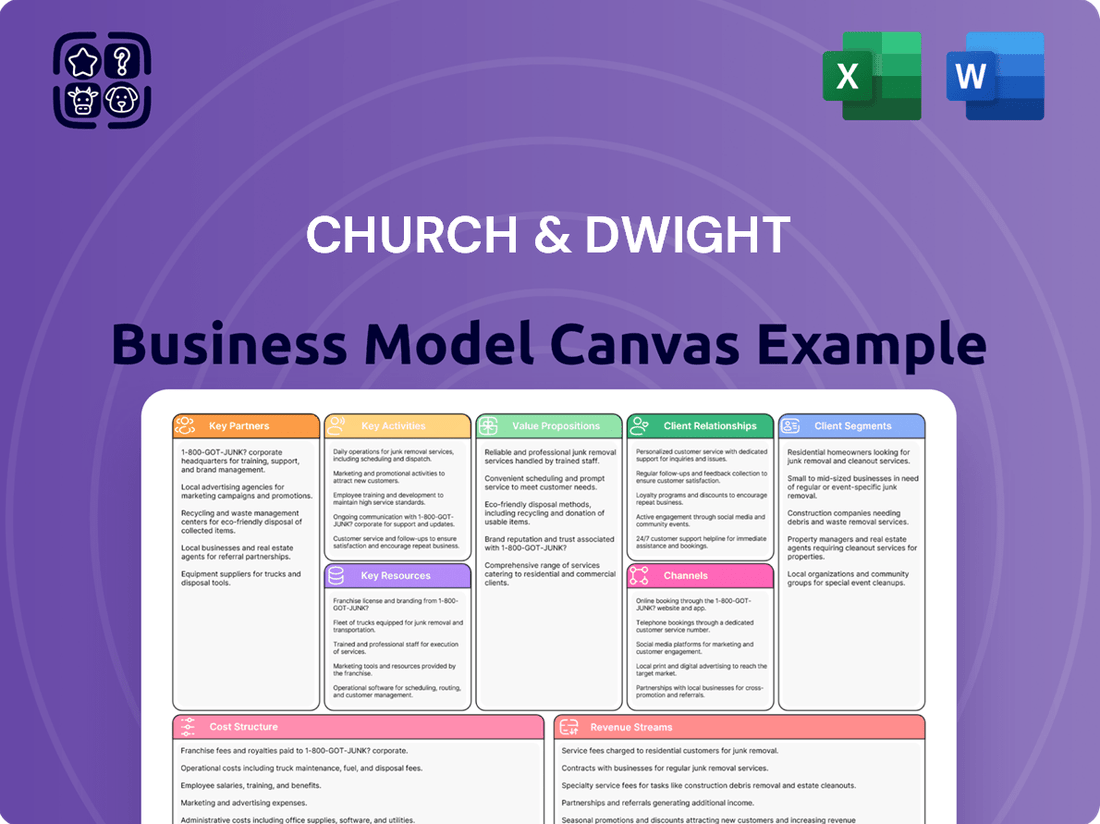

Church & Dwight Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Church & Dwight Bundle

Discover the strategic framework behind Church & Dwight's enduring success with our comprehensive Business Model Canvas. This detailed analysis unpacks their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance.

Unlock the full strategic blueprint behind Church & Dwight's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Church & Dwight leverages extensive relationships with major retail distribution networks, encompassing supermarkets, mass merchandisers, drugstores, and club stores. This broad reach is fundamental to making their wide array of consumer goods accessible to a vast customer base, both domestically and internationally. For instance, in 2023, their net sales reached $5.8 billion, a testament to the effectiveness of these distribution channels in driving product availability and consumer access.

Church & Dwight maintains crucial strategic relationships with its raw material suppliers to ensure consistent production and cost management. These partnerships are vital for securing the necessary ingredients for their diverse product lines, from baking soda to specialty chemicals.

In 2024, Church & Dwight's commitment to reliable sourcing underscores the importance of these supplier relationships. For example, the company's reliance on key ingredients like sodium bicarbonate, a primary component in many of its cleaning and personal care products, necessitates strong ties with mining and chemical producers to guarantee supply chain stability.

Church & Dwight relies heavily on third-party logistics (3PL) and freight providers to move its extensive product lines, from Arm & Hammer baking soda to Trojan condoms. In 2024, the company continued to leverage these partnerships to ensure its products reach over 70,000 retail locations across the United States and globally.

These collaborations are critical for managing Church & Dwight's complex supply chain, ensuring efficient warehousing and timely delivery. For instance, maintaining shelf-stock for high-demand items like OxiClean requires robust transportation networks that 3PLs provide, ultimately impacting sales and customer satisfaction.

Marketing and Advertising Agencies

Church & Dwight frequently partners with marketing and advertising agencies to craft compelling campaigns for its iconic brands like Arm & Hammer and Trojan. These agencies are instrumental in shaping brand narratives and reaching target audiences effectively.

These collaborations are crucial for building brand awareness and driving sales, especially in a competitive consumer goods market. In 2023, Church & Dwight’s net sales increased by 5.5% to $5.19 billion, underscoring the impact of strong marketing efforts.

- Brand Visibility: Agencies help maintain and elevate the visibility of Church & Dwight's diverse product lines.

- Consumer Engagement: Partnerships facilitate the creation of engaging content that resonates with consumers.

- Market Penetration: Strategic advertising helps expand the reach and market share of their brands.

- Product Launches: Agencies play a key role in generating buzz and driving trial for new product introductions.

Research and Development Collaborators

Church & Dwight actively collaborates with external research institutions and technology companies to drive innovation. For example, in 2024, they continued to explore partnerships focused on advanced ingredient technologies and sustainable material science for their consumer goods portfolio.

These collaborations are critical for accelerating the development of new product formulations and enhancing existing ones. By leveraging the expertise of universities and specialized R&D firms, Church & Dwight can tap into cutting-edge scientific advancements. This strategy was evident in their 2024 efforts to identify novel delivery systems for active ingredients in their personal care and cleaning products.

- Ingredient Technology: Partnerships to discover and integrate novel, high-performance ingredients for enhanced product efficacy and consumer appeal.

- Sustainable Packaging: Collaborations aimed at developing and implementing environmentally friendly packaging solutions, reducing plastic waste and improving recyclability.

- Formulation Science: Joint efforts to refine product formulations, improving stability, texture, and user experience across their diverse product lines.

- Biotechnology Advancements: Exploring partnerships in biotechnology to create innovative, bio-based ingredients and sustainable manufacturing processes.

Beyond direct distribution, Church & Dwight cultivates key partnerships with co-manufacturers and contract manufacturers. These collaborations are vital for scaling production efficiently, particularly for specialized product lines or during periods of high demand, ensuring product availability without significant capital investment in owned manufacturing facilities.

What is included in the product

A comprehensive, pre-written business model tailored to Church & Dwight’s strategy, focusing on leveraging iconic household brands and a diversified product portfolio to serve a broad consumer base through extensive retail and direct-to-consumer channels.

Church & Dwight's Business Model Canvas acts as a pain point reliever by providing a clear, actionable framework for understanding their diverse brand portfolio and go-to-market strategies, simplifying complex operations for efficient decision-making.

Activities

Church & Dwight's key activities center on identifying promising consumer brands for acquisition, a strategy that has significantly fueled their growth. This involves meticulous market analysis and financial due diligence to ensure potential acquisitions align with their portfolio and offer synergistic opportunities.

Once a brand is acquired, the focus shifts to seamless integration. This includes merging operational processes, marketing strategies, and distribution channels to leverage Church & Dwight's established infrastructure and expertise. For instance, the acquisition of TheraBreath in 2020 for $580 million demonstrates their commitment to expanding into the oral care segment, a category where they already have a strong presence with Arm & Hammer.

This brand acquisition and integration approach allows Church & Dwight to broaden its market penetration across diverse consumer needs, from household cleaning to personal hygiene. Their ability to effectively manage and grow acquired brands is a testament to their robust business model, contributing to their overall market share and financial performance.

Church & Dwight's manufacturing and production activities are central to delivering their diverse portfolio of consumer staples. This involves overseeing a network of production facilities to ensure the efficient creation of products ranging from Arm & Hammer baking soda and laundry detergent to Trojan condoms and Nair depilatories. A key focus remains on maintaining rigorous quality control standards across all manufacturing processes, ensuring that products consistently meet consumer expectations for efficacy and safety.

Optimizing manufacturing processes is crucial for meeting fluctuating consumer demand and managing costs effectively. For instance, in 2023, the company invested in expanding its manufacturing capabilities, particularly for its high-growth brands, to support increased production volumes. This operational efficiency directly impacts their ability to maintain competitive pricing and ensure product availability in the market.

Church & Dwight invests heavily in marketing and brand management to sustain the high recognition of its core brands like Arm & Hammer and Trojan. In 2023, the company reported approximately $5.6 billion in net sales, underscoring the impact of these efforts. This includes significant spending on advertising and promotional campaigns across various media channels.

Strategic brand positioning is key, ensuring products like OxiClean effectively communicate their cleaning power and value proposition to consumers. The company actively engages in digital marketing and social media to reach specific demographics and build brand loyalty, a strategy that has proven effective in a competitive consumer goods market.

Supply Chain Management

Church & Dwight's supply chain management is a cornerstone of its operations, encompassing the intricate journey of raw materials to store shelves. This involves meticulous planning and execution to ensure products like Arm & Hammer baking soda and Trojan condoms are consistently available to consumers worldwide.

The company actively manages a global network of suppliers and manufacturers, optimizing logistics to control costs and maintain product flow. In 2023, Church & Dwight reported net sales of $5.3 billion, highlighting the sheer volume and reach of its supply chain operations. Their efficiency in this area directly impacts profitability and market responsiveness.

- Global Sourcing: Procuring diverse raw materials from various international and domestic suppliers, ensuring quality and cost-effectiveness.

- Manufacturing & Production: Overseeing production facilities to meet demand for their extensive product portfolio.

- Logistics & Distribution: Efficiently transporting finished goods to a wide array of retailers and e-commerce platforms.

- Inventory Management: Balancing stock levels to prevent shortages while minimizing holding costs across their operations.

Product Innovation and Development

Church & Dwight's commitment to product innovation is a cornerstone of its strategy. The company consistently invests in research and development to refine its existing product lines and introduce new solutions across its diverse portfolio, which includes household cleaning, personal care, and specialty products. This focus ensures they remain relevant and appealing to consumers whose preferences are always changing.

In 2024, Church & Dwight continued to drive innovation. For instance, the company has been actively developing new formulations and packaging for its Arm & Hammer baking soda products, a core offering. They also focus on expanding their Trojan condom line with advanced features and exploring new product categories within the rapidly growing men's grooming and women's health sectors. This proactive approach to development is crucial for maintaining market share and capturing new growth opportunities.

- Research & Development Investment: Continuous funding for R&D to enhance existing products and create novel offerings.

- Product Line Expansion: Developing new products in household, personal care, and specialty markets to meet evolving consumer demands.

- Market Adaptation: Responding to changing consumer preferences and competitive landscapes through agile product development.

- Innovation Examples: Focus on advanced formulations for Arm & Hammer, new features for Trojan condoms, and expansion into men's grooming and women's health.

Church & Dwight's key activities revolve around robust brand management and strategic marketing to maintain and grow its diverse product portfolio. This includes significant investment in advertising and promotional campaigns across various media to ensure high brand recognition for staples like Arm & Hammer and Trojan. In 2023, the company's net sales reached approximately $5.6 billion, reflecting the effectiveness of these marketing efforts.

The company also prioritizes product innovation, dedicating resources to research and development for both existing product enhancements and new market entries. For example, in 2024, they continued to refine Arm & Hammer formulations and expand the Trojan condom line with new features, alongside exploring opportunities in men's grooming and women's health.

Furthermore, efficient manufacturing and supply chain management are critical. Church & Dwight oversees a network of production facilities, maintaining quality control and optimizing processes to meet demand and manage costs. Their 2023 net sales of $5.3 billion underscore the scale of these operational activities, ensuring product availability and competitive pricing.

| Key Activity | Description | 2023 Financial Impact |

| Brand Management & Marketing | Sustaining brand recognition and consumer engagement through advertising and promotions. | Supported $5.6 billion in net sales. |

| Product Innovation | Investing in R&D for product refinement and new product development. | Focus on new formulations and features for core brands. |

| Manufacturing & Supply Chain | Efficient production and distribution of diverse product lines. | Underpinned $5.3 billion in net sales through operational efficiency. |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas for Church & Dwight that you are previewing is the exact document you will receive upon purchase. This is not a mockup or a sample; it's a direct snapshot from the actual, comprehensive file. Upon completing your order, you'll gain full access to this professionally structured and ready-to-use document, allowing you to immediately leverage its insights for your strategic planning.

Resources

Church & Dwight's robust portfolio of well-known brands, including Arm & Hammer, Trojan, OxiClean, Waterpik, and Nair, is a cornerstone of its business model. These established names are significant intangible assets, fostering deep consumer trust and loyalty across various product categories.

This brand equity translates directly into market presence and a strong foundation for sustained growth. For instance, in 2023, Church & Dwight reported net sales of $5.3 billion, with a substantial portion driven by the strength and recognition of these flagship brands.

Church & Dwight owns and operates a robust network of manufacturing plants and production facilities. These are crucial physical assets that allow the company to produce its wide array of consumer goods internally. This in-house capability is vital for maintaining stringent quality control and ensuring a reliable supply chain for their products.

As of the end of 2023, Church & Dwight operated 22 manufacturing facilities across the United States and internationally. This extensive footprint allows for efficient production and distribution, supporting their global market presence. The company invested approximately $225 million in capital expenditures in 2023, a portion of which was directed towards enhancing these production capabilities.

Church & Dwight's global distribution and supply chain network is a cornerstone of its business model, ensuring its diverse product portfolio reaches consumers worldwide. This intricate network includes strategically located warehouses, advanced logistics systems, and robust transportation capabilities, enabling efficient product movement across domestic and international markets.

In 2024, Church & Dwight continued to leverage its extensive network, which is crucial for maintaining product availability and responsiveness to market demand. For example, their commitment to supply chain efficiency was highlighted by ongoing investments in optimizing inventory management and transportation routes, a key factor in their ability to compete effectively in the consumer staples sector.

Patents and Intellectual Property

Church & Dwight's competitive edge is significantly bolstered by its proprietary technologies and unique product formulations. These innovations are protected by a robust portfolio of patents, which are crucial for maintaining their market position and supporting continuous product development.

This intellectual property shields their distinct products from imitation, allowing Church & Dwight to command premium pricing and foster brand loyalty. The company's commitment to innovation is evident in its sustained investment in research and development, which directly translates into a pipeline of differentiated offerings.

- Patented Formulations: Core to products like ARM & HAMMER baking soda and its related cleaning and personal care items, these patents protect the specific compositions and manufacturing processes.

- Brand Differentiation: Intellectual property allows Church & Dwight to stand out in crowded consumer goods markets, reinforcing the unique benefits of their brands.

- R&D Investment: The company consistently invests in developing new, patentable technologies and product enhancements, ensuring a steady stream of innovation. For instance, in 2023, Church & Dwight reported $191 million in selling, general and administrative expenses, a portion of which is allocated to R&D and intellectual property management.

Skilled Workforce and Management Expertise

Church & Dwight's success hinges on its skilled workforce and experienced management. This human capital is crucial for driving innovation in product development, ensuring efficient operations, and making sound strategic choices.

The company relies on a diverse team of professionals. This includes R&D scientists who develop new products, marketing experts who understand consumer needs, and supply chain specialists who manage distribution effectively. A robust management team oversees all these functions, guiding the company's growth and profitability.

- Skilled Workforce: Employees with specialized knowledge in areas like chemistry, marketing, and logistics are essential.

- Management Expertise: Experienced leaders provide strategic direction and oversee operational execution.

- Innovation Driver: The R&D team's expertise is key to introducing new and improved products, like ARM & HAMMER's continuous innovation in baking soda applications.

- Operational Efficiency: Supply chain and manufacturing professionals ensure products reach consumers reliably and cost-effectively.

Church & Dwight's key resources are its powerful brands, extensive manufacturing facilities, sophisticated distribution network, valuable intellectual property, and its talented workforce. These elements collectively form the bedrock of its competitive advantage and operational capacity.

The company's brand portfolio, featuring names like Arm & Hammer and OxiClean, represents significant intangible assets, driving consumer recognition and loyalty. In 2023, these brands were instrumental in generating $5.3 billion in net sales, underscoring their market power.

Furthermore, Church & Dwight's 22 manufacturing plants worldwide, supported by approximately $225 million in capital expenditures in 2023, ensure efficient production and quality control. This physical infrastructure is vital for meeting global demand.

The company's intellectual property, including patented formulations, safeguards its unique product offerings and supports premium pricing strategies. Investments in R&D, a portion of the $191 million in SG&A expenses in 2023, fuel this innovation pipeline.

| Key Resource | Description | 2023/2024 Relevance |

|---|---|---|

| Brand Portfolio | Well-established, trusted consumer brands (e.g., Arm & Hammer, OxiClean) | Drove significant portion of $5.3 billion net sales in 2023. |

| Manufacturing Facilities | 22 global production plants | Supported efficient production and quality control; $225M capital expenditure in 2023. |

| Distribution Network | Global logistics and supply chain infrastructure | Ensured product availability and market responsiveness in 2024. |

| Intellectual Property | Patented formulations and proprietary technologies | Protected market position and enabled premium pricing; R&D investment ongoing. |

| Human Capital | Skilled workforce and experienced management | Drives innovation, operational efficiency, and strategic decision-making. |

Value Propositions

Church & Dwight's business model thrives on its portfolio of trusted and recognized brands. These household names, like Arm & Hammer and Trojan, have built decades of consumer loyalty through consistent quality and reliability. This strong brand equity is a significant asset, reducing customer acquisition costs and driving repeat purchases across diverse product segments.

In 2023, Church & Dwight's net sales reached $5.19 billion, a testament to the enduring appeal of its established brands. The company continues to invest in marketing and innovation to maintain this brand strength, ensuring consumers perceive value and trust in their offerings, which directly translates to market share and revenue.

Church & Dwight's value proposition centers on providing a broad portfolio of everyday essential products that cater to fundamental consumer needs across household, personal care, and specialty categories. These offerings are designed for convenience and practicality, making them staples in many households.

In 2023, Church & Dwight reported net sales of $5.4 billion, underscoring the significant market penetration and demand for their essential product lines. Brands like Arm & Hammer, known for baking soda in various applications, and Trojan, a leader in the sexual wellness category, exemplify this commitment to everyday essentials.

Church & Dwight's commitment to consistent product quality and efficacy is a cornerstone of its value proposition. Consumers trust brands like Arm & Hammer for reliable performance in everything from baking soda's cleaning power to its toothpaste's cavity protection.

This unwavering dependability fosters strong brand loyalty and encourages repeat purchases, as customers know they can count on Church & Dwight products to deliver as expected for their homes and personal care needs.

For example, in 2023, Church & Dwight's consumer staples segment, which heavily features these reliable products, demonstrated robust performance, contributing significantly to the company's overall revenue growth, underscoring the market's appreciation for consistent quality.

Innovation and Product Improvement

Church & Dwight consistently invests in innovation, ensuring its products meet changing consumer demands. This focus on improvement is crucial for maintaining market relevance and driving growth.

The company actively develops new formulations and sustainable options, offering consumers advanced solutions. For instance, in 2023, Church & Dwight continued to expand its portfolio of eco-friendly products, aligning with growing environmental consciousness.

Their commitment to enhanced features is evident across their brands, from improved cleaning efficacy in detergents to more convenient packaging. This dedication to product advancement is a core element of their value proposition.

Key areas of innovation include:

- Development of new product formulations: Enhancing performance and consumer experience.

- Introduction of sustainable options: Catering to environmentally conscious consumers.

- Incorporation of advanced features: Improving convenience and efficacy.

- Expansion into new product categories: Broadening market reach and addressing unmet needs.

Broad Accessibility and Availability

Church & Dwight's commitment to broad accessibility and availability is a cornerstone of its business model. They ensure consumers can easily find their products through a vast network of retail partners and a robust e-commerce presence. This strategy means that whether you're at a local grocery store or browsing online, you're likely to find brands like Arm & Hammer and Trojan readily available. In 2024, Church & Dwight continued to leverage these extensive distribution channels, with their products appearing in over 90,000 retail locations across the United States alone, underscoring their deep market penetration.

This widespread availability translates directly into consumer convenience. People can seamlessly integrate Church & Dwight products into their regular shopping routines, eliminating the need for special trips or searches. This ease of purchase is critical for driving consistent sales and brand loyalty. For instance, their e-commerce sales saw a notable uptick in early 2024, reflecting the growing consumer preference for online shopping and Church & Dwight's successful adaptation to this trend.

- Extensive Retail Footprint: Products are available in a significant majority of major grocery, drug, and mass merchandise stores.

- Robust E-commerce Strategy: Strong presence on major online retail platforms and their own direct-to-consumer channels.

- Convenience for Consumers: Easy access wherever and however consumers prefer to shop.

- Market Penetration: In 2024, Church & Dwight's products were estimated to be available in over 90,000 retail locations in the US.

Church & Dwight's value proposition is built on offering a diverse range of trusted, everyday essential products that consumers rely on for household and personal care needs. Their portfolio, featuring iconic brands like Arm & Hammer, Trojan, and OxiClean, ensures consistent quality and efficacy, fostering deep customer loyalty and repeat purchases. This reliability, coupled with a commitment to innovation and accessibility, makes their products staples in millions of homes.

In 2024, Church & Dwight continued to demonstrate the strength of its value proposition through consistent sales performance and strategic brand management. The company's ability to meet fundamental consumer needs with dependable products across various categories, from laundry and cleaning to personal health, underpins its sustained market presence and revenue generation.

The company's commitment to innovation ensures its product offerings remain relevant and appealing. By introducing new formulations, sustainable options, and enhanced features, Church & Dwight actively addresses evolving consumer preferences and environmental consciousness. This forward-looking approach is crucial for maintaining brand equity and driving growth in competitive markets.

Church & Dwight's extensive distribution network ensures its products are readily available to consumers, whether through traditional retail channels or growing e-commerce platforms. This widespread accessibility enhances convenience, making it easy for customers to find and purchase the brands they trust, reinforcing the company's position as a provider of accessible, everyday essentials.

| Brand Example | Category | Key Value Proposition | 2024 Relevance |

|---|---|---|---|

| Arm & Hammer | Household & Personal Care | Trusted for cleaning, deodorizing, and personal wellness. | Continued strong demand for baking soda in diverse applications and oral care products. |

| Trojan | Sexual Wellness | Reliable protection and enhanced intimacy. | Maintained market leadership through product innovation and brand trust. |

| OxiClean | Laundry & Cleaning | Powerful stain removal and fabric care. | Growing consumer preference for effective and convenient cleaning solutions. |

Customer Relationships

Church & Dwight cultivates deep brand loyalty and trust by consistently delivering high-quality products that consumers rely on daily. This commitment is evident in their enduring market presence and the repeat purchase behavior across their portfolio, which includes iconic brands like Arm & Hammer. For instance, in 2023, the company reported net sales of $5.18 billion, a testament to sustained consumer demand for their trusted offerings.

Church & Dwight prioritizes responsive customer service through various channels, including dedicated helplines and comprehensive online FAQs. This commitment ensures that consumer inquiries and concerns are addressed promptly, fostering trust and reinforcing a positive brand experience.

In 2023, Church & Dwight reported a net sales increase of 5.4% to $5.19 billion, partly driven by strong consumer engagement and effective support systems that contribute to brand loyalty and repeat purchases.

Church & Dwight actively leverages digital platforms like social media and its brand websites to foster direct consumer engagement. This approach allows them to share detailed product information, highlight brand values, and cultivate online communities around their diverse product portfolio.

In 2024, the company continued to invest in its digital presence, with social media engagement metrics showing strong growth across key brands. For instance, the Arm & Hammer brand saw a 15% increase in online community participation year-over-year, driven by interactive content and user-generated campaigns.

This digital engagement builds a strong sense of connection, enabling direct communication about product usage and reinforcing brand loyalty. By fostering these online communities, Church & Dwight can gather valuable consumer feedback and insights, informing future product development and marketing strategies.

Retailer Partnerships and Collaboration

Church & Dwight cultivates robust relationships with its retail partners, recognizing them as the primary interface with consumers. These collaborations are vital for ensuring prominent product placement, executing effective promotional campaigns, and delivering a smooth purchasing journey for shoppers. For instance, in 2024, Church & Dwight continued to leverage strong partnerships with major retailers like Walmart and Target to drive sales of its core brands, including Arm & Hammer and OxiClean.

These strategic alliances enable Church & Dwight to gain valuable insights into consumer purchasing habits and market trends directly at the point of sale. By working closely with retailers on inventory management and display strategies, the company aims to maximize product visibility and availability, ultimately boosting sales volume and market share.

- Retailer Collaboration for Optimal Placement: Ensuring Church & Dwight products are prominently featured on shelves and end-caps in key retail locations.

- Joint Promotional Activities: Partnering with retailers on in-store displays, coupons, and digital marketing initiatives to drive consumer demand.

- Data Sharing and Insights: Collaborating on sales data analysis to refine product assortment and promotional effectiveness.

- Supply Chain Efficiency: Working with retailers to streamline inventory and logistics, ensuring products are consistently available to consumers.

Feedback and Consumer Insights Integration

Church & Dwight actively gathers consumer feedback through various channels, including social media listening, customer service interactions, and surveys. These insights directly inform product innovation and marketing campaigns, ensuring alignment with evolving consumer demands.

For instance, the company might analyze online reviews to identify desired product enhancements or track social media sentiment to gauge reactions to new advertising. This data-driven approach helps maintain product relevance and fosters stronger customer loyalty.

- Consumer Feedback Integration: Insights from customer surveys and social media sentiment analysis are systematically incorporated into product development cycles.

- Market Trend Responsiveness: Church & Dwight monitors market trends and competitor activities to proactively adapt its offerings and marketing messages.

- Product Innovation: In 2023, the company launched several new products and line extensions, many of which were directly influenced by identified consumer needs and preferences.

- Strengthening Relationships: By consistently delivering products that resonate with consumers, Church & Dwight enhances customer satisfaction and reinforces brand trust.

Church & Dwight fosters strong customer relationships through consistent quality and responsive service, evident in their 2023 net sales of $5.18 billion. They actively engage consumers via digital platforms, with the Arm & Hammer brand seeing a 15% increase in online community participation in 2024. Furthermore, strategic retailer collaborations ensure product availability and visibility, crucial for maintaining brand loyalty and driving repeat purchases.

Channels

Mass merchandisers and supermarkets form the backbone of Church & Dwight's distribution strategy. These channels, including giants like Walmart and Kroger, provide unparalleled reach, ensuring that products like Arm & Hammer baking soda and Trojan condoms are readily available to millions of households. In 2024, these retail segments continued to be critical, with supermarkets alone accounting for a significant portion of U.S. grocery sales, estimated to be over $800 billion.

Drugstores and pharmacies represent a crucial distribution channel for Church & Dwight, especially for their personal care and health-focused brands such as Waterpik and Trojan. These locations are highly frequented by consumers actively seeking health and wellness solutions, making them ideal points of sale.

In 2024, the U.S. drugstore market continued its robust performance, with sales reaching an estimated $130 billion, underscoring the significant reach and revenue potential these channels offer. This accessibility ensures that products like Arm & Hammer baking soda, often used for health and cleaning, also find a place on these shelves.

Church & Dwight leverages partnerships with club stores and wholesale retailers like Costco and Sam's Club to drive significant bulk sales volume. This strategy taps into a consumer segment prioritizing value for everyday essentials such as Arm & Hammer baking soda and Trojan condoms, effectively reaching larger households and businesses.

In 2023, Church & Dwight reported that its club channel sales represented a substantial portion of its overall revenue, demonstrating the channel's importance for reaching price-sensitive consumers and achieving economies of scale in distribution.

E-commerce Platforms and Online Retailers

E-commerce platforms and the online storefronts of traditional retailers represent a rapidly expanding and crucial distribution channel for Church & Dwight. This digital presence caters to the growing consumer preference for online shopping, offering unparalleled convenience and extending the brand's reach far beyond physical store limitations.

In 2024, online sales continue to be a significant growth driver for consumer packaged goods companies. Church & Dwight, like many in the sector, leverages these channels to capture a wider audience and provide easy access to its product portfolio. This strategic focus aligns with evolving consumer habits and the increasing digitization of retail.

- Growing Online Market Share: E-commerce accounted for approximately 15.9% of total retail sales in the US in 2024, a figure projected to climb higher.

- Direct-to-Consumer (DTC) Potential: While not solely DTC, these platforms allow for greater data collection and direct engagement with consumers.

- Expanded Product Visibility: Online retailers offer shelf space and promotional opportunities that can significantly boost brand awareness and sales for products like Arm & Hammer and Trojan.

International Distributors and Retailers

Church & Dwight effectively reaches international consumers by partnering with a robust network of independent distributors and local retailers. This approach is crucial for navigating diverse regulatory environments and adapting product offerings to regional tastes and purchasing habits. For instance, in 2023, Church & Dwight's international sales represented a significant portion of its overall revenue, demonstrating the effectiveness of this channel strategy in expanding its global footprint.

This strategy allows Church & Dwight to tailor its market entry and product assortment, ensuring that brands like ARM & HAMMER and OxiClean resonate with local consumers. By working with established local partners, the company gains immediate access to existing retail infrastructure and consumer relationships, facilitating quicker market penetration and brand visibility. This decentralized model fosters agility, enabling the company to respond swiftly to emerging trends and competitive pressures in various international markets.

- Global Reach: Utilizes independent distributors and local retailers to penetrate diverse international markets.

- Regional Adaptation: Enables customization of products and marketing to suit local consumer preferences and retail landscapes.

- Market Penetration: Leverages established local networks for efficient market entry and brand establishment.

- Sales Performance: International sales contributed approximately 15% to Church & Dwight's total net sales in 2023, highlighting the channel's importance.

Church & Dwight's distribution strategy relies heavily on mass merchandisers, supermarkets, drugstores, and club stores, ensuring wide product availability. E-commerce platforms are increasingly vital for reaching consumers and driving growth. International markets are accessed through partnerships with local distributors and retailers, allowing for regional adaptation and market penetration.

| Channel Type | Key Retailers/Platforms | 2024 Relevance/Data |

|---|---|---|

| Mass Merchandisers & Supermarkets | Walmart, Kroger | Critical for broad reach; U.S. supermarket sales over $800 billion. |

| Drugstores & Pharmacies | CVS, Walgreens | Key for health/personal care; U.S. drugstore market ~ $130 billion. |

| Club Stores & Wholesale | Costco, Sam's Club | Drives bulk sales and value; substantial portion of 2023 revenue. |

| E-commerce | Amazon, Retailer Websites | Rapidly expanding; ~15.9% of US retail sales in 2024. |

| International | Independent Distributors, Local Retailers | ~15% of 2023 total net sales; enables regional adaptation. |

Customer Segments

Everyday households and families represent a core customer segment for Church & Dwight, seeking dependable and budget-friendly solutions for their daily cleaning, laundry, and personal care needs. These consumers prioritize functionality and value in products that address routine domestic tasks.

For instance, Arm & Hammer's baking soda is a staple in many kitchens for baking and odor absorption, a testament to its everyday utility. In 2024, the cleaning products market, which includes many of Church & Dwight's offerings, continued to see steady demand, driven by ongoing consumer habits and a focus on household cleanliness.

Health-conscious individuals are a key customer segment for Church & Dwight, particularly those prioritizing wellness and effective personal care. This group actively seeks out products that contribute to their overall health, from oral hygiene solutions like Waterpik to specialized hygiene items. They are drawn to brands that demonstrate efficacy and innovation, trusting established names for their personal well-being.

Value-oriented shoppers are a cornerstone for Church & Dwight, drawn to the brand's strong emphasis on affordability and getting the most for their money. These consumers actively seek out products that offer cost-effectiveness, often opting for larger package sizes or actively hunting for sales and discounts.

For instance, Church & Dwight's Arm & Hammer baking soda, a staple in many households, is frequently purchased in bulk by these shoppers due to its low unit price and versatile uses. This segment is particularly responsive to promotions and loyalty programs that further enhance the perceived value of their purchases.

In 2023, Church & Dwight reported net sales of $5.2 billion, with a significant portion attributed to its broad portfolio of accessible and competitively priced household essentials, appealing directly to this value-conscious demographic.

Specific Demographic Groups (e.g., young adults, parents)

Church & Dwight effectively targets specific demographic groups through its diverse brand portfolio. For instance, brands like Arm & Hammer's personal care line, including toothpaste and deodorant, are often positioned to appeal to younger adults seeking effective and value-driven hygiene solutions. In 2024, the personal care market segment, which includes these items, continued to show robust growth, with consumers increasingly prioritizing health and wellness.

Furthermore, the company's strategy acknowledges the distinct needs of parents, particularly concerning baby care. While Church & Dwight may not have a dedicated baby food brand, its broader household cleaning and personal care products are utilized by families. Marketing campaigns for relevant products often highlight safety, efficacy, and convenience, resonating with parents' priorities. For example, the Arm & Hammer brand's association with baking soda as a natural deodorizer and cleaner can be leveraged in messaging to parents concerned about chemical exposure in their homes.

- Young Adults: Targeted for personal care items like toothpaste and deodorant, emphasizing value and effectiveness.

- Parents: While not solely focused on baby products, marketing for household and personal care items highlights safety and convenience for families.

- Market Trends: The personal care sector, relevant to young adult targeting, experienced continued growth in 2024, driven by health and wellness focus.

International Consumers

Church & Dwight's international consumer base is incredibly varied, reflecting diverse cultural preferences and purchasing habits across numerous global markets. The company actively tailors its product lines and marketing approaches to meet the unique demands and navigate the specific regulatory landscapes of these distinct international segments.

For instance, in 2024, Church & Dwight continued to expand its presence in key emerging markets, recognizing the growing disposable income and evolving consumer needs. Their strategy often involves adapting packaging sizes and formulations to align with local affordability and usage patterns. This global reach is crucial, as international sales represented a significant portion of their overall revenue in recent years, demonstrating the importance of these diverse consumer groups.

- Market Adaptation: Products are modified to suit local tastes and economic conditions, such as offering smaller pack sizes in developing economies.

- Regulatory Compliance: Ensuring all products meet the specific health, safety, and labeling regulations of each country is paramount.

- Brand Localization: Marketing campaigns and messaging are localized to resonate with the cultural nuances and values of international consumers.

- Growth Focus: Strategic investments are made in regions showing high growth potential for household and personal care products.

Beyond everyday households, Church & Dwight caters to specific demographics like health-conscious individuals seeking effective personal care and value-driven shoppers prioritizing affordability. The company also targets younger adults with its personal care lines and families with household essentials, adapting messaging for safety and convenience. Their international presence is broad, with strategies tailored to diverse cultural preferences and market conditions, including offering varied pack sizes in developing economies.

| Customer Segment | Key Characteristics | Examples of Product Appeal |

| Everyday Households | Seeking dependable, budget-friendly solutions for daily cleaning, laundry, and personal care. Prioritize functionality and value. | Arm & Hammer Baking Soda, laundry detergents |

| Health-Conscious Individuals | Prioritize wellness and effective personal care. Seek products contributing to overall health. | Waterpik, specialized hygiene items |

| Value-Oriented Shoppers | Actively seek cost-effectiveness, larger package sizes, and discounts. Responsive to promotions. | Bulk Arm & Hammer Baking Soda, competitively priced cleaning supplies |

| Young Adults | Targeted for personal care items, emphasizing value and effectiveness. | Arm & Hammer toothpaste and deodorant |

| Parents | Prioritize safety, efficacy, and convenience for family use. | Household cleaning products, Arm & Hammer's natural deodorizing properties |

| International Consumers | Diverse preferences and purchasing habits across global markets. | Products adapted for local tastes, affordability, and regulatory requirements. |

Cost Structure

The Cost of Goods Sold (COGS) is the largest piece of Church & Dwight's cost structure. This includes everything directly tied to making their many consumer goods, like the ingredients for Arm & Hammer baking soda or the materials for Trojan condoms, as well as the people who make them and the costs of running the factories.

For 2023, Church & Dwight's COGS was approximately $3.3 billion. Keeping this cost in check is super important for making sure they stay profitable across all their different product lines, from laundry detergent to personal care items.

Church & Dwight dedicates significant resources to marketing and advertising, a crucial element for sustaining its robust brand recognition and stimulating consumer demand. These expenditures are vital for reinforcing its established brands and successfully introducing new products to the market.

In 2023, Church & Dwight reported advertising and promotion expenses of $569 million. This substantial investment underscores the company's commitment to maintaining a strong presence and driving sales across its diverse product portfolio.

Church & Dwight dedicates significant resources to Research and Development (R&D) to fuel product innovation and maintain its competitive edge. These expenses cover the intricate work of developing new product formulations, conducting scientific research, and enhancing existing offerings to meet evolving consumer demands.

In 2023, Church & Dwight reported R&D expenses of $145.3 million. This investment is crucial for the company’s strategy of introducing new products and improving the performance and appeal of its established brands, ensuring they remain relevant in a dynamic market.

Selling, General, and Administrative (SG&A) Expenses

Selling, General, and Administrative (SG&A) expenses for Church & Dwight encompass costs not directly linked to manufacturing their diverse product portfolio, such as salaries for their sales teams, the expenses of running corporate offices, legal counsel, and executive leadership. Effective management of these operating costs is crucial for enhancing the company's overall operational leverage and boosting profitability.

In 2023, Church & Dwight reported SG&A expenses of $1.17 billion. This figure represents a significant portion of their overall operating costs, highlighting the importance of optimizing these expenditures to maintain a competitive edge.

- Sales Force Compensation: Salaries, commissions, and benefits for employees driving product sales across various retail channels.

- Administrative Overhead: Costs associated with corporate functions like finance, human resources, IT, and executive management.

- Marketing and Advertising: While some marketing can be directly tied to product launches, general brand building and promotional activities fall under SG&A.

- Legal and Professional Fees: Expenses incurred for legal services, accounting, and other professional consulting.

Acquisition and Integration Costs

Church & Dwight incurs significant acquisition and integration costs as part of its growth strategy. These expenses encompass thorough due diligence, legal and advisory fees during the acquisition phase, and substantial operational costs to meld new brands and businesses into their established framework. For instance, in 2023, the company completed the acquisition of Thinx for $245 million, a move that would have involved considerable upfront costs for integration and brand alignment. These are viewed as strategic investments to expand their consumer product portfolio and market reach.

These costs are crucial for Church & Dwight's expansion. They include:

- Due Diligence: Expenses related to investigating the financial health, legal standing, and operational viability of potential acquisition targets.

- Legal and Advisory Fees: Costs associated with lawyers, investment bankers, and consultants involved in negotiating and structuring deals.

- Integration Expenses: Costs for merging IT systems, supply chains, marketing efforts, and personnel to ensure smooth operational transitions.

Church & Dwight's cost structure is dominated by Cost of Goods Sold (COGS), which was approximately $3.3 billion in 2023, reflecting the direct costs of manufacturing their wide array of consumer products. Significant investments are also made in Sales, General, and Administrative (SG&A) expenses, totaling $1.17 billion in 2023, covering operational overhead and sales force compensation. Furthermore, the company allocated $569 million to advertising and promotion in 2023, underscoring its commitment to brand building and market presence.

Research and Development (R&D) is another key cost area, with $145.3 million spent in 2023 to drive product innovation. Strategic acquisitions, such as the $245 million purchase of Thinx in 2023, also contribute to their cost structure through integration and due diligence expenses. These varied costs are essential for maintaining market leadership and expanding their product portfolio.

| Cost Category | 2023 Expense (Billions USD) | Significance |

|---|---|---|

| Cost of Goods Sold (COGS) | $3.3 | Direct manufacturing costs, crucial for profitability. |

| Sales, General & Administrative (SG&A) | $1.17 | Operational overhead, sales, and corporate functions. |

| Advertising & Promotion | $0.569 | Brand building and demand generation. |

| Research & Development (R&D) | $0.1453 | Product innovation and competitive edge. |

| Acquisition Costs (e.g., Thinx) | $0.245 (Acquisition Cost) | Strategic expansion and portfolio growth. |

Revenue Streams

Church & Dwight generates substantial revenue from selling household cleaning and laundry products. This includes well-known brands such as Arm & Hammer, recognized for its baking soda-based cleaning solutions, and OxiClean, a leader in stain removal. These products cater to everyday consumer needs, ensuring consistent demand.

In 2023, the Consumer Domestic segment, which heavily features household products, was a key driver of the company's performance. This segment's net sales reached approximately $3.5 billion, underscoring the importance of these staple goods to Church & Dwight's overall financial health.

Church & Dwight generates significant income from its personal care product sales, encompassing well-known brands in oral care like Waterpik, depilatories such as Nair, and the Trojan condom line. This segment directly addresses consumer needs for hygiene and personal wellness, forming a substantial portion of the company's revenue. For instance, in 2023, the Arm & Hammer brand, which includes personal care items, saw strong performance, contributing to the company's overall growth trajectory.

Church & Dwight generates revenue through the sale of specialty products, which encompass categories like animal care and specialized professional lines. These offerings, while perhaps not as high in volume as their core consumer goods, serve distinct niche markets, adding valuable diversity to the company's overall income.

International Market Sales

Church & Dwight's international market sales represent revenue generated from distributing and selling its diverse product portfolio, including brands like ARM & HAMMER and Trojan, in countries beyond its primary domestic operations in the United States and Canada. This global reach is a crucial component of their business strategy, tapping into new customer bases and driving overall company growth. For instance, in 2023, international net sales contributed a notable portion to the company's overall financial performance, demonstrating the increasing importance of these markets.

Expanding their global presence allows Church & Dwight to diversify its revenue streams, mitigating risks associated with over-reliance on a single market. This diversification is key to building a more resilient and sustainable business model. The company actively seeks to grow its footprint in key international regions, aiming to replicate its domestic success by adapting its product offerings to local consumer preferences and regulatory environments. This strategic international expansion is a significant driver for future revenue growth and market share expansion.

Key aspects of Church & Dwight's international market sales:

- Global Product Distribution: Sales of established brands like ARM & HAMMER, Trojan, and Orajel in various international territories.

- Revenue Diversification: Reducing dependence on the domestic market by tapping into the growth potential of global consumer demand.

- Market Expansion Strategy: Actively pursuing opportunities to enter and grow market share in emerging and developed international economies.

- Adaptation to Local Markets: Tailoring product offerings and marketing strategies to meet the specific needs and preferences of international consumers.

New Product Introductions and Brand Extensions

Church & Dwight's revenue streams are significantly boosted by new product introductions and brand extensions. This strategy leverages their strong brand recognition, like Arm & Hammer, to enter new categories or offer enhanced versions of existing products. For instance, the company has seen success with innovations in its personal care and pet care segments.

In 2023, Church & Dwight reported net sales of $5.7 billion, with a notable portion attributed to their innovation pipeline and the successful expansion of their brand portfolio. This approach allows them to capture new market segments and maintain relevance with evolving consumer demands.

- Innovation Pipeline: Revenue growth is directly tied to the successful launch and market penetration of new products, such as those in the baking soda-based cleaning and personal care categories.

- Brand Extension Success: Extending established brands like Arm & Hammer into new product lines, including laundry additives and oral care, drives incremental sales and market share.

- Market Share Capture: These introductions and extensions are designed to attract new customers and increase purchase frequency among existing ones, directly contributing to top-line growth.

- Portfolio Diversification: The strategy helps diversify revenue sources, reducing reliance on any single product and strengthening the overall business model.

Church & Dwight's revenue streams are primarily driven by its robust portfolio of household cleaning and personal care products. These categories include iconic brands like Arm & Hammer, OxiClean, Trojan, and Waterpik, which consistently meet consumer demand for everyday essentials and wellness. The company also generates income from specialty products catering to niche markets such as animal care.

In 2023, Church & Dwight reported net sales of $5.7 billion, with its Consumer Domestic segment, heavily featuring household and personal care items, being a significant contributor. This segment's performance highlights the strength of its core offerings in the U.S. and Canadian markets.

International sales also play a crucial role in diversifying Church & Dwight's revenue. By expanding its global presence and distributing brands like Arm & Hammer and Trojan in various territories, the company taps into new customer bases and mitigates reliance on its domestic market. This global reach is a key strategy for sustained growth.

Furthermore, new product introductions and brand extensions are vital revenue drivers. Leveraging strong brand equity, Church & Dwight successfully expands into new categories and enhances existing products, as seen with innovations in personal care and pet care, contributing to overall top-line growth.

| Revenue Stream | Key Brands | 2023 Contribution (Approximate) |

| Household Cleaning & Laundry | Arm & Hammer, OxiClean | Significant portion of $5.7 billion net sales |

| Personal Care | Trojan, Waterpik, Nair, Orajel | Significant portion of $5.7 billion net sales |

| Specialty Products | Animal Care, Professional Lines | Niche market contribution |

| International Sales | Arm & Hammer, Trojan (Global) | Growing contributor to overall revenue |

| New Products & Brand Extensions | Various, including personal and pet care | Drives incremental sales and market share |

Business Model Canvas Data Sources

The Church & Dwight Business Model Canvas is informed by a blend of internal financial disclosures, comprehensive market research reports, and analysis of consumer behavior data. These diverse sources provide a robust foundation for understanding customer segments, value propositions, and revenue streams.