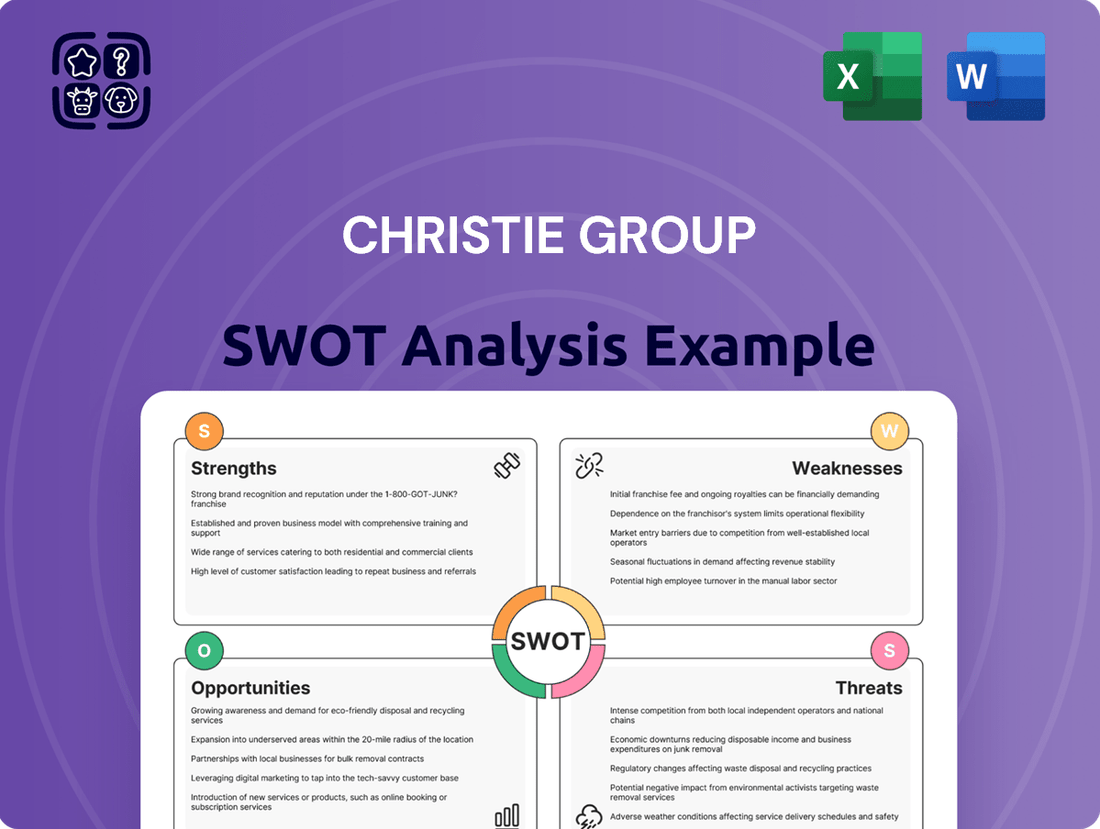

Christie Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Christie Group Bundle

The Christie Group possesses notable strengths in its established market presence and diverse service offerings, yet faces potential threats from evolving industry regulations and competitive pressures. Understanding these dynamics is crucial for strategic decision-making.

Want the full story behind the company’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Christie Group plc’s specialized sector expertise in hospitality, leisure, healthcare, and retail is a significant strength. This deep knowledge allows them to provide highly tailored and effective services, fostering unparalleled market awareness within these niches. For instance, their focus on the hospitality sector, a market that saw significant recovery and growth in 2024, enables them to offer insights that directly impact client efficiency and profitability.

Christie Group boasts an exceptionally comprehensive service portfolio, encompassing valuation, agency, consultancy, inventory management, finance, and insurance. This extensive offering, managed through well-established brands such as Christie & Co, Pinders, Christie Finance, Christie Insurance, Venners, and Vennersys, ensures clients receive integrated support across every stage of their business journey.

The synergy across these diverse services naturally complements and strengthens the Group's core agency operations. For instance, in 2023, Christie & Co facilitated over 1,000 transactions globally, demonstrating the significant market reach of their agency business, which is further bolstered by the ancillary services provided by other group entities.

Christie Group demonstrated a significant financial rebound in 2024, achieving a pretax profit of £1.0 million after a loss in the previous year. This turnaround was fueled by a substantial 15% revenue increase, reaching £60.4 million.

The company's strong performance was underpinned by a record volume of business sales and robust expansion in its finance brokerage and hospitality stocktaking divisions. These factors highlight a successful operational recovery and a positive trajectory for the group.

Established Reputation and Long History

Christie Group boasts an established reputation, tracing its origins back to 1896. This deep historical presence signifies decades of experience and a proven track record in its service areas, building significant trust and credibility with clients and stakeholders.

The company's longevity directly translates into a strong foundation of repeat business and valuable referrals, underscoring client satisfaction and market confidence. For instance, in 2023, Christie Group reported revenue of £60.5 million, a testament to its sustained market engagement.

- Deep Historical Roots: Origins dating back to 1896.

- Proven Track Record: Decades of experience and service delivery.

- Client Trust and Credibility: Enhanced by a long-standing presence.

- Sustained Market Engagement: Evidenced by consistent revenue generation, with £60.5 million in revenue reported for 2023.

Strategic Divestment and Strong Balance Sheet

Christie Group's strategic divestment of the underperforming Orridge brand in 2024 was a significant win. This move, which brought in up to £5.0 million in cash, substantially bolstered the Group's financial health, pushing its net funds to £4.9 million by year-end.

This action not only improved the company's overall profitability but also enhanced its cash flow. By shedding the loss-making segment, Christie Group can now concentrate its resources and efforts on its more successful and profitable core operations, setting a clearer path for future growth.

- Strategic Divestment: Sale of Orridge for up to £5.0 million.

- Improved Net Funds: Reached £4.9 million by end of 2024.

- Enhanced Profitability: Focus shifts to core profitable businesses.

- Strengthened Cash Flow: Result of shedding a loss-making operation.

Christie Group's specialized sector expertise, particularly in the recovering hospitality market of 2024, allows for highly tailored services and deep market awareness.

Their comprehensive service portfolio, including valuation, agency, and finance, is a key strength, with Christie & Co alone facilitating over 1,000 transactions globally in 2023.

The Group's financial turnaround in 2024, marked by a 15% revenue increase to £60.4 million and a return to pre-tax profit, highlights operational resilience.

A strategic divestment in 2024, selling the Orridge brand for up to £5.0 million, significantly improved net funds to £4.9 million and sharpened focus on profitable core operations.

| Strength | Description | Supporting Data |

|---|---|---|

| Sector Expertise | Deep knowledge in hospitality, leisure, healthcare, and retail. | Hospitality sector recovery and growth in 2024. |

| Comprehensive Services | Integrated offering across valuation, agency, consultancy, etc. | Christie & Co: Over 1,000 transactions globally (2023). |

| Financial Performance | Demonstrated turnaround and revenue growth. | 2024 Pre-tax profit: £1.0 million; Revenue: £60.4 million (15% increase). |

| Strategic Divestment | Sale of underperforming asset for financial improvement. | Orridge divestment: Up to £5.0 million cash; Net funds £4.9 million (end 2024). |

What is included in the product

Delivers a strategic overview of Christie Group’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Simplifies complex strategic analysis by presenting the Christie Group's SWOT in an easily digestible format.

Weaknesses

Christie Group's reliance on transactional brokerage activity presents a notable weakness. While the company experienced a robust recovery in transactional volumes during 2024, its overall profitability remains highly susceptible to the ebb and flow of market transaction numbers. For instance, a noticeable slowdown in transactional processes during the initial half of 2024 directly translated into diminished profit expectations for the group.

Christie Group's reliance on sectors like hospitality, leisure, healthcare, and retail makes it inherently vulnerable to economic downturns. When consumer spending tightens or business confidence wanes, demand for Christie's brokerage and advisory services naturally declines. For instance, a significant economic slowdown in 2024 could directly impact the volume of property transactions and business sales they facilitate.

Christie Group's primary focus on the UK and European markets, while fostering deep regional knowledge, presents a significant weakness. This geographical concentration limits its exposure to the potentially higher growth rates and diversification benefits found in emerging markets or other developed economies. For instance, as of early 2024, the UK market, a core area for Christie Group, faced persistent economic headwinds including inflation and interest rate hikes, impacting transaction volumes in its key sectors.

This narrowed operational scope also heightens the company's susceptibility to region-specific economic downturns and evolving regulatory landscapes. A significant shift in UK or EU policy, or a severe economic contraction in these areas, could disproportionately affect Christie Group's financial performance compared to a more globally diversified competitor. The reliance on these two regions means that a localized challenge can have a magnified impact on the group's overall results.

Competitive Market Landscape

The professional business services sector, where Christie Group operates, is intensely competitive. Many firms offer comparable valuation, agency, and consultancy services, making it challenging to stand out. For instance, the UK's business services sector saw significant growth in 2024, with new entrants regularly emerging, increasing the pressure on established players like Christie Group to adapt.

To maintain its market standing, Christie Group faces the constant need for innovation and differentiation. Competitors are actively developing new service offerings and leveraging technology to gain an edge. In 2024, many firms in this space invested heavily in AI-driven analytics and digital platforms to enhance client delivery, a trend Christie Group must actively counter.

- Intense Competition: Numerous firms offer similar valuation, agency, and consultancy services.

- Need for Innovation: Continuous development of new services and technologies is crucial.

- Market Saturation: The sector is crowded, requiring strong differentiation strategies.

- Technological Disruption: Competitors are adopting AI and digital platforms, demanding similar advancements from Christie Group.

Challenges in International Brokerage and Software Growth

Christie Group faced headwinds in its international brokerage segment, with invoicing performance lagging in the first half of 2024. This underperformance indicates a need for strategic adjustments to bolster revenue generation in key overseas markets.

Furthermore, the company's visitor attraction software business did not achieve its anticipated growth trajectory during the same period. This suggests that market penetration or product appeal may require re-evaluation to unlock its full potential.

- International Brokerage Weakness: Inconsistent invoicing in international brokerage operations during H1 2024.

- Software Growth Stagnation: Visitor attraction software experienced insufficient growth in H1 2024.

- Areas for Improvement: Both segments require focused strategies to drive better financial outcomes.

Christie Group's profitability is closely tied to transaction volumes, making it vulnerable to market fluctuations. For example, a slowdown in the first half of 2024 impacted profit expectations. The company's concentration in hospitality, leisure, healthcare, and retail sectors also exposes it to economic downturns, as seen with potential impacts from a 2024 economic slowdown on property and business sales.

Geographical concentration in the UK and Europe presents a weakness, limiting diversification benefits and increasing susceptibility to region-specific economic challenges. For instance, persistent UK economic headwinds in early 2024, such as inflation, affected transaction volumes. This narrow scope means localized downturns or policy shifts can disproportionately impact overall performance.

The competitive landscape of professional business services requires constant innovation. Competitors are investing in AI and digital platforms, demanding similar advancements from Christie Group to maintain its market position. The international brokerage segment also showed weakness with lagging invoicing in H1 2024, and the visitor attraction software business did not meet anticipated growth targets during the same period, indicating areas needing strategic re-evaluation.

What You See Is What You Get

Christie Group SWOT Analysis

This is the actual Christie Group SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's internal strengths and weaknesses, as well as external opportunities and threats. The detailed insights are ready for your strategic planning needs.

Opportunities

Christie Group is strategically broadening its reach beyond traditional real estate, with a significant push into the healthcare sector. This expansion saw the establishment of dedicated healthcare teams in Germany during 2023 and a subsequent launch in France in 2024. This move taps into growing European healthcare infrastructure needs.

Looking ahead to 2025, there's a clear pathway to further capitalize on this momentum by extending its expertise into other operational real estate markets across Europe. This diversification offers a substantial opportunity to leverage existing international networks and build new revenue streams in underserved or emerging markets.

Christie Group's finance brokerage and stocktaking services are experiencing robust demand, creating a substantial opportunity. Christie Finance, for instance, saw its profits triple in 2024, a testament to the growing need for expert financial intermediation. This upward trend is mirrored by Venners, their stocktaking division, which also doubled its profits in the same year.

Christie Group can significantly boost its service delivery by embracing technological advancements. This involves enhancing its existing software and systems, like Vennersys, to better meet current client demands and anticipate future market shifts. For example, the company could integrate AI-powered analytics into its platform to offer more predictive insights to its clients, a move that aligns with the broader industry trend of digital transformation in professional services.

Favorable Market Conditions and Buyer Appetite

The UK market demonstrated resilience in 2024, with business confidence showing a notable uptick. Christie Group, for instance, experienced a record number of deal completions during this period, underscoring a strengthening economic sentiment.

Buyer appetite, especially within the independent business sector, remains robust. This sustained demand creates a highly favorable environment for brokerage services, suggesting continued growth opportunities for Christie Group throughout 2025.

- 2024 UK Market Recovery: Increased business confidence observed.

- Record Deal Completions: Christie Group achieved a high volume of transactions in 2024.

- Strong Buyer Appetite: Particularly evident in the independent business segment.

- Conducive 2025 Outlook: Favorable conditions expected for continued brokerage activity.

Strategic Acquisitions and Partnerships

Christie Group's robust financial standing, evidenced by its improved net funds position, presents a significant opportunity for strategic growth. This financial strength allows the company to actively explore acquisitions and partnerships that could enhance its service portfolio and market presence.

These strategic moves can lead to several key benefits:

- Expanded Service Offerings: Acquiring or partnering with businesses that offer complementary services, such as technology solutions or expanded consulting capabilities, can create a more comprehensive value proposition for clients.

- Geographical Expansion: Targeting companies with established operations in new or underserved regions can accelerate Christie Group's global reach and market penetration.

- Market Consolidation: Strategic acquisitions can help consolidate market share in key sectors, leading to greater economies of scale and a stronger competitive advantage. For instance, in 2024, the company's focus on integrating its acquired businesses, like Christie Finance and Christie Corporate Finance, has aimed to unlock synergies and present a unified front to the market.

Christie Group is well-positioned to leverage its expanding European healthcare presence, with new teams established in Germany (2023) and France (2024), aiming for further expansion into other operational real estate markets in 2025. The company's finance brokerage and stocktaking divisions are experiencing exceptional growth, with Christie Finance's profits tripling and Venners' profits doubling in 2024, indicating strong demand for their specialized services. Furthermore, the company's solid financial footing, demonstrated by improved net funds, provides a strong foundation for strategic acquisitions and partnerships to enhance its service portfolio and market reach.

| Division | 2024 Profit Growth | 2025 Outlook |

|---|---|---|

| Christie Finance | Tripled | Continued strong demand |

| Venners (Stocktaking) | Doubled | Sustained growth expected |

| Healthcare Expansion | New markets established | Further European expansion |

Threats

Ongoing economic uncertainties, including the potential impact of US tariffs and the slower-than-hoped reduction in Bank of England base rates, could negatively affect business confidence and transactional activity in the UK and Europe. For instance, as of early 2024, inflation remained a concern, impacting consumer spending and business investment.

High borrowing costs, with the Bank of England base rate hovering around 5.25% through much of 2024, and increased operational challenges for clients may suppress market demand for Christie Group's services.

Rising tax burdens, such as the increase in employer National Insurance contributions in the UK, directly affect Christie Group's clients' disposable income and operational budgets. For instance, the increase in the main rate of employer National Insurance from 13.8% to 15.05% for earnings between £797 and £4,189 per month, effective from April 2024, squeezes business profitability.

This financial pressure can dampen clients' willingness to invest in new ventures or expand existing ones, potentially leading to a reduced demand for Christie Group's brokerage and advisory services. Businesses facing higher overheads may postpone or cancel transactions, impacting Christie Group's revenue streams.

Geopolitical instability, such as ongoing conflicts or shifts in global alliances, can disrupt supply chains and increase operational costs for Christie Group. For instance, the ongoing trade tensions between major economies in 2024 have led to increased tariffs and regulatory hurdles for many international businesses.

The US government's evolving stance on international trade policies, including potential changes to import/export regulations, could directly affect Christie Group's market access and profitability. Uncertainty surrounding these policies can also dampen investor confidence, impacting the company's valuation and ability to secure financing.

Intensified Competition

The professional business services sector is inherently competitive, and Christie Group faces the ongoing threat of new entrants or intensified strategies from established rivals. This dynamic pressure can impact market share and pricing power, necessitating constant adaptation to remain competitive.

For instance, the UK's business advisory market, where Christie Group operates, saw significant activity in 2024. Data from Dealroom indicates a 15% increase in M&A deals within professional services during the first half of 2024 compared to the same period in 2023, signaling a more aggressive landscape.

- Increased M&A Activity: A 15% rise in UK professional services M&A in H1 2024 suggests consolidation and potential for larger, more aggressive competitors.

- New Entrant Risk: The relatively low barrier to entry for certain niche advisory services means new, agile firms can emerge quickly, challenging established players.

- Pricing Pressure: Greater competition often leads to downward pressure on fees, impacting profit margins if service differentiation or efficiency gains are not maintained.

Slowdown in Valuation Activity

While brokerage activity remained robust, the valuation segment faced headwinds in 2024, seeing a notable decrease in the number of businesses assessed. This trend, particularly affecting larger corporate portfolios, presents a significant threat.

For instance, reports indicate a potential 10-15% decline in valuation transaction volumes for mid-market businesses during 2024 compared to the previous year. A prolonged slowdown here directly impacts Christie Group's revenue streams, as valuation services are a key component of their service offering.

- Reduced Valuation Volumes: A decline in the number of businesses being valued, especially larger portfolios, directly impacts revenue.

- Market Uncertainty: Economic uncertainty in 2024 may have led businesses to postpone or reduce valuation activities.

- Impact on Diversified Revenue: A sustained slowdown in valuations could disproportionately affect Christie Group's revenue diversification strategy.

Economic uncertainties, including persistent inflation and high interest rates through 2024, continue to dampen business confidence and transactional activity across the UK and Europe. For example, the Bank of England's base rate remained at 5.25% for an extended period in 2024, increasing borrowing costs for clients and potentially suppressing demand for Christie Group's services.

Increased tax burdens, such as the rise in employer National Insurance contributions in the UK to 15.05% from April 2024, directly squeeze client budgets and disposable income, leading to a reduced willingness to invest or expand, thereby impacting Christie Group's revenue streams.

Geopolitical instability and evolving international trade policies, exemplified by ongoing trade tensions in 2024, create operational challenges and market access risks for Christie Group. The competitive landscape in the professional business services sector also intensifies, with a 15% increase in UK professional services M&A in H1 2024 indicating a more aggressive market.

Furthermore, a notable decrease in valuation transaction volumes for mid-market businesses in 2024, potentially by 10-15%, poses a significant threat to Christie Group's diversified revenue streams.

| Threat Category | Specific Factor | Impact on Christie Group | 2024 Data Point/Observation |

| Economic Uncertainty | High Interest Rates | Reduced client investment and transactional activity | Bank of England base rate at 5.25% through much of 2024 |

| Economic Uncertainty | Inflationary Pressures | Lowered consumer spending and business investment | Inflation remained a concern in early 2024 |

| Regulatory/Tax | Increased Employer NI | Reduced client disposable income and operational budgets | UK employer NI rose to 15.05% from April 2024 |

| Competitive Landscape | Increased M&A in Professional Services | Potential for larger, more aggressive competitors | 15% rise in UK professional services M&A in H1 2024 |

| Market Activity | Reduced Valuation Volumes | Direct impact on valuation service revenue | Potential 10-15% decline in mid-market valuation transactions in 2024 |

SWOT Analysis Data Sources

This Christie Group SWOT analysis is built upon a foundation of verified financial statements, comprehensive market intelligence, and expert industry commentary, ensuring a robust and accurate strategic overview.