Church & Dwight Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Church & Dwight Bundle

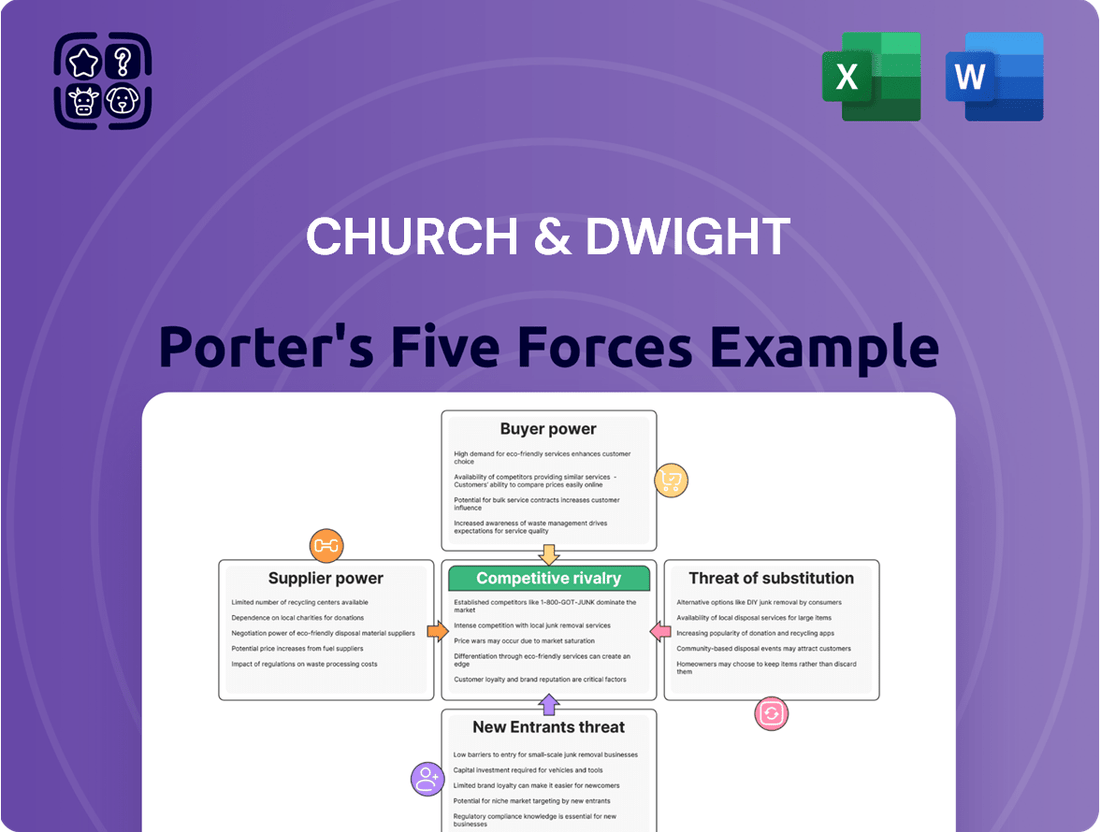

Church & Dwight, a staple in many households, navigates a competitive landscape shaped by several powerful forces. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats of new entrants and substitutes is crucial for their continued success. This brief snapshot only scratches the surface.

Unlock the full Porter's Five Forces Analysis to explore Church & Dwight’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The concentration of raw material suppliers significantly impacts Church & Dwight's operational costs and profitability. For instance, if the specialized ingredients crucial for its Arm & Hammer baking soda products or its personal care items are sourced from a limited number of global producers, these suppliers gain considerable leverage. This concentration can lead to price increases or less favorable payment terms, directly affecting Church & Dwight's margins.

In 2024, the global supply chain for many chemical and plastic components, essential for packaging and product formulation, remained subject to fluctuations. Reports indicated that certain key chemical inputs saw price increases of up to 15% year-over-year due to geopolitical factors and increased demand from other industries. This highlights the importance of Church & Dwight's strategy to maintain strong relationships with multiple suppliers and actively explore alternative material sourcing to counter such pressures.

Church & Dwight's bargaining power of suppliers is influenced by the costs associated with switching. If it's expensive or disruptive to change suppliers, current suppliers gain more leverage. For instance, developing new formulations or re-validating ingredients for consumer products can be time-consuming and costly, making a switch less appealing.

The uniqueness of supplier inputs significantly impacts Church & Dwight's bargaining power. When suppliers offer highly specialized, proprietary, or patented ingredients essential for Church & Dwight's distinctive product formulations, especially in areas like personal care or niche specialty items, their leverage increases. This is because if these critical components cannot be readily replicated or sourced from alternative providers, Church & Dwight's reliance on that specific supplier grows, potentially leading to less favorable terms.

Threat of Forward Integration by Suppliers

The potential for suppliers to move into manufacturing or distribution themselves, known as forward integration, can significantly boost their negotiating power. This would mean they are not just providing raw materials but also competing directly with Church & Dwight. While not a frequent occurrence for bulk commodity suppliers in the consumer goods industry, this remains a theoretical risk that could diminish Church & Dwight's leverage.

This threat is particularly relevant when considering suppliers of specialized components or unique formulations. For instance, if a supplier of a key active ingredient for a popular Church & Dwight product were to develop their own finished goods line, they could disrupt Church & Dwight's market position. This strategic maneuver would directly challenge Church & Dwight's established distribution channels and brand recognition.

- Supplier Forward Integration Risk: The possibility of suppliers entering Church & Dwight's core business of consumer product manufacturing and distribution.

- Impact on Bargaining Power: Forward integration by suppliers would directly increase their leverage over Church & Dwight by introducing competition.

- Industry Relevance: While less common for raw material providers in FMCG, this threat is monitored for suppliers of specialized components or proprietary ingredients.

Importance of Church & Dwight to Suppliers

The relative importance of Church & Dwight's business to a supplier's overall revenue stream significantly influences the supplier's willingness to negotiate. If Church & Dwight accounts for a substantial percentage of a supplier's sales, that supplier is likely to offer more favorable terms to secure and maintain this crucial business relationship.

Conversely, for large, diversified suppliers, Church & Dwight might represent only a small fraction of their total client base. In such scenarios, Church & Dwight's individual leverage with the supplier could be diminished, as the supplier has numerous other revenue streams to rely on.

- Supplier Dependence: Church & Dwight's purchasing volume directly impacts a supplier's revenue. For example, if a key ingredient supplier derives over 15% of its annual revenue from Church & Dwight, it has less bargaining power.

- Market Share Impact: For specialized suppliers where Church & Dwight is a major customer, the loss of this business could significantly affect the supplier's market share and profitability.

- Diversification of Suppliers: Church & Dwight's strategy to diversify its supplier base for critical raw materials, such as baking soda or hydrogen peroxide, mitigates the bargaining power of any single supplier.

The bargaining power of suppliers for Church & Dwight is moderate. While some key ingredients are specialized, limiting supplier options, the company's scale and commitment to long-term relationships help mitigate excessive price hikes. For instance, in 2024, Church & Dwight continued to secure stable pricing for its core sodium bicarbonate needs, a testament to its supplier management, even amidst general supply chain cost pressures. The potential for forward integration by suppliers of unique components remains a theoretical risk, but the cost and complexity for these suppliers to enter Church & Dwight's established consumer product markets are significant deterrents.

| Factor | Impact on Church & Dwight | 2024 Context/Data |

|---|---|---|

| Supplier Concentration | Moderate to High for specialized inputs | Key chemical inputs saw up to 15% price increases year-over-year in 2024 for some industries. |

| Switching Costs | Significant for proprietary formulations | Re-validation of ingredients for consumer products is time-consuming and costly. |

| Supplier Forward Integration Risk | Low but present for specialized components | Theoretical risk; high barriers to entry for suppliers in consumer product manufacturing. |

| Supplier Dependence on Church & Dwight | Varies; can be high for niche suppliers | If Church & Dwight represents >15% of a supplier's revenue, their bargaining power is reduced. |

What is included in the product

Tailored exclusively for Church & Dwight, analyzing its position within its competitive landscape by examining the intensity of rivalry, threat of new entrants, bargaining power of buyers and suppliers, and the threat of substitutes.

Eliminate the guesswork in competitive analysis by providing a structured framework to identify and address key industry pressures.

Gain clarity on the strategic levers available to mitigate threats and capitalize on opportunities within the consumer goods landscape.

Customers Bargaining Power

Church & Dwight's customer base is dominated by large, consolidated retail chains. These include major supermarkets, drugstores, mass merchandisers, and prominent e-commerce platforms. These key customers buy products in massive quantities, making them crucial sales channels for the company.

The sheer volume purchased by these retail giants grants them substantial bargaining power. In 2024, major retailers like Walmart, Kroger, and Amazon continued to exert significant influence over their suppliers. This concentration allows them to negotiate for more favorable pricing, demand promotional support, and secure extended payment terms, directly impacting Church & Dwight's profitability.

Customers in the household and personal care sectors, especially for frequently purchased items, tend to be very sensitive to price changes. This means retailers face pressure to offer competitive prices, which they then pass on to manufacturers like Church & Dwight.

For instance, in 2024, the average consumer spent a significant portion of their disposable income on essential household goods, making price a primary driver for many purchasing decisions. This high price sensitivity directly impacts Church & Dwight's need to maintain competitive pricing strategies to secure shelf space and consumer attention.

While price sensitivity is a significant factor, Church & Dwight's strong brand loyalty, built through decades of trusted products like Arm & Hammer and Trojan, helps to cushion the impact of price fluctuations for a segment of its customer base.

Retailers can easily stock numerous competing brands from other major consumer packaged goods (CPG) companies, alongside their own private label products. This extensive choice across many product segments significantly bolsters their negotiating position with Church & Dwight.

The wide availability of alternatives allows retailers to demand more favorable terms, threatening to reduce shelf space or order volume for Church & Dwight products if their demands aren't met. This leverage directly increases customer bargaining power.

Low Switching Costs for Retailers

For retailers, the costs associated with switching between consumer packaged goods (CPG) brands are minimal. These typically involve straightforward adjustments to inventory systems and how products are displayed on shelves.

This low barrier to substitution grants retailers considerable bargaining power. They can readily swap out brands that aren't performing well or aren't as profitable for alternatives that promise better margins or greater consumer demand.

- Low Switching Costs: Retailers face minimal operational and financial hurdles when changing CPG suppliers.

- Inventory and Shelf Adjustments: The primary changes involve updating inventory management and reallocating shelf space.

- Retailer Leverage: This ease of substitution empowers retailers to negotiate favorable terms or switch to more profitable brands.

Retailers' Ability to Private Label

Large retailers, like Walmart and Target, are increasingly developing their own private label brands. This capability allows them to directly compete with established manufacturers such as Church & Dwight.

For instance, Walmart's Great Value brand offers a wide range of products, and its success puts pressure on national brands to remain competitive on price and quality. This gives retailers significant leverage when negotiating terms with suppliers.

- Retailers' Private Label Investment: Many large retailers are significantly increasing their investment in private label development, aiming to capture a larger share of the market.

- Competitive Threat: The existence of strong private label alternatives provides retailers with a credible threat to switch shelf space or reduce orders for manufacturer brands if terms are not favorable.

- Negotiation Leverage: This ability to offer comparable products under their own brand name empowers retailers to negotiate better pricing, promotional support, and payment terms from companies like Church & Dwight.

- Market Share Impact: In 2023, private label products accounted for approximately 20% of CPG sales in the US, a figure that has been steadily growing, demonstrating their increasing influence.

Church & Dwight faces significant bargaining power from its large retail customers due to their substantial purchasing volumes and the ease with which they can switch brands. Retailers leverage this power to negotiate lower prices, demand promotional assistance, and secure favorable payment terms, directly impacting Church & Dwight's profit margins.

The growing trend of retailers developing their own private label brands further amplifies their bargaining power. In 2023, private label products captured around 20% of US CPG sales, a figure expected to rise, giving retailers a powerful alternative to national brands and increasing their leverage in negotiations.

| Factor | Impact on Church & Dwight | 2024 Trend/Data Point |

|---|---|---|

| Customer Concentration | High dependence on a few large retailers | Major retailers like Walmart, Kroger, Amazon remain dominant sales channels. |

| Purchasing Volume | Grants significant negotiating leverage | Retailers' bulk orders allow for demands on pricing and promotions. |

| Price Sensitivity | Pressure to maintain competitive pricing | Consumers' focus on essential goods in 2024 means retailers pass price pressures upstream. |

| Availability of Alternatives | Retailers can easily substitute brands | Wide range of competing CPGs and private labels available. |

| Low Switching Costs for Retailers | Ease of changing suppliers | Minimal operational changes required for retailers to switch CPG brands. |

| Private Label Growth | Direct competition from retailers | Private labels accounted for ~20% of US CPG sales in 2023, increasing retailer leverage. |

Preview the Actual Deliverable

Church & Dwight Porter's Five Forces Analysis

This preview showcases the comprehensive Church & Dwight Porter's Five Forces analysis, offering a detailed examination of the competitive landscape. The document you see here is the exact, professionally formatted report you will receive immediately after completing your purchase, ensuring no discrepancies or missing information. You can trust that the insights and data presented are complete and ready for your immediate use and strategic planning.

Rivalry Among Competitors

Church & Dwight navigates a consumer product landscape teeming with formidable rivals. Giants like Procter & Gamble, Unilever, and Colgate-Palmolive boast extensive global reach and diverse product portfolios, creating a highly competitive environment. This broad spectrum of competitors means Church & Dwight faces distinct, well-entrenched adversaries in each of its operating segments, from household cleaning to personal care.

The sheer number and diversity of these competitors compel aggressive strategies for market share and consumer loyalty. For instance, in the laundry detergent market, Church & Dwight's Arm & Hammer brand competes directly with Procter & Gamble's Tide and Unilever's Persil, both global powerhouses with substantial marketing budgets. Similarly, in the oral care segment, its Arm & Hammer toothpaste faces off against Colgate-Palmolive's flagship brand and Procter & Gamble's Crest, brands that consistently invest heavily in innovation and advertising.

The household and personal care sectors, where Church & Dwight operates, are generally mature. This means growth is slower compared to newer industries. For instance, the global household cleaning products market was projected to grow at a compound annual growth rate (CAGR) of around 4.5% between 2023 and 2028. In mature markets, companies often gain customers by winning them from competitors rather than from overall market expansion.

This slower growth environment naturally fuels intense competition. When the pie isn't getting much bigger, companies fight harder for their existing slices. This often translates into more aggressive pricing, increased advertising, and frequent promotional offers to entice consumers. For Church & Dwight, this means constant pressure to innovate and differentiate its brands like Arm & Hammer and OxiClean.

The consumer packaged goods industry, including companies like Church & Dwight, requires substantial initial investment in manufacturing plants, R&D, and distribution networks. For instance, in 2024, major CPG players continued to invest billions in upgrading and expanding their production capabilities to meet growing demand and maintain efficiency.

These significant fixed costs mean companies must operate at high volumes to spread their expenses, intensifying price and promotional competition. This often leads to a relentless focus on market share, as underutilization of capacity becomes very costly.

Furthermore, high exit barriers, such as the specialized nature of manufacturing equipment and the deep-rooted brand loyalty built over years, make it difficult for companies to leave the market. This can trap capital and resources, forcing even struggling firms to remain competitive, thus perpetuating rivalry.

Product Differentiation and Brand Loyalty

Church & Dwight, like many consumer packaged goods companies, faces a competitive landscape where product differentiation can be a challenge, often leading to price-sensitive consumers. For instance, in the laundry detergent market, while brands like Arm & Hammer offer unique selling propositions, the core functionality is similar across many competitors. This necessitates a strategic focus on building and maintaining strong brand loyalty to counter direct price wars.

To combat this, Church & Dwight invests heavily in innovation and marketing. Their strategy involves continuous product development and robust advertising campaigns designed to resonate with consumers and foster a connection beyond just price. This approach is vital for carving out market share and ensuring repeat purchases in a crowded marketplace.

- Brand Recognition: Church & Dwight benefits from established brands like Arm & Hammer, which have high consumer awareness.

- Price Sensitivity: Many CPG products, including those in Church & Dwight's portfolio, can be subject to price-based competition due to perceived low differentiation.

- Innovation and Marketing: Companies like Church & Dwight invest in R&D and advertising to create perceived differences and build loyalty.

- Market Share Defense: Strong brand loyalty is a key defense against direct price rivalry, encouraging repeat purchases.

Advertising and Marketing Intensity

The consumer goods sector, where Church & Dwight operates, is characterized by intense advertising and marketing efforts. Companies must constantly spend heavily on promotions and campaigns to stand out and keep consumers engaged. For instance, in 2023, the U.S. advertising market reached an estimated $300 billion, with a significant portion dedicated to consumer packaged goods.

Church & Dwight faces rivals with substantial marketing budgets, necessitating continuous and significant investment to maintain and expand its market share. This high level of marketing intensity directly fuels competitive rivalry, increasing the overall cost of doing business for all players in the industry.

- High Marketing Spend: Consumer goods companies often allocate 10-20% of their revenue to marketing and advertising.

- Brand Loyalty: Effective marketing builds brand loyalty, a critical factor in a crowded marketplace.

- Competitive Pressure: Rivals’ aggressive campaigns force continuous spending to avoid losing market position.

Church & Dwight operates in a highly competitive consumer packaged goods market, facing giants like Procter & Gamble and Unilever. These established players possess vast global reach and diverse product portfolios, creating a challenging environment where market share is hard-won. The intensity of this rivalry is amplified by the mature nature of many CPG sectors, where growth is often achieved by taking share from competitors rather than expanding the overall market.

In 2024, the consumer staples sector continued to see significant marketing investments, with major companies allocating substantial budgets to advertising and promotions. For instance, total U.S. advertising spending was projected to exceed $330 billion in 2024, a considerable portion of which supports CPG brands. This high marketing spend creates a constant pressure for Church & Dwight to innovate and differentiate its offerings, such as Arm & Hammer and OxiClean, to maintain brand visibility and consumer loyalty in a crowded marketplace.

| Key Competitors | Market Presence | Marketing Intensity | Product Differentiation Challenge |

| Procter & Gamble | Global | High | High |

| Unilever | Global | High | High |

| Colgate-Palmolive | Global | High | High |

| Church & Dwight (Arm & Hammer) | North America focused, expanding | High | Moderate to High |

SSubstitutes Threaten

The most significant threat of substitution for Church & Dwight comes from generic and private label products. These alternatives offer similar functionality at substantially lower prices, directly appealing to budget-conscious consumers. For instance, in 2023, private label brands continued to gain market share across various CPG categories, with some reports indicating growth rates exceeding national brands in certain segments.

Retailers' direct access to shoppers allows them to promote their private label offerings effectively, often at the point of sale. This proximity and pricing power can divert sales from established brands like Church & Dwight. The ability to offer lower prices is a key driver, as consumers often perceive little difference in performance between national and private label options for everyday essentials.

Church & Dwight's strategy to combat this threat relies heavily on its strong brand equity and the perceived value it delivers. Investments in marketing and product innovation aim to reinforce brand loyalty and justify premium pricing. The company's focus on creating differentiated products with unique benefits, such as Arm & Hammer's baking soda applications beyond cleaning, helps to build a moat against commoditization.

For certain household cleaning or personal care needs, consumers might choose homemade or do-it-yourself solutions using common household ingredients. This trend, while a niche threat, can slightly decrease demand for specific packaged goods.

For example, a growing interest in natural ingredients has seen a rise in online tutorials for making cleaning products from vinegar and baking soda. While this doesn't significantly impact Church & Dwight's overall sales volume, it represents a consumer shift towards perceived cost-effective and natural alternatives, particularly in segments like laundry detergents or surface cleaners.

Consumers often look for solutions beyond direct product replacements. For instance, specialized cleaning tools like high-powered vacuums or steam cleaners can reduce reliance on chemical cleaning agents for household tasks. In 2024, the market for smart home cleaning devices saw significant growth, indicating a shift towards alternative methods that offer convenience and potentially better results for certain needs.

Changes in Consumer Lifestyle and Habits

Evolving consumer preferences, like a move towards minimalism or greater sustainability, can introduce indirect substitutes for Church & Dwight's offerings. For example, the growing popularity of multi-purpose cleaning solutions might reduce the need for several specialized products, impacting demand for individual items in their portfolio.

A significant trend is the increased consumer consciousness regarding natural and eco-friendly alternatives. This shift can lead consumers away from conventional, chemical-based products, presenting a substitution threat to brands like Arm & Hammer, which historically relied on traditional formulations.

Church & Dwight needs to proactively adapt its product development and marketing to align with these changing consumer lifestyles. This includes innovating with sustainable ingredients and promoting multi-functional benefits to counter the threat of substitutes.

In 2024, the global market for sustainable cleaning products was projected to reach over $12 billion, indicating a substantial shift in consumer spending that Church & Dwight must address to maintain market share.

- Shift to Minimalism: Consumers opting for fewer, more versatile products.

- Sustainability Focus: Growing demand for eco-friendly and natural ingredients.

- Multi-purpose Products: Substitution for single-use or specialized items.

- Brand Adaptation: Church & Dwight's need to innovate and market accordingly.

Low Switching Costs for Consumers

For many of Church & Dwight's core household and personal care products, the effort and expense involved for consumers to switch to a competitor or a generic alternative are quite minimal. This low barrier to entry means customers can readily experiment with new brands or private label options based on factors like price points, special deals, or even appealing new product claims. For instance, in 2024, the average household spent approximately $1,500 annually on cleaning supplies and personal care items, a significant portion of which is discretionary and easily shifted between brands.

This ease of switching effectively gives consumers more power, making them more inclined to explore and adopt substitutes when available. This dynamic puts continuous pressure on Church & Dwight to not only maintain competitive pricing but also to consistently innovate its product offerings and foster strong brand loyalty to retain its customer base.

- Low Financial Switching Costs: Consumers can often purchase a new brand of toothpaste or laundry detergent for under $10, making trial an easy decision.

- Low Psychological Switching Costs: There's little emotional attachment or learning curve required to try a different brand of paper towels or air freshener.

- Impact of Promotions: In 2024, promotional activities, including discounts and coupons, significantly influenced purchasing decisions in the CPG sector, with many consumers reporting they switched brands due to a compelling offer.

- Brand Loyalty Challenges: Church & Dwight must work harder to differentiate its brands, like Arm & Hammer or OxiClean, when substitutes are readily available and attractively priced.

The threat of substitutes for Church & Dwight is significant, primarily driven by private label brands and DIY alternatives. Consumers can easily switch to lower-priced generic options that offer comparable functionality, especially for everyday essentials. For example, in 2024, private label market share continued its upward trend in many CPG categories, often outpacing national brands.

The ease with which consumers can switch brands, due to low financial and psychological switching costs, further amplifies this threat. A simple purchase of a new detergent or toothpaste for under $10 makes trying alternatives a low-risk decision for shoppers.

Church & Dwight counters this by emphasizing brand equity, product innovation, and the unique benefits of its offerings. The company's focus on differentiated products, like Arm & Hammer's multi-purpose applications, aims to build loyalty and justify premium pricing against more commoditized substitutes.

Emerging trends like minimalism and sustainability also present indirect substitution threats, with consumers favoring multi-purpose or eco-friendly products over specialized chemical cleaners. The global market for sustainable cleaning products was projected to exceed $12 billion in 2024, highlighting this significant consumer shift.

| Substitution Threat Factor | Impact on Church & Dwight | Supporting Data (2024 Estimates/Trends) |

|---|---|---|

| Private Label Brands | High | Continued market share gains in CPG, often growing faster than national brands. |

| DIY/Homemade Solutions | Moderate (Niche) | Growth in online tutorials for natural cleaning agents, leveraging common ingredients. |

| Specialized Cleaning Tools | Moderate | Increased market for smart home cleaning devices, reducing reliance on chemical agents. |

| Minimalist/Sustainable Lifestyles | Moderate | Growing demand for multi-purpose and eco-friendly products; sustainable cleaning market projected over $12 billion. |

| Switching Costs (Financial & Psychological) | High | Low cost of trial for CPG items (e.g., <$10); minimal learning curve for new brands. |

Entrants Threaten

Entering the consumer packaged goods (CPG) sector, particularly with a broad product range like Church & Dwight's, necessitates significant upfront capital. This includes funding for state-of-the-art manufacturing plants, developing resilient supply networks, and launching impactful marketing initiatives. For instance, in 2023, the CPG industry saw substantial investments in automation and sustainability, further increasing entry costs.

These high capital demands act as a formidable barrier, effectively discouraging many potential competitors from entering the market. Church & Dwight benefits from its established infrastructure and economies of scale, giving it a distinct competitive edge over newcomers who lack such foundational resources.

Church & Dwight's portfolio, featuring iconic brands such as Arm & Hammer, Trojan, and OxiClean, enjoys decades of deep-seated consumer trust and loyalty. This established brand equity presents a significant hurdle for any new player seeking to enter the market.

New entrants would need to invest heavily in marketing and sales to even begin to replicate the brand recognition and consumer affinity that Church & Dwight has cultivated over many years. For instance, in 2023, the company continued to invest in brand building, with marketing and sales expenses totaling approximately $700 million, underscoring the scale of investment required to challenge established brands.

This formidable barrier means that potential new competitors face not only the challenge of product differentiation but also the immense task of overcoming decades of consumer preference and habit, making market entry exceptionally difficult and costly.

Established distribution channels present a formidable barrier for new entrants aiming to compete with Church & Dwight. Securing prime shelf space in major retailers like supermarkets and mass merchandisers is incredibly difficult, as these spaces are already occupied by established brands with long-standing relationships. In 2023, for instance, the top five CPG companies held a significant share of shelf space in major grocery chains, making it tough for newcomers to gain visibility.

Economies of Scale in Production and Marketing

Church & Dwight, like other major players, leverages substantial economies of scale in production and marketing. This means they can produce more units at a lower cost per unit, a significant advantage. For instance, their massive purchasing power for raw materials like baking soda allows for better pricing than smaller competitors can secure.

This cost efficiency extends to advertising. In 2023, Church & Dwight invested over $1.3 billion in advertising and promotion, enabling them to secure more favorable rates on media buys compared to nascent brands. This makes it incredibly challenging for new entrants to match their per-unit cost advantage or achieve comparable marketing reach and impact, effectively acting as a barrier.

- Lower per-unit production costs due to high-volume manufacturing.

- Enhanced negotiation power with suppliers for raw materials.

- More efficient advertising spend due to larger media buys.

- Difficulty for new entrants to achieve comparable cost structures.

Regulatory Hurdles and Product Safety Standards

The consumer products sector, including companies like Church & Dwight, faces significant regulatory challenges. Strict rules govern everything from product safety and ingredient disclosure to advertising accuracy and environmental impact. For instance, the U.S. Food and Drug Administration (FDA) oversees many of Church & Dwight's products, requiring adherence to Good Manufacturing Practices (GMPs).

Navigating these complex and often evolving regulatory frameworks, both domestically and internationally, is a major hurdle for potential new entrants. Meeting stringent compliance standards for product safety, labeling, and environmental sustainability demands substantial investment in research, development, and quality control. This can significantly increase the cost and time required to bring a new product to market, acting as a substantial barrier.

- FDA regulations for food and drug products add compliance costs.

- International regulations require tailored product formulations and labeling.

- Advertising standards necessitate substantiation of claims, increasing legal and marketing expenses.

- Environmental regulations impact manufacturing processes and packaging choices.

The threat of new entrants for Church & Dwight remains relatively low, primarily due to the substantial capital investment required to establish manufacturing facilities, secure robust supply chains, and execute impactful marketing campaigns. For example, in 2023, the CPG industry continued to see significant investment in advanced manufacturing technologies, pushing entry barriers higher.

Established brands like Church & Dwight, with decades of consumer trust and loyalty, present a significant hurdle. New players must invest heavily in marketing and sales to build comparable brand recognition. In 2023, Church & Dwight's marketing and sales expenses were around $700 million, illustrating the scale of investment needed to challenge established brands.

Access to prime retail shelf space is also a major barrier, as established brands like Church & Dwight have long-standing relationships with major retailers. In 2023, the top CPG companies maintained a dominant share of shelf space, making it difficult for newcomers to gain visibility.

Economies of scale in production and marketing provide Church & Dwight with a significant cost advantage. Their large-scale purchasing power for raw materials and more efficient advertising spend, with over $1.3 billion invested in advertising and promotion in 2023, makes it challenging for new entrants to compete on cost.

Navigating complex regulatory environments, such as FDA requirements for product safety and labeling, adds further costs and time to market entry. Compliance with these regulations, which vary internationally, demands significant investment in research, development, and quality control, acting as a substantial barrier.

| Barrier Type | Description | Impact on New Entrants | Example Data (2023/2024) |

|---|---|---|---|

| Capital Requirements | High costs for manufacturing, supply chain, and marketing. | Discourages new entrants due to significant upfront investment. | CPG industry saw increased automation investments, raising capital needs. |

| Brand Loyalty and Equity | Decades of consumer trust in brands like Arm & Hammer. | Requires substantial marketing spend to achieve comparable recognition. | Church & Dwight's marketing/sales expenses approx. $700 million. |

| Distribution Channels | Securing shelf space in major retailers is difficult. | New entrants struggle for visibility against established brands. | Top 5 CPG companies held significant shelf space in grocery chains. |

| Economies of Scale | Lower per-unit costs in production and advertising. | New entrants cannot easily match cost efficiencies. | Church & Dwight invested >$1.3 billion in advertising and promotion. |

| Regulatory Hurdles | Compliance with safety, labeling, and environmental standards. | Increases cost and time to market for new products. | FDA regulations require adherence to Good Manufacturing Practices. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Church & Dwight is built upon a foundation of comprehensive data, including their annual reports, SEC filings, and investor presentations. We supplement this with industry-specific market research from firms like Mintel and Euromonitor, alongside macroeconomic data from sources such as the Bureau of Labor Statistics.