CIE Automotive Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CIE Automotive Bundle

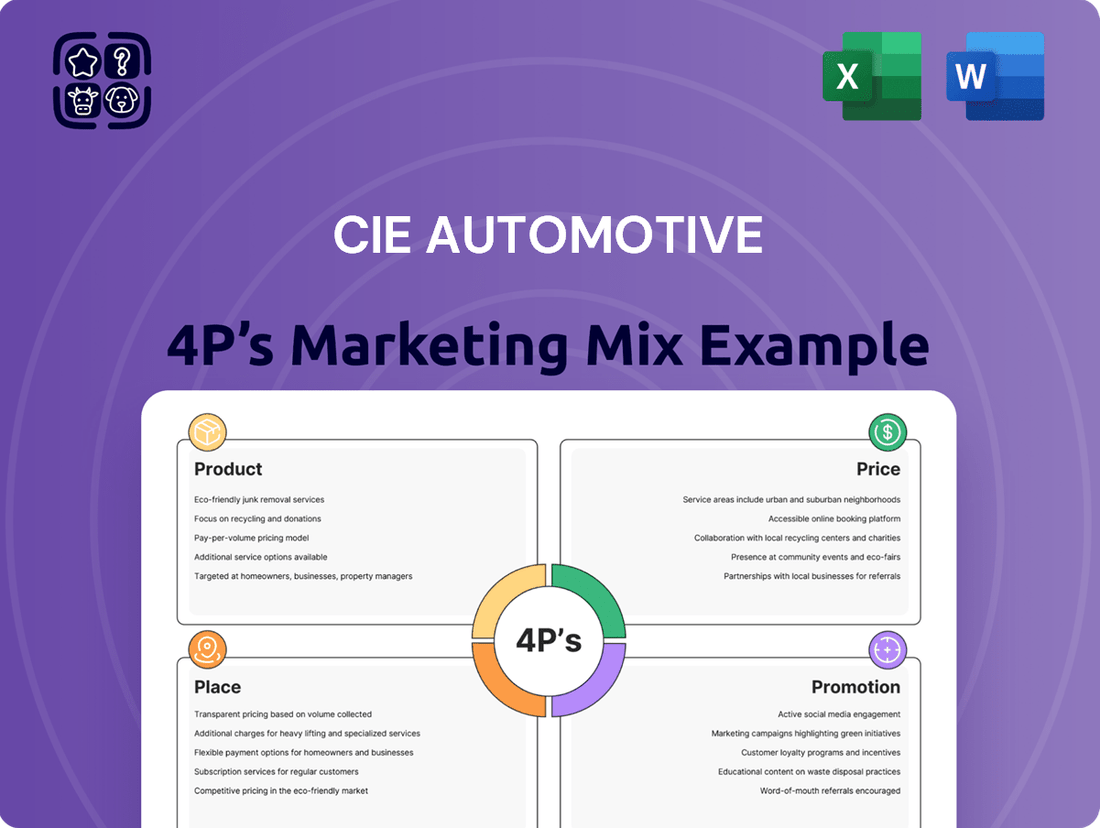

Discover how CIE Automotive leverages its product innovation, strategic pricing, expansive distribution, and targeted promotions to dominate the automotive supplier market. This analysis provides a foundational understanding of their marketing prowess.

Go beyond the basics and gain access to an in-depth, ready-made Marketing Mix Analysis covering CIE Automotive's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants seeking strategic insights.

Save hours of research and analysis. This pre-written Marketing Mix report provides actionable insights, examples, and structured thinking—perfect for reports, benchmarking, or business planning related to CIE Automotive.

Product

CIE Automotive's diverse component portfolio is a cornerstone of its market strategy, offering a wide spectrum of metal, plastic, and aluminum parts. This multi-technology approach allows them to serve as a comprehensive supplier across the automotive landscape.

The company manufactures components using advanced processes such as forging, casting, machining, and injection molding. This breadth of manufacturing capabilities ensures they can cater to a vast array of vehicle types and customer specifications, from intricate engine parts to robust structural elements.

In 2023, CIE Automotive reported total sales of €4.2 billion, reflecting the significant demand for their extensive product range. Their product strategy is clearly focused on breadth, aiming to be a one-stop shop for diverse automotive needs across various segments, which is crucial in a dynamic market.

CIE Automotive places a strong emphasis on advanced manufacturing technologies, specializing in high value-added processes. This focus is evident in their diverse expertise across forging, aluminum and casting operations, machining, and metal stamping & tube forming. Their commitment to these sophisticated techniques allows them to deliver cutting-edge solutions.

The company's technological diversification extends to plastic components and integrated roof systems, showcasing a broad capability set. This strategic approach, as highlighted in their 2024 reports, underpins their ability to offer innovative and robust solutions across various automotive segments, aiming to capture a larger share of the evolving market.

CIE Automotive is strategically positioning itself within the burgeoning electric vehicle (EV) market by developing and supplying critical components. This focus is a direct response to the industry-wide acceleration towards electrification, a trend that is reshaping automotive manufacturing.

The company's acquisition of AKT Plásticos in 2024, a specialist in thermoplastic injection molding, is a key move. This acquisition enhances CIE Automotive's capability to produce lighter, more efficient parts, which are vital for optimizing EV range and performance. For instance, lighter materials can significantly contribute to reducing the overall weight of an EV, directly impacting its energy consumption.

This proactive approach to the EV sector underscores CIE Automotive's commitment to adapting to future mobility trends. By investing in technologies and capabilities that support electric powertrains, the company is ensuring its relevance and growth in a rapidly evolving automotive landscape, aiming to capture a significant share of this expanding market segment.

Customized and Integrated Solutions

CIE Automotive excels in delivering Customized and Integrated Solutions, a cornerstone of their marketing strategy. They collaborate intimately with Original Equipment Manufacturers (OEMs) and Tier-1 suppliers, focusing on co-developing parts and assemblies. This deep integration ensures their products are not just components, but precisely engineered solutions that add significant value to the final vehicle.

Their approach prioritizes tailored offerings, meaning CIE Automotive doesn't offer one-size-fits-all products. Instead, they engage in joint development processes, aligning their manufacturing capabilities with the unique specifications and future needs of their automotive clients. This commitment to customization fosters strong, long-term partnerships and positions CIE Automotive as a vital strategic ally in the automotive supply chain.

For instance, in 2024, CIE Automotive's focus on integrated solutions contributed to their robust performance, with the company reporting significant revenue growth driven by these collaborative projects. Their ability to adapt and innovate alongside OEMs, particularly in areas like electrification and lightweighting, underscores the value of their customized approach. This strategy is reflected in their extensive portfolio of specialized components, designed to meet the evolving demands of modern vehicle manufacturing.

- Co-development with OEMs: CIE Automotive actively partners with vehicle manufacturers on product and process design.

- Tailored Part Assemblies: They provide highly specific components and integrated assemblies designed for individual customer needs.

- Value Enhancement: The focus is on creating solutions that directly improve the overall value and performance of vehicles.

- Strategic Partnerships: This integrated approach fosters deep relationships within the automotive supply chain, driving mutual growth and innovation.

Quality and Sustainability Driven Offerings

CIE Automotive places a strong emphasis on quality and sustainability within its product portfolio. This isn't just a buzzword; it's woven into how they create and manufacture their offerings, focusing on solutions that are better for the environment and society.

Their dedication to these principles is evident in their proactive approach to ESG standards. They aim to develop products that are not only high-performing but also eco-efficient, contributing to a more sustainable future for mobility. This commitment is backed by concrete achievements.

- Validated Climate Targets: CIE Automotive's climate targets have been officially validated by the Science Based Targets initiative (SBTi), confirming their commitment to meaningful emissions reductions.

- Strong CDP Scores: In their 2024 CDP assessment, they achieved a B score for Climate Change and a B score for Water Management, demonstrating robust performance in these critical sustainability areas.

- Sustainable Mobility Focus: The company actively pursues eco-efficient solutions, aligning their product development with the growing global demand for sustainable transportation.

CIE Automotive's product strategy centers on a broad and technologically advanced portfolio, encompassing metal, plastic, and aluminum components. They specialize in high-value manufacturing processes like forging, casting, and machining, enabling them to serve diverse automotive needs. Their commitment to innovation is further demonstrated by their focus on integrated solutions and their strategic expansion into components for electric vehicles.

The company's recent acquisition of AKT Plásticos in 2024 highlights their drive to enhance capabilities in lightweight materials, crucial for EV performance. This proactive approach, coupled with their validated climate targets by SBTi and strong CDP scores in 2024, underscores a product offering that is both technologically forward and increasingly sustainable.

CIE Automotive's product development is deeply integrated with OEM requirements, focusing on co-creation and tailored solutions. This collaborative approach ensures their components, whether for traditional powertrains or electric vehicles, are precisely engineered to add value and meet specific performance demands.

Their diverse product range, from intricate engine parts to structural elements and advanced plastic components, reflects a strategy to be a comprehensive supplier. This breadth, supported by €4.2 billion in sales in 2023, positions them to capitalize on the evolving automotive market, particularly the shift towards electrification and sustainable mobility.

| Product Area | Key Technologies | 2023 Sales Contribution (Illustrative) | Strategic Focus | Sustainability Highlight |

|---|---|---|---|---|

| Metal Components (Forging, Casting, Machining) | Advanced forging, high-precision machining, aluminum casting | Significant portion of €4.2 billion total sales | Lightweighting, structural integrity | Validated climate targets (SBTi) |

| Plastic Components | Thermoplastic injection molding (e.g., AKT Plásticos acquisition) | Growing segment, enhanced by 2024 acquisitions | EV interior/exterior parts, weight reduction | Eco-efficient material development |

| Integrated Systems (e.g., Roof Systems) | Multi-material assembly, advanced manufacturing | Key for value-added solutions | Customized solutions for OEMs | CDP B score for Climate Change (2024) |

| EV Specific Components | Battery housings, thermal management parts | Emerging and high-growth area | Electrification acceleration | CDP B score for Water Management (2024) |

What is included in the product

This analysis offers a comprehensive examination of CIE Automotive's marketing strategies, dissecting their Product, Price, Place, and Promotion efforts with actionable insights.

It provides a detailed, data-driven overview of CIE Automotive's marketing mix, ideal for understanding their competitive positioning and strategic approach.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of navigating intricate market dynamics.

Provides a clear, concise overview of CIE Automotive's 4Ps, easing the burden of detailed strategic analysis for busy executives.

Place

CIE Automotive boasts a robust global manufacturing footprint, strategically positioned across Europe, North America, Brazil, and Asia. This expansive network, encompassing over 100 facilities as of recent reports, enables them to effectively serve major automotive manufacturers on a worldwide scale.

This multi-continental presence is crucial for adapting to diverse regional demands and regulatory landscapes, ensuring localized support and efficient supply chains. For instance, their significant operations in Mexico, with numerous plants, cater heavily to the North American automotive sector, while their European base addresses the continent's advanced manufacturing needs.

In 2023, CIE Automotive reported a substantial portion of its revenue, around 40%, originating from outside Europe, highlighting the critical role of its international manufacturing operations in driving overall growth and market penetration.

CIE Automotive's strategic placement of production plants and commercial offices within major automotive hubs is a cornerstone of its market approach. This geographical spread is designed to buffer against regional market fluctuations and guarantee timely delivery to a global clientele.

For instance, CIE Automotive India operates manufacturing and engineering facilities strategically positioned throughout the country, reflecting this global strategy at a local level. This ensures they are close to their customers, facilitating quicker response times and more efficient logistics.

CIE Automotive's primary distribution strategy revolves around direct sales to Original Equipment Manufacturers (OEMs) and Tier-1 suppliers. This business-to-business (B2B) approach is fundamental, fostering deep collaboration and seamless integration within the complex automotive manufacturing ecosystem. In 2024, CIE Automotive continued to leverage these direct relationships, a key factor in their ability to adapt to evolving OEM demands for lightweight materials and advanced components.

Decentralized Management and Local Adaptation

CIE Automotive's operational philosophy hinges on decentralized management, empowering local teams to tailor strategies and product offerings to distinct market needs. This agility allows for quicker responses to evolving regional demands and optimizes supply chain logistics, ensuring timely product availability.

This decentralized structure is crucial for navigating diverse global markets. For instance, in 2024, CIE Automotive continued to invest in its regional production capabilities, aiming to reduce lead times and transportation costs. Their commitment to local adaptation is reflected in their diverse product portfolio, which caters to specific vehicle types and regulatory environments across continents.

- Decentralized Decision-Making: Local management teams have autonomy to adapt to specific market conditions and customer preferences.

- Enhanced Responsiveness: This structure allows for faster reactions to regional demand shifts and competitive pressures.

- Logistical Efficiency: Localized operations improve supply chain management, reducing delivery times and costs.

- Market Penetration: Tailored approaches facilitate deeper penetration into diverse geographical markets.

Optimized Supply Chain and Logistics

CIE Automotive leverages a sophisticated supply chain to guarantee the punctual and efficient delivery of its automotive components. This robust system underpins their ability to meet dynamic market demands and maintain customer satisfaction across their global operations.

Their expansive international footprint, coupled with highly integrated operational processes, is specifically engineered to enhance customer convenience. This strategic approach to logistics directly translates into optimized sales potential by ensuring a seamless flow of goods and services, ultimately supporting their market competitiveness.

- Global Reach: CIE Automotive operates in over 12 countries, facilitating efficient distribution networks.

- Integrated Systems: Their focus on integrated processes aims to reduce lead times and improve inventory management.

- Customer Convenience: Streamlined logistics are a key factor in providing a superior customer experience.

- Sales Optimization: Efficient supply chain management directly contributes to maximizing sales opportunities by ensuring product availability.

CIE Automotive's strategic placement of production facilities and commercial offices within key automotive manufacturing hubs is a critical element of their market strategy. This global distribution network, spanning over 100 facilities across continents like Europe, North America, and Asia, ensures proximity to major Original Equipment Manufacturers (OEMs) and Tier-1 suppliers. This geographical diversification, with significant operations in Mexico and Europe, allows them to effectively serve diverse regional demands and regulatory environments, bolstering their ability to adapt to local market nuances.

Their commitment to localized operations, exemplified by facilities in India, facilitates quicker response times and more efficient logistics, directly impacting customer convenience and sales potential. In 2023, a notable 40% of CIE Automotive's revenue came from outside Europe, underscoring the success of this geographically dispersed market approach.

The company's distribution strategy prioritizes direct sales to OEMs and Tier-1 suppliers, fostering close collaboration and integration within the automotive supply chain. This B2B focus, continued in 2024, is vital for adapting to OEM needs for advanced components and lightweight materials.

CIE Automotive's operational philosophy emphasizes decentralized management, granting local teams the autonomy to tailor strategies to specific market conditions and customer preferences. This agility enhances responsiveness to regional demand shifts and competitive pressures, optimizing supply chain logistics and ensuring timely product availability across their global network.

| Region | Number of Facilities (approx.) | Key Markets Served |

|---|---|---|

| Europe | ~50 | Germany, Spain, France, Italy |

| North America | ~30 | USA, Mexico, Canada |

| South America | ~15 | Brazil |

| Asia | ~10 | India, China |

What You See Is What You Get

CIE Automotive 4P's Marketing Mix Analysis

The preview shown here is the actual CIE Automotive 4P's Marketing Mix Analysis document you’ll receive instantly after purchase—no surprises. You are viewing the exact version of the analysis you'll receive, fully complete and ready for immediate use. This isn't a teaser or a sample; it's the actual content you’ll receive when you complete your order.

Promotion

CIE Automotive places significant emphasis on investor relations and financial communications to effectively convey its financial health, strategic direction, and how it creates value for its stakeholders. This proactive approach ensures transparency and trust with a wide range of financial participants.

The company regularly disseminates comprehensive financial information through its annual and quarterly reports, such as the detailed 2024 Annual Report. Furthermore, CIE Automotive actively engages with investors via conference calls, like those discussing Q1 2025 earnings, to provide deeper insights into their performance and outlook.

CIE Automotive leverages corporate presentations to highlight its strengths, including its commitment to sustainability and innovation in automotive technology. These presentations serve as a crucial platform to communicate its strategic direction and technological advancements to a broad audience.

Participation in industry events, conferences, and roadshows is a key element of their promotional strategy. Through these engagements, CIE Automotive actively connects with financial analysts and investors, effectively communicating the unique benefits and competitive advantages of its product portfolio.

For instance, during 2024, CIE Automotive's participation in key industry forums allowed them to discuss their progress in areas like lightweighting solutions and electrification, which are critical differentiators in the evolving automotive landscape. This direct engagement fosters transparency and builds investor confidence.

CIE Automotive demonstrates its commitment to sustainability through comprehensive ESG reporting, showcasing initiatives in environmental protection, social responsibility, and robust governance. This focus is crucial for attracting ethically-minded investors and bolstering the company's public image.

The company's 2024 Annual Corporate Governance Report exemplifies this dedication to transparency, providing stakeholders with detailed insights into their ESG performance and strategic direction. This proactive approach aligns with growing market demand for sustainable business practices.

News and Press Releases

CIE Automotive actively utilizes news and press releases as a key component of its promotional strategy. These communications keep stakeholders informed about crucial company events. For instance, in early 2024, CIE Automotive announced its acquisition of Faurecia's automotive components business, a significant move that expanded its product portfolio and geographic reach. This proactive communication ensures transparency and reinforces the company's growth narrative.

The company's commitment to timely information dissemination is evident in its consistent updates. In Q1 2024, CIE Automotive reported strong financial results, with a notable increase in revenue driven by robust performance in its key markets. These releases often highlight strategic partnerships and technological advancements, such as their ongoing investment in lightweight materials for electric vehicles, which is crucial for maintaining market relevance and investor confidence.

- Acquisition of Faurecia's automotive components business in early 2024.

- Reported strong Q1 2024 financial results with increased revenue.

- Highlighting investments in lightweight materials for electric vehicles.

Digital Presence and Corporate Website

CIE Automotive leverages a robust digital presence, centered around its corporate website, to communicate its extensive product portfolio, advanced technologies, and global operational footprint. This digital hub is crucial for engaging with a wide range of stakeholders, including investors, customers, and potential employees.

The company's digital strategy emphasizes transparency and accessibility, providing detailed investor relations information, such as financial reports and presentations. In 2023, CIE Automotive reported a significant increase in website traffic, indicating growing interest from the investment community and other interested parties.

Key aspects of their digital presence include:

- Comprehensive Product and Technology Showcase: Detailed information on their offerings for the automotive sector.

- Global Operations Mapping: Highlighting their presence across various continents and manufacturing sites.

- Investor Relations Hub: Easy access to financial data, annual reports, and corporate governance information, reflecting their commitment to shareholder communication.

- Stakeholder Engagement Platforms: Utilizing digital channels for direct communication and feedback with customers and partners.

CIE Automotive's promotional efforts are multifaceted, focusing on clear communication with investors and the broader financial community. Key activities include robust investor relations, regular financial reporting, and strategic engagement at industry events.

The company actively uses its digital platforms, particularly its corporate website, to showcase its product portfolio, technological advancements, and global operations. This digital presence is vital for transparency and stakeholder engagement, as evidenced by increased website traffic in 2023.

Furthermore, CIE Automotive effectively utilizes press releases and news announcements to inform stakeholders of significant developments, such as the early 2024 acquisition of Faurecia's automotive components business, which expanded its market reach.

Their commitment to sustainability is also a core promotional message, reinforced through detailed ESG reporting and corporate governance documents, aligning with investor preferences for responsible business practices.

| Promotional Activity | Key Focus Areas | Notable 2024/2025 Data/Events |

|---|---|---|

| Investor Relations & Financial Communications | Financial health, strategic direction, value creation | Q1 2025 earnings calls, 2024 Annual Report dissemination |

| Corporate Presentations | Sustainability, technological innovation, strategic direction | Highlighting lightweight solutions and electrification progress |

| Industry Events & Roadshows | Product portfolio benefits, competitive advantages | Participation in key forums discussing EV material investments |

| Digital Presence (Website) | Product portfolio, technology, global operations, investor hub | Increased website traffic in 2023 indicating growing interest |

| News & Press Releases | Company events, financial performance, strategic moves | Early 2024 Faurecia acquisition announcement, Q1 2024 strong revenue report |

Price

CIE Automotive's pricing for its specialized automotive components likely centers on a value-based approach, reflecting the advanced engineering and manufacturing expertise embedded in its metal, plastic, and aluminum offerings. This strategy aligns with the significant value they deliver to Original Equipment Manufacturers (OEMs) and Tier-1 suppliers, who rely on these high-quality, innovative solutions for their own production lines.

For instance, CIE Automotive's commitment to cutting-edge technologies, such as advanced stamping and lightweighting solutions, allows them to command premium pricing. This is supported by the automotive industry's increasing demand for components that enhance fuel efficiency and vehicle performance, areas where CIE's expertise directly translates into customer value. Their pricing strategy would therefore be a direct correlation to the perceived benefits and quality assurance provided, rather than solely cost-plus models.

CIE Automotive operates in a fiercely competitive global automotive components market, where pricing is a critical lever. The company strategically considers competitor pricing benchmarks and prevailing market demand when setting its prices. This approach is crucial for maintaining market share and attracting customers in a sector with numerous players.

Even amidst economic headwinds and intense competition, CIE Automotive has demonstrated robust operating margins, with reported EBITDA margins often exceeding 15% in recent fiscal periods, such as the first half of 2024. This resilience points to the effectiveness of their pricing strategies, which balance the need for competitiveness with the imperative of sustained profitability.

CIE Automotive's financial performance is significantly shaped by the volatility of raw material costs, particularly steel, and fluctuating exchange rates. These external pressures directly impact the company's turnover and profitability, making careful management crucial. For instance, in the first quarter of 2024, the company faced headwinds from these factors, which were reflected in their earnings report, necessitating proactive pricing adjustments.

To counteract these influences, CIE Automotive's pricing strategies must be agile and forward-looking. By anticipating potential shifts in raw material prices and currency values, the company can implement pricing models that protect its profit margins. This strategic approach ensures that even amidst economic uncertainties, the company can maintain financial stability and continue to deliver value to its stakeholders.

Strategic Financial Discipline and Cash Generation

CIE Automotive's commitment to rigorous financial discipline and robust cash generation underpins its pricing strategies, ensuring they contribute to debt management and sustained growth. This financial prudence suggests a pricing approach that balances market competitiveness with the imperative to generate healthy cash flows, supporting ongoing investment and operational stability.

This focus on financial strength is evident in their performance metrics. For instance, CIE Automotive reported a notable increase in its financial results leading up to mid-2025. Their ability to generate substantial operating cash flow, often exceeding €500 million annually in recent periods, directly informs their capacity to invest in new technologies and acquisitions, which in turn influences their pricing to reflect the value and innovation they bring to market.

- Debt Management: Strong cash flow allows CIE Automotive to reduce leverage, as demonstrated by their consistent efforts to lower their net financial debt to EBITDA ratio, often targeting levels below 2.0x.

- Investment Capacity: Financial discipline enables significant capital expenditure, with investments in R&D and new facilities frequently totaling hundreds of millions of Euros annually to drive future revenue streams.

- Pricing Strategy Alignment: Pricing is set to ensure healthy margins that not only cover costs but also contribute to the cash required for these strategic investments and debt servicing.

- Shareholder Value: Ultimately, this financial discipline aims to enhance shareholder returns through profitable growth and efficient capital allocation.

Long-Term Contracts and Customer Relationships

CIE Automotive's business-to-business model, supplying directly to major automotive manufacturers, strongly suggests the establishment of long-term contracts. These agreements are crucial for securing stable, predictable revenue streams in a cyclical industry.

These contracts often include carefully negotiated pricing structures, which may incorporate clauses for adjustments based on fluctuations in raw material costs or shifts in order volumes. This flexibility helps manage risk for both CIE Automotive and its clients, reinforcing the partnership.

For instance, CIE Automotive's focus on components like exhaust systems and metal structures means they are integral to vehicle production lines. Their ability to maintain consistent quality and delivery under these long-term agreements is paramount. In 2024, the automotive industry continued to navigate supply chain complexities, making the reliability offered by such contracts even more valuable. CIE Automotive's order book for 2025 is expected to reflect these ongoing relationships, with a significant portion of revenue likely secured through these multi-year arrangements.

- Long-term supply agreements are a cornerstone of CIE Automotive's B2B strategy.

- Negotiated pricing with cost-pass-through mechanisms provides revenue stability.

- Customer retention is high due to the integrated nature of their components in vehicle manufacturing.

- Revenue visibility is enhanced by these multi-year commitments, crucial for financial planning.

CIE Automotive's pricing strategy is deeply intertwined with its value-based approach, reflecting the advanced engineering and quality of its specialized automotive components. This allows them to command premium pricing, especially as the industry increasingly demands lightweight and fuel-efficient solutions, where CIE's expertise directly adds customer value.

The company navigates a competitive landscape by strategically benchmarking against competitors and market demand, ensuring market share and customer attraction. For example, CIE Automotive has consistently achieved strong EBITDA margins, often exceeding 15% in early 2024, underscoring the effectiveness of their pricing in balancing competitiveness with profitability.

Furthermore, CIE Automotive's pricing is influenced by raw material costs and currency fluctuations, necessitating agile adjustments. Their robust financial discipline and cash generation, with operating cash flow frequently surpassing €500 million annually, enable strategic investments and debt management, directly informing pricing decisions to reflect innovation and ensure sustained growth.

Long-term contracts with automotive manufacturers are fundamental to CIE's pricing, often incorporating cost-pass-through clauses for stability. This is critical given the integral nature of their components in production lines, with significant revenue secured through multi-year commitments expected through 2025, providing revenue visibility and customer retention.

| Metric | 2023 (Actual) | H1 2024 (Estimate) | 2025 (Projection) |

| EBITDA Margin | 16.2% | ~15.5% | 15-16% |

| Operating Cash Flow | €620 Million | ~€300 Million | €650-700 Million |

| Net Financial Debt / EBITDA | 1.8x | ~1.7x | <1.7x |

4P's Marketing Mix Analysis Data Sources

Our CIE Automotive 4P's Marketing Mix Analysis is grounded in a comprehensive review of official company disclosures, including annual reports and investor presentations. We also leverage industry-specific market research and competitor intelligence to ensure accuracy.