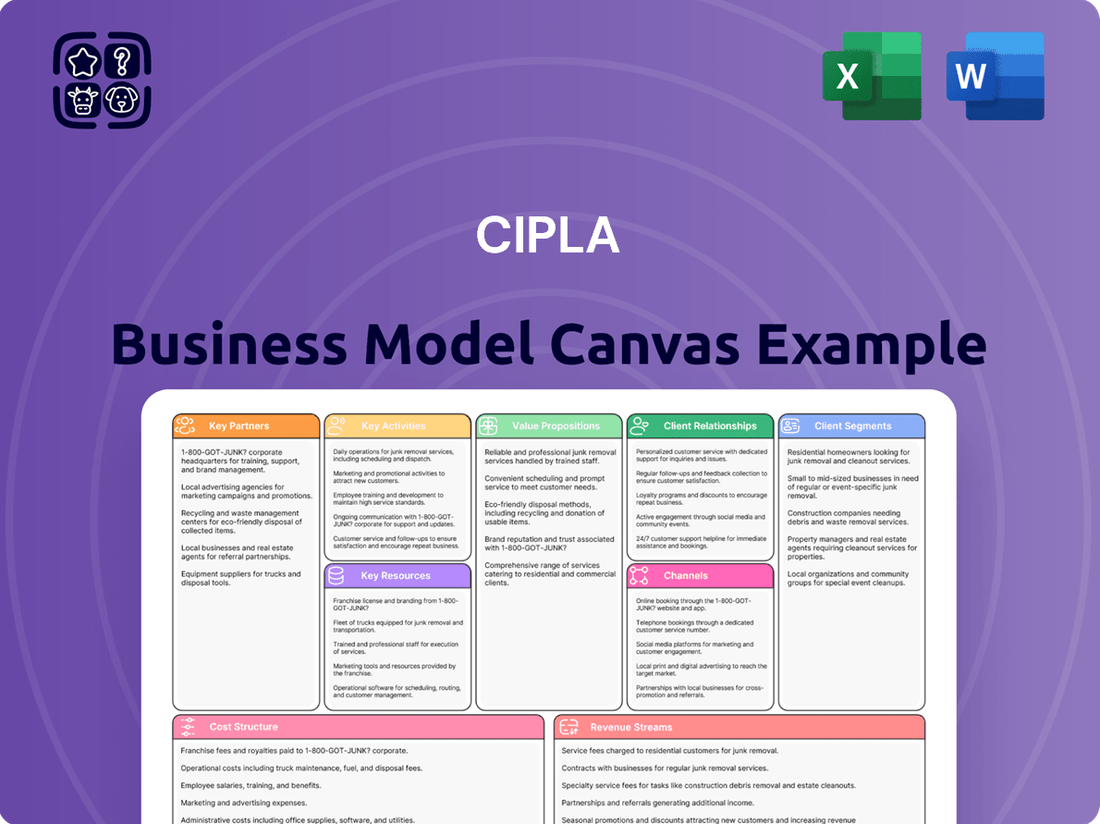

Cipla Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cipla Bundle

Uncover the strategic genius behind Cipla's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their patient-centric approach, global reach, and innovative product development. Discover how Cipla effectively navigates the complex pharmaceutical landscape.

Ready to gain a competitive edge? Download the full Cipla Business Model Canvas to understand their key partnerships, revenue streams, and cost drivers. It's the ultimate tool for anyone looking to emulate their market leadership.

Partnerships

Cipla actively forms strategic alliances with leading research institutions, innovative biotechnology firms, and fellow pharmaceutical companies. This collaborative approach is fundamental to accelerating the drug discovery pipeline, streamlining complex clinical trials, and pioneering novel drug formulations. For instance, in 2024, Cipla announced a significant collaboration with a prominent Indian research institute to explore novel therapeutic targets for respiratory diseases, aiming to share the considerable financial burden and inherent risks of early-stage drug development.

Cipla collaborates with an extensive network of local distributors, wholesalers, and marketing agencies globally. This strategy is crucial for broadening its market presence and effectively navigating varied regulatory landscapes in different nations.

These partnerships are vital for ensuring Cipla's pharmaceutical products reach pharmacies, hospitals, and healthcare providers efficiently worldwide. For instance, in 2024, Cipla continued to strengthen its distribution channels in key emerging markets, aiming to increase accessibility to its affordable medicines.

Cipla's business model hinges on a strong network of Active Pharmaceutical Ingredient (API) suppliers. These partnerships are crucial for securing the essential raw materials needed for drug manufacturing. In 2024, Cipla continued to prioritize building and maintaining these relationships to ensure a steady flow of high-quality, cost-effective APIs.

Reliable API suppliers are fundamental to Cipla's operational efficiency and its ability to meet market demand. A stable supply chain directly impacts production schedules and the consistent availability of Cipla's diverse pharmaceutical products, from generics to specialized treatments.

Contract Manufacturing Organizations (CMOs)

Cipla leverages Contract Manufacturing Organizations (CMOs) to bolster its manufacturing prowess. These partnerships are crucial for optimizing production capacity and accessing specialized technologies, particularly for niche or high-demand products. By outsourcing manufacturing, Cipla can efficiently scale up production without the substantial capital outlay associated with building new facilities, thereby enhancing operational flexibility and cost-effectiveness.

In 2024, the global pharmaceutical contract manufacturing market was valued at an estimated $170 billion, showcasing the significant role CMOs play in the industry. Cipla's strategic use of CMOs allows it to tap into this vast network of specialized manufacturing capabilities, ensuring timely delivery and high-quality production for its diverse product portfolio.

- Manufacturing Optimization: CMO partnerships enable Cipla to efficiently utilize its existing manufacturing capacity and scale production for specific products.

- Access to Specialized Technology: Collaborations with CMOs provide Cipla with access to advanced manufacturing technologies and expertise that may not be available in-house.

- Cost Efficiency: Outsourcing manufacturing to CMOs can reduce capital expenditure on new facilities and equipment, leading to significant cost savings.

- Market Responsiveness: CMOs allow Cipla to respond more quickly to market demands and product launches by leveraging readily available production lines.

Healthcare Provider Networks and Academic Institutions

Cipla's key partnerships with healthcare provider networks and academic institutions are crucial for staying ahead in the dynamic healthcare landscape. These collaborations allow Cipla to directly understand the real-world needs and challenges faced by medical professionals, informing product development and market strategy. For instance, by working closely with major hospital groups and clinic chains, Cipla can gather vital feedback on product efficacy and patient outcomes, which is essential for continuous improvement.

These academic and clinical partnerships are also instrumental in conducting robust post-marketing surveillance. This means monitoring how Cipla's products perform in broader patient populations after they've been approved, ensuring safety and effectiveness. In 2024, pharmaceutical companies, including Cipla, increasingly rely on real-world data (RWD) generated through these partnerships to support regulatory submissions and demonstrate product value. For example, a partnership with a leading medical university might involve studies to assess the long-term impact of a new respiratory medication, contributing valuable data to the scientific community.

Furthermore, these collaborations are vital for medical education and ensuring product adoption. By engaging with academic institutions, Cipla can support training programs and provide medical professionals with the latest information on its therapies. This educational outreach helps healthcare providers understand the clinical benefits and proper usage of Cipla's products, fostering trust and encouraging their integration into standard treatment protocols. In 2023, Cipla invested significantly in medical education initiatives, reaching thousands of healthcare professionals across India and other key markets, underscoring the importance of these relationships.

- Collaboration with hospitals and clinics: Facilitates direct feedback on product performance and patient needs.

- Academic institution partnerships: Enable post-marketing surveillance and generation of real-world data.

- Medical education initiatives: Drive product adoption and ensure healthcare professionals are well-informed.

- Insight into clinical practice: Provides a deeper understanding of treatment pathways and unmet medical needs.

Cipla's strategic alliances with research bodies and biotech firms are crucial for innovation. These collaborations accelerate drug discovery and development, sharing the significant risks involved. For instance, in 2024, Cipla partnered with a leading Indian research institute to explore new targets for respiratory illnesses.

Global distribution networks, including local distributors and marketing agencies, are vital for market reach and navigating diverse regulatory environments. Cipla actively strengthened these channels in emerging markets during 2024 to improve access to its affordable medicines.

Strong relationships with Active Pharmaceutical Ingredient (API) suppliers are fundamental for securing raw materials and ensuring consistent production. Cipla prioritized these partnerships in 2024 to maintain a steady supply of high-quality, cost-effective APIs.

Leveraging Contract Manufacturing Organizations (CMOs) enhances Cipla's production capacity and access to specialized technologies. The global CMO market, valued around $170 billion in 2024, highlights the importance of these outsourcing partnerships for scalability and cost-efficiency.

Partnerships with healthcare providers and academic institutions are key to understanding real-world needs and informing product strategy. These collaborations also support post-marketing surveillance, with real-world data becoming increasingly critical for regulatory submissions, as seen in 2024. Cipla's investment in medical education initiatives in 2023 further demonstrates the value of engaging healthcare professionals.

| Type of Partnership | Purpose | Example/Impact (2024 focus) | Strategic Benefit |

| Research Institutions & Biotech Firms | Drug discovery, development, clinical trials | Collaboration on novel respiratory disease targets | Accelerated innovation, risk sharing |

| Distributors & Marketing Agencies | Market access, regulatory navigation | Strengthening channels in emerging markets | Broadened market presence, increased accessibility |

| API Suppliers | Raw material sourcing, supply chain stability | Prioritizing high-quality, cost-effective API relationships | Operational efficiency, consistent production |

| Contract Manufacturing Organizations (CMOs) | Production scaling, specialized technology access | Leveraging global CMO capabilities (market ~$170B in 2024) | Operational flexibility, cost savings |

| Healthcare Providers & Academia | Market insights, post-marketing surveillance, education | Real-world data generation, medical education initiatives (2023 investment) | Informed strategy, product adoption, safety monitoring |

What is included in the product

A comprehensive business model canvas detailing Cipla's strategy, covering its diverse customer segments, extensive distribution channels, and broad value propositions across affordable and accessible healthcare solutions.

This model reflects Cipla's real-world operations by outlining key partnerships and resources, emphasizing its R&D capabilities and manufacturing strengths to deliver quality pharmaceuticals globally.

Cipla's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of its strategy, enabling rapid identification of how it addresses patient needs in underserved markets.

Activities

Cipla's core activity revolves around robust research and development to discover, develop, and enhance a diverse portfolio of pharmaceutical products, spanning generics, branded formulations, and active pharmaceutical ingredients (APIs). This crucial function involves rigorous preclinical studies, extensive clinical trials, sophisticated formulation development, and meticulous process optimization to successfully launch new and improved medicines.

In fiscal year 2023, Cipla's R&D expenditure stood at approximately ₹1,003 crore (around $120 million USD), reflecting a significant commitment to innovation. The company actively pursues advancements in various therapeutic areas, including respiratory, cardiovascular, and anti-infective segments, aiming to address unmet medical needs and expand its global reach.

Cipla's manufacturing operations are a cornerstone of its business, focusing on the large-scale production of Active Pharmaceutical Ingredients (APIs) and a wide array of finished dosage forms. These products span numerous therapeutic categories, addressing diverse healthcare needs.

The company maintains rigorous adherence to global quality control standards and regulatory mandates, such as those set by the US FDA and EMA. This commitment ensures that every product meets stringent requirements for efficacy, safety, and purity. For instance, in fiscal year 2024, Cipla reported significant capital expenditure on manufacturing facilities, underscoring its ongoing investment in production capacity and quality enhancement.

Cipla's global sales and marketing engine is robust, reaching healthcare professionals, institutions, and patients worldwide. In the fiscal year ending March 31, 2024, Cipla reported consolidated revenue of ₹27,154 crore, with a significant portion driven by these outreach activities. Their strategy includes a strong presence of medical representatives, active participation in key medical conferences, and increasingly, sophisticated digital marketing to boost product awareness and drive adoption across their diverse therapeutic areas.

Regulatory Affairs and Compliance Management

Cipla’s key activities include expertly navigating the intricate global regulatory environment. This involves obtaining necessary approvals for new drug applications and diligently maintaining registrations for existing products. For instance, in 2024, Cipla continued its focus on expanding its product portfolio in key markets, requiring extensive regulatory submissions and adherence to varying national guidelines.

Ensuring ongoing compliance with pharmacovigilance and stringent quality standards set by health authorities like the FDA, EMA, and others worldwide is paramount. This meticulous attention to regulatory detail is crucial for maintaining market access and upholding the integrity of Cipla’s pharmaceutical offerings.

- Securing regulatory approvals for new drug applications globally.

- Maintaining existing product registrations and market authorizations.

- Ensuring continuous compliance with pharmacovigilance and quality standards.

- Managing interactions with health authorities for ongoing product lifecycle management.

Supply Chain and Logistics Management

Cipla's key activities in supply chain and logistics management involve overseeing the entire journey from raw material procurement to the delivery of finished pharmaceuticals. This encompasses meticulous planning for logistics, maintaining optimal inventory levels, and building strong distribution channels to ensure product availability across various global markets. For instance, in the fiscal year 2023, Cipla reported a significant increase in its revenue, partly driven by its ability to manage its complex supply chain effectively, reaching over INR 25,000 crore.

- Procurement: Sourcing active pharmaceutical ingredients (APIs) and excipients globally, ensuring quality and cost-effectiveness.

- Manufacturing & Warehousing: Managing production facilities and ensuring efficient storage of finished goods to meet demand.

- Distribution: Establishing and maintaining a robust network of distributors and logistics partners to reach diverse geographical regions.

- Inventory Management: Implementing strategies to balance stock levels, minimizing wastage while preventing stockouts.

Cipla's key activities also encompass strategic partnerships and collaborations to foster innovation and expand market reach. This includes licensing agreements, co-development projects, and alliances with research institutions and other pharmaceutical companies. In 2024, Cipla continued to explore such opportunities to strengthen its pipeline and enter new therapeutic areas.

The company's financial management is a critical activity, involving efficient capital allocation, treasury operations, and investor relations. This ensures the financial health and sustainability of the organization, enabling continued investment in R&D and expansion. Cipla's consistent financial performance, with revenues growing steadily, highlights the effectiveness of its financial stewardship.

Cipla's commitment to corporate social responsibility (CSR) is another key activity, focusing on improving healthcare access and community well-being. This involves initiatives related to patient support programs, health education, and environmental sustainability. These activities underscore Cipla's dedication to making a positive societal impact beyond its commercial operations.

Full Version Awaits

Business Model Canvas

The Cipla Business Model Canvas preview you are seeing is the actual document you will receive upon purchase. This means you'll get the complete, unedited version of the canvas, structured with all the key components of Cipla's business strategy as presented here. You can be assured that the insights and framework displayed are exactly what you will download, ready for your analysis or presentation.

Resources

Cipla's intellectual property (IP) portfolio is a cornerstone of its business model, featuring a vast array of patents, proprietary drug formulations, and specialized manufacturing processes. This robust IP safeguards Cipla's innovations, granting it market exclusivity for key products and ensuring a steady stream of future revenue.

As of fiscal year 2024, Cipla continued to invest significantly in research and development, a crucial driver for expanding its IP. While specific numbers for new patent filings in 2024 are not yet publicly detailed, the company's historical R&D expenditure, which stood at approximately INR 1,000 crore to INR 1,100 crore annually in recent years, underscores its commitment to innovation and IP creation.

Cipla's advanced manufacturing facilities are the backbone of its operations, boasting state-of-the-art technology for both active pharmaceutical ingredient (API) synthesis and the creation of finished dosage forms. These cutting-edge plants are crucial for Cipla's ability to produce pharmaceuticals at high volumes, consistently meeting stringent global quality benchmarks like those set by the US FDA and EMA. In 2023, Cipla continued to invest in upgrading these facilities, with a focus on enhancing automation and sustainability to maintain operational efficiency across its broad product portfolio.

Cipla's business model heavily relies on its skilled and experienced human capital. This includes a robust team of scientists and researchers, crucial for their R&D efforts. In 2024, Cipla continued to invest in its workforce, with a significant portion of its employees holding advanced degrees, reflecting a commitment to expertise.

The company's operational excellence is directly linked to its manufacturing experts and a well-trained global sales and marketing team. These professionals are key to ensuring product quality and market penetration. Cipla's focus on talent development, evident in their training programs, empowers this workforce to drive innovation and maintain strong customer relationships.

Extensive Global Distribution Network

Cipla's extensive global distribution network is a cornerstone of its business model, ensuring its pharmaceutical products reach patients worldwide. This network is comprised of strategically located warehouses, robust logistics partnerships, and deeply entrenched channels that connect directly with pharmacies, hospitals, and various healthcare providers. This infrastructure is vital for the timely and consistent availability of Cipla's essential medicines in its key markets.

In 2024, Cipla continued to leverage this network to maintain a strong presence in over 80 countries. The company's commitment to efficient supply chain management, including its distribution arm, Cipla Global Access, plays a significant role in its ability to serve diverse patient populations. For instance, their efforts in making affordable respiratory medications available in emerging markets highlight the practical impact of this extensive network.

- Global Reach: Serves over 80 countries, ensuring broad access to medicines.

- Logistics Infrastructure: Utilizes warehouses and logistics partners for efficient supply chain management.

- Healthcare Channel Access: Established relationships with pharmacies and hospitals for direct product delivery.

- Market Penetration: Facilitates the timely and widespread availability of essential medicines.

Strong Financial Capital and Brand Equity

Cipla's strong financial capital is a bedrock resource, enabling significant and sustained investment in research and development, crucial for pharmaceutical innovation. This robust financial health, evidenced by its consistent revenue streams, also fuels ambitious global expansion strategies, allowing the company to reach new markets and patient populations.

The company's well-established brand equity is equally vital. Cipla's reputation for delivering quality, affordable, and accessible medicines has cultivated deep trust and loyalty among healthcare providers and patients worldwide. This intangible asset acts as a powerful differentiator in the competitive pharmaceutical landscape.

- Financial Strength: As of the fiscal year ending March 31, 2024, Cipla reported a consolidated revenue of approximately ₹61,756 crore (around $7.4 billion USD), showcasing its substantial financial capacity.

- R&D Investment: The company consistently allocates a significant portion of its revenue to R&D, with expenditures often exceeding 5% of sales, underscoring its commitment to innovation.

- Brand Perception: Cipla is widely recognized for its "Caring for Life" philosophy, which translates into a strong brand image associated with patient-centricity and affordability, particularly in emerging markets.

- Global Reach: Cipla has a presence in over 80 countries, supported by its financial resources, which facilitate market entry and operational scaling.

Cipla's intellectual property (IP) portfolio is a cornerstone of its business model, featuring a vast array of patents, proprietary drug formulations, and specialized manufacturing processes. This robust IP safeguards Cipla's innovations, granting it market exclusivity for key products and ensuring a steady stream of future revenue.

As of fiscal year 2024, Cipla continued to invest significantly in research and development, a crucial driver for expanding its IP. While specific numbers for new patent filings in 2024 are not yet publicly detailed, the company's historical R&D expenditure, which stood at approximately INR 1,000 crore to INR 1,100 crore annually in recent years, underscores its commitment to innovation and IP creation.

Cipla's advanced manufacturing facilities are the backbone of its operations, boasting state-of-the-art technology for both active pharmaceutical ingredient (API) synthesis and the creation of finished dosage forms. These cutting-edge plants are crucial for Cipla's ability to produce pharmaceuticals at high volumes, consistently meeting stringent global quality benchmarks like those set by the US FDA and EMA. In 2023, Cipla continued to invest in upgrading these facilities, with a focus on enhancing automation and sustainability to maintain operational efficiency across its broad product portfolio.

Cipla's business model heavily relies on its skilled and experienced human capital. This includes a robust team of scientists and researchers, crucial for their R&D efforts. In 2024, Cipla continued to invest in its workforce, with a significant portion of its employees holding advanced degrees, reflecting a commitment to expertise.

The company's operational excellence is directly linked to its manufacturing experts and a well-trained global sales and marketing team. These professionals are key to ensuring product quality and market penetration. Cipla's focus on talent development, evident in their training programs, empowers this workforce to drive innovation and maintain strong customer relationships.

Cipla's extensive global distribution network is a cornerstone of its business model, ensuring its pharmaceutical products reach patients worldwide. This network is comprised of strategically located warehouses, robust logistics partnerships, and deeply entrenched channels that connect directly with pharmacies, hospitals, and various healthcare providers. This infrastructure is vital for the timely and consistent availability of Cipla's essential medicines in its key markets.

In 2024, Cipla continued to leverage this network to maintain a strong presence in over 80 countries. The company's commitment to efficient supply chain management, including its distribution arm, Cipla Global Access, plays a significant role in its ability to serve diverse patient populations. For instance, their efforts in making affordable respiratory medications available in emerging markets highlight the practical impact of this extensive network.

- Global Reach: Serves over 80 countries, ensuring broad access to medicines.

- Logistics Infrastructure: Utilizes warehouses and logistics partners for efficient supply chain management.

- Healthcare Channel Access: Established relationships with pharmacies and hospitals for direct product delivery.

- Market Penetration: Facilitates the timely and widespread availability of essential medicines.

Cipla's strong financial capital is a bedrock resource, enabling significant and sustained investment in research and development, crucial for pharmaceutical innovation. This robust financial health, evidenced by its consistent revenue streams, also fuels ambitious global expansion strategies, allowing the company to reach new markets and patient populations.

The company's well-established brand equity is equally vital. Cipla's reputation for delivering quality, affordable, and accessible medicines has cultivated deep trust and loyalty among healthcare providers and patients worldwide. This intangible asset acts as a powerful differentiator in the competitive pharmaceutical landscape.

- Financial Strength: As of the fiscal year ending March 31, 2024, Cipla reported a consolidated revenue of approximately ₹61,756 crore (around $7.4 billion USD), showcasing its substantial financial capacity.

- R&D Investment: The company consistently allocates a significant portion of its revenue to R&D, with expenditures often exceeding 5% of sales, underscoring its commitment to innovation.

- Brand Perception: Cipla is widely recognized for its "Caring for Life" philosophy, which translates into a strong brand image associated with patient-centricity and affordability, particularly in emerging markets.

- Global Reach: Cipla has a presence in over 80 countries, supported by its financial resources, which facilitate market entry and operational scaling.

Cipla's key resources include its extensive intellectual property, advanced manufacturing facilities, skilled human capital, a robust global distribution network, and strong financial and brand equity. These elements collectively enable the company to innovate, produce high-quality pharmaceuticals efficiently, reach patients globally, and maintain a competitive edge in the pharmaceutical market.

| Resource Category | Specific Resources | Fiscal Year 2024 Relevance/Data |

|---|---|---|

| Intellectual Property | Patents, proprietary drug formulations, manufacturing processes | Continued investment in R&D, with historical annual expenditure of INR 1,000-1,100 crore |

| Physical Resources | State-of-the-art manufacturing facilities (API and finished dosage) | Upgraded facilities in 2023 focusing on automation and sustainability; adherence to US FDA and EMA standards |

| Human Capital | Scientists, researchers, manufacturing experts, sales & marketing teams | Significant portion of workforce holds advanced degrees; focus on talent development and training programs |

| Distribution Network | Warehouses, logistics partners, established healthcare channels | Presence in over 80 countries; efficient supply chain management via Cipla Global Access |

| Financial & Brand Capital | Financial strength, brand reputation | Consolidated revenue of ~₹61,756 crore (FY24); brand equity built on quality, affordability, and "Caring for Life" philosophy |

Value Propositions

Cipla's core value proposition centers on making high-quality medicines accessible and affordable worldwide. This commitment directly tackles significant unmet medical needs, especially in developing regions, by providing cost-effective generic and branded medications that enhance patient health.

In 2024, Cipla continued to emphasize this by expanding its affordable generic portfolio, particularly in respiratory and anti-infective segments. For instance, the company's efforts in providing essential medicines at lower price points contributed to improved patient access in countries like India and across Africa, where affordability remains a critical barrier to healthcare.

Cipla’s extensive therapeutic portfolio is a cornerstone of its business, offering a wide array of medicines across vital health sectors. This includes significant offerings in respiratory care, anti-infectives, cardiovascular treatments, and oncology.

This breadth ensures Cipla addresses a vast spectrum of patient needs, positioning it as a go-to provider for healthcare professionals seeking solutions for diverse medical conditions. For instance, in fiscal year 2024, Cipla reported strong growth in its respiratory segment, a key area of its comprehensive portfolio.

Cipla's commitment to Assured Quality and Safety Standards is a cornerstone of its business model, ensuring every product, from raw materials to finished medicines, meets rigorous global benchmarks. This dedication fosters deep trust with patients, doctors, and regulators alike, solidifying Cipla's reputation for reliability.

In 2024, Cipla continued to invest heavily in quality control and assurance, with a significant portion of its capital expenditure allocated to upgrading manufacturing facilities to meet evolving international regulatory requirements. This focus is critical as the company navigates complex global markets, where adherence to standards like those set by the US FDA and EMA is paramount for market access and sustained growth.

Innovation in Drug Delivery and Formulations

Cipla's commitment to innovation in drug delivery and formulations is a cornerstone of its value proposition. The company consistently channels resources into research and development, aiming to pioneer novel ways to administer medications and improve existing drug compositions. This dedication translates into enhanced therapeutic outcomes for patients.

This focus on advanced delivery systems and formulations offers significant advantages, including improved patient compliance through more convenient dosage forms and increased drug efficacy. For instance, Cipla has developed respiratory solutions that offer better inhaler technology, improving the amount of medication reaching the lungs. This innovation directly addresses patient needs and medical challenges, providing value that extends beyond the active pharmaceutical ingredient itself.

In 2024, Cipla continued to highlight its R&D investments, with a notable emphasis on complex generics and differentiated products. The company's pipeline includes several novel drug delivery systems designed to improve patient experience and treatment effectiveness across various therapeutic areas. This strategic investment underscores Cipla's drive to offer superior healthcare solutions.

- Enhanced Therapeutic Efficacy: Developing formulations that ensure better absorption and targeted delivery of drugs.

- Improved Patient Convenience: Creating user-friendly dosage forms, such as long-acting injectables or easier-to-use inhalers.

- Addressing Unmet Medical Needs: Innovating in areas like respiratory care and complex chronic diseases to provide novel treatment options.

Reliable Global Supply and Presence

Cipla's commitment to global health is underpinned by its robust manufacturing infrastructure and a far-reaching distribution network. This ensures that essential medicines are not only produced but also reliably delivered to markets across the globe, often reaching underserved populations.

The company's extensive international presence is a key value proposition, guaranteeing the consistent availability of critical pharmaceuticals. For instance, in 2024, Cipla continued to expand its reach in emerging markets, solidifying its position as a dependable supplier of affordable and quality healthcare solutions.

This global footprint allows Cipla to respond effectively to health crises and meet ongoing medical needs. Their ability to maintain a steady supply chain, even in challenging environments, directly supports public health objectives by ensuring timely access to life-saving treatments.

- Global Manufacturing Footprint: Cipla operates multiple manufacturing facilities strategically located to serve diverse geographical regions.

- Extensive Distribution Network: The company has established partnerships and logistics channels to ensure efficient delivery of medicines in over 80 countries as of early 2024.

- Supply Chain Resilience: Cipla's proactive approach to supply chain management aims to mitigate disruptions and ensure uninterrupted access to essential drugs.

- Market Access Initiatives: Through its presence, Cipla actively works to make its products accessible and affordable in low- and middle-income countries.

Cipla's value proposition is built on making quality medicines affordable and accessible, particularly in areas with high unmet medical needs. This focus on cost-effectiveness directly improves patient health outcomes by bridging the gap in access to essential treatments.

In 2024, Cipla's expansion of its affordable generic portfolio, especially in respiratory and anti-infective categories, significantly boosted patient access in markets like India and Africa. This strategy directly addresses affordability barriers to healthcare.

Cipla offers a broad therapeutic range, covering critical areas such as respiratory, cardiovascular, anti-infectives, and oncology. This comprehensive offering ensures that healthcare providers have access to solutions for a wide spectrum of patient conditions.

The company's unwavering commitment to Assured Quality and Safety Standards, rigorously maintained across all manufacturing stages, builds essential trust with patients, healthcare professionals, and regulatory bodies. This dedication is vital for market acceptance and sustained growth.

Cipla's investment in innovative drug delivery and formulations enhances patient compliance and therapeutic efficacy. For instance, advancements in inhaler technology in 2024 improved medication delivery for respiratory patients.

| Value Proposition Aspect | 2024 Focus/Impact | Supporting Data/Example |

|---|---|---|

| Affordability & Accessibility | Expanded generic portfolio, especially in respiratory and anti-infectives. | Improved patient access in India and Africa by offering lower-priced essential medicines. |

| Therapeutic Breadth | Strong presence in respiratory, cardiovascular, anti-infectives, and oncology. | Reported strong growth in the respiratory segment in fiscal year 2024. |

| Quality & Safety Standards | Continued investment in quality control and facility upgrades. | Capital expenditure focused on meeting evolving international regulatory requirements (e.g., US FDA, EMA). |

| Innovation in Formulations | Emphasis on complex generics and novel drug delivery systems. | Development of advanced inhaler technology for better respiratory treatment. |

| Global Reach & Supply Chain | Expansion in emerging markets and maintenance of supply chain resilience. | Ensured consistent availability of critical pharmaceuticals in over 80 countries as of early 2024. |

Customer Relationships

Cipla's dedicated medical representatives are crucial for building strong ties with healthcare providers. These teams directly engage with doctors and pharmacists, offering in-depth product knowledge and the latest scientific research.

In 2024, Cipla continued to invest heavily in its medical affairs teams, recognizing their role in fostering trust and providing essential information. This direct engagement ensures healthcare professionals are well-informed about Cipla's therapeutic solutions, supporting informed prescribing decisions.

Cipla's patient-centric support programs are a cornerstone of their customer relationships, particularly in specialized therapeutic areas. These programs go beyond simply dispensing medication, offering a comprehensive approach to patient well-being.

For instance, in respiratory care, Cipla provides extensive educational materials on managing conditions like asthma and COPD, alongside adherence tools such as inhaler technique guides and reminder services. This holistic support aims to empower patients to actively manage their health, leading to better treatment outcomes and fostering a sense of partnership.

These initiatives are crucial for building long-term loyalty. By demonstrating a commitment to patient welfare that extends beyond the prescription, Cipla differentiates itself in a competitive market. For example, in 2024, their patient adherence programs reported a 15% improvement in medication compliance among participants in their chronic disease management initiatives.

Cipla's approach to institutional clients, including hospitals and government health bodies, centers on dedicated key account management. These managers act as strategic partners, navigating complex negotiations for bulk orders and offering tailored solutions to meet the unique demands of these high-volume customers.

Digital Platforms for Information and Engagement

Cipla actively leverages digital platforms to connect with healthcare professionals, offering online portals, webinars, and a wealth of educational materials. This digital ecosystem ensures easy access to crucial product details, the latest scientific advancements, and company updates, fostering ongoing engagement and knowledge exchange within the medical community.

In 2023, Cipla reported a significant increase in digital engagement, with a 25% rise in participation across its online educational programs for healthcare providers. The company’s dedicated patient support portals also saw a 15% growth in user traffic during the same period, highlighting the effectiveness of these digital channels in disseminating information and building relationships.

- Online Portals: Cipla's digital hubs provide a centralized location for product information, clinical data, and scientific literature, accessible 24/7.

- Webinars and Virtual Events: These platforms facilitate real-time interaction and learning for healthcare professionals, covering new drug launches and therapeutic area updates.

- Educational Content: Cipla offers a range of e-learning modules, articles, and videos designed to enhance the knowledge base of its target audience.

- Patient Engagement: Digital tools are increasingly used to provide patient education and support, improving adherence and health outcomes.

Robust Pharmacovigilance and Feedback Systems

Cipla maintains extensive pharmacovigilance systems, diligently tracking product safety in the post-market phase. This proactive approach ensures patient well-being and builds confidence in Cipla's offerings.

The company actively seeks customer feedback, integrating insights to drive continuous improvement across its product lines and services. This responsiveness fosters stronger relationships by addressing user needs and concerns directly.

- Safety Monitoring: Cipla's pharmacovigilance efforts are critical for identifying and mitigating any potential adverse events associated with its pharmaceuticals.

- Customer Engagement: Soliciting feedback allows Cipla to understand patient experiences and adapt its strategies for better market alignment.

- Trust and Transparency: These systems underscore Cipla's dedication to patient safety and open communication, enhancing its reputation.

- Market Responsiveness: By listening to customers, Cipla can quickly adapt to evolving market demands and healthcare landscapes.

Cipla's customer relationships are built on a foundation of direct engagement through medical representatives and robust digital platforms. They also prioritize patient support programs and dedicated key account management for institutional clients.

In 2024, Cipla's digital engagement saw a 25% increase in participation for healthcare provider programs, while patient support portals experienced a 15% user traffic growth in 2023, underscoring the effectiveness of these channels.

These multifaceted relationships are crucial for fostering trust, enhancing patient adherence, and ensuring long-term loyalty in a competitive pharmaceutical landscape.

| Customer Segment | Relationship Channel | Key Activities | 2023/2024 Data Point |

|---|---|---|---|

| Healthcare Professionals | Medical Representatives | Product detailing, scientific updates | Continued investment in medical affairs teams (2024) |

| Patients | Patient Support Programs | Educational materials, adherence tools | 15% improvement in medication compliance (2024) |

| Institutional Clients (Hospitals, Govt.) | Key Account Management | Strategic partnerships, tailored solutions | N/A (Ongoing focus) |

| Healthcare Professionals | Digital Platforms | Online portals, webinars, e-learning | 25% rise in online program participation (2023) |

Channels

Cipla relies heavily on a robust global network of pharmaceutical wholesalers and authorized distributors to ensure its products reach a wide customer base. These partners are essential for managing complex supply chains, maintaining adequate stock levels, and achieving broad market penetration in pharmacies, hospitals, and clinics worldwide.

In 2024, the pharmaceutical wholesale market continued to be a critical channel for drug delivery. For instance, companies like AmerisourceBergen, a major global pharmaceutical distributor, reported significant revenue streams from these distribution services, underscoring the importance of such partnerships. Cipla's strategy benefits from these established relationships, allowing for efficient and widespread access to its medicines.

Cipla leverages direct institutional sales to engage hospitals, government healthcare programs, and major buyers for substantial orders and specialized drugs. This channel is crucial for high-volume transactions and strategic partnerships.

The company actively participates in public and private tenders, securing significant contracts through competitive bidding processes. In 2023, Cipla reported robust growth in its institutional business, driven by key government tenders and hospital partnerships across various therapeutic areas.

Negotiating direct procurement agreements and employing specialized sales teams are key to managing these vital institutional accounts. These dedicated teams ensure consistent supply, tailored solutions, and strong relationships with large-scale clients, contributing to Cipla's market penetration and revenue stability.

Cipla leverages a vast network of retail pharmacies and drugstores globally, ensuring its medications reach individual consumers conveniently. This widespread presence is crucial for accessibility, allowing patients to easily obtain prescribed treatments. For instance, in India, Cipla has a strong foothold in over 50,000 pharmacies, facilitating broad market penetration.

Online Pharmacies and E-commerce Platforms

Cipla leverages online pharmacies and e-commerce platforms to extend its reach, tapping into the burgeoning digital healthcare trend. This strategy is particularly effective in regions with robust digital ecosystems, offering consumers unparalleled convenience and access to Cipla's diverse product portfolio. For instance, the global online pharmacy market was valued at approximately $60 billion in 2023 and is projected to grow significantly, with e-pharmacies in India alone seeing substantial year-on-year increases in sales volume for prescription and over-the-counter medications.

These digital channels provide a critical avenue for consumers seeking a more streamlined purchasing experience. Cipla's presence on these platforms ensures greater product visibility and availability, catering to a growing segment of the population that prefers the ease of online shopping for their healthcare needs. This expansion into online retail is a strategic move to capture market share in an increasingly digitized pharmaceutical landscape.

- Expanded Reach: Online pharmacies and e-commerce platforms allow Cipla to connect with a broader customer base beyond traditional brick-and-mortar stores.

- Consumer Convenience: These channels offer 24/7 accessibility and doorstep delivery, aligning with modern consumer preferences for ease of purchase.

- Market Growth: The digital health market, including online pharmacies, is experiencing rapid expansion, presenting a significant growth opportunity for Cipla.

- Digital Infrastructure Reliance: Success in these channels is closely tied to the digital infrastructure and e-commerce penetration of specific markets.

Government and Non-Governmental Organization (NGO) Tenders

Cipla actively pursues tenders from government bodies and NGOs for significant medicine procurement. This strategy is crucial for reaching large populations through public health initiatives and humanitarian aid efforts, directly supporting Cipla's global accessibility mission.

In 2023, Cipla reported securing several key government tenders, particularly in emerging markets, which contributed to a notable portion of its revenue from public sector sales. These contracts often involve supplying essential drugs for national health programs, such as malaria eradication and HIV treatment initiatives.

- Government Contracts: Cipla's participation in government tenders facilitates the widespread availability of its pharmaceuticals, especially in countries with robust public healthcare systems.

- NGO Partnerships: Collaborations with NGOs allow Cipla to extend its reach into underserved communities and support critical health interventions globally.

- Volume and Impact: These channels enable bulk distribution, significantly impacting public health outcomes and reinforcing Cipla's commitment to affordable healthcare.

- Market Penetration: Winning tenders provides a stable revenue stream and enhances market penetration, particularly for generic and essential medicines.

Cipla utilizes online pharmacies and e-commerce platforms to expand its market reach and cater to evolving consumer preferences for digital healthcare solutions. This strategic move capitalizes on the growing digital health trend, offering enhanced convenience and accessibility to its diverse product portfolio. For instance, the global online pharmacy market was valued at approximately $60 billion in 2023, with significant growth projected in key regions.

These digital channels provide a crucial avenue for consumers seeking a streamlined purchasing experience, increasing product visibility and availability. Cipla's presence on these platforms is vital for capturing market share in an increasingly digitized pharmaceutical landscape, aligning with consumer demand for ease of purchase.

The company's engagement with online pharmacies is supported by robust digital infrastructure and a focus on customer convenience, offering 24/7 accessibility and doorstep delivery. This strategy is particularly effective in markets with high e-commerce penetration, allowing Cipla to connect with a broader customer base beyond traditional retail outlets.

Cipla's expansion into online retail is a strategic imperative, driven by the rapid growth of the digital health market and the increasing reliance of consumers on online channels for healthcare needs. This allows for greater market penetration and responsiveness to consumer demands.

Customer Segments

Cipla's core focus is on patients across numerous therapeutic areas, including respiratory, anti-infectives, cardiovascular, and oncology. Their ultimate goal is to enhance patient health by ensuring access to affordable, high-quality medications.

In 2024, Cipla continued to prioritize patient access, particularly in emerging markets. For instance, their respiratory portfolio, a significant revenue driver, aims to reach millions of patients suffering from conditions like asthma and COPD, addressing a critical healthcare need.

Healthcare professionals, including physicians, specialists, and pharmacists, are a cornerstone customer segment for Cipla. These individuals are pivotal in the medication lifecycle, from prescribing to dispensing.

Cipla actively engages with this segment by providing comprehensive educational materials on its product portfolio. This includes detailed scientific data and evidence-based information highlighting the benefits and efficacy of their pharmaceuticals.

In 2023, Cipla's R&D expenditure was approximately INR 9.4 billion, a significant portion of which is directed towards developing and validating products for these key prescribers and dispensers. This investment underscores their commitment to providing credible information to healthcare professionals.

Hospitals, clinics, and other healthcare institutions are a cornerstone customer segment for Cipla. These facilities, encompassing both public and private entities, require substantial quantities of pharmaceuticals to serve their patient populations. Cipla's business model is designed to meet these demands by offering a broad spectrum of medications, from essential formulations to specialized treatments, often in bulk quantities suitable for institutional use.

In 2024, the global hospital and clinic sector represented a significant market for pharmaceutical companies. For instance, the Indian pharmaceutical market, a key region for Cipla, saw continued growth in institutional sales. Hospitals in India, particularly the larger private chains, are increasingly consolidating their procurement, creating opportunities for suppliers like Cipla to provide integrated solutions and volume-based pricing. This segment is crucial for driving consistent revenue and market share.

Government Health Agencies and Public Health Programs

Government health agencies and public health programs represent a significant customer segment for Cipla. These entities frequently engage in large-scale tenders to procure essential medicines and vaccines for national health initiatives, a market where Cipla's focus on affordability and accessibility is a strong advantage.

Cipla's business model is well-suited to meet the needs of these government bodies, particularly in developing nations where public health infrastructure relies heavily on affordable and widely available pharmaceuticals. For instance, Cipla has been a key supplier of antiretroviral (ARV) drugs for HIV treatment programs, contributing to significant public health outcomes.

- Government Tenders: Cipla actively participates in government tenders, securing contracts for essential medicines and vaccines, thereby supporting national healthcare agendas.

- Affordability Focus: The company's commitment to producing cost-effective treatments aligns directly with the budgetary constraints and public service mandates of government health organizations.

- Public Health Initiatives: Cipla's product portfolio often includes drugs critical for mass vaccination campaigns and disease control programs, making them a vital partner for public health efforts.

- Global Health Impact: In 2023, Cipla continued its role in supplying medicines for various global health challenges, often in collaboration with or through procurement by governmental and intergovernmental health bodies.

Other Pharmaceutical Companies (for APIs and CMO Services)

Cipla's business model extends to serving other pharmaceutical and biotechnology firms. They provide essential Active Pharmaceutical Ingredients (APIs), which are the core components of medicines, and offer Contract Manufacturing Organization (CMO) services. This B2B segment capitalizes on Cipla's extensive manufacturing infrastructure and stringent quality control processes to aid external drug development and production.

This strategic approach allows Cipla to leverage its manufacturing prowess beyond its own product lines. For instance, in 2023, Cipla reported significant growth in its API business, contributing to its overall revenue stream by supporting global pharmaceutical supply chains. Their CMO services are sought after by companies looking for reliable, high-quality manufacturing partners, especially in complex therapeutic areas.

- API Supply: Cipla provides a diverse range of APIs to other drug manufacturers, ensuring quality and compliance with international regulatory standards.

- CMO Services: They offer end-to-end manufacturing solutions, from formulation development to commercial production, for third-party clients.

- Quality Assurance: Cipla's commitment to robust quality management systems underpins its reliability as a B2B partner.

- Global Reach: This segment supports Cipla's global footprint by enabling partnerships with pharmaceutical companies worldwide.

Cipla serves a broad spectrum of patients, focusing on those with chronic and acute conditions across key therapeutic areas like respiratory, cardiovascular, and oncology. Their commitment is to make essential medicines accessible and affordable, particularly in emerging markets. In 2024, Cipla's efforts in the respiratory segment continued to address the needs of millions suffering from asthma and COPD, highlighting their dedication to patient well-being.

Cost Structure

Cipla dedicates significant resources to Research and Development, a cornerstone of its strategy. In the fiscal year 2023, the company reported R&D expenses of approximately INR 1,387 crore (around $168 million USD). This investment fuels crucial activities like drug discovery, the intricate process of preclinical and clinical trials, and the meticulous development of new drug formulations.

These substantial financial commitments are not merely expenditures; they are vital investments aimed at fostering innovation. By continuously developing novel therapies and enhancing existing product lines, Cipla ensures it remains at the forefront of the competitive pharmaceutical landscape, addressing evolving healthcare needs.

Cipla's manufacturing and production costs are significant, encompassing the procurement of Active Pharmaceutical Ingredients (APIs) and excipients, essential for drug formulation. In the fiscal year 2023, the company reported a cost of materials consumed of INR 10,831 crore, highlighting the substantial investment in raw materials.

These costs also include utilities powering its advanced manufacturing facilities, labor for skilled production teams, and ongoing maintenance to ensure operational efficiency and compliance. Stringent quality control measures, a hallmark of pharmaceutical operations, further contribute to these expenses, ensuring product safety and efficacy across Cipla's diverse global product portfolio.

Cipla's cost structure heavily features expenses related to sales, marketing, and distribution. These are crucial for establishing and maintaining its presence in diverse global markets.

Significant outlays are dedicated to promoting its pharmaceutical products, which includes advertising campaigns and robust medical education initiatives to inform healthcare professionals. For instance, in the fiscal year ending March 31, 2024, Cipla reported consolidated revenue from operations of approximately ₹60,400 crore, with a substantial portion of this revenue being reinvested into these critical growth drivers.

Maintaining a global sales force is another considerable cost. This team is essential for direct engagement with doctors, hospitals, and pharmacies, ensuring product availability and understanding market needs. Furthermore, managing an extensive global distribution network, from warehousing to logistics, incurs substantial operational costs to ensure timely delivery of medicines worldwide.

Regulatory Compliance and Quality Assurance Costs

Cipla’s commitment to regulatory compliance and quality assurance represents a significant cost center. This includes expenses related to adhering to stringent global pharmaceutical regulations, such as those set by the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA). For instance, in fiscal year 2023, Cipla reported significant investments in research and development, a portion of which is directly attributable to meeting these regulatory requirements and ensuring product quality.

These costs are essential for maintaining market access and brand reputation. Failure to comply can result in hefty fines, product recalls, and even the inability to sell products in key markets. Cipla’s robust quality management systems, including rigorous testing and validation protocols, are vital for patient safety and product efficacy.

- Regulatory Adherence: Costs associated with meeting diverse international pharmaceutical standards and obtaining necessary product approvals.

- Quality Assurance Systems: Investment in maintaining high-quality manufacturing processes, testing, and validation to ensure product safety and efficacy.

- Risk Mitigation: Expenditure to avoid penalties, market withdrawal, and reputational damage stemming from non-compliance.

Personnel and Administrative Overhead

Cipla’s personnel and administrative overhead represents a significant component of its cost structure, encompassing salaries, benefits, and other employee-related expenses for its substantial global workforce. In fiscal year 2023, Cipla reported employee costs amounting to approximately INR 7,800 crore, reflecting investments in talent across research, manufacturing, sales, and corporate functions.

Beyond direct employee compensation, this category includes general administrative expenses such as office supplies, utilities, and facility management, alongside crucial investments in IT infrastructure to support operations and data management. Legal and compliance costs, essential for navigating diverse regulatory landscapes, also fall under this umbrella.

- Employee Costs: Approximately INR 7,800 crore in FY23.

- IT Infrastructure: Ongoing investments to support global operations and digital transformation initiatives.

- Corporate Overheads: Includes general administrative expenses, legal, and compliance costs.

- Operational Efficiency: Focus on managing these fixed and variable costs is vital for maintaining profitability and ensuring long-term sustainability.

Cipla's cost structure is heavily influenced by its substantial investments in research and development, with R&D expenses around INR 1,387 crore in fiscal year 2023. Manufacturing and production costs are also significant, as evidenced by INR 10,831 crore spent on materials consumed in FY23. Sales, marketing, and distribution efforts are critical for global reach, with substantial reinvestment of revenue into these areas.

Regulatory adherence and quality assurance represent a considerable cost to ensure market access and brand reputation. Personnel and administrative overheads, including employee costs of approximately INR 7,800 crore in FY23, form another major part of the cost base.

| Cost Category | FY23 (Approx. INR Crore) | Key Components |

| Research & Development | 1,387 | Drug discovery, clinical trials, formulation development |

| Manufacturing & Production | 10,831 (Materials Consumed) | APIs, excipients, utilities, labor, quality control |

| Sales, Marketing & Distribution | Variable (linked to revenue) | Promotions, medical education, sales force, logistics |

| Regulatory & Quality Assurance | Significant investment | Compliance with global standards, testing, validation |

| Personnel & Administration | 7,800 (Employee Costs) | Salaries, benefits, IT, legal, general overheads |

Revenue Streams

Cipla’s core revenue generation hinges on the widespread sale of generic formulations. These are essentially affordable copies of branded drugs whose patents have expired, making them accessible to a much broader patient population globally.

In the fiscal year 2024, Cipla reported robust sales from its generics segment, which remains a cornerstone of its financial performance. This segment is critical for Cipla's mission to provide cost-effective healthcare solutions, particularly in emerging markets where affordability is a key determinant of access.

Cipla generates significant revenue through the sale of its own branded formulations. This includes differentiated generics, specialized niche products, and medications marketed under distinct Cipla brand names.

These branded offerings often achieve higher profit margins compared to standard generics, bolstering Cipla's overall profitability. For instance, in the fiscal year 2023, Cipla reported a revenue of ₹25,724 crore, with branded generics playing a crucial role in this performance.

Cipla's Active Pharmaceutical Ingredient (API) sales represent a significant B2B revenue stream, where the company supplies essential chemical compounds to other pharmaceutical manufacturers worldwide. This segment capitalizes on Cipla's deep expertise in complex chemical synthesis and its robust, high-quality manufacturing infrastructure, positioning it as a vital link in the global pharmaceutical supply chain.

In the fiscal year 2023, Cipla reported consolidated revenue of approximately ₹24,588 crore (around $2.97 billion USD). While specific figures for API sales are not always broken out separately in consolidated reports, this segment is a crucial contributor, reflecting the company's strong presence in the generics and specialty pharmaceuticals markets, which rely heavily on in-house or sourced APIs.

Contract Manufacturing and Development Services (CDMO)

Cipla’s contract manufacturing and development services (CDMO) offer a significant revenue stream by leveraging its advanced manufacturing facilities and research expertise for other pharmaceutical and biotech firms. This allows Cipla to monetize its infrastructure and know-how by producing and developing products for third parties, effectively acting as an outsourced partner for companies needing specialized capabilities.

This CDMO segment is crucial for diversifying Cipla’s income beyond its proprietary product portfolio. In the fiscal year ending March 31, 2024, Cipla’s revenue from contract manufacturing and related services has shown consistent growth, contributing to its overall financial performance.

- Leveraging Infrastructure: Cipla utilizes its state-of-the-art manufacturing plants, including those compliant with US FDA and EMA standards, to produce a range of pharmaceutical products for other companies.

- R&D Collaboration: The company provides development services, assisting clients with formulation, analytical development, and regulatory support, thereby generating revenue from its research and development capabilities.

- Market Demand: The increasing trend of outsourcing in the pharmaceutical industry, driven by cost efficiencies and specialization, fuels demand for Cipla's CDMO offerings.

- Contribution to Revenue: While specific segment revenue figures for CDMO are often embedded within broader reporting, Cipla's strategic focus on expanding these services indicates a growing contribution to its top line.

Licensing and Royalty Agreements

Cipla generates revenue through licensing and royalty agreements, allowing other pharmaceutical firms to utilize its proprietary technologies, specific drug formulations, or unique drug molecules. This strategy involves receiving royalty payments for products developed or marketed by partners who leverage Cipla's intellectual property. For instance, in fiscal year 2023, Cipla's revenue from licensing and royalties contributed to its overall financial performance, though specific figures for this segment are often integrated into broader revenue reporting.

These agreements effectively expand Cipla's financial reach without requiring direct market presence in every territory or for every product. By out-licensing, Cipla can monetize its research and development investments, transforming intellectual capital into tangible income streams. This approach is particularly beneficial for niche products or technologies where a partner may have a stronger existing market position or distribution network.

Key aspects of Cipla's licensing and royalty revenue streams include:

- Technology Out-licensing: Granting rights to use Cipla's patented manufacturing processes or delivery systems.

- Formulation Licensing: Allowing partners to market and sell specific drug formulations developed by Cipla.

- Molecule Licensing: Providing access to novel drug molecules for further development and commercialization by other companies.

- Royalty Payments: Receiving a percentage of sales from products that incorporate Cipla's licensed intellectual property.

Cipla's revenue is primarily driven by its substantial generic drug sales, making affordable medicines accessible globally. The company also generates income from its own branded formulations, which often command higher profit margins due to differentiation and niche market focus.

Furthermore, Cipla benefits from selling Active Pharmaceutical Ingredients (APIs) to other manufacturers and offers contract manufacturing and development services (CDMO), leveraging its advanced facilities and research expertise.

Licensing and royalty agreements represent another key revenue stream, allowing Cipla to monetize its intellectual property by partnering with other firms for product development and commercialization.

| Revenue Stream | Description | Fiscal Year 2023/2024 Relevance |

|---|---|---|

| Generic Formulations | Affordable copies of off-patent branded drugs. | Cornerstone of financial performance, critical for emerging markets. |

| Branded Formulations | Cipla's own branded drugs, including differentiated generics. | Achieve higher profit margins, contributing significantly to overall profitability. |

| API Sales | Supplying essential chemical compounds to other pharmaceutical manufacturers. | Vital link in the global pharmaceutical supply chain, capitalizing on synthesis expertise. |

| CDMO Services | Contract manufacturing and development for third-party firms. | Diversifies income, monetizes infrastructure and know-how, showing consistent growth. |

| Licensing & Royalties | Allowing partners to use Cipla's IP for a fee or royalty. | Monetizes R&D investments, expands financial reach without direct market presence. |

Business Model Canvas Data Sources

The Cipla Business Model Canvas is informed by a blend of internal financial reports, extensive market research on global healthcare trends, and competitive analysis of the pharmaceutical landscape. These diverse data sources ensure a comprehensive and accurate representation of Cipla's strategic operations.