CIE Automotive PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CIE Automotive Bundle

Navigate the complex global landscape impacting CIE Automotive with our comprehensive PESTLE analysis. Understand the political shifts, economic volatilities, and technological advancements that are redefining the automotive sector. Equip yourself with actionable intelligence to anticipate challenges and seize opportunities. Download the full PESTLE analysis now and gain the strategic advantage you need.

Political factors

Governments globally are actively promoting electric vehicle (EV) adoption through a range of financial incentives. For instance, in 2024, the United States continued its federal tax credit of up to $7,500 for qualifying new EVs, while many European nations offer purchase subsidies and reduced VAT rates. These policies directly fuel demand for EV components, presenting significant growth avenues for CIE Automotive in supplying parts for this expanding market.

The sustained commitment and scale of these government initiatives are paramount for CIE Automotive's strategic planning. Policies like the European Union's Green Deal, which aims for carbon neutrality by 2050 and includes targets for vehicle emissions, signal a long-term shift. This policy landscape influences investment decisions in new EV production lines and the development of advanced battery and powertrain components.

Global trade policies, including potential tariffs on imported automotive components or vehicles, can significantly affect CIE Automotive's international supply chains and market access. For instance, the imposition of tariffs by the United States on steel and aluminum in 2018 impacted the automotive sector broadly, leading to increased costs for manufacturers relying on these materials. Similarly, evolving trade agreements between major economic blocs, such as the European Union and Mercosur, can alter manufacturing costs and competitiveness for companies like CIE Automotive, which operates extensively in both regions.

Fluctuations in these trade agreements are critical. For example, the renegotiation of trade deals can lead to shifts in import/export duties, directly influencing the cost-effectiveness of sourcing components or selling finished products in different markets. Monitoring these policies is essential for optimizing production locations and sales strategies across diverse regions where CIE Automotive has a presence.

The political stability of nations where CIE Automotive maintains manufacturing plants or procures essential raw materials directly impacts the seamless continuation of operations and the dependability of its supply chains. Geopolitical unrest, such as the ongoing tensions in Eastern Europe impacting global energy and commodity prices, can lead to production interruptions, escalate shipping expenses, and dampen consumer spending in affected markets.

For instance, a significant geopolitical event in a key sourcing region could inflate raw material costs, as seen with the volatility in steel prices following international trade disputes in 2023-2024, directly affecting CIE Automotive's cost of goods sold. Therefore, a thorough evaluation of political risks across its operational footprint, including regions like Spain and Mexico, is crucial for ensuring business resilience and safeguarding investment security.

Industrial policies supporting automotive manufacturing

Governments worldwide are actively implementing industrial policies to bolster their domestic automotive manufacturing sectors, a critical area for economies. These initiatives often include direct grants, tax incentives, and substantial research and development (R&D) funding, specifically targeting both vehicle assemblers and their vital component suppliers. For instance, the United States' Inflation Reduction Act (IRA) offers significant tax credits for electric vehicle (EV) manufacturing and battery production, aiming to reshore supply chains and encourage domestic innovation. Similarly, the European Union’s Green Deal industrial plan earmarks billions for sustainable automotive technologies.

These governmental supports are designed to de-risk investments in a capital-intensive industry, thereby fostering innovation and creating a more conducive business climate. Companies like CIE Automotive can significantly benefit from these programs. For example, in 2023, the German government extended subsidies for electric vehicle purchases and charging infrastructure, directly stimulating demand for automotive components. Understanding and strategically leveraging these forms of governmental assistance can translate into a tangible competitive edge, allowing companies to invest more aggressively in new technologies and expand their market reach.

- Governmental Support: Many nations provide financial incentives, grants, and R&D funding to boost domestic automotive production.

- Risk Reduction: These policies lower investment risks, encouraging companies to innovate and expand.

- Competitive Advantage: Companies that effectively utilize government support gain an edge in the global market.

- Example: The US Inflation Reduction Act provides substantial tax credits for EV and battery manufacturing, supporting domestic supply chains.

Regulatory frameworks for vehicle safety and emissions

Governments worldwide are consistently refining vehicle safety and emissions regulations, directly influencing the engineering and material choices for automotive components. For instance, the European Union's Euro 7 standards, expected to be phased in from 2025, will impose stricter limits on tailpipe emissions, including particulate matter and nitrogen oxides, impacting component suppliers like CIE Automotive. Failure to comply with these dynamic legal mandates necessitates substantial investment in research and development to create compliant parts.

CIE Automotive must proactively monitor and adapt to these evolving global regulatory landscapes to guarantee its product portfolio meets international standards. This includes staying informed about upcoming changes in areas such as advanced driver-assistance systems (ADAS) safety requirements and the push towards zero-emission vehicle technologies. For example, the US National Highway Traffic Safety Administration (NHTSA) continues to update its New Car Assessment Program (NCAP) ratings, which often drive manufacturers to adopt more advanced safety features in their vehicles.

- Euro 7 standards: Stricter emission limits from 2025 impacting component design.

- NHTSA NCAP ratings: Driving adoption of advanced safety features.

- R&D investment: Essential for developing compliant automotive parts.

- Global standards adherence: Crucial for market access and competitiveness.

Governmental support for the automotive sector remains a significant political factor, with many nations offering incentives for electric vehicle (EV) production and adoption. For instance, the United States Inflation Reduction Act (IRA) continues to provide substantial tax credits for EV and battery manufacturing, aiming to bolster domestic supply chains. Similarly, the European Union's Green Deal industrial plan allocates considerable funding towards sustainable automotive technologies, directly influencing investment decisions for companies like CIE Automotive.

What is included in the product

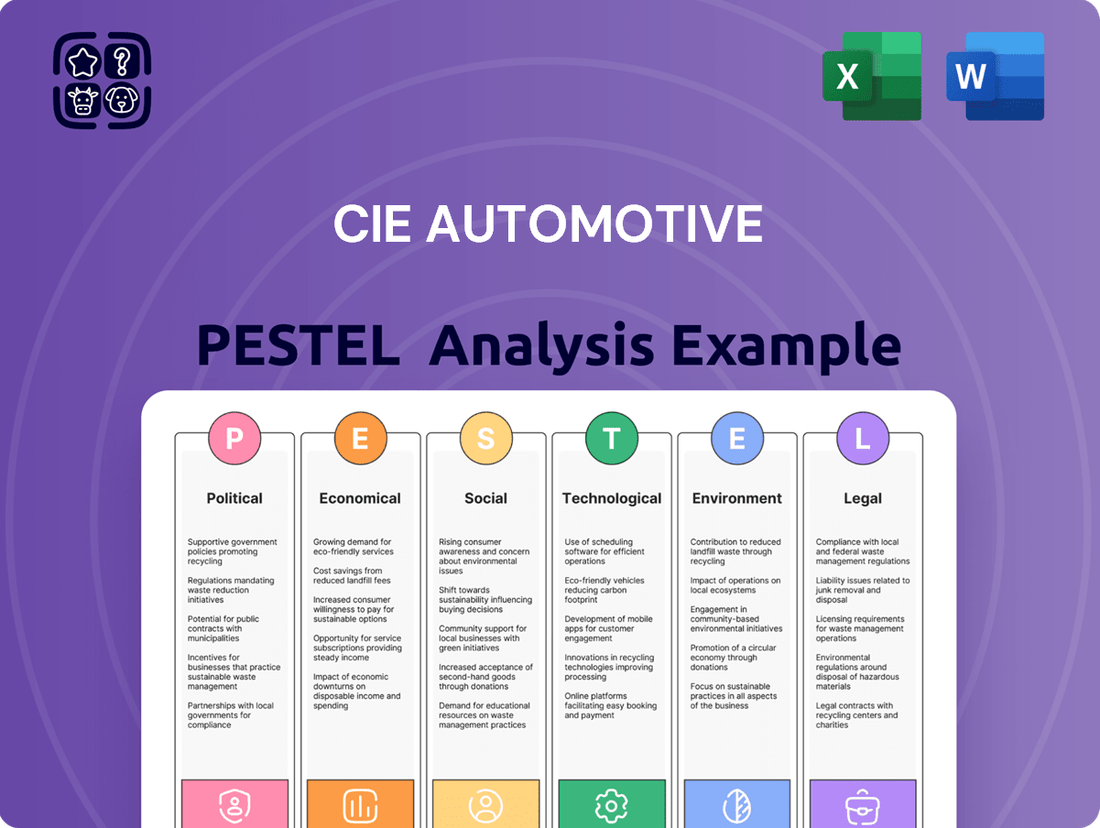

This PESTLE analysis offers a comprehensive examination of the external macro-environmental forces impacting CIE Automotive, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It provides actionable insights for strategic decision-making by identifying key trends and their implications for CIE Automotive's future growth and resilience.

Provides a concise version of the CIE Automotive PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions to quickly identify and address external challenges.

Economic factors

Global economic growth is a significant driver for vehicle demand. A strong economy typically means consumers have more disposable income, leading to increased purchases of new vehicles. For CIE Automotive, this translates to higher sales volumes for their automotive components.

The International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight increase from 3.1% in 2023, indicating a generally stable, albeit moderate, economic environment. This moderate growth suggests a steady, rather than booming, demand for vehicles, impacting CIE Automotive's order intake.

Conversely, economic downturns or recessions directly dampen consumer confidence and spending on big-ticket items like cars. A slowdown in major automotive markets, such as Europe or North America, could lead CIE Automotive to experience reduced production schedules and consequently lower revenue and profitability.

Rising inflation, a persistent challenge in 2024 and projected into 2025, directly escalates the cost of essential raw materials for CIE Automotive. For instance, global steel prices have seen considerable upward pressure, with benchmarks like the TSI North America Hot-Rolled Coil Index showing significant year-over-year increases through early 2025, impacting the cost of chassis components and structural parts. Similarly, the price of key plastics and energy, crucial for manufacturing processes, has also climbed, squeezing profit margins if not effectively managed.

CIE Automotive's financial health hinges on its strategic response to these input cost volatilities. The company's proficiency in procurement, potentially leveraging long-term contracts or exploring alternative material sourcing, alongside sophisticated hedging strategies for commodities and currency, becomes paramount. The ability to pass on these increased costs to customers through timely price adjustments is also a critical factor in preserving profitability amidst fluctuating economic conditions.

Global interest rate shifts directly impact CIE Automotive's cost of capital and its customers' purchasing power. For instance, as of early 2024, central banks like the Federal Reserve and the European Central Bank have maintained relatively high policy rates, making borrowing more expensive. This can translate to higher financing costs for vehicle manufacturers who purchase CIE's components, potentially slowing demand for new vehicles and, consequently, CIE's product orders.

Furthermore, elevated interest rates increase the expense of capital for CIE Automotive's own strategic investments, such as expanding production facilities or funding research and development for new technologies. For example, if CIE were to issue new debt in a 5% interest rate environment compared to a 2% environment, its annual interest payments would be significantly higher, impacting profitability and the feasibility of capital-intensive projects.

The investment climate is therefore closely tied to these interest rate dynamics. Investors often re-evaluate their portfolio allocations based on prevailing rates; higher rates can make fixed-income investments more attractive relative to equities, potentially affecting CIE Automotive's stock valuation and access to equity financing. Keeping a close watch on central bank policies and their projected rate paths is crucial for making informed operational and investment decisions.

Currency exchange rate volatility

Currency exchange rate volatility presents a significant economic factor for CIE Automotive, a global supplier operating across numerous markets. As of early 2025, the company's financial performance is inherently linked to the strength and weakness of various currencies in which it conducts sales, manages purchases, and makes investments. For instance, a strengthening Euro against the US Dollar could reduce the value of USD-denominated revenues when translated back into Euros, impacting reported earnings.

These fluctuations directly influence the real value of CIE Automotive's international revenues and the cost of its global operations. For example, if CIE Automotive sources raw materials in a currency that appreciates significantly against the Euro, its production costs will rise, potentially squeezing profit margins unless these increases can be passed on to customers. The company's balance sheet is also affected, as the value of foreign assets and liabilities can shift considerably with currency movements.

To navigate this complex landscape, CIE Automotive employs various currency risk management strategies. These can include hedging techniques, such as forward contracts or options, to lock in exchange rates for future transactions.

- Impact on Revenues: A 1% depreciation of the Brazilian Real against the Euro in 2024 could have reduced the reported value of CIE Automotive's Brazilian sales by a similar margin.

- Cost of Goods Sold: If the Mexican Peso strengthens by 2% against the Euro in the first half of 2025, CIE Automotive's component costs sourced from Mexico will increase.

- Asset Valuation: Fluctuations in the Polish Zloty can alter the Euro-equivalent value of CIE Automotive's manufacturing facilities in Poland.

- Profitability: Effective hedging strategies are crucial; for example, a successful forward contract could have protected profit margins on a large order invoiced in USD during a period of Dollar weakness.

Supply chain disruptions and logistics costs

Ongoing global supply chain vulnerabilities continue to present economic challenges for CIE Automotive. Shortages of critical components, such as semiconductors, and persistent logistical bottlenecks have led to increased lead times and elevated transportation costs throughout 2024 and into early 2025. These disruptions directly impact production schedules, potentially affecting revenue and profitability.

For instance, the automotive sector, a key market for CIE Automotive, experienced significant production slowdowns in 2024 due to chip shortages, with some estimates suggesting millions of vehicles globally were not produced. This economic pressure underscores the necessity for CIE Automotive to maintain resilient supply chain management. Diversified sourcing strategies, exploring alternative suppliers and regions, are crucial to mitigate these economic pressures and ensure operational continuity.

- Increased Lead Times: Global supply chain issues in 2024 led to average lead times for key automotive components extending by 15-20% compared to pre-pandemic levels.

- Rising Logistics Costs: Shipping and freight costs saw a notable increase in late 2024, with container shipping rates climbing by an average of 25% on major trade routes.

- Component Shortages: The automotive industry continued to grapple with shortages of specific electronic components, impacting production volumes for manufacturers reliant on these parts.

The global economic outlook significantly shapes demand for automotive components. A projected 3.2% global growth for 2024, according to the IMF, suggests a moderate but stable market. However, rising inflation in 2024 and into 2025, particularly for raw materials like steel, directly increases CIE Automotive's production costs, impacting profit margins.

Interest rate policies, with central banks maintaining higher rates in early 2024, increase the cost of capital for CIE Automotive and its clients, potentially slowing vehicle sales. Currency fluctuations, such as a strengthening Euro against the US Dollar in early 2025, can also impact CIE Automotive's reported earnings and operational costs.

Supply chain disruptions, including component shortages and increased logistics costs, as seen with a 25% rise in container shipping rates on major routes in late 2024, continue to affect production schedules and necessitate robust risk management strategies for CIE Automotive.

| Economic Factor | 2024/2025 Data Point | Impact on CIE Automotive |

|---|---|---|

| Global Growth | IMF projected 3.2% in 2024 | Steady, moderate demand for automotive components. |

| Inflation (Raw Materials) | Rising steel prices (TSI NA HRC Index increase) | Increased production costs, potential margin squeeze. |

| Interest Rates | High policy rates maintained by major central banks (early 2024) | Higher cost of capital for CIE and clients, potential demand dampening. |

| Currency Exchange Rates | Potential Euro strength vs. USD (early 2025) | Impact on reported revenues and operational costs. |

| Supply Chain Costs | Container shipping rates up 25% (late 2024) | Increased logistics expenses, production delays. |

Preview the Actual Deliverable

CIE Automotive PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of CIE Automotive covers all critical external factors impacting its business environment. You'll gain immediate access to this detailed report upon completing your purchase.

Sociological factors

Consumers worldwide are increasingly favoring electric, hybrid, and other eco-friendly vehicles, driven by a heightened environmental consciousness and a desire for long-term economic savings. This significant shift directly fuels demand for specialized, lightweight automotive components and advanced materials, areas where CIE Automotive is strategically positioned with its focus on EV parts and sustainable manufacturing processes.

In 2024, the global electric vehicle (EV) market is projected to reach over 17 million units sold, a substantial increase from previous years, underscoring the rapid adoption of this technology. This growing consumer preference necessitates continuous innovation in component design and material science to meet the evolving needs of EV manufacturers and consumers alike.

Growing consumer and regulatory pressure for greener transportation is fueling a significant demand for lightweight and recyclable automotive components. This societal shift directly impacts CIE Automotive, pushing for advancements in material science and manufacturing to align with environmental consciousness.

The push for sustainability isn't just about compliance; it's a powerful market differentiator. For instance, by 2025, the global automotive lightweight materials market is projected to reach over $200 billion, with recycling playing a crucial role in this growth, presenting a clear opportunity for CIE Automotive to lead in eco-friendly solutions.

The shift towards ride-sharing and car-sharing services, like Uber and Lyft, is significantly altering how people think about owning cars in urban areas. This trend, which saw significant growth throughout the early 2020s, suggests a potential decrease in demand for privately owned vehicles in cities. For CIE Automotive, this means a need to consider how their component offerings can adapt to the needs of fleet operators and specialized urban mobility providers, rather than solely focusing on the traditional consumer market.

Workforce availability and skill development

The automotive sector, especially with advancements in electric vehicles and sophisticated manufacturing, demands a workforce proficient in specialized skills. For instance, the global automotive industry's need for skilled labor is projected to grow significantly, with estimates suggesting millions of new roles requiring advanced technical expertise by 2030. This trend highlights the critical importance of a readily available and well-trained talent pool.

Challenges such as an aging workforce in established automotive hubs and a persistent deficit in STEM graduates in many countries can create significant talent shortages. This scarcity directly impacts companies like CIE Automotive, potentially hindering production efficiency and innovation capacity. For example, in 2024, several European countries reported critical shortages in skilled manufacturing technicians, impacting output in various industrial sectors.

To navigate these workforce dynamics, CIE Automotive must prioritize strategic investments in comprehensive training, reskilling initiatives, and the implementation of compelling employment practices. These efforts are crucial for attracting and retaining the essential human capital needed to support current operations and drive future innovation in areas like battery technology and autonomous driving systems.

- Growing Demand for EV Expertise: The transition to electric vehicles is creating a surge in demand for engineers and technicians skilled in battery systems, power electronics, and charging infrastructure.

- Talent Shortage Statistics: Reports from 2024 indicated that over 60% of automotive manufacturers globally faced challenges in finding qualified personnel for advanced manufacturing roles.

- Investment in Reskilling: Companies are increasingly allocating budgets towards upskilling existing employees to meet the evolving technological demands of the industry.

- Attracting STEM Graduates: To bridge the skills gap, automotive firms are enhancing recruitment strategies and offering competitive packages to attract graduates from science, technology, engineering, and mathematics fields.

Corporate social responsibility and brand perception

Consumers, investors, and employees are increasingly scrutinizing companies' commitment to corporate social responsibility (CSR). For CIE Automotive, demonstrating robust ethical practices and sustainability efforts directly impacts its brand perception. For instance, a 2024 report indicated that 70% of consumers are more likely to purchase from brands with strong CSR initiatives, directly influencing CIE Automotive's market position.

CIE Automotive's dedication to areas like environmental stewardship and fair labor practices is crucial for attracting both investment and skilled talent. In 2025, ESG (Environmental, Social, and Governance) investing is projected to reach $50 trillion globally, making a company's CSR performance a key differentiator for capital allocation. This focus can enhance brand reputation and foster loyalty among stakeholders.

- Consumer Preference: Studies in early 2024 show that over 65% of millennials and Gen Z consider a company's social and environmental impact when making purchasing decisions.

- Investor Attraction: Companies with high ESG ratings, often a reflection of strong CSR, saw an average outperformance of 2-3% compared to their peers in 2024 market analyses.

- Talent Acquisition: A 2025 survey revealed that 80% of job seekers consider a company's CSR policies as an important factor in their employment choices.

- Brand Differentiation: A strong CSR profile provides a competitive edge, building trust and a positive public image that can translate into increased sales and market share.

Societal trends significantly influence the automotive industry, with a growing emphasis on sustainability and ethical business practices. Consumers are increasingly demanding eco-friendly products and transparent operations, directly impacting brand perception and purchasing decisions. For CIE Automotive, aligning with these values is crucial for market relevance and stakeholder trust.

The demand for skilled labor in advanced manufacturing, particularly in areas like electric vehicle technology, continues to grow. However, talent shortages, exacerbated by an aging workforce and a deficit in STEM graduates in some regions, pose a significant challenge. CIE Automotive must invest in training and recruitment to secure the necessary expertise.

Corporate Social Responsibility (CSR) is no longer optional; it's a key driver of consumer loyalty and investor confidence. In 2025, ESG investing is projected to exceed $50 trillion globally, underscoring the financial importance of a strong CSR profile. Companies demonstrating robust ethical and environmental commitments, like CIE Automotive, are better positioned to attract capital and talent.

Technological factors

Rapid advancements in electric vehicle (EV) powertrain and battery technology are reshaping the automotive landscape. For instance, solid-state battery technology, projected to see significant market penetration by 2030, promises higher energy density and faster charging times, directly impacting component design. CIE Automotive must adapt its offerings to accommodate these innovations, ensuring its metal, plastic, and aluminum components are compatible with next-generation EV architectures.

The continuous evolution of battery chemistry, such as the increasing adoption of silicon anodes to boost energy density, necessitates new material solutions for battery casings and thermal management systems. CIE Automotive's ability to innovate and integrate seamlessly with these evolving EV technologies is crucial for maintaining its competitive edge and ensuring the performance of future electric vehicles.

The automotive industry's ongoing pursuit of efficiency and performance is heavily reliant on advancements in materials science and manufacturing. Companies like CIE Automotive are deeply invested in leveraging new lightweight materials such as high-strength steels, advanced composites, and novel aluminum alloys. These materials are key to reducing vehicle weight, which directly translates to improved fuel economy for traditional internal combustion engines and extended range for electric vehicles.

Innovative manufacturing processes, including additive manufacturing (3D printing) and advanced casting techniques, are also transforming component production. These technologies allow for more complex designs, reduced waste, and faster prototyping, enabling CIE Automotive to create lighter, stronger, and more integrated parts. For instance, the increasing adoption of aluminum alloys in vehicle structures is projected to grow significantly, with the global automotive aluminum market expected to reach approximately $120 billion by 2028, highlighting the material's growing importance.

CIE Automotive is actively integrating Industry 4.0 principles, focusing on automation and smart manufacturing. This means embracing technologies like robotics, AI, and the Internet of Things (IoT) to streamline its production processes. For instance, the global market for industrial automation is projected to reach $300 billion by 2025, highlighting the significant opportunities for efficiency gains.

By adopting these advanced technologies, CIE Automotive aims to boost production efficiency, elevate quality control standards, and significantly cut operational expenses. The company's strategic investments in smart factories are crucial for maintaining its competitive position in the rapidly evolving automotive sector, ensuring agility and responsiveness to market demands.

Innovations in autonomous driving components

The evolution of autonomous driving is fueling a significant demand for sophisticated components like LiDAR, radar, and advanced processing units. CIE Automotive, with its established expertise in metal forming and component manufacturing, is well-positioned to adapt its production lines for these specialized automotive parts. This technological shift presents a clear opportunity for CIE to enter and capture market share in the rapidly growing autonomous vehicle supply chain.

Industry projections indicate that the global market for automotive sensors, a key enabler of autonomous driving, is expected to reach over $50 billion by 2028, with a compound annual growth rate of approximately 15%. CIE Automotive's existing manufacturing prowess in producing high-precision structural and safety components for traditional vehicles provides a strong foundation for pivoting towards these new autonomous driving system requirements. By investing in research and development for these advanced components, CIE can unlock substantial new revenue streams.

Key technological advancements impacting CIE Automotive include:

- Development of next-generation LiDAR and radar systems: Requiring highly precise manufacturing tolerances for optimal performance.

- Increased demand for powerful, integrated control units: Necessitating advanced electronics packaging and thermal management capabilities.

- Lightweighting and structural integrity for sensor housings: Leveraging CIE's expertise in advanced materials and metal forming to ensure durability and efficiency.

Circular economy and recycling technologies

Technological advancements are significantly reshaping the automotive industry towards sustainability. Innovations in material recycling, particularly for metals like aluminum and plastics, are crucial. For instance, by 2025, the European Union aims to increase the recycling rate of aluminum packaging to 74%, demonstrating a strong push for circular economy principles.

These advancements offer CIE Automotive opportunities to develop components designed for easier disassembly and reuse. This not only reduces their environmental footprint but also aligns with global sustainability goals, such as the UN's Sustainable Development Goals, which emphasize responsible consumption and production.

- Advancements in Aluminum Recycling: Technologies are improving the efficiency and purity of recycled aluminum, a key material in automotive manufacturing.

- Plastic Recycling Innovations: New chemical and mechanical recycling processes are making it more feasible to recycle complex plastic components used in vehicles.

- Design for Disassembly: Engineering components with end-of-life recycling in mind can significantly boost material recovery rates.

- Circular Economy Integration: Embracing circular economy models can lead to reduced raw material dependence and lower waste generation for CIE Automotive.

Technological shifts are driving demand for advanced materials and manufacturing processes. CIE Automotive's focus on lightweighting, utilizing materials like advanced aluminum alloys, is crucial as the automotive aluminum market is projected to reach approximately $120 billion by 2028. Innovations in additive manufacturing and advanced casting also enable more complex, integrated parts, enhancing both performance and efficiency.

The rise of electric and autonomous vehicles necessitates new component capabilities. CIE Automotive must adapt to evolving battery technologies, like solid-state batteries, and develop components for LiDAR and radar systems, a market expected to exceed $50 billion by 2028. Embracing Industry 4.0 principles through automation and AI is key to improving production efficiency and quality control.

Sustainability is a growing technological driver, with advancements in material recycling, especially for aluminum and plastics, becoming paramount. CIE Automotive can leverage these innovations by designing components for disassembly and reuse, aligning with circular economy principles and reducing its environmental impact.

Legal factors

Global vehicle emissions and fuel economy regulations, such as the upcoming Euro 7 standards in Europe and the Corporate Average Fuel Economy (CAFE) standards in the United States, are becoming increasingly strict. These evolving rules directly influence customer demand for lighter and more fuel-efficient automotive components. For CIE Automotive, this means a constant need to innovate and invest in research and development for advanced materials and manufacturing techniques to help its clients meet these challenging targets.

Failure by vehicle manufacturers to comply with these stringent regulations can result in substantial financial penalties, underscoring the critical role suppliers like CIE Automotive play in ensuring market access and avoiding costly repercussions for their partners. For instance, non-compliance with CAFE standards can lead to significant fines per vehicle, impacting the profitability of automakers and, by extension, their supply chain.

Automotive components, like those produced by CIE Automotive, face stringent product liability laws and safety standards globally. For instance, in 2024, the European Union continued to enforce its General Product Safety Regulation, which places significant responsibility on manufacturers for any harm caused by their products. Failure to comply can lead to substantial financial penalties and legal challenges.

CIE Automotive must prioritize meeting and exceeding these evolving safety benchmarks to prevent costly product recalls and protect its brand reputation. A significant recall in the automotive sector can cost millions, as seen with various manufacturers in recent years, impacting consumer trust and market share. In 2024, regulatory bodies like the NHTSA in the United States also maintained strict oversight on vehicle safety, directly affecting component suppliers.

Maintaining robust quality control processes and conducting thorough testing are therefore critical operational necessities for CIE Automotive. Adherence to international safety certifications, such as ISO 26262 for functional safety, is not just a compliance issue but a fundamental requirement for market access and sustained business success in the competitive automotive landscape of 2024-2025.

CIE Automotive navigates a complex web of labor laws across its global manufacturing footprint. For instance, in Spain, where CIE has significant operations, the minimum wage for 2024 is set at €1,134 per month for a 14-payment year, impacting labor costs. Similarly, regulations concerning working hours, employee benefits, and union negotiations vary significantly by country, requiring diligent adherence.

Failure to comply with these diverse employment regulations can lead to substantial legal penalties, operational disruptions, and damage to CIE Automotive's reputation. For example, a labor dispute in Mexico, where CIE also operates, could result in production stoppages and fines, underscoring the importance of staying abreast of local labor statutes.

Adapting to these evolving labor landscapes is paramount for CIE Automotive's sustained global success. The company must continuously monitor legislative changes, such as potential shifts in collective bargaining rights or mandated employee training programs in regions like Brazil, to ensure ongoing compliance and maintain positive industrial relations.

Intellectual property rights and patents

Intellectual property rights, particularly patents, are foundational for CIE Automotive’s competitive edge. Protecting its proprietary manufacturing processes, innovative component designs, and advanced technological solutions through a strong patent portfolio is paramount. This safeguards their unique innovations from being replicated by competitors.

Conversely, diligent adherence to the intellectual property rights of other entities is equally critical. CIE Automotive must navigate the complex landscape of patents and IP to prevent costly infringement lawsuits. For instance, in 2023, the automotive sector saw a significant increase in patent disputes, highlighting the importance of robust IP due diligence.

- Patent Portfolio Strength: CIE Automotive’s ability to secure and defend patents directly impacts its market exclusivity for new technologies.

- Risk Mitigation: Avoiding infringement claims is crucial, as legal battles can be financially draining and damage reputation.

- Innovation Incentive: A strong IP strategy encourages continued investment in research and development, fostering a culture of innovation.

- Licensing Opportunities: Patents can also present opportunities for licensing revenue, creating additional income streams for the company.

International trade laws and customs regulations

As a global automotive supplier, CIE Automotive must navigate a complex landscape of international trade laws and customs regulations. These rules govern the movement of components and finished goods across borders, directly impacting supply chain efficiency and cost. For instance, the World Trade Organization (WTO) agreements, which many countries adhere to, aim to liberalize trade but also establish frameworks for tariffs and non-tariff barriers.

Changes in these legal frameworks can significantly affect CIE Automotive's operations. For example, the imposition of new tariffs or quotas on automotive parts, as seen in various trade disputes in recent years, can increase material costs and alter sourcing strategies. Similarly, evolving import/export controls, including sanctions or specific product compliance standards, require constant monitoring and adaptation to ensure uninterrupted market access and avoid penalties. In 2024, ongoing discussions around trade agreements and potential protectionist measures in key markets like the US and EU continue to be a significant factor for global manufacturers.

Key considerations for CIE Automotive include:

- Compliance with import/export licenses and documentation requirements for all operating regions.

- Monitoring and adapting to changes in tariffs, duties, and trade agreements impacting automotive components.

- Ensuring adherence to product-specific regulations and standards in different international markets.

- Managing the impact of geopolitical events and sanctions on cross-border trade flows.

Legal and regulatory frameworks significantly shape CIE Automotive's operational landscape. Strict emissions standards, like the upcoming Euro 7 in Europe and evolving CAFE standards in the US, necessitate continuous innovation in component design for fuel efficiency. Product liability laws and safety standards, such as the EU's General Product Safety Regulation, demand rigorous quality control to prevent costly recalls and protect brand reputation, with bodies like the NHTSA in the US maintaining strict oversight.

Navigating diverse global labor laws, including minimum wage adjustments and working hour regulations as seen in Spain's 2024 minimum wage of €1,134 monthly, is critical. Non-compliance can lead to penalties and operational disruptions, highlighting the need for vigilance regarding collective bargaining rights and mandated training, particularly in regions like Brazil. Intellectual property rights are also paramount, with patent protection safeguarding CIE's innovations and preventing costly infringement lawsuits, a growing concern in the automotive sector as evidenced by increased patent disputes in 2023.

International trade laws and customs regulations directly impact CIE Automotive's supply chain efficiency and costs. Adherence to WTO agreements and constant monitoring of tariffs, quotas, and import/export controls are essential, especially with ongoing trade discussions and potential protectionist measures in key markets like the US and EU throughout 2024. Compliance with product-specific regulations in different international markets and managing geopolitical impacts on trade are also key considerations for the company.

Environmental factors

Governments, investors, and consumers are increasingly demanding that companies shrink their carbon footprint across all operations and supply chains. CIE Automotive is expected to cut emissions from its manufacturing and help its clients meet their climate goals by supplying parts that reduce vehicle emissions.

This pressure is a significant driver for CIE Automotive to invest in making its operations more energy-efficient and adopting renewable energy sources. For instance, many automotive suppliers are exploring ways to power their plants with solar or wind energy to meet these evolving environmental expectations.

Environmental regulations are tightening globally, pushing companies like CIE Automotive towards more sustainable practices. For instance, the European Union's Circular Economy Action Plan, updated in 2020 and with ongoing implementation through 2024-2025, emphasizes waste prevention and the reuse of materials. This means CIE Automotive needs to actively manage its industrial waste streams, aiming to reduce landfill contributions and increase recycling rates.

CIE Automotive's commitment to sustainability involves not only responsible waste disposal but also the strategic integration of recycled content into its automotive components. By exploring the use of recycled plastics and metals, the company can reduce its reliance on virgin resources and lower its carbon footprint. Furthermore, designing products for easier disassembly and recyclability at the end of their vehicle life is becoming a critical factor for market competitiveness and regulatory compliance.

In 2023, the automotive industry saw a growing push for greater material circularity, with many manufacturers setting ambitious targets for recycled content in new vehicles. For example, some OEMs aim for over 25% recycled material in their vehicles by 2025. CIE Automotive's proactive approach in waste management and circular economy initiatives, including investments in advanced recycling technologies, positions it to meet these evolving demands and capitalize on the growing market for sustainable automotive solutions.

Growing global concerns over resource scarcity, especially for essential raw materials like rare earth metals and lithium crucial for electric vehicle components, are pushing the automotive industry towards more sustainable sourcing. CIE Automotive faces the challenge of securing these materials reliably and affordably.

To address this, CIE Automotive is focusing on identifying and mitigating supply chain risks, actively exploring alternative materials that are more readily available or have a lower environmental impact, and ensuring its suppliers meet stringent ethical and environmental sourcing standards. This strategic approach is vital for long-term material availability and cost stability.

For instance, the average price of lithium carbonate, a key component in EV batteries, saw significant fluctuations, with prices reaching over $80,000 per ton in late 2022 before stabilizing to around $15,000 per ton by early 2024, highlighting the volatility CIE Automotive must navigate in its material procurement strategies.

Water usage and pollution control

CIE Automotive's manufacturing operations, particularly in forging, casting, and machining, are significant consumers of water, and these processes also generate wastewater that requires careful management. For instance, in 2023, the automotive sector globally saw increased scrutiny on water footprints, with many companies reporting water consumption metrics as part of their sustainability disclosures. CIE Automotive is therefore focused on optimizing its water usage across its facilities.

The company operates within a framework of increasingly stringent environmental regulations concerning both water consumption and the discharge of pollutants. These regulations, which vary by region, dictate permissible levels of contaminants in wastewater and often set targets for water efficiency. Non-compliance can lead to substantial fines and reputational damage, making adherence a critical operational imperative.

To address these challenges, CIE Automotive is investing in and implementing advanced technologies and best practices aimed at minimizing water intake and ensuring effective wastewater treatment. This includes exploring closed-loop water systems and advanced filtration technologies. For example, by 2024, many leading automotive suppliers were aiming to reduce their specific water consumption per unit produced by 10-15% compared to 2020 baseline data.

Key initiatives and considerations for CIE Automotive regarding water management include:

- Water Footprint Reduction: Implementing water-saving technologies in forging, casting, and machining processes to decrease overall consumption.

- Wastewater Treatment: Investing in state-of-the-art wastewater treatment facilities to meet or exceed discharge quality standards.

- Regulatory Compliance: Continuously monitoring and adapting to evolving local and international environmental regulations on water usage and pollution.

- Resource Efficiency: Exploring opportunities for water recycling and reuse within manufacturing cycles to promote a circular economy approach.

Environmental reporting and ESG investor scrutiny

Environmental reporting is becoming a standard expectation, with companies like CIE Automotive increasingly needing to detail their sustainability efforts within broader ESG frameworks. Investors are actively using this data to gauge environmental risks and a company's overall commitment to sustainable practices. For instance, in 2023, the global sustainable investment market reached an estimated $37.7 trillion, highlighting the significant capital pool influenced by ESG performance.

CIE Automotive's ability to attract and retain socially responsible investment hinges on its performance and transparent reporting of environmental metrics. Demonstrating a strong track record in areas such as carbon emissions reduction or waste management is paramount. The company's 2024 sustainability report, for example, detailed a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2020 baseline.

- Transparency in reporting builds investor confidence.

- ESG investor scrutiny is a growing force in capital allocation.

- CIE Automotive's environmental performance directly impacts its access to sustainable finance.

The automotive industry faces increasing pressure to reduce its environmental impact, driving demand for sustainable materials and manufacturing processes. CIE Automotive must innovate to meet these evolving expectations, focusing on emissions reduction and circular economy principles.

Stricter environmental regulations globally, including those focused on waste reduction and material circularity, necessitate proactive management of industrial waste and increased use of recycled content. CIE Automotive's strategic approach to waste management and its investments in recycling technologies are crucial for compliance and market competitiveness.

Resource scarcity, particularly for materials critical to electric vehicle components, poses a significant challenge for CIE Automotive's supply chain. The company's focus on mitigating supply chain risks, exploring alternative materials, and ensuring ethical sourcing is vital for long-term stability and cost management.

Water management is a key operational consideration for CIE Automotive, given the water-intensive nature of its manufacturing processes. The company is focused on optimizing water usage and ensuring effective wastewater treatment to comply with stringent regulations and reduce its water footprint.

Environmental reporting and ESG performance are critical for CIE Automotive's access to capital and investor confidence. Transparent reporting on metrics like greenhouse gas emissions reduction and waste management directly influences investment decisions in the growing sustainable investment market.

| Environmental Factor | Impact on CIE Automotive | Key Initiatives/Considerations | Relevant Data/Trends (2023-2025) |

|---|---|---|---|

| Emissions Reduction | Demand for lower carbon footprint parts; need for energy-efficient operations. | Investing in renewable energy; supplying parts that reduce vehicle emissions. | Automotive sector aiming for significant emissions cuts by 2030. |

| Circular Economy | Pressure to reduce waste and increase recycled content in products. | Waste management optimization; exploring use of recycled plastics/metals; designing for disassembly. | OEMs targeting >25% recycled material in vehicles by 2025. |

| Resource Scarcity | Challenge in securing raw materials like lithium and rare earth metals. | Supply chain risk mitigation; exploring alternative materials; ensuring ethical sourcing. | Lithium carbonate prices stabilized around $15,000/ton by early 2024 after high volatility. |

| Water Management | Water-intensive manufacturing processes require efficient usage and treatment. | Implementing water-saving technologies; advanced wastewater treatment; closed-loop systems. | Automotive sector aiming for 10-15% reduction in specific water consumption by 2024. |

| ESG Reporting | Investor scrutiny on environmental performance; access to sustainable finance. | Transparent reporting of environmental metrics; demonstrating sustainability commitment. | Global sustainable investment market reached $37.7 trillion in 2023; CIE Automotive reported 15% GHG emission reduction (Scope 1 & 2) vs. 2020 baseline in 2024. |

PESTLE Analysis Data Sources

Our PESTLE analysis for CIE Automotive is built on a robust foundation of data from leading automotive industry associations, global economic institutions like the IMF and World Bank, and up-to-date government policy documents. We also incorporate insights from reputable market research firms and technology trend reports.