Cipla Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cipla Bundle

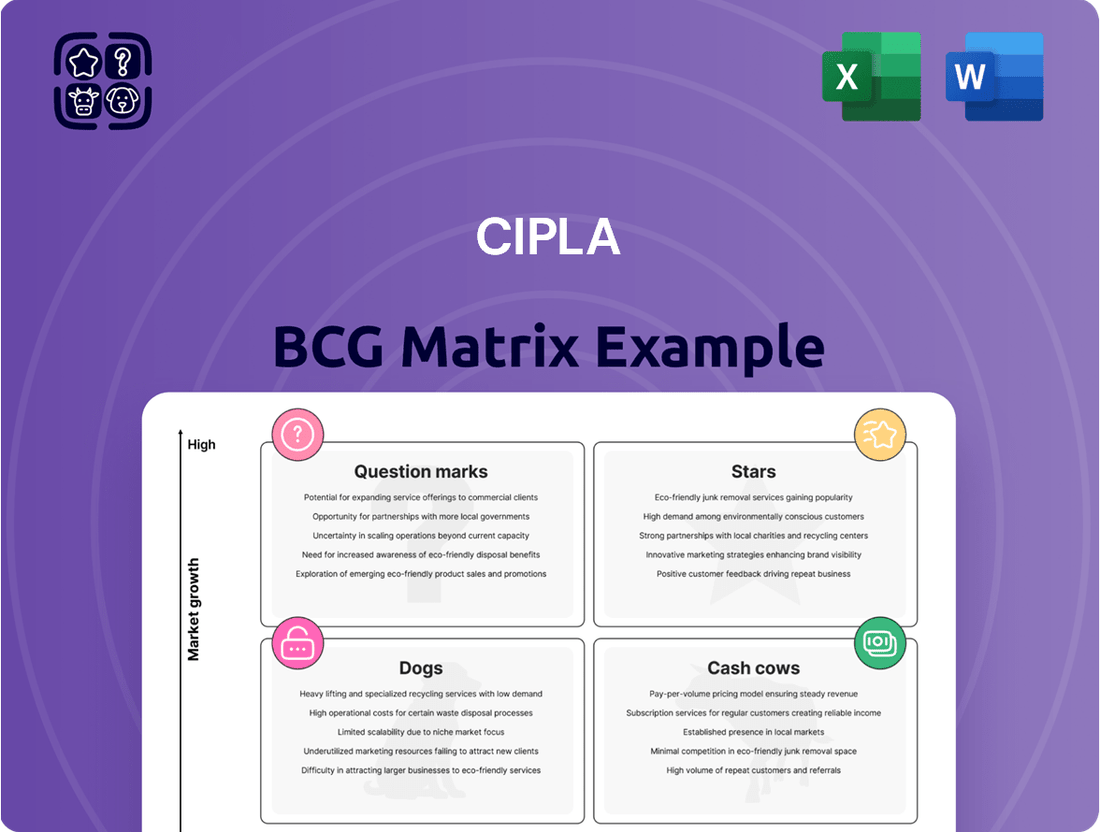

Curious about Cipla's strategic product portfolio? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. Understand their current market position and identify opportunities for growth and resource allocation.

Don't miss out on the actionable insights that can drive your own business strategy. Purchase the full Cipla BCG Matrix report to gain a comprehensive understanding of their product landscape, complete with data-driven recommendations and a clear path forward for smart investment decisions.

Stars

Cipla's US respiratory portfolio is a significant growth engine, particularly within its generics segment. The market share for Albuterol, a key product, saw a notable rise, reaching 15.5% by April 2024 and climbing further to 21% by December 2024.

This impressive market penetration highlights Cipla's strong leadership in the high-growth respiratory market in the US. These products are positioned as crucial contributors to the company's overall revenue generation.

Cipla's private market business in South Africa is a shining star, demonstrating impressive growth. In FY24, it expanded by a significant 26% when measured in local currency. This outpaces the general market's growth, firmly establishing Cipla as a leader in this key segment.

North America's differentiated assets are a significant driver for Cipla, generating over $900 million in annual revenue for fiscal year 2024.

This strong performance is largely attributed to key products like Lanreotide, which commands a substantial market share of approximately 21% within its specialized segment.

This positions Lanreotide as a strong contender in a growing niche, contributing significantly to Cipla's overall market presence in the region.

Indian Branded Prescription - Chronic Portfolio

Cipla's Indian branded prescription chronic portfolio is a true star performer. It consistently outpaces the broader market, accounting for a significant 60% of Cipla's total Indian revenue. This robust performance is driven by key therapeutic areas like Respiratory and Cardiac, which are showing strong, healthy growth trajectories.

This segment's dominance is underscored by its impressive market share and growth rates. For example, in the fiscal year 2024, Cipla's branded chronic business in India grew at a notable 12%, significantly higher than the overall Indian pharmaceutical market growth of approximately 8-9% during the same period. The Respiratory segment alone saw a 15% year-on-year increase, while the Cardiac segment reported a 10% rise.

- Dominant Revenue Contributor: The chronic portfolio represents 60% of Cipla's total Indian sales, highlighting its critical role in the company's domestic success.

- Above-Market Growth: This segment consistently grows faster than the overall Indian pharmaceutical market, demonstrating strong competitive positioning.

- Key Therapeutic Strength: Respiratory and Cardiac therapies are leading the charge, exhibiting healthy and consistent growth rates that solidify the portfolio's star status.

- Fiscal Year 2024 Performance: The branded chronic business achieved 12% growth in FY24, with Respiratory up 15% and Cardiac up 10%.

Flagship Indian Brands (e.g., Foracort)

Foracort, a leading respiratory medication, has solidified its position as the top prescription brand in India, reaching an impressive monthly run-rate of Rs. 100 crore. This remarkable achievement highlights its significant market penetration and robust growth trajectory within the Indian pharmaceutical landscape.

The brand's consistent performance in both volume and value growth is a testament to its strong market presence and its potential for continued expansion. This makes Foracort a key player within Cipla's portfolio, likely categorized as a Star or Cash Cow depending on its market share and growth rate relative to competitors.

- Foracort's Market Dominance: Ranked as the number one prescription brand in India.

- Financial Milestone: Achieved a monthly run-rate of Rs. 100 crore.

- Growth Indicators: Demonstrates consistent volume and value growth.

- Strategic Importance: Represents a high-growth potential product within Cipla's portfolio.

Cipla's US respiratory products, especially generics like Albuterol, are performing exceptionally well, with Albuterol's market share reaching 21% by December 2024. North America's differentiated assets, including Lanreotide with a 21% market share in its niche, generated over $900 million in revenue in fiscal year 2024. Cipla's Indian branded prescription chronic portfolio, particularly Respiratory and Cardiac, is a star, growing 12% in FY24 and contributing 60% of total Indian revenue. Foracort, a leading respiratory brand in India, achieved a Rs. 100 crore monthly run-rate, showcasing strong growth and market leadership.

| Product/Segment | Key Market | FY24 Revenue/Growth | Market Share | Status |

| US Respiratory Generics (e.g., Albuterol) | United States | Significant Revenue Growth | Albuterol: 21% (Dec 2024) | Star |

| North America Differentiated Assets (e.g., Lanreotide) | North America | >$900 million | Lanreotide: ~21% | Star |

| Indian Branded Prescription Chronic Portfolio | India | 12% Growth (FY24) | 60% of India Revenue | Star |

| Foracort | India | Rs. 100 crore Monthly Run-Rate | #1 Prescription Brand | Star |

What is included in the product

The Cipla BCG Matrix analyzes its product portfolio by market share and growth rate, guiding investment decisions.

The Cipla BCG Matrix offers a clear, one-page overview, painlessly categorizing each business unit for strategic clarity.

Cash Cows

Cipla's established Indian trade generics business is a true cash cow, holding a dominant position in the domestic pharmaceutical landscape. This strength is fueled by efficient operations and a continuously growing distribution network across India.

This segment is a powerhouse for Cipla, consistently churning out substantial cash flow. For instance, in the fiscal year 2023-24, Cipla reported a robust revenue growth, with its domestic formulations business, which heavily includes trade generics, showing strong performance, contributing significantly to the company's overall profitability and providing a stable financial base.

Cipla's core anti-infectives and urology segments in India are firmly established as Cash Cows within its business portfolio. The company consistently ranks among the top 5 players in these therapeutic areas within the Indian domestic market, showcasing its significant market share and brand recognition.

These mature segments benefit from consistent demand and a well-penetrated market, translating into steady, high-margin cash flows for Cipla. For instance, the Indian anti-infectives market alone was valued at approximately $3.5 billion in 2023 and is projected to grow at a CAGR of around 5-6% through 2028, demonstrating the sustained demand for these essential medicines.

Cipla's established base business in North America serves as a significant cash cow, consistently contributing to revenue streams beyond new product introductions. This mature segment benefits from a degree of pricing stability and enduring demand, ensuring reliable cash generation within the region. For instance, Cipla's North American revenue for the fiscal year ending March 31, 2024, reached approximately INR 7,700 crore (around $925 million USD based on average exchange rates), showcasing the substantial financial contribution of this established market.

Active Pharmaceutical Ingredients (APIs) Manufacturing

Cipla's extensive experience in manufacturing Active Pharmaceutical Ingredients (APIs) underpins its robust pharmaceutical operations. This segment, while mature, consistently generates significant and reliable income for the company, acting as a vital cash cow.

The API manufacturing division is crucial for Cipla's vertical integration strategy, ensuring quality control and cost-effectiveness in its final drug formulations. In fiscal year 2024, Cipla reported a consolidated revenue of INR 27,163 crore, with its generics and API businesses forming the bedrock of this performance.

- API Manufacturing Stability: This segment offers a predictable revenue stream, essential for funding other business ventures.

- Vertical Integration: Cipla's in-house API production enhances supply chain security and cost management.

- Contribution to Profitability: The reliable income from APIs bolsters Cipla's overall financial health and profitability.

- Market Position: Cipla is a significant player in the global API market, supplying to numerous regulated markets.

Overall One-India Business

Cipla's combined 'One-India' business, which includes both its branded prescription and trade generics segments, stands out as a significant cash cow. This division was a powerhouse in fiscal year 2024, generating a substantial 43% of Cipla's overall revenue.

The consistent performance and strong market positioning of its Indian operations ensure a reliable stream of capital for the company. This steady inflow of funds is crucial for Cipla's strategic investments and overall financial health.

- Revenue Contribution: 43% of total Cipla revenue in FY24.

- Business Segments: Branded Prescription and Trade Generics.

- Market Position: Demonstrates consistent growth and market leadership.

- Financial Impact: Acts as a primary cash generator for the company.

Cipla's established Indian trade generics business is a true cash cow, holding a dominant position in the domestic pharmaceutical landscape. This strength is fueled by efficient operations and a continuously growing distribution network across India, consistently churning out substantial cash flow.

Cipla's core anti-infectives and urology segments in India are firmly established as Cash Cows within its business portfolio, benefiting from consistent demand and a well-penetrated market. These mature segments translate into steady, high-margin cash flows for Cipla, with the Indian anti-infectives market valued at approximately $3.5 billion in 2023.

Cipla's established base business in North America also serves as a significant cash cow, consistently contributing to revenue streams with a degree of pricing stability and enduring demand. For instance, Cipla's North American revenue for the fiscal year ending March 31, 2024, reached approximately INR 7,700 crore (around $925 million USD).

The company's API manufacturing division, crucial for vertical integration, also acts as a vital cash cow, generating significant and reliable income. In fiscal year 2024, Cipla reported consolidated revenue of INR 27,163 crore, with its generics and API businesses forming the bedrock of this performance.

| Business Segment | Contribution to FY24 Revenue | Key Characteristics |

|---|---|---|

| Indian Trade Generics | Significant contributor to overall profitability | Dominant market position, efficient operations |

| Indian Anti-infectives & Urology | Steady, high-margin cash flows | Mature segments, consistent demand |

| North America Generics | Approximately INR 7,700 crore (FY24) | Pricing stability, enduring demand |

| API Manufacturing | Integral to overall performance | Vertical integration, cost-effectiveness |

What You’re Viewing Is Included

Cipla BCG Matrix

The Cipla BCG Matrix preview you are viewing is the identical, fully completed document you will receive upon purchase. This means you're seeing the actual strategic analysis, with no missing sections or placeholder data, ready for immediate application to Cipla's product portfolio.

Rest assured, the Cipla BCG Matrix you're previewing is the final, unwatermarked report you'll download after completing your purchase. This comprehensive document has been meticulously prepared to offer actionable insights into Cipla's market positions, ensuring you receive the exact strategic tool needed for informed decision-making.

Dogs

Cipla's consumer business has experienced a slowdown, largely due to weaker seasonal demand. This suggests a product category that isn't performing as robustly as others, requiring a closer look at its future direction.

The segment's lower and potentially uneven growth trajectory means Cipla needs to strategically evaluate its consumer offerings. This could involve making changes to boost performance or deciding to scale back investment in areas that aren't yielding significant returns.

Cipla's divestment of Quality Chemical Industries Limited (QCIL) in Q3 FY24 illustrates a strategic move to streamline operations by shedding non-core assets. This action suggests QCIL was likely a low-growth, low-market-share entity within Cipla's portfolio, impacting overall resource allocation and profitability.

Cipla's older, highly commoditized generic products, particularly in mature markets like the US, are experiencing significant challenges. These products often face intense price competition, leading to substantial price erosion. For instance, many established generic drugs see their prices drop by double-digit percentages year-over-year due to the sheer number of manufacturers vying for market share.

Consequently, these offerings can be categorized as 'dogs' within Cipla's portfolio. They demand considerable resources for manufacturing, regulatory compliance, and distribution, yet yield diminishing returns. The profitability margins on these older generics have shrunk considerably, making them less attractive investments compared to newer, differentiated products.

In 2024, the generic pharmaceutical landscape continues to be highly competitive, with regulatory pressures and payer demands further squeezing margins on established products. Cipla's strategy likely involves managing these 'dog' products efficiently, perhaps through cost optimization or by focusing on niche markets where competition is less fierce, rather than investing heavily in their growth.

Products Affected by Regulatory Delays

Products manufactured at Cipla facilities like Pithampur and Goa, which have faced USFDA observations, are particularly vulnerable to regulatory delays. These observations can halt new product approvals and restrict the export of existing ones, impacting market access and revenue generation.

For instance, if a key product in Cipla's pipeline is manufactured at a facility with outstanding USFDA issues, its launch timeline could be pushed back significantly. This delay directly affects its potential to capture market share and generate sales, potentially classifying it as a 'dog' if the issues are prolonged and costly to resolve.

The financial implications are substantial. Delays in product approvals mean lost revenue opportunities. By the end of fiscal year 2024, Cipla was actively working on resolving USFDA observations across several sites, aiming to mitigate these risks and ensure timely market entry for its diverse product portfolio.

- USFDA Observations Impact: Manufacturing sites with USFDA observations face potential delays in product approvals and market entry.

- Growth Limitation: Regulatory hurdles can severely restrict the growth potential of affected products.

- Financial Ramifications: Delays translate to lost revenue and increased costs for remediation.

- Strategic Importance: Efficiently resolving regulatory issues is crucial for preventing promising products from becoming 'dogs'.

Seasonally Weak Anti-infectives and Trade Generics

Cipla's domestic anti-infectives and trade generics segments, while generally robust, encountered seasonal headwinds in the second quarter of fiscal year 2025. This temporary downturn suggests that these business areas might be classified as 'dogs' within the BCG matrix during specific off-peak periods due to fluctuating demand patterns.

For instance, during Q2 FY25, these segments likely saw a dip in their growth trajectory, a common occurrence for products tied to seasonal illness cycles. This seasonality can lead to periods of underperformance, impacting overall market share and revenue generation for these particular offerings.

- Seasonal Weakness in Q2 FY25: Cipla's domestic anti-infectives and trade generics faced a slowdown in demand during the second quarter of fiscal year 2025.

- Potential 'Dog' Classification: This seasonal fluctuation in demand can temporarily categorize these segments as 'dogs' in the BCG matrix, indicating low growth.

- Impact on Growth: Periods of low demand directly affect the growth rates of these specific business units within Cipla's portfolio.

Cipla's older, commoditized generics in mature markets, particularly the US, are facing significant price erosion due to intense competition. These products, often seeing double-digit annual price drops, are prime examples of 'dogs' in Cipla's portfolio. They require substantial resources for operations but generate diminishing returns, with profitability margins shrinking considerably.

Manufacturing sites with USFDA observations, such as Pithampur and Goa, pose a risk to products, potentially delaying approvals and market access. These regulatory hurdles can severely limit growth, leading to lost revenue and increased remediation costs, a scenario that can turn promising products into 'dogs' if not addressed promptly. By the end of FY24, Cipla was actively working to resolve these observations to mitigate such risks.

The domestic anti-infectives and trade generics segments experienced seasonal headwinds in Q2 FY25, indicating a temporary classification as 'dogs' due to fluctuating demand. This dip in growth trajectory, common for products tied to seasonal illness cycles, impacts market share and revenue generation during off-peak periods.

Cipla's divestment of Quality Chemical Industries Limited (QCIL) in Q3 FY24 also points to a strategic move to shed low-growth, low-market-share assets, likely classifying QCIL as a 'dog' within its portfolio and impacting overall resource allocation.

Question Marks

Cipla's biosimilars pipeline is a key growth driver, with a partnered filgrastim biosimilar slated for a US launch in the second quarter of fiscal year 2026. This strategic move targets a high-growth market fueled by upcoming patent expiries, where Cipla aims to establish a significant market share.

Cipla's strategic positioning of generic Advair and Symbicort filings within its BCG Matrix highlights them as question marks. These represent significant market opportunities, given the high value of these respiratory drugs, but their current low market share necessitates regulatory approvals and successful commercialization to shift their status.

The potential market for generic respiratory inhalers is substantial. For instance, the global respiratory inhalers market was valued at approximately $30 billion in 2023, with significant growth projected. Cipla's entry into these segments with generics of blockbuster drugs like Symbicort (budesonide/formoterol) and Advair (fluticasone/salmeterol) aims to capture a share of this expanding market.

Cipla is strategically positioning itself to enter India's burgeoning weight management market. This segment is experiencing robust growth, driven by increasing health consciousness and the rising prevalence of obesity across the nation. For instance, India's obesity prevalence was estimated to be around 20-30% in urban adults as of 2023, a significant figure that presents a substantial opportunity.

As a new entrant, Cipla begins with a relatively low market share in this competitive space. However, the company's objective is to aggressively pursue significant market share by offering innovative solutions to meet the escalating demand for effective weight management strategies. This move aligns with Cipla's broader strategy to diversify its portfolio into high-growth therapeutic areas.

Oncology Pipeline and New Therapeutic Areas

Cipla is actively exploring acquisitions to bolster its presence in promising therapeutic areas like oncology, mental health, obesity, and genomics. These segments are identified as key growth drivers for the future, though Cipla's current market share in these areas is still developing.

The company's strategic focus on oncology, in particular, reflects a significant investment in building a robust pipeline. For instance, by the end of 2024, Cipla aims to have several novel oncology candidates in advanced clinical trial stages, targeting unmet medical needs in various cancer types.

Cipla’s expansion into these new therapeutic areas is supported by substantial R&D investments. In the fiscal year 2023-2024, the company allocated approximately 8% of its revenue towards research and development, a notable increase from previous years, with a significant portion earmarked for oncology and other high-potential segments.

- Oncology Pipeline Growth: Cipla is prioritizing the development of new oncology treatments, aiming for multiple late-stage clinical trial initiations by year-end 2024.

- Strategic Acquisitions: The company is actively evaluating acquisition opportunities to accelerate market entry and build a stronger portfolio in oncology, mental health, obesity, and genomics.

- R&D Investment: A significant portion of Cipla's increased R&D budget, projected at 8% of FY24 revenue, is dedicated to advancing its oncology pipeline and exploring new therapeutic frontiers.

- Emerging Market Focus: While these areas represent future growth, Cipla is strategically investing to establish a competitive market presence in these high-potential segments.

New Ventures Segment

Cipla's New Ventures segment is a crucial part of its growth strategy, focusing on emerging opportunities. This segment is designed to foster innovation and explore new market spaces that may not yet be fully developed but hold significant future potential. The company's commitment to this area is evident in its financial performance.

In the fourth quarter of fiscal year 2025, the New Ventures segment experienced remarkable growth, posting a 35.4% increase year-on-year. This substantial expansion highlights Cipla's successful execution of its investment strategy in these nascent, high-potential areas. These ventures are typically in their early stages of market penetration, requiring substantial capital infusion to scale effectively.

- Segment Focus: Cipla's New Ventures segment is dedicated to exploring and developing early-stage, high-growth potential business areas.

- Q4 FY25 Performance: This segment achieved a strong 35.4% year-on-year growth in Q4 FY25, signaling successful strategic investments.

- Investment Rationale: The growth reflects significant investments in nascent markets that require capital to achieve scale and market penetration.

Cipla's generic Advair and Symbicort filings are classified as question marks within its BCG Matrix. These products target lucrative respiratory markets, with the global respiratory inhalers market valued at approximately $30 billion in 2023. However, their current low market share necessitates successful regulatory approval and market penetration to transition into stars.

| Product/Therapeutic Area | Market Growth | Cipla's Market Share | BCG Classification | Strategic Focus |

|---|---|---|---|---|

| Generic Advair/Symbicort | High | Low | Question Mark | Regulatory Approval & Commercialization |

| Biosimilars (Filgrastim) | High | Low (New Market Entry) | Question Mark | US Launch & Market Penetration |

| Weight Management (India) | High | Low (New Entrant) | Question Mark | Aggressive Market Share Pursuit |

| Oncology | High | Developing | Question Mark | R&D Investment & Acquisitions |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable insights.