This uneven distribution presents both challenges and opportunities for pharmaceutical companies aiming to broaden their reach.

Globally, the World Health Organization reported in early 2025 that over 2 billion people still lack access to essential healthcare services. Cipla's strategy, focusing on affordable and quality medications, directly targets these underserved populations, aiming to bridge the gap in medical infrastructure and improve health outcomes.

Patient Expectations and Adherence

Patient expectations are shifting significantly, with a growing demand for treatments that not only work well but are also easy to incorporate into daily life. This push for convenience and better outcomes directly impacts how pharmaceutical companies like Cipla approach drug development and marketing. For instance, the global adherence market is projected to reach over $3 billion by 2027, highlighting the economic incentive for solutions that improve patient compliance.

Companies are increasingly adopting patient-centric models, focusing on personalized medicine and therapies that address individual needs. This trend is evident in the rise of digital health tools and patient support programs designed to enhance adherence and overall treatment experience. In 2024, Cipla continued its focus on patient support initiatives, particularly in chronic disease management, aiming to improve long-term outcomes and build patient loyalty.

- Evolving Demands: Patients now expect more than just efficacy; convenience and ease of use are paramount.

- Patient-Centricity: Pharmaceutical strategies are increasingly centered around the patient's journey and experience.

- Market Growth: The global adherence market is expanding, reflecting the economic importance of patient compliance.

- Digital Integration: Technology plays a crucial role in meeting new patient expectations for support and engagement.

Corporate Social Responsibility (CSR) and Community Health

Societal expectations for corporate responsibility are increasingly shaping business practices, with companies like Cipla actively investing in Corporate Social Responsibility (CSR) initiatives. These efforts often focus on critical areas such as healthcare accessibility, environmental sustainability, and educational advancement, reflecting a broader societal demand for businesses to contribute positively beyond their core operations.

Cipla's commitment to social good is evident in its planned CSR spending for Fiscal Year 2025, which is set to exceed its statutory obligations. This proactive approach underscores a strategic understanding that robust CSR programs can enhance brand reputation and foster stronger community relationships.

- Healthcare Initiatives: Cipla's CSR often targets improving healthcare access and affordability, particularly in underserved communities.

- Environmental Stewardship: The company is likely to continue investing in eco-friendly practices and sustainability projects, aligning with global environmental concerns.

- Educational Support: CSR programs may also include initiatives aimed at enhancing educational opportunities, especially in science and health-related fields.

- Community Engagement: Cipla's approach involves direct engagement with communities to identify needs and implement impactful, long-term solutions.

Societal attitudes towards health and wellness are evolving, with a growing emphasis on preventative care and lifestyle management. This shift is driving demand for pharmaceuticals addressing chronic conditions and well-being. For instance, the global preventive healthcare market was valued at approximately $37.5 billion in 2023 and is projected to grow significantly, indicating a strong societal trend towards proactive health management.

Patient expectations are also changing, with a greater demand for convenient, easy-to-use treatments and personalized medicine. Cipla's focus on patient-centric approaches, including digital health tools and support programs, aligns with this trend, aiming to improve adherence and overall patient experience. The global patient adherence market is expected to reach over $3 billion by 2027, highlighting the economic importance of meeting these evolving patient needs.

Corporate social responsibility (CSR) is increasingly influencing business practices, with companies like Cipla investing in initiatives that address societal needs beyond core operations. Cipla's commitment to enhancing healthcare accessibility and affordability, particularly in underserved communities, reflects a broader societal expectation for businesses to contribute positively. Their planned CSR spending for FY2025 exceeding statutory obligations underscores this commitment.

Technological factors

Cipla's commitment to Research and Development (R&D) is a significant technological driver, with investments focused on expanding its product pipeline. For instance, the company's R&D expenditure was approximately INR 1,759 crore in the fiscal year 2023, a crucial factor in developing new drugs and therapies.

The pharmaceutical industry is rapidly integrating advanced technologies like Artificial Intelligence (AI) and machine learning into R&D. These tools are accelerating drug discovery, optimizing clinical trial design, and enhancing manufacturing efficiency, which Cipla can leverage to maintain its competitive edge.

Cipla's strategic focus on product filings and ongoing development efforts directly correlates with its R&D investments. This technological advancement in its research capabilities is essential for building a robust pipeline of innovative treatments, ensuring future growth and market relevance.

The biotechnology sector, including gene therapies and personalized medicine, is rapidly expanding, presenting both opportunities and challenges for pharmaceutical companies like Cipla. These advancements are revolutionizing treatment approaches, but they demand substantial capital for research and development, alongside specialized scientific knowledge. The global personalized medicine market was valued at approximately USD 500 billion in 2023 and is projected to reach over USD 900 billion by 2030, indicating significant growth potential.

Cipla's investment in advanced manufacturing technologies, including automation and continuous manufacturing, is crucial for boosting efficiency and lowering production costs. For instance, the company has been focusing on digital transformation initiatives to streamline operations, aiming to improve output quality and speed to market.

Adherence to updated Good Manufacturing Practices (GMP) remains a cornerstone of Cipla's operations, ensuring product safety and efficacy. This commitment is vital as regulatory bodies worldwide, including the US FDA and European EMA, continuously update GMP guidelines to reflect the latest scientific advancements and quality standards.

Digital Health and Telemedicine

The rise of digital health and telemedicine is fundamentally reshaping healthcare delivery and patient engagement with pharmaceutical companies like Cipla. This technological shift allows for remote patient monitoring and more personalized interactions, creating new avenues for data collection and service provision. For instance, by 2025, the global telemedicine market is projected to reach over $300 billion, indicating a significant shift towards digital healthcare solutions.

These advancements offer Cipla opportunities to enhance patient support programs and gather real-world evidence on drug efficacy. The increasing adoption of wearable health devices and mobile health applications by consumers, with an estimated 70% of global internet users expected to use mHealth apps by 2025, further underscores this trend.

Key technological factors impacting Cipla include:

- Growth in Telemedicine Adoption: The expanding reach of telehealth services offers new channels for patient consultation and prescription fulfillment.

- Advancements in Health Monitoring Tech: Wearable devices and remote sensors enable continuous patient data collection, aiding in personalized medicine.

- Digital Patient Engagement Platforms: The development of apps and online portals for patient education, adherence support, and data sharing.

- AI and Data Analytics in Healthcare: Leveraging artificial intelligence for diagnostic support, treatment optimization, and predictive health insights.

Data Analytics and Artificial Intelligence (AI)

The pharmaceutical industry is experiencing a significant shift driven by data analytics and artificial intelligence (AI). These technologies are revolutionizing drug discovery and development, leading to more efficient processes and improved outcomes. Cipla, like its peers, is increasingly leveraging these advancements.

AI's impact is evident in accelerating research and development (R&D) cycles. By analyzing vast datasets, AI can identify potential drug candidates and predict their efficacy more rapidly than traditional methods. This also extends to optimizing clinical trial design and patient selection, ultimately speeding up the journey from lab to market. For instance, the global AI in drug discovery market was valued at approximately $1.5 billion in 2023 and is projected to grow substantially, indicating strong industry investment.

Companies are making substantial investments in data infrastructure and AI capabilities to gain a competitive edge. This focus on data-driven decision-making is crucial for navigating the complex regulatory landscape and market dynamics. Cipla's strategic focus on digital transformation and data analytics is a testament to this trend.

- AI in drug discovery market projected for significant growth, reflecting industry-wide adoption.

- Enhanced R&D efficiency through AI-powered predictive analytics.

- Improved clinical trial outcomes and faster regulatory approvals.

- Strategic investments in data infrastructure and AI talent are becoming critical.

Technological advancements are reshaping the pharmaceutical landscape, with AI and data analytics at the forefront. Cipla's investment in these areas, alongside digital health initiatives, is crucial for future growth. The company's R&D expenditure, approximately INR 1,759 crore in FY23, fuels innovation in drug discovery and development, leveraging technologies like AI to accelerate processes and improve outcomes.

The integration of AI in drug discovery is a significant trend, with the market valued at around $1.5 billion in 2023 and expected to grow substantially. This technological shift enables enhanced R&D efficiency through predictive analytics, potentially leading to faster clinical trial outcomes and regulatory approvals. Strategic investments in data infrastructure and AI talent are becoming paramount for companies like Cipla to maintain a competitive edge.

| Technology Area | Impact on Cipla | Key Data/Trend |

|---|---|---|

| AI in Drug Discovery | Accelerated R&D, improved candidate identification | Global AI in drug discovery market ~$1.5 billion (2023) |

| Digital Health/Telemedicine | Enhanced patient engagement, remote monitoring | Telemedicine market projected >$300 billion by 2025 |

| Advanced Manufacturing | Increased efficiency, cost reduction | Focus on digital transformation for streamlined operations |

| Biotechnology | Opportunities in personalized medicine, gene therapies | Personalized medicine market ~$500 billion (2023) |

Legal factors

Government regulations on drug pricing, particularly for essential and generic medicines, significantly influence Cipla's revenue streams and profit margins. These policies are designed to enhance affordability and accessibility, which can present considerable hurdles for pharmaceutical firms like Cipla.

For instance, India's National Pharmaceutical Pricing Authority (NPPA) actively monitors and caps prices of essential medicines. In 2023, NPPA continued its efforts to regulate prices, impacting the profitability of drugs under its purview, a segment Cipla operates within.

The pharmaceutical industry in India operates under stringent legal frameworks, with the Uniform Code of Pharmaceutical Marketing Practices (UCPMP) 2024 setting key guidelines. This updated code emphasizes integrity, transparency, and accountability in all marketing and promotional activities. A significant aspect is the outright prohibition of offering gifts or any financial inducements to healthcare professionals, aiming to curb unethical practices and ensure patient welfare remains paramount.

Cipla, like all pharmaceutical players in India, must strictly adhere to these regulations. The UCPMP 2024 aims to foster a more ethical marketing environment, impacting how companies engage with doctors and pharmacists. Non-compliance can lead to penalties, affecting brand reputation and potentially incurring financial liabilities, underscoring the critical importance of legal adherence in Cipla's marketing strategies.

The legal landscape surrounding intellectual property (IP) and patent enforcement significantly impacts pharmaceutical companies like Cipla. Protecting novel drug formulations and active pharmaceutical ingredients (APIs) is paramount for innovation and market exclusivity. For instance, the duration of patent protection, typically 20 years from filing, dictates when generic manufacturers can enter the market.

Cipla's business model, heavily reliant on producing and marketing generic versions of off-patent drugs, means it must expertly navigate these IP laws. This includes understanding patent expiry dates and challenging potentially invalid patents. In 2023, the global pharmaceutical patent litigation landscape saw continued activity, with significant investments in R&D often tied to patent strength.

Product Liability and Consumer Protection Laws

Cipla, like all pharmaceutical manufacturers, operates under stringent product liability and consumer protection laws. These regulations mandate that all medications must be demonstrably safe and effective before reaching the market. Failure to meet these standards can result in severe legal penalties, including substantial fines and product recalls, underscoring the critical need for rigorous quality assurance processes.

In 2024, the global pharmaceutical market is increasingly scrutinized for product safety. For instance, regulatory bodies worldwide, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), have stepped up enforcement actions. In the fiscal year ending March 31, 2024, Cipla reported a significant focus on maintaining compliance, with investments in quality control systems aimed at mitigating risks associated with product defects and ensuring adherence to evolving consumer protection mandates.

- Regulatory Scrutiny: Pharmaceutical companies face intense oversight from agencies like the FDA and EMA, demanding unwavering product safety and efficacy.

- Financial Repercussions: Non-compliance can lead to hefty fines, costly litigation, and reputational damage, impacting financial performance.

- Quality Control Investment: Cipla's commitment to robust quality control is essential for navigating complex legal landscapes and safeguarding consumer trust.

- Evolving Standards: Staying abreast of and adapting to new consumer protection legislation is a continuous challenge for the industry.

Anti-Trust and Competition Laws

Anti-trust and competition laws are crucial for maintaining a fair pharmaceutical market, preventing monopolistic behavior and ensuring a level playing field for companies like Cipla. These regulations are designed to protect consumers and foster innovation by encouraging healthy competition.

Cipla must diligently comply with these laws to avoid penalties and maintain its reputation. For instance, in India, the Competition Act of 2002 governs anti-competitive agreements, abuse of dominant position, and combinations that could cause an appreciable adverse effect on competition.

- Adherence to Competition Act, 2002: Cipla must ensure its business practices do not involve price-fixing, bid-rigging, or other anti-competitive agreements.

- Dominant Position Scrutiny: The company must be mindful of its market share and avoid abusing any dominant position it may hold in specific therapeutic areas.

- Merger Control: Any significant mergers or acquisitions undertaken by Cipla would be subject to review by the Competition Commission of India (CCI) to assess their impact on market competition.

Cipla's operations are significantly shaped by legal frameworks governing drug pricing and marketing. The Indian government, through bodies like the National Pharmaceutical Pricing Authority (NPPA), continues to regulate prices of essential medicines, impacting Cipla's revenue. The Uniform Code of Pharmaceutical Marketing Practices (UCPMP) 2024 mandates ethical engagement with healthcare professionals, with non-compliance risking penalties. Furthermore, intellectual property laws and patent enforcement directly influence Cipla's generic drug business model, requiring careful navigation of patent lifecycles and potential litigation.

Environmental factors

The pharmaceutical sector, including Cipla, is under growing scrutiny to mitigate its environmental impact, particularly concerning climate change and carbon emissions. This pressure stems from regulatory bodies, investors, and consumers alike, driving a need for sustainable operational practices.

Cipla has proactively responded by setting clear climate targets. The company is committed to achieving carbon neutrality for its manufacturing facilities in India by the end of 2025. Furthermore, Cipla aims for substantial reductions in its Scope 1 and Scope 2 emissions, demonstrating a tangible commitment to environmental stewardship.

Water usage in manufacturing and the growing global issue of water scarcity are critical environmental considerations. Cipla has proactively addressed this by achieving water-positive status across its Indian manufacturing facilities, demonstrating a commitment to conservation.

This achievement means Cipla conserves more water than it consumes, a significant environmental feat. For instance, in FY23, Cipla's water conservation efforts resulted in a net positive impact, contributing to the sustainability of local water resources.

Effective waste management, including reducing landfill waste and increasing recycling, is vital for environmental sustainability. Cipla has made significant strides, achieving zero waste to landfill across all its manufacturing plants and research and development centers. This commitment highlights their dedication to minimizing environmental impact.

Biodiversity and Ecosystem Protection

Pharmaceutical manufacturing, by its nature, can have an impact on local biodiversity and ecosystems. This includes water usage, waste generation, and land use for facilities. Cipla acknowledges this and is actively engaged in mitigating these effects.

Cipla's commitment to environmental stewardship is demonstrated through initiatives like tree plantations near its manufacturing sites. For example, in fiscal year 2023, Cipla reported planting over 10,000 saplings across its operational areas, contributing to ecological balance and conservation efforts. These efforts aim to offset the environmental footprint of its operations and promote biodiversity.

These initiatives are crucial for maintaining ecological health and supporting conservation. They also align with growing global expectations for corporate environmental responsibility. By investing in green belts and conservation projects, Cipla aims to foster a healthier environment around its operations.

Key aspects of Cipla's biodiversity and ecosystem protection efforts include:

- Afforestation Programs: Planting native species to restore habitats and improve air and water quality.

- Waste Management: Implementing robust systems to minimize and treat waste, preventing pollution of natural resources.

- Water Conservation: Employing water-efficient technologies and promoting water recycling to reduce strain on local water bodies.

- Biodiversity Assessments: Conducting studies to understand and protect local flora and fauna in areas surrounding their facilities.

Sustainable Sourcing and Supply Chain

The increasing global emphasis on sustainability is directly impacting the pharmaceutical sector, with a growing demand for ethically sourced raw materials and environmentally conscious supply chains. This trend necessitates that companies like Cipla scrutinize their entire value chain for responsible practices.

Cipla's dedication to environmental stewardship is a critical component of its strategy, aiming to align its operations with prevailing global sustainability standards and investor expectations. This commitment is not just about compliance but also about building long-term resilience and brand reputation in an evolving market landscape.

- Growing Investor Scrutiny: In 2024, ESG (Environmental, Social, and Governance) investments continued to gain traction, with a significant portion of global assets under management being directed towards sustainable funds. This puts pressure on pharmaceutical companies to demonstrate robust environmental practices.

- Supply Chain Transparency: By 2025, regulatory bodies and consumer groups are expected to further push for greater transparency in pharmaceutical supply chains, including the origin of active pharmaceutical ingredients (APIs) and the environmental footprint of logistics.

- Resource Efficiency: Cipla's focus on sustainable sourcing also translates to optimizing resource utilization, such as water and energy, in its manufacturing processes. For instance, many leading pharmaceutical firms are setting targets to reduce their water consumption per unit of production by 15-20% by 2025.

- Circular Economy Principles: The company is exploring ways to integrate circular economy principles, such as waste reduction and recycling, throughout its operations to minimize its environmental impact and enhance resource efficiency.

Cipla is actively addressing environmental concerns, including carbon emissions and water scarcity, by setting ambitious sustainability targets. The company aims for carbon neutrality in its Indian manufacturing facilities by the end of 2025 and has already achieved water-positive status across these sites, conserving more water than it consumes.

Effective waste management is also a priority, with Cipla achieving zero waste to landfill across all its manufacturing and R&D centers. Furthermore, the company is engaged in mitigating the impact of its operations on local biodiversity through initiatives like tree plantations, planting over 10,000 saplings in FY23.

The pharmaceutical sector faces increasing pressure for sustainable supply chains and ethically sourced materials, driving companies like Cipla to scrutinize their entire value chain. This focus on environmental stewardship is crucial for long-term resilience and meeting evolving investor expectations.

| Environmental Initiative | Target/Status | Year |

|---|---|---|

| Carbon Neutrality (Indian Manufacturing) | Achieve | 2025 |

| Water Positive (Indian Manufacturing) | Achieved | FY23 |

| Zero Waste to Landfill (All Facilities) | Achieved | Ongoing |

| Saplings Planted | 10,000+ | FY23 |

PESTLE Analysis Data Sources

Our Cipla PESTLE Analysis is grounded in a comprehensive review of data from official government publications, reputable financial institutions like the IMF and World Bank, and leading pharmaceutical industry reports. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors influencing Cipla's operations and market position.