Cipla Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cipla Bundle

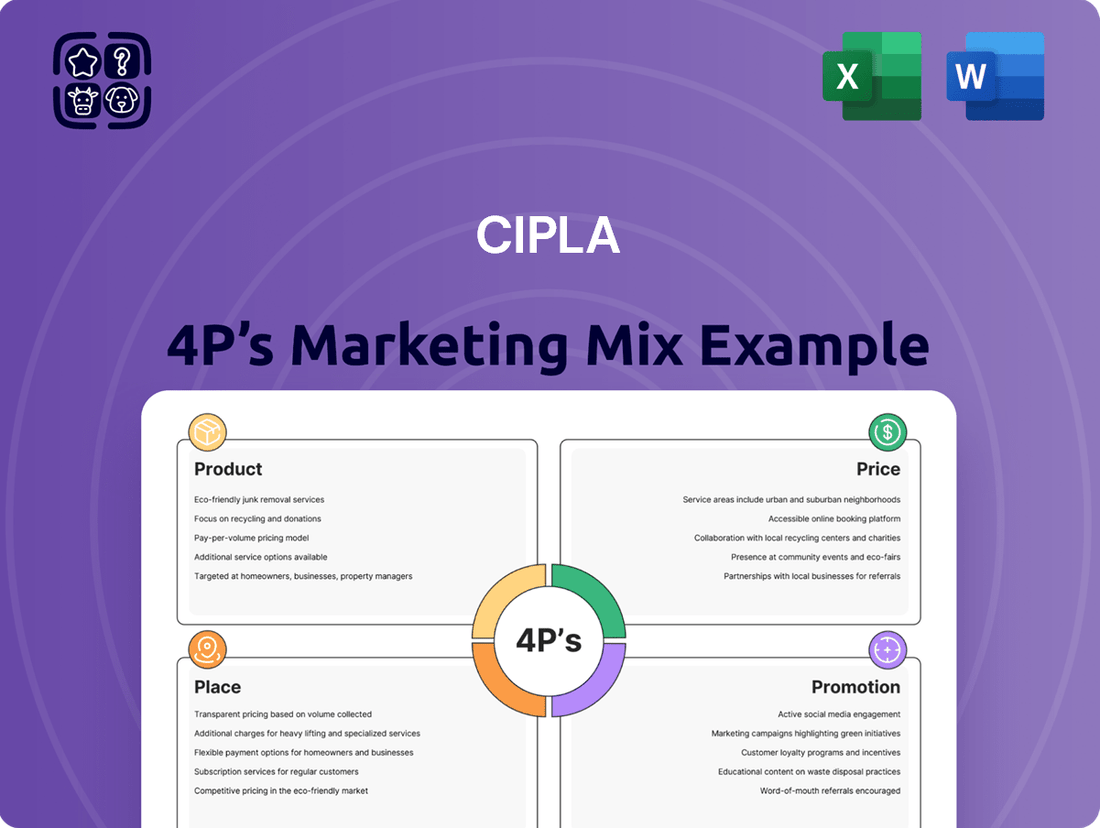

Cipla's marketing success is built on a robust 4Ps strategy, from its diverse product portfolio addressing critical health needs to its strategic pricing that enhances accessibility. Discover how their widespread distribution network and impactful promotional campaigns ensure reach and resonance with their target audience.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Cipla's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights into this pharmaceutical giant.

Product

Cipla's product strategy is defined by its vast and diverse pharmaceutical portfolio, featuring over 1,500 products in roughly sixty dosage forms. This extensive offering spans both generic and branded medications, catering to a wide array of therapeutic areas and health needs.

The company's commitment to accessibility and affordability is evident in its broad product range, which aims to serve patients globally. For instance, in 2023, Cipla reported strong growth in its respiratory and anti-infective segments, reflecting the demand for its core therapeutic offerings.

Cipla's strategic focus on key therapeutic areas underpins its market position. The company maintains a robust presence in respiratory, anti-infectives, cardiovascular, and oncology segments, demonstrating a commitment to addressing significant health challenges.

As a pioneer in respiratory healthcare, Cipla has solidified its leadership in treatments for asthma and Chronic Obstructive Pulmonary Disease (COPD). This leadership is evidenced by their consistent innovation and market share in these critical areas.

Beyond its established strengths, Cipla is actively expanding its portfolio into emerging areas such as weight management and Central Nervous System (CNS) disorders, reflecting a forward-looking approach to healthcare needs.

Cipla's strategic focus on generics significantly bolsters its market position, providing accessible and affordable healthcare solutions. In fiscal year 2024, the company continued to expand its generic portfolio, aiming to capture a larger share of markets where patent expiries create opportunities. This commitment drives down healthcare costs for patients globally.

Beyond finished medicines, Cipla's robust Active Pharmaceutical Ingredient (API) manufacturing capabilities are a key differentiator. These APIs are not only vital for their own product lines but are also supplied to other pharmaceutical companies, underscoring Cipla's role as a critical component in the global drug supply chain. Their API segment is a significant contributor to their revenue, demonstrating their backward integration strength.

Strategic Expansion and Innovation

Cipla's strategic expansion and innovation are central to its product strategy. The company is actively investing in research and development to broaden its product portfolio and enhance its capabilities. This commitment is demonstrated by a significant investment of ₹379 crore in FY24 for R&D activities.

The company has recently introduced novel products, including inhaled insulin and plazomicin. Looking ahead, Cipla has ambitious plans to launch an additional 2-3 peptide assets by FY26, further strengthening its therapeutic offerings.

Cipla is also venturing into cutting-edge, technology-driven solutions. These include exploring advancements in CAR-T cell therapy, oligonucleotides, and biosimilars, positioning the company at the forefront of pharmaceutical innovation.

- R&D Investment: ₹379 crore in FY24.

- Recent Product Launches: Inhaled insulin, plazomicin.

- Future Pipeline: 2-3 peptide assets planned for FY26.

- New-Age Technologies: Exploring CAR-T cell therapy, oligonucleotides, biosimilars.

Patient-Centric Development

Cipla's product development philosophy is deeply patient-centric, focusing on unmet needs in niche therapeutic areas. This approach aims to create therapies that are not only effective but also help reduce the societal stigma associated with certain health conditions. For instance, their work in respiratory care often involves developing inhaler devices that are easier for patients to use, directly addressing a practical patient need.

The core of Cipla's patient-centricity lies in their commitment to making life-saving medicines accessible and affordable. This principle, encapsulated in their 'Caring for Life' ethos, translates into ensuring that essential treatments reach those who need them most, regardless of their economic standing. In 2023, Cipla continued to expand its affordable generics portfolio, particularly in chronic disease management, impacting millions of lives.

- Patient Needs Focus: Cipla prioritizes understanding patient requirements for differentiated therapies in niche indications.

- Stigma Reduction: Their product development aims to alleviate stigma surrounding specific health conditions.

- Affordability and Access: A key pillar is ensuring life-saving drugs are available at affordable prices.

- 'Caring for Life' Ethos: This commitment underscores healthcare as a right, driving accessibility initiatives.

Cipla's product strategy is a cornerstone of its 'Caring for Life' philosophy, emphasizing accessibility, affordability, and innovation across a broad spectrum of healthcare needs. The company boasts a diverse portfolio exceeding 1,500 products, covering numerous therapeutic areas with a strong focus on respiratory, anti-infectives, and cardiovascular segments.

Cipla's commitment to R&D is substantial, with investments of ₹379 crore in FY24 fueling the development of both established generics and novel treatments. Recent launches include inhaled insulin and plazomicin, with plans to introduce 2-3 peptide assets by FY26. The company is also exploring advanced areas like CAR-T cell therapy and biosimilars, demonstrating a forward-looking approach.

The company's patient-centric approach is evident in its development of user-friendly devices, such as inhalers, and its dedication to reducing the stigma associated with certain health conditions. This focus ensures that essential medicines are not only effective but also practical and accessible to a global patient base, particularly through its expanding range of affordable generics.

| Product Category | Key Therapeutic Areas | Recent/Planned Developments | R&D Investment (FY24) |

|---|---|---|---|

| Generics & Branded Medicines | Respiratory, Anti-infectives, Cardiovascular, Oncology, CNS, Weight Management | Expanding affordable generics portfolio; launched inhaled insulin and plazomicin; 2-3 peptide assets planned by FY26. | ₹379 crore |

| Active Pharmaceutical Ingredients (APIs) | Supplying critical drug components | Robust API manufacturing capabilities support own products and external sales, demonstrating backward integration. | N/A (part of overall R&D) |

| New-Age Therapies | CAR-T cell therapy, Oligonucleotides, Biosimilars | Active exploration and development in cutting-edge pharmaceutical innovation. | N/A (part of overall R&D) |

What is included in the product

This analysis offers a comprehensive breakdown of Cipla's marketing strategies, detailing their Product innovation, Price accessibility, Place distribution, and Promotion efforts within the pharmaceutical industry.

It's designed for professionals seeking a strategic overview of Cipla's market positioning, grounded in real-world practices and competitive insights.

Simplifies Cipla's marketing strategy by presenting the 4Ps in a clear, actionable format, alleviating the complexity of market analysis.

Provides a concise overview of Cipla's product, price, place, and promotion strategies, acting as a quick reference to address marketing challenges.

Place

Cipla's extensive global reach is a cornerstone of its marketing strategy, with operations spanning over 80 countries and exports reaching close to 160 nations by early 2024. This vast network ensures its pharmaceutical offerings are accessible to a wide array of customers across continents, including significant markets in the USA, Africa, and Europe.

Cipla's robust distribution network is a cornerstone of its market presence, ensuring widespread product availability. This expansive network includes over 100,000 points of sale, reaching diverse customer segments across India and internationally.

The company leverages strategic partnerships with numerous distributors, hospitals, and healthcare providers to facilitate efficient product delivery. This comprehensive approach allows Cipla to effectively serve patients, even in remote and underserved regions, reinforcing its commitment to accessibility.

Cipla's strategic manufacturing footprint is a cornerstone of its global reach. The company operates more than 30 plants within India and an additional 16 facilities across six countries, including key markets like the US, South Africa, and China.

In fiscal year 2025, Cipla actively enhanced its production capacity. This expansion included new or upgraded facilities in India, such as Goa, Indore, Patalganga, and Bommasandra, alongside North American sites in Long Island and Fall River, bolstering output for a diverse range of pharmaceutical products.

Expansion into New Markets

Cipla is strategically broadening its reach into promising new territories. In its home market of India, the company is focused on solidifying its leadership in established areas while also pushing into smaller cities and towns, specifically targeting tier 2-6 markets to capture untapped growth potential.

The company's international expansion is also gaining momentum. Notably, Cipla anticipates beginning shipments to the United States from its manufacturing facility in China during the latter half of fiscal year 2024-2025. This move is designed to diversify its production footprint and reduce exposure to potential trade tariffs.

- Geographic Focus: Expansion into tier 2-6 markets within India.

- US Market Entry: Commencement of supplies from China facility in H2 FY24-25.

- Strategic Rationale: Diversification of production base and mitigation of tariff risks.

Leveraging Digital and Local Partnerships

Cipla effectively boosts market penetration and accessibility by forming strategic alliances with both global health entities and local businesses in diverse geographical areas. These collaborations are key to tapping into localized market understanding and established distribution channels. For instance, Cipla's exclusive distribution agreement with Sanofi India for its Central Nervous System (CNS) product portfolio, announced in early 2024, exemplifies this strategy, aiming to broaden its market reach and ensure prompt availability of essential medications.

These partnerships are crucial for navigating complex local regulatory environments and consumer preferences. By integrating with local networks, Cipla can tailor its distribution strategies more effectively. This approach was evident in their continued expansion of partnerships in emerging markets throughout 2024, focusing on regions with significant unmet medical needs.

- Global Health Collaborations: Cipla actively partners with international health organizations to address widespread health challenges, enhancing its global footprint and access to innovative treatments.

- Local Distribution Networks: Leveraging local companies provides Cipla with deep market insights and established logistical infrastructure, critical for efficient product delivery.

- Sanofi India Partnership (2024): The exclusive distribution deal for Sanofi's CNS products in India strengthens Cipla's therapeutic offerings and market presence in a key segment.

- Emerging Market Focus: Cipla's 2024 strategy included strengthening local ties in Africa and Southeast Asia, aiming to improve access to affordable medicines in these critical regions.

Cipla's strategic placement is defined by its expansive global footprint and deep penetration into diverse markets. The company's commitment to accessibility is underscored by its presence in over 80 countries, with exports reaching approximately 160 nations by early 2024, ensuring its pharmaceutical products are widely available to a broad customer base.

Domestically, Cipla is actively expanding its reach into tier 2-6 markets within India, aiming to tap into previously underserved regions and solidify its market leadership. Internationally, the company is strategically diversifying its production base, with plans to commence shipments to the United States from its China manufacturing facility in the latter half of fiscal year 2024-2025, a move designed to mitigate trade tariff risks.

These placement strategies are further bolstered by strategic partnerships, such as the early 2024 exclusive distribution agreement with Sanofi India for its Central Nervous System (CNS) product portfolio. This collaboration aims to enhance Cipla's therapeutic offerings and expand its market presence in a key segment, demonstrating a focused approach to market penetration.

Cipla's robust distribution network, comprising over 100,000 points of sale in India and strategic alliances with hospitals and healthcare providers, ensures efficient product delivery even to remote areas, reinforcing its commitment to patient access and market coverage.

| Market Reach | Key Markets (Early 2024) | Distribution Points (India) | Manufacturing Facilities (Global) | US Supply Chain Initiative | |

|---|---|---|---|---|---|

| Countries Served | 80+ | USA, Africa, Europe | 100,000+ | 16 (across 6 countries) | China to US (H2 FY24-25) |

| Export Reach | ~160 Nations | N/A | N/A | N/A | N/A |

| Domestic Focus | N/A | Tier 2-6 Markets | N/A | N/A | N/A |

What You See Is What You Get

Cipla 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Cipla 4P's Marketing Mix Analysis details Product, Price, Place, and Promotion strategies. You're viewing the exact version of the analysis you'll receive—fully complete, ready to use.

Promotion

Cipla's 'Caring for Life' ethos is more than a tagline; it's the bedrock of their marketing and mission. This philosophy guides their commitment to societal well-being, extending beyond pharmaceuticals into critical areas like health, education, and environmental sustainability.

This deep-seated commitment is reflected in their substantial investments in Corporate Social Responsibility (CSR). For instance, in the fiscal year 2023, Cipla reported spending ₹159 crore on CSR activities, significantly impacting communities and reinforcing their 'Caring for Life' promise.

Cipla's promotional strategy is a robust blend of digital and traditional marketing, ensuring broad reach. This integrated approach aims to educate both healthcare professionals and the public, fostering understanding and encouraging product adoption.

In 2023, Cipla's digital marketing efforts saw significant investment, with a notable increase in online engagement across platforms like LinkedIn and medical forums, targeting physicians. Simultaneously, their offline campaigns, including medical conferences and patient awareness programs, continued to be a cornerstone of their promotional mix, reinforcing brand presence within the healthcare ecosystem.

Cipla's targeted communication strategy within its marketing mix focuses on distinct messaging for healthcare professionals and consumers. For medical experts, the company utilizes digital platforms, scientific journals, and industry conferences to share updates on new therapies and research, ensuring they are informed about Cipla's latest advancements.

For the general public, Cipla employs mass media to raise awareness about health conditions and highlight its affordable treatment solutions. This is complemented by direct outreach, with field representatives actively engaging communities, especially in rural regions, to provide essential health information and access to medication.

Corporate Social Responsibility (CSR)

Cipla’s Corporate Social Responsibility (CSR) is a cornerstone of its promotional strategy, highlighting a deep commitment to societal well-being. Through the Cipla Foundation, the company actively engages in impactful initiatives across critical areas like healthcare access, environmental stewardship, education, skill development, and disaster relief. This dedication is not just about philanthropy; it's a strategic element that enhances brand reputation and fosters customer loyalty.

Cipla’s CSR efforts translate into tangible benefits for communities. For instance, the company’s commitment to healthcare access includes providing free medication to terminally ill cancer patients and supporting palliative care centers. In the fiscal year 2023-24, Cipla’s CSR expenditure reached approximately ₹200 crore, with a significant portion directed towards healthcare and community development programs, reinforcing its brand as a responsible corporate citizen.

- Healthcare Access: Providing free medication and palliative care support, impacting thousands of lives annually.

- Environmental Sustainability: Initiatives focused on reducing carbon footprint and promoting eco-friendly practices across operations.

- Education & Skilling: Investing in educational programs and vocational training to empower underprivileged youth.

- Disaster Response: Swift and substantial aid during natural calamities, demonstrating commitment to community resilience.

Strategic Collaborations

Cipla actively pursues strategic alliances to broaden its promotional impact and operational strengths. These collaborations are vital for reaching wider audiences and communicating product value more effectively.

Recent examples include exclusive distribution agreements, such as the one with Sanofi for Central Nervous System (CNS) products in India, which commenced in early 2024. These partnerships allow Cipla to tap into established networks, significantly boosting its market presence and brand perception.

By teaming up with global generic manufacturers, Cipla enhances its promotional capabilities and market penetration. This strategic approach is crucial for conveying product benefits and reinforcing its standing in competitive markets.

- Sanofi CNS Deal: Exclusive distribution rights for Sanofi's CNS portfolio in India, effective early 2024.

- Global Generic Partnerships: Leveraging tie-ups with international generic firms to expand promotional reach.

- Network Expansion: Collaborations enable access to broader distribution channels and customer bases.

- Brand Enhancement: Strategic alliances contribute to strengthening Cipla's overall brand image and market position.

Cipla's promotional strategy is deeply intertwined with its 'Caring for Life' philosophy, leveraging both digital and traditional channels. Their significant CSR spending, amounting to approximately ₹200 crore in FY 2023-24, serves as a powerful promotional tool, enhancing brand reputation and fostering trust. Strategic alliances, such as the early 2024 distribution agreement with Sanofi for CNS products in India, further amplify their reach and market presence.

| Promotional Aspect | Key Initiatives | Financial Year Data |

|---|---|---|

| Corporate Social Responsibility (CSR) | Healthcare access, environmental sustainability, education, disaster response | ₹200 crore (approx. FY 2023-24) |

| Digital Marketing | Online engagement, targeting physicians on platforms like LinkedIn | Increased investment in 2023 |

| Traditional Marketing | Medical conferences, patient awareness programs | Continued cornerstone of promotional mix |

| Strategic Alliances | Exclusive distribution agreements, global generic partnerships | Sanofi CNS deal (early 2024) |

Price

Cipla's affordability strategy is central to its marketing mix, ensuring life-saving medications are within reach. For instance, in the fiscal year 2023-24, Cipla continued its focus on accessible pricing, particularly in its key emerging markets, contributing to a significant portion of its revenue growth.

Cipla employs a competitive pricing strategy, particularly in the generics segment, aiming to offer affordable alternatives to originator brands. This approach is crucial for market penetration and volume growth, especially in price-sensitive emerging markets. For instance, in fiscal year 2024, Cipla's generic portfolio continued to be a significant revenue driver, with a focus on expanding access to essential medicines.

Cipla utilizes value-based pricing for its innovative and specialty pharmaceuticals, reflecting the significant benefits these treatments provide to patients. This strategy directly links the price of a drug to its perceived value, considering factors like enhanced health outcomes, quality of life improvements, and the uniqueness of the therapeutic approach.

For instance, in 2023, Cipla's investment in R&D for specialty products reached approximately INR 700 crore, underscoring their commitment to innovation. This investment fuels the development of novel treatments, which then command prices reflecting their advanced nature and patient impact, while Cipla also works to ensure these advancements remain accessible.

Tiered Global Pricing Strategy

Cipla employs a tiered global pricing strategy, acknowledging significant economic disparities across its markets. This approach allows for price adjustments based on a country's specific economic conditions and healthcare infrastructure, a crucial factor for accessibility in lower-income regions.

This tiered strategy directly impacts market penetration. For instance, while Cipla might offer a particular medication at a higher price point in developed nations like the United States or Germany, it can make the same drug more affordable in emerging markets such as India or parts of Africa. This flexibility is key to Cipla's commitment to making healthcare accessible.

- Price Differentiation: Cipla adjusts drug prices to match the purchasing power and healthcare affordability of different countries.

- Market Accessibility: This strategy aims to broaden access to essential medicines in lower-income economies.

- Economic Sensitivity: Pricing is directly linked to local economic indicators and healthcare system capacity.

- Global Reach: Enables Cipla to compete effectively across diverse international markets.

Cost Optimization and Reinvestment

Cipla focuses on cost optimization, particularly in its research and development (R&D) and manufacturing processes. This efficiency, coupled with economies of scale, helps maintain healthy profit margins. For instance, in FY24, Cipla reported a revenue of INR 27,168 crore, with a strong focus on operational efficiency contributing to its financial performance.

The company's pricing strategy in the Indian market is a key enabler for reinvestment. By successfully implementing price adjustments, Cipla generates revenue that fuels further investment in R&D and market expansion. This strategic approach ensures continued innovation and growth, particularly evident in their sustained market presence and product development pipeline.

- Cost Efficiency: Robust optimization in R&D and manufacturing keeps production costs low.

- Economies of Scale: Leveraging large-scale operations to reduce per-unit costs.

- Strategic Pricing: Domestic market pricing allows for revenue generation to support reinvestment.

- Reinvestment Focus: Profits are channeled back into R&D and business expansion initiatives.

Cipla's pricing strategy is multifaceted, balancing affordability with value-based approaches. The company employs competitive pricing for generics, driving volume and market share, especially in price-sensitive regions. For innovative products, value-based pricing reflects enhanced patient outcomes. This tiered global approach ensures accessibility across diverse economic landscapes.

| Pricing Strategy Element | Description | Example/Impact |

| Affordability & Accessibility | Ensuring life-saving medications are within reach for a broad population. | Continued focus in emerging markets in FY23-24 contributed to revenue growth. |

| Competitive Pricing (Generics) | Offering affordable alternatives to originator brands for market penetration. | Generic portfolio remained a significant revenue driver in FY24, expanding access to essential medicines. |

| Value-Based Pricing (Innovations) | Linking drug price to patient benefits, health outcomes, and quality of life. | R&D investment of approx. INR 700 crore in 2023 for specialty products supports this. |

| Tiered Global Pricing | Adjusting prices based on country-specific economic conditions and healthcare infrastructure. | Enables higher pricing in developed nations and greater affordability in emerging markets like India and parts of Africa. |

| Cost Optimization & Reinvestment | Focus on R&D and manufacturing efficiency to maintain margins and fund future growth. | FY24 revenue of INR 27,168 crore reflects operational efficiency; pricing in India supports reinvestment in R&D and expansion. |

4P's Marketing Mix Analysis Data Sources

Our Cipla 4P's Marketing Mix Analysis is grounded in a comprehensive review of company disclosures, including annual reports and investor presentations, alongside market intelligence from industry publications and competitor analysis.