CIMB Group Holdings Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CIMB Group Holdings Bundle

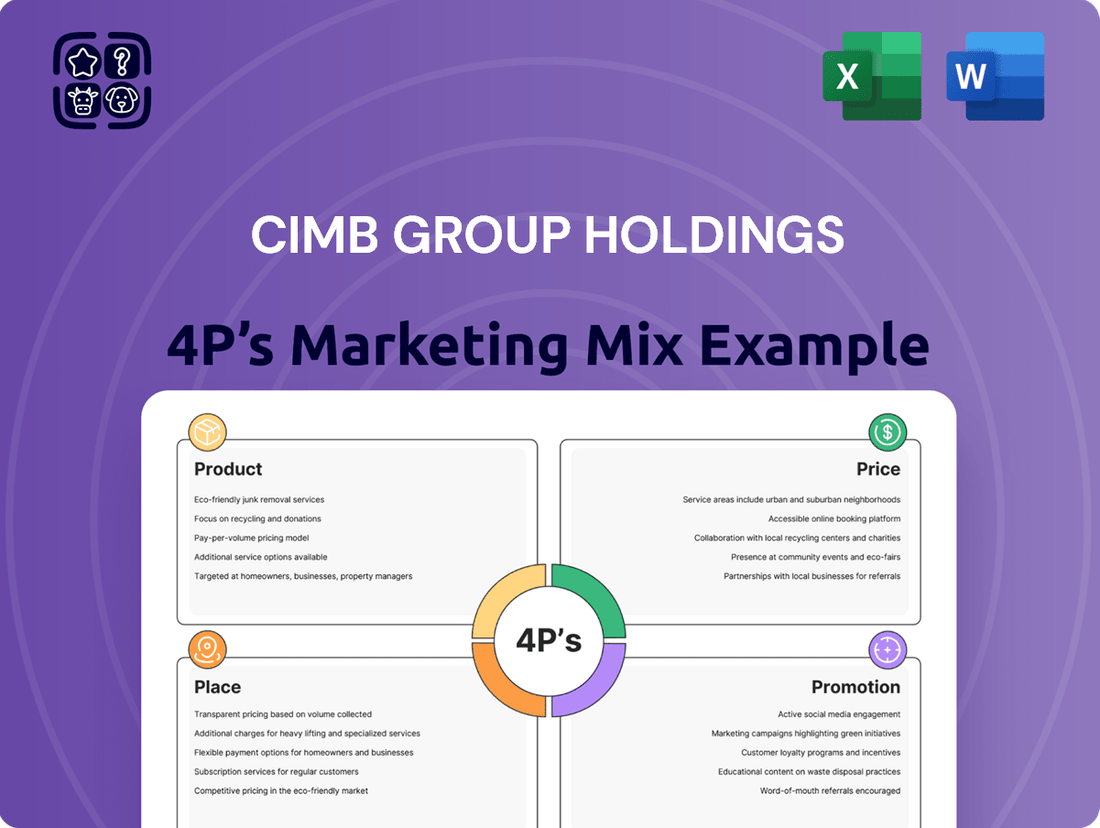

CIMB Group Holdings strategically leverages its diverse product portfolio, competitive pricing, extensive digital and physical distribution channels, and targeted promotional campaigns to capture market share. Understanding how these elements intertwine is crucial for anyone seeking to grasp their competitive edge.

Dive deeper into the intricacies of CIMB's marketing mix – from their innovative product offerings and dynamic pricing strategies to their expansive reach and impactful promotions. This comprehensive analysis provides actionable insights for business professionals and students alike.

Save yourself hours of research with our pre-written, editable 4Ps Marketing Mix Analysis for CIMB Group Holdings. Gain a structured understanding of their product, price, place, and promotion strategies, perfect for reports, benchmarking, or business planning.

Product

CIMB Group Holdings' product strategy centers on delivering comprehensive banking solutions. This encompasses consumer, commercial, and wholesale banking, offering a wide array of accounts, loans, credit cards, and investment products. By providing these diverse financial tools, CIMB aims to serve a broad customer base across the ASEAN region.

For instance, as of the first quarter of 2024, CIMB reported a total loan portfolio of RM477.1 billion, demonstrating the breadth of its lending products. The group's commitment to innovation is evident in its digital banking offerings, which saw a 16.4% year-on-year growth in consumer digital transactions by the end of 2023, highlighting their focus on evolving customer needs.

CIMB Islamic Bank stands as a cornerstone of CIMB Group's strategy, offering a comprehensive suite of Shariah-compliant financial products. These include diverse financing options, sukuk issuances, Islamic investment banking, and takaful solutions designed for individuals, businesses, and institutions.

This commitment to ethical finance addresses the increasing global demand for Shariah-compliant products. CIMB Islamic's leadership is underscored by its significant market presence, aiming to capture a larger share of the rapidly expanding Islamic finance sector, which is projected to reach trillions globally in the coming years.

CIMB Group Holdings is significantly boosting its digital offerings, pouring resources into advanced digital banking. A prime example is the ongoing enhancement and deployment of their CIMB OCTO App, showcasing a commitment to digital transformation.

These digital products are engineered for a smooth and secure user journey, incorporating user-friendly navigation and robust security measures. This focus ensures customers can bank with confidence and ease.

The strategic emphasis on digital innovation allows CIMB to deliver banking services that are not only convenient but also highly efficient, available to customers whenever and wherever they need them. This accessibility is key in today's fast-paced world.

Sustainable Finance Offerings

CIMB Group Holdings' sustainable finance offerings are a cornerstone of its commitment to environmental and social responsibility. The Group actively promotes its Green, Social, and Sustainable Impact s and Services (GSSIPS) framework, which guides its product development and client engagement in this vital area.

These offerings include tailored sustainability-linked financing and advisory services specifically designed for Small and Medium-sized Enterprises (SMEs). This support helps businesses integrate sustainable practices into their operations, fostering growth while minimizing environmental impact. For individuals, CIMB provides preferential financing options for green homes and electric vehicles, making sustainable choices more accessible and affordable.

These initiatives directly address regional environmental and social priorities, reinforcing CIMB's role in promoting responsible business practices across its markets. For instance, by the end of 2023, CIMB had mobilized RM10.6 billion in sustainable finance, exceeding its 2023 target of RM10 billion, demonstrating significant progress in its sustainability agenda.

- Green, Social, and Sustainable Impact s and Services (GSSIPS): CIMB's overarching framework for sustainable finance.

- SME Support: Sustainability-linked financing and advisory services for small and medium-sized enterprises.

- Individual Incentives: Preferential financing for green homes and electric vehicles.

- Mobilization Achievement: RM10.6 billion mobilized in sustainable finance by end-2023, surpassing the RM10 billion target for the year.

Tailored Business and Wealth Management

CIMB Group's Product strategy for its business and wealth management segment is highly differentiated, focusing on delivering specialized financial solutions. For businesses, this includes a robust suite of services such as credit facilities, advanced cash management, trade finance, and complete securities services designed to optimize operational efficiency and growth.

For its affluent clientele, CIMB offers sophisticated wealth management platforms complemented by strategic bancassurance partnerships. These services are meticulously crafted to provide comprehensive wealth protection and facilitate effective legacy planning for high-net-worth individuals, ensuring their financial well-being and long-term objectives are met.

CIMB's commitment to tailored solutions is evident in its approach, aiming to enhance business performance and provide holistic wealth management. For instance, CIMB Singapore reported a 10% increase in its wealth management assets under management in 2024, reflecting the growing demand for its specialized offerings.

- Business Solutions: Credit facilities, cash management, trade finance, securities services.

- Wealth Management: Sophisticated platforms and bancassurance for affluent clients.

- Objectives: Enhance business performance and provide holistic wealth protection and legacy planning.

- Market Focus: Catering to diverse financial needs of both corporate and high-net-worth individual clients.

CIMB Group Holdings' product strategy is multifaceted, encompassing a broad spectrum of financial solutions designed to meet diverse customer needs. This includes a strong emphasis on digital innovation, exemplified by the continuous enhancement of their CIMB OCTO App, ensuring convenient and secure banking experiences for users.

The group also prioritizes Shariah-compliant financial products through CIMB Islamic Bank, offering a comprehensive range of Islamic finance solutions. Furthermore, CIMB is committed to sustainable finance, actively promoting its Green, Social, and Sustainable Impact s and Services (GSSIPS) framework, which saw RM10.6 billion mobilized by the end of 2023.

| Product Category | Key Offerings | Target Audience | 2023/2024 Data Point | Strategic Focus |

| Consumer Banking | Accounts, Loans, Credit Cards, Digital Banking | Individuals | 16.4% YoY growth in consumer digital transactions (end-2023) | Digitalization, accessibility |

| Islamic Banking | Shariah-compliant financing, Sukuk, Takaful | Individuals, Businesses, Institutions | Expanding market share in global Islamic finance sector | Ethical finance, Shariah compliance |

| Sustainable Finance | Green/Social/Sustainable Financing, Green Mortgages/EV Loans | SMEs, Individuals | RM10.6 billion mobilized (end-2023), exceeding RM10 billion target | Environmental, Social, Governance (ESG) integration |

| Business & Wealth Management | Credit Facilities, Cash Management, Trade Finance, Wealth Platforms | Businesses, Affluent Individuals | 10% increase in wealth management AUM (CIMB Singapore, 2024) | Specialized solutions, wealth protection, legacy planning |

What is included in the product

This analysis provides a comprehensive overview of CIMB Group Holdings' marketing strategies, detailing its product offerings, pricing structures, distribution channels, and promotional activities.

It offers a deep dive into CIMB's marketing positioning, using actual brand practices and competitive context to inform managers, consultants, and marketers.

This CIMB Group Holdings 4P's analysis provides a clear, actionable roadmap to address market challenges, simplifying complex strategies into easily digestible insights for confident decision-making.

It serves as a vital tool to alleviate marketing pain points by offering a structured, visual representation of CIMB's strategy, enabling quick understanding and effective communication across teams.

Place

CIMB Group Holdings boasts an extensive physical and operational network spanning eight ASEAN nations, including Malaysia, Indonesia, Singapore, Thailand, Cambodia, Vietnam, Myanmar, and the Philippines. This deep regional penetration in 2024 allows CIMB to effectively serve a diverse customer base and facilitate efficient cross-border financial activities. As of the first half of 2024, CIMB reported over 15 million retail customers across the region, highlighting the reach of this extensive network.

CIMB Group Holdings is significantly bolstering its digital presence, with a clear focus on a digital-first strategy. This involves substantial financial commitments to enhance its online platforms, notably CIMB Clicks and the CIMB OCTO App. These investments are designed to offer customers seamless, round-the-clock access to a comprehensive suite of banking services.

These advanced digital channels empower customers with 24/7 self-service capabilities for account management, payments, and a broad spectrum of digital transactions. For instance, CIMB reported a substantial increase in digital transactions, with over 90% of customer transactions conducted digitally in 2024, highlighting the effectiveness of this channel strategy.

This strategic emphasis on robust digital channels not only maximizes customer convenience but also drives operational efficiency by streamlining service delivery. The bank's ongoing development of these platforms aims to solidify its position as a leading digital bank in the region, catering to evolving customer expectations for accessible and efficient banking solutions.

CIMB Group Holdings strategically maintains a physical branch network, even as it pushes for digital transformation. These branches are crucial for customers who value face-to-face service, need specialized advice, or prefer traditional banking channels. This approach ensures CIMB remains accessible to a broad customer base across its key markets, blending digital convenience with physical presence.

Partnerships and Ecosystem Integration

CIMB actively cultivates strategic alliances with key players across the digital landscape. These collaborations, particularly with prominent e-commerce sites and burgeoning fintech innovators, are crucial for embedding CIMB's banking services directly into the daily digital lives of consumers. This strategy not only broadens the bank's customer base but also fosters deeper engagement by providing financial tools within familiar online environments.

By integrating banking functionalities into popular platforms, CIMB enhances customer convenience and expands its market reach significantly. This ecosystem approach is a cornerstone of their digital strategy, aiming to capture new demographics and solidify their position as a digitally-forward financial institution. For instance, CIMB's partnerships have seen them offer integrated payment solutions on leading marketplaces, driving transaction volumes and customer acquisition.

- E-commerce Integration: CIMB has partnered with major online retailers to offer embedded financing and payment options, boosting sales for merchants and providing convenient credit access for shoppers.

- Fintech Collaborations: Working with fintech firms allows CIMB to leverage cutting-edge technology for new product development and service delivery, such as digital wallets and peer-to-peer lending platforms.

- Digital Ecosystem Expansion: These partnerships are vital for CIMB's goal of becoming a seamless part of customers' digital journeys, moving beyond traditional banking channels to meet users where they are.

- Customer Acquisition & Engagement: By being present on popular platforms, CIMB effectively acquires new customers and increases engagement through contextual financial offerings.

Targeted Market Presence

CIMB Group Holdings strategically tailors its market presence, particularly in Singapore, by focusing on high-potential niches. This involves concentrating efforts on specific customer segments, such as the Malaysian community residing in Singapore, and actively working to increase its market share within the consumer and commercial banking sectors.

This targeted approach allows CIMB to optimize its resource allocation, ensuring that investments are directed towards areas with the greatest potential for growth and profitability. By addressing the unique needs and opportunities within these key segments, CIMB aims to solidify its competitive position.

- Singapore Market Focus: Concentration on Malaysian community and consumer/commercial banking.

- Resource Optimization: Directing investments to high-potential niches.

- Competitive Strengthening: Enhancing position in key banking segments.

- Customer Needs Alignment: Addressing specific market opportunities.

CIMB Group Holdings leverages a dual-pronged approach to its physical and digital "Place" strategy. Its extensive network of over 600 branches across ASEAN in early 2025 provides essential face-to-face service and specialized advice, catering to customers who prefer traditional banking. Simultaneously, a robust digital presence, exemplified by the CIMB Clicks platform and the CIMB OCTO App, ensures 24/7 accessibility and convenience for over 15 million retail customers, with digital transactions accounting for more than 90% of all customer interactions in 2024.

| Channel | Reach (H1 2024) | Key Features | Strategic Importance |

|---|---|---|---|

| Physical Branches | 600+ across ASEAN | Face-to-face service, specialized advice | Accessibility for traditional banking preferences |

| Digital Platforms (CIMB Clicks, OCTO App) | 15M+ retail customers | 24/7 access, self-service, payments, digital transactions | Digital-first strategy, operational efficiency |

Same Document Delivered

CIMB Group Holdings 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of CIMB Group Holdings' 4P's Marketing Mix is fully complete, ready to guide your strategic decisions. You are viewing the exact version of the analysis you'll receive, ensuring transparency and immediate value.

Promotion

CIMB Group Holdings leverages integrated marketing campaigns to reinforce its brand promise, Moving forward with you. These initiatives ensure a consistent message across diverse platforms, amplifying brand reach and engagement. For instance, in 2024, CIMB saw a significant uplift in digital engagement metrics following its integrated campaign featuring the mascot Octo, with social media mentions increasing by 15%.

Their recent 3D Digital Out-of-Home (DOOH) advertising, showcasing Octo, effectively captured public attention, boosting brand visibility in key urban centers. This innovative approach aims to create a memorable brand experience, fostering a sense of connection and shared celebration with consumers. The campaign's success was evident in a 10% increase in foot traffic to CIMB branches in areas where the DOOH ads were prominently displayed during the Q4 2024 period.

CIMB heavily emphasizes digital engagement for its promotions, often embedding them within its CIMB OCTO App and CIMB Clicks platforms. These digital pushes frequently feature attractive incentives like cashback, preferential interest rates, and participation in prize draws.

These app-centric promotions are strategically crafted to boost user activity within the mobile banking applications, encouraging customers to explore and adopt new products. For instance, in Q1 2024, CIMB reported a significant increase in digital transactions, directly correlating with the rollout of targeted in-app offers.

CIMB Group Holdings emphasizes its sustainability commitment through robust communication, actively promoting its Green, Social, and Sustainable Impact Products and Services (GSSIPS). This strategy highlights their role in supporting SMEs' green transitions and encouraging sustainable living.

The bank's communication efforts focus on tangible actions, such as their ambition to achieve significant decarbonization targets by 2030. For instance, CIMB aims to facilitate RM30 billion in sustainable finance by 2024, showcasing a concrete commitment to environmental, social, and governance (ESG) principles.

These communications are crucial for building CIMB's reputation as a responsible and forward-thinking financial institution. By sharing their progress and initiatives, they aim to attract environmentally conscious customers and investors, thereby strengthening brand loyalty and market position.

Customer-Centric Messaging

CIMB Group's messaging is laser-focused on what matters most to customers, highlighting tangible advantages like competitive interest rates and fee-free services. For instance, their digital platforms are designed for seamless accessibility, catering to the modern consumer's need for convenience. This direct benefit communication is a cornerstone of their strategy.

The bank actively showcases its commitment to customer well-being through targeted campaigns. The 'Stronger@6' campaign in the Philippines, launched in 2024, exemplifies this by emphasizing CIMB's stability and dedication to offering valuable banking experiences. Such initiatives aim to foster a strong sense of reliability and partnership.

This customer-centric philosophy is crucial for building enduring trust. By consistently aligning their communications with customer aspirations and needs, CIMB aims to create a resonance that goes beyond transactional banking. This approach is vital in a competitive financial landscape.

- Customer Benefit Focus: Messaging prioritizes clear advantages like higher interest rates and zero fees.

- Campaign Example: The 2024 'Stronger@6' initiative in the Philippines highlights reliability and rewarding experiences.

- Trust Building: A consistent customer-centric approach fosters deeper connections and loyalty.

- Digital Accessibility: Emphasis on ease of access to banking services through digital platforms.

Public Relations and Corporate Social Responsibility (CSR)

CIMB Group actively cultivates a positive brand image through robust public relations and impactful Corporate Social Responsibility (CSR) programs. These initiatives are designed to resonate with stakeholders and underscore the group's commitment to broader societal well-being.

Recent CSR efforts by CIMB have focused on tangible community impact. For instance, their partnerships aim to uplift underserved student populations, providing educational resources and mentorship. Furthermore, CIMB has extended support to healthcare Small and Medium Enterprises (SMEs), enhancing their financial flexibility and operational capacity.

These activities demonstrate CIMB's dedication to contributing positively beyond its primary financial services. By investing in education and supporting vital sectors like healthcare SMEs, CIMB reinforces its role as a responsible corporate citizen.

- Brand Perception: CIMB's PR and CSR activities are crucial for building trust and a favorable public image.

- Societal Impact: Initiatives like supporting underserved students and healthcare SMEs directly contribute to community development.

- Strategic Alignment: These efforts align with CIMB's broader strategy to be a responsible financial institution.

- Stakeholder Engagement: Demonstrating commitment to social causes fosters stronger relationships with customers, employees, and the wider community.

CIMB's promotional strategy heavily emphasizes digital channels, utilizing the CIMB OCTO App and CIMB Clicks for targeted offers like cashback and preferential rates. This focus on app-centric promotions aims to drive user engagement and product adoption. For example, Q1 2024 saw a notable rise in digital transactions directly linked to these in-app incentives.

The bank also employs integrated marketing campaigns, such as the 2024 Octo mascot initiative, which boosted digital engagement by 15%. Innovative advertising, like their 3D Digital Out-of-Home displays, enhanced brand visibility and led to a 10% increase in branch foot traffic in key urban areas during Q4 2024.

CIMB communicates its commitment to sustainability by promoting Green, Social, and Sustainable Impact Products and Services (GSSIPS), aiming to facilitate RM30 billion in sustainable finance by 2024. This highlights their dedication to ESG principles and attracts environmentally conscious customers.

Customer-centric messaging, exemplified by the 2024 'Stronger@6' campaign in the Philippines, focuses on tangible benefits like competitive rates and fee-free services, building trust and loyalty. Their digital platforms prioritize accessibility, catering to modern consumer needs for convenience.

Price

CIMB Group Holdings actively leverages competitive deposit rates as a key component of its marketing mix, aiming to attract and retain a broad customer base. This strategy is evident in their offerings of attractive interest rates across various deposit products, including savings and fixed deposit accounts.

In specific markets, CIMB has distinguished itself by offering market-leading deposit rates, a tactic that has proven effective in bolstering liquidity. For instance, in Malaysia, as of early 2024, several CIMB savings accounts offered interest rates that were competitive with or exceeded the prevailing base lending rates, making them appealing to depositors seeking higher yields.

These attractive deposit rate strategies are not static; CIMB regularly evaluates and adjusts them to align with evolving market conditions and economic trends. This dynamic approach ensures their deposit products remain appealing and contribute to the group's overall financial strength and market position.

CIMB Group Holdings' loan pricing strategy for personal, auto, and corporate loans is dynamic, adapting to current market conditions and the bank's risk tolerance. This approach ensures competitive interest rates, often adjusted in line with central bank policy and economic indicators, to foster prudent loan growth and maintain strong asset quality.

CIMB Group Holdings prioritizes transparent fee structures, offering customers clear and readily available information on all charges. This commitment extends to detailing transaction fees, administrative costs for early withdrawals, and other service-related expenses, ensuring customers are fully informed about the financial implications of their banking activities.

For instance, CIMB's standard savings account may have a minimal monthly administrative fee, often below RM1 (approximately $0.21 USD as of mid-2024), while specific transaction fees, such as for interbank transfers, are clearly outlined in their service brochures and online platforms, typically ranging from RM0.50 to RM2.00 per transaction.

Promotional Pricing and Incentives

CIMB Group Holdings actively uses promotional pricing and incentives to boost customer acquisition and product uptake. For instance, in 2024, they ran a campaign offering up to RM100 cashback on new CIMB debit card activations, alongside a 3.88% p.a. interest rate for their FastSaver account for the first six months for new sign-ups. These tactics are crucial for attracting new clientele and fostering loyalty among existing customers.

The bank’s incentive structure is designed to drive engagement across its diverse financial products. Recent initiatives include:

- Cashback Promotions: Offering direct monetary rewards for using CIMB debit or credit cards, with specific campaigns in early 2025 targeting online spending, providing up to 5% cashback.

- High-Interest Rate Campaigns: Introducing limited-time special interest rates on savings accounts and fixed deposits to attract new funds, with some accounts in 2024 offering rates exceeding 4% p.a.

- Prize Draws and Rewards: Incentivizing increased transaction volumes or new account openings with opportunities to win substantial prizes, such as luxury vehicles or travel vouchers, a strategy that saw a 15% increase in new account openings during Q3 2024.

Value-Based Pricing for Business Solutions

CIMB Group Holdings adopts a value-based pricing strategy for its commercial and wholesale banking clients, particularly for bespoke financial solutions. This approach ensures that the cost of services like tailored credit facilities, advanced cash management, and treasury products directly correlates with the complexity, scale, and the tangible benefits these offerings deliver to businesses.

For instance, in 2024, CIMB's focus on digital transformation in its wholesale banking segment likely means pricing for advanced treasury solutions is benchmarked against the efficiency gains and risk mitigation they provide. This strategy is crucial for maintaining competitiveness in a market where clients increasingly seek solutions that offer clear strategic advantages.

The perceived value is a key determinant, meaning pricing for sophisticated cash management systems would reflect the potential for improved liquidity, reduced operational costs, and enhanced working capital management for the client. This client-centric pricing model underscores CIMB's commitment to delivering strategic partnerships rather than just transactional services.

- Value-Based Pricing: Aligns costs with the complexity, scope, and perceived benefits of customized financial solutions.

- Client Benefits: Pricing reflects strategic advantages gained from services like tailored credit, cash management, and treasury products.

- Market Competitiveness: Ensures offerings are priced competitively based on the tangible value delivered to businesses.

- Digital Integration: Pricing for digital financial tools is benchmarked against efficiency and risk mitigation improvements in 2024/2025.

CIMB Group Holdings employs a multi-faceted pricing strategy that encompasses competitive deposit rates, dynamic loan pricing, and transparent fee structures to attract and retain customers. Promotional pricing and value-based strategies are also key, particularly for wholesale banking clients, ensuring alignment with market conditions and client benefits.

CIMB's pricing is designed to offer value, with deposit rates often exceeding market averages to boost liquidity, as seen with savings accounts offering rates competitive with or above base lending rates in Malaysia during early 2024. Loan pricing is agile, adjusting with central bank policies and economic indicators to foster growth while maintaining asset quality.

The bank also utilizes promotional pricing, such as cashback on debit card activations and enhanced interest rates on new accounts in 2024, to drive customer acquisition. For its commercial clients, value-based pricing ensures that the cost of bespoke financial solutions reflects the tangible benefits and efficiency gains delivered, a strategy reinforced by digital integration in 2024/2025.

CIMB's fee transparency is demonstrated by minimal administrative fees on standard accounts, often under RM1, and clearly communicated transaction fees, typically between RM0.50 to RM2.00. These pricing elements are crucial for building trust and encouraging engagement across their product suite.

4P's Marketing Mix Analysis Data Sources

Our CIMB Group Holdings 4P's Marketing Mix Analysis is built upon a comprehensive review of official company disclosures, including annual reports and investor presentations. We also integrate insights from industry analysis, market research reports, and competitive benchmarking to ensure a robust understanding of their strategic positioning.