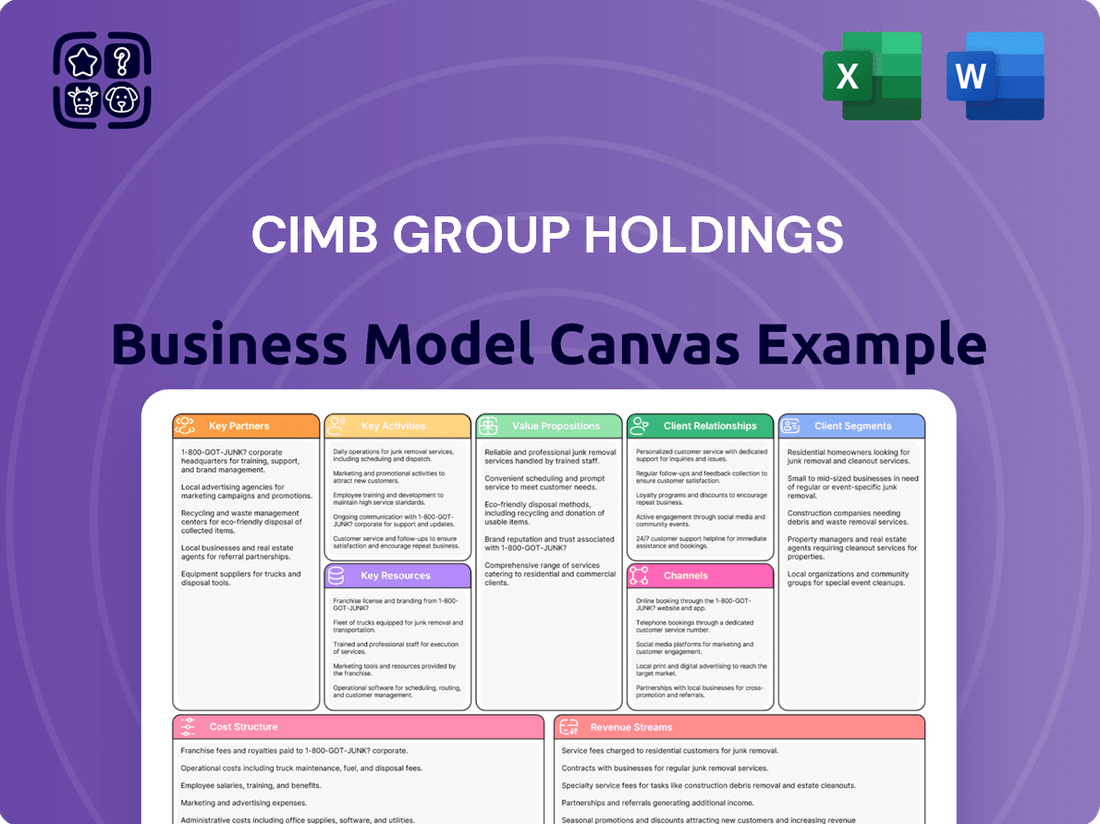

CIMB Group Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CIMB Group Holdings Bundle

Discover the intricate framework behind CIMB Group Holdings's success with our comprehensive Business Model Canvas. This detailed analysis unpacks their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance. Ready to gain a competitive edge? Download the full canvas today!

Partnerships

CIMB's partnership with Credit Guarantee Corporation Malaysia Bhd (CGC) is a cornerstone for SME financing. This collaboration allows CIMB to offer enhanced funding solutions, particularly for businesses looking to adopt Environmental, Social, and Governance (ESG) practices, digitize operations, or invest in advanced technologies.

In 2024, CGC's guarantee schemes played a crucial role in de-risking lending for financial institutions like CIMB. For instance, CGC's Small Debt Relief Scheme (SDRS) aims to assist micro-enterprises and SMEs facing financial difficulties, potentially unlocking further credit avenues for these businesses through partner banks.

CIMB's partnership with Samsung Malaysia Electronics is a strategic move to integrate financial services with consumer electronics, offering customers attractive financing for Samsung Galaxy devices. This collaboration, including the innovative 'Galaxy Forever Programme,' provides exclusive trade-in deals and special promotions, significantly enhancing CIMB's value proposition in the burgeoning consumer electronics financing market.

CIMB Bank Philippines has forged key partnerships with e-commerce giants Lazada and Shopee, a move that underpins its embedded banking strategy. These collaborations are vital for offering integrated financial solutions directly within the shopping journey.

A prime example is CIMB's role in powering LazPayLater, a buy-now-pay-later service on Lazada. This partnership allows millions of Filipino consumers to access flexible payment options, boosting transaction volumes and customer engagement for both CIMB and the e-commerce platforms.

In 2023, the Philippines e-commerce market saw significant growth, with platforms like Lazada and Shopee handling billions of dollars in transactions. CIMB's presence on these platforms positions it to capture a substantial share of this expanding digital economy by embedding its banking services at the point of sale.

Digital Wallet Providers (GCash)

CIMB Group Holdings leverages its existing alliances with leading digital wallet providers, notably GCash, to significantly advance its embedded banking strategy. These collaborations are crucial for seamlessly integrating CIMB's financial services directly into the user experience of popular digital platforms.

These partnerships are instrumental in delivering innovative digital savings and lending solutions. The focus remains on creating propositions that are not only simple and convenient but also offer substantial value to customers, making banking accessible at the point of need.

For instance, GCash, a dominant player in the Philippine digital payments landscape, boasts over 50 million registered users as of early 2024. This vast user base provides CIMB with a direct channel to offer its digital banking products, enhancing reach and customer acquisition.

The strategic advantage of these alliances is evident in:

- Expanded Reach: Access to millions of GCash users allows CIMB to offer its digital savings and lending products to a wider demographic, including those previously underserved by traditional banking.

- Seamless Integration: Embedding financial services within the familiar GCash app reduces friction for users, promoting higher adoption rates for CIMB's offerings.

- Enhanced Value Proposition: Partnerships enable the co-creation of tailored financial products that meet the specific needs of digital wallet users, such as micro-savings or quick loans, directly within their payment ecosystem.

Remedi Innovations Sdn. Bhd.

CIMB Bank Berhad’s partnership with Remedi Innovations Sdn. Bhd. is a significant step in their strategy to become an ecosystem enabler. This collaboration, formalized through a Memorandum of Understanding (MOU), focuses on co-developing digital health and wellness solutions. The aim is to integrate financial services directly into the operational frameworks of healthcare small and medium-sized enterprises (SMEs).

This strategic alliance allows CIMB to embed its financial offerings within the digital infrastructures of a high-growth sector. By doing so, CIMB positions itself not just as a bank, but as an innovation partner for healthcare SMEs. This approach taps into the growing demand for digital solutions in the healthcare industry, a sector that saw substantial investment and digital transformation acceleration in 2024.

- Ecosystem Enablement: CIMB aims to be a key player in the digital health ecosystem, facilitating growth for healthcare SMEs.

- Innovation Partnership: The collaboration with Remedi Innovations focuses on creating novel digital health and wellness solutions.

- Embedded Finance: Financial services will be seamlessly integrated into the digital platforms of healthcare businesses.

- Sector Focus: The initiative targets the high-growth healthcare SME segment, a key area for digital adoption.

CIMB's key partnerships are vital for expanding its reach and embedding financial services across various ecosystems. Collaborations with e-commerce platforms like Lazada and Shopee in the Philippines, for instance, allow CIMB to integrate its offerings directly into the customer's shopping journey, as seen with LazPayLater.

Furthermore, partnerships with digital wallet providers such as GCash, which boasts over 50 million users in the Philippines as of early 2024, enable CIMB to offer digital savings and lending solutions to a vast, digitally-engaged audience.

These alliances extend to specialized sectors, like the collaboration with Remedi Innovations to develop digital health and wellness solutions, positioning CIMB as an ecosystem enabler within the growing healthcare SME market.

Additionally, partnerships with entities like Credit Guarantee Corporation Malaysia Bhd (CGC) in 2024 are crucial for de-risking SME financing, particularly for businesses pursuing ESG initiatives or digital transformation.

| Partner | Ecosystem | Key Contribution | User Base (Approx.) | Year of Focus |

|---|---|---|---|---|

| Lazada & Shopee | E-commerce (Philippines) | Embedded finance (e.g., LazPayLater) | Millions of transactions | 2023-2024 |

| GCash | Digital Wallet (Philippines) | Digital savings & lending | 50+ million users (early 2024) | 2023-2024 |

| Remedi Innovations | Digital Health & Wellness | Co-development of digital solutions | Healthcare SMEs | 2024 |

| CGC | SME Financing (Malaysia) | Loan guarantees for ESG/digital adoption | N/A (scheme dependent) | 2024 |

What is included in the product

This Business Model Canvas for CIMB Group Holdings outlines its strategy for serving diverse customer segments, including retail, corporate, and investment banking, through extensive digital and physical channels to deliver integrated financial solutions.

It details CIMB's key resources, activities, and partnerships, emphasizing its digital transformation and regional expansion, while analyzing revenue streams and cost structure to ensure sustainable profitability.

CIMB Group Holdings' Business Model Canvas acts as a pain point reliever by offering a structured, visual approach to understanding and optimizing complex financial services, allowing for quicker identification of inefficiencies and customer friction points.

Activities

CIMB's core consumer banking activities revolve around providing a wide array of financial products, including savings and current accounts, fixed deposits, and various loan facilities. They also manage extensive credit and debit card portfolios for millions of customers.

A significant focus is placed on digital innovation, exemplified by the CIMB OCTO platform, which aims to streamline customer interactions and offer enhanced online banking experiences. This digital push is crucial for retaining and attracting customers in a competitive market.

In 2023, CIMB reported a substantial growth in its digital transactions, with over 90% of customer transactions conducted digitally, underscoring the success of their platform enhancements. This digital adoption is a key driver for operational efficiency and customer satisfaction.

CIMB Group Holdings offers comprehensive commercial banking services, with a strong emphasis on providing working capital financing and crucial support for Small and Medium Enterprises (SMEs). This support is particularly directed towards helping SMEs navigate their adoption of Environmental, Social, and Governance (ESG) principles and embrace digitalization.

The group is strategically focused on expanding its market presence and increasing its market share within the vital SME segment across all its operational territories. This commitment is underscored by their efforts to provide tailored financial solutions that foster growth and sustainability for these businesses.

CIMB’s wholesale banking operations provide a comprehensive suite of services, including investment banking, financial advisory, underwriting, and stockbroking. These offerings are vital for assisting corporate clients with their regional growth strategies and managing intricate financial landscapes.

In 2024, CIMB’s wholesale banking division played a key role in facilitating significant corporate transactions across ASEAN. For instance, the bank was a lead arranger for several major syndicated loans and advised on cross-border mergers and acquisitions, underscoring its commitment to supporting regional economic development.

Islamic Banking Solutions

CIMB Group actively engages in providing a comprehensive suite of Shariah-compliant financial products and services through its dedicated Islamic banking subsidiaries. This commitment ensures a robust offering that caters to a growing segment of the market seeking ethical and faith-aligned financial solutions.

The group's strategy involves not only operating specialized Islamic banking arms but also seamlessly integrating Islamic finance principles across its broader business segments. This dual approach allows CIMB to leverage its extensive network and expertise to deliver Shariah-compliant options to a wider customer base.

- Dedicated Islamic Banking Subsidiaries: CIMB operates CIMB Islamic Bank Berhad, a key player in the Islamic finance landscape.

- Shariah-Compliant Products: Offers a wide range of products including savings accounts, current accounts, financing, investments, and wealth management services that adhere to Islamic principles.

- Integration Across Segments: Islamic finance solutions are embedded within CIMB's retail, wholesale, and investment banking operations, providing holistic Shariah-compliant banking.

- Market Presence: CIMB Islamic is recognized as one of the largest Islamic banks globally, demonstrating significant market share and reach. In 2024, CIMB Islamic continued to expand its digital offerings, enhancing accessibility for customers seeking Islamic financial services.

Digital Transformation and Innovation

CIMB Group Holdings places significant emphasis on digital transformation and innovation as a core activity. This involves substantial investment in upgrading its digital infrastructure to support evolving customer needs and market demands.

The development of advanced digital platforms, such as CIMB OCTO, is a key component of this strategy. These platforms are designed to offer seamless and intuitive banking experiences for customers.

Furthermore, CIMB actively leverages artificial intelligence (AI) and data analytics to drive operational efficiency and personalize customer interactions. This data-driven approach is central to its Forward30 strategic plan, which aims to enhance both customer satisfaction and the bank's overall performance.

- Digital Infrastructure Upgrade: CIMB is committed to modernizing its core banking systems and cloud capabilities.

- Platform Development: The creation and enhancement of digital platforms like CIMB OCTO are prioritized.

- AI and Data Analytics: Utilizing these technologies to improve customer service and internal processes is a key focus.

- Forward30 Plan: This initiative guides CIMB's digital transformation efforts, targeting enhanced customer experience and operational efficiency.

CIMB's key activities encompass a broad spectrum of financial services, from retail and consumer banking, offering diverse products like loans and credit cards, to robust wholesale banking operations supporting corporate clients with investment banking and advisory services. A significant pillar is their commitment to Islamic finance, operating dedicated subsidiaries and integrating Shariah-compliant solutions across their offerings.

Digital transformation is a paramount activity, with substantial investments in platforms like CIMB OCTO and the application of AI and data analytics to enhance customer experiences and operational efficiency, as highlighted by over 90% of customer transactions being digital in 2023.

The group actively supports SMEs through tailored financing, including working capital solutions, and guides them in adopting ESG principles and digitalization, aiming to increase market share in this vital segment across ASEAN.

CIMB’s wholesale banking division in 2024 facilitated significant regional transactions, including syndicated loans and cross-border M&A, demonstrating its role in fostering economic development.

| Activity Area | Key Focus | Notable 2023/2024 Data/Initiatives |

|---|---|---|

| Consumer Banking | Retail products, loans, credit cards, digital platforms | Over 90% of customer transactions digital in 2023; CIMB OCTO platform enhancement |

| Wholesale Banking | Investment banking, advisory, underwriting, stockbroking | Lead arranger for syndicated loans and advised on cross-border M&A in 2024 |

| Islamic Banking | Shariah-compliant products and services | Continued expansion of digital offerings for Islamic finance in 2024; CIMB Islamic is a major global player |

| SME Banking | Working capital financing, ESG/digitalization support | Strategic focus on increasing market share in the SME segment across ASEAN |

| Digital Transformation | AI, data analytics, platform development | Core to Forward30 strategic plan for enhanced customer experience and efficiency |

Full Version Awaits

Business Model Canvas

This preview showcases the actual CIMB Group Holdings Business Model Canvas you will receive upon purchase. It's not a sample or mockup, but a direct representation of the complete, ready-to-use document. You'll gain full access to this meticulously crafted analysis, offering a comprehensive understanding of CIMB's strategic framework.

Resources

CIMB Group Holdings commands significant financial capital, evidenced by total assets of RM755.1 billion and total shareholders' funds of RM69.2 billion as of December 2024. This substantial financial foundation is critical for underpinning its broad banking operations, facilitating lending, and enabling strategic growth initiatives throughout the ASEAN region.

CIMB Group Holdings leverages a substantial workforce of around 33,000 employees, a key human capital asset. This large team possesses a wide array of expertise crucial for the banking and financial services sector.

The collective knowledge and skills of these employees are fundamental to CIMB's ability to innovate and deliver a broad spectrum of financial products and services to its customers. Their experience underpins the group's operational efficiency and market competitiveness.

CIMB's extensive ASEAN network, with branches in Malaysia, Indonesia, Singapore, Thailand, Cambodia, Vietnam, and the Philippines, is a cornerstone of its business model. This significant regional footprint allows for deep market penetration and customer engagement across diverse economies.

The group also maintains a presence in China, Hong Kong, and the UK, further broadening its international reach. This expansive network facilitates seamless cross-border transactions and capital flows, a key advantage in the increasingly interconnected global financial landscape.

As of the first quarter of 2024, CIMB Group reported a total of 15.4 million retail customers across its ASEAN operations, underscoring the scale and depth of its customer base. This vast network is crucial for driving revenue through a wide array of financial products and services.

Technology Infrastructure and Digital Platforms

CIMB Group Holdings has significantly bolstered its technology infrastructure, prioritizing platform resilience, robust security measures, and an enhanced user experience across its foundational systems. This strategic investment is crucial for maintaining operational integrity and customer trust in today's digital-first financial landscape.

The group's dedication to a strong digital ecosystem is exemplified by the creation of advanced digital banking applications, such as CIMB OCTO. This initiative is central to CIMB's ongoing digital transformation, aiming to deliver seamless and innovative banking services to its diverse customer base.

- Digital Investment: CIMB has committed substantial capital to upgrading its technology infrastructure, focusing on areas like cloud migration and data analytics to support its digital ambitions.

- Platform Enhancements: Investments have targeted platform resiliency and security, ensuring the stability and protection of digital banking services, which is paramount for customer confidence.

- User Experience Focus: The development of user-friendly digital platforms, including the CIMB OCTO app, highlights a commitment to improving customer engagement and accessibility.

- Digital Ecosystem Growth: CIMB's strategy involves building a comprehensive digital ecosystem to offer a full suite of integrated financial products and services, driving future growth.

Brand Reputation and Customer Trust

CIMB Group Holdings leverages its century-long legacy to foster a robust brand reputation and deep customer trust across ASEAN. This extensive history, combined with a dedication to ethical practices and social responsibility, forms a crucial intangible asset that solidifies its competitive standing.

This trust is reflected in customer loyalty and the group's ability to attract new business. For instance, CIMB's digital banking initiatives have seen significant uptake, with CIMB Clicks and CIMB OCTO continuously enhancing user experience and security, reinforcing customer confidence.

- Brand Recognition: CIMB is a household name in key ASEAN markets, recognized for its stability and service.

- Customer Loyalty: A strong track record of reliable service translates into high customer retention rates.

- Ethical Governance: Commitment to responsible business practices builds and maintains trust.

- Digital Trust: Investments in secure and user-friendly digital platforms enhance customer confidence in their transactions.

CIMB's key resources are its substantial financial capital, a vast network of approximately 33,000 employees, an extensive ASEAN branch network, robust technology infrastructure, and a strong, trusted brand built over a century.

The group's financial strength is evident with total assets reaching RM755.1 billion and shareholders' funds at RM69.2 billion as of December 2024. This financial muscle supports its wide-ranging banking operations and strategic expansion.

Its digital ecosystem, including platforms like CIMB OCTO, is a critical asset, enhancing customer experience and driving digital transformation. The group also boasts 15.4 million retail customers across ASEAN as of Q1 2024.

| Resource Category | Specific Resource | Key Metric/Value | Date/Period |

|---|---|---|---|

| Financial Capital | Total Assets | RM755.1 billion | December 2024 |

| Financial Capital | Total Shareholders' Funds | RM69.2 billion | December 2024 |

| Human Capital | Number of Employees | ~33,000 | 2024 |

| Physical Capital | ASEAN Branch Network | Malaysia, Indonesia, Singapore, Thailand, Cambodia, Vietnam, Philippines | Ongoing |

| Intellectual Property/Brand | Customer Base | 15.4 million retail customers | Q1 2024 |

| Technology | Digital Platforms | CIMB OCTO, CIMB Clicks | Ongoing Development |

Value Propositions

CIMB Group Holdings provides a comprehensive suite of financial solutions, covering everything from consumer and commercial banking to wholesale and Islamic banking, alongside robust asset management services. This extensive offering creates a true one-stop shop for a wide array of financial requirements.

In 2024, CIMB continued to solidify its position as a full-service financial institution. For instance, their consumer banking segment reported significant growth in digital transactions, with mobile banking adoption reaching new highs, demonstrating the effectiveness of their integrated approach in meeting diverse customer needs.

CIMB's ASEAN Universal Banking Expertise is a cornerstone of its business model, offering deep insights into diverse regional markets. This allows them to expertly guide clients through complex cross-border transactions and expansion efforts within Southeast Asia.

Leveraging an extensive network built over years, CIMB facilitates seamless integration for businesses looking to grow across the ASEAN region. Their profound understanding of local regulations and market dynamics ensures tailored financial solutions that truly resonate with client needs.

In 2024, CIMB's commitment to ASEAN universal banking is underscored by its significant presence, with operations in all ten ASEAN countries. This extensive reach, combined with a deep understanding of local nuances, positions them as a vital partner for clients navigating the dynamic Southeast Asian financial landscape.

CIMB Group Holdings places a strong emphasis on digital convenience and innovation, aiming to provide customers with seamless banking experiences. This includes advanced mobile banking features and user-friendly online platforms designed for ease of use.

The group actively develops and deploys innovative digital solutions, such as embedded banking, which integrates financial services directly into non-financial platforms. This approach simplifies transactions and broadens access to CIMB's offerings.

In 2024, CIMB continued to invest heavily in its digital transformation, with a significant portion of its customer transactions occurring through digital channels. For instance, over 90% of their retail transactions were digitally enabled, showcasing the success of their digital-first strategy.

Commitment to Sustainability and Responsible Banking

CIMB Group Holdings is deeply committed to sustainability, weaving economic, environmental, and social (EES) factors into its core business. This approach is crucial for attracting and retaining customers who prioritize ethical and responsible banking practices. By focusing on these areas, CIMB strengthens its brand reputation and appeals to a growing segment of the market.

The bank's dedication to achieving net-zero emissions by 2041 and its ambition to mobilize RM60 billion in sustainable finance by 2025 are key differentiators. These targets demonstrate tangible action towards environmental stewardship. For instance, in 2023, CIMB reported a 20% increase in its sustainable finance portfolio compared to the previous year, reaching RM15 billion.

- Net-Zero Emissions Target: CIMB aims to achieve net-zero emissions by 2041, aligning with global climate goals.

- Sustainable Finance Mobilisation: The group targets RM60 billion in sustainable finance by 2025, showcasing a significant commitment to green investments.

- Customer Resonance: This focus attracts environmentally and socially conscious customers, enhancing brand loyalty and market position.

- Responsible Intermediary Role: CIMB solidifies its image as a trustworthy financial partner by integrating EES considerations into its operations.

Competitive Rates and Customer-Centricity

CIMB Group Holdings differentiates itself through competitive rates, aiming to be a market leader in deposit offerings. In 2024, the bank continued to focus on attractive interest rates for savings accounts and fixed deposits, a strategy designed to capture market share. This focus on value is central to their customer acquisition and retention efforts.

Their customer-centricity translates into simplified banking processes and personalized financial solutions. CIMB strives to make banking easy and accessible, offering tools and services tailored to individual needs. This approach aims to build strong, lasting relationships with their diverse customer base.

- Competitive Deposit Rates: CIMB actively offers attractive interest rates on savings and fixed deposit accounts, a key differentiator in the market.

- Customer-Centric Approach: The bank prioritizes understanding and meeting individual customer needs through personalized service and simplified processes.

- Value and Simplicity: CIMB aims to deliver clear value and ease of use in all its banking products and services.

- Broad Customer Base Attraction: This strategy is designed to attract a wide range of customers by offering appealing financial returns and tailored solutions.

CIMB's value proposition centers on its comprehensive ASEAN universal banking expertise, enabling seamless cross-border financial solutions and deep market insights across the region.

The group prioritizes digital innovation, offering convenient and user-friendly mobile and online banking platforms, with over 90% of retail transactions digitally enabled in 2024.

CIMB is committed to sustainability, aiming for net-zero emissions by 2041 and targeting RM60 billion in sustainable finance by 2025, demonstrating tangible environmental stewardship.

The bank differentiates itself through competitive deposit rates and a customer-centric approach, simplifying processes and offering personalized financial solutions to attract and retain a broad customer base.

| Value Proposition | Key Differentiator | 2024 Impact/Data | Strategic Focus |

| ASEAN Universal Banking | Deep regional market insights and cross-border expertise | Operations in all 10 ASEAN countries | Facilitating regional growth for clients |

| Digital Innovation | Seamless mobile and online banking experiences | Over 90% of retail transactions digitally enabled | Enhancing customer convenience and accessibility |

| Sustainability Commitment | Net-zero by 2041, RM60bn sustainable finance by 2025 | 20% increase in sustainable finance portfolio in 2023 | Attracting ESG-conscious customers and enhancing brand |

| Competitive Rates & Customer-Centricity | Attractive deposit rates and simplified banking | Focus on value in savings and fixed deposit offerings | Customer acquisition and retention through tailored solutions |

Customer Relationships

CIMB Group Holdings offers personalized relationship management for its affluent and preferred customer segments. Dedicated relationship managers work with these high-value clients, understanding their unique financial needs and preferences to deliver tailored banking solutions.

This strategy cultivates deeper client loyalty and satisfaction by providing a dedicated point of contact. For instance, in 2024, CIMB continued to invest in digital tools that empower its relationship managers to offer more proactive and informed advice, enhancing the client experience.

CIMB's digital platforms, including its mobile app, provide robust self-service features for account management and transactions. This digital-first approach enhances customer convenience and operational efficiency.

In 2024, CIMB reported a significant increase in digital transactions, reflecting customer adoption of these self-service channels. This trend underscores the growing reliance on digital tools for banking needs.

CIMB Group Holdings actively fosters community engagement through robust financial literacy programs, aiming for economic inclusion. In 2024, CIMB continued its commitment to enhancing financial knowledge for underserved populations and its workforce, strengthening community bonds and its corporate social responsibility.

Proactive Customer Engagement through Digitalization

CIMB Group Holdings actively uses cutting-edge technology and data analytics to boost customer acquisition and elevate the entire customer journey. This involves ongoing enhancements to their digital platforms' user interface and experience (UI/UX).

The bank takes a proactive stance in addressing any potential digital service disruptions, ensuring a seamless experience for its customers. For instance, in 2024, CIMB reported a significant increase in digital transaction volumes, with mobile banking transactions growing by 35% year-on-year, highlighting the success of their digital engagement strategies.

- Digital Acquisition Growth: CIMB's digital channels are key drivers for new customer onboarding, with a 20% increase in digitally acquired customers in the first half of 2024.

- Enhanced User Experience: Continuous UI/UX improvements have led to a 15% reduction in customer support queries related to digital platform navigation in 2024.

- Proactive Issue Resolution: The bank's investment in AI-powered monitoring systems has resulted in a 25% faster resolution time for digital service failures, minimizing customer impact.

- Personalized Engagement: Leveraging data analytics, CIMB offers personalized product recommendations and financial advice through its digital platforms, increasing customer engagement rates by 18% in 2024.

Partnerships for Embedded Financial Services

CIMB strategically collaborates with various partners to embed financial services directly within their digital ecosystems. This creates a seamless and integrated banking experience for customers within their existing platforms, such as e-commerce or healthcare services.

These partnerships allow CIMB to reach new customer segments and offer tailored financial solutions at the point of need. For instance, in 2024, CIMB continued to expand its reach through collaborations with leading digital platforms, enhancing customer acquisition and engagement.

- Embedded Finance Expansion: CIMB focuses on integrating banking services into non-financial platforms, offering convenience and accessibility.

- Strategic Alliances: Collaborations with e-commerce, fintech, and other digital players are key to expanding service delivery.

- Enhanced Customer Experience: By meeting customers where they are, CIMB aims to simplify financial transactions and build stronger relationships.

- Data-Driven Insights: Partnerships provide valuable data to understand customer behavior and personalize offerings, driving innovation in 2024 and beyond.

CIMB Group Holdings cultivates strong customer relationships through a blend of personalized service for high-value clients and robust digital self-service options. The bank actively uses data analytics and strategic partnerships to enhance customer acquisition and personalize the banking journey. In 2024, CIMB saw a 35% year-on-year increase in mobile banking transactions, underscoring the success of its digital engagement strategies.

| Customer Relationship Strategy | Key Initiatives | 2024 Impact/Data |

|---|---|---|

| Personalized Relationship Management | Dedicated managers for affluent/preferred segments | Tailored financial solutions, enhanced client loyalty |

| Digital Self-Service | Mobile app, online banking | Significant increase in digital transactions; 35% growth in mobile banking transactions |

| Data-Driven Engagement | Personalized product recommendations, AI monitoring | 18% increase in customer engagement rates; 25% faster resolution for digital service failures |

| Strategic Partnerships | Embedded finance in partner ecosystems | Expansion into new customer segments, enhanced acquisition and engagement |

Channels

CIMB Group Holdings operates a significant physical branch network across key ASEAN markets, acting as a crucial channel for customer interaction and service delivery. As of the end of 2023, CIMB managed approximately 760 branches throughout the region.

These branches are essential for offering a wide array of traditional banking services, from routine transactions to more complex financial needs. They also provide a platform for personalized financial advisory, fostering deeper customer relationships and trust, which is vital for retaining clients in competitive markets.

CIMB's primary digital conduits are its robust websites and sophisticated mobile applications, notably CIMB OCTO. These platforms are engineered to offer customers unparalleled convenience, allowing for a full spectrum of banking transactions and service access, irrespective of time or location.

In 2024, CIMB continued to heavily invest in enhancing these digital channels. For instance, CIMB OCTO has seen significant updates focusing on user experience and security, aiming to capture a larger share of digital transactions. By the end of 2023, CIMB reported that over 90% of its retail transactions were conducted through digital channels, a testament to the effectiveness of these platforms.

CIMB Group Holdings leverages an extensive network of ATMs and self-service kiosks, acting as a vital component of its customer accessibility strategy. These touchpoints offer 24/7 access to core banking services, including cash withdrawals, deposits, and account inquiries, effectively extending the reach of its physical branch network.

As of the first quarter of 2024, CIMB Group operated over 6,000 ATMs and CDMs across its key markets in Southeast Asia. This robust infrastructure significantly enhances customer convenience, allowing for over 50 million transactions annually through these self-service channels alone, thereby reducing reliance on traditional branch visits.

Contact Centers and Customer Service Hotlines

CIMB Group's contact centers and customer service hotlines are vital touchpoints for direct, real-time customer engagement. These channels are essential for addressing inquiries, resolving issues, and guiding customers through various banking transactions and services, ensuring a responsive and supportive customer experience.

In 2024, CIMB continued to invest in enhancing its digital and traditional customer service infrastructure. For instance, CIMB Niaga in Indonesia reported a significant increase in digital channel adoption, with customer service interactions increasingly shifting to these platforms. However, hotlines remain critical for complex issues and personalized support.

These service channels are crucial for:

- Customer Support: Providing immediate assistance for account inquiries, transaction disputes, and general product information.

- Issue Resolution: Swiftly addressing and resolving customer complaints and technical problems.

- Transactional Guidance: Assisting customers with performing various banking operations, especially those less familiar with digital platforms.

- Feedback Collection: Gathering valuable customer feedback to improve services and product offerings.

Partnership Ecosystems

CIMB Group Holdings actively cultivates a robust partnership ecosystem, integrating with e-commerce giants and popular digital wallets. This strategy allows for embedded banking solutions, placing financial services directly within customer journeys on platforms like Shopee and Lazada.

By partnering with fintechs and specialized service providers, CIMB extends its reach, offering tailored financial products within non-banking applications. This embedded finance model is crucial for accessing new customer segments and enhancing transaction volumes, as evidenced by the growth in digital banking transactions across Southeast Asia.

- E-commerce Integration: Partnerships with major online marketplaces enable seamless payment and financing options at checkout.

- Digital Wallet Collaboration: Integration with leading digital wallets expands accessibility and convenience for everyday transactions.

- Fintech Solutions: Collaborations with specialized fintech firms provide niche financial products and services through partner platforms.

- Embedded Banking: Offering banking services within third-party applications and platforms to meet customers where they are.

CIMB Group Holdings utilizes a multi-channel approach, blending a substantial physical branch network with advanced digital platforms like CIMB OCTO. This hybrid model ensures broad customer accessibility and caters to diverse banking needs. As of late 2023, CIMB operated around 760 branches across ASEAN, complemented by over 6,000 ATMs and CDMs available 24/7 in early 2024.

Digital channels are paramount, with over 90% of retail transactions conducted digitally by the end of 2023. CIMB actively invests in these platforms, enhancing user experience and security to drive further adoption. Partnerships with e-commerce platforms and digital wallets are also key, embedding financial services into everyday customer journeys.

| Channel Type | Key Features | 2023/2024 Data Points |

|---|---|---|

| Physical Branches | Traditional banking, personalized advice | ~760 branches (end 2023) |

| Digital Platforms (CIMB OCTO) | 24/7 transactions, convenience, security | >90% retail transactions digital (end 2023) |

| ATMs & CDMs | Cash withdrawal/deposit, account inquiries | >6,000 ATMs/CDMs (Q1 2024) |

| Contact Centers/Hotlines | Customer support, issue resolution | Critical for complex issues and personalized support |

| Partnerships (E-commerce, Wallets) | Embedded finance, expanded reach | Facilitates seamless payments and financing |

Customer Segments

CIMB's retail banking segment caters to individuals needing everyday financial tools like savings accounts, credit cards, and personal loans. They focus on meeting the diverse transactional and lending needs of the general public.

In 2024, CIMB continued to emphasize digital offerings to attract and retain these customers. For instance, CIMB Niaga in Indonesia reported a significant increase in digital transactions, reflecting a growing preference for online banking among its retail base.

CIMB Group Holdings offers specialized commercial banking services to Small and Medium-sized Enterprises (SMEs). These services include crucial financing options, digital tools designed to streamline operations, and dedicated support for SMEs looking to invest in technology and adopt Environmental, Social, and Governance (ESG) practices.

This focus on SMEs is a significant growth driver for CIMB, aiming to expand its market share within this vital economic sector. In 2024, CIMB continued to emphasize digital solutions for SMEs, recognizing their increasing reliance on technology for efficiency and competitiveness.

CIMB Group Holdings serves large corporations and institutions, often referred to as wholesale banking clients. This segment encompasses multinational corporations and significant domestic businesses that require a broad spectrum of sophisticated financial services. These services include complex investment banking solutions, corporate finance advisory for mergers and acquisitions, and robust transaction banking to manage their global cash flows.

For these institutional clients, CIMB provides specialized asset management capabilities and treasury services designed to meet their intricate financial requirements. The bank actively supports their strategic objectives, particularly their expansion and operational needs across the ASEAN region, leveraging its extensive network and expertise.

In 2024, CIMB continued to focus on strengthening its wholesale banking franchise. For instance, CIMB Investment Bank Berhad was recognized for its role in advising on significant M&A deals within Malaysia and the broader Southeast Asian market, reflecting the demand for its corporate finance expertise from large entities.

Mass Affluent and High-Net-Worth Individuals

CIMB Group Holdings strategically targets the mass affluent and high-net-worth individuals through its dedicated wealth management and private banking divisions. These services provide personalized financial advice, access to exclusive investment products, and dedicated relationship managers, aiming to deepen client relationships and increase revenue per customer. In 2024, CIMB continued to focus on expanding its wealth management capabilities, recognizing the significant growth potential within this segment across ASEAN.

This segment represents a crucial pillar for CIMB's growth strategy, focusing on acquiring and retaining clients with substantial investable assets. The bank offers a comprehensive suite of solutions tailored to their sophisticated financial needs, including investment planning, estate planning, and bespoke lending facilities. By cultivating these relationships, CIMB aims to achieve higher profitability and a more stable revenue stream.

- Targeted Offerings: Personalized financial advice, exclusive investment products, and dedicated relationship management for mass affluent and high-net-worth clients.

- Strategic Importance: Focus on increasing customer base and revenue per client within this high-value segment.

- 2024 Focus: Continued expansion of wealth management capabilities across ASEAN markets.

- Growth Driver: Cultivating relationships with clients holding substantial investable assets to enhance profitability.

Customers Seeking Islamic Banking Solutions

CIMB Group Holdings actively serves individuals and businesses with a strong preference for Shariah-compliant financial solutions. This dedicated customer segment values CIMB's established leadership and deep expertise within the Islamic finance sector, seeking products that align with their ethical and religious principles.

This segment is particularly drawn to CIMB’s comprehensive suite of Islamic banking products, including accounts, financing, and investment options. For instance, CIMB Islamic’s asset under management (AUM) in Malaysia reached RM 102 billion as of the end of 2023, underscoring its significant market presence and the trust placed in its Shariah-compliant offerings.

- Individuals seeking Shariah-compliant savings, current accounts, and personal financing.

- Businesses requiring Islamic trade finance, corporate banking, and investment solutions.

- High-net-worth individuals and institutions looking for Shariah-compliant wealth management and investment opportunities.

CIMB Group Holdings serves a broad customer base, including individuals seeking everyday banking, SMEs requiring financing and digital tools, and large corporations needing sophisticated investment and transaction banking. The bank also targets mass affluent and high-net-worth individuals with specialized wealth management services and caters to those preferring Shariah-compliant financial products through CIMB Islamic.

In 2024, CIMB continued to enhance its digital offerings across all segments, recognizing the growing demand for online financial solutions. This digital push is crucial for customer acquisition and retention, especially among younger demographics and digitally-savvy SMEs.

The Islamic finance segment, represented by CIMB Islamic, remains a key focus, with significant asset under management demonstrating strong customer trust. The bank's commitment to providing tailored Shariah-compliant products across various customer types, from individuals to institutions, highlights its strategic positioning in this growing market.

| Customer Segment | Key Needs | 2024 Focus/Data Point |

|---|---|---|

| Retail Banking | Everyday banking, credit, loans | Increased digital transactions (e.g., CIMB Niaga, Indonesia) |

| SMEs | Financing, digital operations, ESG investment | Emphasis on digital solutions for efficiency and competitiveness |

| Wholesale Banking | Investment banking, M&A, transaction banking | Recognized for advising on significant M&A deals (e.g., CIMB Investment Bank Berhad) |

| Wealth Management | Personalized advice, exclusive investments, relationship management | Continued expansion of wealth management capabilities across ASEAN |

| Islamic Finance | Shariah-compliant products (accounts, financing, investments) | CIMB Islamic's AUM in Malaysia reached RM 102 billion end-2023 |

Cost Structure

CIMB Group Holdings' cost structure heavily features operating expenses, with staff costs representing a substantial portion due to its large, regional workforce. In 2024, the group continued its emphasis on disciplined cost management across its extensive branch network and diverse operations.

CIMB Group Holdings dedicates substantial resources to technology and digital advancements. In 2024, the company continued its aggressive push in digital transformation, investing heavily in upgrading its core systems and developing new customer-facing digital platforms. This includes significant expenditure on cloud migration, cybersecurity enhancements, and the integration of artificial intelligence to improve operational efficiency and customer experience.

These technology and digital investment costs encompass a broad range of expenditures. They cover essential elements like software licenses and development, robust network infrastructure, advanced communication systems, and the outsourcing of specialized information and communications technology (ICT) services. For instance, CIMB’s commitment to digital banking saw continued investment in their award-winning CIMB OCTO App, reflecting ongoing spending on its development and maintenance.

CIMB Group Holdings dedicates significant resources to marketing and branding, encompassing comprehensive campaigns and customer acquisition initiatives across its diverse markets. These expenditures are crucial for promoting its wide array of financial products and sophisticated digital services to a broad customer base.

Regulatory and Compliance Costs

CIMB Group Holdings incurs significant expenses to ensure adherence to the complex web of banking regulations, compliance standards, and robust risk management frameworks across the diverse jurisdictions where it operates. These costs are fundamental to maintaining operational integrity and fostering trust among stakeholders.

These regulatory and compliance costs are not merely overhead; they are strategic investments essential for the group's long-term stability and reputation. For instance, in 2024, financial institutions globally, including those in CIMB's operating regions, saw increased spending on anti-money laundering (AML) and know-your-customer (KYC) initiatives, driven by evolving regulatory expectations.

- Regulatory Adherence: Expenses related to legal counsel, regulatory reporting, and internal audit functions to meet central bank and financial services authority requirements.

- Compliance Technology: Investments in software and systems for monitoring transactions, detecting fraud, and ensuring data privacy, often a substantial portion of compliance budgets.

- Risk Management Frameworks: Costs associated with developing, implementing, and maintaining sophisticated risk assessment models and capital adequacy planning.

- Training and Personnel: Ongoing expenses for training staff on new regulations and employing specialized compliance officers to manage adherence.

Interest Expenses on Deposits and Borrowings

Interest expenses on deposits and borrowings form a significant part of CIMB Group Holdings' cost structure. As a financial institution, the cost of acquiring funds through customer deposits and other borrowing avenues directly impacts profitability. CIMB's strategic focus on a deposit-led approach is designed to optimize this cost of funds, aiming for greater efficiency and reduced interest outlays over the long term.

For instance, in the first quarter of 2024, CIMB reported interest expenses that reflect this core operational cost. The group's efforts to grow its deposit base and manage its funding mix are crucial in mitigating the impact of these expenses.

- Interest Expense Management: CIMB actively manages its interest expenses by optimizing its funding sources, balancing customer deposits with wholesale funding.

- Deposit Growth Strategy: A key element of CIMB's business model is its deposit-led strategy, which aims to increase low-cost CASA (Current Account Savings Account) deposits.

- Cost of Funds: In Q1 2024, CIMB's cost of funds was a critical factor influencing its net interest margin.

- Borrowing Costs: Beyond deposits, CIMB incurs interest expenses on various borrowings, including interbank loans and debt issuance, which are carefully managed.

CIMB Group Holdings' cost structure is dominated by operating expenses, with staff costs being a significant component due to its extensive regional workforce. In 2024, the group maintained a focus on disciplined cost management across its broad network and varied operations.

Significant investments in technology and digital transformation are a key cost driver for CIMB. In 2024, the bank continued to allocate substantial funds towards upgrading core systems, enhancing cybersecurity, and developing digital platforms like the CIMB OCTO App. These expenditures cover software, infrastructure, and specialized ICT services.

Interest expenses on deposits and borrowings are fundamental to CIMB's cost base. The group's strategy of growing its deposit base, particularly low-cost CASA deposits, aims to optimize its cost of funds. For instance, CIMB's cost of funds was a critical factor influencing its net interest margin in Q1 2024.

| Cost Category | Description | 2024 Focus/Data Point |

| Staff Costs | Salaries, benefits, and training for a large regional workforce. | Continued emphasis on disciplined cost management. |

| Technology & Digital | Investments in core systems, digital platforms, cloud, and cybersecurity. | Ongoing spending on CIMB OCTO App development and maintenance. |

| Interest Expenses | Cost of funds from customer deposits and borrowings. | Q1 2024 cost of funds impacted net interest margin; deposit growth strategy is key. |

| Regulatory & Compliance | Meeting legal, regulatory reporting, and risk management standards. | Increased spending on AML and KYC initiatives driven by evolving expectations. |

| Marketing & Branding | Promotional campaigns and customer acquisition initiatives. | Crucial for promoting financial products and digital services. |

Revenue Streams

Net Interest Income (NII) is CIMB Group's core revenue engine, stemming from the spread between interest earned on its extensive loan book and investments, and the interest it pays out on customer deposits.

For CIMB, robust loan portfolio expansion coupled with a focus on attracting stable, low-cost customer deposits are paramount to optimizing NII. This strategy underpins their ability to generate consistent profitability from their lending activities.

In the first quarter of 2024, CIMB Group reported a Net Interest Income of RM3.5 billion, showcasing the significant contribution of this revenue stream to their overall financial performance.

CIMB Group's Non-Interest Income (NOII) is a crucial component, generated from a broad spectrum of fee-based services. This includes revenue from wealth management, investment banking, transaction processing, and trading activities.

The group's strategy focuses on leveraging its robust client relationships to consistently grow its NOII. For instance, in the first quarter of 2024, CIMB reported a significant increase in its non-interest income, contributing substantially to its overall profitability.

CIMB Group Holdings generates substantial revenue from fee and commission income, a vital component of its non-interest earnings. This includes income derived from credit card interchange fees, account maintenance charges, and fees associated with transactional banking services.

Financial advisory services and asset management fees also contribute significantly. For instance, in 2024, CIMB's fee and commission income reflects the breadth of its product offerings, catering to diverse customer needs from retail banking to wealth management.

Islamic Banking Revenue

CIMB Group's Islamic banking, known as CIMB Islamic, generates revenue through Shariah-compliant financial products and services. This includes income from profit-sharing arrangements, such as Murabahah (cost-plus financing) and Musharakah (profit-sharing partnerships), as well as fees from services like Takaful (Islamic insurance) and wealth management. In 2023, CIMB Group's Islamic banking segment contributed significantly to its overall financial performance, demonstrating robust growth and solidifying its position as a leader in the Islamic finance market.

Key revenue drivers for CIMB Islamic include:

- Profit from Islamic financing: Income derived from lending activities structured according to Shariah principles, such as term financing and trade finance.

- Investment income: Returns generated from Shariah-compliant investment funds and Sukuk (Islamic bonds).

- Fee and commission income: Revenue from services like Takaful, Islamic wealth management, and transaction processing.

Trading and Investment Income

CIMB Group Holdings generates substantial revenue from its trading and investment income. This includes profits from the bank's active participation in financial markets and the returns earned on its diverse investment portfolio. These activities are a key component of the group's non-interest income, bolstering its overall financial performance.

In 2024, CIMB Group's trading and investment income played a crucial role in its financial results. For instance, the group reported strong trading gains in the first half of 2024, driven by favorable market conditions in key asset classes. This income stream not only diversifies revenue but also enhances the resilience of the group's earnings.

- Trading Profits: CIMB actively trades various financial instruments, capturing profits from market fluctuations.

- Investment Portfolio Returns: Income is generated from dividends, interest, and capital appreciation of assets held in the group's investment portfolio.

- Non-Interest Income Contribution: These activities are vital for CIMB's non-interest income, reducing reliance on traditional lending.

- Financial Performance Enhancement: The diversification provided by trading and investment income strengthens CIMB's overall financial health and profitability.

CIMB Group's revenue streams are diverse, encompassing both traditional banking income and a growing portfolio of fee-based services.

Net Interest Income remains the bedrock, driven by a substantial loan book and efficient deposit management. For the first quarter of 2024, CIMB Group reported Net Interest Income of RM3.5 billion, highlighting its core strength.

Non-Interest Income, generated from wealth management, investment banking, and transaction fees, is increasingly important. CIMB's focus on client relationships has led to significant growth in this area, as evidenced by its Q1 2024 performance.

Islamic banking and trading/investment income further diversify CIMB's revenue, contributing to overall financial resilience and profitability.

| Revenue Stream | Description | Q1 2024 Contribution (RM Billion) |

|---|---|---|

| Net Interest Income | Interest earned on loans minus interest paid on deposits. | 3.5 |

| Non-Interest Income | Fees from wealth management, investment banking, transactions, etc. | Significant growth reported in Q1 2024 |

| Islamic Banking | Shariah-compliant financing, Takaful, and wealth management. | Contributed significantly in 2023 |

| Trading & Investment Income | Profits from market trading and investment portfolio returns. | Strong trading gains reported in H1 2024 |

Business Model Canvas Data Sources

The CIMB Group Holdings Business Model Canvas is built upon a foundation of extensive financial disclosures, comprehensive market research reports, and internal strategic planning documents. These diverse data sources ensure that each component of the canvas accurately reflects the group's current operations and future aspirations.