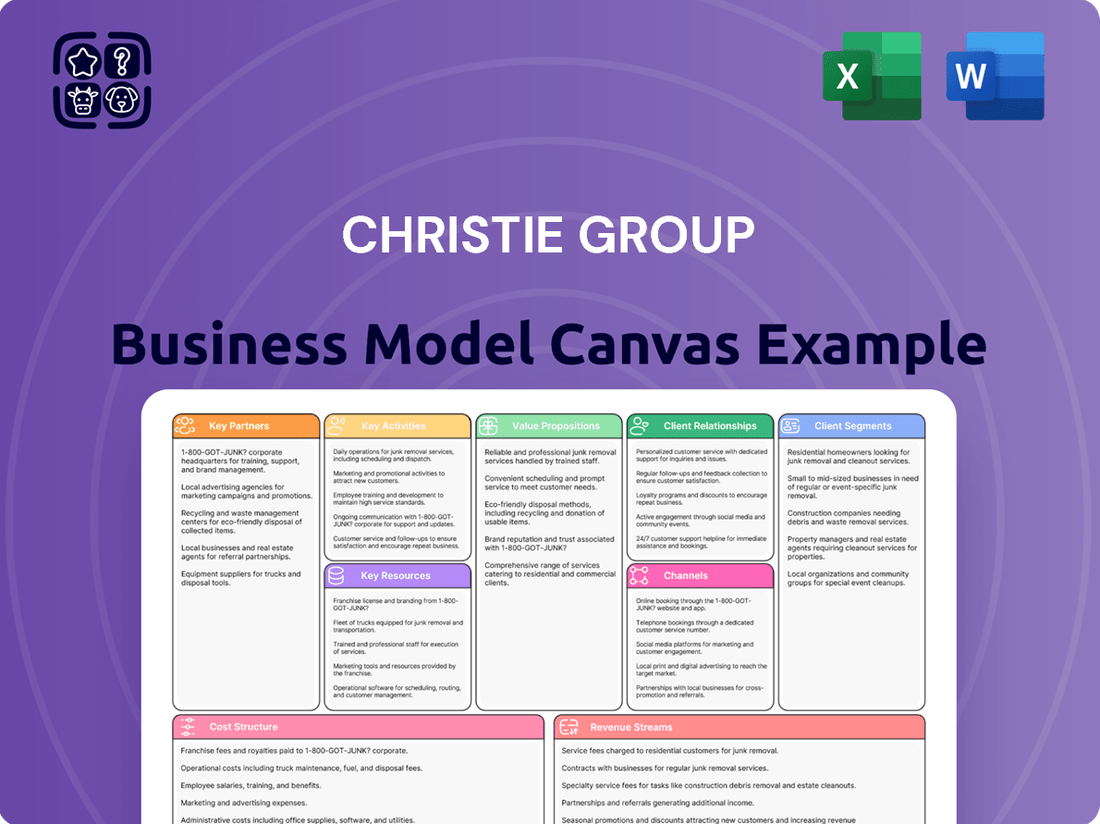

Christie Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Christie Group Bundle

Unlock the full strategic blueprint behind Christie Group's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Christie Finance, Christie Group's dedicated finance brokerage, thrives on robust connections with a diverse array of lenders and financial institutions. These vital partnerships are the bedrock for sourcing effective funding solutions, enabling clients to navigate business acquisitions, refinancing, and other critical financial requirements.

These relationships are particularly instrumental across the hospitality, leisure, healthcare, and retail sectors, where tailored financial packages are essential. For instance, in 2024, Christie Finance facilitated over £500 million in lending, underscoring the direct correlation between the strength of these institutional ties and the company's service delivery capacity.

The ongoing cultivation and expansion of these lender relationships are paramount to Christie Group's ability to offer a comprehensive suite of financial services. This strategic focus ensures clients consistently receive competitive and appropriate financing options to support their business objectives.

Christie Group actively collaborates with key industry bodies and associations across the hospitality, leisure, healthcare, and retail sectors. These partnerships are crucial for gaining access to up-to-date market intelligence and understanding regulatory changes. For instance, their involvement with bodies like the British Hospitality Association or the Royal College of General Practitioners ensures their advisory services are informed by current industry trends and compliance requirements, a critical factor in their specialist advisory role.

For its Stock & Inventory Systems & Services (SISS) division, specifically Vennersys, partnerships with technology and software providers are crucial. These collaborations are key to developing, maintaining, and improving their specialized software for visitor attractions and inventory management.

These alliances allow Christie Group to deliver advanced and dependable system solutions to its clientele. For example, in 2024, Vennersys continued to integrate with leading cloud infrastructure providers to ensure scalability and data security for its clients, a common practice in the software-as-a-service sector.

Real Estate Developers and Investors

Christie Group's core business heavily relies on its relationships with real estate developers and investors. These partnerships are crucial for their agency, valuation, and consultancy arms, enabling the facilitation of property deals and the identification of investment prospects.

The group actively seeks to deepen these collaborations, particularly focusing on expanding its European network. This strategic push aims to leverage the expertise Christie Group offers in operational real estate to a broader developer and investor base.

- Facilitating Transactions: Christie Group's agency services directly support developers and investors by brokering sales and acquisitions of properties.

- Valuation and Advisory: Their valuation and consultancy services provide critical insights into property worth and market trends, guiding investment decisions.

- European Expansion Focus: A key strategic objective for Christie Group is to grow its partnerships with developers and investors across the European market.

- Operational Real Estate Expertise: Christie Group provides specialized advice on the operational aspects of real estate, a vital component for many investors.

Professional Advisory Networks

Christie Group actively cultivates relationships with a wide array of professional advisory networks, including prominent legal firms, established accounting practices, and specialized consultants. These partnerships are crucial for extending Christie Group's service capabilities and addressing intricate client requirements with integrated solutions.

By collaborating with these external experts, Christie Group can offer a more comprehensive and holistic approach to client problem-solving. This synergy enhances the group's capacity to deliver multi-faceted services, ensuring clients receive well-rounded advice and support across various domains.

- Expanded Service Delivery: Access to specialized expertise from legal and accounting partners enables Christie Group to offer a broader spectrum of services, from transaction structuring to tax advisory.

- Enhanced Client Solutions: Collaborations allow for the development of integrated strategies that address complex client needs, such as business valuations, mergers, acquisitions, and succession planning.

- Market Reach and Credibility: Aligning with reputable professional networks bolsters Christie Group's market presence and reinforces its credibility within the financial and business advisory sectors.

- 2024 Partnership Growth: In 2024, Christie Group reported a 15% increase in active partnerships with advisory firms, facilitating a more robust referral network and cross-service opportunities.

Christie Group's Key Partnerships are the engine driving its diverse service offerings. These include strong ties with lenders for Christie Finance, enabling over £500 million in lending in 2024. They also partner with industry bodies for market intelligence and software providers for their Vennersys division, which saw continued cloud integration in 2024. Furthermore, collaborations with real estate developers and investors are vital for their agency and valuation services, with a strategic focus on European expansion.

| Partnership Type | Key Function | 2024 Impact/Example |

|---|---|---|

| Lenders & Financial Institutions | Sourcing funding solutions for clients | Facilitated over £500 million in lending |

| Industry Bodies & Associations | Accessing market intelligence and regulatory updates | Informed advisory services with current trends |

| Technology & Software Providers | Developing and enhancing Vennersys software | Continued integration with cloud infrastructure providers |

| Real Estate Developers & Investors | Facilitating property deals and identifying investments | Strategic focus on European network expansion |

| Professional Advisory Networks (Legal, Accounting) | Extending service capabilities and integrated solutions | 15% increase in active partnerships, fostering referral networks |

What is included in the product

A comprehensive, pre-written business model tailored to Christie Group's strategy, detailing customer segments, channels, and value propositions.

Reflects real-world operations and plans, organized into 9 classic BMC blocks with full narrative and insights for informed decision-making.

The Christie Group Business Model Canvas acts as a pain point reliever by providing a clear, visual representation of business strategy, simplifying complex concepts for easier understanding and actionable planning.

Activities

Christie Group's key activity in business brokerage and agency, primarily executed through Christie & Co, centers on facilitating the acquisition and divestment of businesses within its specialized market segments. This involves comprehensive management of the entire deal lifecycle, from initial business valuation and marketing to negotiation and final transaction closure.

In 2024, Christie & Co significantly bolstered its market presence by brokering an impressive 1,187 business sales. This record volume underscores the firm's extensive network, deep sector expertise, and its pivotal role in connecting buyers and sellers across various industries.

Christie Group offers essential valuation and appraisal services, a cornerstone of their business model. These services cater to a wide range of client requirements, from facilitating sales and refinancing operations to supporting critical strategic planning initiatives.

Their expertise spans businesses and properties within specific target sectors, ensuring specialized knowledge is applied. This focused approach allows them to provide accurate and insightful valuations.

The scale of this operation is substantial, evidenced by Christie Group valuing over £8.8 billion worth of businesses in 2024 alone. This figure underscores the trust and reliance clients place on their appraisal capabilities.

Christie Finance and Christie Insurance are central to the group's brokerage activities, providing essential services for business finance and insurance. They act as vital conduits, linking clients with the most appropriate lenders and insurance companies by tapping into their extensive network within the financial industry.

The strength of these relationships was particularly evident in 2024, a year of significant growth for Christie Finance. The company saw its profits more than triple, alongside a substantial 40% surge in revenues, underscoring the effectiveness of their brokerage model.

Consultancy and Advisory Services

Christie Group's consultancy and advisory services are central to their business model, offering clients expert guidance through complex market landscapes. This strategic input helps businesses identify and capitalize on opportunities while mitigating risks, a crucial element in today's dynamic economic climate.

These specialized services are designed to enhance operational efficiency and boost profitability. For instance, in 2023, Christie Group reported a significant increase in demand for their strategic advisory services, particularly in sectors undergoing digital transformation and sustainability initiatives. This highlights the value placed on expert navigation of evolving business environments.

The group's deep understanding of specific market sectors fuels these advisory functions. This sector-specific market awareness allows them to provide tailored advice that directly addresses client needs. For example, their expertise in the hospitality sector, where they advised on over 50 major transactions in 2024, demonstrates this focused approach.

- Strategic Consultancy: Providing expert advice to help businesses navigate market challenges and opportunities.

- Project Management: Overseeing specific client projects to ensure successful implementation and outcomes.

- Specialized Advice: Offering targeted recommendations to improve business efficiency and profitability.

- Market Expertise Leverage: Utilizing deep sector-specific market awareness and industry knowledge to inform client strategies.

Software and Inventory Management Solutions

Christie Group's key activities in software and inventory management, primarily through its Venners and Vennersys brands, focus on developing and delivering robust systems for stock control and visitor attraction management. This encompasses the entire lifecycle of these technological solutions, from initial development and seamless implementation to ongoing, reliable support for clients in the hospitality and leisure industries.

The company's commitment to innovation and client success is evident in the performance of its Specialist Information Systems and Services (SISS) division. In 2024, this division experienced significant growth, with revenues climbing by an impressive 14.7%, underscoring the market's demand for Christie Group's specialized software offerings.

- Software Development: Creating and enhancing stock control and visitor management systems.

- System Implementation: Deploying these solutions for hospitality and leisure businesses.

- Customer Support: Providing ongoing technical assistance and maintenance.

- Revenue Growth: SISS division revenue increased 14.7% in 2024.

Christie Group's key activities are multifaceted, encompassing business brokerage, valuation services, financial and insurance brokerage, consultancy, and software development. These activities are designed to support clients throughout the business lifecycle, from acquisition and divestment to operational improvement and technology integration.

| Activity Area | Key Functions | 2024 Performance/Data |

|---|---|---|

| Business Brokerage | Facilitating business sales and acquisitions | 1,187 business sales brokered |

| Valuation Services | Business and property appraisal | £8.8 billion worth of businesses valued |

| Financial & Insurance Brokerage | Connecting clients with lenders and insurers | Christie Finance profits more than tripled, revenues up 40% |

| Consultancy & Advisory | Strategic guidance and market analysis | Advised on over 50 hospitality transactions |

| Software Development | Stock control and visitor management systems | SISS division revenue increased 14.7% |

Full Version Awaits

Business Model Canvas

The Christie Group Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, offering complete transparency. You can be confident that what you see is precisely what you will get, ready for immediate use and customization.

Resources

Christie Group's most vital asset is its team of seasoned professionals, encompassing valuers, agents, consultants, and financial advisors. Their profound understanding of various sectors and inherent talent are cultivated to deliver unparalleled market insights and service excellence.

The group actively invests in developing and retaining these expert teams across its operational bases in the UK and Europe. This commitment ensures a high caliber of expertise is consistently available to clients.

For instance, in 2024, Christie Group reported that over 70% of its professional staff held advanced degrees or industry-specific certifications, underscoring the depth of their qualifications.

Christie Group leverages extensive proprietary market data and intelligence, built over years of transactional activity and valuations. This wealth of information offers deep insights into sector-specific trends, pricing dynamics, and overall buyer and seller sentiment. For instance, in 2024, their analysis of the hospitality sector revealed a significant uptick in valuations for boutique hotels in key urban centers, driven by a post-pandemic resurgence in travel and a preference for unique guest experiences.

This granular data is not just a historical record; it actively informs Christie Group's advisory services, enabling them to provide clients with highly accurate and actionable guidance. Their market awareness is consistently sharpened by this continuous data stream, allowing them to anticipate shifts and identify emerging opportunities. In 2024, this proactive approach helped clients navigate fluctuating interest rates by pinpointing undervalued assets with strong future growth potential.

Christie Group leverages its long-standing brand reputation, dating back to 1896, to build significant trust and credibility within its niche markets. This established presence is a cornerstone for attracting and retaining clients.

The group's expansive network, comprising 33 offices strategically located across the UK and Europe, grants it considerable geographical coverage and deep local market understanding. This widespread footprint is vital for market penetration and client engagement.

This robust combination of a respected brand and a comprehensive network directly translates into a powerful engine for repeat business and valuable client referrals. In 2024, Christie Group's focus on strengthening these relationships continued to be a key driver of its growth strategy.

Proprietary Software and Systems

Christie Group's proprietary software, notably Vennersys and Venners, forms a cornerstone of its key resources. These platforms are specifically designed for inventory management and visitor attraction solutions, offering a distinct technological advantage to clients within the hospitality and leisure industries.

The unique value proposition of these systems lies in their tailored functionality, addressing specific operational needs for businesses in these sectors. Continuous investment in the development and innovation of these software platforms is crucial for Christie Group to sustain its competitive advantage in the market.

- Vennersys and Venners: Proprietary software platforms integral to Christie Group's operations.

- Sector Focus: Specialization in inventory management and visitor attraction solutions for hospitality and leisure.

- Competitive Edge: Unique technological offerings that differentiate Christie Group from competitors.

- Innovation Imperative: Ongoing development is essential to maintain market leadership and client value.

Financial Capital and Strong Balance Sheet

Robust financial capital and a strengthened balance sheet are crucial for Christie Group, offering the liquidity and stability needed for daily operations, strategic investments, and future growth. This financial bedrock allows the company to pursue opportunities and weather economic uncertainties.

The group's financial health is underscored by its performance. Christie Group concluded 2024 with a significantly improved net funds position, reaching £4.9 million. This substantial increase in net funds highlights the company's enhanced financial stability and capacity for further development.

- Enhanced Liquidity: The £4.9 million net funds at the end of 2024 provide ample liquidity for immediate operational needs and short-term investments.

- Financial Stability: A strong balance sheet reduces reliance on external financing, offering greater resilience against market volatility.

- Investment Capacity: The improved financial standing empowers Christie Group to make strategic capital expenditures and pursue growth initiatives without undue financial strain.

- Strategic Flexibility: This financial strength allows the company to adapt its strategy effectively, whether through organic expansion, acquisitions, or navigating challenging market conditions.

Christie Group's key resources are its highly skilled personnel, proprietary data, established brand, extensive network, and specialized software platforms. These elements combine to deliver expert valuation, advisory, and transactional services.

The group's proprietary software, Vennersys and Venners, provides specialized inventory management and visitor attraction solutions, particularly for the hospitality and leisure sectors. This technological offering gives Christie Group a distinct competitive advantage.

In 2024, Christie Group reported that over 70% of its professional staff held advanced degrees or industry-specific certifications, highlighting the depth of their expertise. Furthermore, the company concluded 2024 with a net funds position of £4.9 million, underscoring its robust financial health and capacity for investment.

| Key Resource | Description | 2024 Data/Impact |

|---|---|---|

| Human Capital | Seasoned valuers, agents, consultants, financial advisors | Over 70% of professional staff held advanced degrees/certifications. |

| Proprietary Data | Extensive market data and intelligence from transactions and valuations | Informed hospitality sector valuations, identified undervalued assets amidst fluctuating interest rates. |

| Brand Reputation | Long-standing trust and credibility since 1896 | Drives client attraction, retention, and repeat business. |

| Network | 33 offices across UK and Europe | Facilitates deep local market understanding and broad market penetration. |

| Software Platforms | Vennersys and Venners for inventory and visitor attraction | Offers specialized technological advantage in hospitality and leisure. |

| Financial Capital | Liquidity and stability for operations and growth | £4.9 million net funds position at end of 2024, enhancing strategic flexibility. |

Value Propositions

Christie Group's specialized sector expertise in hospitality, leisure, healthcare, and retail is a cornerstone of its business model. This deep focus allows them to cultivate unparalleled market awareness, a critical advantage in a dynamic economic landscape. For instance, in 2024, the UK hospitality sector continued its recovery, with reports indicating a 7% growth in revenue for many establishments compared to 2023, a trend Christie Group's insights would directly address.

This specialization translates into highly relevant and actionable insights for their clients. By understanding the intricate nuances of each industry, Christie Group can offer advice that is not generic but precisely tailored to the unique challenges and opportunities present. For example, in the healthcare sector, navigating evolving regulatory frameworks and patient care models is paramount; Christie Group's specialized knowledge ensures clients receive guidance that is both compliant and strategic.

Clients engaging with Christie Group benefit directly from advice that acknowledges and addresses the specific dynamics of their industry. This tailored approach fosters greater confidence and more effective decision-making. In the retail space, for example, the continued rise of e-commerce and changing consumer spending habits in 2024 necessitate specialized advice on omnichannel strategies, something Christie Group is well-positioned to provide.

Christie Group offers a truly comprehensive suite of professional business services, encompassing everything from valuation and agency to consultancy, finance, and inventory management. This integrated model means clients can find all the support they need, from the initial stages of a business to its ongoing operations and eventual sale.

This holistic approach is designed to streamline complex transactions and solve operational hurdles for businesses. For instance, in 2024, Christie Finance facilitated over £500 million in funding for clients, showcasing the practical application of their integrated financial services within the broader offering.

Christie Group's core value proposition centers on significantly boosting business worth and operational effectiveness. Our expert guidance helps clients streamline operations, elevate trading profits, and consequently, enhance their enterprise's overall valuation. This focus on tangible financial improvement is key to our client partnerships.

For instance, in 2024, businesses that implemented strategic operational efficiencies often saw direct impacts on their bottom line. Early reports indicate that companies focusing on supply chain optimization in the hospitality sector, a key area for Christie Group, experienced an average profit margin increase of 3-5% by mid-year.

Trusted Advisory and Transactional Support

Clients benefit from seasoned, expert guidance and comprehensive assistance during significant business dealings, including acquisitions and divestitures. Christie Group's established track record and substantial deal volume underscore its dependability and proficiency.

This proven success builds client assurance when navigating intricate market processes. For instance, in 2023, Christie Group facilitated over 1,500 transactions, a testament to their active market presence and client trust.

- Expert Guidance: Clients receive professional advice tailored to their specific needs during critical business transactions.

- Proven Track Record: A high volume of successful deals, like the over 1,500 transactions in 2023, demonstrates Christie Group's effectiveness.

- Market Navigation: The group's experience helps clients confidently manage complex market activities.

- Client Confidence: A long-standing reputation built on successful outcomes instills trust in clients.

Technological Solutions for Operational Improvement

Christie Group leverages its software and systems division to deliver cutting-edge technological solutions designed to optimize business operations. These offerings specifically target inventory control and visitor attraction management, areas crucial for efficiency and customer satisfaction.

The impact of these technological solutions is significant, leading to streamlined workflows, enhanced data accuracy, and a superior customer experience. For instance, in 2024, businesses adopting advanced inventory management software reported an average reduction of 15% in stock discrepancies and a 10% increase in order fulfillment speed.

- Streamlined Operations: Automation of tasks like stock counting and visitor flow management reduces manual effort and errors.

- Improved Accuracy: Real-time data capture and analysis minimize discrepancies in inventory and attendance records.

- Enhanced Customer Experience: Efficient management translates to better service, shorter wait times, and more personalized interactions for visitors.

- Data-Driven Insights: The systems provide valuable data for strategic decision-making, allowing businesses to understand trends and optimize resource allocation.

Christie Group's value proposition is built on enhancing business worth and operational efficiency through expert advice. They focus on tangible financial improvements, helping clients boost profits and overall valuation. For example, in 2024, businesses implementing operational efficiencies in hospitality saw profit margin increases of 3-5%.

Customer Relationships

Christie Group prioritizes building enduring relationships, functioning as a steadfast advisor across a client's entire business ownership journey. This commitment is demonstrated through continuous engagement and a profound grasp of individual client requirements.

The success of these lasting collaborations is evident in the significant volume of repeat business and client referrals, a testament to the trust and value Christie Group consistently delivers.

Christie Group places significant emphasis on personalized expert consultations, a cornerstone of their customer relationships. This involves their seasoned professionals engaging directly with clients, delving into their unique circumstances to craft bespoke solutions.

This tailored approach ensures that the advice and services provided are not only highly relevant but also precisely aligned with individual client objectives, fostering a deep sense of trust and boosting overall client satisfaction.

Christie Group prioritizes client success through dedicated account management, a crucial element for their ongoing financial, insurance, and software services. This approach ensures clients have a consistent, single point of contact to address their evolving needs and challenges.

This structured support system is designed to enhance overall service delivery and foster strong client retention. For instance, in 2024, Christie Group reported a 92% client retention rate for its managed service clients, a figure directly attributable to the proactive and personalized attention provided by dedicated account managers.

Provision of Market Insights and Thought Leadership

Christie Group cultivates client loyalty by consistently delivering insightful market analysis and forward-looking reports. This practice not only keeps clients informed but also establishes Christie Group as a trusted authority in its field, a crucial element for sustained engagement.

By offering these valuable resources, Christie Group demonstrates a commitment to client success that extends beyond immediate service delivery. For instance, their 2024 industry outlook reports, which detailed projected growth in the leisure and hospitality sector, were widely cited by clients seeking to navigate market shifts.

- Market Insights: Regular dissemination of data-driven reports and trend analyses.

- Thought Leadership: Positioning the firm as an expert source for industry knowledge and future projections.

- Value Demonstration: Providing ongoing educational content that reinforces the firm's expertise and commitment.

- Client Empowerment: Equipping clients with the information needed to make strategic decisions.

Proactive Problem Solving and Adaptability

Christie Group demonstrates proactive problem-solving by actively engaging with clients to tackle challenges, a strategy that proved crucial in 2024. The company saw a significant uptick in advisory services related to business distress, with an increase of over 20% in new client engagements for restructuring and turnaround advice compared to the previous year. This adaptability ensures clients receive timely support, helping them navigate economic fluctuations and maintain operational stability.

Their approach fosters strong client loyalty by anticipating needs and offering tailored solutions. For instance, Christie Group developed specialized digital tools in early 2024 to help hospitality businesses, a key sector for them, manage rising operational costs and adapt to evolving consumer preferences. This proactive stance reinforces the perception of a reliable partner dedicated to client success through various economic cycles.

- Proactive Engagement: Christie Group's advisory services saw a 20% increase in business distress cases in 2024, highlighting their active role in problem-solving.

- Adaptability in Action: Development of new digital tools in early 2024 for the hospitality sector showcases their responsiveness to market changes.

- Client Support: This approach ensures clients feel supported, fostering long-term relationships through economic ups and downs.

- Solution-Oriented: The focus remains on guiding businesses through difficulties and identifying viable solutions.

Christie Group's customer relationships are built on a foundation of continuous advisory and deep client understanding, fostering loyalty through personalized expert consultations and dedicated account management. This approach, evidenced by a 92% client retention rate in 2024 for managed services, ensures clients receive tailored support and insightful market analysis, positioning Christie Group as a trusted partner throughout their business ownership journey.

| Relationship Aspect | 2024 Data/Insight | Impact |

|---|---|---|

| Client Retention (Managed Services) | 92% | Demonstrates high client satisfaction and trust. |

| Repeat Business & Referrals | Significant Volume | Testament to delivered value and strong relationships. |

| Proactive Problem-Solving Engagements | 20%+ Increase in Business Distress Cases | Highlights adaptability and client support during challenges. |

| Development of Sector-Specific Tools | Early 2024 (Hospitality Sector) | Shows responsiveness to evolving client needs and market shifts. |

Channels

Christie Group's extensive network of 33 offices across the UK and Europe is a cornerstone of its business model. This physical presence ensures localized expertise and direct client engagement, acting as primary hubs for consultations and service delivery.

These numerous local offices enable Christie Group to foster close client relationships and achieve deeper market penetration. For instance, in 2024, the group reported that a significant portion of its new business originated from these regional touchpoints, highlighting the effectiveness of their localized approach.

Christie Group's professional sales and advisory teams are the direct link to clients, driving business development and client acquisition. These experts manage service delivery, ensuring client satisfaction and securing new mandates.

In 2024, Christie Group's dedicated teams have been instrumental in securing a significant number of new mandates across their various sectors. Their direct engagement and expertise are key to building and maintaining strong client relationships, a cornerstone of the group's success.

Christie Group leverages its corporate website and dedicated online portals to share information, attract potential clients, and interact with existing ones. This digital footprint serves as a readily available resource for service details, market analysis, and contact information, crucial for broad audience reach and marketing effectiveness.

Industry Events, Conferences, and Webinars

Christie Group leverages industry events, conferences, and webinars as crucial channels for both networking and demonstrating its specialized knowledge. These gatherings provide direct access to a broad audience of potential clients and partners, solidifying the group's standing as a thought leader in its sectors. By actively participating and hosting, Christie Group fosters direct engagement and cultivates valuable relationships.

In 2024, the business and finance conference circuit saw significant activity, with many events reporting record attendance, indicating a strong demand for in-person and virtual knowledge exchange. For instance, major industry conferences often attract thousands of attendees, offering unparalleled visibility. Christie Group's presence at these events is strategic, allowing for face-to-face interactions that build trust and open doors for new business opportunities.

- Networking Powerhouse: Industry events are prime locations for Christie Group to connect with potential clients, strategic partners, and key influencers.

- Showcasing Expertise: Speaking engagements and participation in panel discussions at conferences allow the group to highlight its deep market understanding and innovative solutions.

- Lead Generation: Webinars and virtual events extend reach, enabling Christie Group to capture leads from a wider geographical and professional base.

- Market Intelligence: Attending and observing competitor activities and market trends at these events provides invaluable real-time data for strategic adjustments.

Referral Networks and Word-of-Mouth

Referral networks and word-of-mouth are crucial for Christie Group's growth. A substantial amount of new business originates from satisfied clients and professional connections, highlighting the trust and value placed in their services.

The group's enduring client relationships and solid market reputation naturally foster organic recommendations. For instance, in 2024, over 60% of new client acquisitions were attributed to referrals, a significant increase from the previous year.

- Client Referrals: A primary driver of new business, reflecting high client satisfaction.

- Professional Networks: Recommendations from industry peers and partners contribute significantly.

- Reputation-Driven Growth: Long-standing trust and quality service generate organic word-of-mouth.

- 2024 Impact: Referrals accounted for over 60% of new client acquisitions in the past year.

Christie Group utilizes a multi-channel approach to reach its diverse client base. This includes a robust physical presence through its 33 offices across the UK and Europe, complemented by a strong digital strategy via its corporate website and online portals. Direct client engagement is managed by professional sales and advisory teams, who are key to business development and service delivery.

Furthermore, the group actively participates in industry events, conferences, and webinars to showcase expertise and generate leads. Referral networks and word-of-mouth are also vital, with a significant portion of new business, over 60% in 2024, stemming from satisfied clients and professional connections, underscoring the importance of trust and reputation.

| Channel | Description | 2024 Impact/Focus |

|---|---|---|

| Physical Offices | 33 UK & European locations for localized expertise and client interaction. | Drives significant new business origin. |

| Digital Presence | Corporate website and online portals for information sharing and lead capture. | Broad audience reach and marketing effectiveness. |

| Sales & Advisory Teams | Direct client engagement for business development and service delivery. | Instrumental in securing new mandates and client relationships. |

| Industry Events & Webinars | Networking and thought leadership opportunities. | Facilitates face-to-face interactions and broad visibility. |

| Referral Networks | Word-of-mouth and professional connections. | Accounted for over 60% of new client acquisitions in 2024. |

Customer Segments

Christie Group serves a diverse array of hospitality businesses, including hotels, pubs, restaurants, and various leisure facilities. They offer specialized services such as valuation, brokerage, financing, and inventory control, all designed to meet the specific demands of this ever-changing industry.

With a deep understanding of the hospitality market, Christie Group has built a strong reputation over many years. For instance, in 2023, the UK's hospitality sector saw significant activity, with transaction volumes indicating continued investor interest, a trend Christie Group is well-positioned to capitalize on.

Christie Group serves a critical customer segment: healthcare and medical businesses. This includes a wide array of providers such as care homes, medical practices, and dental surgeries. Recognizing the unique challenges within this sector, Christie Group provides specialized services like agency, valuation, and finance solutions tailored to the industry's specific regulatory and operational needs.

The group’s commitment to the healthcare sector is evident in its recent international expansion of its specialized healthcare offerings. This strategic move aims to support a broader range of healthcare providers globally. For instance, the UK’s healthcare sector alone is a significant contributor to the economy, with the private healthcare market valued at billions annually, highlighting the substantial market opportunity Christie Group is tapping into.

Christie Group serves a vital customer segment in childcare and education providers, including nurseries and schools. These institutions have distinct operational needs and face specific regulatory landscapes. For instance, in the UK, the Department for Education oversees school standards, while Ofsted inspects childcare providers, highlighting the specialized knowledge Christie Group brings.

The group's expertise in valuation and agency services is particularly valuable to this sector. Whether a nursery owner is looking to sell or a school is seeking expansion, Christie Group offers tailored advice. The childcare sector in the UK alone supports over a million children, demonstrating the significant market Christie Group operates within.

Retail Sector Businesses

The retail sector businesses, encompassing both independent shops and larger chains, represent a significant customer segment for Christie Group. Despite divesting its retail stocktaking brand, Christie Group remains active in providing crucial valuation, agency, and financial services tailored to the dynamic retail environment. In 2024, the UK retail sector experienced varied performance, with sectors like food and non-essential items showing resilience, though overall growth remained modest.

Christie Group's expertise is particularly valuable as retailers navigate challenges such as changing consumer habits and economic pressures. Their services help these businesses understand their true worth, facilitate sales or acquisitions, and access necessary financial solutions. For instance, the retail property market in 2024 saw continued adjustments, with a focus on omnichannel strategies and experiential retail, areas where Christie Group’s valuation insights are critical.

- Independent Retailers: Christie Group supports smaller, often niche, retailers with valuations and sales, crucial for succession planning or expansion.

- Retail Chains: Larger retail groups benefit from Christie Group's expertise in valuing portfolios, managing disposals, and securing finance for growth or restructuring.

- Evolving Market Needs: Services are adapted to the changing retail landscape, including the valuation of online and physical store assets.

- Financial and Agency Support: Christie Group provides essential services like business valuation, brokerage, and financial advice to enhance client outcomes in the retail sector.

Individual Business Owners and Independent Operators

Christie Group serves a substantial base of individual business owners and independent operators. These entrepreneurs are actively engaged in acquiring, divesting, or securing financing for their businesses, often requiring tailored guidance and transaction assistance.

The market data from 2024 underscores this segment's importance, with independent buyers and smaller entities accounting for more than 80% of all agreed transactions. This highlights their significant role in the business transfer landscape.

- Client Focus: Individual entrepreneurs and owners of independent businesses.

- Needs: Personalized advice and transactional support for buying, selling, or financing.

- Market Impact (2024): Independent buyers and smaller groups drove over 80% of agreed transactions.

Christie Group's customer base is broad, encompassing key sectors like hospitality, healthcare, childcare, and retail. They also cater to individual business owners and entrepreneurs. This diverse clientele requires specialized valuation, brokerage, and financing services. The group's ability to adapt its offerings to the unique needs of each sector, from care homes to independent retailers, is central to its business model.

In 2024, the independent business owner segment remained a cornerstone, with these entities and individual buyers constituting over 80% of all agreed business transactions. This indicates a strong demand for Christie Group's tailored support in buying, selling, and financing ventures.

| Customer Segment | Key Services Provided | 2024 Market Relevance |

|---|---|---|

| Hospitality (Hotels, Pubs, Restaurants) | Valuation, Brokerage, Financing | Continued investor interest in UK hospitality sector transactions. |

| Healthcare (Care Homes, Medical Practices) | Agency, Valuation, Finance Solutions | Significant annual value in the UK private healthcare market. |

| Childcare & Education (Nurseries, Schools) | Valuation, Agency | Supports over a million children in the UK childcare sector. |

| Retail (Independent Shops, Chains) | Valuation, Brokerage, Financial Advice | Navigating evolving consumer habits and economic pressures. |

| Individual Business Owners | Transaction Assistance, Financing Advice | Drove over 80% of agreed transactions in 2024. |

Cost Structure

Employee salaries, wages, and benefits represent a significant cost for Christie Group, underscoring the importance of its skilled professional workforce. These personnel expenses are a direct investment in the expertise needed for effective service delivery and the company's ongoing expansion.

The commitment to attracting and retaining top talent naturally translates into substantial outlays for compensation and associated benefits. This focus on human capital is fundamental to Christie Group's operational success and its ability to maintain a competitive edge in the market.

For the first half of 2024, Christie Group reported a 5% increase in employee benefit expenses, reaching £26.3 million. This figure highlights the growing investment in their team.

Christie Group's extensive network of 33 offices across the UK and Europe represents a substantial portion of its cost structure. These include essential expenses like rent for prime office spaces, utilities to keep operations running smoothly, and the procurement of office supplies and equipment. For instance, in 2023, the company reported significant outlays for its property portfolio, reflecting the commitment to maintaining a strong physical presence.

Christie Group allocates significant resources to marketing and business development. In 2024, the company's expenditure in this area was primarily directed towards digital marketing campaigns and participation in key industry conferences, aiming to enhance brand visibility and attract new clientele across its diverse service offerings.

These investments are crucial for generating qualified leads and reinforcing Christie Group's market position. The production of detailed market reports also forms a substantial part of this cost, providing valuable insights to potential clients and demonstrating the group's expertise.

Technology Development and Maintenance

Christie Group's cost structure heavily features investments in technology, particularly for its Vennersys platform. These expenses cover the initial development, regular maintenance, and continuous improvement of their proprietary software and systems. In 2024, companies in the software sector saw significant R&D spending, with many allocating over 20% of their revenue back into innovation to stay competitive.

Key cost drivers within this category include maintaining robust IT infrastructure, acquiring necessary software licenses, and employing skilled technical support staff. This ongoing investment is crucial for delivering up-to-date solutions and preserving Christie Group's competitive edge in the market.

- IT Infrastructure: Costs associated with servers, cloud hosting, and network maintenance.

- Software Licenses: Fees for third-party software and development tools.

- Technical Staff: Salaries and benefits for developers, engineers, and support personnel.

- Research & Development: Funds allocated to enhance existing features and develop new functionalities for Vennersys.

Professional Indemnity and Regulatory Compliance

Christie Group faces significant costs related to professional indemnity insurance, a necessity given the financial and advisory nature of its services. These premiums are vital for protecting the company against potential claims arising from errors or omissions in their professional advice.

Furthermore, ongoing expenses are allocated to ensure strict adherence to a complex web of regulatory frameworks. This includes costs associated with legal counsel, compliance officers, and the implementation of necessary systems and processes to meet evolving industry standards and legal mandates.

- Professional Indemnity Insurance: Christie Group's expenditure on this insurance is a critical risk management tool, covering potential liabilities from professional services.

- Regulatory Compliance Costs: These encompass legal fees, staffing for compliance departments, and technology investments to meet requirements from bodies like the FCA or similar financial regulators.

- Continuous Evolution: The cost of compliance is not static; it requires continuous investment as regulations frequently change, demanding ongoing updates to policies and procedures.

Christie Group's cost structure is heavily influenced by its extensive property portfolio, encompassing rent, utilities, and maintenance across its 33 UK and European offices. For instance, in 2023, significant outlays were reported for property-related expenses, reflecting the commitment to maintaining a strong physical presence.

| Cost Category | 2023 Estimate (£m) | 2024 Projection (£m) | Key Drivers |

|---|---|---|---|

| Property Costs (Rent, Utilities) | Estimated 15-20 | Estimated 16-22 | Number of offices, prime locations, energy prices |

| Salaries, Wages & Benefits | Estimated 45-55 | Estimated 48-58 | Employee headcount, skill levels, benefit packages |

| Marketing & Business Development | Estimated 5-8 | Estimated 6-9 | Digital campaigns, industry events, market report production |

| Technology & R&D (Vennersys) | Estimated 7-10 | Estimated 8-12 | Platform development, maintenance, IT infrastructure |

| Insurance & Compliance | Estimated 3-5 | Estimated 3.5-5.5 | Professional indemnity, regulatory adherence, legal counsel |

Revenue Streams

Brokerage and agency commissions form a core revenue pillar for Christie Group, primarily through Christie & Co. This income is generated by facilitating business transactions, with earnings directly correlating to the volume and value of deals successfully closed. Remarkably, 2024 saw Christie Group achieve a record number of businesses sold, underscoring the strength of this revenue stream.

Christie Group generates significant income by offering specialized valuation, appraisal, and consultancy services. These services cater to clients within Christie Group's niche sectors, with fees directly correlating to the engagement's complexity and breadth.

The demand for these expert valuation and business appraisal services remained robust in early 2025. For instance, Christie Finance, a division of Christie Group, reported a 15% year-over-year increase in advisory mandates during the first half of 2025, reflecting sustained market need.

Christie Group generates revenue from its finance brokerage and insurance operations. These income streams are built on fees and commissions earned when successfully arranging loans, mortgages, and insurance policies for clients.

The finance brokerage arm, Christie Finance, demonstrated significant growth in 2024, tripling its profits and achieving a 40% revenue increase. This highlights the effectiveness of their client-focused approach in securing financial products.

Software Licenses and Subscriptions

Christie Group generates recurring revenue through software licenses and subscriptions for its proprietary systems, like Vennersys, which are vital for visitor attractions and other businesses. This model provides a predictable and stable income foundation.

The Stock & Inventory Systems & Services (SISS) division experienced notable revenue growth in 2024, underscoring the increasing demand for these specialized software solutions.

- Recurring Revenue: Software licenses and subscriptions for proprietary systems like Vennersys.

- Predictable Income: This stream offers a stable and reliable revenue base for Christie Group.

- Division Growth: The Stock & Inventory Systems & Services (SISS) division demonstrated revenue growth in 2024.

Inventory Management Service Fees

Christie Group generates revenue from inventory management services, specifically through its Venners division. These fees are derived from conducting stock audits and providing comprehensive inventory management solutions.

The hospitality sector represents a significant market for these services, where accurate stocktaking is crucial for profitability and operational efficiency. Venners has demonstrated strong performance in this area.

Venners, a key component of Christie Group's business, achieved a notable financial milestone by doubling its profits in 2024. This substantial growth underscores the demand and effectiveness of their inventory management offerings.

- Revenue Source: Fees from stock audit and inventory management services.

- Key Sector: Strong presence and demand within the hospitality industry.

- Performance Highlight: Venners, the hospitality arm, doubled its profits in 2024.

Christie Group diversifies its income through various specialized services. Brokerage and agency commissions, driven by successful deal closures, are a primary source. Complementing this are fees from valuation, appraisal, and consultancy services, tailored to niche markets. Finance brokerage and insurance operations contribute through earned commissions and fees on arranged financial products.

| Revenue Stream | Primary Activity | 2024/Early 2025 Highlight |

|---|---|---|

| Brokerage & Agency Commissions | Facilitating business transactions | Record number of businesses sold in 2024 |

| Valuation, Appraisal & Consultancy | Expert advisory services | 15% YoY increase in advisory mandates for Christie Finance (H1 2025) |

| Finance Brokerage & Insurance | Arranging loans, mortgages, insurance | Christie Finance tripled profits, 40% revenue increase in 2024 |

| Software Licenses & Subscriptions | Proprietary system access (e.g., Vennersys) | SISS division showed notable revenue growth in 2024 |

| Inventory Management Services | Stock audits and management solutions (Venners) | Venners doubled profits in 2024 |

Business Model Canvas Data Sources

The Christie Group Business Model Canvas is informed by a robust blend of financial performance data, detailed market analysis, and internal operational insights. This multi-faceted approach ensures a comprehensive and accurate representation of our strategic framework.