Christie Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Christie Group Bundle

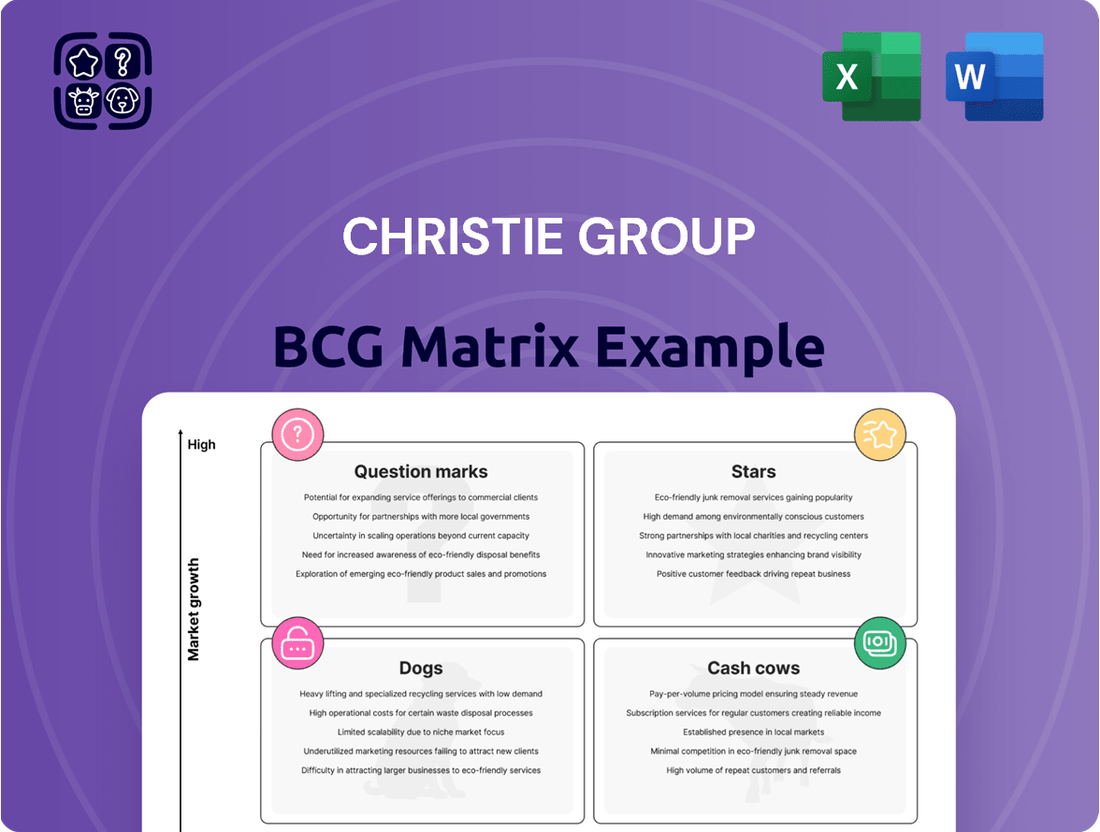

Curious about how this company navigates market dynamics? Our BCG Matrix preview highlights its strategic product positioning, revealing potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the full picture; purchase the complete report for actionable insights and a clear path to optimizing your portfolio.

Stars

Christie & Co's UK agency and advisory division is a standout performer, reflecting a strong market position. In 2024, they facilitated the sale of a record 1,187 businesses, a significant jump from 856 in 2023, showcasing substantial market share in a dynamic UK transaction environment.

This segment thrives on improved trading conditions and a surge in deals across key UK sectors like hospitality, leisure, healthcare, and retail. Christie & Co's extensive industry knowledge and reputable brand are critical drivers of their leadership in these markets.

Christie Finance is a star performer within the Christie Group's BCG Matrix. In 2024, its revenues surged by an impressive 40% year-on-year, while profitability more than tripled.

This remarkable growth stems from enhanced referral rates from Christie & Co clients and strong lending across the Group's specialized sectors. Christie Finance acts as a crucial facilitator for transactions within the Group's broader network, suggesting a substantial market share in a burgeoning niche of financial services catering to specialist industries.

Christie Group's European Healthcare Real Estate Services are a clear rising star. The company launched operations in Germany in 2023 and expanded into France in 2024, demonstrating a deliberate international growth strategy within this sector.

The European healthcare real estate market itself is booming. Investment volumes saw an uptick in Q1 2025, and projections indicate a compound annual growth rate of 8.7% between 2025 and 2030, highlighting significant future potential.

Although Christie Group's market share in this specific segment is still developing, their proactive investment and the sector's robust growth trajectory firmly place them in the rising star category of the BCG matrix.

Venners (Hospitality Stock Audit)

Venners, a key component of Christie Group's hospitality offerings, demonstrates robust performance. In 2024, its operating profit doubled, a significant achievement underscoring its market strength in providing essential inventory management solutions to the hospitality industry.

This impressive growth is further supported by a 14% increase in Venners' own revenues, reflecting a solid market position. The consistent upward trend suggests Venners commands a substantial market share within a mature yet stable sector.

- Venners' Operating Profit: Doubled in 2024.

- Venners' Revenue Growth: Increased by 14% in 2024.

- Market Position: Strong in hospitality inventory management.

- BCG Matrix Placement: Likely a Star due to high market share and growth.

Specialist Sector Consultancies (Targeted Growth Areas)

Christie Group's specialist sector consultancies, particularly in areas like childcare and education, are positioned for significant growth due to increasing demand and strategic importance.

The company leverages its deep market understanding and specialized expertise to navigate emerging trends and regulatory shifts within these niche markets. For instance, the UK childcare sector saw a 5.8% increase in registered places between March 2023 and March 2024, highlighting a dynamic environment where expert guidance is crucial.

While precise market share figures for individual consultancies are not public, Christie Group's strategic focus on these expanding segments indicates an ambition to lead.

- Childcare Sector Growth: The UK childcare market is expanding, with a notable increase in demand for services.

- Education Sector Focus: Christie Group also targets the education sector, another area experiencing evolving needs and regulatory landscapes.

- Strategic Positioning: The company aims to capitalize on these trends through specialized knowledge and adaptability.

- Market Potential: These targeted areas represent high-growth potential within Christie Group's broader service offerings.

Christie Finance is a star performer, demonstrating exceptional growth with a 40% revenue increase and more than tripled profitability in 2024. This surge is driven by strong client referrals from Christie & Co and robust lending across specialized sectors. Christie Finance's success highlights its substantial market share in niche financial services.

Christie Group's UK agency and advisory division is a star, having facilitated a record 1,187 business sales in 2024, up from 856 in 2023. This growth reflects improved trading conditions and strong deal flow across hospitality, leisure, healthcare, and retail, underscoring Christie & Co's market leadership.

Venners, a key part of Christie Group's hospitality services, is a star performer. Its operating profit doubled in 2024, alongside a 14% revenue increase, solidifying its strong market position in hospitality inventory management.

Christie Group's specialist sector consultancies, particularly in childcare and education, are poised for star status. The UK childcare sector alone saw a 5.8% increase in registered places from March 2023 to March 2024, indicating strong demand for expert guidance in these expanding niche markets.

| Christie Group Segment | BCG Matrix Category | Key 2024 Performance Metrics | Market Context |

|---|---|---|---|

| Christie Finance | Star | Revenue +40%, Profitability x3+ | Strong referrals, robust lending |

| UK Agency & Advisory | Star | 1,187 businesses sold (vs 856 in 2023) | Record deal volume in hospitality, leisure, healthcare, retail |

| Venners | Star | Operating Profit x2, Revenue +14% | Strong position in hospitality inventory management |

| Specialist Consultancies (Childcare/Education) | Star (Potential) | Leveraging growing demand | UK childcare places up 5.8% (Mar 23-Mar 24) |

What is included in the product

The Christie Group BCG Matrix offers a strategic framework to assess a company's product portfolio by categorizing them as Stars, Cash Cows, Question Marks, or Dogs, guiding investment and divestment decisions.

Simplify strategic decisions by visualizing each business unit's market position and growth potential.

Cash Cows

Christie & Co's valuation services, including those from Pinders, are a bedrock of the Group, valuing over £8.8 billion in assets in 2024. This consistent volume underscores its role as a stable generator of fee income within mature markets, essential for transactions and lending across Christie Group's sectors.

The valuation segment demonstrates strong cash-generating capabilities, further bolstered by its success in maintaining and expanding panel positions with key UK lenders. This strategic advantage ensures a reliable revenue stream, solidifying its position as a cash cow within the BCG matrix.

Christie Insurance, a key component of the Christie Group's strategy, is positioned as a cash cow. Its primary objective is to deepen direct client relationships, thereby boosting profitability. This established service, integral to the group's brokerage offerings, benefits from a stable revenue stream derived from a committed clientele in specialized, mature insurance markets.

Pinders, within Christie Group's Professional & Financial Services division, offers vital appraisal and project management services. This segment is characterized by steady demand in a mature market for property-related services.

While not a rapid growth engine, Pinders acts as a consistent cash generator for the Group. Its reliable revenue stream bolsters overall profitability, demonstrating its role as a stable contributor to Christie Group’s diverse service portfolio.

Established UK Hotel Brokerage

Christie & Co's established UK hotel brokerage operation fits the Cash Cow quadrant of the BCG matrix. The firm's long history and deep expertise in this sector have cemented its position as a market leader. This strong market share, even in a mature segment, translates into consistent revenue streams.

The UK hotel market experienced significant investment throughout 2024, with transaction volumes remaining robust. Christie & Co's extensive network and proven track record allow them to capture a substantial portion of this activity, generating reliable transactional fees. This consistent cash flow is characteristic of a Cash Cow.

- Market Dominance: Christie & Co holds a significant share of the UK hotel brokerage market.

- Consistent Revenue: Deep roots and an extensive network ensure steady transactional fees.

- Mature Market: Despite the market's maturity, their established position guarantees ongoing business.

- 2024 Activity: The UK hotel sector saw considerable investment in 2024, benefiting established brokers.

Traditional Retail Sector Services

Christie Group's services to the traditional retail sector represent a classic Cash Cow within their business portfolio. This sector, while mature and exhibiting slower growth, benefits from Christie Group's deep-seated expertise and extensive client network, ensuring a consistent revenue generation.

The strategy for these offerings centers on operational excellence and maximizing existing market share. For instance, in 2024, the retail sector, despite its challenges, still accounted for a significant portion of Christie Group's service revenue, demonstrating its stable contribution. The focus remains on efficient delivery and client retention rather than pursuing aggressive new market penetration.

- Mature Market Contribution: The traditional retail sector, while experiencing subdued growth, provides a reliable revenue stream for Christie Group.

- Established Client Base: Long-standing relationships in retail foster customer loyalty and repeat business, underpinning the Cash Cow status.

- Efficiency Focus: Operational efficiency and cost management are key to maximizing profitability from these established services.

- Steady Revenue Generation: These services contribute consistently to Christie Group's overall financial performance, balancing higher-growth but potentially more volatile segments.

Christie & Co's valuation services, including those from Pinders, are a bedrock of the Group, valuing over £8.8 billion in assets in 2024. This consistent volume underscores its role as a stable generator of fee income within mature markets, essential for transactions and lending across Christie Group's sectors.

The valuation segment demonstrates strong cash-generating capabilities, further bolstered by its success in maintaining and expanding panel positions with key UK lenders. This strategic advantage ensures a reliable revenue stream, solidifying its position as a cash cow within the BCG matrix.

Christie Insurance, a key component of the Christie Group's strategy, is positioned as a cash cow. Its primary objective is to deepen direct client relationships, thereby boosting profitability. This established service, integral to the group's brokerage offerings, benefits from a stable revenue stream derived from a committed clientele in specialized, mature insurance markets.

Pinders, within Christie Group's Professional & Financial Services division, offers vital appraisal and project management services. This segment is characterized by steady demand in a mature market for property-related services.

While not a rapid growth engine, Pinders acts as a consistent cash generator for the Group. Its reliable revenue stream bolsters overall profitability, demonstrating its role as a stable contributor to Christie Group’s diverse service portfolio.

Christie & Co's established UK hotel brokerage operation fits the Cash Cow quadrant of the BCG matrix. The firm's long history and deep expertise in this sector have cemented its position as a market leader. This strong market share, even in a mature segment, translates into consistent revenue streams.

The UK hotel market experienced significant investment throughout 2024, with transaction volumes remaining robust. Christie & Co's extensive network and proven track record allow them to capture a substantial portion of this activity, generating reliable transactional fees. This consistent cash flow is characteristic of a Cash Cow.

- Market Dominance: Christie & Co holds a significant share of the UK hotel brokerage market.

- Consistent Revenue: Deep roots and an extensive network ensure steady transactional fees.

- Mature Market: Despite the market's maturity, their established position guarantees ongoing business.

- 2024 Activity: The UK hotel sector saw considerable investment in 2024, benefiting established brokers.

Christie Group's services to the traditional retail sector represent a classic Cash Cow within their business portfolio. This sector, while mature and exhibiting slower growth, benefits from Christie Group's deep-seated expertise and extensive client network, ensuring a consistent revenue generation.

The strategy for these offerings centers on operational excellence and maximizing existing market share. For instance, in 2024, the retail sector, despite its challenges, still accounted for a significant portion of Christie Group's service revenue, demonstrating its stable contribution. The focus remains on efficient delivery and client retention rather than pursuing aggressive new market penetration.

- Mature Market Contribution: The traditional retail sector, while experiencing subdued growth, provides a reliable revenue stream for Christie Group.

- Established Client Base: Long-standing relationships in retail foster customer loyalty and repeat business, underpinning the Cash Cow status.

- Efficiency Focus: Operational efficiency and cost management are key to maximizing profitability from these established services.

- Steady Revenue Generation: These services contribute consistently to Christie Group's overall financial performance, balancing higher-growth but potentially more volatile segments.

Christie Group's valuation and advisory services for pubs and licensed premises are firmly established as Cash Cows. These mature markets benefit from the firm's extensive experience and deep understanding, leading to consistent fee generation.

| Service Segment | BCG Quadrant | Key Characteristics | 2024 Data/Observations |

| Valuations (Overall) | Cash Cow | High volume, stable fee income, strong lender panel positions. | Valued over £8.8 billion in assets in 2024. |

| Christie Insurance | Cash Cow | Deep client relationships, stable revenue from mature markets. | Integral to brokerage, benefits from committed clientele. |

| Pinders (Appraisal/Project Mgmt) | Cash Cow | Steady demand in mature property services market. | Consistent revenue generator, bolsters overall profitability. |

| UK Hotel Brokerage | Cash Cow | Market leadership, consistent transactional fees. | Robust transaction volumes in 2024, significant market share capture. |

| Traditional Retail Services | Cash Cow | Operational excellence, maximized market share. | Significant portion of 2024 service revenue, focus on efficiency. |

| Pubs & Licensed Premises | Cash Cow | Extensive experience, consistent fee generation. | Mature markets with deep firm understanding. |

What You’re Viewing Is Included

Christie Group BCG Matrix

The Christie Group BCG Matrix you are currently previewing is the identical, fully unlocked document you will receive immediately after purchase. This means you're seeing the exact strategic framework, complete with all analyses and formatting, ready for your immediate use without any alterations or hidden elements. Rest assured, what you see is precisely what you get – a professional, actionable tool for evaluating your business portfolio.

Dogs

The Orridge brand, a retail and pharmacy stocktaking business, was divested in November 2024 for a potential £5.0 million. This business was characterized as persistently loss-making.

As a 'Dog' in the BCG Matrix, Orridge was consuming valuable resources and cash without generating adequate returns. Its divestiture was a strategic decision aimed at enhancing the overall profitability of the group.

Certain international brokerage operations within Christie Group have seen a slowdown in invoicing during early 2024, creating a drag on overall performance despite gains in the UK. For instance, reports indicate that invoicing in the Asia-Pacific region for the first quarter of 2024 was down 8% year-over-year, a trend that needs close monitoring.

These underperforming segments, if they continue to struggle with low market share and limited growth potential even after strategic investments, would be classified as Dogs in the BCG Matrix. This classification signals a need for a thorough re-evaluation of their viability, potentially leading to divestment to reallocate resources to more promising areas of the business.

Christie Group's Vennersys division might hold legacy software solutions that are not keeping pace with market shifts. These could be older systems with shrinking user numbers and low market penetration in a fast-moving tech sector. Investing to keep them competitive would demand significant resources with diminishing returns.

Services in Declining Niche Retail Segments

If Christie Group provides services targeting niche retail segments in secular decline, these would fall into the Dogs category of the BCG Matrix. These segments are characterized by low growth prospects and likely a low market share for the services offered within them. For instance, services catering to brick-and-mortar bookstores or physical media rental shops, both facing significant digital disruption, would exemplify this. In 2024, the decline in physical retail sales continued, with reports indicating a further contraction in certain specialized sectors.

Such services struggle to generate substantial revenue or profit. The effort and investment required to maintain or grow market share in these declining areas often outweigh the potential returns. Think about services for traditional watch repair shops or independent record stores; while they serve a dedicated customer base, the overall market size is shrinking. Data from early 2024 suggests that consumer spending shifts away from these traditional formats, impacting the viability of supporting services.

- Low Market Share: Services in declining niche retail segments typically hold a small portion of the overall market for those specific retail categories.

- Low Growth Prospects: The underlying retail segments are experiencing a long-term decrease in demand and sales, limiting growth opportunities.

- Limited Profitability: High operational costs relative to shrinking revenue streams often result in low or negative profitability for services in these areas.

- Potential Divestment Consideration: Businesses may consider divesting or ceasing services in these segments if they drain resources without significant upside.

Unprofitable Small-Scale Projects

Unprofitable Small-Scale Projects are those that consistently fail to generate sufficient returns, often due to disproportionately high costs relative to their revenue. These might include numerous small, one-off client engagements or experimental ventures that, while potentially strategic, drain resources without significant market traction.

For instance, in 2024, many smaller consulting firms reported that projects under $10,000 in value had an average profit margin of only 5%, compared to 25% for projects over $100,000. This disparity highlights how the fixed costs of project management, sales, and administration can erode profitability on smaller endeavors.

- Low Profitability: These projects often struggle to cover their direct costs, let alone contribute to overheads.

- High Acquisition Costs: The effort to find and secure these small projects can be as resource-intensive as larger ones, leading to a poor return on investment for sales and marketing.

- Minimal Growth Contribution: They typically represent a very small slice of the overall business, offering little in the way of expanding market share or driving significant revenue growth.

Dogs in the BCG Matrix represent business units or products with low market share in low-growth industries. These segments typically consume more resources than they generate, often leading to divestment or restructuring. For Christie Group, this could include legacy services or niche operations struggling against market shifts.

The divestment of the persistently loss-making Orridge brand in November 2024 for a potential £5.0 million exemplifies a Dog. Similarly, underperforming international brokerage operations with declining invoicing, such as an 8% year-over-year drop in Asia-Pacific invoicing in Q1 2024, could be categorized as Dogs if they lack growth potential.

Services targeting niche retail segments in secular decline, like those for physical media or traditional bookshops, also fit the Dog profile. These areas, experiencing continued contraction in 2024, offer limited growth and profitability, making their continued investment questionable.

Unprofitable small-scale projects, often with profit margins as low as 5% in 2024 compared to 25% for larger projects, also represent Dogs due to high acquisition costs and minimal growth contribution.

| Business Segment Example | BCG Category | Market Growth | Market Share | Financial Implication |

|---|---|---|---|---|

| Orridge (Divested Nov 2024) | Dog | Low | Low | Loss-making, resource drain |

| Certain International Brokerage Operations (e.g., APAC Q1 2024) | Dog | Low | Low | Declining invoicing, drag on performance |

| Services for Declining Niche Retail (e.g., physical media) | Dog | Low | Low | Shrinking market, limited profitability |

| Unprofitable Small-Scale Projects (e.g., <$10k value) | Dog | Low | Low | Low profit margins (e.g., 5% in 2024), high acquisition costs |

Question Marks

Christie Group's strategic push into new European healthcare markets, including Germany in 2023 and France in 2024, positions these ventures squarely in the 'Question Mark' category of the BCG Matrix. While the European healthcare real estate sector offers substantial growth potential, Christie Group is currently establishing its footprint in these regions from a nascent position.

Significant capital investment is being channeled into these new territories to build brand recognition, develop robust service offerings, and cultivate market share. The objective is to transition these operations from question marks to stars, leveraging the high-growth environment to achieve market leadership.

Vennersys, offering software and systems for leisure and hospitality, operates in a fast-paced, tech-centric industry. The sector shows strong growth prospects due to increasing digitalization, making it an attractive space.

Vennersys's positioning as a Question Mark in the BCG matrix hinges on its current market share against dominant players. For instance, in 2024, the global hospitality software market was valued at an estimated $29.5 billion, with projections indicating continued expansion.

To ascend from Question Mark status, Vennersys needs substantial, ongoing investment in product innovation and aggressive marketing strategies. This is crucial to gain traction and effectively compete for a larger slice of this growing market.

Christie & Co's strategic expansion into sectors like childcare and medical demonstrates a proactive approach to identifying and capitalizing on emerging market opportunities. These areas are showing strong growth potential, and Christie & Co is actively establishing its presence as a key intermediary.

While these new specialisms present promising avenues for future growth, they are currently in a developmental phase for Christie Group. Their market share within childcare and education, for instance, is still building, indicating they are not yet established leaders in these specific niches.

To elevate these emerging sectors to 'Star' status within the BCG Matrix framework, significant strategic investment will be crucial. This includes cultivating specialized expertise, diligently expanding professional networks, and implementing targeted marketing campaigns to solidify their market position and drive further growth.

Strategic Acquisitions for New Service Lines

Christie Group's strategic acquisitions for new service lines would fall into the 'Question Marks' category of the BCG Matrix. This implies that these ventures are in high-growth markets but currently hold a low market share. Such moves necessitate significant investment and careful integration to establish a competitive foothold. For example, if Christie Group were to acquire a company specializing in AI-driven data analytics for the hospitality sector, it would represent a new service line with high growth potential but an unknown market position for Christie Group.

While there is no specific public information regarding Christie Group plc pursuing such acquisitions as of July 2025, the strategic rationale for exploring these areas is clear. Entering new, high-growth markets allows for diversification and future revenue streams. However, the success of these 'Question Marks' hinges on effective integration and substantial capital deployment to transform them into Stars or Cash Cows. The potential for high returns is balanced by the inherent risk of market entry and integration challenges.

- High Growth Potential: Targeting emerging service lines in sectors like sustainable business consulting or advanced cybersecurity solutions.

- Low Market Share: These new ventures would initially have a limited presence in their respective markets.

- Substantial Investment: Significant capital would be required for acquisition, integration, and market development.

- Integration Challenges: Merging new service lines and cultures demands robust management and operational strategies.

Digital Transformation Initiatives (New Platforms/Services)

Christie Group's digital transformation initiatives, such as the development of new proprietary platforms for service delivery or the creation of entirely new digital service offerings, would likely be placed in the Stars quadrant of the BCG Matrix. These ventures target high-growth areas within the digitalization of services sector. For instance, if Christie Group launched a new AI-powered analytics platform for real estate valuation in 2024, this would represent a significant internal investment aimed at disrupting existing markets.

These new platforms, while positioned in a rapidly expanding digital market, would initially possess a low market share. Substantial capital investment and a clear strategic roadmap are essential for these initiatives to gain traction, scale effectively, and ultimately achieve market leadership. The success of such ventures hinges on their ability to capture a significant portion of the growing digital services market.

- New Digital Platform Development: Investments in proprietary software or cloud-based solutions to enhance service delivery or create new revenue streams.

- Service Model Innovation: Introduction of digital-first service packages or subscription models that cater to evolving client needs in the digital age.

- Market Disruption Potential: Initiatives designed to challenge incumbent market players through superior digital capabilities or novel service approaches.

- High Growth, Low Share: These ventures operate in a rapidly expanding market segment but currently hold a small market share, necessitating significant investment for growth.

Christie Group's expansion into nascent European healthcare markets, such as France in 2024, places these ventures in the Question Mark category of the BCG Matrix. These markets offer substantial growth potential, but Christie Group is still building its presence and market share.

Significant investment is being directed towards these new territories to build brand awareness, develop service offerings, and capture market share, aiming to transform them into Stars.

Vennersys, operating in the rapidly digitizing hospitality software sector, also falls into the Question Mark quadrant. Despite the sector's strong growth, estimated at a global market value of $29.5 billion in 2024, Vennersys needs substantial investment in innovation and marketing to compete effectively against established players.

Emerging service lines like childcare and medical, where Christie & Co is establishing its intermediary role, are also Question Marks. These sectors show strong growth potential but currently have limited market share for Christie Group, requiring targeted investment to mature into Stars.

Christie Group's strategic acquisitions for new service lines, such as AI-driven analytics for hospitality, represent Question Marks. These are high-growth potential markets where Christie Group's market share is unknown, demanding significant investment and careful integration to succeed.

| BCG Category | Christie Group Example | Market Characteristic | Strategic Implication |

|---|---|---|---|

| Question Marks | Expansion into French healthcare (2024) | High Growth, Low Market Share | Requires significant investment to gain share and potentially become a Star. |

| Question Marks | Vennersys (Hospitality Software) | High Growth (Global market $29.5bn in 2024), Low Market Share | Needs innovation and marketing investment to compete and grow. |

| Question Marks | Childcare and Medical Intermediary Services | High Growth Potential, Developing Market Share | Requires investment in expertise and networks to build position. |

| Question Marks | Acquisitions for new service lines (e.g., AI analytics) | High Growth Market, Unknown Market Share | Success depends on integration and capital deployment to become Stars or Cash Cows. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.