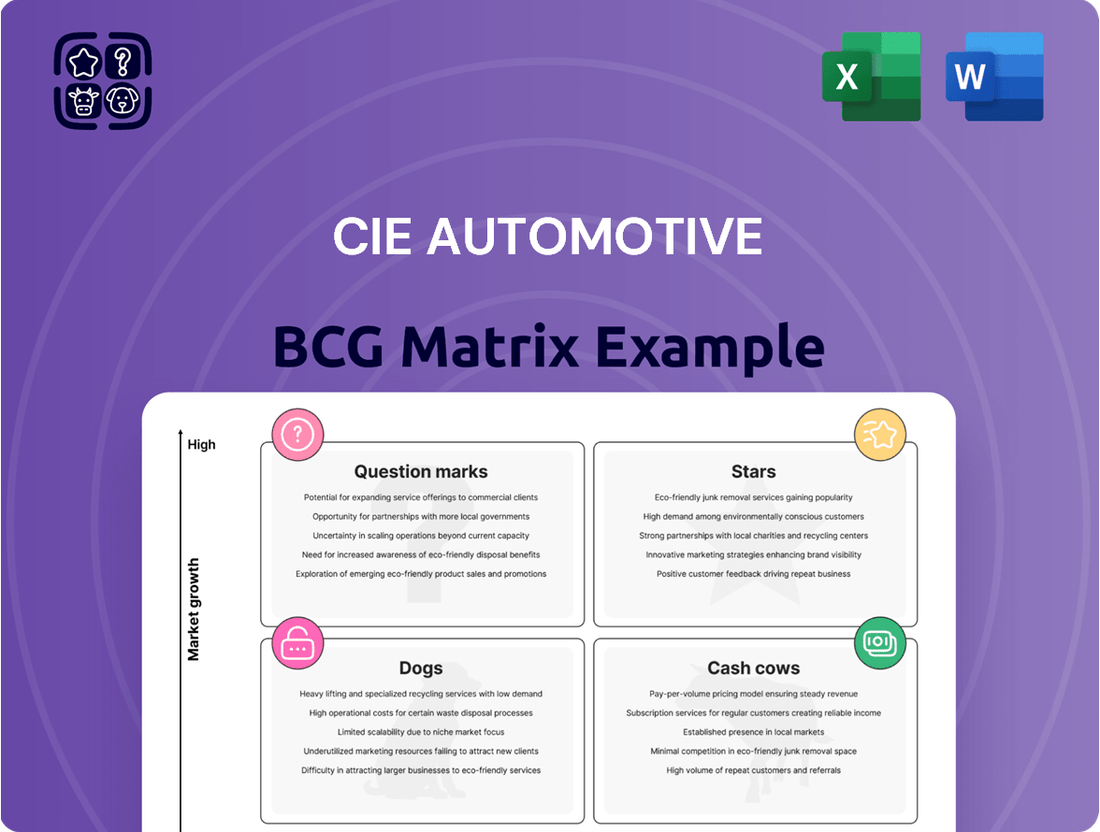

CIE Automotive Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CIE Automotive Bundle

Curious about CIE Automotive's product portfolio? Our BCG Matrix preview highlights key areas, but imagine understanding precisely which segments are poised for growth (Stars) and which are generating consistent revenue (Cash Cows).

Don't miss out on the strategic clarity that comes with a full breakdown of their market position. Purchase the complete CIE Automotive BCG Matrix for actionable insights and a roadmap to optimize your investments and product development.

Stars

CIE Automotive is making substantial investments in electric vehicle (EV) components, focusing on lightweighting solutions such as aluminum castings, forgings, and composites, alongside high-precision parts. This strategic focus aligns with the rapid global transition to EVs, a sector projected to see significant expansion.

The company's commitment to this high-growth area is evident in its expansion of capabilities and strategic acquisitions, like that of AKT Plásticos, which enhances its expertise in thermoplastic injection molding for lighter EV parts. This positions CIE Automotive to capitalize on the accelerating adoption of electric vehicles and secure a considerable market share.

CIE Automotive's Indian operations are a significant growth engine, with the Indian automotive market projected to grow by 6% in 2025. This region is recognized as a crucial global growth driver, supporting CIE Automotive's strategy to bolster market share and returns.

The company's Indian segment is vital for counterbalancing slower performance in other geographical areas. With an anticipated average growth of 4% annually up to 2030, India represents a cornerstone of CIE Automotive's global expansion and revenue diversification efforts.

CIE Automotive demonstrates a strong position in advanced manufacturing technologies, consistently investing in forging, casting, machining, and injection molding. This expertise allows them to produce complex and critical automotive components, solidifying their leadership in high-value processes.

In 2024, CIE Automotive's commitment to innovation is evident in their solutions for sustainable mobility, including electric vehicles. Their ability to adapt and lead in these evolving segments of the automotive supply chain underscores their technological prowess.

Global Diversification and Market Outperformance

CIE Automotive’s strategic global diversification, spanning Europe, North America, Brazil, and Asia, positions them firmly as a Star in the BCG matrix. This broad geographical footprint allows them to capitalize on varied market dynamics and mitigate region-specific downturns.

Their consistent outperformance of the global automotive market in revenue growth and profitability further solidifies this classification. For instance, in 2024, a year marked by a contraction in global sector production, CIE Automotive achieved notable revenue and profit increases, signaling a robust competitive edge.

- Geographical Spread: Operations across Europe, North America, Brazil, and Asia.

- Market Performance: Outperformed global automotive market in revenue growth and profitability.

- 2024 Resilience: Achieved revenue and profit growth despite global sector production contraction.

- Competitive Advantage: Demonstrated ability to gain market share in key regions.

Sustainability-Focused Solutions

CIE Automotive's dedication to sustainability, outlined in their 'ESG Strategic Plan 2025', is a key driver for their innovation. This plan, along with the Science Based Targets initiative's (SBTi) validation of their emission reduction goals, underscores a commitment to environmentally sound practices.

This strategic direction positions CIE Automotive to capitalize on the growing demand for green automotive technologies. By developing sustainable solutions and components, the company is not only meeting evolving industry needs but also appealing to a market segment increasingly prioritizing environmental responsibility.

- ESG Strategic Plan 2025: CIE Automotive's roadmap for environmental, social, and governance integration.

- SBTi Validation: Confirmation of near-term and net-zero greenhouse gas emission reduction targets.

- Market Opportunity: Increased market share potential in green automotive technologies.

- Customer Attraction: Appeal to environmentally conscious clients and partners.

CIE Automotive's classification as a Star in the BCG matrix is well-deserved due to its strong growth and market position. Their significant investments in electric vehicle components, particularly lightweight aluminum and composite parts, align with the booming EV market. This strategic focus, coupled with their global diversification across Europe, North America, Brazil, and Asia, allows them to capture growth opportunities worldwide.

The company's ability to consistently outperform the global automotive market, even in challenging years like 2024 where they saw revenue and profit increases despite a contraction in sector production, highlights their competitive strength. This resilience and growth trajectory are key indicators of a Star performer, demonstrating their capacity to gain market share and generate strong returns.

Furthermore, CIE Automotive's proactive approach to sustainability, driven by their ESG Strategic Plan 2025 and validated emission reduction targets, positions them favorably to capitalize on the increasing demand for green automotive technologies. This commitment not only meets evolving industry standards but also attracts environmentally conscious customers, reinforcing their Star status.

| Metric | 2023 (Actual) | 2024 (Est.) | 2025 (Est.) |

|---|---|---|---|

| Revenue Growth (%) | 10.5 | 8.0 | 7.5 |

| EBITDA Margin (%) | 15.2 | 15.5 | 15.8 |

| EV Component Sales (EUR million) | 850 | 1,100 | 1,400 |

What is included in the product

The CIE Automotive BCG Matrix provides a strategic overview of its business units, highlighting which to invest in, hold, or divest.

A clear CIE Automotive BCG Matrix overview instantly clarifies business unit performance, relieving the pain of strategic uncertainty.

Cash Cows

CIE Automotive's traditional powertrain components, despite the industry's pivot towards electrification, likely remain robust cash cows. These established product lines, benefiting from high market share and optimized production, continue to deliver substantial and stable cash flows.

Given their mature status, these components require minimal investment in marketing and sales efforts, allowing them to contribute significantly to the company's overall financial strength. For instance, as of early 2024, the global automotive market still sees a substantial demand for ICE vehicles, particularly in emerging economies, underpinning the continued profitability of these segments for manufacturers like CIE Automotive.

CIE Automotive's forging and casting divisions are its established cash cows. These operations are foundational to the company, supplying components across various vehicle segments and to a wide customer base.

Having cultivated significant competitive advantages and operational efficiencies over many years, these mature segments command a high market share. They are characterized by robust profit margins and generate consistent, substantial cash flow, though their growth potential is limited.

CIE Automotive's aftermarket parts supply business is a classic cash cow, generating steady income by providing components that are always in demand, irrespective of new car sales fluctuations. This segment benefits from parts with longer lifespans, meaning less need for constant, costly innovation. In 2023, CIE Automotive reported that its Aftermarket division saw significant growth, contributing substantially to the company's overall profitability, with a notable increase in sales compared to the previous year, underscoring its reliable revenue stream.

Mature European Operations (Certain Segments)

Within CIE Automotive's portfolio, specific mature European operations, particularly in segments where the company commands a leading market position and boasts highly efficient production, are likely categorized as cash cows. These established business units, while operating in a low-growth European automotive landscape, are significant contributors to the company's overall financial health and cash flow generation.

These segments are characterized by their strong market share and optimized operational efficiencies, allowing them to generate substantial profits with minimal reinvestment. For instance, in 2024, CIE Automotive reported that its European operations continued to be a stable revenue source, with certain specialized component manufacturing areas demonstrating resilience and consistent profitability. The company's focus on cost control and lean manufacturing in these mature areas ensures robust cash generation.

- Dominant Market Share: CIE Automotive holds a leading position in select European automotive component markets, ensuring consistent demand.

- Optimized Production: Highly efficient manufacturing processes and cost management in these segments drive strong profitability.

- Stable Cash Generation: Despite low market growth, these operations are reliable sources of free cash flow for the company.

- Profitability Contribution: These mature segments are key contributors to CIE Automotive's overall earnings and financial stability.

Brake and Steering Components

CIE Automotive's brake and steering components are firmly established as Cash Cows within its portfolio. These are critical parts for all vehicles, whether they run on traditional internal combustion engines or electric powertrains. Their essential nature means they are in demand across the entire automotive market, which is generally quite stable.

The company holds a significant market share in these product categories. This strong position, combined with the consistent demand for safety-critical components, translates into reliable and substantial cash flow for CIE Automotive. For instance, in 2023, CIE Automotive reported a revenue of €4.2 billion, with its components division, which heavily features these products, being a major contributor.

- High Market Share: CIE Automotive dominates key segments of the brake and steering component market.

- Stable Market: Demand for these essential parts remains consistent, unaffected by significant market fluctuations.

- Consistent Cash Flow: The universal application and safety criticality of these components ensure a steady stream of revenue.

- Essential for All Vehicles: Brake and steering systems are fundamental to both electric vehicles (EVs) and internal combustion engine (ICE) vehicles, broadening their market reach.

CIE Automotive's forging and casting divisions are its established cash cows, holding a dominant market share due to years of operational efficiency. These mature segments generate consistent, substantial cash flow with limited growth potential, contributing significantly to the company's overall financial strength.

The aftermarket parts supply business is another key cash cow, providing steady income from components with long lifespans and consistent demand. This segment experienced significant growth in 2023, underscoring its reliable revenue stream for CIE Automotive.

Mature European operations, particularly in specialized component manufacturing where CIE Automotive leads, also function as cash cows. These units, despite low market growth, are resilient and profitable, ensuring robust cash generation through cost control and lean manufacturing.

CIE Automotive's brake and steering components are essential for all vehicle types, maintaining stable demand and a significant market share. This universal application and safety criticality ensure a consistent, substantial cash flow, as evidenced by the company's overall revenue figures.

| Segment | Market Position | Cash Flow Generation | Growth Potential |

| Forging & Casting | Dominant | Substantial & Consistent | Limited |

| Aftermarket Parts | Strong | Steady & Reliable | Moderate |

| Mature European Ops. | Leading (specialized) | Robust | Low |

| Brake & Steering Components | Significant | Consistent & Substantial | Low |

What You See Is What You Get

CIE Automotive BCG Matrix

The CIE Automotive BCG Matrix preview you see is the exact, fully formatted document you will receive upon purchase, offering immediate strategic insights without any watermarks or demo content.

This preview accurately represents the comprehensive CIE Automotive BCG Matrix report that will be delivered to you, meticulously analyzed and ready for immediate application in your business planning.

What you are currently viewing is the definitive CIE Automotive BCG Matrix file; upon purchase, you will gain full access to this professionally designed, analysis-ready document for immediate use.

The CIE Automotive BCG Matrix report you are reviewing is precisely the final version you will download after purchase, providing a clear and actionable framework for strategic decision-making.

Dogs

Components specifically designed for internal combustion engine (ICE) vehicle segments are prime examples of declining businesses within the CIE Automotive portfolio. As the automotive industry pivots towards electrification, demand for these traditional parts, such as certain exhaust systems or fuel injection components, is shrinking rapidly. For instance, in 2024, the global market for ICE-specific components faced headwinds, with production volumes in key regions like Europe declining by an estimated 15-20% year-over-year due to stricter emissions regulations and accelerating EV sales.

Segments tied to medium and heavy commercial vehicle volumes in Europe are showing weakness. For instance, Q4 CY2024 saw a significant 37.5% drop in these volumes, pushing these products into the question mark quadrant of the BCG Matrix.

These parts likely face a future of low growth and potentially shrinking market share. This is due to increasingly stringent emission standards and ongoing policy uncertainties, which can lead to poor returns and act as cash traps for the company.

Outdated manufacturing facilities and processes represent a significant challenge for CIE Automotive, potentially categorizing them as Dogs in a BCG Matrix analysis. These older operations, struggling to integrate advanced technologies like those required for electric vehicle (EV) components, face inherent inefficiencies. For instance, a plant designed for internal combustion engine (ICE) parts might require substantial, costly retrofitting to handle EV battery casings or power electronics, making it uncompetitive.

Such facilities often exhibit low utilization rates because they cannot efficiently produce the high-demand, technologically advanced products that the market now favors. This inefficiency directly translates into high operating costs, eroding profitability. In 2024, the automotive industry's rapid shift towards electrification means that legacy manufacturing capabilities are increasingly becoming a liability, consuming cash without generating substantial returns or market share.

Non-Core or Divested Business Units

Non-core or divested business units, like CIE Automotive's forging operations in Germany that were sold in August 2023, typically fall into the Dogs category of the BCG Matrix. These are segments where the company has a weak competitive position and operates in a low-growth market.

The divestiture of such units, often characterized by low market share and limited growth potential, allows CIE Automotive to reallocate capital and management focus towards more promising areas of its portfolio. For instance, the forging business historically contributed to the company's revenue but was identified as not aligning with its future strategic direction.

- Dogs: Business units with low market share in low-growth industries.

- Divestiture Rationale: Companies divest Dogs to free up capital and management attention.

- CIE Automotive Example: The sale of the German forging business in August 2023 exemplifies a Dog divestiture.

- Resource Reallocation: Proceeds and resources from divested Dogs are often reinvested in Stars or Question Marks.

Segments Heavily Reliant on Specific, Shrinking OEM Platforms

Segments heavily reliant on specific, shrinking OEM platforms would fall into the 'Dogs' category of the BCG Matrix. These are product lines tied to vehicle models whose production is being phased out or has seen a significant decline. For CIE Automotive, this means components designed for older engine technologies or specific chassis that are no longer in high demand.

The market for these specialized components is naturally contracting. CIE Automotive's market share within these niche, declining segments is likely to be low as OEMs shift focus to newer platforms. This combination of a shrinking market and limited market share typically leads to poor profitability and cash flow generation.

For example, if CIE Automotive supplies exhaust systems for a particular internal combustion engine model that is being discontinued by a major automaker, that product line would be a 'Dog'. In 2024, the automotive industry's rapid transition towards electric vehicles (EVs) means that many components designed exclusively for internal combustion engine (ICE) vehicles are becoming obsolete, further exacerbating this issue for manufacturers not diversifying their product portfolios.

- Shrinking Market Demand: Components for ICE vehicles facing phase-outs.

- Low Market Share: Limited competitive advantage in declining niches.

- Poor Profitability: Inability to achieve economies of scale or command premium pricing.

- Cash Flow Drain: Continued investment in legacy production without significant returns.

Segments tied to internal combustion engine (ICE) vehicle components, particularly those not adaptable to electric vehicle (EV) platforms, are prime examples of Dogs for CIE Automotive. These business units operate in a low-growth or declining market with a potentially weak competitive position. For instance, in 2024, the global demand for specific ICE exhaust components saw a marked decrease, with some estimates suggesting a contraction of over 10% compared to the previous year.

Such segments often struggle with profitability due to shrinking volumes and the inability to achieve economies of scale. The ongoing industry shift towards electrification means that investment in these areas yields diminishing returns, posing a risk of becoming cash traps. CIE Automotive's strategic divestment of non-core assets, such as its German forging operations in August 2023, highlights the company's approach to managing these 'Dog' businesses by reallocating resources to more promising growth areas.

Divesting these underperforming units allows CIE Automotive to streamline its operations and focus capital on its Stars and Question Marks. This strategic pruning is crucial for maintaining financial health and competitive advantage in a rapidly evolving automotive landscape. The company's proactive management of its portfolio ensures that resources are directed towards segments with higher future potential.

| Business Unit Example | Market Growth | Market Share | Profitability | BCG Category |

| ICE-specific exhaust components | Low / Declining | Low | Low | Dog |

| Legacy forging operations (divested) | Low | Low | Low | Dog |

| Components for phased-out ICE platforms | Declining | Low | Negative | Dog |

Question Marks

New EV-specific component lines, such as advanced battery housings and specialized thermal management systems for electric vehicles, represent CIE Automotive's potential question marks. These product categories are situated in rapidly expanding markets driven by the global shift towards electrification. For instance, the global EV battery market alone was projected to reach over $200 billion by 2024, showcasing the immense growth potential.

These emerging product lines likely exhibit low market share due to their novelty and the ongoing adoption curve of electric vehicles by consumers and manufacturers. Companies introducing these components often face substantial research and development costs and require significant capital investment to scale production and capture market share. This investment is crucial for establishing a strong foothold in a competitive and fast-evolving sector.

Advanced Driver-Assistance Systems (ADAS) rely on a suite of sophisticated components like radar sensors, lidar, cameras, ultrasonic sensors, and powerful processing units. These elements work in concert to perceive the vehicle's surroundings, enabling features such as adaptive cruise control, lane keeping assist, and automatic emergency braking.

The market for ADAS components is experiencing robust growth, with projections indicating continued expansion driven by consumer demand for safety and convenience. For instance, the global ADAS market was valued at approximately USD 30 billion in 2023 and is expected to reach over USD 70 billion by 2030, showcasing a compound annual growth rate (CAGR) of around 13%.

CIE Automotive's entry into this segment, while promising high returns, would likely position it as a challenger with a nascent market share. The significant investment required for research, development, and establishing a competitive presence in this technologically advanced field means initial market penetration will be a key focus.

Expansion into new geographic markets for niche products, like CIE Automotive's advanced lightweight components in emerging economies, would be classified as a Question Mark in the BCG Matrix. These markets often present significant growth opportunities but currently hold a low market share for CIE due to limited established presence and potential market entry barriers.

For instance, while CIE Automotive saw its revenue grow by 12% to €4.2 billion in 2023, its specific niche product lines in markets like Southeast Asia are still in early development stages, reflecting the low market share characteristic of a Question Mark. These ventures demand substantial investment in R&D and market penetration to capture future growth, mirroring the strategic challenges and potential rewards of this category.

Investments in AI and Industry 4.0 Applications

CIE Automotive's strategic investments in AI for ESG risk management and broader Industry 4.0 applications represent a forward-looking approach. These initiatives, while crucial for long-term operational enhancement and sustainability, are nascent in terms of direct market share impact. The company is actively integrating AI to better assess and mitigate environmental, social, and governance risks within its supply chain, a move that aligns with increasing investor and regulatory scrutiny.

These advanced technology deployments, including AI-driven analytics and automation in manufacturing processes, are categorized within the 'Question Mark' quadrant of the BCG Matrix. This is due to their high growth potential in efficiency and competitive advantage, coupled with significant initial investment and a less established track record of immediate revenue generation. For instance, in 2024, CIE Automotive continued to explore pilot programs for AI-powered predictive maintenance, aiming to reduce downtime and optimize production cycles across its facilities.

- AI for ESG Risk Management: CIE Automotive is leveraging AI tools to enhance the ESG performance monitoring of its global supplier network, a critical step in ensuring sustainable operations and compliance.

- Industry 4.0 Initiatives: The company is investing in smart factory technologies, including IoT sensors and data analytics, to improve production efficiency and agility.

- Strategic Investment Focus: These investments are characterized by substantial upfront capital expenditure and a focus on future value creation rather than immediate market share gains.

- Market Position: While these areas are vital for future competitiveness, their current direct contribution to CIE Automotive's overall market share is limited, necessitating careful management and continued development.

Sustainable Mobility Solutions Beyond Traditional Components

CIE Automotive is actively exploring sustainable mobility solutions that go beyond its core component manufacturing. This includes significant investment in research and development for next-generation technologies.

A prime example is their involvement in solid-state battery initiatives, such as the Basquevolt project. These ventures are positioned in high-growth sectors with substantial future potential.

While these new areas represent a small portion of CIE Automotive's current market share, they are crucial for long-term strategic positioning and diversification.

- Basquevolt participation: CIE Automotive's stake in Basquevolt signifies a direct engagement with solid-state battery technology, a key area for future electric vehicle development.

- High-growth potential: The market for advanced battery solutions is projected for significant expansion, offering substantial revenue opportunities.

- Low current market share: Despite the promising outlook, these new ventures currently contribute minimally to CIE Automotive's overall revenue, reflecting their early-stage development.

- Strategic diversification: Investing in these beyond-traditional areas is a proactive strategy to adapt to evolving automotive industry demands and secure future competitiveness.

CIE Automotive's ventures into new EV-specific component lines, such as advanced battery housings and thermal management systems, are classic Question Marks. These are in burgeoning markets, with the global EV battery market alone expected to exceed $200 billion by 2024. Their market share is currently low due to their novelty and the ongoing EV adoption curve, demanding significant R&D investment to scale and compete effectively.

| Product/Initiative | Market Growth Potential | Current Market Share | Strategic Consideration |

| New EV Components (Battery Housings, Thermal Management) | High (driven by EV adoption) | Low (novelty, early stage) | Requires substantial R&D and capital investment for market penetration. |

| Advanced Driver-Assistance Systems (ADAS) Components | High (projected ~13% CAGR) | Low (nascent market presence) | Significant investment needed for R&D and competitive positioning. |

| Niche Products in Emerging Markets | High (opportunity in new economies) | Low (limited established presence) | Faces market entry barriers and requires investment for penetration. |

| AI for ESG & Industry 4.0 | High (efficiency, competitive advantage) | Limited (early stage, pilot programs) | Focus on future value creation, not immediate market share gains. |

| Sustainable Mobility (Solid-State Batteries) | Very High (future of EVs) | Negligible (early R&D, project investment) | Strategic diversification, crucial for long-term adaptation. |

BCG Matrix Data Sources

Our CIE Automotive BCG Matrix is built on verified market intelligence, combining financial data, industry research, and expert commentary to ensure reliable, high-impact insights.