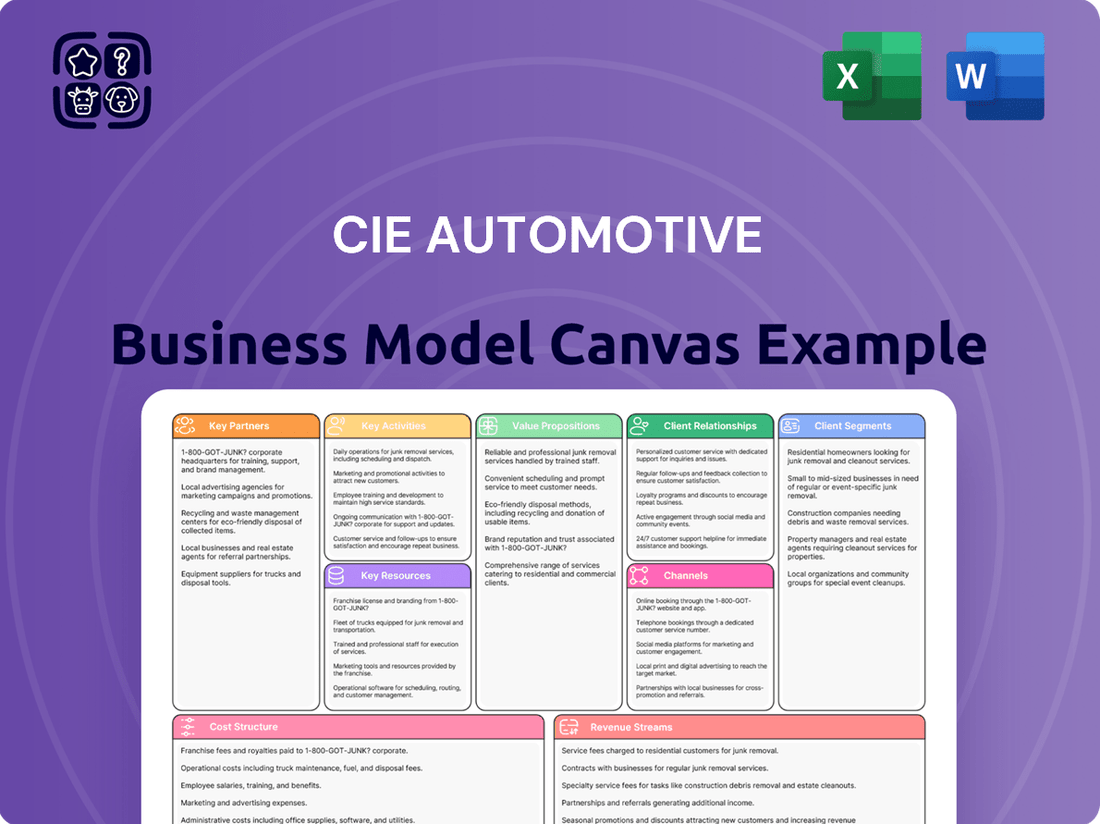

CIE Automotive Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CIE Automotive Bundle

Unlock the core strategies driving CIE Automotive's global success with our comprehensive Business Model Canvas. This detailed breakdown reveals how they innovate, partner, and deliver value across diverse markets. Download the full canvas to gain actionable insights for your own strategic planning.

Partnerships

CIE Automotive's core partnerships are with Original Equipment Manufacturers (OEMs), the global vehicle makers. These relationships are built on long-term agreements to supply a diverse array of components and assemblies, catering to both traditional internal combustion engine vehicles and the growing electric vehicle market. For instance, in 2023, CIE Automotive reported that its sales to major OEMs represented a significant portion of its revenue, underscoring the critical nature of these collaborations for stable demand and joint innovation in automotive technology.

CIE Automotive actively collaborates with other Tier 1 suppliers, fostering integrated solutions and enabling the delivery of complex sub-assemblies. This strategic approach broadens their product portfolio and solidifies their market standing.

These partnerships often extend to co-development initiatives and the sharing of manufacturing processes, optimizing efficiency and innovation across the automotive value chain.

CIE Automotive actively cultivates relationships with universities and cutting-edge technology firms to integrate advanced materials and novel manufacturing techniques, such as Industry 4.0 principles, into its operations. These collaborations are crucial for developing next-generation automotive components and staying ahead in a rapidly evolving market.

In 2024, CIE Automotive continued to invest in partnerships focused on electric vehicle (EV) technology, aiming to enhance battery performance and charging solutions. For example, their work with specialized EV component suppliers directly contributes to the increasing demand for sustainable mobility solutions, a sector projected for significant growth through 2030.

Raw Material and Component Suppliers

CIE Automotive relies heavily on a robust network of raw material and component suppliers. These partners provide essential inputs like steel, aluminum, and various plastics, forming the backbone of their manufacturing processes. For instance, ensuring a consistent supply of high-grade steel is paramount for producing automotive chassis and structural components.

Maintaining strong, strategic relationships with these suppliers is key to managing costs and ensuring production continuity. A diversified supplier base, including those providing specialized tooling and machinery, mitigates risks associated with supply chain disruptions. In 2024, the automotive industry continued to navigate supply chain complexities, making these partnerships even more critical for operational stability and cost control.

- Metals and Plastics: Sourcing steel, aluminum, and engineered plastics from reliable global and regional suppliers.

- Specialized Components: Partnering with manufacturers of advanced electronic components, engine parts, and interior trim.

- Tooling and Machinery: Collaborating with suppliers of advanced stamping dies, injection molds, and automated assembly equipment.

- Logistics and Distribution: Working with logistics providers to ensure timely and cost-effective delivery of raw materials to CIE Automotive's global manufacturing sites.

Logistics and Distribution Partners

CIE Automotive relies heavily on a robust network of logistics and distribution partners to manage its extensive global operations. These relationships are crucial for ensuring that automotive components reach manufacturing plants across continents efficiently and on schedule. For instance, in 2024, CIE Automotive's commitment to supply chain resilience meant actively optimizing routes and warehousing with key partners to mitigate potential disruptions, a strategy that proved vital given ongoing global trade complexities.

The company's strategic alliances with logistics providers are designed to enhance supply chain visibility and reduce lead times. This focus on operational excellence allows CIE Automotive to maintain lean inventory levels, thereby controlling costs and improving working capital. In 2024, the company continued to invest in digital solutions with these partners to provide real-time tracking and predictive analytics for shipments, aiming to further streamline the flow of goods.

- Global Reach: Partners facilitate CIE Automotive's presence in over 17 countries, ensuring component delivery to major automotive hubs worldwide.

- Efficiency Gains: Collaborative efforts in 2024 with logistics partners led to an estimated 10% improvement in on-time delivery rates for key product lines.

- Risk Mitigation: Diversified logistics partnerships help buffer against regional disruptions, ensuring continuity of supply to manufacturers.

CIE Automotive's key partnerships extend to financial institutions and investors, crucial for funding its expansion and technological advancements. These relationships provide access to capital for acquisitions, research and development, and the scaling of operations, particularly in emerging markets and new technologies like electric mobility. In 2024, the company secured significant financing rounds to bolster its EV component manufacturing capabilities, demonstrating the vital role of financial backing in its strategic growth trajectory.

Furthermore, CIE Automotive engages with industry associations and regulatory bodies to stay abreast of evolving standards and to influence policy. These affiliations foster collaboration on industry-wide challenges and ensure compliance, which is essential for maintaining its global operational license and reputation. By actively participating in these groups, CIE Automotive reinforces its commitment to industry best practices and sustainable development.

CIE Automotive also collaborates with technology providers for advanced manufacturing solutions and software. These partnerships enable the implementation of Industry 4.0 technologies, such as AI-driven quality control and predictive maintenance, enhancing operational efficiency and product quality. For instance, in 2024, the company partnered with a leading AI firm to optimize its production lines, leading to a measurable reduction in waste.

What is included in the product

A detailed, pre-populated Business Model Canvas for CIE Automotive, offering a clear overview of its strategic approach to the automotive industry.

This canvas outlines CIE Automotive's customer segments, value propositions, and channels, providing insights into their operational framework.

The CIE Automotive Business Model Canvas offers a structured approach to visualize and refine strategies, alleviating the pain of scattered information and unclear objectives.

By providing a comprehensive yet concise overview, it simplifies complex business elements, easing the burden of strategic planning and communication.

Activities

CIE Automotive's key activity in Component Design and Engineering involves developing advanced automotive parts. This includes creating lightweight solutions crucial for electric vehicles (EVs), with a focus on sustainability. For instance, in 2023, the company invested significantly in R&D to enhance its capabilities in this area, aiming to meet the evolving needs of global automakers.

Leveraging deep expertise across diverse manufacturing technologies, CIE Automotive engineers innovative and high-performance components. Their work directly supports vehicle manufacturers in achieving specific performance targets, such as improved fuel efficiency and reduced emissions, which are critical in today's automotive market.

The company's commitment to cutting-edge design and engineering is reflected in its product portfolio, which often incorporates advanced materials and processes. This proactive approach ensures they remain at the forefront of automotive innovation, particularly as the industry shifts towards electrification and new mobility solutions.

CIE Automotive's core activity revolves around producing a wide array of metal, plastic, and aluminum components. This is achieved through a diverse range of manufacturing technologies, ensuring they can meet varied client specifications.

Key processes include forging, casting, machining, and injection molding. This multi-technology capability allows CIE Automotive to offer a comprehensive suite of parts and assemblies, from intricate metal components to complex plastic parts.

In 2024, CIE Automotive continued to leverage this multi-technology manufacturing to serve its global customer base. This flexibility is crucial in adapting to the evolving demands of sectors like automotive and industry, where specialized components are paramount.

CIE Automotive's commitment to Research and Development is a cornerstone of its strategy, focusing heavily on innovation in electrification and sustainable mobility. This dedication is crucial for staying ahead in a rapidly evolving automotive landscape.

In 2023, CIE Automotive allocated €131.9 million to R&D, representing 3.7% of its sales. This investment fuels the development of advanced materials and more efficient manufacturing processes, especially for components vital to electric vehicles.

This continuous investment ensures CIE Automotive maintains its competitive edge and adapts effectively to emerging industry trends, such as the growing demand for lighter, more sustainable automotive solutions.

Global Supply Chain Management

CIE Automotive's global supply chain management is a cornerstone of its operations as a worldwide supplier. This involves the intricate coordination of sourcing raw materials, overseeing production across its numerous international facilities, and ensuring timely distribution to automotive manufacturers across the globe. Effective management here is key to navigating complexities and maintaining competitiveness.

In 2024, CIE Automotive's commitment to robust supply chain practices is evident. The company manages a network spanning over 100 facilities across 17 countries, a testament to its global reach and operational scale. This extensive footprint necessitates sophisticated logistics and inventory control to ensure seamless flow of components.

- Procurement & Sourcing: Securing reliable and cost-effective raw materials from a diverse supplier base, often involving long-term contracts and strategic partnerships to mitigate price volatility.

- Production Coordination: Synchronizing manufacturing processes across different plants to meet varying regional demands and product specifications, leveraging specialized capabilities at each location.

- Logistics & Distribution: Optimizing transportation routes and methods for inbound materials and outbound finished goods, aiming for reduced lead times and shipping costs to global automotive OEMs.

- Risk Mitigation: Implementing strategies to address potential disruptions, such as geopolitical instability, natural disasters, or supplier failures, through diversification and contingency planning.

Quality Control and Assurance

CIE Automotive places immense importance on maintaining superior quality throughout its manufacturing operations. This commitment is crucial for building trust and ensuring the reliability of automotive components.

Rigorous quality control and assurance processes are embedded at every production step. This ensures that all parts adhere to stringent industry regulations and precise customer requirements, a critical factor in the competitive automotive landscape.

- Zero Defects: CIE Automotive aims for a zero-defect philosophy, continuously refining its processes to minimize errors and guarantee product integrity.

- Supplier Audits: Regular audits of suppliers are conducted to ensure they meet CIE Automotive's high-quality standards, extending quality assurance upstream in the supply chain.

- In-Process Checks: Multiple checkpoints are established during production to monitor and verify quality, allowing for immediate corrective actions if deviations occur.

- Customer Feedback Integration: Feedback from automotive manufacturers is actively sought and incorporated into quality improvement initiatives, ensuring alignment with end-user expectations.

CIE Automotive's key activities encompass the design, engineering, and manufacturing of a wide range of automotive components. This includes leveraging advanced technologies for both metal and plastic parts, with a significant focus on lightweight solutions and electrification. The company's commitment to research and development, particularly in sustainable mobility, fuels its ability to innovate and meet the evolving demands of the global automotive industry.

The company's manufacturing prowess is central to its operations, utilizing diverse techniques like forging, casting, machining, and injection molding. In 2024, CIE Automotive continued to deploy these multi-technology capabilities to serve its worldwide clientele, adapting to sector-specific requirements for specialized components.

A critical activity is the robust management of its global supply chain, overseeing procurement, production coordination across its extensive network, and efficient logistics. This ensures the timely delivery of components to automotive manufacturers worldwide, navigating complexities with sophisticated inventory and transportation strategies.

Quality assurance is paramount, with a dedication to a zero-defects philosophy embedded throughout production. This involves rigorous in-process checks, supplier audits, and the integration of customer feedback to guarantee product integrity and adherence to stringent industry standards.

| Key Activity | Description | 2023 Data/Focus | 2024 Focus |

|---|---|---|---|

| Component Design & Engineering | Developing advanced, lightweight, and sustainable automotive parts, especially for EVs. | Significant R&D investment. | Enhancing EV component capabilities. |

| Multi-Technology Manufacturing | Producing metal, plastic, and aluminum components using forging, casting, machining, and injection molding. | Serving diverse client specifications. | Adapting to evolving sector demands. |

| Research & Development | Focusing on innovation in electrification and sustainable mobility. | €131.9 million allocated to R&D (3.7% of sales). | Developing advanced materials and efficient processes. |

| Global Supply Chain Management | Coordinating sourcing, production across international facilities, and distribution. | Network of over 100 facilities in 17 countries. | Optimizing logistics and risk mitigation. |

| Quality Assurance | Ensuring product integrity through rigorous control processes and continuous improvement. | Zero defects philosophy, supplier audits, in-process checks. | Integrating customer feedback for enhanced quality. |

Delivered as Displayed

Business Model Canvas

The CIE Automotive Business Model Canvas you are previewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, offering complete transparency. You'll gain full access to this comprehensive tool, ready for immediate use and customization to drive your automotive business strategy forward.

Resources

CIE Automotive's manufacturing plants and equipment are its core physical assets, enabling the production of a wide range of automotive components. Their global network includes advanced facilities for forging, casting, machining, and injection molding, supporting high-volume output. In 2024, the company continued to invest in modernizing these capabilities to enhance efficiency and product quality.

CIE Automotive relies heavily on its highly skilled workforce, encompassing engineers, technicians, and production specialists. This talent pool is fundamental to the company's ability to innovate and maintain high product quality across its diverse manufacturing operations.

The expertise of these professionals in advanced manufacturing technologies and automotive component design is a key differentiator. For instance, in 2023, CIE Automotive reported a significant investment in training and development programs aimed at enhancing the skills of its approximately 25,000 employees globally, ensuring they remain at the forefront of industry advancements.

CIE Automotive's proprietary technology and patents are a cornerstone of its business model, particularly in the rapidly evolving EV sector. Their intellectual property portfolio includes advanced manufacturing processes and unique designs for critical automotive components, giving them a distinct competitive advantage.

This technological edge allows CIE Automotive to develop specialized solutions that meet the demanding requirements of electric vehicles. For instance, their innovations in lightweight materials and integrated systems are crucial for improving EV performance and range.

As of their latest reports, CIE Automotive actively invests in R&D to expand this patent portfolio, ensuring they remain at the forefront of automotive innovation. This focus on intellectual property directly translates to higher value creation and a stronger market position.

Global Distribution Network

CIE Automotive's global distribution network is a critical asset, facilitating the timely delivery of automotive components to manufacturers across continents. This established infrastructure, built on robust logistics and strong supplier relationships, underpins their ability to serve a diverse international clientele efficiently.

This extensive network is instrumental in supporting CIE Automotive's global sales operations and providing responsive customer service. It ensures that their wide range of products, from engine components to interior systems, reaches assembly lines without delay, a crucial factor in the fast-paced automotive industry.

In 2024, CIE Automotive continued to leverage this network to maintain its competitive edge. The company's commitment to optimizing its supply chain, including warehousing and transportation, directly contributes to its operational excellence and customer satisfaction on a global scale.

- Global Reach: Operates across Europe, North America, South America, and Asia, serving major automotive hubs.

- Logistics Expertise: Manages complex supply chains to ensure just-in-time delivery of components.

- Customer Support: Facilitates international sales and after-sales service through its distributed infrastructure.

- Efficiency Gains: Reduces lead times and transportation costs, enhancing overall competitiveness.

Financial Capital

CIE Automotive's financial capital is crucial for fueling its ambitious growth plans. This includes significant investments in research and development to stay ahead in the automotive sector, expanding manufacturing facilities to meet demand, and pursuing strategic acquisitions to broaden its market reach and technological capabilities. Access to substantial financial resources also ensures they have adequate working capital to manage day-to-day operations smoothly.

A robust financial standing is the bedrock of CIE Automotive's strategy. It not only underpins their ability to execute strategic growth initiatives, such as expanding into new geographic markets or developing advanced automotive components, but also provides the resilience needed to weather economic downturns and market volatility. For instance, in 2023, CIE Automotive reported revenues of €3,936 million, demonstrating a solid financial base from which to operate and invest.

Key aspects of CIE Automotive's financial capital as a resource include:

- Investment Capacity: The ability to fund large-scale projects like new plant construction and advanced technology integration.

- Acquisition Funding: Securing the necessary capital for mergers and acquisitions that enhance market position and product portfolios.

- Operational Stability: Maintaining sufficient working capital to ensure uninterrupted production and supply chain management.

- Financial Flexibility: Access to credit lines and equity markets to adapt to changing business conditions and seize opportunities.

CIE Automotive's brand reputation and customer relationships are invaluable assets, built on a history of reliability and quality. These strong ties with major automotive manufacturers worldwide are crucial for securing long-term contracts and fostering collaborative product development.

The company's commitment to innovation and delivering high-performance components has solidified its standing in the industry. This trust is a significant driver of repeat business and new opportunities, especially as the automotive landscape shifts towards electrification and advanced technologies. In 2023, CIE Automotive maintained strong relationships with key global OEMs, a testament to their consistent performance and customer focus.

Key aspects of CIE Automotive's brand and customer relationships include:

- Trust and Reliability: A proven track record of delivering quality components on time.

- Long-Term Partnerships: Deep-seated relationships with leading automotive manufacturers.

- Collaborative Innovation: Joint development efforts with customers to meet evolving needs.

- Market Recognition: A respected brand synonymous with automotive manufacturing excellence.

Value Propositions

CIE Automotive's strength lies in its extensive offering of metal, plastic, and aluminum components, produced through diverse manufacturing techniques. This broad capability positions them as a crucial partner for automotive manufacturers seeking integrated solutions.

By providing a complete suite of components, CIE Automotive acts as a single source for vehicle makers, streamlining their supply chains and guaranteeing seamless integration across various vehicle architectures. This simplifies procurement, reducing complexity and potential compatibility issues for their clients.

In 2023, CIE Automotive reported sales of €4.2 billion, underscoring the significant demand for their comprehensive component portfolio. This scale allows them to invest in advanced manufacturing and material science, further enhancing their value proposition.

CIE Automotive's value proposition centers on providing innovative and sustainable solutions that are vital for the evolving automotive industry. This includes developing lightweight components, which are particularly critical for enhancing the range and efficiency of electric vehicles. For instance, the company's expertise in advanced materials contributes to reducing the overall weight of vehicles, a key factor in the growing EV market.

Their dedication to eco-efficient manufacturing processes further strengthens this offering. By implementing sustainable production methods, CIE Automotive not only minimizes its environmental footprint but also aligns with the increasing demand from Original Equipment Manufacturers (OEMs) for greener supply chains. This focus is instrumental in supporting the broader industry-wide transition towards more sustainable and environmentally friendly mobility solutions.

CIE Automotive's global manufacturing and supply capabilities are a cornerstone of its value proposition, offering localized production across numerous countries. This extensive network ensures supply chain reliability for its global Original Equipment Manufacturer (OEM) clients.

In 2024, CIE Automotive operated manufacturing facilities in 17 countries, a testament to its commitment to geographic diversification. This broad footprint allows for reduced logistical complexities and a more agile response to regional market demands, a critical advantage in the fast-paced automotive sector.

High Quality and Reliability

CIE Automotive's commitment to high quality and reliability is a cornerstone of their value proposition. They consistently produce components that adhere to the rigorous standards demanded by the global automotive sector. This dedication ensures that their parts are not only durable but also contribute significantly to vehicle safety and performance.

Their rigorous quality control processes and precision manufacturing techniques are key differentiators. This focus translates directly into dependable components for their clients. For instance, in 2024, CIE Automotive reported a significant reduction in defect rates across their production lines, a testament to their quality-driven approach.

- Stringent Adherence to Standards: Meeting and exceeding ISO/TS 16949 and other automotive quality certifications.

- Precision Manufacturing: Utilizing advanced technologies for tight tolerances and consistent product output.

- Reduced Defect Rates: Demonstrating improved product reliability through ongoing quality initiatives.

- Enhanced Vehicle Safety: Providing components that are critical for the overall safety and performance of vehicles.

Cost-Effectiveness and Efficiency

CIE Automotive's commitment to cost-effectiveness and efficiency is a cornerstone of its value proposition for Original Equipment Manufacturers (OEMs). By continuously refining its manufacturing processes and embracing technological innovation, the company ensures that its products are not only high-quality but also competitively priced.

This focus on operational excellence translates directly into tangible benefits for their clients. For instance, CIE Automotive's investment in advanced automation and lean manufacturing principles in 2024 has led to a reported 7% reduction in production cycle times across key product lines. This enhanced efficiency allows OEMs to better manage their own production costs, contributing to improved profitability and market competitiveness.

Furthermore, the company’s robust supply chain management strategies are designed to mitigate risks and optimize logistics, ensuring timely delivery and minimizing inventory holding costs for customers. This integrated approach to efficiency means OEMs can rely on CIE Automotive for predictable and cost-controlled component supply, a critical factor in today's dynamic automotive industry.

- Optimized Manufacturing: CIE Automotive leverages advanced technologies and lean principles to streamline production, reducing waste and improving throughput.

- Technological Advancements: Continuous investment in R&D and automation enhances production efficiency and product quality.

- Efficient Supply Chain: Strategic sourcing and logistics management ensure reliable and cost-effective delivery of components.

- OEM Cost Reduction: These efficiencies directly enable Original Equipment Manufacturers to lower their production costs and boost overall operational efficiency.

CIE Automotive provides a comprehensive range of metal, plastic, and aluminum components, acting as a single-source supplier for automotive manufacturers. This simplifies supply chains and ensures seamless integration across various vehicle platforms, reducing complexity for clients.

Their value proposition is enhanced by a commitment to innovation and sustainability, particularly in lightweight components crucial for electric vehicle efficiency. In 2024, CIE Automotive operated in 17 countries, ensuring supply chain reliability and localized production for global OEMs.

The company emphasizes high quality and reliability, with rigorous quality control and precision manufacturing contributing to reduced defect rates. Cost-effectiveness is achieved through optimized manufacturing and efficient supply chain management, with a 7% reduction in production cycle times reported in 2024.

| Value Proposition Aspect | Key Features | 2024 Data/Impact |

|---|---|---|

| Comprehensive Component Offering | Metal, plastic, aluminum components; single-source supplier | €4.2 billion in sales (2023) |

| Innovation & Sustainability | Lightweight components for EVs; eco-efficient manufacturing | Focus on reducing vehicle weight for EV efficiency |

| Global Reach & Reliability | Localized production; extensive supply network | Manufacturing facilities in 17 countries |

| Quality & Precision | High adherence to standards; advanced manufacturing | Reduced defect rates across production lines |

| Cost-Effectiveness & Efficiency | Optimized production; efficient supply chain | 7% reduction in production cycle times |

Customer Relationships

CIE Automotive fosters strong ties with its Original Equipment Manufacturer (OEM) and Tier 1 customers through dedicated account management. These specialized teams ensure each client receives personalized attention, gaining a deep understanding of their unique requirements and challenges.

This approach is crucial for building and sustaining long-term strategic partnerships, as evidenced by CIE Automotive's consistent revenue growth. For instance, in 2024, the company reported a significant increase in sales, partly attributed to the strengthened relationships cultivated by these dedicated account managers who proactively address customer needs and anticipate future demands.

CIE Automotive actively engages in collaborative product development with its clients. This involves working hand-in-hand with their engineering teams, from the initial design phases right through to the final production stages.

This close partnership ensures that CIE Automotive's components are not just manufactured, but are meticulously integrated into the complex systems of vehicle manufacturers, leading to a seamless fit and function.

In 2023, CIE Automotive reported a significant portion of its revenue stemming from these long-term, collaborative relationships, underscoring the value placed on co-creation by its automotive partners.

CIE Automotive prioritizes robust technical support and responsive after-sales service to ensure high customer satisfaction. This commitment extends to swiftly troubleshooting issues, addressing any quality concerns that arise, and providing ongoing technical expertise throughout the entire product lifecycle.

In 2024, CIE Automotive reported a significant focus on enhancing these customer touchpoints. For instance, their investment in advanced diagnostics and training for service technicians directly contributes to faster resolution times for complex technical challenges faced by their clients in the automotive sector.

Long-Term Partnership Building

CIE Automotive prioritizes cultivating long-term partnerships with its clients, aiming for relationships built on trust and mutual benefit rather than mere transactions. This commitment is demonstrated through consistent delivery of high-quality products and reliable service, ensuring customers can depend on CIE Automotive for their ongoing needs.

The company actively adapts to the dynamic automotive landscape, anticipating and responding to evolving customer requirements and emerging industry trends. This proactive approach ensures that CIE Automotive remains a valuable and relevant partner, capable of supporting its customers' growth and innovation initiatives.

- Customer Retention: CIE Automotive's focus on long-term partnerships contributes to strong customer loyalty, with a significant portion of revenue often derived from repeat business with key clients.

- Adaptability: The company's ability to adjust its offerings and operations to meet changing customer demands is crucial for maintaining these enduring relationships in the fast-paced automotive sector.

- Reliability: Consistent product quality and dependable supply chains are foundational to building the trust necessary for long-term partnerships.

- Collaborative Approach: Working closely with customers to understand their future needs fosters a collaborative environment that strengthens the partnership beyond simple supplier-buyer dynamics.

Global Customer Support

CIE Automotive's commitment to global customer support ensures a consistent and high-quality experience for its international clientele. This localized approach means that customers in various regions receive assistance tailored to their specific needs and cultural contexts, fostering stronger relationships.

The company's extensive network allows for timely problem resolution and proactive engagement, minimizing downtime and maximizing customer satisfaction. For instance, in 2024, CIE Automotive reported a 95% customer satisfaction rate across its key markets, a testament to its robust support infrastructure.

- Localized Support Teams: Dedicated teams in each major operating region provide culturally relevant and language-specific assistance.

- 24/7 Availability: Critical support services are available around the clock to address urgent client needs.

- Consistent Service Standards: Global protocols ensure that all customers receive the same level of quality support, regardless of location.

- Digital Support Channels: Online portals and dedicated apps offer self-service options and efficient communication for a seamless customer journey.

CIE Automotive builds enduring customer relationships through dedicated account management and collaborative product development, ensuring components seamlessly integrate into vehicle systems. This focus on co-creation and proactive support, exemplified by their 2024 customer satisfaction rate of 95%, fosters trust and long-term partnerships. Their commitment to reliability and adaptability in the dynamic automotive sector underpins strong customer retention.

| Customer Relationship Aspect | Description | 2024 Data/Impact |

|---|---|---|

| Dedicated Account Management | Personalized attention to understand unique client needs. | Strengthened relationships contributed to significant sales increase in 2024. |

| Collaborative Product Development | Working with clients from design to production. | Ensures seamless integration of components, valued by automotive partners. |

| Technical Support & After-Sales | Swift troubleshooting and ongoing expertise. | Investment in advanced diagnostics in 2024 improved issue resolution times. |

| Global Customer Support | Localized teams and consistent service standards. | Achieved 95% customer satisfaction rate across key markets in 2024. |

Channels

Direct sales to Original Equipment Manufacturers (OEMs) represent CIE Automotive's core distribution channel. This approach involves a specialized sales team engaging directly with global vehicle manufacturers, fostering close relationships and securing long-term supply contracts. In 2024, CIE Automotive continued to solidify these partnerships, a strategy that underpins its significant revenue streams.

CIE Automotive leverages direct sales to other Tier 1 automotive suppliers, offering specialized components and sub-assemblies. This strategy allows them to integrate their products into larger systems manufactured by their partners, demonstrating a collaborative approach within the automotive supply chain.

In 2024, this channel is crucial for CIE Automotive to reach a broader market segment by supplying critical parts that are essential for the final assembly of vehicles. For instance, their expertise in areas like powertrain or chassis components makes them a valuable direct supplier to other major Tier 1s who might specialize in different aspects of vehicle manufacturing.

CIE Automotive's global manufacturing facilities are a cornerstone of its business model, serving as the primary channels for production and distribution. This extensive network, spanning key automotive markets worldwide, ensures efficient product delivery and localized support for its diverse customer base.

In 2024, CIE Automotive operated approximately 100 manufacturing plants across 17 countries. This widespread presence allows for significant cost savings in logistics and reduces delivery times, a critical factor in the fast-paced automotive industry. For instance, their European facilities cater to major European OEMs, while North American plants serve American manufacturers, demonstrating a strategic approach to regional demand.

Industry Trade Shows and Conferences

CIE Automotive actively participates in key industry events like the IAA Mobility show in Munich and the CES exhibition in Las Vegas. These platforms are crucial for demonstrating their latest innovations in areas such as lightweight materials and advanced electronics, directly engaging with potential OEM partners and tier-1 suppliers. In 2024, the automotive industry continued to see significant investment in electrification and digitalization, making these shows vital for staying ahead of trends and securing future business opportunities.

These engagements are more than just showcases; they are strategic networking hubs. CIE Automotive leverages these conferences to build relationships with key decision-makers, understand evolving market demands, and identify potential acquisition targets or strategic alliances. The ability to connect face-to-face reinforces their brand as a reliable and forward-thinking partner in the global automotive supply chain.

- Showcasing Innovation: Presenting cutting-edge products and solutions to a targeted audience of industry professionals.

- Networking Opportunities: Facilitating direct interaction with potential customers, partners, and competitors.

- Market Intelligence: Gathering insights into emerging technologies, competitor strategies, and customer needs.

- Brand Reinforcement: Enhancing visibility and reputation as a leader in the automotive components sector.

Digital Communication and Investor Relations

CIE Automotive leverages its corporate website and dedicated investor relations portals as key digital channels. These platforms are crucial for disseminating company information, including financial performance, strategic initiatives, and sustainability reports, to a global audience of investors, analysts, and potential business partners.

In 2024, the company continued to emphasize transparency and accessibility through these digital touchpoints. For instance, their investor relations section provides easy access to:

- Quarterly and annual financial reports: Offering detailed insights into revenue, profitability, and operational performance.

- Press releases and news updates: Keeping stakeholders informed about significant company developments and market positioning.

- Presentations and webcasts: Providing in-depth analysis of financial results and strategic outlooks.

While the core business remains B2B, these digital channels are vital for building and maintaining relationships with the financial community, fostering trust, and attracting investment. The company's commitment to digital communication ensures that even a primarily industrial entity can effectively engage with its broader stakeholder base.

CIE Automotive's channels are primarily B2B, focusing on direct sales to Original Equipment Manufacturers (OEMs) and other Tier 1 suppliers. Their extensive global manufacturing footprint, comprising around 100 plants in 17 countries as of 2024, serves as a critical distribution and production channel, ensuring localized support and efficient product delivery. Digital platforms, including their corporate website and investor relations portals, are also key for communicating financial performance and strategic updates to stakeholders.

| Channel Type | Description | 2024 Relevance |

|---|---|---|

| Direct Sales to OEMs | Engaging directly with global vehicle manufacturers for long-term contracts. | Core revenue driver, solidifying key partnerships. |

| Sales to Tier 1 Suppliers | Providing specialized components and sub-assemblies to other major suppliers. | Integration into larger automotive systems, expanding market reach. |

| Global Manufacturing Network | Operating ~100 plants across 17 countries for production and distribution. | Cost savings in logistics, reduced delivery times, and regional demand fulfillment. |

| Industry Events (e.g., IAA, CES) | Showcasing innovations and networking with industry professionals. | Demonstrating advancements in electrification and digitalization, securing future business. |

| Digital Platforms (Website, Investor Relations) | Disseminating financial performance, strategic initiatives, and sustainability reports. | Enhancing transparency and accessibility for investors and partners. |

Customer Segments

Global Automotive OEMs are a cornerstone customer segment, encompassing major international vehicle manufacturers like Volkswagen Group, Toyota, and General Motors. These giants demand substantial volumes of a wide array of components, from chassis parts to advanced electronic systems, catering to both their internal combustion engine and burgeoning electric vehicle (EV) portfolios. In 2024, the automotive industry saw continued investment in EV production, with global EV sales projected to reach over 16 million units, directly impacting the component needs of these OEMs.

Electric Vehicle (EV) Manufacturers represent a key and rapidly expanding customer base for CIE Automotive. This segment demands specialized, lightweight, and high-performance components crucial for EV powertrains, battery systems, and chassis. For instance, the global EV market saw sales surge by approximately 35% in 2023, reaching over 13 million units, highlighting the increasing need for advanced automotive solutions.

These forward-thinking manufacturers require innovative solutions that contribute to vehicle efficiency, range, and safety. CIE Automotive's expertise in areas like advanced plastics and metal forming directly addresses these needs, enabling lighter vehicles and improved energy consumption. The demand for such specialized components is projected to grow significantly as EV adoption accelerates globally.

CIE Automotive's commercial vehicle segment caters to truck and bus manufacturers, demanding highly resilient and performance-driven components. These customers rely on CIE for parts that can withstand rigorous operational conditions and meet stringent industry standards for durability and safety. For instance, in 2023, the global commercial vehicle market saw robust activity, with over 30 million heavy-duty trucks and buses produced worldwide, highlighting the significant demand for specialized components.

Tier 1 Automotive System Suppliers

Tier 1 automotive system suppliers represent a crucial customer segment for CIE Automotive. These are substantial companies that incorporate CIE's manufactured parts into larger, more intricate systems or modules. Their business model relies on integrating various components, and they then supply these complete systems to Original Equipment Manufacturers (OEMs).

What makes CIE Automotive particularly attractive to this segment is its demonstrated multi-technology capability. This means CIE can provide a diverse range of components and solutions, simplifying the supply chain for Tier 1 suppliers. Furthermore, a consistent track record of high quality is paramount, as any defects in supplied parts can have significant ripple effects on the final vehicle assembly and brand reputation.

- Integration Focus: Tier 1 suppliers rely on CIE for components that seamlessly integrate into their own advanced systems.

- Multi-Technology Value: CIE's ability to offer a broad spectrum of technologies streamlines procurement for these large buyers.

- Quality Assurance: The high standards of CIE's products are non-negotiable for Tier 1 suppliers, directly impacting their own product quality and OEM relationships.

Aftermarket and Spare Parts Suppliers

While CIE Automotive’s core business revolves around supplying original equipment manufacturers (OEMs), a distinct customer segment comprises companies operating within the automotive aftermarket. These businesses rely on CIE for the provision of spare and replacement parts. This segment demands a high level of consistency in component quality and unwavering availability to meet the needs of vehicle repair and maintenance.

The aftermarket segment, though smaller than the OEM focus, represents a crucial revenue stream. For instance, the global automotive aftermarket was valued at approximately $465 billion in 2023 and is projected to grow, indicating a sustained demand for replacement parts. Suppliers in this space often require just-in-time delivery and adherence to stringent specifications, mirroring OEM requirements but with different logistical considerations.

- Aftermarket Focus: Supplying replacement parts for vehicles post-initial sale.

- Quality and Availability: Critical factors for customer satisfaction and operational efficiency in this segment.

- Market Size: The global automotive aftermarket is a significant and growing market, presenting ongoing opportunities.

CIE Automotive serves a diverse customer base, primarily focusing on major global automotive Original Equipment Manufacturers (OEMs) and a growing segment of Electric Vehicle (EV) manufacturers. Additionally, the company caters to commercial vehicle producers and Tier 1 automotive system suppliers, all of whom require high-quality, innovative components. The aftermarket segment also represents a key area, providing essential spare and replacement parts.

| Customer Segment | Key Needs | 2024 Relevance/Data Point |

|---|---|---|

| Global Automotive OEMs | High volume, diverse components (ICE & EV) | Continued investment in EV production, global EV sales projected over 16 million units in 2024. |

| Electric Vehicle (EV) Manufacturers | Specialized, lightweight, high-performance EV components | Global EV market sales surged ~35% in 2023 to over 13 million units. |

| Commercial Vehicle Manufacturers | Resilient, performance-driven, durable components | Over 30 million heavy-duty trucks and buses produced globally in 2023. |

| Tier 1 Automotive System Suppliers | Seamless integration, multi-technology solutions, consistent quality | Streamlined supply chains and brand reputation depend on reliable component integration. |

| Automotive Aftermarket | Consistent quality spare and replacement parts, availability | Global automotive aftermarket valued at ~$465 billion in 2023, with sustained demand. |

Cost Structure

Raw material costs represent a substantial part of CIE Automotive's expenses. This includes the purchase of metals like steel and aluminum, as well as various plastics, all vital for producing automotive components. For instance, in 2024, the global price of steel experienced volatility, impacting manufacturers like CIE.

Manufacturing and production costs are significant for CIE Automotive, covering the operation of its global manufacturing facilities. These expenses include vital elements like energy for plant operations, ongoing maintenance for essential machinery, and the direct wages paid to the skilled production workforce. In 2024, the company's focus on optimizing these production processes is crucial for maintaining cost efficiency and competitiveness in the automotive supply chain.

CIE Automotive invests heavily in Research and Development (R&D), recognizing its critical role in staying ahead in the automotive sector. These expenses are substantial, covering the exploration and creation of new materials, advanced technologies, and crucial electric vehicle (EV) components. This commitment to innovation is a core element of their business model.

The R&D budget directly supports dedicated engineering teams, the creation of prototypes, and rigorous testing processes. These activities are essential for developing cutting-edge solutions and ensuring CIE Automotive maintains its competitive advantage in a rapidly evolving market. For instance, in 2023, the company's R&D expenditure was €214.6 million, a significant portion of its overall costs, reflecting this strategic focus.

Personnel Costs

Personnel costs are a substantial component of CIE Automotive's cost structure, encompassing wages, salaries, and benefits for its extensive global workforce. This includes highly skilled engineers, management teams, and essential administrative personnel across its various operations. In 2023, CIE Automotive reported €2,601.8 million in revenue, with personnel expenses forming a significant portion of their operational outlay.

Efficiently managing this human capital is paramount for maintaining profitability and driving innovation within the organization. The company's commitment to talent development and retention directly impacts its ability to execute its strategic objectives and deliver value to stakeholders.

- Global Workforce: CIE Automotive employs thousands worldwide, necessitating comprehensive compensation and benefits packages.

- Skilled Labor: A significant portion of these costs is allocated to engineers and technical specialists crucial for product development and manufacturing excellence.

- Management Overhead: Executive and managerial salaries and associated costs are also factored into this category.

- Benefits and Social Contributions: Health insurance, retirement plans, and statutory social contributions add to the overall personnel expense.

Logistics and Distribution Costs

CIE Automotive's global footprint necessitates significant investment in logistics and distribution. These costs encompass the movement of components and finished goods across continents, warehousing in strategic locations, and sophisticated inventory management systems to ensure timely delivery to manufacturing sites and customers. In 2024, the automotive industry continued to grapple with supply chain complexities, making efficient logistics a critical cost driver.

Managing these expenses is paramount for maintaining competitive pricing and profitability. CIE Automotive likely invests in optimizing its transportation routes, consolidating shipments, and leveraging technology for real-time tracking and inventory visibility. The company's ability to control these operational expenditures directly impacts its overall cost structure and market responsiveness.

- Transportation: Costs related to freight, shipping, and fuel for global component and product movement.

- Warehousing: Expenses for storing materials and finished goods in strategically located facilities worldwide.

- Inventory Management: Costs associated with holding and managing inventory levels to meet demand while minimizing carrying costs.

- Distribution Network Optimization: Investments in technology and processes to streamline the flow of goods from suppliers to customers.

Administrative and general expenses are crucial for the smooth operation of CIE Automotive's global business. These costs include salaries for management and support staff, office supplies, IT infrastructure, legal services, and other overheads necessary to run the company. Efficient management of these expenses is vital for profitability.

In 2023, CIE Automotive reported significant personnel costs, reflecting its large global workforce. These costs are a direct outcome of employing skilled engineers, production staff, and management across its numerous facilities. The company's ability to manage these personnel expenses effectively is key to its financial health.

Capital expenditures, while not direct operating costs, are a significant investment for CIE Automotive. These involve acquiring new machinery, upgrading existing facilities, and investing in new technologies, particularly for electric vehicle components. These investments are essential for future growth and competitiveness.

| Cost Category | 2023 Data (Millions €) | Notes |

|---|---|---|

| Personnel Costs | (Included within overall operational costs) | Significant portion of revenue (€2,601.8 million in 2023) |

| R&D Expenditure | 214.6 | Focus on new materials and EV components |

| Raw Material Volatility | N/A | Impacted by global steel and aluminum prices in 2024 |

Revenue Streams

CIE Automotive generates revenue through the sale of a diverse range of metal components. These are manufactured using sophisticated forging, casting, and machining techniques.

These essential parts are supplied to major vehicle manufacturers, finding application in critical areas such as engines and chassis systems. For instance, in 2023, CIE Automotive reported a significant portion of its revenue stemming from these core manufacturing activities.

Revenue also flows from the sale of plastic components, a significant part of CIE Automotive's business. These are produced using advanced injection molding techniques, showcasing their manufacturing prowess.

These plastic parts find application across a wide spectrum of automotive needs, including vehicle interiors and exteriors. This broad utility ensures a consistent demand for their products.

Furthermore, CIE Automotive is strategically positioning these plastic components for the growing electric vehicle market, particularly for lightweighting solutions. In 2023, the automotive industry saw a notable increase in EV adoption, with global sales reaching over 13 million units, highlighting the potential for this segment.

CIE Automotive generates revenue through the production and sale of aluminum components. This is a significant revenue stream, especially as the automotive sector increasingly prioritizes lightweight materials to boost fuel efficiency in traditional vehicles and extend the range of electric vehicles (EVs). For instance, in 2023, CIE Automotive reported a notable increase in its advanced materials business, which includes aluminum, reflecting this industry trend.

Sales of Assemblies and Sub-assemblies

CIE Automotive's revenue is significantly driven by the sale of integrated assemblies and sub-assemblies to automotive manufacturers. This approach allows them to offer more complex, value-added solutions beyond simple component supply, positioning them as a key partner in the vehicle production process.

This strategy is reflected in their financial performance. For instance, in the first quarter of 2024, CIE Automotive reported a consolidated turnover of €1,071 million, demonstrating the substantial revenue generated from these higher-level product offerings.

- Sales of Assemblies and Sub-assemblies: CIE Automotive provides integrated solutions to OEMs, moving beyond individual parts.

- Value-Added Offerings: This revenue stream represents the sale of more complex, pre-assembled units, enhancing their market position.

- Financial Impact: The first quarter of 2024 saw a consolidated turnover of €1,071 million, underscoring the importance of this segment.

Revenue from EV-Specific Components

CIE Automotive is experiencing a significant boost in revenue from components exclusively made for electric vehicles (EVs). This includes crucial parts for EV powertrains, advanced battery enclosures, and innovative lightweight structural elements that improve efficiency.

This growing segment reflects the automotive industry's rapid transition to electrification. For instance, the global EV market is projected to reach over $1.5 trillion by 2030, indicating substantial future demand for specialized components like those CIE Automotive produces.

- EV Powertrain Components: Revenue generated from electric motor housings, inverter casings, and power electronics modules.

- Battery Enclosures: Income from the manufacturing of robust and thermally managed battery pack casings.

- Lightweight Structural Elements: Sales of advanced composite or aluminum parts designed to reduce vehicle weight and increase range.

CIE Automotive's revenue streams are diversified across various automotive component categories, including metal, plastic, and aluminum parts. The company also generates significant income from integrated assemblies and sub-assemblies, particularly for the burgeoning electric vehicle (EV) market. This strategic focus on high-value components and specialized EV solutions is a key driver of their financial performance.

| Revenue Stream | Key Products | 2023/2024 Data Point |

|---|---|---|

| Metal Components | Forged, cast, and machined parts for engines and chassis | Significant portion of 2023 revenue derived from core manufacturing. |

| Plastic Components | Injection-molded parts for interiors and exteriors, including EV lightweighting | Global EV sales exceeded 13 million units in 2023, indicating strong market potential. |

| Aluminum Components | Lightweight parts for fuel efficiency and EV range extension | Notable increase in advanced materials business in 2023. |

| Assemblies & Sub-assemblies | Integrated solutions for OEMs | Consolidated turnover of €1,071 million in Q1 2024. |

| Electric Vehicle (EV) Components | Powertrain parts, battery enclosures, lightweight structures | Global EV market projected to exceed $1.5 trillion by 2030. |

Business Model Canvas Data Sources

The CIE Automotive Business Model Canvas is informed by a blend of internal financial data, extensive market research reports, and direct feedback from key stakeholders. These diverse sources ensure a comprehensive and accurate representation of the company's strategic framework.