CIMB Group Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CIMB Group Holdings Bundle

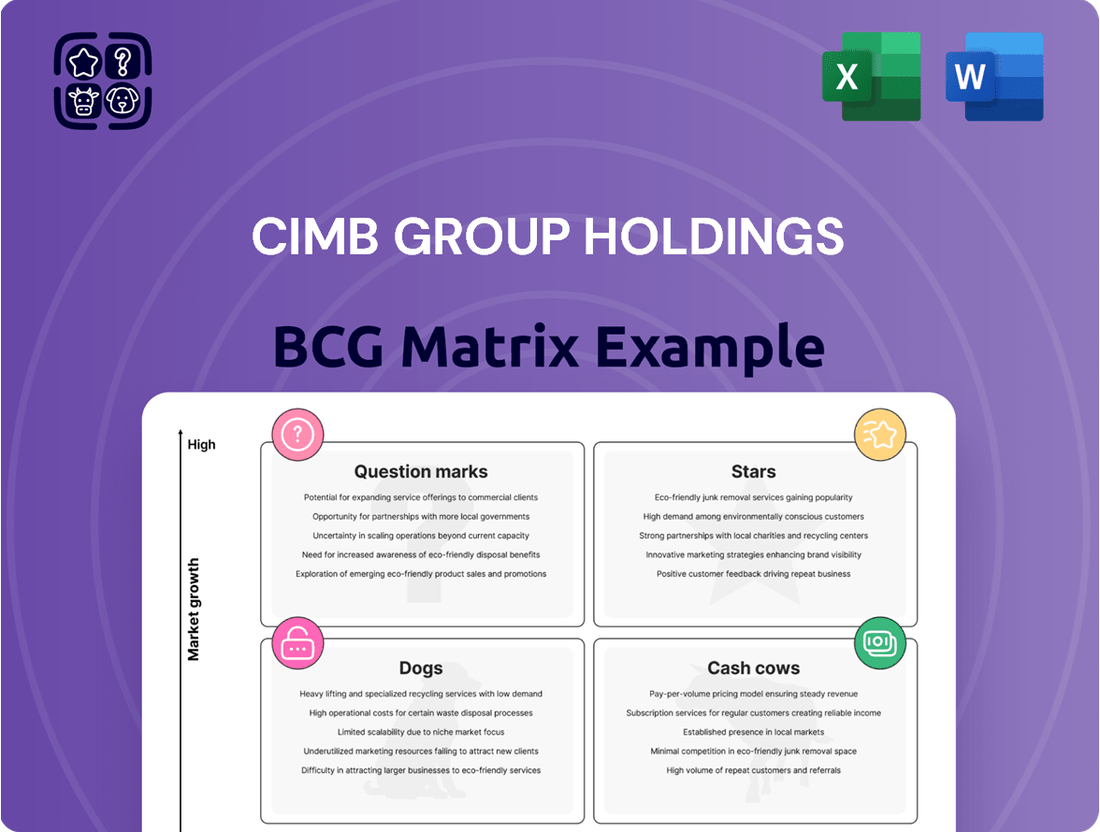

Curious about CIMB Group Holdings' strategic positioning? Our BCG Matrix analysis reveals which of their offerings are market leaders (Stars), consistent revenue generators (Cash Cows), underperforming assets (Dogs), or potential growth opportunities (Question Marks). This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

CIMB Islamic is a shining example of a Star in CIMB Group's BCG Matrix. It holds a dominant position in the Islamic capital markets across ASEAN, consistently topping sukuk league tables in Malaysia. This strong market share in a rapidly expanding financial sector is a testament to its strategic focus and success.

The bank's leadership is further reinforced by its consistent innovation in Sharia-compliant financial products. CIMB Islamic's active participation in significant deals, including the issuance of sustainability-linked sukuk, highlights its forward-thinking approach and commitment to responsible finance. For instance, in 2023, CIMB advised on over RM10 billion in sukuk issuances, showcasing its deal-making prowess.

CIMB's Singapore operations, serving as a crucial wealth and treasury hub for ASEAN, are experiencing robust expansion. This growth is underscored by Singapore's increasing contribution to the group's financial performance, reflecting its strategic importance.

In the first quarter of 2025, Singapore accounted for 14% of CIMB Group's profit before tax, a notable increase from 11% in the same period of the previous year. This upward trend highlights the effectiveness of the bank's strategic initiatives within the city-state.

The bank's success in Singapore is partly attributed to its targeted approach in niche markets, such as facilitating cross-border transfers for the Malaysian community residing there. Furthermore, strategic bancassurance partnerships are playing a vital role in driving this positive momentum and expanding its service offerings.

CIMB Bank Philippines has experienced robust expansion, with its customer base and loan disbursements showing impressive growth. It’s recognized as a leading digital bank on a global scale, reflecting its successful digital-first strategy.

In Vietnam, CIMB also demonstrates strong performance in digital banking, operating entirely through digital channels. This commitment to fully digital operations in rapidly expanding emerging markets highlights their potential for substantial future growth and market penetration.

Sustainable Finance Initiatives

CIMB Group Holdings is actively pursuing sustainable finance, setting ambitious goals to drive growth in this critical sector. The group has more than tripled its commitment, aiming for RM300 billion in sustainable finance by 2030. This significant increase underscores CIMB's strategic focus on a market segment that is not only expanding rapidly but also gaining substantial investor and regulatory attention.

The company's commitment is further demonstrated through initiatives like its GreenBizReady program, designed to support businesses in their transition to greener practices. Additionally, CIMB's offering of sustainability-linked loans directly incentivizes environmentally responsible corporate behavior. These efforts position CIMB within a high-growth, high-potential area of the financial market, where it aims to establish a leadership position.

Key aspects of CIMB's sustainable finance strategy include:

- RM300 billion sustainable finance target by 2030, a substantial increase from previous commitments.

- GreenBizReady programme, supporting businesses in adopting sustainable practices.

- Sustainability-linked loans, aligning financial products with environmental performance.

- Focus on a high-growth sector, capitalizing on increasing demand for ESG-compliant financial solutions.

Wholesale Banking in Key ASEAN Markets

CIMB's wholesale banking operations are a powerhouse in the Asia Pacific region, consistently generating substantial non-interest income thanks to its robust client relationships. This segment is a cornerstone of the group's success, particularly in supporting the expansion of large ASEAN corporations.

The bank's strategic emphasis on key markets like Malaysia, Singapore, and Indonesia highlights its significant market penetration within a rapidly expanding corporate segment. This focus positions CIMB to capitalize on the increasing cross-border activities of major regional businesses.

- Market Leadership: CIMB's wholesale banking is a dominant force in Asia Pacific, driving significant non-interest income.

- Strategic Focus: The bank prioritizes supporting large ASEAN corporates, particularly in Malaysia, Singapore, and Indonesia, for regional expansion.

- Growth Driver: This strategy taps into a growing segment of businesses actively expanding across the ASEAN region.

CIMB Islamic, a leader in ASEAN Islamic capital markets, consistently ranks high in sukuk issuances, demonstrating its strong market share and strategic success. Its commitment to Sharia-compliant innovation is evident in its participation in significant deals, including sustainability-linked sukuk, with RM10 billion in sukuk issuances advised on in 2023 alone.

CIMB's Singapore operations are a vital wealth and treasury hub, showing strong growth and contributing significantly to the group's performance. In Q1 2025, Singapore represented 14% of CIMB Group's profit before tax, up from 11% year-on-year, driven by niche market strategies and bancassurance partnerships.

CIMB Bank Philippines is a global digital banking leader, experiencing robust expansion in its customer base and loan disbursements. Similarly, CIMB Vietnam operates entirely digitally in a growing market, showcasing potential for future penetration.

CIMB Group is aggressively pursuing sustainable finance, targeting RM300 billion by 2030, more than tripling its previous commitment. Initiatives like the GreenBizReady program and sustainability-linked loans underscore CIMB's strategic focus on this high-growth, ESG-conscious market segment.

CIMB's wholesale banking operations are a significant contributor to non-interest income across Asia Pacific, particularly supporting large ASEAN corporations. The bank's strategic focus on Malaysia, Singapore, and Indonesia aims to capture the increasing cross-border activities of these key regional businesses.

| Business Unit | BCG Category | Key Performance Indicators | Strategic Rationale |

|---|---|---|---|

| CIMB Islamic | Star | Dominant in ASEAN Islamic capital markets, tops sukuk tables in Malaysia, RM10bn+ sukuk advised in 2023. | High growth potential in Islamic finance, strong market leadership. |

| CIMB Singapore | Star | 14% of group PBT in Q1 2025 (up from 11% YoY), crucial wealth & treasury hub. | Strategic importance, effective niche market penetration and partnerships. |

| CIMB Bank Philippines | Star | Leading global digital bank, robust customer and loan growth. | Successful digital-first strategy in a high-growth market. |

| CIMB Vietnam | Star | Fully digital operations, strong performance in expanding emerging market. | Capitalizing on digital adoption and market growth potential. |

| Sustainable Finance | Star | Target RM300bn by 2030, GreenBizReady program, sustainability-linked loans. | Focus on a rapidly expanding, high-demand ESG sector. |

| Wholesale Banking (APAC) | Star | Dominant in APAC, drives significant non-interest income, supports large ASEAN corporates. | Leveraging strong client relationships and regional corporate expansion. |

What is included in the product

CIMB Group Holdings' BCG Matrix analyzes its business units' market share and growth potential.

It guides strategic decisions on investing in Stars, milking Cash Cows, developing Question Marks, and divesting Dogs.

A clear BCG Matrix visualizes CIMB's portfolio, simplifying strategic decisions and alleviating the pain of resource allocation uncertainty.

Cash Cows

CIMB's Malaysian consumer banking division is a prime example of a Cash Cow. As Malaysia's second-largest lender, CIMB boasts a substantial retail branch network, allowing it to capture a significant market share in the country's mature consumer banking landscape. This segment is a consistent powerhouse, generating robust net interest income that forms a cornerstone of CIMB Group's overall profitability. For instance, in the first quarter of 2024, CIMB reported a net profit of RM1.77 billion, with its consumer banking operations playing a pivotal role in this strong financial performance.

CIMB's commercial banking in Malaysia is a strong performer, much like its consumer banking arm. It caters to a wide range of businesses, solidifying its position as a dominant force in the market.

This segment is a significant contributor to CIMB Group's overall profitability. In 2024, CIMB reported a pre-tax profit of RM 7.7 billion for its Malaysian operations, with commercial banking playing a crucial role in this success, benefiting from its mature market presence and established competitive edge.

CIMB Niaga, Indonesia's second-largest private bank, demonstrates strong performance in its consumer and SME banking divisions. These segments are considered cash cows for CIMB Group Holdings due to their consistent profitability and significant contribution to the group's overall financial health.

Despite a competitive Indonesian banking landscape, CIMB Niaga's established market share in consumer and SME banking provides a stable and reliable source of cash flow. For instance, as of the first quarter of 2024, CIMB Niaga reported a net profit of IDR 1.47 trillion, with its loan growth driven by both retail and business segments.

Traditional Deposit-Led Strategy

CIMB Group Holdings' traditional deposit-led strategy has been a cornerstone of its operations, fostering a robust and stable funding base. This approach has consistently yielded healthy growth in total deposits, a critical factor for profitability, especially in mature banking environments.

The bank's emphasis on current and savings accounts (CASA) has resulted in a high CASA ratio, which is a significant advantage. This low-cost funding source is instrumental in generating reliable cash flow, underpinning the group's financial stability and capacity for investment.

- CIMB's total deposits grew by 9.1% year-on-year to RM639.1 billion as of the first quarter of 2024.

- The CASA ratio stood at a healthy 37.5% in Q1 2024, reflecting efficient low-cost funding.

- This strategy directly contributes to CIMB's net interest margin, which averaged 2.3% in 2023.

Established Branch Network

CIMB Group's established branch network, boasting over 600 branches and nearly 6,000 self-service machines across ASEAN, represents a significant Cash Cow. This extensive physical footprint in mature markets ensures a strong and stable market share, fostering customer loyalty and consistent cash flow generation. Even with the ongoing digital shift, this established network continues to be a reliable source of revenue for the group.

The sheer scale of CIMB's physical presence is a key differentiator. In 2024, this network continued to serve a substantial customer base, acting as a bedrock for the group's financial performance. The ability to maintain high market share in these established regions directly translates into predictable and robust cash inflows, a hallmark of a Cash Cow.

- Extensive ASEAN Network: Over 600 branches and nearly 6,000 self-service machines.

- Mature Market Dominance: High market share and customer loyalty in established regions.

- Stable Cash Generation: Reliable revenue stream despite digital transformation.

- Brand Trust: Physical presence reinforces customer confidence and engagement.

CIMB's established deposit-led strategy, particularly its focus on Current and Savings Accounts (CASA), fuels its Cash Cow status. This approach ensures a low-cost funding base, directly boosting profitability. The group's total deposits grew by 9.1% year-on-year to RM639.1 billion in Q1 2024, with a healthy CASA ratio of 37.5% in the same period. This efficiency contributed to CIMB's net interest margin, which averaged 2.3% in 2023, underscoring the stable cash generation from these core operations.

| Metric | Value (Q1 2024) | Significance |

|---|---|---|

| Total Deposits | RM639.1 billion (+9.1% YoY) | Indicates a strong and growing funding base. |

| CASA Ratio | 37.5% | Highlights efficient, low-cost funding. |

| Net Interest Margin (2023 Avg.) | 2.3% | Demonstrates consistent profitability from lending activities. |

Delivered as Shown

CIMB Group Holdings BCG Matrix

The CIMB Group Holdings BCG Matrix preview you are currently viewing is the identical, fully formatted report you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just the complete strategic analysis ready for your immediate use.

This preview accurately represents the final CIMB Group Holdings BCG Matrix document you will download upon completing your purchase. It's a professionally crafted analysis, designed for strategic clarity and ready to be integrated into your business planning without any further revisions.

What you see here is the actual, unedited CIMB Group Holdings BCG Matrix file that will be yours once you complete the purchase. You'll gain instant access to this analysis-ready document, perfect for editing, printing, or presenting to stakeholders.

The CIMB Group Holdings BCG Matrix report you are reviewing is the exact document you will receive after your purchase. This professionally designed file is analysis-ready and instantly downloadable, providing you with the strategic insights you need without any delays.

Dogs

CIMB Group Holdings views its Thailand operations as a challenging market within its ASEAN network. The country's economy has been experiencing sluggish growth and faces structural headwinds, impacting the banking sector. In 2023, Thailand's GDP growth was around 1.9%, which is lower than many of its regional peers.

While there are signs of stabilization in CIMB Thailand's performance, the bank acknowledges the need for a more refined approach to client segmentation. This suggests that the bank may have a relatively low market share in a low-growth environment, necessitating strategic adjustments to enhance customer outcomes and profitability.

CIMB Group Holdings has been actively addressing its legacy IT infrastructure, a key component in its business portfolio. The group has publicly stated its commitment to significant technology upgrades, channeling substantial investments to overcome past shortcomings in digital services and customer experience. This strategic move suggests that certain older, less efficient IT systems within CIMB could be categorized as 'Dogs' in a BCG matrix analysis, characterized by low performance and high operational expenses.

Non-core or divested businesses within CIMB Group's BCG Matrix would represent units with low market share in low-growth markets. These are typically areas CIMB has strategically exited or significantly reduced focus on, aligning with its Forward23+ strategy to streamline operations and concentrate on core strengths. For instance, if CIMB had a small, underperforming insurance subsidiary in a mature market, it would likely be categorized here.

Products with Low Digital Adoption

Products with low digital adoption within CIMB Group Holdings, despite significant digital initiatives, represent a challenge. These are often traditional services where customer migration to digital channels remains sluggish. This inertia translates to continued reliance on higher-cost physical touchpoints, impacting overall operational efficiency.

For instance, certain legacy loan application processes or specific types of over-the-counter transactions might fall into this category. While CIMB has invested heavily in its digital platforms, the adoption rates for these particular offerings haven't kept pace, creating a drag on resource allocation. In 2024, CIMB reported that while digital transactions surged, a notable percentage of customer interactions for certain complex financial products still occurred through branch channels, indicating a persistent gap.

- Legacy Loan Processing: Traditional application methods for certain personal or business loans continue to see significant in-branch submissions, despite the availability of online portals.

- Over-the-Counter Services: Specific transactional services, like certain types of fund transfers or bill payments, still exhibit a preference for branch-based execution by a segment of the customer base.

- Customer Onboarding for Niche Products: While overall digital onboarding is strong, a few specialized financial products have experienced slower digital uptake for new customer acquisition.

Certain Mortgage Portfolios in Indonesia

Certain mortgage portfolios in Indonesia, under CIMB Group Holdings, are likely positioned as Cash Cows or Question Marks within the BCG Matrix. CIMB Niaga's strategic shift away from mortgages to optimize risk-adjusted returns suggests a potential slowdown in growth or profitability for this segment. This indicates that some mortgage offerings might be experiencing lower performance relative to other loan products.

- Strategic Reallocation: CIMB Niaga's focus shift from mortgages signals a move towards higher-yielding or faster-growing business areas.

- Underperformance Indication: The emphasis on optimizing risk-adjusted returns implies that certain mortgage segments may not be meeting internal performance benchmarks.

- 2024 Data Context: While specific 2024 portfolio performance data for Indonesian mortgages is not publicly detailed by CIMB Niaga in isolation, the broader Indonesian mortgage market in 2024 saw continued demand, though interest rate sensitivity remained a factor.

CIMB Group Holdings identifies certain legacy IT systems and specific products with low digital adoption as potential 'Dogs' in its business portfolio. These are areas characterized by low market share and low growth, often requiring significant investment to maintain or improve. For example, some older loan processing systems and niche products with sluggish digital uptake continue to rely on higher-cost physical channels, impacting overall efficiency.

Products with low digital adoption within CIMB Group Holdings, despite significant digital initiatives, represent a challenge. These are often traditional services where customer migration to digital channels remains sluggish. This inertia translates to continued reliance on higher-cost physical touchpoints, impacting overall operational efficiency. In 2024, CIMB reported that while digital transactions surged, a notable percentage of customer interactions for certain complex financial products still occurred through branch channels, indicating a persistent gap.

CIMB's Thailand operations, facing sluggish economic growth around 1.9% in 2023, also present characteristics of 'Dogs' if market share remains low. The bank’s acknowledgment of needing a more refined client segmentation strategy suggests potential underperformance in this low-growth market.

Certain legacy loan application processes and specific over-the-counter transactions, despite digital alternatives, still see significant in-branch activity. This continued reliance on physical touchpoints for these services, even in 2024, indicates lower efficiency and potential 'Dog' status due to slow digital migration.

Question Marks

CIMB Group is actively supporting the Johor-Singapore Special Economic Zone (JS-SEZ) by committing RM10 billion in funding facilities. This significant investment aims to capitalize on the high growth potential of this new economic corridor, fostering cross-border trade and investment.

The launch of CIMB's ASEAN Financial Passport is a key initiative designed to streamline financial services for businesses operating within the JS-SEZ. This passport facilitates easier access to capital and financial solutions across the region, enhancing the attractiveness of the JS-SEZ for investors.

While the JS-SEZ represents a promising opportunity, CIMB's market share within this developing zone and the ultimate success of its JS-SEZ initiatives are still being established. This positions the initiatives as question marks within the BCG matrix, requiring careful monitoring and strategic adjustments.

CIMB's Forward30 plan, launched in March 2025, heavily features AI-led initiatives and hyper-personalization. These innovations aim to revolutionize customer engagement through AI-enhanced advisory services and predictive analytics for deeper customer understanding and operational efficiency. For instance, by July 2025, CIMB aims to pilot AI-driven personalized investment recommendations, projecting a potential 15% uplift in engagement for pilot users.

These advanced AI capabilities, while positioned for high growth, are currently in their early stages of market penetration and revenue generation for CIMB. Their contribution to the group's overall financial performance is still developing, placing them in a position that aligns with the characteristics of a question mark in the BCG matrix. The strategic focus is on nurturing these nascent but promising areas for future market leadership.

CIMB's cross-border remittance services, particularly beyond the strong Malaysia-Singapore corridor, represent a significant high-growth opportunity. While the bank has built robust infrastructure for the SGD-MYR route, replicating this success across other ASEAN markets is a key strategic focus.

The bank's 'ASEAN passport' initiative is designed to streamline these cross-border transactions, aiming to capture a larger share of the burgeoning remittance market in regions like Indonesia, Thailand, and the Philippines. However, wider adoption and market penetration in these newer corridors are still in the developmental stages.

New Digital Products (e.g., MaxSave in Philippines)

CIMB Bank Philippines has introduced MaxSave, a digital time deposit product designed to attract customers with its competitive interest rates. This initiative is part of CIMB's broader strategy to leverage digital channels for market expansion.

The bank is also enhancing its embedded banking services through strategic alliances, such as its collaboration with LazPayLater. These efforts are geared towards reaching new customer demographics and fostering accelerated growth in the digital banking space.

- MaxSave offers high interest rates on digital time deposits.

- Expansion of embedded banking through partnerships like LazPayLater.

- Focus on capturing new market segments and driving rapid growth.

- Long-term market share and profitability are still under development.

Sustainability Advisory and Innovative Financing Solutions (beyond loans)

CIMB Group is actively broadening its sustainable finance offerings, moving beyond traditional loans to include specialized advisory services and innovative financing mechanisms. This strategic expansion targets high-growth segments like transition finance, which supports companies in shifting to lower-carbon operations, and nature-based carbon finance, leveraging environmental assets for financial solutions. By 2024, CIMB aims to solidify its presence in these evolving markets, recognizing their significant potential for future revenue streams.

The group is developing expertise in blended finance, a crucial tool for mobilizing private capital towards sustainable development goals by combining public or philanthropic funds with commercial investment. This approach is particularly relevant for emerging markets and projects with higher perceived risk. CIMB's commitment to these newer areas reflects a forward-looking strategy to capture market share in the rapidly expanding sustainable finance landscape.

- Sustainability Advisory: CIMB is building capabilities to guide clients on ESG integration, reporting, and strategy development.

- Transition Finance: Focus on financing the shift of carbon-intensive industries towards greener operations.

- Nature-Based Carbon Finance: Exploring financial instruments linked to natural capital and carbon sequestration projects.

- Blended Finance: Structuring deals that combine different types of capital to de-risk and attract private investment for sustainability initiatives.

CIMB's initiatives in the Johor-Singapore Special Economic Zone (JS-SEZ) and its AI-driven customer engagement strategies fall into the question mark category. While these represent significant growth opportunities, their market penetration and revenue generation are still in early development stages, requiring close observation and strategic adaptation.

Similarly, the expansion of CIMB's cross-border remittance services beyond established corridors and the growth of its digital products like MaxSave in the Philippines are positioned as question marks. These ventures aim to capture new market segments and drive rapid growth, but their long-term market share and profitability are yet to be fully realized.

CIMB's expanding sustainable finance offerings, including transition finance and nature-based carbon finance, also fit the question mark profile. These are high-potential areas for future revenue, but their current market share and established profitability are still being built, necessitating strategic nurturing.

BCG Matrix Data Sources

Our CIMB Group Holdings BCG Matrix is built on a foundation of verified market intelligence, integrating financial disclosures, industry research, and competitor benchmarks to ensure strategic clarity.