Church & Dwight Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Church & Dwight Bundle

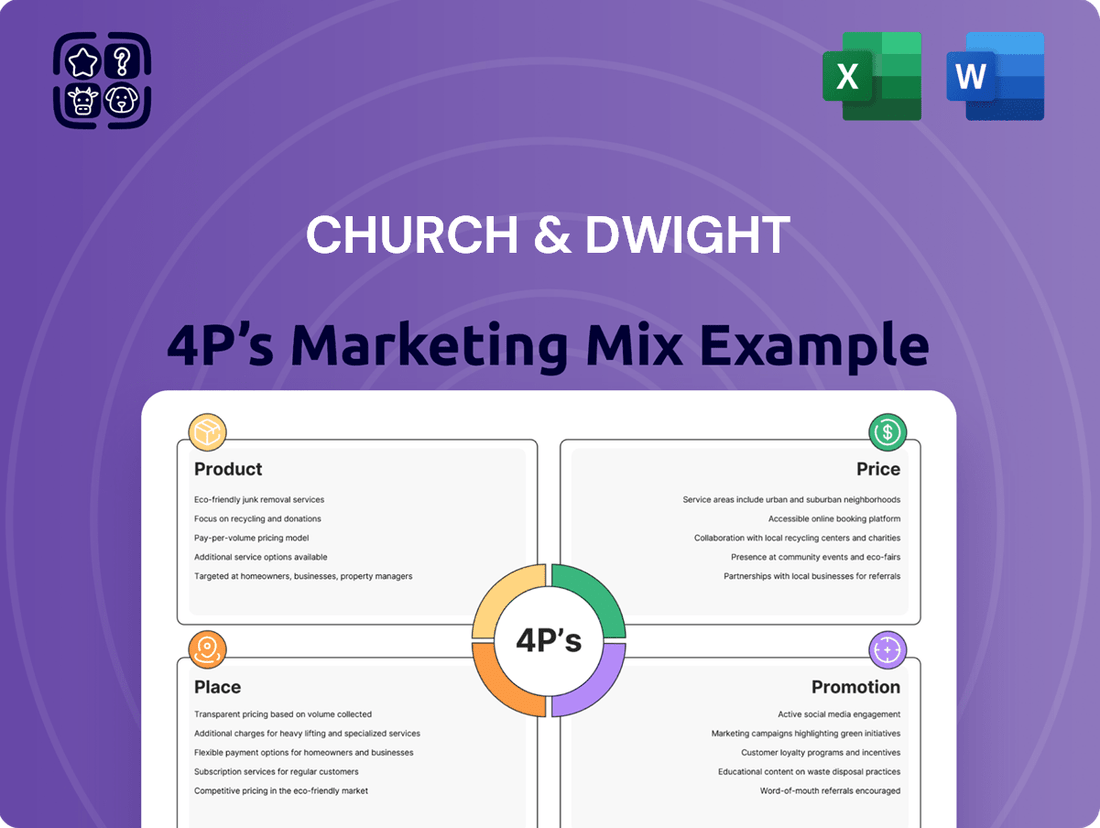

Church & Dwight masterfully leverages its iconic brands like Arm & Hammer through a shrewd 4Ps marketing mix. Their product diversification, from baking soda to laundry detergent and personal care, showcases a commitment to consumer needs. Discover how their pricing strategies and extensive distribution channels contribute to their market dominance.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Church & Dwight's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights into this consumer goods giant.

Product

Church & Dwight boasts a diverse portfolio of household and personal care essentials, anchored by iconic brands. This includes Arm & Hammer, a staple in laundry and cleaning, OxiClean for powerful stain removal, Waterpik for advanced oral hygiene, and Trojan for trusted sexual health solutions. This breadth ensures broad market penetration and caters to a wide array of consumer needs.

Church & Dwight's product strategy heavily emphasizes acquiring and nurturing well-recognized brands. This approach involves a dynamic portfolio management strategy, where underperforming brands are divested to free up resources for acquiring new ones that fit their growth-oriented objectives.

This focus is clearly illustrated by their recent strategic acquisitions. In 2020, Church & Dwight acquired ZICAM, a leading brand in the cold remedy market, and THERABREATH, a rapidly growing oral care brand. More recently, in 2021, they acquired HERO, a brand specializing in children's health products, particularly allergy relief. These moves underscore their commitment to expanding their presence in fast-moving consumer goods within high-growth health and wellness sectors.

Church & Dwight's commitment to continuous innovation is a cornerstone of its growth strategy. The company consistently allocates substantial resources to research and development, focusing on both novel product creation and the improvement of its established brands.

Looking ahead to 2025, new product introductions are projected to be a primary catalyst for a notable uptick in net sales. This forward-looking approach ensures the company remains competitive and responsive to evolving consumer demands in the marketplace.

Notable examples of this innovation include the ongoing national rollout of ARM & HAMMER™ POWER SHEETS™ Laundry Detergent, a product designed for convenience and efficacy. Furthermore, the VITAFUSION brand is seeing advancements, with the introduction of new sugar-free gummy vitamin options, catering to a growing health-conscious consumer base.

Tailoring s for Evolving Consumer Needs

Church & Dwight actively tailors its product offerings to meet the dynamic needs and preferences of its diverse consumer base. This strategic approach ensures their brands not only resonate with target audiences but also effectively address specific consumer pain points. For instance, the company has observed a significant uptick in demand for products supporting localized supply chains and sustainable, eco-friendly attributes, a trend that directly influences product development and marketing efforts.

The company's innovation pipeline is deeply intertwined with market insights. Their dedicated innovation teams work hand-in-hand with marketing and research departments to pinpoint emerging consumer desires and translate these into tangible product solutions. This collaborative process is crucial for maintaining brand relevance and driving market share in a competitive landscape. In 2023, Church & Dwight reported net sales of $5.49 billion, reflecting continued consumer engagement with their product portfolio.

Key aspects of their product strategy include:

- Consumer-Centric Design: Products are engineered to solve problems and align with user expectations, enhancing brand loyalty.

- Sustainability Focus: Responding to growing consumer demand for environmentally responsible products and supply chains.

- Market Responsiveness: Continuous research and development cycles ensure products adapt to evolving consumer needs and preferences.

- Brand Differentiation: Tailoring ensures each product line offers unique value propositions within its respective category.

Strong Brand Recognition and Market Leadership

Church & Dwight's robust brand recognition is a cornerstone of its market leadership. The company actively cultivates and maintains strong positions across numerous consumer product categories.

As of 2024, Church & Dwight boasts an impressive portfolio of 14 'power brands,' with each brand achieving over $100 million in annual sales. This significant brand depth provides a substantial competitive advantage.

- Market Dominance: Strong brand equity allows Church & Dwight to command premium pricing and customer loyalty.

- Portfolio Strength: The presence of 14 power brands, each exceeding $100 million in annual revenue, demonstrates widespread market penetration.

- Diversification Benefits: This diversified brand portfolio mitigates risk by reducing dependence on any single product, ensuring stability.

- Resilience: The company's established brands offer resilience against market fluctuations and competitive pressures.

Church & Dwight's product strategy centers on a portfolio of strong, often acquired brands, with a focus on innovation and consumer needs. As of 2024, they manage 14 power brands, each generating over $100 million annually, showcasing significant market penetration and brand equity.

Recent product developments highlight this, such as the national rollout of ARM & HAMMER™ POWER SHEETS™ Laundry Detergent and new sugar-free options for the VITAFUSION gummy vitamin line. These innovations address convenience and health-conscious consumer trends.

The company actively seeks acquisitions in high-growth sectors, exemplified by the 2020 additions of ZICAM and THERABREATH, and the 2021 acquisition of HERO. This approach ensures their product mix remains relevant and competitive in evolving markets.

Church & Dwight's product development is deeply informed by market insights, ensuring alignment with consumer demands for sustainability and localized supply chains. This commitment to consumer-centric design and market responsiveness fuels brand loyalty and growth.

| Product Strategy Pillar | Description | 2024/2025 Relevance |

|---|---|---|

| Brand Portfolio Strength | Management of 14 power brands exceeding $100M annual sales. | Demonstrates market dominance and diversification. |

| Innovation Focus | R&D investment in new products and improvements. | Projected to drive sales growth, exemplified by ARM & HAMMER™ POWER SHEETS™. |

| Strategic Acquisitions | Acquisition of brands in high-growth health & wellness sectors. | Expansion into areas like cold remedies (ZICAM) and oral care (THERABREATH). |

| Consumer Responsiveness | Tailoring products to meet evolving consumer preferences. | Focus on sustainability and convenience, seen in VITAFUSION's sugar-free options. |

What is included in the product

This analysis provides a comprehensive breakdown of Church & Dwight's marketing strategies, examining their Product innovation, Price positioning, Place distribution, and Promotion tactics.

It offers a deep dive into how Church & Dwight leverages its 4Ps to maintain market leadership and competitive advantage, grounded in real-world brand practices.

This 4P's analysis acts as a pain point reliver by clearly outlining Church & Dwight's strategic product, price, place, and promotion decisions, providing actionable insights for optimizing marketing efforts.

Place

Church & Dwight leverages an extensive retail distribution network, reaching consumers through supermarkets, mass merchandisers, and wholesale clubs. This broad accessibility is crucial for their brands like Arm & Hammer and OxiClean. In 2023, the company reported net sales of $5.1 billion, a testament to the effectiveness of this wide-reaching strategy.

Their distribution also extends to drugstores, convenience stores, and specialty retailers, ensuring product availability across various shopping occasions. This multi-channel approach, catering to diverse consumer needs, underpins their market presence and sales performance.

Church & Dwight is strategically enhancing its e-commerce footprint, understanding that digital channels are crucial for connecting with today's shoppers. This focus is paying off, as global online sales represented 21.4% of total consumer sales in 2024, a clear indicator of their digital-first approach.

This robust online presence enables direct interaction with consumers, fostering loyalty and gathering valuable insights. Furthermore, it significantly broadens the company's market reach, allowing them to access customers beyond the limitations of physical retail locations.

Church & Dwight is making significant strides in international markets, evidenced by robust organic growth within its International Division. This expansion is a key pillar of their strategy, aiming to tap into markets where their brands have yet to reach their full potential. For instance, the successful launch of brands like HERO across multiple countries highlights their capability to penetrate new territories and build global recognition.

The company's approach involves strategic investments in underpenetrated international markets, a move that broadens their customer base and revenue streams. This global diversification is crucial for mitigating risks associated with reliance on a single market. By continuing to introduce and grow their portfolio internationally, Church & Dwight is positioning itself for sustained long-term growth and increased market share on a global scale.

Efficient Supply Chain and Inventory Management

Church & Dwight prioritizes efficient supply chain and inventory management to ensure its diverse product portfolio, including iconic brands like Arm & Hammer, is readily available to consumers. This focus on accessibility is a cornerstone of their marketing strategy, directly impacting customer convenience and brand loyalty.

The company actively employs strategies to optimize its operations. For instance, investments in automation and a lean approach to inventory control help reduce holding costs and minimize stockouts. Nearshoring initiatives are also being explored to bolster operational resilience and potentially improve delivery times, especially in light of global supply chain disruptions experienced in recent years.

These operational efficiencies directly translate to enhanced customer satisfaction and, consequently, improved sales performance. By ensuring products are consistently on shelves and readily accessible, Church & Dwight reinforces its brand promise of reliability and convenience.

- Focus on Availability: Ensures products like Arm & Hammer are consistently available to meet consumer demand.

- Operational Efficiency: Leverages automation and nearshoring to boost operating margins and mitigate risks.

- Customer Convenience: Optimized logistics directly contribute to a seamless shopping experience for customers.

- Sales Optimization: Enhanced supply chain performance supports increased sales and market penetration.

Direct Sales to Industrial Customers and Livestock Producers

Beyond the familiar aisles of consumer retail, Church & Dwight strategically extends its reach to industrial clients and livestock producers. This is primarily achieved through a robust network of specialized distributors, ensuring their specialty products effectively penetrate these distinct markets. This dual approach to place highlights a sophisticated distribution strategy, allowing the company to capture diverse revenue streams and solidify its presence across a broader economic landscape.

For instance, Church & Dwight's Arm & Hammer brand, renowned in households, also plays a crucial role in industrial applications and animal nutrition. In 2024, the company's Animal Nutrition segment, a key area for livestock producers, continued to be a significant contributor, demonstrating the success of this diversified placement strategy. This approach allows them to leverage brand recognition and product efficacy in sectors beyond direct consumer engagement, broadening their market footprint.

- Industrial Distribution: Specialty products are channeled through dedicated distributors to reach industrial sectors.

- Livestock Producer Focus: The Animal Nutrition segment, utilizing products like sodium bicarbonate, serves livestock producers.

- Market Diversification: This placement strategy taps into different revenue streams and market segments.

- Brand Leverage: Extends the utility and recognition of brands like Arm & Hammer into B2B and agricultural markets.

Church & Dwight's 'Place' strategy is multifaceted, encompassing a wide retail presence and a growing e-commerce focus. Their extensive distribution network spans supermarkets, mass merchandisers, and drugstores, ensuring broad consumer access to brands like Arm & Hammer and OxiClean. In 2023, net sales reached $5.1 billion, reflecting the effectiveness of this widespread availability.

Same Document Delivered

Church & Dwight 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis delves into Church & Dwight's Product, Price, Place, and Promotion strategies, offering a complete picture of their marketing approach. You'll gain immediate access to the full, ready-to-use report.

Promotion

Church & Dwight allocates significant resources to advertising and promotion, a key element of its marketing strategy. In 2024, the company's investment in these areas reached $480 million, underscoring its commitment to brand visibility and consumer engagement.

Looking ahead to 2025, marketing expenses are projected to represent over 11% of sales. This substantial spend is strategically concentrated in the first half of the year to effectively support new product launches and ongoing innovation.

Church & Dwight effectively leverages multi-brand and integrated marketing campaigns to reinforce its product portfolio. For instance, the Arm & Hammer brand's 'The Whole Darn Arm' campaign underscores its established reliability and consumer value across diverse media channels.

These integrated efforts span traditional broadcast and streaming television, alongside popular social media platforms like Instagram, TikTok, and YouTube, ensuring broad and targeted audience reach. This multi-channel approach is crucial for maintaining brand visibility and driving engagement in a competitive market.

Church & Dwight's promotional strategies are deeply rooted in innovation, with a strong focus on new product introductions to capture consumer attention. This approach is evident in their consistent rollout of new products and line extensions across their diverse brand portfolio, from Arm & Hammer to Trojan.

The company strategically allocates marketing resources to support these innovations, anticipating that new product launches will be a significant driver of net sales growth. For instance, in 2023, new products and innovations contributed substantially to their sales performance, a trend expected to continue into 2024 and 2025.

Targeting Specific Consumer Segments

Church & Dwight excels at targeting specific consumer segments, a key aspect of their marketing mix. For instance, the Arm & Hammer brand resonates with 'hard-working millennial families,' emphasizing trust, value, and empowerment, especially during times of economic uncertainty. This focused approach ensures their messaging effectively reaches and connects with these core demographics.

The company leverages precision analytics to refine its promotional efforts, ensuring they are not only optimized for impact but also efficiently reach the most relevant consumer groups. This data-driven strategy allows for more personalized and effective marketing campaigns.

- Target Audience Focus: Millennial families are a key demographic for Arm & Hammer, with messaging centered on trust and value.

- Data-Driven Optimization: Precision analytics are employed to tailor promotions and reach specific consumer segments effectively.

- Economic Sensitivity: Marketing messages often address economic uncertainties, positioning products as empowering and valuable.

Digital Marketing and Social Media Engagement

Church & Dwight actively leverages digital marketing and social media to connect with consumers. Their promotional strategy includes digital advertising across a wide array of media properties, utilizing both programmatic ad buys and direct placements on key e-commerce platforms such as Walmart.com.

The company's social media engagement is a significant component of its promotional mix, with campaigns strategically deployed on popular platforms like Snapchat and YouTube. This multi-channel digital approach aims to build brand awareness and foster direct interaction with their target demographics.

In 2023, Church & Dwight's digital advertising spend was estimated to be in the hundreds of millions, reflecting a strong commitment to online channels. For instance, their investment in programmatic advertising alone saw substantial growth, indicating a data-driven approach to reaching specific consumer segments.

- Digital Reach: Advertisements placed on over 500 media properties, including direct e-commerce site integrations.

- Social Media Presence: Active campaigns on platforms like Snapchat and YouTube, reaching younger demographics.

- Programmatic Investment: Significant allocation towards programmatic advertising for targeted audience engagement.

- E-commerce Integration: Direct ad placements on major retail sites like Walmart.com to capture point-of-purchase interest.

Church & Dwight's promotional strategy heavily relies on integrated marketing campaigns that span traditional and digital media. In 2024, the company invested $480 million in advertising and promotion, with projections for 2025 indicating this spend will exceed 11% of sales, with a concentration in the first half of the year to support innovation.

The company effectively targets key demographics, such as millennial families for Arm & Hammer, emphasizing trust and value, especially during economic uncertainty. This targeted approach is enhanced by precision analytics to optimize campaign impact and efficiency.

Digital marketing and social media are central to their promotional mix, with significant investment in digital advertising across numerous media properties and direct placements on e-commerce sites. Campaigns on platforms like Snapchat and YouTube are used to build brand awareness and foster consumer interaction.

| Marketing Mix Element | 2024 Investment (Millions USD) | 2025 Projection (as % of Sales) | Key Focus Areas |

|---|---|---|---|

| Promotion (Advertising & Marketing) | $480 | > 11% | New Product Launches, Brand Visibility, Digital Engagement |

| Digital Advertising Spend | Hundreds of Millions (2023 Est.) | Continued Growth | Programmatic Buys, E-commerce Platforms (e.g., Walmart.com) |

| Social Media Engagement | Integral Component | Strategic Deployment | Snapchat, YouTube, TikTok, Instagram |

Price

Church & Dwight's pricing strategy balances value and premium positioning across its brands. For instance, Arm & Hammer’s baking soda offers a clear value proposition, while products like Orajel or certain Trojan condoms cater to premium segments with higher perceived benefits. This dual approach allows them to capture a wider market share by appealing to different consumer needs and price sensitivities.

The company emphasizes delivering high quality at competitive price points, a strategy that has historically served them well. In 2023, Church & Dwight reported net sales of $5.3 billion, indicating strong market acceptance of their pricing strategies. This performance suggests consumers find the value proposition compelling, even in premium product lines.

Church & Dwight has strategically adjusted its pricing to offset escalating input costs, a move crucial for safeguarding its profit margins, especially throughout 2023 and into early 2024. For instance, the company noted in its Q4 2023 earnings call that pricing actions were a significant driver of their net sales growth.

However, the ongoing inflationary environment and a more discerning consumer base have created some resistance to these price increases. This has, in turn, prompted a noticeable shift in consumer behavior, with shoppers increasingly opting for more budget-friendly alternatives or private label brands when available, impacting sales volumes for some of their products.

The company remains vigilant, actively tracking economic trends and shifts in consumer purchasing habits. This continuous monitoring allows Church & Dwight to adapt its strategies, balancing the need for price adjustments with maintaining consumer appeal and market share in a dynamic economic landscape.

Church & Dwight's pricing strategy carefully considers external market dynamics, including competitor pricing and prevailing market demand. While major competitors might possess larger marketing war chests, Church & Dwight leverages its portfolio of premium household and personal care items to cultivate strong brand loyalty, enabling it to sidestep direct price-based competition whenever feasible.

In 2024, Church & Dwight's net sales reached $5.3 billion, with their Arm & Hammer brand, a key player in the baking soda and household cleaning segments, demonstrating resilience against price pressures. This suggests their strategy of focusing on perceived value and brand equity over aggressive price cuts is proving effective in maintaining market position.

Impact of Tariffs on Pricing and Margins

Tariffs have directly impacted Church & Dwight’s margins, forcing the company to consider price adjustments to absorb rising input expenses. For instance, in the first quarter of 2024, the company noted that tariffs and other supply chain costs were a headwind. This pressure necessitates strategic pricing decisions to maintain profitability.

To counteract these external cost pressures and bolster operating margins, Church & Dwight has actively pursued efficiency improvements. Strategies such as increased automation in manufacturing and nearshoring of certain production processes have been implemented. These initiatives aim to create a more resilient and cost-effective supply chain, helping to mitigate the financial impact of tariffs and other global economic factors.

- Tariff Impact: Tariffs have been identified as a key factor influencing Church & Dwight's pricing strategies and impacting overall profit margins.

- Margin Mitigation: The company is actively working to boost operating margins through investments in automation and nearshoring.

- Cost Offset: These operational improvements are designed to offset increased input costs stemming from external pressures like tariffs.

- Q1 2024 Mention: Tariffs and supply chain costs were specifically cited as margin headwinds in early 2024.

Pricing Reflecting Product Innovation and Value Proposition

Church & Dwight's pricing strategy for new product innovations, such as their ARM & HAMMER laundry detergent sheets, is designed to capture the value associated with enhanced convenience and improved environmental impact. These premium offerings are positioned to attract consumers willing to pay more for these differentiated benefits.

This approach allows the company to capitalize on incremental growth opportunities by highlighting the unique selling propositions of their latest product formulations. For example, the convenience of detergent sheets, which reduce plastic waste and are easier to store, justifies a higher price point compared to traditional liquid detergents.

- Premium Pricing for Innovation: New product launches, like ARM & HAMMER laundry detergent sheets, are priced to reflect their advanced formulation and convenience.

- Value-Based Strategy: Pricing captures the incremental value and unique benefits offered, such as reduced plastic waste and ease of use.

- Market Positioning: This strategy aims to attract consumers seeking innovative and environmentally conscious laundry solutions, supporting higher revenue per unit.

Church & Dwight's pricing strategy effectively balances value and premium positioning, evident in their 2023 net sales of $5.3 billion. They strategically adjust prices to offset rising input costs, a move that contributed to net sales growth in Q4 2023, despite some consumer resistance due to inflation. New innovations like ARM & HAMMER laundry detergent sheets are priced at a premium to reflect their convenience and environmental benefits.

| Metric | 2023 Data | Early 2024 Trend |

| Net Sales | $5.3 billion | Continued growth driven by pricing actions |

| Pricing Impact | Key driver of net sales growth | Offsetting inflationary pressures and tariffs |

| Consumer Behavior | Some resistance to price increases, shift to value | Vigilant monitoring of economic trends and purchasing habits |

4P's Marketing Mix Analysis Data Sources

Our Church & Dwight 4P's analysis leverages a comprehensive blend of public company disclosures, including SEC filings and investor presentations, alongside proprietary market data. We also incorporate insights from brand websites, retail partner platforms, and competitive intelligence reports.