Church & Dwight Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Church & Dwight Bundle

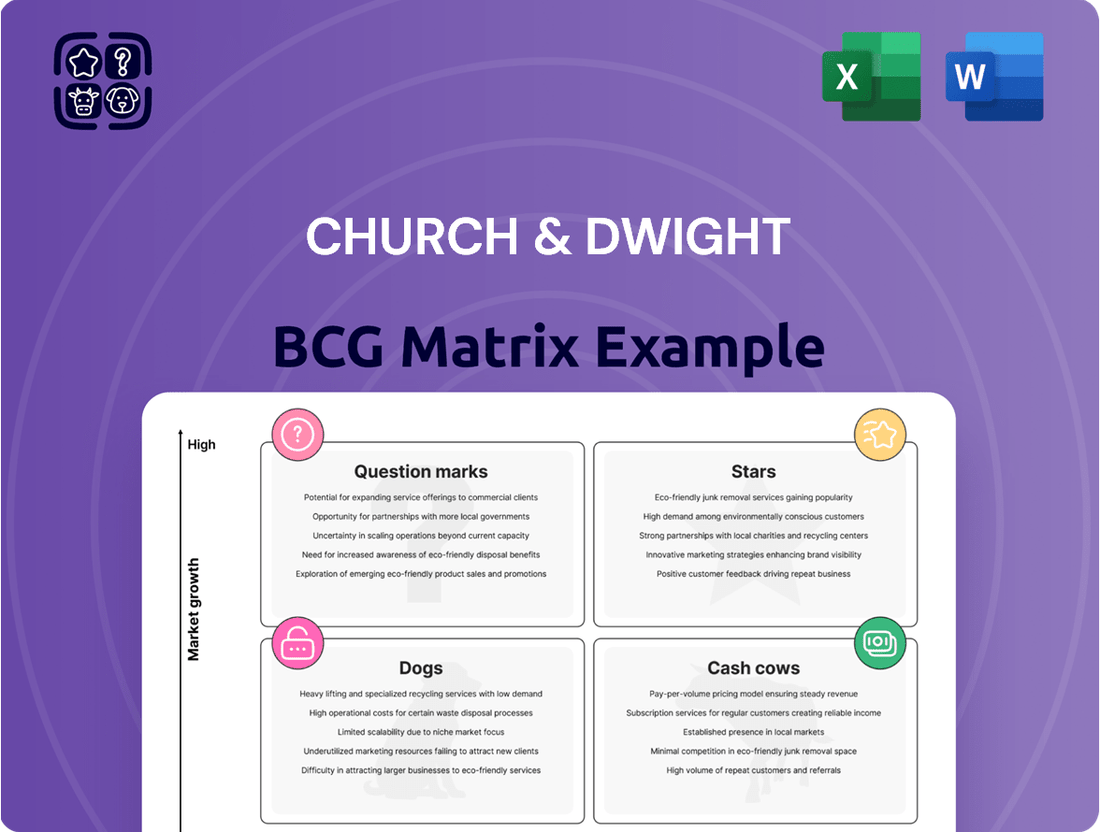

Curious about Church & Dwight's product portfolio performance? Our BCG Matrix analysis reveals which brands are driving growth (Stars), generating consistent revenue (Cash Cows), need careful evaluation (Question Marks), or are underperforming (Dogs). Understanding these positions is crucial for strategic resource allocation.

Ready to move beyond guesswork and make informed decisions about Church & Dwight's brands? Purchase the full BCG Matrix report for a comprehensive breakdown of each product's market share and growth rate, complete with actionable insights to optimize your investment strategy and unlock future success.

Stars

Waterpik is a strong performer for Church & Dwight, likely positioned as a Star in the BCG Matrix. It commands a significant portion, around 40-45%, of the water flosser market in 2024. This segment itself is part of a larger oral care market that's expanding, expected to hit USD 86.8 billion by 2035, growing at a healthy 6.75% annual rate from 2025 to 2035.

The company's focus on innovation, particularly with its expanding cordless Waterpik offerings, is fueling international sales growth. This suggests Waterpik is capitalizing on market opportunities and maintaining a competitive edge.

Batiste Dry Shampoo stands as a prominent Star within Church & Dwight's portfolio, dominating the rapidly expanding dry shampoo sector. The global dry shampoo market is experiencing robust growth, with forecasts indicating a compound annual growth rate (CAGR) between 5.8% and 10.5% from 2025 to 2034, underscoring Batiste's strong market position and the category's high potential.

Church & Dwight's strategic investment in Batiste, including the launch of innovative products like sweat-activated and touch-activated formulations, is designed to maintain its leadership. These advancements ensure Batiste remains relevant and appealing to consumers in a dynamic market, solidifying its status as a key growth driver for the company.

HERO Acne Products have emerged as a star performer for Church & Dwight, significantly boosting sales across both domestic and international consumer segments. This acquisition, a strategic move into a high-growth area, aligns perfectly with the company's focus on fast-moving consumer goods. For instance, Church & Dwight reported strong sales growth in their Specialty Products segment in early 2024, with HERO being a key contributor.

TheraBreath Mouthwash

TheraBreath Mouthwash stands out as a significant asset for Church & Dwight, holding the distinction of being the #1 alcohol-free mouthwash brand. This strong market position fuels its contribution to the company's overall sales growth, both domestically and internationally.

The brand's performance is characterized by consistent growth, demonstrating its robust appeal within the oral care market. In 2024, Church & Dwight reported continued positive momentum for its oral care segment, with TheraBreath playing a pivotal role in this expansion.

TheraBreath’s strategic entry into the antiseptic mouthwash category, marked by new product introductions, signals a proactive approach to capitalize on evolving consumer needs and capture greater market share. This expansion aligns with the broader trend of increased consumer interest in advanced oral hygiene solutions.

- #1 Alcohol-Free Mouthwash Brand: TheraBreath holds a leading position in its category.

- Consistent Sales Growth: The brand contributes positively to Church & Dwight's domestic and international revenue streams.

- Market Expansion: Entry into the antiseptic mouthwash segment aims to capture further market share in a growing sector.

Nair Hair Removal

Nair, a prominent brand in the personal care sector, operates within the burgeoning hair removal market. This market is poised for substantial expansion, with projections indicating a compound annual growth rate (CAGR) between 4.9% and 8.6% from 2025 through 2034.

Within this dynamic landscape, Nair's strong position in the cream segment is noteworthy. The cream segment was a dominant force in the hair removal market throughout 2024, underscoring Nair's strategic alignment with key consumer preferences.

Several factors fuel the demand for hair removal products, benefiting brands like Nair. These include heightened consumer consciousness regarding personal grooming standards and continuous innovation in hair removal technologies. These trends collectively contribute to the sustained growth trajectory of the industry.

- Market Growth: Hair removal market projected CAGR of 4.9% to 8.6% (2025-2034).

- Segment Dominance: Cream segment led the market in 2024, a key area for Nair.

- Driving Factors: Increased personal grooming awareness and technological advancements boost demand.

Church & Dwight's Stars represent brands with high market share in rapidly growing industries, indicating strong current performance and future potential. These brands are often leaders in their respective categories, benefiting from favorable market trends and strategic company investments. Their robust sales figures and market dominance position them as key growth drivers for Church & Dwight.

Waterpik's commanding 40-45% share of the water flosser market in 2024 exemplifies a Star. Batiste Dry Shampoo also shines as a Star, capitalizing on the dry shampoo market's projected 5.8% to 10.5% CAGR (2025-2034). HERO Acne Products, a strategic acquisition, has driven significant sales growth, and TheraBreath's #1 position in alcohol-free mouthwash further solidifies its Star status within the expanding oral care sector.

What is included in the product

This BCG Matrix analysis provides a tailored look at Church & Dwight's portfolio, highlighting which units to invest in, hold, or divest.

The Church & Dwight BCG Matrix provides a clear, one-page overview of its business units, easing the pain of strategic decision-making.

This optimized layout simplifies complex portfolio analysis, offering a distraction-free view for C-level executives.

Cash Cows

Arm & Hammer laundry detergent is a prime example of a cash cow for Church & Dwight. Its consistent performance contributes significantly to the company's domestic sales growth, benefiting from a strong market position in the mature laundry care segment. This brand is a reliable generator of cash, even amidst a cautious outlook for the US consumer, demonstrating its enduring appeal and demand.

Arm & Hammer Baking Soda is a classic Cash Cow for Church & Dwight. As the leading U.S. producer of sodium bicarbonate, it benefits from a mature market with consistent, predictable demand. This foundational product requires little in the way of marketing spend due to its widespread brand recognition and numerous household applications, generating a reliable stream of cash for the company.

Arm & Hammer's Hardball Clumping Litter, a key player in the mature pet care market, exemplifies a Cash Cow within Church & Dwight's portfolio. Its recent national expansion, following successful market tests, highlights its stability and predictable revenue generation.

The product leverages the robust brand recognition of Arm & Hammer, a significant advantage in a segment with limited growth potential. This established presence allows it to consistently capture market share, particularly within the competitive lightweight litter category, reinforcing its role as a reliable income generator.

Trojan Condoms

Trojan Condoms represent a classic cash cow for Church & Dwight. This well-established brand operates in a mature market, ensuring consistent revenue generation. Its strong market presence and brand recognition mean it requires minimal investment to maintain its position, thereby contributing significantly to the company's overall cash flow.

The brand's enduring popularity and extensive distribution network solidify its status. In 2023, the global condom market was valued at approximately $10.5 billion and is projected to grow at a steady CAGR of around 5% through 2030, indicating a stable yet growing demand for products like Trojan. This stability allows Trojan to reliably generate profits that can fund other ventures within Church & Dwight's portfolio.

- Brand Strength: Trojan is a dominant force in the sexual wellness market, benefiting from decades of brand building and consumer trust.

- Market Maturity: The condom market is well-established, meaning growth is steady rather than explosive, ideal for a cash cow that provides consistent returns.

- Profitability: High brand loyalty and efficient operations enable Trojan to generate substantial and predictable profits for Church & Dwight.

- Investment Efficiency: Unlike growth-stage products, Trojan requires less capital for marketing and development, allowing its earnings to be redeployed elsewhere in the company.

Orajel Oral Pain Relief

Orajel, a leading brand in oral pain relief, represents a significant Cash Cow for Church & Dwight. Its established presence in a mature segment of the oral care market translates to a high market share and consistent, reliable demand. This strong position allows Orajel to generate substantial and predictable cash flow for the parent company.

The oral care market continues its upward trajectory, with projections indicating steady growth. Within this, Orajel's specific niche of oral pain relief benefits from consistent consumer need for effective solutions to common discomforts. This stability underpins its Cash Cow status.

- Orajel's market share in the oral pain relief category remains robust, contributing significantly to Church & Dwight's overall revenue.

- The brand's long history and strong consumer recognition foster brand loyalty, ensuring continued sales and cash generation.

- In 2024, Church & Dwight reported that its Consumer Health segment, which includes Orajel, demonstrated strong performance, reflecting the consistent demand for its established brands.

Arm & Hammer’s portfolio includes several established brands that function as cash cows, generating consistent profits with minimal investment. These products benefit from strong brand recognition and operate in mature markets, ensuring a steady revenue stream. This allows Church & Dwight to allocate resources to growth areas.

The company's strategy leverages these reliable income generators to fund innovation and expansion in other segments. For instance, Arm & Hammer’s laundry detergents and baking soda are staples that consistently contribute to the company's financial stability. Similarly, Trojan condoms and Orajel oral pain relief products are well-entrenched in their respective markets.

These cash cows are crucial for maintaining Church & Dwight's financial health, providing the necessary capital for research and development, acquisitions, and marketing efforts for their emerging products. Their predictable performance underpins the company's ability to navigate market fluctuations and pursue strategic growth initiatives.

In 2023, Church & Dwight’s net sales reached $5.19 billion, with a significant portion attributed to its established brands. The Consumer Health segment, which includes Orajel, saw strong performance, underscoring the consistent demand for its mature product lines.

| Product Category | Key Brands | Market Status | Cash Cow Contribution |

| Laundry Care | Arm & Hammer Detergent | Mature | High, consistent revenue |

| Baking Soda | Arm & Hammer Baking Soda | Mature | Stable, low investment |

| Pet Care | Arm & Hammer Clumping Litter | Mature | Reliable income generator |

| Sexual Wellness | Trojan Condoms | Mature | Significant profit contributor |

| Oral Care | Orajel | Mature | Robust market share, predictable cash flow |

What You See Is What You Get

Church & Dwight BCG Matrix

The Church & Dwight BCG Matrix you are previewing is the identical, fully formatted report you will receive immediately after purchase. This comprehensive analysis, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional and ready-to-use document. You can confidently download this exact file to inform your business planning and decision-making processes.

Dogs

Spinbrush toothbrushes have shown a sales decline in the fourth quarter of 2024. This is happening even as the overall oral care market is expanding, suggesting Spinbrush might be losing its footing against newer, more competitive electric toothbrush options.

This performance places Spinbrush in a challenging position within the BCG matrix, likely categorizing it as a Dog. Such products typically need very little capital injection, and if their market performance doesn't pick up, divestiture becomes a strong consideration for the company.

OxiClean Stain Fighters experienced a decline in organic sales during the first quarter of 2025, which unfortunately weighed down the Domestic Division's performance. This trend indicates that the brand is struggling to hold onto its market share or is positioned in a very competitive, possibly mature, market where its current products aren't seeing much growth. For instance, in Q1 2025, OxiClean's domestic organic sales saw a dip of 2.1% compared to the previous year.

Church & Dwight's vitamin business, including brands like Vitafusion, faced significant headwinds in 2024, recording non-cash asset impairment charges. This segment saw declines in both the fourth quarter of 2024 and the first quarter of 2025, suggesting a challenging market position for the company's vitamin offerings.

The underperformance points to a likely low market share within a market that may be experiencing slow growth or is highly fragmented, making it difficult for Church & Dwight to gain traction. These products are essentially cash traps, consuming capital with little to show in terms of returns.

Consequently, the vitamin business is a prime candidate for strategic review, potentially leading to divestiture or a substantial restructuring effort to improve its financial performance or exit the segment altogether.

Megalac™ Dairy Supplement Business

Church & Dwight's decision to shut down its Megalac™ dairy supplement business in the first quarter of 2024 clearly positions it as a 'Dog' within the BCG Matrix. This strategic exit indicates the business unit was underperforming, characterized by low market share and limited growth potential, making it no longer a viable investment.

The discontinuation of Megalac™ aligns with typical strategies for 'Dogs' in the BCG Matrix. These businesses often consume resources without generating significant returns, prompting companies to divest or cease operations to reallocate capital to more promising ventures.

Church & Dwight's action reflects a proactive approach to portfolio management. By eliminating underperforming assets like Megalac™, the company can focus on its core strengths and higher-growth segments, ultimately enhancing overall profitability and shareholder value.

- Megalac™ Dairy Supplement Business: Shut down by Church & Dwight in Q1 2024.

- BCG Matrix Classification: Identified as a 'Dog' due to low market share and low growth prospects.

- Strategic Rationale: Discontinuation is a common strategy for underperforming business units to optimize resource allocation.

- Financial Impact: Exit allows Church & Dwight to focus resources on more profitable and growing segments of its portfolio.

Food Safety Business

Church & Dwight's exit from the food safety business in the second quarter of 2024 firmly places this segment in the Dog category of the BCG Matrix. This strategic divestiture mirrors the earlier decision regarding the Megalac business, signaling a move to shed assets that are not contributing meaningfully to the company's growth or profitability.

Businesses classified as Dogs typically generate low returns, often breaking even or even consuming cash. For Church & Dwight, exiting this segment allows for the reallocation of capital and management focus towards areas with higher growth potential, thereby optimizing the overall portfolio performance.

- Strategic Divestiture: Church & Dwight completed the sale of its food safety business in Q2 2024.

- Underperforming Asset: This segment was classified as a Dog due to its low or negative returns.

- Resource Reallocation: The divestiture frees up capital and management attention for more promising ventures.

- Portfolio Optimization: Removing non-core or underperforming assets is a common strategy to improve overall business health.

The Spinbrush business, experiencing sales declines in late 2024, is a prime example of a Dog in Church & Dwight's portfolio. This indicates a low market share in a competitive electric toothbrush market, necessitating minimal capital investment and potentially leading to divestiture if performance doesn't improve.

Similarly, the vitamin segment, including Vitafusion, faced significant challenges in 2024 with non-cash asset impairment charges and declines in both Q4 2024 and Q1 2025. This points to a low market share in a slow-growth or fragmented market, acting as a cash trap for the company.

Church & Dwight's strategic decisions to shut down the Megalac™ dairy supplement business in Q1 2024 and divest its food safety business in Q2 2024 highlight their classification as Dogs. These actions reflect a proactive approach to shedding underperforming assets with low growth prospects and limited returns.

These 'Dog' segments, like Megalac™ and the food safety business, consume resources without generating significant returns. By exiting these areas, Church & Dwight can reallocate capital and management focus to more promising, higher-growth segments, thereby optimizing its overall portfolio performance.

| Business Segment | BCG Classification | Key Performance Indicators (2024/2025) | Strategic Action |

| Spinbrush | Dog | Sales decline (Q4 2024) | Potential divestiture |

| Vitamins (e.g., Vitafusion) | Dog | Non-cash impairment charges (2024), Sales decline (Q4 2024 & Q1 2025) | Strategic review, potential restructuring/divestiture |

| Megalac™ Dairy Supplement | Dog | Business shut down (Q1 2024) | Divestiture/Cessation of operations |

| Food Safety Business | Dog | Business divested (Q2 2024) | Divestiture |

Question Marks

Arm & Hammer's Deep Clean Laundry line, launched in 2024 into the mid-tier segment, represents a strategic move by Church & Dwight. This new entry, while currently holding a low market share, is positioned within the substantial and dynamic laundry detergent market.

The innovation in cleaning technology is a key differentiator for Deep Clean. With the global laundry detergent market projected to reach over $200 billion by 2028, this product aims to capture a portion of that growth.

Significant promotional and placement efforts are essential for Deep Clean's success. These investments are critical to increasing market adoption and potentially elevating it to a Star product within the BCG matrix, given the market's size and ongoing evolution.

Arm & Hammer Power Sheets Laundry Detergent, launched online in August 2023 and rolling out to physical stores in early 2024, is Church & Dwight's answer to eco-friendly and convenient laundry. This product directly tackles plastic waste with its dissolvable sheets, tapping into a market that saw the sustainable cleaning products segment grow by an estimated 10% in 2023.

Positioned as a potential 'Question Mark' in the BCG Matrix, Power Sheets are in a rapidly expanding market for sustainable and convenient laundry solutions. However, its market share is still nascent, meaning significant investment in marketing and distribution is crucial to gain traction and prevent it from becoming a 'Dog' category.

TheraBreath Deep Clean Oral Rinse entered the antiseptic mouthwash market in 2024, a segment experiencing robust growth. This product targets a substantial 30% share of the overall oral care market, indicating a significant opportunity. Its strategic positioning leverages the increasing consumer demand for effective germ-killing oral hygiene products.

Church & Dwight's TheraBreath Deep Clean Oral Rinse, launched in 2024, is positioned as a potential "Star" in their portfolio. The antiseptic mouthwash segment is a high-growth area within oral care, with projections suggesting continued expansion. TheraBreath's entry aims to capture market share from established competitors through aggressive marketing campaigns, capitalizing on the growing consumer preference for germ-killing oral hygiene solutions, a trend that saw the global mouthwash market valued at approximately $8.1 billion in 2023.

Batiste Sweat Activated and Touch Activated Dry Shampoos

Batiste's new Sweat Activated and Touch Activated dry shampoos, launched in 2024, represent a strategic move into a burgeoning dry shampoo market. While these innovative products leverage advanced technology for extended freshness, their market share is currently minimal as new entrants. Church & Dwight faces the challenge of significant investment in consumer awareness and brand development to elevate these offerings from Question Marks to Stars within the BCG matrix.

The global dry shampoo market was valued at approximately $2.7 billion in 2023 and is projected to grow at a compound annual growth rate of over 7% through 2030. This rapid expansion presents an opportunity for Batiste's new variants. However, as recently introduced products, their specific contribution to this market share is yet to be firmly established, placing them squarely in the Question Mark quadrant.

- Market Entry: Launched in 2024, these products are new to a dynamic and expanding dry shampoo sector.

- Nascent Market Share: As recent innovations, their market penetration and sales figures are still developing.

- Investment Requirement: Significant marketing and educational campaigns are crucial to build consumer adoption and brand recognition.

- Potential for Growth: With successful execution, these technologically advanced products could capture substantial market share and become future Stars.

Zicam Cold Remedy

Zicam, acquired by Church & Dwight, demonstrated accretive growth in Q1 2025, contributing positively to the company's performance. This acquisition signals Church & Dwight's strategic move into the fast-moving consumable product sector, where Zicam is expected to tap into significant growth potential within the broader cold and flu market.

Despite the inherent seasonality of the cold remedy market, Zicam's positioning as a high-growth potential product is notable. Its current market share, when viewed against the entire cold and flu market, suggests it is a Question Mark in the BCG Matrix. This classification indicates that Zicam requires ongoing investment to strengthen its market position and broaden its consumer reach.

- Accretive Acquisition: Zicam contributed positively to Church & Dwight's earnings in Q1 2025.

- Growth Potential: Positioned as a fast-moving consumable, Zicam is expected to drive growth for Church & Dwight.

- Market Standing: Zicam's current market share in the cold and flu sector classifies it as a Question Mark, necessitating further investment.

- Strategic Importance: The acquisition aligns with Church & Dwight's strategy to expand its presence in high-potential consumer product categories.

Question Marks represent products with low market share in high-growth industries. For Church & Dwight, these are often new product launches or acquired brands that require significant investment to gain traction. The company must carefully manage these to avoid them becoming Dogs or to nurture them into Stars.

Arm & Hammer Power Sheets and Batiste's new dry shampoos are prime examples of Question Marks. They operate in expanding markets but have yet to establish a dominant market share, highlighting the need for substantial marketing and distribution support to achieve their growth potential.

Zicam, post-acquisition, also fits the Question Mark profile. While showing accretive growth, its position within the broader cold and flu market necessitates continued investment to solidify its market standing and capture a larger share of this high-potential sector.

The success of these Question Marks hinges on strategic resource allocation, effective marketing campaigns, and product differentiation to capture consumer attention in competitive, growing markets.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data, including Church & Dwight's official financial reports, market research on consumer goods, and industry growth trend analyses to accurately position each business unit.