Christie Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Christie Group Bundle

Navigate the complex external landscape impacting Christie Group with our meticulously crafted PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces at play, giving you a crucial competitive advantage. Equip yourself with actionable intelligence to anticipate challenges and seize opportunities. Download the full version now for strategic clarity.

Political factors

The UK government's approach to business rates and taxation presents a direct influence on Christie Group's key markets. For instance, the planned reduction in business rates relief for the retail, hospitality, and leisure sectors from 75% to 40% for the 2025-2026 period will increase operating expenses for many of Christie Group's clients.

These fiscal adjustments can alter investment appetite and business expansion plans within these sectors, consequently impacting demand for Christie Group's valuation and advisory services. For example, a higher tax burden might lead businesses to postpone property acquisitions or disposals, areas where Christie Group provides crucial expertise.

Government-mandated increases to the National Living Wage and National Minimum Wage are directly impacting labor costs for businesses within the hospitality and retail sectors, key client bases for Christie Group. For instance, the National Living Wage is set to increase to £11.44 per hour from April 2024, a significant rise that directly elevates payroll expenses for employers.

These rising employment costs, coupled with potential changes in employer National Insurance Contributions (NICs), can exert considerable pressure on profit margins for Christie Group's clients. This squeeze may limit their capacity to invest in essential services, property upgrades, or expansion, potentially affecting demand for Christie Group's advisory and transactional services.

Government policies and funding for the UK and European healthcare sectors are crucial for Christie Group, as they directly shape investment and operational activity. For instance, the UK government's commitment to increasing the NHS budget, with a projected £159 billion for 2024-2025, signals continued demand for healthcare infrastructure and services, a key market for Christie Group.

Shifts in healthcare infrastructure expansion, such as the development of new hospitals and community care facilities, alongside evolving reimbursement rates for medical services, present both opportunities and potential headwinds. The increasing emphasis on digital health integration, spurred by initiatives like the NHS Long Term Plan which aims to digitize patient records and expand telehealth services, could create new avenues for Christie Group's advisory and transactional services within the healthcare segment.

Brexit and Trade Policies

The enduring consequences of Brexit continue to shape the United Kingdom's trade relationships, potentially impacting Christie Group's cross-border activities. Changes in tariffs or new trade regulations between the UK and the EU could influence the valuation of businesses and the volume of transactions within Christie Group's purview. For instance, the UK's trade deficit with the EU widened to £102.8 billion in 2023, highlighting ongoing adjustments in trade flows.

Labor mobility restrictions stemming from Brexit may also affect the availability of skilled professionals within the sectors Christie Group operates in. Furthermore, shifts in investment patterns between the UK and European markets, influenced by post-Brexit policies, could alter the landscape for mergers and acquisitions.

- Brexit's impact on UK-EU trade: The UK's trade in goods with the EU in 2023 saw exports valued at £178.7 billion and imports at £281.5 billion.

- Potential for new tariffs: Any introduction of new tariffs could increase operational costs for businesses and affect their market valuations.

- Labor market adjustments: Changes in immigration rules may influence the availability of specialized talent crucial for certain business transactions.

Regulatory Environment for Property Transactions

The regulatory environment significantly impacts Christie Group's property transaction services. Changes in planning policies and land use regulations, such as those seen in the UK's Levelling-Up agenda aiming to streamline development, can alter the volume and complexity of valuations and agency work. For instance, government incentives for brownfield development or affordable housing projects directly influence market activity and the demand for Christie Group's expertise.

Policies that encourage specific property conversions, like the UK government's relaxed planning rules for office-to-residential conversions, can unlock new revenue streams. In 2024, the UK government continued to explore measures to boost housing supply, which could lead to increased transaction volumes and a greater need for specialized valuation services. These shifts require Christie Group to remain agile in adapting its service offerings to capitalize on emerging market opportunities driven by regulatory adjustments.

- UK Planning Reforms: Ongoing reforms in England, like the proposed changes to the National Planning Policy Framework (NPPF) in early 2024, aim to accelerate development, potentially increasing property transaction volumes.

- Office-to-Residential Conversions: Government support for these conversions, evidenced by previous planning permission exemptions, creates demand for valuations of mixed-use and residential assets.

- Environmental Regulations: Stricter environmental standards for new builds and renovations, a growing focus in 2024-2025, will impact development feasibility and necessitate specialized advice on compliance.

Government fiscal policies, including changes to business rates and taxation, directly influence Christie Group's client base. For example, the planned reduction in business rates relief for retail and hospitality sectors from 75% to 40% for 2025-2026 will increase costs for many clients, potentially impacting their investment decisions and demand for advisory services.

Increases in the National Living Wage, such as the rise to £11.44 per hour from April 2024, directly escalate labor costs for businesses, particularly within hospitality and retail. This, combined with potential shifts in National Insurance Contributions, can pressure client profit margins and their capacity for expansion or property transactions.

Government spending on healthcare, like the UK's projected £159 billion NHS budget for 2024-2025, signals continued activity in healthcare infrastructure development. Evolving digital health initiatives, such as expanding telehealth services, also create new opportunities for Christie Group's advisory and transactional expertise in this sector.

Regulatory shifts, such as UK planning policy reforms aimed at streamlining development and incentives for office-to-residential conversions, significantly impact property transaction volumes. For instance, proposed changes to the National Planning Policy Framework in early 2024 aim to accelerate development, potentially boosting demand for Christie Group's valuation and agency services.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the Christie Group, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into how these forces create both challenges and strategic advantages for the organization.

Provides a concise version of the Christie Group PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors.

Economic factors

Central bank policy shifts, particularly by the Bank of England and the European Central Bank, directly influence borrowing costs for businesses within Christie Group's operational sectors. For instance, a projected interest rate cut in the UK during 2025, following a period of elevated rates, could significantly reduce the cost of capital, thereby stimulating new investments and property market transactions.

Conversely, periods of rising interest rates, as seen in late 2023 and early 2024, tend to dampen mergers and acquisitions (M&A) activity by making financing more expensive. This also increases the debt servicing burden for companies, potentially impacting their ability to undertake strategic growth initiatives or property acquisitions.

Consumer confidence and the ability to spend are really important for businesses in hospitality, leisure, and retail. When people feel good about the economy and their own finances, they tend to spend more. This directly affects the revenue of companies Christie Group works with.

The ongoing cost-of-living challenges have made many consumers more careful with their money. They're actively looking for good value and are less likely to splurge. This cautious approach means Christie Group's clients might see lower demand for their services as their customers tighten their belts.

For example, in early 2024, consumer confidence indices in the UK, a key market for Christie Group, showed signs of improvement but remained sensitive to inflation and interest rate changes. This suggests that while people might be a little more optimistic, their actual spending power is still a major consideration, impacting how much discretionary spending is available for leisure and hospitality.

Inflationary pressures continue to significantly impact operational costs for businesses within Christie Group's purview. Sectors like hospitality and leisure are grappling with escalating energy prices, increased rental agreements, and persistent supply chain disruptions, all contributing to higher overheads.

While broader inflation is projected to moderate, service sector inflation, especially driven by labor costs, presents an ongoing hurdle. For instance, the UK's Services PMI for May 2024 indicated a rise in input costs, with many firms reporting higher wage bills, which directly squeezes profit margins and challenges the long-term viability of many businesses.

Real Estate Market Activity and Investment Volumes

The health of the real estate market, particularly investment volumes and transaction activity across the UK and Europe, is a critical factor for Christie Group's valuation and agency businesses. A noticeable uptick in property investment activity is expected in 2025, fueled by a narrowing gap between what buyers are willing to pay and what sellers expect, alongside a potentially more accessible cost of capital.

For instance, in 2024, the UK commercial real estate investment market saw a significant slowdown, with transaction volumes dropping considerably compared to previous years. However, early indicators for 2025 suggest a more positive trend.

Key drivers for this anticipated recovery include:

- Improving Economic Sentiment: A more stable economic outlook generally boosts investor confidence.

- Interest Rate Stabilization: A plateau or slight decrease in interest rates can make financing more attractive, encouraging investment.

- Yield Adjustments: Real estate yields are expected to become more competitive relative to other asset classes, drawing capital back into property.

Economic Growth and GDP Outlook

The broader economic growth outlook for the UK and European markets directly shapes the operating environment for Christie Group and its clientele. For 2025, the UK's Gross Domestic Product (GDP) growth is anticipated to remain subdued, falling below its historical average. This slower domestic growth could present challenges for businesses reliant on the UK market.

Conversely, improved economic expansion in the Euro Area and other Western European nations offers a more optimistic scenario for Christie Group's European ventures. For instance, the International Monetary Fund (IMF) projected Euro Area GDP growth at 1.7% for 2025, a notable uptick from previous forecasts, which could translate into increased transaction volumes and client activity for Christie Group across the continent.

- UK GDP Growth Forecast (2025): Projected to be below average, indicating a potentially slower domestic market.

- Euro Area GDP Growth Forecast (2025): Expected to be around 1.7%, suggesting a more robust economic environment in key European markets.

- Impact on Christie Group: Positive economic trends in Europe can bolster European operations, while slower UK growth may necessitate strategic adjustments.

- Clientele Benefit: Stronger European economies can lead to increased investment and M&A activity, benefiting Christie Group's clients.

Economic factors significantly influence Christie Group's performance, with central bank policies impacting borrowing costs and M&A activity. Consumer confidence, though showing signs of recovery in early 2024, remains sensitive to inflation, affecting discretionary spending in hospitality and leisure sectors.

Inflationary pressures continue to raise operational costs, particularly in services due to rising labor expenses, as indicated by UK Services PMI data in May 2024. The real estate market is showing signs of recovery for 2025, with investment volumes expected to increase due to stabilizing interest rates and competitive yields.

While UK GDP growth is forecast to be subdued in 2025, the Euro Area's economic expansion, projected at 1.7% by the IMF, presents a more optimistic outlook for Christie Group's European operations.

| Economic Factor | 2024 Trend/Outlook | 2025 Forecast/Impact |

|---|---|---|

| Interest Rates | Elevated, dampening M&A | Potential cuts improving cost of capital |

| Consumer Confidence | Improving but sensitive to inflation | Cautious spending impacting leisure/hospitality |

| Inflation | Persistent, especially services/labor | Moderating but service inflation remains a hurdle |

| UK GDP Growth | Subdued | Expected to remain below historical average |

| Euro Area GDP Growth | Improving | Projected at 1.7% by IMF |

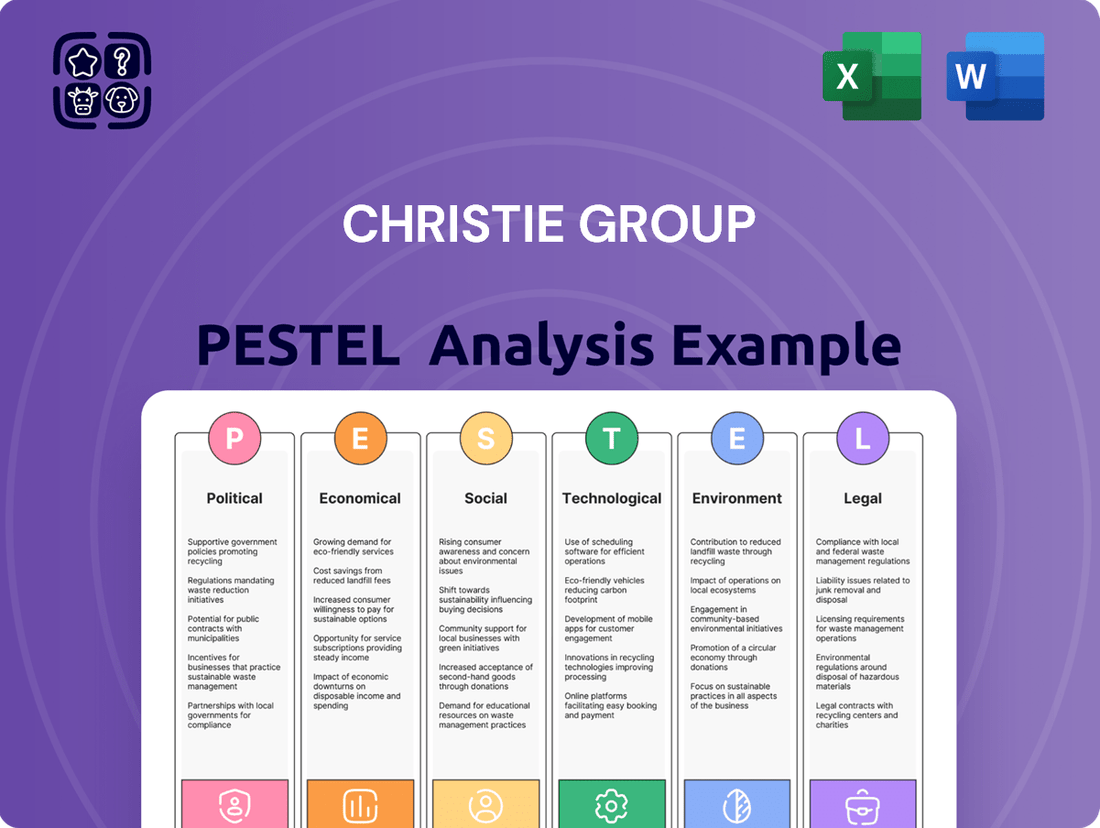

Preview Before You Purchase

Christie Group PESTLE Analysis

The preview shown here is the exact Christie Group PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. It details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Christie Group.

The content and structure shown in the preview is the same document you’ll download after payment, providing a comprehensive overview for strategic decision-making.

Sociological factors

Consumer preferences are definitely shifting. We're seeing a greater emphasis on getting good value, especially in hospitality and retail, which directly impacts how businesses like those Christie Group serves operate. On top of that, there's a growing desire for products and services that are kinder to the environment, pushing companies to rethink their sourcing and operations.

Demographics are also playing a huge role. The population is aging, and this isn't just a trend; it's creating significant opportunities. This demographic shift is fueling substantial growth in the healthcare sector, leading to increased demand for services and products that cater to older adults.

The availability and cost of skilled labor in sectors like hospitality, healthcare, and retail are crucial sociological considerations. For instance, in the UK, the hospitality sector faced significant staffing challenges post-pandemic, with reports indicating a shortage of around 160,000 workers by early 2024, driving up wage demands.

These labor shortages and increasing employment costs directly influence business strategies, pushing companies to prioritize staff retention and operational efficiencies. This trend impacts Christie Group by increasing demand for consultancy services focused on optimizing workforce management and inventory control to mitigate rising labor expenses.

Consumers are increasingly shifting their spending towards experiences rather than material goods. This is particularly evident in sectors like travel and hospitality. For instance, global tourism spending reached an estimated $1.3 trillion in 2024, a significant increase from pre-pandemic levels, highlighting this trend.

This growing preference for experiential consumption directly benefits leisure and hospitality businesses. Christie Group can leverage this by offering specialized advisory and valuation services for properties involved in these experience-driven formats, such as boutique hotels, unique event venues, or adventure tourism facilities.

Urban vs. Regional Demand Shifts

The pandemic and the rise of remote work have significantly altered demand patterns between urban centers and regional areas. While major cities like London have seen a robust rebound in hotel occupancy, often boosted by large-scale events, many provincial locations are experiencing a slower, more uneven recovery. This divergence necessitates a careful recalibration of Christie Group's geographical focus and strategic approaches for its agency and valuation services.

For instance, London's hotel occupancy rates reached approximately 80% in early 2024, a strong indicator of its recovery driven by business travel and events. Conversely, some regional markets are still working to regain pre-pandemic levels, with occupancy rates hovering around 60-70% depending on local economic drivers and tourism appeal. This creates a dynamic where:

- Urban centers are attracting renewed investment interest due to higher occupancy and RevPAR (Revenue Per Available Room).

- Regional markets require tailored strategies that may focus on niche tourism or specific local economic strengths.

- Christie Group's valuation services must account for these localized demand fluctuations to provide accurate assessments.

- Agency services need to adapt by identifying and capitalizing on the unique opportunities present in both recovering urban and developing regional hospitality sectors.

Health and Wellbeing Focus

A significant societal shift towards prioritizing health and wellbeing is reshaping consumer behavior and service demands across various industries. This heightened awareness translates into a greater demand for preventative healthcare, routine medical check-ups, and the adoption of innovative digital health platforms. For Christie Group, whose expertise lies within the healthcare sector, this trend presents a substantial opportunity for growth as demand for their specialized services is likely to increase.

The global digital health market is a prime example of this evolution. Valued at approximately $200 billion in 2023, it's projected to reach over $600 billion by 2029, demonstrating a clear consumer and industry embrace of technology in health management. This growth trajectory indicates a strong market appetite for solutions that promote wellness and facilitate easier access to healthcare services, directly benefiting companies like Christie Group that are positioned to capitalize on these advancements.

- Increased Demand for Preventative Care: Consumers are proactively seeking services that help them stay healthy, leading to higher utilization of wellness programs and early detection services.

- Growth in Digital Health Solutions: The market for telehealth, remote patient monitoring, and health apps is expanding rapidly, offering new avenues for service delivery and engagement.

- Focus on Mental Wellbeing: Societal recognition of mental health's importance is driving demand for related services and support systems.

- Personalized Health Approaches: Individuals are increasingly seeking tailored health advice and treatments based on their unique genetic makeup and lifestyle, fostering innovation in personalized medicine.

Societal attitudes towards work-life balance are evolving, with a growing segment of the workforce seeking greater flexibility and purpose in their careers. This impacts sectors like hospitality and retail, where staffing models are being re-evaluated to attract and retain talent. The emphasis on employee wellbeing is also a key consideration, influencing operational costs and business strategies.

The increasing demand for sustainable and ethically sourced products is a significant sociological driver. Consumers are more informed and vocal about their preferences, pushing businesses to adopt greener practices and transparent supply chains. This trend is particularly pronounced in food and beverage, influencing sourcing and operational decisions for hospitality businesses.

Shifting consumer preferences towards experiences over material possessions continue to shape the market, especially in leisure and hospitality. Global tourism spending in 2024 reached approximately $1.3 trillion, underscoring this trend and creating opportunities for businesses offering unique experiences.

The aging demographic presents substantial growth opportunities, particularly in healthcare and related services. This demographic shift fuels demand for specialized care and products catering to older adults, impacting service delivery and investment in the sector.

Technological factors

Technological advancements, especially in AI, machine learning, and computer vision, are fundamentally reshaping how properties are valued, leading to greater efficiency, accuracy, and transparency. These innovations are crucial for firms like Christie Group to stay competitive in the evolving proptech landscape.

Integrating sophisticated tools such as automated valuation models (AVMs) and AI-powered analytics is no longer optional but a necessity for providing robust and reliable property valuations. For instance, by mid-2024, the global proptech market was projected to reach over $30 billion, with AVMs playing a significant role in streamlining the valuation process.

The digital transformation wave is reshaping key client sectors for Christie Group. In retail, for instance, the global retail analytics market was valued at approximately USD 10.5 billion in 2023 and is projected to reach USD 30.6 billion by 2030, showcasing a significant shift towards data-driven decision-making. This surge fuels demand for AI-powered tools that optimize inventory, personalize customer experiences, and streamline operations.

Similarly, the hospitality industry is witnessing accelerated adoption of digital solutions. The global hospitality technology market size was valued at USD 20.3 billion in 2023 and is expected to grow at a CAGR of 12.5% from 2024 to 2030. This includes everything from contactless check-ins and AI-powered customer service bots to sophisticated property management systems, all aimed at enhancing guest experiences and operational efficiency.

The healthcare sector's digital evolution is equally profound, with digital health integration becoming paramount. The digital health market was valued at USD 236.8 billion in 2023 and is anticipated to expand to USD 847.2 billion by 2030, growing at a CAGR of 20.0%. This includes telemedicine, electronic health records, and AI in diagnostics, all demanding robust IT infrastructure and specialized software, areas where Christie Group's expertise is crucial.

As businesses increasingly digitize, cybersecurity is no longer optional, especially for firms like Christie Group that manage sensitive client data in sectors like healthcare and retail. The escalating sophistication of cyber threats means robust defenses are critical to safeguarding proprietary information and maintaining client confidence.

The global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, underscoring the immense financial risk associated with data breaches. Christie Group's reliance on digital platforms for its consultancy and software services necessitates continuous investment in advanced cybersecurity protocols to prevent breaches and protect its reputation.

Integration of AI and Automation in Operations

The hospitality and retail industries are increasingly adopting AI and automation to optimize costly operations. This includes AI-driven staff scheduling, self-service check-in kiosks, and automated inventory tracking, all aimed at boosting efficiency and reducing labor expenses. For instance, a 2024 report indicated that businesses implementing AI in inventory management saw an average reduction of 15% in stockouts and a 10% decrease in carrying costs.

Christie Group's inventory management and systems solutions are well-positioned to capitalize on these technological advancements. By integrating AI and automation, Christie Group can offer clients enhanced operational efficiency, improved accuracy in stock control, and the potential for data-driven insights into consumer behavior and demand forecasting. This allows for more sophisticated service offerings, potentially leading to increased client retention and new business opportunities in a competitive market.

- AI in inventory management can reduce stockouts by up to 15% (2024 data).

- Automation in check-in processes can decrease guest waiting times by an average of 30%.

- AI-powered scheduling can optimize labor costs by an estimated 10-20% in retail and hospitality.

Blockchain for Secure Transactions and Record-Keeping

Blockchain technology is revolutionizing commercial real estate by providing unparalleled security, transparency, and efficiency in transactions and record-keeping. This distributed ledger technology creates immutable digital records, which can significantly simplify processes like property transfers and lease management, directly benefiting Christie Group's core agency and valuation services.

The adoption of blockchain in real estate is gaining momentum. For instance, by mid-2024, several pilot programs were underway globally, demonstrating the potential to reduce transaction times by up to 50% and cut associated costs by as much as 20%. This efficiency gain is crucial for firms like Christie Group, which handle a high volume of property deals and valuations.

- Streamlined Property Transfers: Blockchain can automate and secure the transfer of property titles, reducing the need for intermediaries and speeding up the process.

- Enhanced Lease Management: Smart contracts on a blockchain can automate rent payments and lease renewals, minimizing disputes and administrative overhead.

- Improved Data Integrity: Tamper-proof records ensure the accuracy and reliability of property data, crucial for valuation services.

- Increased Transparency: All parties involved in a transaction can access a shared, verifiable ledger, fostering trust and reducing fraud.

Technological advancements are rapidly transforming property valuation and management. AI and machine learning are enabling more accurate and efficient automated valuation models (AVMs), a key driver in the projected over $30 billion global proptech market by mid-2024.

The retail and hospitality sectors are heavily investing in digital solutions. Retail analytics, valued at $10.5 billion in 2023, and hospitality technology, valued at $20.3 billion in 2023, highlight the demand for AI and automation to optimize operations and enhance customer experiences.

Cybersecurity is paramount, with the global cost of cybercrime projected to reach $10.5 trillion annually by 2025, necessitating robust defenses for firms like Christie Group handling sensitive data.

Blockchain technology is enhancing transparency and efficiency in real estate transactions, with pilot programs by mid-2024 showing potential for 50% faster property transfers and 20% cost reductions.

| Technology | Impact on Christie Group | Market Data (2023-2025) |

|---|---|---|

| AI & Machine Learning | Enhanced property valuation (AVMs), operational efficiency in client sectors | Global Proptech Market: >$30 billion (mid-2024 projection) |

| Digital Transformation | Demand for data-driven solutions in retail and hospitality | Retail Analytics Market: $10.5 billion (2023) |

| Cybersecurity | Essential for data protection and client trust | Global Cybercrime Cost: Projected $10.5 trillion annually by 2025 |

| Blockchain | Streamlined transactions, improved data integrity in real estate | Potential 50% faster property transfers (mid-2024 pilot programs) |

Legal factors

Changes to business rates legislation, particularly the reduction in relief for the retail, hospitality, and leisure sectors, directly affect Christie Group's clients by altering their property tax liabilities. For example, the tapering of the retail, hospitality, and leisure relief from 75% to 50% for the 2024-25 financial year increases the burden on businesses in these sectors.

The introduction of permanently lower rates from 2026, following the Autumn Statement 2023's announcement of a freeze in the small business multiplier, offers some stability but requires careful navigation. Christie Group must remain adept at advising clients on these evolving property valuations and financial planning strategies to mitigate potential impacts.

In the UK, the National Living Wage (NLW) and National Minimum Wage (NMW) are set to increase. For individuals aged 21 and over, the NLW is expected to rise to £11.44 per hour from April 2024, representing a significant jump from previous years. This legal mandate directly impacts Christie Group's clients by increasing their payroll expenses.

Furthermore, changes to employer National Insurance Contributions (NICs) also present a legal factor. For the 2024-2025 tax year, the main rate of employer NICs is 13.8% on earnings above the secondary threshold. Christie Group's advisory role would involve helping businesses adapt their financial planning and workforce management to absorb these mandated cost increases effectively.

The evolving landscape of data protection, including the UK's Data (Use and Access) Act and potential EU GDPR revisions, directly influences Christie Group's client data management. Compliance is paramount to preserving client trust and mitigating risks, particularly for their software and systems offerings.

Failure to adhere to these stringent regulations can result in significant financial penalties; for instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher. Christie Group's commitment to robust data security practices is therefore essential for its operational integrity.

Health and Safety Regulations (e.g., Martyn's Law)

Legislation such as the UK's Terrorism Protection of Premises Bill, often referred to as Martyn's Law, is set to introduce significant new statutory duties for businesses operating public venues. This includes the hospitality and leisure sectors, which are key markets for Christie Group's clients. These new regulations will require a proactive approach to assessing and mitigating risks associated with terrorist attacks.

The implementation of Martyn's Law could translate into increased demand for Christie Group's consultancy services. Businesses will likely need expert guidance to understand and comply with the new obligations, potentially creating new revenue streams for the group in areas such as risk assessment and security planning.

- Increased Compliance Burden: Businesses in the hospitality and leisure sectors will face new legal requirements for security preparedness.

- Demand for Expertise: Christie Group is well-positioned to offer consultancy on risk assessment and mitigation strategies related to terrorism.

- Operational Adjustments: Clients may need to invest in new security measures or training, impacting their operational costs and strategies.

Sector-Specific Regulations (e.g., Tourism Tax, MUP)

Sector-specific regulations significantly shape the hospitality landscape. For instance, potential new tourism taxes being considered in Wales could directly impact visitor spending and the revenue streams of hotels and attractions. Similarly, ongoing reviews and potential increases in Minimum Unit Pricing (MUP) for alcohol in Scotland, which aims to reduce alcohol-related harm, can influence the cost of goods sold and pricing strategies for pubs and restaurants.

These regional regulatory shifts necessitate close monitoring by Christie Group to offer precise market analysis and valuation counsel. Understanding the financial implications of such changes is crucial for advising clients effectively.

- Wales Tourism Tax: Potential implementation could add a levy on overnight stays, directly affecting consumer costs and business revenue.

- Scotland MUP: Ongoing reviews may lead to higher minimum prices for alcoholic beverages, impacting profitability for on-trade premises.

- Impact on Valuations: Regulatory changes can alter projected earnings, necessitating adjustments in business valuations and investment advice.

- Operational Adjustments: Businesses must adapt pricing and cost management strategies in response to evolving legal frameworks.

Legal factors significantly influence Christie Group's operating environment and client base. Changes in business rates, such as the tapering of retail, hospitality, and leisure relief to 50% for 2024-25, directly impact property tax liabilities for clients. Furthermore, the mandated increase in the National Living Wage to £11.44 per hour for those 21 and over from April 2024 raises payroll expenses for businesses.

Data protection laws, like the UK's Data (Use and Access) Act and potential GDPR revisions, necessitate robust data management practices to avoid substantial penalties, which can reach up to 4% of global annual turnover. Emerging legislation such as Martyn's Law, requiring enhanced security measures for public venues, presents both compliance challenges and opportunities for consultancy services in risk assessment.

Sector-specific regulations, including potential tourism taxes in Wales and reviews of Minimum Unit Pricing for alcohol in Scotland, can alter client revenue streams and cost structures. Christie Group must provide updated market analysis and valuation counsel to navigate these evolving legal frameworks effectively.

| Legal Factor | Impact on Clients | Christie Group Relevance |

|---|---|---|

| Business Rates Relief Taper (2024-25) | Increased property tax liabilities for retail, hospitality, leisure clients. | Advising on property valuations and financial planning. |

| National Living Wage Increase (April 2024) | Higher payroll expenses for businesses. | Assisting with workforce cost management and financial planning. |

| Data Protection Laws (e.g., GDPR) | Risk of significant fines for non-compliance. | Ensuring robust data security for software and systems offerings. |

| Martyn's Law (Terrorism Protection Bill) | New security duties for public venues. | Opportunity for consultancy on risk assessment and security planning. |

| Potential Wales Tourism Tax | Impact on visitor spending and business revenue. | Providing market analysis and valuation counsel on regional shifts. |

| Scotland Minimum Unit Pricing (MUP) Reviews | Influence on cost of goods sold and pricing for hospitality. | Advising on pricing strategies and cost management. |

Environmental factors

Investors and regulators are increasingly demanding that commercial properties achieve Environmental, Social, and Governance (ESG) goals. This trend directly influences property values and investment strategies, as demonstrated by the growing market for green bonds in real estate, which saw significant issuance in 2024. Failing to meet these standards can lead to devalued assets and missed investment opportunities.

Christie Group's valuation and consultancy services must integrate ESG performance metrics to accurately assess property worth and guide clients. For instance, properties with strong energy efficiency ratings or those pursuing certifications like LEED or BREEAM often command higher rents and attract a wider pool of investors in 2024 and 2025. Advising clients on achieving these sustainability targets is becoming a core component of successful real estate strategy.

Increasingly stringent energy efficiency standards for buildings, a key environmental factor, directly influence operational costs and property valuations. For instance, the UK government aims for all commercial buildings to achieve an Energy Performance Certificate (EPC) rating of B by 2030, a significant shift from current averages which often hover around D or C. This regulatory push, coupled with investor demand for sustainable assets, means Christie Group's valuation and consultancy services must meticulously incorporate energy performance data, such as EPC ratings and energy use intensity, into their assessments to accurately reflect market value and potential future liabilities or upgrades.

The hospitality and retail sectors are increasingly prioritizing waste reduction and circular economy principles. This shift means Christie Group's clients are likely to seek expert guidance on adopting sustainable operational practices, directly influencing demand for inventory management and operational consultancy services. For example, a 2024 report indicated that over 60% of UK consumers are willing to pay more for products from businesses with strong environmental credentials, creating a clear market incentive for these initiatives.

Climate Change and Physical Risks to Property

While specific 2024-2025 data for Christie Group's exposure isn't publicly detailed, the escalating frequency of extreme weather events globally presents a tangible threat. For instance, the NOAA reported that in 2023, the U.S. experienced 28 separate weather and climate disasters each exceeding $1 billion in damages, totaling over $165 billion. This trend directly impacts property valuations and insurance premiums, potentially increasing operational costs for real estate-dependent businesses like Christie Group.

These physical risks, stemming from climate change, necessitate a forward-looking approach. Christie Group's long-term strategy should incorporate assessments of how rising sea levels, increased wildfire activity, or more intense storm seasons could affect property portfolios. Such environmental factors can significantly alter market desirability and require substantial investment in resilience measures, impacting future profitability and asset values.

- Increased Insurance Premiums: Extreme weather events are driving up insurance costs globally, impacting property owners and potentially Christie Group's operational expenses.

- Property Devaluation: Areas prone to climate-related disasters may see a decline in property values, affecting Christie Group's asset base and investment returns.

- Mitigation Investment: Businesses may need to invest in climate-resilient infrastructure, adding to capital expenditure and potentially affecting cash flow.

- Regulatory Changes: Evolving environmental regulations related to climate risk disclosure and adaptation could impose new compliance burdens.

Consumer Demand for Sustainable Practices

Consumer demand for sustainability is a powerful driver, with a significant portion of shoppers willing to pay a premium for eco-friendly products. For instance, a 2024 survey indicated that over 60% of consumers consider sustainability when making purchasing decisions, a figure that has steadily climbed in recent years. This trend directly impacts Christie Group's clients in sectors like retail and hospitality, compelling them to integrate greener operational models and supply chains.

This heightened consumer awareness translates into a direct need for advisory services focused on environmental, social, and governance (ESG) compliance and strategy. As businesses face pressure to demonstrate genuine commitment to sustainability, Christie Group can anticipate increased demand for consultancy that helps them navigate these evolving expectations. This includes advising on everything from waste reduction and energy efficiency to ethical sourcing and transparent reporting.

- Growing Consumer Preference: Over 60% of consumers consider sustainability in purchasing decisions (2024 data).

- Willingness to Pay More: Consumers are increasingly open to higher prices for sustainable goods.

- Client Pressure: Retail and hospitality sectors are pressured to adopt greener practices.

- Consultancy Opportunity: Demand for ESG and sustainability advisory services is on the rise.

The increasing focus on environmental, social, and governance (ESG) criteria is reshaping the commercial property market, with investors and regulators prioritizing sustainability. This trend is evident in the robust growth of green real estate bonds, a market that saw substantial issuance in 2024, signaling a clear demand for eco-conscious assets. Consequently, properties demonstrating strong environmental performance, such as those with high energy efficiency ratings or recognized certifications like LEED, are experiencing enhanced valuations and attracting a broader investor base through 2024 and into 2025.

Stricter energy efficiency mandates for buildings are directly impacting operational expenses and property worth, with regulatory bodies pushing for significant improvements in energy performance certificates. For instance, the UK aims for all commercial buildings to achieve an EPC rating of B by 2030, a substantial upgrade from current average ratings. Christie Group's valuation services must therefore meticulously integrate energy performance data, like EPC ratings and energy use intensity, to accurately reflect market value and potential future costs or upgrade requirements.

Extreme weather events are escalating, posing tangible risks to property portfolios and increasing operational costs. In 2023 alone, the U.S. recorded 28 weather and climate disasters exceeding $1 billion each, with total damages surpassing $165 billion. This trend necessitates that Christie Group's clients and strategies account for the potential impacts of rising sea levels, increased wildfire activity, and more intense storms on property desirability and insurance premiums.

| Environmental Factor | Impact on Christie Group Clients | 2024/2025 Relevance |

| ESG Demands | Increased property values for green-certified buildings; potential devaluation for non-compliant assets. | Growing market for green bonds; strong investor preference for sustainable properties. |

| Energy Efficiency Regulations | Higher operational costs for non-compliant buildings; increased demand for energy-efficient upgrades. | UK's target of EPC B for all commercial buildings by 2030; focus on energy use intensity in valuations. |

| Extreme Weather Events | Rising insurance premiums; potential property devaluation in disaster-prone areas; increased mitigation investment. | 2023 U.S. disasters exceeded $165 billion; direct impact on operational costs and asset resilience. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Christie Group is meticulously crafted using a blend of public and proprietary data. This includes official government publications, reputable market research reports, and industry-specific publications to ensure a comprehensive understanding of the macro-environment.