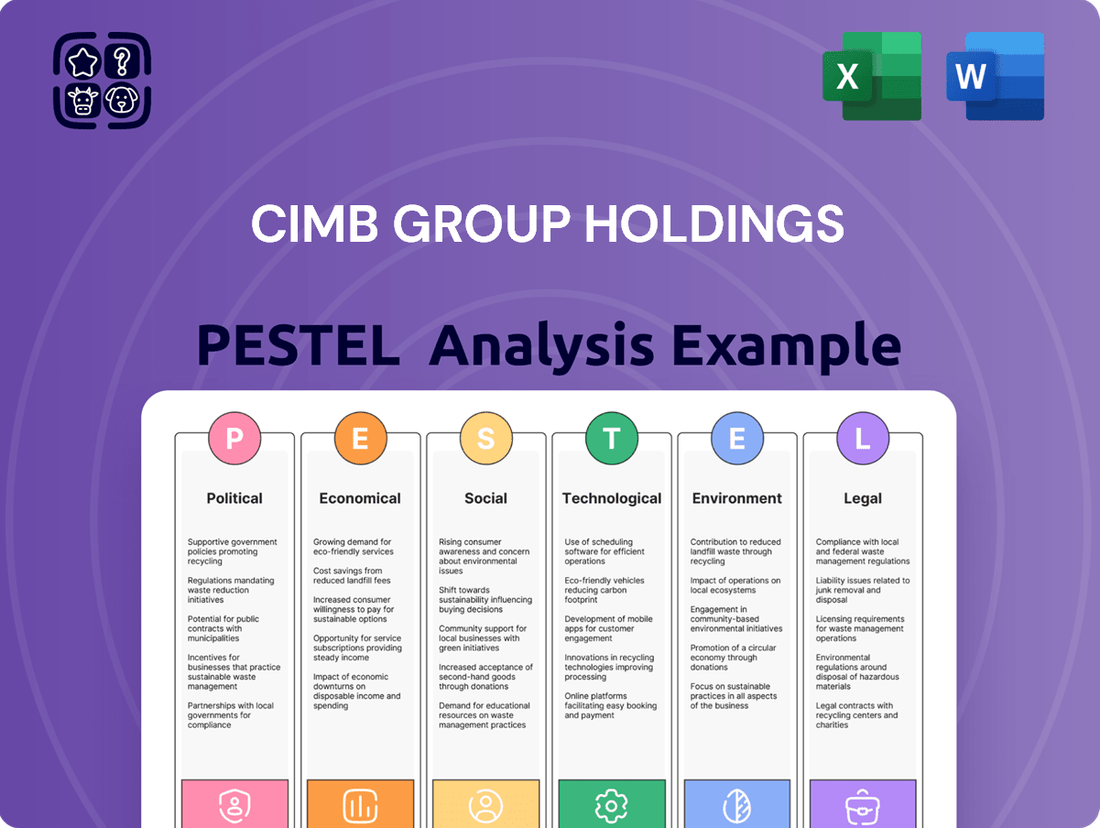

CIMB Group Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CIMB Group Holdings Bundle

Navigate the dynamic landscape of CIMB Group Holdings with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors shaping its strategic direction and future growth. Gain a critical edge by leveraging these expert insights to refine your own market approach.

Unlock the full potential of your strategic planning by diving deep into the external forces impacting CIMB Group Holdings. Our meticulously researched PESTLE analysis provides actionable intelligence crucial for investors, consultants, and business leaders. Download the complete report now and empower your decision-making.

Political factors

CIMB Group's performance is intrinsically linked to the political stability of its core ASEAN markets. For instance, the 2024 Malaysian general election, while resulting in a coalition government, introduced a period of policy recalibration that financial institutions like CIMB closely monitor. A stable policy environment fosters predictability, essential for CIMB's long-term investment planning and operational strategies across its diverse regional footprint.

The banking sector operates under stringent regulatory oversight, and shifts in these financial regulations profoundly affect CIMB Group. For instance, Bank Negara Malaysia's directives on capital adequacy ratios (CAR) and liquidity coverage ratios (LCR) directly influence lending capacity and risk management strategies. As of the first quarter of 2024, CIMB's Common Equity Tier 1 (CET1) ratio stood at a robust 13.5%, well above the regulatory minimums, demonstrating its preparedness for evolving capital requirements.

ASEAN's commitment to economic integration, seen in initiatives like the ASEAN Power Grid and the Johor-Singapore Special Economic Zone, offers CIMB significant opportunities for regional growth and enhanced cross-border financial services. These frameworks streamline operations and foster greater intra-regional trade.

Favorable trade policies and evolving cross-border financial regulations directly benefit CIMB by simplifying its regional expansion and facilitating seamless transactions across its operating markets. This supportive environment is crucial for its strategic objectives.

However, CIMB must remain adaptable to potential headwinds. Protectionist trade policies or escalating trade disputes within the region could impede its regional expansion strategy and negatively impact cross-border financial flows.

Government Initiatives for Financial Inclusion

Governments throughout the ASEAN region are actively promoting financial inclusion, a key policy driver for economic development. This focus translates into initiatives designed to integrate those without access to formal banking services into the financial ecosystem.

CIMB Group Holdings is well-positioned to benefit from these government efforts. Its strong presence in Islamic banking, a segment often catering to underserved communities, and its commitment to enhancing financial literacy directly support national inclusion agendas. For instance, by the end of 2024, CIMB aims to reach over 5 million individuals with its financial literacy programs across Southeast Asia.

- Government Focus: ASEAN nations are prioritizing financial inclusion, aiming to onboard millions of unbanked individuals by 2025.

- CIMB's Alignment: CIMB's Islamic banking and financial literacy programs directly support these government objectives.

- Market Opportunity: These initiatives create avenues for CIMB to tap into new customer segments and drive sustainable growth.

Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) Laws

CIMB Group Holdings, like all financial institutions, operates under increasingly strict Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) laws. These regulations are critical for preventing illicit financial flows and maintaining the integrity of the global financial system. For instance, in 2023, financial institutions globally faced significant scrutiny and penalties for AML compliance failures, underscoring the importance of robust systems.

Adherence to these laws requires continuous investment from CIMB in sophisticated compliance frameworks and cutting-edge technology. This ensures they meet both national and international standards, such as those mandated by Bank Negara Malaysia. Failure to comply can lead to substantial fines and severe reputational damage, impacting customer trust and market standing.

- Regulatory Landscape: CIMB must navigate a complex web of AML/CTF regulations, which are constantly evolving to address new threats.

- Compliance Investment: Significant resources are allocated to technology and personnel for transaction monitoring, customer due diligence, and suspicious activity reporting.

- Risk Mitigation: Proactive compliance helps CIMB avoid legal penalties and safeguards its reputation in the financial sector.

- International Standards: Adherence to frameworks like those from the Financial Action Task Force (FATF) is crucial for cross-border operations.

Political stability within ASEAN markets is paramount for CIMB's operational continuity and strategic planning. For example, the 2024 Malaysian general election led to policy adjustments that financial institutions like CIMB closely monitor. A predictable political climate is crucial for CIMB's long-term investment and regional expansion strategies.

What is included in the product

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces impacting CIMB Group Holdings, offering a comprehensive view of the external landscape.

It provides actionable insights for strategic decision-making by highlighting opportunities and threats within CIMB's operating environment.

A concise PESTLE analysis for CIMB Group Holdings offers a clear roadmap to navigate external challenges, transforming potential disruptions into strategic advantages.

This analysis serves as a vital tool to proactively identify and mitigate risks, ensuring CIMB remains agile and competitive in a dynamic global landscape.

Economic factors

CIMB Group Holdings' performance is intrinsically linked to the economic vitality of the ASEAN region. Robust GDP expansion, especially in significant markets such as Malaysia and Indonesia, fuels demand for CIMB's diverse banking offerings, from consumer financing to corporate lending. For instance, Malaysia's GDP grew by an estimated 4.7% in 2023, and Indonesia's by 5.04%, underscoring the positive correlation between regional growth and banking sector activity.

Conversely, any economic deceleration or downturn across ASEAN poses a direct risk to CIMB. Such conditions typically translate into fewer lending prospects and a higher likelihood of loan defaults, impacting the group's profitability and asset quality. The stability of these economies is therefore a critical factor for CIMB's operational success and strategic planning.

Interest rate fluctuations set by ASEAN central banks significantly impact CIMB's net interest margin (NIM). For instance, a 25 basis point increase in policy rates, as seen in some ASEAN economies during 2023-2024, could boost NIM if CIMB can reprice assets faster than liabilities. However, higher rates also increase borrowing costs for CIMB's customers, potentially affecting loan demand and asset quality.

CIMB's monetary policy management is crucial. The group must actively manage its asset and liability duration gaps to shield profitability from interest rate volatility. For example, during periods of rising rates, a strategy of shortening asset duration while lengthening liability duration can help mitigate NIM compression.

High inflation rates, particularly evident in many Southeast Asian economies in 2024 and projected into 2025, significantly impact consumer spending power. For instance, Indonesia experienced inflation around 3.5% in early 2024, while Malaysia saw figures closer to 2.5%. This erosion of purchasing power can lead to reduced demand for discretionary banking services and potentially increase the non-performing loan ratios for financial institutions like CIMB Group.

CIMB's ability to navigate these inflationary pressures hinges on accurate forecasting across its operational regions, from Malaysia and Indonesia to Thailand and Cambodia. Understanding these trends is vital for optimizing product pricing, such as deposit rates and loan interest, and for robust risk management strategies to mitigate potential credit losses stemming from a weakened consumer base.

Foreign Exchange Rate Volatility

CIMB Group Holdings, operating across diverse Southeast Asian markets, is inherently exposed to foreign exchange rate volatility. Fluctuations in currencies like the Indonesian Rupiah (IDR), Malaysian Ringgit (MYR), and Thai Baht (THB) against major global currencies can significantly alter the reported value of its consolidated financial performance. For instance, a stronger USD could reduce the translated value of earnings generated in these local currencies.

This volatility directly impacts CIMB's profitability and asset valuations. A sharp depreciation of a key operating currency, such as the MYR against the SGD, could decrease the MYR-denominated profits when converted to CIMB's reporting currency. Conversely, a strengthening of a local currency could boost reported earnings but might also impact the competitiveness of its offerings in that market.

- Impact on Profitability: For example, in 2024, a significant depreciation of the Indonesian Rupiah against the US Dollar could have led to a reduction in the translated value of CIMB Niaga's profits.

- Asset and Liability Valuation: Changes in exchange rates can alter the reported book value of assets and liabilities held in foreign currencies, affecting CIMB's balance sheet strength.

- Hedging Strategies: CIMB likely employs hedging strategies to mitigate these risks, but the effectiveness and cost of these strategies can vary with the magnitude of currency movements.

- Regional Economic Interdependence: The interconnectedness of Southeast Asian economies means that currency movements in one country can have ripple effects across the region, further complicating foreign exchange management for CIMB.

Access to Capital and Funding Costs

CIMB Group's ability to secure capital and the associated costs are fundamental to its lending operations and profitability. For instance, in early 2024, global interest rate hikes by central banks like the US Federal Reserve have generally increased funding costs for financial institutions worldwide, including CIMB. This directly impacts the margin CIMB can earn on its loans.

Investor sentiment towards ASEAN economies plays a significant role. Positive economic outlooks in regions where CIMB operates, such as Malaysia, Indonesia, and Thailand, can lead to lower borrowing costs as investors perceive less risk. Conversely, economic uncertainty can drive up these costs. CIMB's credit ratings, assigned by agencies like Moody's and S&P, are also crucial; a strong rating typically translates to more favorable funding terms.

To manage these dynamics, CIMB actively diversifies its funding strategies. This includes accessing various capital markets, such as issuing bonds in different currencies and jurisdictions, as well as leveraging retail deposits. For example, CIMB often participates in the Asian bond market, a key source of funding for regional banks. This diversification helps cushion the impact of any single market's volatility on their overall cost of funds.

- Capital Market Access: CIMB's ability to tap into global and regional debt markets is critical for its growth.

- Funding Cost Influences: Global liquidity, investor confidence in ASEAN, and credit ratings directly impact borrowing expenses.

- Diversification Strategy: Spreading funding sources across different markets and instruments reduces reliance and mitigates risk.

- Impact on Lending: Higher funding costs can squeeze lending margins, affecting CIMB's overall profitability.

Economic growth across ASEAN remains a primary driver for CIMB. For instance, Malaysia's GDP is projected to grow around 4.5-5.5% in 2024, while Indonesia's is expected to be between 4.8-5.2%. These figures indicate continued demand for financial services, supporting CIMB's lending and transaction volumes.

Inflationary pressures, though moderating, continue to influence consumer spending and borrowing costs. With inflation in Malaysia hovering around 2-3% and Indonesia around 3-4% in early 2024, CIMB must carefully manage its pricing strategies for loans and deposits to maintain margins.

Interest rate policies by central banks in key markets like Malaysia and Indonesia directly affect CIMB's net interest margins. As rates have stabilized or slightly decreased in some ASEAN nations in 2024, this can provide some relief to borrowers, potentially boosting loan growth, but also compressing NIMs if not managed effectively.

| Economic Indicator | Malaysia (2024 Projections) | Indonesia (2024 Projections) | Impact on CIMB |

|---|---|---|---|

| GDP Growth | 4.5% - 5.5% | 4.8% - 5.2% | Supports loan demand and transaction volumes. |

| Inflation Rate | 2% - 3% | 3% - 4% | Influences consumer spending and deposit/loan pricing. |

| Policy Interest Rate (approx.) | 3.00% | 6.00% | Affects net interest margins and borrowing costs. |

Preview Before You Purchase

CIMB Group Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of CIMB Group Holdings delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the strategic landscape and potential challenges and opportunities for CIMB.

Sociological factors

Southeast Asia's youthful population, with a median age often in the late twenties, is embracing digital finance. This demographic, projected to continue growing, fuels demand for CIMB's digital banking platforms and mobile payment solutions. For instance, by 2025, the region's internet penetration is expected to exceed 75%, creating a vast digital customer base.

Urbanization is concentrating wealth and economic activity, benefiting CIMB's retail and wealth management arms. Major cities like Jakarta and Kuala Lumpur are experiencing rapid growth, leading to a burgeoning middle class with expanding financial requirements. This trend is evident in the increasing per capita income in these urban centers, which has seen a steady rise over the past decade.

Consumers across ASEAN are increasingly embracing digital financial services, with mobile banking adoption soaring. For instance, in 2024, digital transactions in Southeast Asia were projected to reach over $1 trillion, highlighting a significant shift in how people manage their money. CIMB Group must therefore prioritize a mobile-first strategy, ensuring its digital platforms offer intuitive and secure experiences to capture this growing market segment and retain existing customers.

Financial literacy remains a significant hurdle in Southeast Asia, with many individuals lacking basic understanding of financial products and services. For instance, in 2024, a report indicated that over 60% of adults in some ASEAN nations struggled with fundamental financial concepts, impacting their ability to save and invest effectively.

CIMB Group Holdings is actively addressing this gap through targeted financial literacy programs and the development of accessible financial solutions. By offering micro-investment tools and simplified banking services, CIMB aims to bring more of the unbanked and underbanked population into the formal financial system, thereby expanding its own market reach and fostering economic empowerment.

Cultural and Religious Diversity

CIMB Group Holdings operates in a region characterized by significant cultural and religious diversity, particularly in Southeast Asia. As a leading provider of Islamic banking solutions, CIMB actively caters to the needs of Muslim populations across countries like Malaysia, Indonesia, and Brunei. This commitment requires a deep understanding and respect for varying cultural norms and religious practices to develop relevant financial products and services.

The group's focus on Islamic finance is a strategic response to the growing demand for Sharia-compliant banking. For instance, in 2024, Islamic finance assets in Malaysia were projected to reach over RM1.3 trillion, highlighting the market's substantial size and growth potential. CIMB's ability to offer tailored solutions, from savings accounts to financing, directly addresses the financial preferences of a significant segment of its customer base. This cultural sensitivity is not just about compliance but also about building trust and fostering long-term relationships.

- Islamic Banking Growth: CIMB's Islamic banking arm, CIMB Islamic, is a key differentiator, serving a large Muslim demographic in Southeast Asia.

- Product Customization: The group develops specific financial products that align with Islamic principles, meeting diverse customer needs.

- Market Penetration: By respecting cultural and religious nuances, CIMB enhances its market penetration and customer loyalty in diverse communities.

- Regulatory Landscape: Navigating different religious and cultural interpretations of financial regulations across its operating countries is crucial for CIMB's compliance and strategic planning.

Workforce Demographics and Talent Acquisition

Attracting and retaining skilled talent is a significant sociological hurdle for CIMB, particularly in high-demand fields like digital banking, cybersecurity, and sustainable finance. The competitive landscape for these specialized skills requires CIMB to offer compelling career paths and a supportive work environment. As of early 2024, the global shortage of cybersecurity professionals was estimated to be around 3.4 million, highlighting the intensity of this challenge.

To address this, CIMB is actively investing in employee training and development initiatives. The bank's 3D Academy, for instance, focuses on upskilling employees in digital, data, and disruptive technologies, aiming to cultivate a future-ready workforce. This commitment to continuous learning is crucial for maintaining a competitive edge and ensuring the organization can adapt to evolving industry needs. For example, CIMB's FY2023 report indicated significant investment in learning and development programs, though specific figures for the 3D Academy are not publicly itemized.

- Digital Banking Skills Gap: CIMB faces challenges in finding talent with expertise in areas like AI-driven customer service and blockchain integration.

- Cybersecurity Talent Shortage: The global demand for cybersecurity experts continues to outstrip supply, impacting CIMB's ability to bolster its defenses.

- Sustainable Finance Expertise: As ESG (Environmental, Social, and Governance) factors become more prominent, CIMB needs professionals skilled in green finance and impact investing.

- Employee Development Investment: CIMB's commitment to its 3D Academy underscores the importance of internal upskilling to meet future talent demands.

CIMB Group Holdings navigates a diverse sociological landscape in Southeast Asia, where a youthful, digitally-native population is rapidly adopting mobile financial services. This demographic shift, coupled with increasing urbanization, fuels demand for CIMB's digital platforms and wealth management services. For instance, by 2025, internet penetration in the region is projected to surpass 75%, creating a vast digital customer base eager for accessible financial solutions.

The group's strategic focus on Islamic banking is a direct response to the region's significant Muslim population, with Islamic finance assets in Malaysia alone projected to exceed RM1.3 trillion in 2024. This cultural sensitivity allows CIMB to build trust and cater to specific financial preferences, enhancing market penetration and customer loyalty across diverse communities.

Furthermore, CIMB is actively addressing the talent gap in critical areas like digital banking and cybersecurity, investing in initiatives such as its 3D Academy to upskill its workforce. The global shortage of cybersecurity professionals, estimated at 3.4 million in early 2024, underscores the importance of such internal development programs for maintaining a competitive edge.

Technological factors

CIMB Group is heavily invested in digital transformation, channeling resources into AI, big data, cloud computing, and robotics. This focus aims to streamline operations and elevate customer interactions, a key component of their Forward23+ and the subsequent Forward30 strategic plans.

The group's commitment to digitalization is evident in its ongoing technology partnerships and the development of new digital platforms. For instance, CIMB aimed to onboard 1.5 million new digital banking customers by the end of 2023, showcasing the tangible impact of these technological investments.

The burgeoning FinTech sector across ASEAN presents a dual challenge and opportunity for CIMB Group Holdings. Startups are rapidly introducing innovative digital payment solutions and alternative lending platforms, directly competing for market share.

However, this disruption also opens avenues for strategic partnerships. By collaborating with FinTech firms, CIMB can accelerate its own innovation, enhance operational efficiency, and expand its reach to previously underserved populations, particularly in digital payments where transaction volumes are soaring.

For instance, the digital payment market in Southeast Asia is projected to reach $1.5 trillion by 2025, according to various industry reports, highlighting the significant growth potential and the necessity for established players like CIMB to adapt and integrate these new technologies.

The increasing reliance on digital platforms for banking services amplifies cybersecurity risks for CIMB Group Holdings. In 2024, the financial sector globally experienced a surge in sophisticated cyberattacks, with data breaches costing an average of $4.45 million according to IBM's 2024 Cost of a Data Breach Report. CIMB must therefore prioritize substantial investments in advanced cybersecurity infrastructure and protocols to safeguard sensitive customer data and maintain operational integrity against evolving threats.

Adherence to stringent data privacy regulations, such as the Personal Data Protection Act (PDPA) in Malaysia and similar frameworks across its operating regions, is paramount for CIMB. Non-compliance can lead to significant fines and reputational damage. For instance, regulatory bodies have been increasing penalties for data privacy violations, underscoring the need for CIMB to maintain robust data governance and privacy-by-design principles to protect customer trust and ensure legal compliance.

AI and Analytics Adoption

CIMB Group Holdings is significantly enhancing its operations through the adoption of AI and advanced analytics. This technological shift is particularly evident in risk management, where AI algorithms are employed for more robust fraud detection and sophisticated risk analytics, aiming to minimize financial losses and improve security. For instance, by the end of 2024, CIMB reported a substantial reduction in fraudulent transactions through its AI-powered systems, though specific percentage figures are proprietary.

The bank’s strategic use of big data and analytics provides invaluable insights into customer behavior and emerging market trends. This deeper understanding allows CIMB to craft more personalized financial products and services, thereby increasing customer engagement and loyalty. In 2025, CIMB’s data analytics initiatives are projected to drive a double-digit percentage increase in cross-selling opportunities.

Key applications of AI and analytics at CIMB include:

- Enhanced Risk Management: AI models are being deployed to predict and mitigate credit risk, market risk, and operational risk more effectively.

- Fraud Detection: Real-time AI analysis of transaction patterns helps identify and prevent fraudulent activities, protecting both the bank and its customers.

- Personalized Client Servicing: Analytics enable CIMB to offer tailored advice, product recommendations, and customer support, improving the overall client experience.

- Operational Efficiency: Automation of routine tasks through AI and analytics streamlines back-office processes, leading to cost savings and faster service delivery.

Cloud Computing and Infrastructure Modernization

CIMB Group is actively expanding its cloud-based infrastructure, a strategic move aimed at bolstering operational resilience and enhancing scalability to meet growing digital demands. This expansion is crucial for ensuring the group can adapt quickly to market changes and maintain consistent service delivery.

Modernizing its backend infrastructure is paramount for CIMB to effectively support its expanding suite of digital services. This includes upgrading core systems to ensure they can handle increased transaction volumes and provide a seamless, reliable user experience for customers engaging with CIMB's digital platforms.

In 2023, CIMB announced significant investments in technology, including cloud migration initiatives, as part of its Forward23+ strategy. While specific figures for cloud infrastructure spending aren't always publicly detailed, the emphasis on digital transformation underscores the substantial allocation of resources towards modernizing IT systems. For instance, the group has been focused on improving its data analytics capabilities, which heavily rely on robust and scalable cloud infrastructure.

- Cloud Adoption: CIMB's strategy includes migrating a significant portion of its applications and data to cloud platforms to improve agility and reduce operational costs.

- Infrastructure Modernization: Ongoing upgrades to core banking systems and IT architecture are essential for supporting new digital products and services.

- Digital Service Enhancement: Investment in modern infrastructure directly supports the delivery of improved digital banking experiences, including faster transaction processing and enhanced security.

CIMB Group's technological strategy centers on leveraging AI, big data, and cloud computing to enhance efficiency and customer experience, as outlined in their Forward23+ and Forward30 plans. These investments are crucial for competing in the rapidly evolving ASEAN FinTech landscape, which saw digital payment markets projected to reach $1.5 trillion by 2025.

The group is actively modernizing its infrastructure, including cloud migration, to support its growing digital services and ensure operational resilience. This focus on IT modernization is critical for handling increased transaction volumes and delivering a seamless user experience, with significant investments made in 2023 as part of their digital transformation agenda.

CIMB's adoption of AI and advanced analytics is transforming risk management, fraud detection, and personalized client servicing, with AI-powered systems showing success in reducing fraudulent transactions by the end of 2024. Furthermore, data analytics initiatives in 2025 are expected to drive a double-digit percentage increase in cross-selling opportunities by better understanding customer behavior and market trends.

However, the increasing reliance on digital platforms elevates cybersecurity risks, necessitating substantial investments in advanced infrastructure. Global data breaches in the financial sector averaged $4.45 million in 2024, highlighting the critical need for CIMB to prioritize robust cybersecurity measures and adhere to stringent data privacy regulations to protect customer data and maintain trust.

Legal factors

CIMB Group Holdings navigates a stringent regulatory landscape across Southeast Asia, with key legislation like Malaysia's Financial Services Act 2013 and Capital Markets and Services Act 2007 forming the bedrock of its operations. Compliance with these evolving financial services laws, including specific mandates for Islamic finance, is not merely a formality but a prerequisite for maintaining its banking licenses and market access.

Consumer protection is a significant area of regulatory focus, especially with the rise of digital banking and innovative financial offerings such as buy now, pay later (BNPL) services. These evolving market dynamics necessitate stringent adherence to consumer rights, fair lending principles, and robust data privacy laws.

CIMB Group Holdings must proactively ensure all its products and services align with these consumer protection mandates. Failure to do so could lead to substantial legal penalties and damage to customer confidence, impacting the group's reputation and financial performance.

As a prominent financial institution operating across multiple jurisdictions, CIMB Group Holdings is bound by stringent anti-corruption and anti-bribery legislation. These laws, such as the UK Bribery Act and the US Foreign Corrupt Practices Act, mandate rigorous compliance measures. Failure to adhere can result in substantial fines and reputational damage, impacting investor confidence and market access.

CIMB's commitment to ethical conduct is paramount. The group invests heavily in robust internal controls and compliance training programs to mitigate the risk of illegal activities. For instance, in 2023, CIMB reported a significant allocation towards enhancing its compliance infrastructure and digital anti-fraud systems, underscoring the importance of maintaining a strong ethical framework to safeguard its operations and corporate standing.

Data Privacy and Protection Regulations

The intensifying global emphasis on data privacy demands stringent compliance with data protection legislation, including emerging regulations across the ASEAN region. CIMB must prioritize the secure handling of customer information, from collection to storage and processing, implementing robust measures to align with evolving privacy standards.

For instance, the Personal Data Protection Act (PDPA) in Malaysia, which CIMB operates within, has seen increased enforcement and updates in recent years, reflecting a broader regional trend. Failure to comply can result in significant penalties, impacting customer trust and operational continuity. In 2024, financial institutions globally are investing heavily in data governance and cybersecurity to meet these demands, with a significant portion of IT budgets allocated to privacy compliance.

- Enhanced Data Governance: CIMB needs to fortify its internal data governance frameworks to ensure all customer data handling aligns with current and anticipated privacy laws.

- Customer Consent Management: Robust systems for managing customer consent regarding data usage are crucial for compliance and building trust.

- Cross-Border Data Flows: Navigating varying data localization requirements across different ASEAN markets presents a complex legal challenge for CIMB's regional operations.

- Cybersecurity Investments: Continued investment in advanced cybersecurity measures is essential to protect sensitive customer data from breaches, a growing concern in the digital banking landscape.

Cross-Border Regulatory Harmonization

While the ASEAN region is making strides toward economic integration, the financial sector's regulatory harmonization is a work in progress. CIMB Group Holdings must navigate a complex landscape of differing legal frameworks across its operating countries. This necessitates substantial investment in legal expertise and the development of adaptable compliance strategies to ensure smooth regional operations.

For instance, in 2024, the Monetary Authority of Singapore (MAS) and Bank Negara Malaysia (BNM) continued to collaborate on initiatives aimed at aligning financial regulations, but significant divergence remains in areas like capital requirements and consumer protection laws. CIMB's ability to manage these cross-border legal nuances directly impacts its efficiency and risk exposure.

- Navigating Divergent Legal Frameworks: CIMB must continuously adapt to varying financial regulations across ASEAN markets, impacting product offerings and operational procedures.

- Investment in Legal and Compliance: Significant resources are allocated to legal teams and compliance departments to ensure adherence to diverse national laws.

- Evolving Harmonization Efforts: While progress is being made in ASEAN financial integration, full regulatory alignment is still a long-term goal, presenting ongoing challenges for regional players like CIMB.

CIMB Group Holdings operates within a complex web of legal and regulatory frameworks across Southeast Asia, with national laws like Malaysia's Financial Services Act 2013 and Capital Markets and Services Act 2007 serving as foundational pillars. Compliance with these evolving financial services regulations, including specific provisions for Islamic finance, is critical for maintaining banking licenses and market access.

Consumer protection laws are increasingly stringent, particularly concerning digital banking and innovative products like BNPL services, demanding adherence to fair lending, data privacy, and consumer rights. In 2023, financial institutions globally saw increased scrutiny on these areas, with regulators imposing higher standards for transparency and data security.

The group must also adhere to global anti-corruption and anti-bribery legislation, such as the UK Bribery Act and the US FCPA, requiring robust compliance measures to avoid substantial fines and reputational damage. CIMB's investment in compliance infrastructure and anti-fraud systems in 2023 highlights the proactive approach needed to navigate these legal demands.

Data privacy regulations, like Malaysia's PDPA, are a significant focus, with increased enforcement and updates reflecting a regional trend towards stronger data protection. Financial institutions in 2024 are allocating substantial IT budgets to data governance and cybersecurity to meet these evolving privacy standards.

Environmental factors

CIMB Group Holdings is actively integrating climate change considerations into its business strategy, with a significant commitment to sustainable finance. The group aims to mobilize RM300 billion in sustainable finance by 2030, demonstrating a forward-looking approach to environmental challenges.

As a signatory to the UN Environment Programme Finance Initiative Principles for Responsible Banking, CIMB is dedicated to financing green projects and assisting clients in their sustainability transitions. This commitment extends to setting ambitious decarbonization targets for key high-emitting sectors, including oil & gas and real estate, reflecting a proactive stance on climate action.

Environmental, Social, and Governance (ESG) standards are increasingly shaping investment strategies and corporate image. In 2024, global sustainable investment assets were projected to exceed $50 trillion, highlighting the significant influence of ESG on capital allocation.

CIMB Group Holdings actively embeds ESG principles into its operations, from financing decisions to investment portfolios. This commitment extends to collaborating with clients to foster sustainable practices and minimize their environmental footprint, recognizing the growing demand for responsible business conduct.

CIMB Group Holdings is actively addressing resource scarcity by focusing on its operational footprint. In 2024, the group continued its initiative to measure and audit energy consumption and waste disposal across its facilities, aiming for greater efficiency.

A key sustainability strategy involves the gradual replacement of its gasoline car fleet with electric vehicles, a move that began in prior years and is ongoing. This transition is projected to reduce carbon emissions associated with its business operations, contributing to a more sustainable operational model.

Biodiversity and Nature Preservation

CIMB Group Holdings has formalized its commitment to environmental stewardship by publishing a Statement on Biodiversity and Nature. This statement details their strategy for preserving biodiversity, actively restoring natural habitats, and championing the responsible utilization of resources. This initiative signifies a dedication that extends beyond climate change mitigation, embracing a more holistic approach to environmental responsibility.

This focus on biodiversity is increasingly critical for financial institutions. For instance, in 2023, the World Economic Forum highlighted that over half of global GDP, approximately $44 trillion, is moderately or highly dependent on nature and its services. Financial sector engagement in nature preservation is therefore not just about compliance but also about managing systemic risks and identifying sustainable investment opportunities.

CIMB's proactive stance positions it to navigate evolving regulatory landscapes and growing investor expectations regarding environmental, social, and governance (ESG) performance. As of early 2024, there's a noticeable trend of increased scrutiny on how financial entities address nature-related risks and opportunities, with many regulators exploring mandatory disclosures similar to climate risk reporting.

The implications for CIMB include:

- Enhanced Reputation: Demonstrating leadership in biodiversity preservation can bolster brand image among environmentally conscious stakeholders.

- Risk Mitigation: Proactively addressing nature-related dependencies and impacts can reduce exposure to physical and transition risks.

- Sustainable Finance Opportunities: Developing products and services that support biodiversity restoration and nature-positive activities can open new revenue streams.

- Stakeholder Engagement: A clear biodiversity statement facilitates dialogue with investors, customers, and communities on environmental performance.

Regulatory Pressure for Green Financing and Disclosure

Financial regulators across ASEAN are stepping up their efforts to promote green finance and implement stricter guidelines for managing climate-related risks. This trend is creating a more favorable environment for institutions like CIMB Group Holdings that are committed to sustainability.

CIMB's ambitious sustainable finance targets, which aim for RM30 billion in sustainable finance by 2024, directly respond to this growing regulatory push. Their proactive engagement in assisting clients with Environmental, Social, and Governance (ESG) compliance and navigating emerging sustainable finance taxonomies positions them well to capitalize on these evolving market demands.

- ASEAN Regulatory Momentum: Central banks and financial authorities in countries like Singapore, Malaysia, and Indonesia are actively developing frameworks for green bonds, sustainable loans, and climate risk disclosure.

- CIMB's Sustainable Finance Target: CIMB has committed to mobilizing RM30 billion in sustainable finance by 2024, demonstrating a clear alignment with regional regulatory expectations.

- ESG Advisory Services: The group offers robust advisory services to help businesses integrate ESG principles into their strategies and meet evolving compliance requirements.

- Taxonomy Alignment: CIMB is actively involved in aligning its offerings with emerging sustainable finance taxonomies, ensuring its products and services meet recognized green criteria.

CIMB Group Holdings is demonstrating a strong commitment to environmental stewardship, aiming to mobilize RM300 billion in sustainable finance by 2030. This aligns with a global trend where sustainable investment assets were projected to exceed $50 trillion in 2024, underscoring the financial sector's increasing focus on ESG principles.

The group is actively working to reduce its operational footprint, including measuring energy consumption and waste disposal, and transitioning its vehicle fleet to electric. Furthermore, CIMB's Statement on Biodiversity and Nature highlights a dedication to habitat restoration and responsible resource use, recognizing that over half of global GDP, approximately $44 trillion in 2023, depends on nature.

CIMB's proactive approach to environmental factors positions it favorably within the evolving regulatory landscape across ASEAN, where central banks are implementing stricter guidelines for green finance and climate risk disclosure. This strategic focus is further reinforced by CIMB's commitment to mobilize RM30 billion in sustainable finance by 2024, directly responding to these regional expectations and creating new opportunities in sustainable finance.

PESTLE Analysis Data Sources

Our PESTLE Analysis for CIMB Group Holdings is meticulously constructed using data from reputable financial institutions like the World Bank and IMF, alongside industry-specific reports and government publications. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors influencing the group.