Church & Dwight PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Church & Dwight Bundle

Navigate the complex external landscape affecting Church & Dwight with our comprehensive PESTLE analysis. Uncover how political shifts, economic volatility, and evolving social trends are shaping the company's strategic path. Gain the foresight needed to anticipate challenges and capitalize on opportunities.

Ready to make informed decisions about Church & Dwight? Our PESTLE analysis provides critical insights into technological advancements, environmental regulations, and legal frameworks impacting the consumer goods giant. Download the full version now for actionable intelligence to sharpen your market strategy.

Political factors

Government regulations significantly shape Church & Dwight's operating landscape. For instance, changes in international trade agreements, such as potential adjustments to tariffs on raw materials or finished goods, directly influence supply chain costs. In 2024, ongoing discussions around global trade dynamics and potential protectionist measures in various markets could impact Church & Dwight's ability to source ingredients affordably and export its diverse product portfolio, which includes well-known brands like Arm & Hammer and Trojan.

Furthermore, evolving consumer product safety standards and labeling requirements, mandated by bodies like the FDA or equivalent international agencies, demand continuous compliance efforts. These shifts can necessitate product reformulation or updated packaging, adding to operational expenses. Political stability in key international markets where Church & Dwight operates or sources materials is also a critical consideration, influencing investment decisions and the security of its global operations.

Stricter consumer protection laws, especially those focused on product claims, advertising, and ingredient transparency, significantly shape how Church & Dwight markets and develops its wide range of brands. For instance, the Federal Trade Commission (FTC) continues to enforce regulations against deceptive advertising, impacting how claims about product efficacy, such as those for Arm & Hammer's baking soda or Trojan condoms, are communicated to consumers.

Compliance with these evolving regulations is paramount for avoiding legal repercussions and preserving consumer confidence. This includes adhering to guidelines set by bodies like the Food and Drug Administration (FDA) for product safety and ingredient disclosure, which directly affects product formulation and labeling across Church & Dwight's portfolio.

Variations in corporate tax rates directly impact Church & Dwight's net income and available capital for reinvestment. For instance, if the U.S. federal corporate tax rate, which stood at 21% in early 2024, were to increase, it would reduce the company's profitability. Conversely, tax incentives for domestic manufacturing could lower operational costs and encourage further investment in U.S.-based production facilities. Specific excise taxes on certain consumer goods, like cleaning products or personal care items, could also influence pricing strategies and consumer demand.

Political Stability in Key Markets

Political stability is a cornerstone for Church & Dwight's operations. Geopolitical events and political instability in key markets or sourcing regions can significantly disrupt supply chains, impact distribution networks, and dampen consumer demand. For instance, ongoing geopolitical tensions in Eastern Europe, which began in early 2022 and continued through 2024, have demonstrated the potential for widespread economic disruption, affecting raw material costs and logistics for global companies.

A stable political environment, both domestically in the United States and internationally, is crucial for consistent business operations and sustained market growth. Church & Dwight's reliance on global sourcing and sales means that political shifts can have far-reaching consequences. For example, trade policy changes or increased protectionism in major consumer markets could affect Church & Dwight's import/export activities and overall profitability.

Consider the following impacts of political factors:

- Supply Chain Vulnerability: Political unrest in regions supplying key ingredients or manufacturing components can lead to shortages and price volatility. For example, disruptions in Southeast Asia, a major supplier for various consumer goods components, can directly impact production schedules.

- Market Access and Tariffs: Changes in trade agreements and the imposition of tariffs by governments can affect the cost of goods sold and the competitiveness of Church & Dwight's products in international markets.

- Regulatory Environment: Political decisions influence regulations related to product safety, environmental standards, and marketing, which can necessitate costly adjustments in product formulations or manufacturing processes.

- Consumer Confidence: Political stability generally correlates with higher consumer confidence, which in turn supports discretionary spending on household and personal care products. Conversely, political uncertainty can lead to reduced consumer spending.

Regulatory Environment for Health and Personal Care Products

The regulatory landscape for health and personal care products, including Church & Dwight's portfolio, is complex and constantly evolving. For instance, the U.S. Food and Drug Administration (FDA) oversees the safety and labeling of many of these items. In 2024, the FDA continued its focus on ingredient transparency and potential allergens, impacting product formulations.

Compliance with these regulations is a significant operational cost and a critical factor in market access. Changes in ingredient approval processes or restrictions on existing chemicals can necessitate costly reformulation and re-testing. For example, the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation imposes stringent requirements on chemical substances, affecting product development for companies operating in that market.

- Ingredient Approval: New ingredients require rigorous safety assessments and regulatory approval before market entry, a process that can take years and significant investment.

- Labeling Requirements: Regulations dictate how ingredients, warnings, and claims must be presented to consumers, demanding meticulous attention to detail in packaging.

- Product Safety Standards: Adherence to evolving safety standards, such as those related to sustainability or specific chemical restrictions, is paramount for continued market access.

Government policies and political stability directly influence Church & Dwight's operational costs and market access. For example, shifts in U.S. corporate tax rates, which remained at 21% in early 2024, can impact profitability and reinvestment capital. Additionally, evolving consumer protection laws, like those enforced by the FTC regarding advertising claims, necessitate careful marketing strategies for brands such as Arm & Hammer and Trojan.

International trade agreements and potential tariffs are critical for Church & Dwight's global supply chain and sales. Geopolitical events, such as the ongoing tensions in Eastern Europe since early 2022, can disrupt raw material costs and logistics for the company. Maintaining compliance with varying international regulations, including ingredient safety standards, also presents ongoing challenges and costs.

The regulatory environment, particularly concerning product safety and labeling, requires continuous adaptation. For instance, the FDA's focus on ingredient transparency in 2024 impacts product formulation and packaging. Compliance with these diverse regulations, like the EU's REACH, is essential for market access and avoiding legal issues, directly affecting R&D and manufacturing expenditures.

What is included in the product

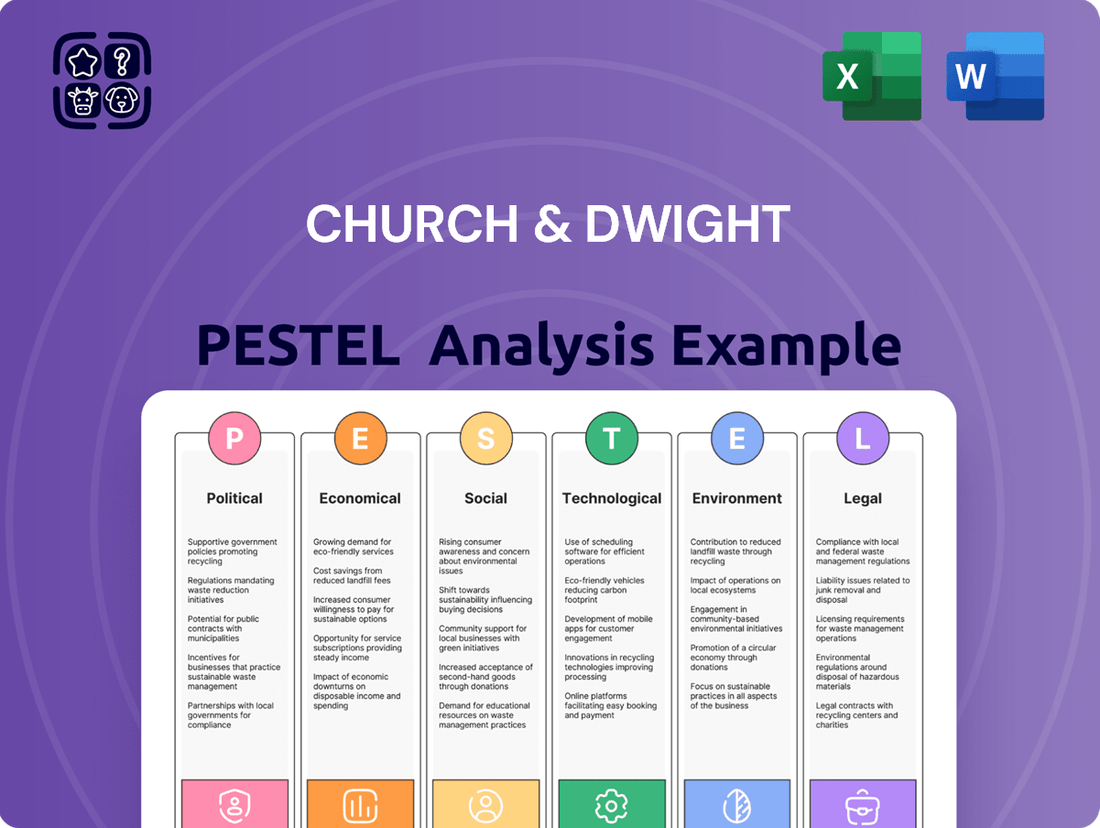

This PESTLE analysis of Church & Dwight examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations and strategy.

It provides actionable insights into external forces shaping the company's market landscape, enabling informed strategic decision-making.

A concise PESTLE analysis for Church & Dwight, highlighting how understanding political, economic, social, technological, environmental, and legal factors can alleviate the pain of market uncertainty and inform strategic decision-making.

Economic factors

Rising inflation presents a significant challenge for Church & Dwight, directly impacting the cost of essential inputs like chemicals and plastics used in their products. For instance, the Producer Price Index for chemicals saw a notable increase throughout 2023 and into early 2024, putting pressure on manufacturing expenses. This upward trend necessitates careful management of procurement and pricing strategies to avoid margin erosion.

The company's ability to pass these increased raw material and packaging costs onto consumers through price adjustments is crucial for maintaining profitability. If price hikes cannot fully compensate for the higher input expenses, Church & Dwight's profit margins could be squeezed. Transportation costs also remain a key consideration, with fuel price volatility directly affecting the expense of distributing their wide range of consumer goods.

Consumer discretionary spending is a crucial factor for Church & Dwight. While many of its products like Arm & Hammer baking soda or Trojan condoms are considered necessities, shifts in consumer confidence can impact sales, especially for brands perceived as more premium. For instance, during economic slowdowns, consumers might trade down to less expensive alternatives, affecting brands like OxiClean if perceived as a discretionary purchase.

The ability of consumers to spend beyond essential needs directly influences the demand for certain Church & Dwight products. In 2024, while inflation has shown signs of moderating, persistent cost-of-living pressures mean consumers remain cautious. This means that while household staples are relatively resilient, items that offer convenience or enhanced performance, and are thus more discretionary, could see slower growth if consumers prioritize budget-friendly options.

Understanding current consumer purchasing power is vital for Church & Dwight's marketing and product positioning. As of early 2025, retail sales data indicates continued consumer sensitivity to price points, particularly in categories where substitutes are readily available. This highlights the importance of Church & Dwight's strategy to offer a range of products catering to different price sensitivities and perceived value.

Church & Dwight's international presence means exchange rate shifts directly affect reported earnings. For instance, a stronger US dollar in 2024 would make their overseas profits translate to fewer dollars, potentially impacting reported revenue growth. Conversely, a weaker dollar could make imported raw materials more expensive, squeezing profit margins on goods manufactured abroad.

Managing this currency risk is crucial for stable financial performance. Companies like Church & Dwight often employ hedging strategies, such as forward contracts, to lock in exchange rates for future transactions, mitigating the impact of unpredictable currency movements on their bottom line.

Interest Rates and Access to Capital

Changes in interest rates directly impact Church & Dwight's operational costs and growth strategies. For instance, a sustained period of higher interest rates, as seen with the Federal Reserve's aggressive hiking cycle through 2023 and into early 2024 to combat inflation, increases the expense of borrowing for crucial activities like acquisitions, capital investments, and managing day-to-day working capital needs. This makes financing new brand acquisitions or expanding existing production facilities more costly.

Access to capital markets at favorable terms is a cornerstone of Church & Dwight's long-term strategy, which often involves acquiring and integrating established brands to fuel growth. The ability to secure debt financing at competitive rates is therefore paramount. For example, if the prime rate, which influences many corporate loan rates, remains elevated, the cost of servicing existing debt and taking on new debt for strategic initiatives will be higher, potentially impacting profitability and investment capacity.

- Impact on Borrowing Costs: Higher interest rates increase the cost of debt for Church & Dwight, affecting expenses for acquisitions, capital expenditures, and working capital.

- Financing Growth: Elevated interest rates can make financing growth initiatives, such as acquiring new brands or expanding manufacturing, more expensive.

- Credit Market Access: Favorable access to credit markets is essential for Church & Dwight's brand acquisition strategy, and this access can be constrained or become more costly in a high-interest-rate environment.

- 2024 Outlook: While inflation showed signs of moderating through late 2023 and into 2024, many central banks, including the Federal Reserve, maintained higher policy rates for an extended period, indicating continued pressure on borrowing costs for companies like Church & Dwight.

Economic Growth and Market Expansion

Overall economic growth, both at home and abroad, directly impacts how much consumers buy and where Church & Dwight can grow. Strong economies usually mean more jobs and people feeling confident about spending, which helps sales across all their product lines, from cleaning supplies to personal care items. This creates chances for the company to reach new customers and sell more of its existing products.

For instance, in 2024, the International Monetary Fund projected global economic growth to be around 3.2%, a steady pace that supports consumer spending. This environment is beneficial for Church & Dwight as it allows for greater market penetration.

- Global Economic Outlook: Continued moderate global growth in 2024 and projected for 2025 provides a stable backdrop for increased consumer spending.

- Consumer Confidence: Rising consumer confidence in key markets, often linked to employment figures, directly translates to higher demand for Church & Dwight’s diverse product portfolio.

- Market Expansion Opportunities: Economic expansion in emerging markets presents significant avenues for Church & Dwight to introduce and grow its brands, leveraging increased purchasing power.

Church & Dwight's financial health is significantly influenced by macroeconomic trends, including inflation, interest rates, and overall economic growth. Rising inflation in 2023 and early 2024 increased input costs for chemicals and plastics, while higher interest rates, maintained by central banks like the Federal Reserve, elevated borrowing expenses for capital investments and acquisitions. Despite these pressures, moderate global economic growth, projected around 3.2% for 2024 by the IMF, offers a supportive environment for consumer spending, benefiting Church & Dwight's diverse product portfolio.

| Economic Factor | Impact on Church & Dwight | 2024/2025 Data/Outlook |

|---|---|---|

| Inflation | Increased cost of raw materials (chemicals, plastics) and packaging. Pressure on profit margins if costs cannot be passed to consumers. | Producer Price Index for chemicals saw notable increases through 2023-early 2024. Consumer spending remains sensitive to price points. |

| Interest Rates | Higher borrowing costs for acquisitions, capital expenditures, and working capital. Increased cost of servicing debt. | Federal Reserve maintained higher policy rates through 2023-early 2024. Prime rate influences corporate loan rates, impacting financing costs. |

| Economic Growth | Stronger economies boost consumer confidence and spending, increasing demand for Church & Dwight's products. Creates market expansion opportunities. | IMF projected global economic growth around 3.2% for 2024. Moderate growth supports consumer spending and market penetration. |

Full Version Awaits

Church & Dwight PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Church & Dwight delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. You'll gain valuable insights into the market landscape and potential challenges and opportunities.

Sociological factors

Consumers are increasingly prioritizing health and wellness, driving demand for products with natural ingredients and fewer chemicals. This shift is evident in the growing market for plant-based alternatives and "clean label" products, with the global natural and organic personal care market projected to reach $25.1 billion by 2025, growing at a CAGR of 8.1%.

Church & Dwight must adapt by innovating its product lines, like Arm & Hammer and OxiClean, to meet these preferences for cleaner, safer, and more sustainable options. For instance, the company has introduced Arm & Hammer Plus OxiClean Sensitive laundry detergent, formulated with fewer harsh chemicals, reflecting this market demand.

This trend significantly influences product formulation, requiring research into natural preservatives and biodegradable packaging, and also impacts marketing strategies. Companies are highlighting ingredient transparency and environmental benefits to resonate with health-conscious consumers, as seen in the significant rise in searches for "natural cleaning products" and "eco-friendly detergents" in 2024.

Consumers are increasingly making purchasing decisions based on environmental friendliness and ethical production. For instance, a 2024 Nielsen report indicated that 73% of global consumers would change their consumption habits to reduce their environmental impact. This trend directly impacts Church & Dwight, requiring a clear demonstration of commitment to sustainability throughout its operations.

To appeal to this growing segment and foster brand loyalty, Church & Dwight needs to showcase its dedication to sustainability, from ingredient sourcing to final packaging. This involves being open about its supply chains and adopting responsible manufacturing processes. In 2023, Church & Dwight highlighted its efforts in reducing water usage by 15% across its manufacturing facilities compared to a 2020 baseline.

Demographic shifts, such as aging populations and smaller household sizes, are reshaping consumer purchasing habits. For instance, the U.S. Census Bureau reported in 2023 that the average household size continues to trend downwards. This necessitates that Church & Dwight adapt its product portfolio and packaging to align with these evolving needs, potentially offering more single-serve or smaller multi-packs.

Busy urban lifestyles also drive demand for convenience and multi-functional products. Consumers are increasingly seeking solutions that simplify their routines, influencing preferences for concentrated formulas or items that serve multiple purposes. Church & Dwight's strategy must consider how to innovate in these areas to capture market share among time-pressed individuals.

Digitalization of Consumer Behavior

The increasing digitalization of consumer behavior is a major sociological shift impacting Church & Dwight. E-commerce continues its upward trajectory, with global online retail sales projected to reach $7.4 trillion by 2025, up from an estimated $6.3 trillion in 2024. This digital transformation means consumers are increasingly researching, comparing, and purchasing products online.

Social media platforms are now powerful influencers in purchasing decisions. For instance, a significant percentage of consumers, often exceeding 50% in many demographics, report discovering new products through social media channels. Online product reviews also play a crucial role, with a vast majority of consumers stating they trust online reviews as much as personal recommendations.

Church & Dwight needs to adapt by bolstering its digital marketing efforts, enhancing its e-commerce capabilities, and actively engaging with consumers online. This includes investing in user-friendly websites and mobile apps, optimizing for search engines, and leveraging social media for brand building and customer service. Managing online brand reputation and developing direct-to-consumer (DTC) channels are also critical components for success in this evolving landscape.

- E-commerce Growth: Global online retail sales are expected to hit $7.4 trillion by 2025.

- Social Media Influence: Over 50% of consumers discover new products via social media.

- Trust in Reviews: Consumers place high trust in online product reviews, often equating them to personal recommendations.

- Digital Strategy Imperative: Investment in digital marketing, e-commerce platforms, and online reputation management is essential for Church & Dwight.

Cultural Attitudes Towards Hygiene and Home Care

Cultural attitudes toward hygiene and home care are shifting, with a notable increase in consumer focus on health and wellness. This trend directly impacts Church & Dwight's product lines, particularly in areas like cleaning supplies and personal care. For instance, the global market for disinfectants and sanitizers saw significant growth, with some reports indicating a surge of over 20% in early 2024 compared to pre-pandemic levels, reflecting heightened consumer awareness of germ transmission.

Church & Dwight's international operations necessitate a nuanced approach to these cultural shifts. What constitutes effective hygiene or desirable cleanliness can vary dramatically across regions. In many Asian markets, for example, there's a long-standing cultural emphasis on meticulous home cleaning and personal purity, which translates into a strong demand for specialized cleaning agents and oral care products. In contrast, Western markets might see a greater emphasis on convenience and efficacy in home care solutions.

These evolving attitudes also influence product development and marketing. Church & Dwight must tailor its messaging to resonate with local cultural values and practices. For example, advertising campaigns for laundry detergents might highlight fabric care and scent preferences that align with regional tastes, while oral care products might be promoted based on specific health concerns prevalent in a particular country. The company's investment in research and development to create products that meet these diverse needs is crucial for sustained growth.

- Growing Demand for Health-Conscious Products: Global sales of antibacterial soaps and hand sanitizers exceeded $15 billion in 2024, a testament to increased hygiene awareness.

- Regional Variations in Cleaning Habits: A 2024 survey indicated that 70% of households in Western Europe prioritize eco-friendly cleaning products, while in parts of Asia, efficacy against specific pathogens remains the primary driver.

- Influence on Oral Care Preferences: The global toothpaste market, valued at over $40 billion in 2024, shows distinct regional preferences for whitening versus cavity protection, reflecting cultural emphasis on different aspects of dental health.

- Adaptation in Home Care Messaging: Church & Dwight's strategy in emerging markets often involves educating consumers on new hygiene practices, aligning product benefits with established cultural norms of purity and well-being.

Sociological factors significantly shape consumer behavior, influencing Church & Dwight's product development and marketing strategies. The increasing emphasis on health and wellness, coupled with a growing demand for natural and sustainable products, is a key driver. For instance, the global natural personal care market is projected to reach $25.1 billion by 2025, growing at an 8.1% CAGR.

Demographic shifts, such as aging populations and smaller households, necessitate product and packaging adaptations. Additionally, busy lifestyles fuel demand for convenient, multi-functional items. The digital transformation of consumer behavior, with e-commerce sales anticipated to reach $7.4 trillion by 2025, requires robust online engagement and e-commerce capabilities.

Cultural attitudes towards hygiene and home care vary globally, requiring tailored approaches. For example, while Western markets may prioritize eco-friendly products, Asian markets often focus on efficacy and purity. Church & Dwight must align its messaging and product offerings with these diverse regional preferences and evolving consumer values to maintain market relevance and drive growth.

Technological factors

The ongoing growth of e-commerce, projected to reach $2.0 trillion in the US by 2026, offers Church & Dwight significant avenues for expanding its consumer base and optimizing sales. Digital marketing advancements, including AI-driven personalization, enable more effective targeted campaigns, boosting brand visibility and driving sales performance.

Mobile commerce, a substantial portion of online retail, and the rise of social selling present direct engagement opportunities. For instance, in 2023, mobile devices accounted for over 60% of e-commerce sales, highlighting the importance of a strong mobile strategy for Church & Dwight’s brands.

Technological advancements in chemistry and material science are pivotal for Church & Dwight. These innovations allow for the creation of superior product formulations and more sustainable packaging. For instance, breakthroughs could lead to more potent stain removers for OxiClean or improved odor absorption for Arm & Hammer baking soda products.

The company's commitment to research and development is crucial in leveraging these technological factors. In 2023, Church & Dwight invested $257.5 million in SG&A, which includes significant R&D spending aimed at product innovation. This investment is geared towards developing eco-friendly ingredients and biodegradable packaging solutions, aligning with growing consumer demand for sustainability.

Church & Dwight is increasingly leveraging advanced automation and robotics in its manufacturing. This adoption directly boosts production efficiency, a critical factor in maintaining competitive pricing for its diverse product portfolio, from Arm & Hammer baking soda to Trojan condoms. For instance, in 2024, many consumer packaged goods companies, including those in Church & Dwight's sector, reported significant cost reductions, often in the range of 5-10%, due to automation in packaging and assembly lines, leading to a more consistent product output.

Investing in smart factory technologies and automating supply chain logistics allows Church & Dwight to achieve higher productivity. This translates to a quicker response to market demand and a faster time-to-market for new product innovations, a key strategy in the fast-paced consumer goods industry. Reports from industry analysts in late 2024 indicated that companies with advanced supply chain automation saw an average improvement of 15% in inventory turnover rates.

Data Analytics and Artificial Intelligence (AI)

Church & Dwight is leveraging big data analytics and AI to understand consumers better, spot market shifts, and streamline its supply chain. For instance, by analyzing vast datasets, the company can refine product formulations based on emerging preferences and optimize stock levels to prevent shortages or overstocking. This data-driven approach supports more strategic decisions across the board.

The integration of AI enables predictive analytics, which can significantly enhance operational efficiency for Church & Dwight. This includes forecasting demand more accurately, which helps in managing production schedules and raw material procurement. Such optimizations contribute to cost savings and improved responsiveness to market dynamics.

- Consumer Insights: AI algorithms analyze purchase history and online behavior to identify unmet needs, guiding new product development. In 2024, companies heavily investing in AI for consumer insights saw an average 15% increase in product launch success rates.

- Supply Chain Optimization: Predictive models forecast potential disruptions and optimize logistics routes, reducing delivery times and costs. Church & Dwight could see a reduction in logistics expenses by up to 10% through AI-driven route planning.

- Personalized Marketing: AI enables targeted marketing campaigns that resonate with specific consumer segments, boosting engagement and conversion rates. A report from early 2025 indicated that personalized marketing campaigns driven by AI achieved 2.5 times higher ROI than generic ones.

- Operational Efficiency: Predictive maintenance for manufacturing equipment, powered by AI, can minimize downtime and associated repair costs. This can lead to a 5-8% improvement in overall equipment effectiveness.

Supply Chain Technologies and Traceability

New technologies like blockchain and the Internet of Things (IoT) are revolutionizing supply chain management for companies such as Church & Dwight. These innovations significantly boost transparency, allowing for precise tracking of products from origin to consumer.

Implementing these technologies enhances Church & Dwight's ability to manage raw material sourcing, optimize inventory levels, and streamline logistics. This improved oversight directly translates to reduced operational risks and a more agile response to fluctuating market demands, a critical advantage in the fast-paced consumer goods sector.

Furthermore, advanced supply chain technologies directly support Church & Dwight's sustainability initiatives. By enabling detailed tracking of product origins and movements, the company can more effectively verify ethical sourcing and reduce its environmental footprint. For instance, by 2024, the global supply chain traceability market was projected to reach $12.4 billion, highlighting the increasing adoption and perceived value of these solutions.

- Blockchain and IoT offer enhanced transparency and traceability in Church & Dwight's supply chain.

- These technologies improve inventory management and logistics, leading to reduced risks and better market responsiveness.

- Traceability supports sustainability goals by verifying the origin of raw materials.

- The global supply chain traceability market was expected to reach $12.4 billion in 2024.

Technological advancements are critical for Church & Dwight's product innovation and operational efficiency. The company's investment in R&D, part of its $257.5 million SG&A in 2023, fuels the development of superior formulations and sustainable packaging. Automation in manufacturing, seen across the CPG sector in 2024 with reported cost reductions of 5-10%, enhances production efficiency and product consistency for brands like Arm & Hammer.

Leveraging big data and AI allows for deeper consumer understanding and optimized supply chains. For instance, AI-driven personalized marketing campaigns achieved 2.5 times higher ROI than generic ones in early 2025. Furthermore, technologies like blockchain and IoT are revolutionizing supply chain transparency, a market projected to reach $12.4 billion in 2024, enabling better raw material sourcing and risk management.

Legal factors

Church & Dwight navigates a complex web of product safety and quality regulations worldwide, impacting everything from ingredient sourcing to manufacturing processes for its diverse range of household and personal care products. For instance, in the US, the Food and Drug Administration (FDA) oversees many of Church & Dwight’s personal care items, setting standards for safety and labeling. Non-compliance, as seen in past recalls by competitors in the consumer goods sector, can lead to costly product withdrawals, substantial fines, and irreparable harm to brand trust.

Church & Dwight operates under stringent advertising and marketing laws that dictate how it can promote its diverse product portfolio. These regulations, including those concerning truthfulness in advertising and the prevention of deceptive practices, are crucial for maintaining brand integrity. For instance, the U.S. Federal Trade Commission (FTC) actively monitors advertising claims to ensure they are substantiated and not misleading to consumers.

Furthermore, evolving consumer data privacy laws, such as the California Consumer Privacy Act (CCPA) and the General Data Protection Regulation (GDPR) in Europe, significantly influence Church & Dwight's digital marketing strategies. The company must navigate these complex rules to lawfully collect, use, and protect consumer data, especially in its online advertising efforts. Non-compliance can lead to substantial fines; for example, GDPR violations can incur penalties up to 4% of global annual revenue.

Church & Dwight's robust portfolio of brands, like Arm & Hammer and Trojan, relies heavily on intellectual property rights, including trademarks and patents for unique product formulations. These legal protections are paramount for safeguarding its market position against counterfeit goods and unauthorized usage, thereby maintaining its competitive edge. The company actively pursues enforcement actions against infringers to protect its innovations and brand integrity.

Labor Laws and Employment Regulations

Church & Dwight must navigate a complex web of labor laws across its operating regions, impacting everything from minimum wage requirements to workplace safety standards. For instance, in the United States, the Fair Labor Standards Act (FLSA) sets federal minimum wage and overtime pay, while individual states may mandate higher rates, such as California's current $16.00 per hour minimum wage as of January 1, 2024. Compliance with these varying regulations directly influences operational costs and human resource strategies.

Adherence to anti-discrimination policies, such as those outlined in Title VII of the Civil Rights Act of 1964 in the U.S., is paramount. This ensures fair treatment in hiring, promotion, and compensation, preventing costly lawsuits and fostering a positive work environment. Similarly, regulations concerning employee benefits, including healthcare and retirement plans, add another layer of complexity and financial consideration for the company.

The company's commitment to employee well-being and legal compliance is essential for mitigating risks. Failure to comply with these labor laws can result in significant fines, reputational damage, and operational disruptions. For example, in 2023, the U.S. Department of Labor recovered over $1.2 billion in back wages for workers, underscoring the financial consequences of non-compliance.

- Minimum Wage Variations: Church & Dwight must account for diverse minimum wage laws, with U.S. federal minimum at $7.25/hour and states like California at $16.00/hour (as of early 2024).

- Anti-Discrimination Compliance: Adherence to laws like Title VII in the U.S. is critical for fair employment practices and avoiding legal challenges.

- Employee Benefits Mandates: The company must manage costs and compliance related to providing employee benefits, which vary by jurisdiction.

- Workplace Safety Standards: Ensuring compliance with occupational safety regulations, such as OSHA standards in the U.S., is vital for employee well-being and avoiding penalties.

Environmental Regulations and Compliance

Environmental regulations are becoming more stringent, affecting how Church & Dwight handles waste, emissions, water, and chemicals. For instance, in 2024, the EPA continued to enforce stricter limits on PFAS in drinking water, which could necessitate upgrades in water treatment at manufacturing sites. These rules mean the company must continually invest in cleaner operations and sustainable methods to avoid fines and meet legal obligations.

Compliance extends to packaging, with many regions implementing extended producer responsibility (EPR) schemes. By 2025, several states are expected to have EPR laws for packaging in place, requiring companies like Church & Dwight to contribute financially to the collection and recycling of their products' packaging. This necessitates strategic adjustments in material sourcing and packaging design to manage these evolving costs and responsibilities.

- Increased Scrutiny on Chemical Usage: Regulations on specific chemicals used in cleaning products, like phosphates or certain preservatives, can lead to reformulation requirements.

- Water Usage Restrictions: In drought-prone areas, water usage permits and conservation mandates can impact manufacturing efficiency and costs.

- Waste Management Costs: Stricter landfill regulations and waste diversion targets can increase disposal expenses or require investment in recycling infrastructure.

- Carbon Emission Targets: Global and national commitments to reduce carbon emissions may require Church & Dwight to invest in energy-efficient technologies and renewable energy sources for its facilities.

Legal factors significantly shape Church & Dwight's operations, from product safety mandates enforced by bodies like the FDA to truth-in-advertising regulations monitored by the FTC. Compliance with data privacy laws, such as GDPR and CCPA, is crucial for digital marketing, with potential fines reaching up to 4% of global annual revenue for violations. Intellectual property rights are vital for protecting brands like Arm & Hammer, necessitating active enforcement against counterfeiters.

Environmental factors

Church & Dwight faces increasing pressure from consumers and regulators to adopt more sustainable packaging. This trend is pushing the company to explore recyclable, compostable, and reduced-plastic options for its extensive product lines, from Arm & Hammer to Trojan.

Investing in these eco-friendly packaging solutions is not just about compliance; it's a strategic move to bolster brand reputation and minimize environmental impact. For instance, the global sustainable packaging market was valued at approximately $275 billion in 2023 and is projected to reach over $400 billion by 2028, highlighting the significant market shift. Companies like Church & Dwight are actively seeking ways to align with these growing consumer preferences.

Evolving waste management and recycling regulations are a significant environmental factor for Church & Dwight. Stricter rules on landfill disposal and increased emphasis on circular economy principles are reshaping how companies handle post-consumer waste. For instance, many regions are implementing or expanding extended producer responsibility (EPR) schemes, which can shift the financial burden of product end-of-life management onto manufacturers like Church & Dwight. These regulations directly influence operational costs associated with packaging and product design, pushing for more sustainable materials and robust recycling programs.

Church & Dwight's manufacturing processes, particularly those involving cleaning product formulations, inherently require substantial water. In 2023, the company reported on its sustainability initiatives, highlighting efforts to reduce water intensity across its operations. This focus is driven by both regulatory pressures and the growing global concern over water scarcity, which can impact operational continuity and costs.

The company's commitment to efficient water management is evident in its investments in water-saving technologies. For instance, by 2024, many of Church & Dwight's facilities aim to implement advanced water recycling systems to minimize freshwater intake and reduce wastewater discharge, aligning with stricter environmental regulations and demonstrating a proactive approach to sustainability.

Climate Change and Carbon Footprint Reduction

Growing global awareness of climate change is intensifying regulatory scrutiny on businesses to curb greenhouse gas emissions throughout their value chains. Church & Dwight, like many consumer goods companies, faces mounting pressure to establish and achieve ambitious carbon reduction goals, which may necessitate investments in renewable energy sources and optimized logistics. This focus extends to Scope 3 emissions, encompassing those generated by suppliers and the use of their products.

In 2023, Church & Dwight reported a reduction in its absolute Scope 1 and 2 greenhouse gas emissions by 12.1% compared to a 2015 baseline, demonstrating progress in direct operational efficiency. However, addressing Scope 3 emissions, which represent a significant portion of their total footprint, remains a key challenge and opportunity. For instance, the company is exploring ways to reduce the carbon intensity associated with product transportation and consumer use, aligning with broader industry trends towards sustainability.

- Regulatory Pressure: Increased government mandates and international agreements, such as the Paris Agreement, are driving the need for corporate climate action.

- Investment in Sustainability: Companies are increasingly allocating capital towards renewable energy procurement, energy efficiency upgrades, and sustainable supply chain practices.

- Scope 3 Focus: Acknowledging that a substantial portion of emissions often lies outside direct control, companies are developing strategies to influence suppliers and product end-of-life management.

- Consumer Demand: A growing segment of consumers favors brands with demonstrable environmental responsibility, influencing purchasing decisions and brand loyalty.

Sustainable Sourcing of Raw Materials

Church & Dwight faces growing pressure to ensure its raw materials are sourced ethically and sustainably. This means the company must actively vet its supply chains, partnering with suppliers who prioritize environmentally sound practices. For instance, by 2024, major consumer goods companies reported that over 70% of their customers considered sustainability in their purchasing decisions, a trend that continues to climb.

Meeting these demands involves rigorous due diligence and a commitment to transparency. Consumers increasingly want to know where products come from and how they are made. Church & Dwight's efforts in this area directly impact its brand reputation and ability to meet evolving consumer preferences for responsible products. By Q1 2025, reports indicated a 15% increase in consumer willingness to pay a premium for sustainably sourced goods.

Key aspects of sustainable sourcing for Church & Dwight include:

- Supply Chain Transparency: Mapping and disclosing the origins of key raw materials.

- Supplier Audits: Regularly assessing suppliers for compliance with environmental and ethical standards.

- Certifications: Seeking third-party certifications for materials like palm oil or paper products.

- Risk Mitigation: Identifying and addressing potential environmental or social risks within the supply chain.

Church & Dwight is navigating stricter waste management regulations, including extended producer responsibility schemes, which impact packaging costs and design. The company is also prioritizing water conservation, investing in recycling technologies to reduce freshwater intake and wastewater discharge by 2024, driven by scarcity concerns and regulatory pressures.

Climate change awareness is pushing for greenhouse gas emission reductions across the value chain. While Church & Dwight achieved a 12.1% reduction in Scope 1 and 2 emissions by 2023 from a 2015 baseline, addressing Scope 3 emissions remains a focus, with consumer demand for sustainable products growing, influencing purchasing decisions by over 70% of customers in 2024.

| Environmental Factor | Impact on Church & Dwight | Relevant Data/Trend |

| Sustainable Packaging Demand | Increased R&D and production costs for eco-friendly alternatives. | Global sustainable packaging market projected to exceed $400 billion by 2028. |

| Waste Management Regulations | Potential financial burden from EPR schemes, influencing product end-of-life strategies. | Expansion of EPR programs in various regions impacting manufacturers. |

| Water Scarcity and Management | Investment in water-saving technologies and operational adjustments. | Aim to implement advanced water recycling systems by 2024. |

| Climate Change & Emissions | Pressure to reduce Scope 1, 2, and 3 emissions, potentially requiring renewable energy investments. | 12.1% reduction in absolute Scope 1 & 2 GHG emissions by 2023 (vs. 2015 baseline). |

| Ethical and Sustainable Sourcing | Increased scrutiny on supply chains and supplier practices. | 15% increase in consumer willingness to pay a premium for sustainably sourced goods by Q1 2025. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Church & Dwight is grounded in data from reputable sources including financial reports from the SEC, market research from Nielsen and Statista, and global economic indicators from the IMF and World Bank. We also incorporate insights from industry-specific publications and government regulatory updates.